Government of India has launched RBI Floating Rate Savings Bonds, 2020 (Taxable) scheme starting from 01 July 2020 to enable person resident in India/HUF to invest in a taxable bond. These RBI Floating Rate Savings Bonds replaces the RBI 7.75% bonds which RBI discontinued On May 28 2020. The article covers RBI Floating Rate Savings Bonds and who should invest in it.

Table of Contents

RBI Savings Bonds 2020 Floating Rate

| Item | Details |

| Eligibility for Investment | The Bonds are open to investment by individuals (including Joint Holdings) and Hindu Undivided Families.

NRIs are not eligible for making investments in these Bonds. |

| Interest Rate is Floating | The interest on the bonds is payable semi-annually on 1st Jan and 1st July every year.

The coupon on 1st January 2021 shall be paid at 7.15%. The Interest rate for next half-year will be reset every six months, the first reset being on January 01, 2021. There is no option to pay interest on a cumulative basis. |

| Benchmark | NSC(National Saving Certificate) + .35%. NSC rate between Apr-Jun 2020 is 6.8%

(Technically National Saving Certificate rate with a spread of 35 basis points over the respective NSC rate.) Interest Rates of Post office Small Savings Schemes discusses the interest rate of Post office small saving schemes. |

| Tenor | The Principal will be repayable on the expiration of 7 (Seven) years from the date of issue.

Premature redemption shall be allowed for specified categories of senior citizens. |

| Tax treatment | Interest on the Bonds will be taxable under the Income-tax Act and as per tax slabs. |

| Where to get the bonds | Applications for the Bonds in the form of Bond Ledger Account will be received in the designated branches of SBI, Nationalised banks, IDBI Bank Ltd, Axis Bank Ltd, HDFC Bank Ltd and ICICI Bank Ltd. |

| Subscription | Subscription to the bonds will be in the form of cash (upto ₹20,000/- only)/drafts/cheques or any electronic mode acceptable to the Receiving Office. |

| Till when will be the bonds available | The Bonds will be on tap till further notice and issued in non-cumulative form only. |

| Limit of investment | There will be no maximum limit for investment in the Bonds. |

| Form of the Bonds | The Bonds will be issued only in the electronic form and held at the credit of the holder in an account called Bond Ledger Account (BLA), opened with the Receiving Office. |

| Tradability /Advances | The Bonds shall not be tradable in the secondary market and shall not be eligible as collateral for loans from banks, Financial Institutions and Non-Banking Financial Company (NBFC) etc. |

| Transferability | The Bonds in the form of Bond Ledger Account shall not be transferable except transfer to a nominee(s)/legal heir in case of death of the holder of the bonds. |

| Nomination | A sole holder or a sole surviving holder of a Bond, being an individual, can make a nomination. |

| Premature redemption | Premature redemption is allowed for specified categories of senior citizens as per the following rules: – For a person between 60 to 70 years of age, premature redemption can be done after 6 years. – For a person between 70 to 80 years age, this period is 5 years – For the person above 80 years of age the redemption can be done after 4 years. For premature redemption, the person has to submit their age proof document to the respective bank. In the case of joint holders, the eligibility would be based on the person with a maximum age. |

Difference between old and new RBI Saving Bonds

In both bonds, interest earned was taxable as per one income slabs. The major differences are shown below.

| Description | RBI Saving Floating Bonds 2020 | 7.75% RBI Saving Bonds |

| Cumulative | No Cumulative option is available. | Both Cumulative and Non-Cumulative options were available |

| Interest rate | Interest rate is floating. Will follow NSC.

Fixed at 7.15% till Jan 2021 |

The interest rate was fixed at 7.75% |

Should you invest in RBI Floating Rate Savings Bonds 2020?

Remember that one would get 7.15% return only till Jan 2021. (six months). The interest rate of these bonds would be adjusted as per the rates announced by the Govt.

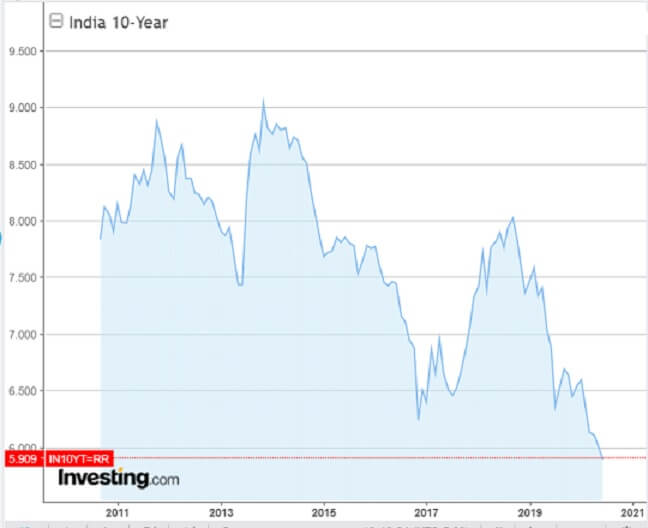

Currently, the bank FDs offer interest rates of around 6% for a tenure of 5+ years. Interest rates are going down. Are we at the bottom of the interest rate trough is not sure? So be prepared for more rate cuts. The NSC rates follow the 10-year Govt bonds. The movement is shown in the image below. The interest rate movement of NSC is shown in the table below from our article Interest Rates of Post office Small Savings Schemes

| Time period | Apr-Jun 2020 | Jul-Mar, 2020 | Apr-Jun, 2019 | Jan-Mar, 2019 | Oct-Dec, 2018 | Jul-Sep, 2018 | Apr-Jun, 2018 | Jan-Mar, 2018 |

| NSC | 6.8 | 7.9 | 8.0 | 8.0 | 8.0 | 7.6 | 7.6 | 7.6 |

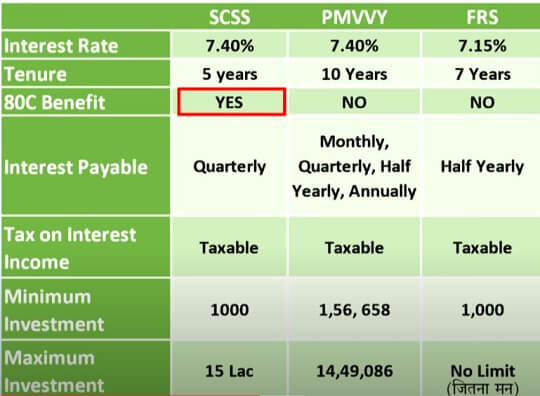

For Senior Citizens, Senior Citizen Savings Scheme offers a better interest rate(7.4%) and Pradhan Mantri Vaya Vandana Yojana (PMVVY) offers 7.4% For others, it is a secured option but you are tied up for 7 years and interest is taxable as per the income slab

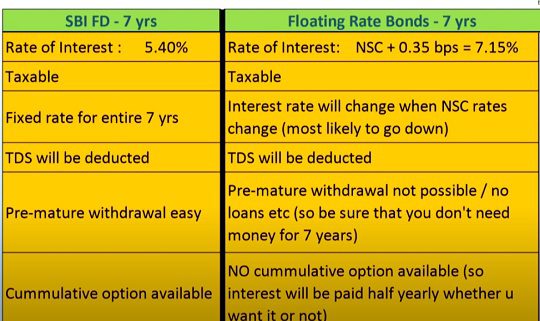

Compare RBI Floating Rate Saving Bonds(FRS) with Fixed Deposits

RBI Floating Rate Savings Bonds 2020 is better than Fixed Deposits. The table below shows the comparison of RBI Floating Rate Saving Bonds(FRS) with Fixed Deposits.

Compare FloatRate Saving Bonds(FRS) with Senior Citizen Scheme and PMVVY

Related Articles:

- What are 7.75% Government Savings Bonds? RBI Bonds

- Interest Rates of Post office Small Savings Schemes

- Senior Citizen and Retirement, Income Tax, Form 15H,Will

- Senior Citizen Savings Scheme, SCSS