Money transactions require paperwork. For example, Mutual fund investors do a number of transactions on any given day such as buy, sell or switch units. They could also request for a bank mandate change or an address change. Who takes care of the records for Mutual Fund companies? CAMS and Karvy take care of record keeping for most of the Mutual Fund companies and are called Registrar and Transfer Agents. This article explains Who are Registrar and Transfer Agents? How do Registrar and Transfer Agent help Mutual fund companies and Mutual Fund investors?

Table of Contents

Registrar and Transfer agent

Who are Registrar and Transfer Agent?

Mutual funds, publicly-traded companies, and financial institutions often have many investors who own a small portion of the organization, require accurate records and have rights regarding information provision. The registrar or transfer agents are the trusts or institutions that register and maintain detailed records of the transactions of investors for the convenience of companies or mutual fund houses. Some companies choose to act as their own transfer agents, but most choose a third-party financial institution such as banks to fill the role.

You can find out which transfer agent a company uses by visiting the investor relations section of the company’s website.

Who are R&T agent for Mutual Funds – CAMS , Karvy etc?

Mutual fund investors do a number of transactions on any given day such as buy, sell or switch units. They could also request for a bank mandate change or an address change. Mutual fund houses have to maintain records of each such transaction. A mutual fund may or may not want to invest in these processes nor would have the skilled expertise to handle these huge transactions on a professional basis. If they don’t they outsource this work to an agency which can handle these requests from investors on a regular basis. An Registrar and Transfer agents (R&T agent) help them in maintaining the paper work on behalf of the fund house, through its offices across the country.

Registrar and Transfer Agents are also help distributors and Mutual Fund Companies (AMC : Asset Management Companies). The R&T gives a 360-degrees solution to all the three stakeholders of MF business—investor, distributor and the AMC. It’s all about front-end and back-end integration.

The major Registrar and Transfer Agents in the Indian Mutual Fund space are:

- Computer Age Management Services (CAMS) Ltd Registrar for HDFC, ICICI, SBI, Birla,

DSP BlackRock and several other Mutual Funds - Karvy Computershare Ltd is Registrar and Transfer Agent for fund houses such as Reliance, UTI, Principal, LIC, TATA and several other Mutual Funds

- Franklin Templeton International Services (India) Pvt. Ltd is the in-house R&T for Franklin Templeton Mutual Funds

- Deutsche Investor Services Ltd : Registrar for Deutsche Mutual Fund

- Sundaram BNP Paribas Fund Services: Registrar for Sundaram and BNP Paribas Mutual Funds

Investors can also get consolidated account statements across funds houses serviced by Cams, Karvy and Franklin Templeton, on the websites of both Cams and Karvy.

How does an R&T agent help Investor?

A Registrar & Transfer agent typically acts as a third-party on behalf of a fund house. The R&T agent has a wide network of branches across the country to service investors and help them execute their transactions. It acts as single-window system for investors helping investors to

- Information and detail on new fund offers and existing ones.dividend distributions or even maturity dates in case of FMPs (fixed maturity plans)

- Give forms of fund houses,

- Complete their transactions. It’s like investing with mutual fund directly.

- Obtain their account statements

- They don’t charge the Investor directly. They are paid by the Mutual Fund companies who recover the charges from investor.

While such information is also available at fund houses, an R&T agent is a one-stop shop for all the information. Investors can get information about various investments in different schemes of different fund houses at a single place. Image below shows the Investor services offered by CAMS from their webpage. You would similar one at Karvy.

Who is distributor of Mutual Funds?

Distributor is the person who acts for both Applicant or unit holder and Mutual Fund provides support for transaction processing. Now there is a distinction between distributor and advisor.

- Until a few years ago, mutual funds thrived on the salesmanship of independent distributors who canvassed investors for a commission, which was paid by the funds from an entry fee charged to new investors. In 2009, Sebi banned such entry loads.

- To encourage mutual funds to directly approach investors, Sebi has created two plans: A direct plan that will have a higher net asset value, and a distributor plan that will have a net asset value lower by about 0.5 percentage point to accommodate commissions. Our article Direct Investing in Mutual Funds explains direct investing in mutual fund in detail.

- Insurance agents, mutual fund distributors and stock brokers, among others, are not advisors, they are distributors. All these individuals represent a product manufacturer and earn commissions (upfront or trailing) and do not charge the investor.

An advisor as one who offers advice on buying, selling and dealing with securities and investment products for a consideration. The advisor cannot receive any compensation from those who bring out investment products, such as mutual funds, but have to earn their income from investors.

One can become a distributor of the products of mutual funds by obtaining an

- Acquirer’s Reference Number or ARN code from the Association of Mutual Funds in India (AMFI)

- Getting certification

- Certification from the Association of Mutual Funds in India (AMFI) having passed the AMFI Mutual Fund (Advisors) Module before June 01, 2010 .

- Valid certification from the National Institute of Securities Markets (NISM) by passing the NISM certification examination on or after June 01, 2010. For more details regarding the NISM certification examination, please visit www.nism.ac.in

- Empanelling as distributor with required mutual Fund company.

- Distributor can be Individuals, sole proprietorships, partnership firms, companies, societies, co-operatives and trusts.

- HDFC Mutual Fund Distributor shows requirements of how to become a Mutual Fund Distributor.

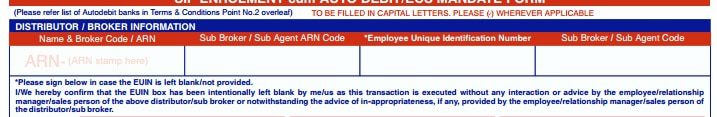

Application form showing distributor or broker Information.

How does an R&T agent help Distributors of Mutual Funds?

R&Ts also serve the distributors. It helps them buy and sell funds on their client’s behalf. It enables distributors to submit application forms online (after making a scanned copy of it through a scanner installed in the agent’s office); the agent no longer needs to physically reach the R&T’s office by 3pm (cut-off time to submit application to be eligible for same day’s net asset value or NAV). and also generate consolidated account statements across fund houses. An agent can also get a report of sales done by him between any two given dates. He can get this on any frequency he wants, such as monthly and quarterly. All the distributor needs to do is punch in his requirements on the R&T’s website (typically R&T gives every agent a username and password) and he gets the report within hours.

R&Ts have also started processing know-your-customer forms for investors and know-your-distributor forms for distributors. R&Ts such as Cams have branched out into servicing insurance companies too.

How does an R&T agent help Mutual Fund Companies?

R & Ts have also helped fund houses to reduce costs. As R & T offices are present across many locations in India means that fund houses don’t need to open up branches in those cities.

They also focus on electronic communication, be it account statements, newsletters or other communication from the AMC for investors and distributors. Now most fund houses seek your email ID start sending you account statements on email directly also. So need for it has gone down.

R&T services come at a cost to fund houses, which is eventually passed on to the investor, i.e you, as part of the annual cost that MFs charge you. For equity funds, the cost is about 10 basis points or bps (1 bps is one-hundredth of a percentage point), for debt funds about 5-7 bps and for liquid funds about 3-4 bps.

Have I used the Registrar and Transfer Services of Mutual Funds?

Yes. I have invested in various mutual funds schemes. I have used the services provided by CAM, KARVY and Franklin Templeton Mailback services. To get this information your email id should be registered in all your folios. I have personally used

- Consolidated Account, Portfolio Statement, Consolidated Transaction Details – Listing all my investment transactions in various formats, single, detailed, transactions (as excel)

- Consolidated Account Statement – CAMS+Karvy+FTAMIL which is a single Consolidated Account Statement across your entire holdings in CAMS, Karvy and FTAMIL serviced Mutual Funds –

- Consolidated Realised Gains Statement: Information about Investment Performance, Capital Gains and Income for the current and last Financial Years.

Consolidated Realised Gains Statement was very helpful while filling my Income Tax returns to find how much Short Term or Long Term Capital Gain I have made.

Consolidated Transaction Details was helpful in finding how many dividends I have earned.(Yes I had invested in Equity Mutual Fund in dividend option in the beginning but as I got aware I moved to Growth option)

Following image shows the application form where one fills in the Email Id and /or Mobile Number. (Filling one of them now is mandatory)

Related Articles:

- Direct Investing in Mutual Funds

- Rantings of a Mutual Fund Investor

- Investing in Mutual Funds for Beginner

- Finding Info on NFOs of FMP,MFs,FD and Saving Interest Rates

Have you used the services of Registrar and Transfer Agent? With advancement in technology will the role of R & T agents of Mutual Fund become less? What more do you think Registrar and Transfer agent do? Is there a need for Registrar and Transfer Agents? Please share your feedback and comments.

4 responses to “Mutual Funds: Registrar and Transfer Agent : CAMS, Karvy”

You have shared helpful information about the Registrar and Transfer Agent. I am really thankful to you for this information. If you want to get more information about RTA services then visit our website.

Thanks for sharing this useful information about Mutual Funds and Registrar and Transfer Agent. In case for more information, that is avabile at my Offical website about Registrar & Transfer Agent.

Thanks for sharing this useful information about Mutual Funds and Registrar and Transfer Agent. In case for more information, that is avabile at my Offical Blog about Registrar & Transfer Agent.

how the payment to r&T agent is calculated ?