In Any profession, just as soft skills are as important as the technical side if not more, Doing well with money has little to do with how smart you are and a lot to do with how you behave. But that’s not how finance is typically taught or discussed. The finance industry talks too much about what to do, and not enough about what happens in your head when you try to do it. Book The Psychology of Money by Morgan Housel describes flaws, biases, and causes of bad behaviour that the author observed when people deal with money. It explores our relationship with money and how it connects with life’s bigger picture. A simple and easy read, must for everyone. This article has important learnings from the book.

You’re not a spreadsheet. You’re a person. A screwed up, emotional person.

We tend to judge wealth by what we see- Cars, Homes, Vacations, Instagram photos. But that’s not what wealth is.

Successful investing demands a price. But its currency is not dollars and cents. It’s volatility, fear, doubt, uncertainty, and regret

Table of Contents

About Morgan Housel

Morgan Housel is a former columnist at The Motley Fool and The Wall Street Journal. He is a partner at Collaborative Fund

The book is based on a report he wrote in 2018 about the 20 most important causes of self-defeating money behaviour, which drew more than 1 million readers. He graduated from the University of Southern California, in 2008 with an economics degree. He began writing for The Motley Fool as a junior. and also did wealth management. In 2016, he joined the Collaborative Fund, which invests in startups that use their prowess to do good as an economic advantage such as Kickstarter, Lyft and Sweetgreen, as a partner.

Finance, Money is a strange subject. In what other field does someone with no education, no relevant experience, no resources, and no connections vastly outperform someone with the best education, the most relevant experiences, the best resources and the best connections? There will never be a story of a Grace Groner performing heart surgery better than a Harvard-trained cardiologist. Or building a faster chip than Apple’s engineers. Unthinkable. If interested in buying, Click on the image below to buy the book from Amazon.(If you buy something through our links, we would earn money from our affiliate partners)

Human Beings & Finance

You’re not a spreadsheet. You’re a person. A screwed up, emotional person.

Psychology of Money by Morgan Housel is a must-read book. Small (only 226 pages) in 20 chapers, Simple to read (can finish it quickly). It looks at Money, not as formulas, spreadsheets, portfolio but from the human angle, our feelings, our behaviours.

Physics is guided by laws. Finance is guided by people’s behaviours.

Newton and his investment in the South Sea Mania said I can calculate the motion of heavenly bodies, but not the madness of people. – Issac Newton. Details in our article that Economic Bubbles: Tulip Mania, South Sea, Newton, Japan, DotCom, Subprime

Because the author realises Important financial decisions are not made in spreadsheets or in textbooks. They are made at the dinner table. They often aren’t made with the intention of maximizing returns, but minimizing the chance of disappointing a spouse or child. Those kinds of things are difficult to summarize in charts or formulas, and they vary widely from person to person. What works for one person may not work for another.

The Psychology of Money by Morgan Housel describes flaws, biases, and causes of bad behaviour that the author observed when people deal with money. It explores our relationship with money and how it connects with life’s bigger picture

No one would have predicted that we’d have a 35% [market] decline in March and be back at all-time highs by July. If you don’t have a sense of humility after 2020 — that we don’t know what’s going to happen next — then there’s not a lot of hope for you. This should be at least the most humbling year for forecasters they’ve had in their careers.

Role of Luck

What do you want to know about investing that we can’t know? Years ago I asked economist Robert Shiller the question. He answered “The exact role of luck in successful outcomes“

No one thinks luck doesn’t play a role in financial success. But since it’s hard to quantify luck, and rude to suggest people’s success is owed to luck,

People’s lives are a reflection of the experiences they’ve had and the people they’ve met, a lot of which are driven by luck, accident, and chance.

Did failed businesses not try hard enough? Were bad investments not thought through well enough? Are wayward careers the product of laziness?

In some parts, yes. Of course.

But how much? It’s so hard to know. And when it’s hard to know we default to the extremes of assuming failures are predominantly caused by mistakes. Which itself is a mistake.

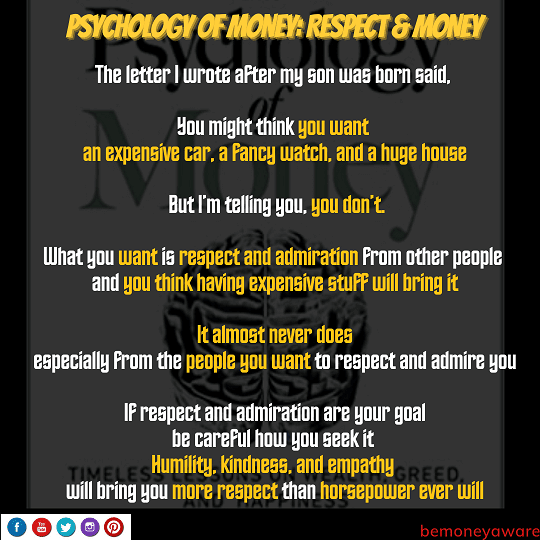

Let’s realise that Financial outcomes are driven by luck, independent of intelligence and effort. Morgan wrote his newborn son a letter, about it

Some people are born into families that encourage education; others are against it. Some are born into flourishing economies encouraging of entrepreneurship; others are born into war and destitution. I want you to be successful, and I want you to earn it. But realize that not all success is due to hard work, and not all poverty is due to laziness. Keep this in mind when judging people, including yourself.

Having Enough

Kurt Vonnegut tells Joseph Heller “Do you know our host has earned more money in a single day than what you have earned from your novel (catch – 22) over its whole history. To which Joseph replied saying “but I have something which our host does not have and that is ENOUGH”.

One can understand the Crime committed by those living on the edge of survival such as Nigerian scam artist

But why did Rajat Gupta, who in 2008 had $100 million, got involved in insider trading?

Bernie Madoff who had everything: unimaginable wealth, prestige, power, freedom, threw all away because they wanted more.

Modern capitalism is a pro at two things: generating wealth & generating envy.

But life isn’t any fun without a sense of enough.

Ceiling of social comparison: Har Ser ka sava ser hota hai

Consider a rookie baseball player who earns $500,000 a year. He is, by any definition, rich.

But say he plays on the same team as Mike Trout, who has a 12-year, $430 million contract. By comparison, the rookie is broke.

But then think about Mike Trout. Thirty-six million dollars per year is an insane amount of money.

But to make it on the list of the top-ten highest-paid hedge fund managers in 2018 you needed to earn at least $340 million in one year.” That’s who people like Trout might compare their incomes to.

And the hedge fund manager who makes $390 million per year compares himself to the top five hedge fund managers, who earned at least $770 million in 2018.

Those top managers can look ahead to people like Warren Buffett, whose personal fortune increased by $3.5 billion in 2018.

And someone like Buffett could look ahead to Jeff Bezos, whose net worth increased by $24 billion in 2018—a sum that equates to more per hour than the “rich” baseball player made in a full year.

Modern capitalism is a pro at two things: Generating wealth and generating envy.The point is that the ceiling of social comparison is so high that virtually no one will ever hit it. Which means it’s a battle that can never be won, or that the only way to win is to not fight to begin with—to accept that you might have enough, even if it’s less than those around you.

The hardest financial skill is getting the goalpost to stop moving.

Taking Risk

Reputation is invaluable.

Freedom and independence are invaluable.

Family and friends are invaluable.

Being loved by those who you want to love you is invaluable.

Happiness is invaluable.

And your best shot at keeping these things is knowing when it’s time to stop taking risks that might harm them. Knowing when you have enough.

The good news is that the most powerful tool for building enough is remarkably simple, and doesn’t require taking risks that could damage any of these things.

Outlier Events move the needle most

Morgan Housel in book Psychology of Money calls these tail events. Which is true for events that move the economy or people that changed world history or innovations

15 billion people were born in the 19th-20th centuries. But try to imagine how different global economy & the whole world would be today if just 7 of them never existed

- Adolf Hitler

- Joseph Stalin

- Mao Zedong

- Gavrilo Princip

- Thomas Edison

- Bill Gates

- Martin Luther King

Consider the projects, events and innovations of the last century

- The Great Depression

- World War II

- The Manhattan Project

- Vaccines

- Antibiotics

- ARPANET,

- 9/11,

- fall of the Soviet Union

The events that moved the needle in the economy and stock market are

- The Great Depression

- World War II

- Dot com bubble

- Sep 11

Everyone who follows the economy or investment markets should hang on their wall: Things that have never happened before happen all the time.

“The correct lesson to learn from surprises: that the world is surprising.” DanielKahneman (psychologist and economist)

People are playing different games

Personal finance is deeply personal, and one of the hardest parts is learning from others while realizing that their goals and actions might be miles removed from what’s relevant to your own life.

Cisco stock price was at $60 in 1999.

A stock trader would think, “this stock is trading for $60 and I think it’ll be worth $65 before tomorrow.”

If you were a long term investor and you thought “Wow, maybe others know something I don’t.” And you went along with it. You even felt smart about it.

What you don’t realize is that the traders moving the marginal price are playing a totally different game than you are.

And if you start taking cues from people playing a different game than you are, you are bound to be fooled and eventually become lost, since different games have different rules and different goals. And when the traders stop playing their game, you would be annihilated.

Few things matter more with money than understanding your own time horizon and not being persuaded by the actions and behaviors of people playing different games.

This goes beyond investing. How you save, how you spend, what your business strategy is, how you think about money, when you retire, and how you think about risk may all be influenced by the actions and behaviours of people who are playing different games than you are

Warren Buffet Success

There are over 2,000 books picking apart how Warren Buffett built his fortune. But none are called “This Guy Has Been Investing Consistently for Three-Quarters of a Century” There are books on economic cycles, trading strategies, and sector bets. But the most powerful and important book should be called “Shut Up And Wait.”

Good investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that kill your confidence when they end. It’s about earning pretty good returns that you can stick with for a long period of time. That’s when compounding runs wild.

How do we judge Wealth

We tend to judge wealth by what we see. We can’t see people’s bank accounts or brokerage statements. So we rely on outward appearances to gauge financial success. Cars. Homes. Vacations. Instagram photos.

Wealth, in fact, is what you don’t see. It’s the cars not purchased. The diamonds not bought. The renovations postponed, the clothes forgone and the first-class upgrade declined. It’s assets in the bank that haven’t yet been converted into the stuff you see.

Singer Rihanna nearly went broke after overspending and sued her financial advisor. The advisor responded: “Was it really necessary to tell her that if you spend money on things, you will end up with the things and not the money?”

You can laugh. But the truth is, yes, people need to be told that.

When most people say they want to be a millionaire, what they really mean is “I want to spend a million dollars,” which is literally the opposite of being a millionaire. This is especially true for young people.

A key use of wealth is using it to control your time and providing you with options

Room For Error

We Underestimate the need for room for error, not just financially but mentally and physically.

Ben Graham once said, “The purpose of the margin of safety is to render the forecast unnecessary.” In his book Intelligent Investor, Ben Graham has dedicated an entire chapter to it.

Can you survive your assets declining by 30%?

On a spreadsheet, maybe yes – in terms of actually paying your bills and staying cash-flow positive.

But what about mentally? It is easy to underestimate what a 30% decline does to your psyche. Your confidence may become shot at the very moment opportunity is at its highest. You – or your spouse – may decide it’s time for a new plan or new career. I know several investors who quit after losses because they were exhausted. Physically exhausted.

Spreadsheets can model the historic frequency of big declines. But they cannot model the feeling of coming home, looking at your kids, and wondering if you’ve made a huge mistake that will impact their lives.

Room for error lets you endure, and endurance lets you stick around long enough to let the odds of benefiting from a low-probability outcome fall in your favor.

The person with enough room for error in his strategy lets them endure hardship(Covid crash) has an edge over the person who gets wiped out, game over, insert more tokens, when they’re wrong.

A homeowner wiped out in 2009 had no chance of taking advantage of cheap mortgage rates in 2010.

Lehman Brothers had no chance of investing in cheap debt in 2009.

My own money is barbelled. I take risks with one portion and am a terrified turtle with the other. This is not inconsistent, but the psychology of money would lead you to believe that it is. I just want to ensure I can remain standing long enough for my risks to pay off. Again, you have to survive to succeed.

Compounding works best if you can give your assets many years to grow. The only way you can survive ups and downs, like recessions, volatility, pandemics, is if you have enough room for error to survive the short run.

Things change, You change

Long term planning is harder than it seems because people’s goals and desires change over time

Every five-year-old boy wants to drive a tractor when they grow up. Then you grow up and realize that driving a tractor maybe isn’t the best career.

So as a teenager you dream of being a lawyer. Then you realize that lawyers work so hard they rarely see their families.

So then you become a stay-at-home parent.

Then at age 70 you realize you should have saved more money for retirement.

Things change. And it’s hard to make long-term decisions when your view of what you’ll want in the future is so liable to shift.

Many of us evolve so much over a lifetime that we don’t want to keep doing the same thing for decades on end. Or anything close to it.

Young people pay good money to get tattoos removed that teenagers paid good money to get. Middle-aged people rushed to divorce people who young adults rushed to marry. Older adults work hard to lose what middle-aged adults worked hard to gain.

So rather than one 80-something-year lifespan, our money has perhaps four distinct 20-year blocks.

Too much devotion to one goal, one path, one outcome, is asking for regret when you’re so susceptible to change. But one thing I’ve learned that may help is coming back to balance and room for error

Video on the book Psychology of Money

Timeless Lessons In Wealth Creation, this video of Morgan Housel To ET NOW

Quotes from the book Psychology of Money

You’re not a spreadsheet. You’re a person. A screwed up, emotional person.

Physics is guided by laws. Finance is guided by people’s behaviours.

Hindsight, the ability to explain the past, gives us the illusion that the world is understandable.

We tend to judge wealth by what we see- Cars, Homes, Vacations, Instagram photos. But that’s not what wealth is.

Save, Just save

Successful investing demands a price. But its currency is not dollars and cents. It’s volatility, fear, doubt, uncertainty, and regret

Good investing is about earning pretty good returns that you can stick with for a long period of time. That’s when compounding runs wild.

The most important part of every plan is planning on your plan not going according to plan

Ben Graham once said, “The purpose of the margin of safety is to render the forecast unnecessary.”

Risk is what’s left over when you think you’ve thought of everything

Someone once described Donald Trump as “Unable to distinguish between what happened and what he thinks should have happened.” This is true for all of us.

We need to believe we live in a predictable, controllable world, so we turn to authoritative-sounding people who promise to satisfy that need.

A million ways to get wealthy, and plenty of books on how to do so. But there’s only one way to stay wealthy: some combination of frugality and paranoia

If interested in buying, Click on the image below to buy the book from Amazon.(If you buy something through our links, we would earn money from our affiliate partners)

Note: If you buy something through our links, we would earn money from our affiliate partners

Related Articles:

Money,Personal Finance Books by Indian authors and International authors

If there’s a common denominator in these, it’s a preference for humility, adaptability, long time horizons, and scepticism of popularity around anything involving money. Which can be summed up as: Be prepared to roll with the punches. Psychology of Money by Morgan Housel is a must-read book. Small (only 226 pages), Simple to read (can finish it quickly). Did you read it? What did you learn from it?