Fixed Deposits (FD) are popular investment instruments in which you invest a lump sum amount for a fixed period of time and you get fixed rate of interest. Now during the period of investment, the interest rates may fluctuate, but your fixed deposit interest rates would remain lock in at the same rate of interest, the rate at which you invested in. This article explains what is premature withdrawal of FD, what is the interest rate that is applicable on FD which is broken, what is penalty on early withdrawal, what calculations once must do to decide whether to break the Fixed Deposit or not?Alternatives to breaking FD taking loan against it.

Table of Contents

What is Breaking of Fixed Deposit?

Breaking a fixed deposit means withdrawing the money before the maturity expires. It is also called as premature withdrawal from Fixed Deposit. This may be necessary if you urgently require the funds or if there are better investment opportunities elsewhere. Repayment of term deposits before maturity is permissible in terms of the directives of the Reserve Bank of India issued from time to time.

Why would people like to break Fixed Deposit?

At times there is emergency but at times to take advantage of higher rate of interest. Many people want to close their old Fixed Deposit account before maturity and open a new account when they see the current interest rates on fixed deposits in the market much higher than rate of interest at which they have opened FD sometime back. The banks,to discourage investors to withdraw FD before maturity, may charge a penalty of 0-1% on the applicable interest rates for the period the FD was with the bank.

What is rate of Interest on the premature withdrawal of Fixed Deposit?

In the event of the FD being closed before completing the original term of the deposit, interest will be paid at the rate applicable on the date of deposit, for the period for which the deposit has remained with the Bank, with premature closure penalty.

For example If you have invested in fixed deposits on 1 July 2012 for 4 years at 9%. For whatever reason you want to break your Fixed Deposit after one year on 1 July 2013. The applicable interest rate for one year fixed deposit in the bank at the time of opening of your FD was 6.5% . So you will earn 6.5% per annum for your deposits and not the original rate of 9%.

At times no interest is payable where premature withdrawal of deposits takes place before completion of the minimum period prescribed. For example

State Bank of India states For Single term deposit of less than Rs 15 lacs, in case of premature withdrawals, the interest rate shall be 0.50% below the rate applicable for the period the deposit remained with the bank or 0.50% below the contracted rate whichever is lower for all tenors provided these have remained with the bank for at least 7 days.

For IDBI Bank Floating Rate Term Deposit Minimum Lock-in period: one year. No premature withdrawal up to one year.

What is the premature closure penalty?

Banks usually levy a penalty in the form of a 0.5-1% lower interest on customers looking to close their Fixed Deposit. Some banks do waive off this penalty if the liquidation of the FD is due to some emergency. But the word emergency is not well defined and this waiver is given on a case-to-case basis. Some banks also waive off the penalty if you reinvest the withdrawn amount with the bank. So it’s a double whamy, you get lower interest rate and you also get penalized.

For example : If you have FD of Rs 1 lakh, for 4 years, earning an 8% interest. So the total interest you will receive will be Rs 37,278.57 over 4 years. In case the FD is broken after 2 years, the interest rate applicable for 2 years was 7.25%. Considering a penalty of 1%,the actual rate applicable will be 6.25% and the total interest received for 2 years will be Rs 13,205.38 and not 19,483.11 (9% for 2 years) or 15,453.95 (7.25% for 2 years). Our Fixed Deposit Calculator helps in calculating the maturity value, interest.

Do all the banks charge the same penalty on breaking of FD?

As per Reserve Bank of India(RBI) instructions are the bank have the freedom to determine its own penal interest rate for premature withdrawal of term deposits. The bank should ensure that the depositors are made aware of the applicable penal rate along with the deposit rate. Charges on penalty of few banks are as follows:

| Bank | Penalty on withdrawal |

| HDFC Bank | 1% |

| ICICI Bank | 0.5 to 1% |

| State Bank of India | 0% to 0.5% |

How do I break my Fixed Deposit?

You need to submit your Fixed Deposit advice( or certificate, reciept) duly signed by all account holders, at the branch for premature liquidation. In the absence of your Fixed Deposit advice, you need to submit the Fixed Deposit Liquidation form.

If booked through Net Banking, banks allow you to do premature withdrawal through Net Banking also.

When is breaking of Fixed Deposit helpful?

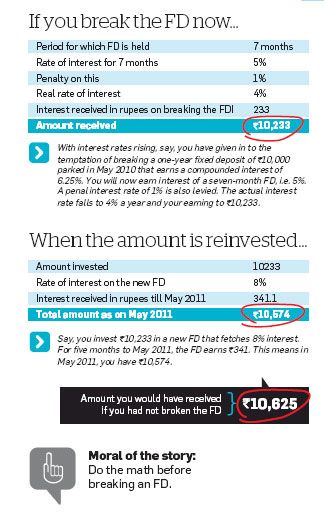

If you intend to break your FD for higher interest rate then please do your maths, at times chasing higher rates is not a smart thing to do. For example Economic Times Why you should not pull out your FD

Another example from WealthMatters Breaking a Fixed Deposit,

If you have a FD of Rs 1 lakh, for 4 years, earning an 8% interest that you withdraw annually. So the total interest you will receive will be Rs 32,000 over 4 years.In case the FD is broken and reinvesting after 2 years at a higher rate of 9%,the rate applicable for 2 years will be 7.25 %.Considering a penalty of 1%,the actual rate applicable will be 6.25% and the total interest received for 2 years will be Rs 12,500. The new FD duration will be 4-2= 2 years and the new interest rate= 9%.So the interest received for these 2 years will be 18,000.So the total interest received by you will be Rs 12,500 +Rs 18,000 =Rs 30,500 i.e. a loss of Rs 1,500.

But such is not always the case. Breaking the FD and reinvesting the sum in a higher-interest FD is a good idea when the original FD is relatively new. For example, consider that 6 months into the deposit in the first case you are considering withdrawing the money and reinvesting it. In this case the actual period of holding would be 6 months and say the rate applicable for 6 months is 6.5% and penalty is 1%.Then the actual rate applicable will be 5.5% and the interest received for 6 months would work out to Rs 2,750.The new FD duration would be 3.5 years and if the new FD rate of interest is 9%.The interest received for these 3.5 years would be 31,500 and the total interest received in 4 years will be Rs 2,750 +Rs 31,500 =Rs 34,250.In this case you will gain a further Rs 2,250 when you break a relatively new FD and reinvest it at a higher rate!

Moral of the story is: if the original FD is old or nearing maturity, it is best to continue with it and reinvest the money only when it matures.Consider, breaking a FD only if it is relatively new. And before you do anything at all do the maths.

Is there an alternative to breaking FD?

Yes. An alternative to breaking a fixed deposit is taking a loan against the FD. From Livemint’s Use your fixed deposit to get a loan

- Your FD continues earning interest. That means the effective rate of interest is just 1-2% on the loan. It’s cheaper than any personal loan or a credit card loan.

- While most banks will give you about 70-90% of your deposit as a loan or an overdraft facility, a few banks may offer a higher amount.The amount of loan you get will vary from bank to bank and will also depend on the amount of FD.

- Fees: Most government-owned banks do not levy a charge on loans against FD, but a few private sector banks may charge a few hundred rupees. If you’ve have a good relationship with the bank, don’t hesitate to ask for a fee waiver in case there is a fee.

- The loan tenor can’t exceed the term of the deposit. Most banks will not let you close the deposit when you are availing the loan. Moreover, some banks specify that they can use any other deposit that you may have in the bank to settle loan dues in case of a default.

- You can schedule your repayment mode on your own, pay a fixed amount every month or as pre-decided with the bank. Some banks insist that the interest be paid every month; you can even settle the loan at the time of the maturity of the FD. Most banks do not have pre-closure charges.

- The documentation involved is almost nil and you just need to visit the bank branch and make a request. It gives you quick access to funds.

The rate of interest you pay for such a loan is 1%-2% over the interest rate of the FD. Even at the cost of 1-2%, it makes more sense than liquidating the asset. To liquidate an FD, most lenders will charge you a premature withdrawal penalty. Usually, the penalty for breaking an FD is 0.5-1% and it is applicable for the period the deposit has remained with the bank. For example:

You have an FD of Rs 1 lakh for two years that earns 9.25% per annum and decide to break it after six months. If the 180-day (six months) FD has an interest rate of 7 % and premature withdrawal penalty is 0.5%, you will get an interest rate of 6.5%. So at the end of six months, your interest would come to Rs 3,229.

If you had remained invested for two years, your Rs 1 lakh would have grown to around Rs 1.20 lakh at the end of the tenor. But if you had taken a loan of, say, Rs90,000 at the end of six months at 10.50% and repaid the principal at the end of 1.5 years, you would have paid around Rs 15,280 as loan interest and the net interest income (total interest income minus cost of loan) at the end of two years would be around Rs 5,555. So despite paying for the loan, there is a profit, while the principal remains intact

Reference : ICICIBank Fixed Deposit FAQ, DNA Banks can penalise you for premature withdrawal of FDs

Thanks:A Special Thanks to our reader Pritesh, who asked the questions on premature withdrawal and promoted us to write this article.

Related Articles :

- Overview of Fixed Deposits

- Fixed Deposit and Interest Rates

- Fixed Deposits and Tax

- Fixed Deposit Calculator

So have you broken your Fixed Deposits, did you have to pay penalty, if broken for higher interest rate did it help you?

37 responses to “Premature withdrawal or Breaking of Fixed Deposit”

Thanks for the information. I have a question .

Considering the dynamics – i always get inclined towards going for fixed deposit with 10years term as i have realised that returns on that works better than risked investment. So my question is

Assume i create fd for 10years for 25000/- in 2022 and i get 50000/- in 2032

1 the additional 25k i receive as interest is taxable at my slab rate in 2032 right ?

2 in 2032 if i am in a good salaried job 🙂 then probably i may not be willing to withdraw rather continue the extend for another 5 years. In this case should I pay interest on 25k or since I am renewing it on entire money – it’s non taxable?

Hay , I have a query about FD

if I renew my FD which interest rate will I get, my initial interest rate or new interest rate . I will “thanks for your info”

New Interest Rate

I wants to break my fd before maturity. Hw much penalty will be chaerged my fd is in Dena Bk

Worth going through this article before investing in FD

If a TDR is issued to a department as security & they return the same TDR after some time.

How the same should be treated by the bank . Cancellation or Maturity?

My father & Mother having joint saving account in SBI & they have fixed deposit of rs 5 lacks. Now my father passed away & my mother want to prematured withdrawal of FD & she submitted death certificate of my father. But bank officer don’t allow to her without pidhi nama. So is it really needed? Pls help me out in this

What is the rule of Tax on pre matured withdrawal. If interest is reveresed for previous year but in current year interest tax to be deduct or no

I am s senior citizen . I deposited 30 lac in Catholic syrian bank for fixed deposit term of One year with a monthly payout at 7.90%. its four months passed. I need to break the deposit now. the bank is charging me a huge fee of Rs.22,000 to break the deposit.

Is this justified.

can i withdraw my 5 year FD (investment us 80c) before maturity?

and what is procedure ?

can i withdraw my 5 year FD (investment us 80c) before maturity?

Deposited 200000 in Kshemanidhi cash certificate in Corporation bank on 20.06.2014 for 5 yr @8.25% & now I want to withdraw the amount. How much money I shall get on 01.09.2016?

Premature closure facility as per the rules lay down by the Bank.

For corporation bank

Penalty for pre-mature withdrawal at the rate of 1% p.a. will be charged on all fresh & renewed deposits on all maturities. However, Penalty on premature withdrawal is waived for all deposits of Rs.1 Crore and above, accepted/renewed for a period up to & inclusive of 180 days w.e.f.12-12-2011.

can i withdraw my 5 year FD (investment us 80c) before maturity?

Thanks for such a noble clarifications..thumbs up.

how i can break my fd premature through netbanking ? what i

Thank you so much for your explanation. Well done.

Thank you so much for writing the comment.

The only website which gives detailed information about money and whatever information we need with regard to savings and deposits, it gives clearly with great advice. Thanks for your great service.

Thanks for kind and encouraging words. There are many good sites. We are just doing our bit.

At SBI “Premature penalty for Retail Term Deposits up to Rs 5.00 lacs will be ‘NIL’ provided the deposits have remained with the bank for at least 7 days.”

Can u please tell effective from which date this provision has come?

Very helpful information

Very encouraging comment. Thank You!

Thank you for sharing. Very insightful and specific- yet detailed. We need more people like you to share these updates. Banks really don’t bother. Thank you.

I’m posting this for the third time, there seems to be an issue.

Thank you for sharing. Very insightful and specific- yet detailed. We need more people like you to share these updates. Banks really don’t bother. Thank you.

I will so the maths whenever I do that. The alternative part was really insightful.

Thanks Saru. Maths can never leave one. Thanks for the comment

I will so the maths whenever I do that. The alternative part was really insightful.

Thanks Saru. Maths can never leave one. Thanks for the comment

Well explained

Thank you So much ….

Well explained

Thank you So much ….

A depositor forecloses his deposit only due to some exigencies. It’s good if the Banks waive the penalty. Thanks for sharing very useful info.

A depositor forecloses his deposit only due to some exigencies. It’s good if the Banks waive the penalty. Thanks for sharing very useful info.

Nice investment idea, thanks

Nice investment idea, thanks

Very nice post describing all the aspect of Fixed Deposit..I really love ur post as they try to make us money conscious….Thank for sharing..

Very nice post describing all the aspect of Fixed Deposit..I really love ur post as they try to make us money conscious….Thank for sharing..