A travel insurance cover of up to Rs 10 lakh can be availed while booking a train ticket online by paying less than one rupee from 31 August 2016. The claims under the new scheme is Rs 10 lakh in case of death, Rs 10 lakh in case of Permanent Total Disability, Rs 7.5 lakh in case of permanent partial disability, Rs 2 lakh for hospitalization expenses for injury and Rs 10,000 for transportation of mortal remains. This article talks Conditions of Railways Travel Insurance, Insurance companies offering Railways Travel Insurance, How to buy Indian Railways Travel Insurance ?

From 10 Dec 2016, the Indian Railways has started giving free accidental insurance cover to the passengers who booked their tickets through online mode

Table of Contents

Conditions of Railways Travel Insurance

On an average, about 15,000 people are said to die in rail mishaps yearly. According to the National Crime Records Bureau, in 2014, 28,360 rail accidents were reported, in which 3,882 were injured and 25,006 lost their lives. Wikipedia Article List of Indian rail incidents covers all the accidents in detail. The passenger insurance scheme was introduced by the railways on September 1, 2016, for 92 paise. The Railway’s travel insurance which was being piloted by Indian Railway Catering and Tourism Corporation (IRCTC) with a premium of 92 paise had reduced the premium to 1 paisa for a limited period from October 7, 2016, and was valid for confirmed long-distance tickets booked until October 31, 2016. From 10 Dec 2016, the Indian Railways has started giving free accidental insurance cover to the passengers who booked their tickets through online mode.

- According to railway officials, about 14 lakh railway passengers buy railway tickets daily — out of which 58 per cent tickets are bought online.

- The scheme is applicable only for Indian Citizens who book their e-ticket through IRCTC Website Application only.

- The Railways Insurance is optional while booking the ticket. If the option is exercised it will be compulsory for all passengers booked under one PNR number.

- The premium is Re. 92 paise per passenger inclusive of all taxes.

- It is for passengers holding tickets such as confirmed, RAC and waitlisted ones.

- On cancellation of the ticket, no refund of the premium will be given.

- The Travel Insurance Scheme is uniform for all classes, 2AC, 3AC etc.

- The cover is not applicable for children up to 5 years of age and foreign citizens.

- In case of passenger opting for insurance, the claim/liability shall be between insured and the Insurance Company

- The scheme offers travelers/nominees/legal heirs a compensation of

- Rs 10 lakh in the event of death or total disability,

- Rs 7.5 lakh for partial disability,

- up to Rs 2 lakh for hospitalisation expenses and

- Rs 10,000 for transportation of mortal remains from the place of a train accident or where an untoward incident, including terrorist attack, dacoity, rioting, shootout or arson, occurs.

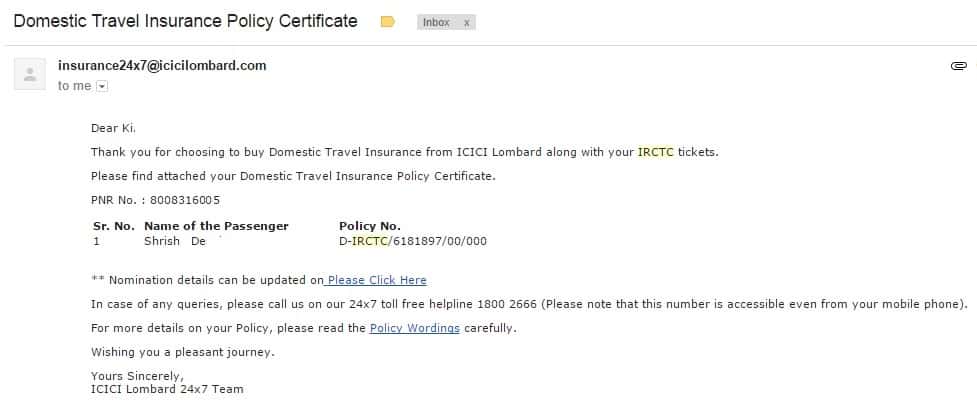

- After booking of ticket, the nomination details are to filled at respective Insurance Company site. You will receive the policy information through SMS and on your registered email IDs directly from Insurance Companies along with the link for filling nomination details. However, Policy number can be viewed from Ticket booked history at IRCTC Page.

- If nomination details are not filled then the settlement shall be made with legal heirs, if the claim arises.

Details of Insurance are IRCTC website OPTIONAL TRAVEL INSURANCE FOR E-TICKET PASSENGERS

Insurance companies offering Railways Travel Insurance

Railways Travel Insurance is being implemented by IRCTC in partnership with ICICI Lombard General Insurance, Royal Sundaram General Insurance and Shriram General Insurance. The three selected insurance companies will get to issue the insurance policy on a rotational basis through an automated system. selected through a bidding process. A total of 19 companies had participated in the bidding process and 17 were found eligible. IRCTC has engaged the firms for one year with the provision of extending the contract on a performance basis. Shriram General was the lowest bidder, quoting 92 paise. ICICI Lombard General quoted 99 paise and Royal Sundaram Rs 1.15. The other two would have to match the lowest bid of Rs 92 paise.

Others in the fray were HDFC Ergo, Reliance General Insurance, Apollo Munich Health Insurance, New India Assurance, Tata AIG, Bharti Axa, National Insurance, Iffco Tokio, Bajaj Allianz, Oriental Insurance, Star Health & Allied Insurance, CholaMandalam MS, United India Insurance and Future Generali India.

How to buy Indian Railways Travel Insurance?

- Login to your account on irctc.co.in

- Plan your journey.

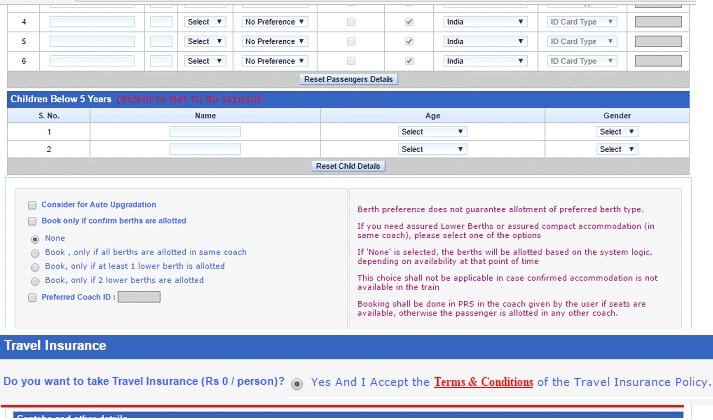

- When you book the tickets, Fill the passenger details.

- At the bottom of adding passenger details is an option for opting for Travel Insurance as shown in Image below

- Click on next and you will be re-directed to payment option selection. Here you will find the break up of travel charges.

You notice that Rs.0.92 (92paisa) also added to your travel amount. - Select the payment option and book your tickets.

- Once tickets confirmed, then you will receive policy information through SMS and on your registered email IDs directly from Insurance Companies along with the link for filling nomination details.

Policy number can be viewed from Ticket booked history on IRCTC Website. Click Transaction ID to check Travel Insurance related details.

How to claim Indian Railways Travel Insurance?

One needs Report of the Railway Authority confirming the accident of the train or untoward incident. Report of the Railway Authority carrying the details of the passengers declared dead.

Claim Indian Railways Travel Insurance in case of Death

Claim will be settled only to nominee declared at the time of buying insurance through IRCTC portal. If nomination not opted, then claim will be paid to Legal Heir only – as per Legal Heir / Succession Certificate.

- Insured person, nominee or legal heir must visit nearest branch office of Insurance Company within the 4 months from the date of accident.

- Duly Completed Personal Accident Claim Form signed by Nominee / Legal Heir along with the NEFT mandate details & cancelled cheque.Photo identity proof of nominee or legal heir.

- Proof of insurance policy details also must be submitted.

- Benefits will be payable by Insurance Company within 15 days of such documents received.

- If there is a delay, then Insurance companies have to pay more than 2% of rate of interest of bank rate.

- Claim will not be acceptable beyond 365 days from the date of expiry of policy.

- Claim will be rejected if found to be fraudulent or supported by fraudulent.

Claim Indian Railways Travel Insurance For Disablement

- Report of the Railway Authority confirming the accident of the train or untoward incident.

- Report of attending doctor confirming the extent of disability.

- Medical bills corresponding to doctor’s prescription.

- Duly Completed Personal Accident Claim Form signed by insured / Nominee.

- Attested copy of disability certificate from Civil Surgeon of that Hospital in which the treatment has undergone stating % of disability.

- Attested copy of FIR.

- All X-Ray / Investigation reports and films supporting to disablement.

- Claim form with NEFT details & cancelled cheque of the beneficiary.

- Photograph before & after disability.

Claim Indian Railways Travel Insurance For Hospitalization

- Report of the Railway Authority confirming the accident of the train or untoward incident.

- Discharge summary.

- Original Hospital Bills and medical bills corresponding to doctor’s prescription.

- Advance and final receipts (All receipts shall be numbered, signed and stamped).

- Prescriptions for medicines.

- Diagnostic Test Reports, X Ray, Scan, ECG and others including doctor’s advice demanding such tests).

- Cash memos/bills for medicines purchased from outside.

History of Railways Travel Insurance

The Railway Passenger Insurance Scheme. was introduced in the 1993-94 railway budget and was administered by the Railway Claims Tribunal. Details of the policy can be read on Railways Tribunal website. It was discontinued on September 20, 2008 , citing higher premiums as a reason. Compensation under the scheme was decided as per the Railway Accident and Untoward incidents (Compensation) Rules 1990. ICICI Lombard was the last insurer for this scheme between September 20, 2007 and September 19, 2008. According to this expired scheme, any passenger with a valid ticket or pass including platform ticket is insured and they are entitled to a compensation of up to Rs 4 lakh in case of any untoward incidents.

Railways and Accidents

On an average, about 15,000 people are said to die in rail mishaps yearly. According to the National Crime Records Bureau, in 2014, 28,360 rail accidents were reported, in which 3,882 were injured and 25,006 lost their lives. Wikipedia Article List of Indian rail incidents covers all the accidents in detail.

About 59 per cent of IR tickets are booked online. The IRCTC site sees 3.2 million average daily user log-ins, with an average of 550,000 tickets booked a day, for about a million passengers.An estimated 15-20 million had opted for the scheme in these 85 days. This compares to 3.2 million log-ins a day on the website and up to 700,000 bookings a day. Newspapers say only about 30 per cent of all tickets booked online opt for travel cover, though the premium of 92 paise for a passenger is one of the lowest in the world.

Indore-Patna Express mishap first test for new Railway insurance

On 20 November 2016, 14 coaches of the Indore-Rajendra Nagar Express 19321 derailed at Pukhrayan, approximately 60 kilometers from Kanpur. At least 150 deaths and 260 injuries have been reported in Pukhrayan train accident. After the Indore-Patna Express mishap, which claimed 145 lives and left 200 more injured, the railways ministry is examining a proposal to make passenger insurance mandatory.

In the derailed Indore-Patna Express 145 people have been killed in the accident which has left 200 more injured.

- The derailed Indore-Patna Express had on board 695 passengers who were travelling on reserved seats.

- Out of them, 128 had opted for the insurance and paid for it at the time of booking.

- Out of the 128 passengers, 78 were in the train during the accident, whereas the remaining were to board later.

Total payout promised to those who died on the train is 26.5 lakh highest ever given in Train accident in India

- PMO + Railways : 5.5 lakh

- UP Govt : 5 Lakhs

- MP Govt : 2 Lakh

- IRCTC Insurance : 10 lakh

- Total : 26.5 lakh (Total adds to 22.5 but Times of India says 26.5)

Related Articles:

- Surge Pricing in Trains,Train Fare,PNR,Types of Trains,Coaches

- Booking Tatkal Ticket

- What is Leave Travel Allowance or LTA

- How to apply for Passport :Fill Form,Pay and Schedule Appointment

- Base fare, UDF,Passenger Fees and Fuel Surcharge: Fees and charges of Airlines

- How much to pay for LPG cylinder , How much LPG subsidy I will get

92 paisa a not big deal. Hence, I suggest all of Indian Railway travellers to chose this option and get the benfit of Indian Railways travel insurance. Do you travel by train? What do you think of Indian Railways Travel Insurnace.

2 responses to “Railways Travel Insurance: How to buy, Policy document,History”

Very nice article. I absolutely love this site. Continue the

good work!

23 Places Where You can Use Old Rs 500 Note Till 15 Dec.

More info@ https://www.moneydial.com/blogs/23-places-can-use-old-rs-500-note-till-15-dec-demonetisation-updates-25-nov/