Public Provident Fund is an ideal vehicle for long term investment, an important retirement saving tool for individuals, more so for those who are not salaried employees. In our article Understanding PPF we covered the investment amount, interest rate, power of compounding, who can open, where can one open. PPF is long term investment and it matures 15 years after close of the financial year in which the initial subscription was made. We also touched upon what happens when PPF account matures. In this article we shall expand on it.

Table of Contents

On Maturity of PPF

A Public Provident Fund (PPF) account has a maturity of 15 years but calculation of 15 years start from the end of financial year in which the account was opened. For example, If you have opened the PPF account on 15 July 2000, then 15 years tenure will start from the end of FY 2000-2001 i.e. 31st march 2001. The lock is till 31 Mar 2015 and so you can withdraw only after be 1st Apr 2016.

After 15 years, you have the following two options :

- Take out the maturity amount and close the account OR

- Continue the existing PPF account for further block period of 5 years. After the expiry of 5 years, you can continue to extend the duration of the PPF account by 5 years. There is no limit to the number of such extensions.

For example, say the term of your PPF account is ending on March 31, 2015. The balance at that time in the account is say Rs 10 lakh. Now, you may opt to continue the account for 5 more years (i.e. till March 31, 2020) and invest regularly as you have been. However, over the period of five years till March 2020, you may withdraw only Rs 6 lakh which is 60% of the balance standing to your credit on March 31, 2015.

For example, if you opened a PPF account in year FY 1999-2000, then it would mature on 1 Apr 2015. From 1st Apr 2015 to 31 Mar 2016 you have an option to encash your PPF balance or to extend the maturity of PPF for 5 years upto 2020. After 2020, you can continue to extend your PPF account to years 2025, 2030 and so on.

Note: Once your account expires, you can open a new PPF account but then it is starting from scratch.

Continuing the PPF

For continuing the PPF account you have two options:

- Continue Without further contributions i.e you may wish to earn the tax-free interest but may not wish to commit further funds. OR

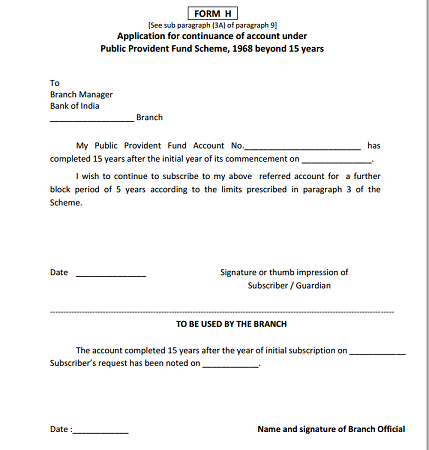

- Continue With further contributions. The rules for contribution to the extended account remain the same as during the 15-year period i.e you can claim 80C deductions on amount invested in PPF and invest upto Maximum Limit (which for For Financial Year 2014-15 and FY 2015-16 is 1.5 lakh(1,50,000)). The investor has to submit Form H.

FormH in pdf format is available at Indiapost webpage Form H. Please remember that Form H is required to be submitted within a period of one year from the date of maturity. So if you PPF matures on 1 Apr 2012, you need to submit Form H for continuation of PPF account with subscription between 1st Apr 2012-31 Mar 2013. One has to submit Form H at the post office or bank where the account is held . Sample image of Form H is given below. You need to fill in your PPF account number and when did the 15 years finished. So if you had started your PPF account in FY 1999-2000 say in Nov 1999 or Feb 2000 PPF matured on 15 years from 31-Mar-2000 i.e 31-Mar-2015, you have to write 1-Apr-2015. (Thanks to reader Kapil for correcting us)

Please Note that:

- The choice to extend the PPF account with subscription has to be made within one year from the date of maturity of the account by Filling Form H.

- First you have to fill the Form H to renew and then make the deposit for that year.

- The Option without further contribution is automatic,means if you do not opt for option with subscription in one year from the end of the maturity period ,second option without subscription will be applied automatically .

- Once the choice is made for a block of five years, it cannot be changed.

- Once an account is continued without contribution for any year, the subscriber cannot change over to with-contributions extension.

- The interest earned during the extended period of the PPF continues to be tax-free.

Liquidity during the extension period

Unlike the initial period of Public Provident Fund Account where Loan facility was available from the third year and Partial withdrawals were allowed only from the sixth year onwards, in extension period PPF is more liquid.

If extended without contribution, any amount can be withdrawn subject to one withdrawal per year. The balance will continue to earn interest till it is completely withdrawn

If extended with contribution, withdrawal up to 60% of the balance at the beginning of each extended period (block of five years) is permitted.

For example, say the term of your PPF account ended on Apr 1, 2012. The balance at that time in the account is say Rs 15 lakh. Now, you may opt to continue the account for 5 more years (i.e. till March 31, 2016) and invest regularly as you have been.However, over the period of five years till March 2016, you may withdraw only Rs 9 lakh which is 60% of the balance standing to your credit on March 31, 2011.

Close or Extend the Account

What is the best option i.e. To close this account and Open new-one or extend it for another five years?

I would suggest extension for another 5 years. Because If you close this account and open another one , you will have to wait for another 15 years for the maturity. And as there is more balance if extending the account, you earn more interest.

Extension and Non Resident Indian

The benefit of extension is not available to the NRI who opened the account before a change in their residency status. Recapping from Understanding PPF NRIs can not open a PPF account. However, if a resident who already has a PPF account and subsequently becomes a NRI, he can continue to invest into PPF till the initial duration (first 15 years) of the PPF expires. After that, the PPF account can not be renewed and would need to be liquidated.

[poll id=”35″]

Related Articles:

- Understanding Public Provident Fund, PPF

- Voluntary Provident Fund, Difference between EPF and PPF

- Basics of Employee Provident Fund: EPF, EPS, EDLIS,

- Taxation of investments : EEE, ETE, TEE..

You can close the Public Provident Fund account after completion of 15 years from the close of the financial year in which the initial subscription was made. You also have the option of extending the PPF for block of 5 years with or without subscription.

102 responses to “On Maturity of PPF account”

I opened my PPF account on 17-Apr-2013

Can you please tell me my PPF maturity date ?

Also the Tentative data on which I should apply for the extension ?

Dear Sir,

I had opened a PPF account with SBI on 29/12/1995 and it completed 15 years on 31/03/2011.

This account was extended for 5 more years, that is, up to31/03/2016. It was again extended for a further 5 years, that is, up to 31/03/2021.

I will be retiring on 31/07/2019. My query is whether I can withdraw full amount on my retirement or how much amount can be withdrawn on retirement. Kindly inform.

I will be grateful.

With kind regards

Ashok Kumar

It is not necessary to close your PPF account.

You have following options which depend on your financial conditions

1. Close the account

2. Extend it without the contribution

3. Extend it with the contribution.

You can extend your PPF as many times as you like.

There is no relation to the retirement of PPF.

For continuing the PPF account you have two options:

Continue Without further contributions i.e you may wish to earn the tax-free interest but may not wish to commit further funds. OR

Continue With further contributions. The rules for contribution to the extended account remain the same as during the 15-year period i.e you can claim 80C deductions on the amount invested in PPF and invest up to Maximum Limit (1.5 lakh(1,50,000)).

The choice to extend the PPF account with the subscription has to be made within one year from the date of maturity of the account by Filling Form H.

Unlike the initial period of Public Provident Fund Account where Loan facility was available from the third year and Partial withdrawals were allowed only from the sixth year onwards, in extension period PPF is more liquid.

If extended without contribution, any amount can be withdrawn subject to one withdrawal per year. The balance will continue to earn interest till it is completely withdrawn

If extended with contribution, withdrawal up to 60% of the balance at the beginning of each extended period (block of five years) is permitted.

For example, say the term of your PPF account ended on Apr 1, 2012. The balance at that time in the account is Rs 15 lakh. Now, you may opt to continue the account for 5 more years (i.e. till March 31, 2016) and invest regularly as you have been.However, over the period of five years till March 2016, you may withdraw only Rs 9 lakh which is 60% of the balance standing to your credit on March 31, 2011.

cartierlovejesduas Mole,I will leave it in the hands of the blogging Gods. I retract my comment about the whore house. That type of comment does not help.Lester

van cleef diamond bracelet copie http://www.topvcabijoux.cn/

Hello Sir/madam , I need some information and your help regarding PPF Amount . this account has been opened by my brother on 1999 in BOI and PPF and in Passbook it showing Interest credited till 2015 and matured on 2015we are not aware it is matured when we come to know we visted bank and request them continuous same PPF account wiht existing amount but bank people deny for that since April 2015 onwards they have not neither given any interest on matured amount nor extending my PPF account.Now my brother has NRI and due to his heavy work schedule he can’t travel he has given authorization letter with signature to me but i want to know is there any possibility to get interest from Bank last 2 and half years

Please suggest should we can received the amount with interest or not in the preiod of 2015 to till date. Should I claim the amount with interest or not ?

PPF amount would mature few months from now. But, the person is missing. What would be the process for closure of the account. Can nominee approach bank to close the PPF account and transfer the proceeds into missing person’s Savings Bank A/C.

Thanks for the informative article. I am looking for very specific information. My father has a PPF account which matured on 31st Mar 2017. The problem is is he suffered a stroke 3 years back rendering his right side being completely paralysed and bed ridden. Hence he can’t sign. What shall be the procedure to withdraw this money since he does not want to continue with the account.

If you want to withdraw money from your PPF account after maturity, visit the post office/bank branch where you have opened the account.

Where do you have the PPF account? Post office or Bank branch? Which bank?

Mostly investors presence is required but you can speak to the incharge to explain your case.

The account is in SBI. They keep sending us around in circles… saying that thumb impression needs to be updated and then again he is required to be physically present for all procedures. Please help and let me know if there is a way out

You can speak to bank manager and he can ask you to submit application on behalf of your father.

You can also raise the question on Social media channel of SBI facebook or twitter and you should get instant reponse

Facebook : https://www.facebook.com/StateBankOfIndia/

Twitter: https://twitter.com/TheOfficialSBI

I have my old account opened on 91. Once extended in 2007. But forgot to extend further. But contributed on regular basis through online payments. Regularly got interest even after 25 years. I updated my computerised passbook regularly which shows regular updation of interest on the entire amount . But it contradicts the idea of auto extension without contribution after one year of maturity .Any idea?

I had opened PPF account at BOI Mumbai. Now it is matured after 15 years. I am working at Gurgaon. Can I get my maturation amount at BOI Gurgaon. Please advice

Hi sir/ mam I need ur help regarding ppf amount ,my amount was matured on 2015 but amount shouldn’t withdrawal, my father was no more so who can take the amount . Now 2016 october is starting so we can recived the amount with interest or not in the preiod of 2015 to 2016. We should claim the amount wid interest or not ?

A PPF ACCOUNT OPENED IN DEC-1995:1ST EXTENSION MADE IN 2011: ACCOUNT MATURED ON 1ST APRIL 2016; ABROAD SINCE SEPT 2014 FOR HIGHER STUDY. CAN EXTEND ?

Yes you can. An NRI can extend his PPF as many times without contribution.

I had opened a PPF account in the name of my minor son. Now 15 years are complete and the son is major. What is the process of closure of account and obtaining proceeeds.

Once PPF account holder becomes major you have to go to bank with the Minor, Id Proof address proof of Minor and photograph.

Submit the application for converting to major account.

The PPF account would be updated.

Then the son can use PPF account. Process would be same as for maturity.

It is not necessary to withdraw on Maturity you can continue with or without contribution also.

You have given very good information about PPF,which is very useful for the subscribers.

HOWEVER,ONE TOPIC HAS BEEN LEFT OUT

DURING THE INITIAL LOCK-IN PERIOD OF 15 YEARS OR, DURING THE EXTENDED PERIOD OF 5 YRS: IF THE SUBSCRIBER DIES, CAN THE NOMINEE WITHDRAW THE ENTIRE AMOUNT. IF YES, WHAT ARE THE FORMALITIES FOR THAT.

Thanks for bringing it to our attention.

Form G – To claim funds in a PPF account by a nominee/legal heir

When an account holder dies, those whom he/she stated as nominees or his/her legal heirs, can claim the amount in his/her PPF account. To do so, Form G will have to be filled out with required details such as the name(s) of the nominee(s)/heir(s) of the account holder. The form asks for confirmation from the claimant that the death certificate of the account holder has been enclosed.

When a nomination exists

Form G filled by all nominees

Death certificate of subscriber

Death certificate of any other nominee(s)

Passbook of the subscriber

When nomination does not exist and claim is backed by legal evidence

Form G filled by legal heir(s)

Death certificate of subscriber

Succession Certificate, Letter of Administration or attested copy of the will

Passbook of the subscriber

When nomination does not exist and the credit in the account is less than Rs.1 lakh

Form G filled by legal heir(s)

Death certificate of subscriber

Annexure I to Form G (Letter of Indemnity) on stamped paper

Annexure II to Form G (Affidavit) on stamped paper

Annexure III to Form G (Letter of Disclaimer on Affidavit) on stamped paper

Points to note

Amount in a PPF account will continue to earn interests as per the terms even after death of the subscriber until the amount is claimed.

A PPF account cannot be continued by anyone in case of death of the subscriber.

Excess amount deposited in a PPF account after death of the subscriber will not attract any interest and will be returned as it is to claimant(s).

Any pending credit availed by the subscriber such as loans will be deducted from the proceeds to be made to claimant(s).

Amounts till Rs.1 lakh can be claimed by legal heir(s) without production of succession certificate.

A legal heir can claim the proceeds of a PPF account even when a nomination has been made to someone else, by producing the succession certificate.

If a nominee chooses to forego the proceeds from an account, his/her share will be divided equally among other nominees.

I am not very much aware of PPF scheme, hence please advice me for my query. Suppose I deposit Rs.1000 per month till 15 years then how much estimated amount I will receive after maturity?

Thanks for this post Sir.

Its little confusing in my case as I started contributing since December 2003. So will it get matured by December 2018 or 2019 March31st ? and in which year shall I submt FormH to continue it ?

HI,

My PPF account has matured on 31/3/2016 and i havent renewed yet. So i wanted to know that can i renew it now and can i immediately remove the eligible amount (50%) on the next day itself from the same.

Also i would like to know that would i be eligible for interest amount from 31/3/2016 to 25/7/2016.

Thanks in advance!

Hi Expert! We have an PPF account from 2000, after maturity 2015, we have extended it for next five years. My question are

1. Can we make partial withdrawal for house renovation? How much?

2.Can we close the account?

You may make partial withdrawal upto 50% of the closing amount as on date of maturity. This 50% is maximum limit for withdrawal in for 5 years cumulative (either in marts or in one go) but only one transaction can be done in one year.

I dont think you can close account except in case of certain emergencies.

My PPF account is maturing soon & would like to withdraw it. My agent is saying I need to open a Post Office Savings account to transfer the money and it is the only way. Unable to find any post related to it. Is this true ? What should be the method of withdrawal of the matured amount ?

Yes it is true. The Post office is now not giving cheque but putting money in saving bank account. They give a cheque book for the post office saving bank account. You can deposit it like any other cheque in the bank

my ppf account will mature in March 2017. I left India in 2006 and have since become a U.S. citizen, I must close the account. But the post office said that as a Non Resident, i cannot open a savings bank account. If they are not issuing checks, how can I receive the amount?

I am going to open a ppf account in SBI. Can someone please tell me the maturity amount after 15 years of total amount 10lKhs. Thanks in advance.

Congratulations. Opening a PPF account is a wise decision.

You can play around with PPF calculators for fixed monthly, yearly amount at Finotax.

I have a PPF Account in Bank of baroda. It matured on 31.3.10.

I had opted for ‘Continue With further contributions’. Now it matured on 31.3.15.

I want to now opt for ‘Continue Without further contributions’ which should be automatic (without filling any form)

But the branch says that since i have not filled Form H, my account will be discontinued from 31.3.16 & i have to compulsory withdraw.

What should i do now?

I am awaiting your reply ‘bemoneyware’. Reply if information provided by you is correct.

Apologies for delay.

There was no clear cut answer that we got.

Theoretically your choice is for a period of 5 years only. So at time of new 5 year block you should be able to continue account with contribution.

When we checked with few banks and post office this is what they said:

The PPF account can be continued (after the term of 15 years) either with or without further subscription. The rules for contribution to the extended account remain the same as during the 15-year period. Once the choice is made for a block of five years, it cannot be changed.The only thing that investors should be careful of is that once an account is continued without contribution for any year, the subscriber cannot change over to with-contributions extension. [Notification F.3(6)-PD/86 dt 20.8.1986].

The choice to extend the PPF account with subscription has to be made within one year from the maturity of the account. If this is not done, then by default the account is deemed to have been extended without further contribution for a period of five years.

We argued with them whether a subscriber whose account has matured and he leaves the matured account without further deposits, can open a new PPF account as he will not be maintaining his existing account i.e. he will not be subscribing to the said account. Similar matter was referred to the Ministry of Finance (DEA) for clarification . The MOF (DEA) had clarified that since the facility of extension for further block periods of 5 years has been provided in the scheme, the subscriber should extend the account instead of opening the new account. Had the facility of extension not been provided in the PPF Scheme, the subscriber could open a new account. In view of this facility the subscriber cannot open a new account in addition to his existing matured account. Then the bank was not sure? They said they will revert back but have done till now.

You can try the same argument- if you don’t allow me to contribute with subscription, let me open a new ppf account. Please do keep us updated

The problem is I want to Continue Without further contribution which should be automatic as one year has completed after 5 years of maturity ie 15+5+1=21 years. But the bank of baroda says I have to close my account because I didnt filled FORM H & I should open new account.

Even there is no reply from Mumbai head of bank.

from what we understand , once you have a PPF account you cannot open another.

Is it possible for you to transfer the account to say SBI or private bank like SBI? Atleast you can talk to the staff there about transferring and get some more input.

My PPF account matured on 30/3/2016.I want to extend the same, however , if i take a time gap and file the extension form on June 30,2016, then will i receive the interest for the 3 months period?

Yes you will receive the interest for 3 months period. You will not be able to contribute to the PPF without extending.

sir, ‘I had opened a ppf account in the name of my mother in 2011. now i need money for her medical expenses . can I close the account . I recently came to know that premature closure of ppf is possible through your blog . the post office people simply refused to close it

Best wishes, hope your mother gets well soon.

Premature withdrawal from PPF is a recent change. It became effective on 1 Apr 2016. Though more details are awaited, brief overview of Premature closure of PPF now possible subject to conditions

– In genuine cases such as serious ailment, higher education of children – More details awaited.

– A penalty of 1% reduction in interest payable on the whole deposit

– Only after five years from the date of opening.

As per old rules:

The normal term of PPF account is 15 years, which could be further extended in multiples of 5 years or so. However, if someone has been investing in PPF for more than 3 years can opt for a loan against their investment effective four years and can start withdrawing their investment effective 7th year.

Lost my first pass book. I have my second pass book. It shows my balance with interest as on today. The Manager of SBI PPF A/C is insisting on my first pass book. I am 84 years old and bedridden. This is my only saving. Is my saving gone.Please help.

Sad to hear that about your case. No you have the second pass book so you cannot lose your savings. Why is the bank manager insisting on first pass book?

Mr. Mehra,

Sorry to hear this sarkari behviour of sarkari banks.

Write an email with complete details to cms.psg@sbi.co.in and general manager of SBI gm1.lhocha@sbi.co.in . The branch manager will learn will surely learn a lesson.

Hello,

I have a PPF account in GPO New Delhi which commenced on March 2000.

Q1. What would be the maturity date for me and what process / forms would be needed to get the maturity amount. DO I need to visit specific branch or any post office?

Q2. Closing the account would mean the no further interest earning on compounded money or are there any more benefits like insurance or … ( I need to finalize whether to close or extend for 5 years)

Q3. Would there be any tax liability? Total amount would not exceed 10Lac..

Please suggest urgently

Also to add that till date I have not communicated with the GPO for extension or closure, so what would be the status as of date..

Sir your PPF account would have been extended for 5 years. Please verify and update us.

Details of PPF are:

A Public Provident Fund (PPF) account has a maturity of 15 years but calculation of 15 years start from the end of financial year in which the account was opened. For example, If you have opened the PPF account in Mar 2000, then 15 years tenure will start from the end of FY 1999-2000 i.e. 31st march 2000. The lock is till 31 Mar 2015 and so you can withdraw only after 1st Apr 2015.

For example, if you opened a PPF account in year FY 1999-2000, then it would mature on 1 Apr 2015.

From 1st Apr 2015 to 31 Mar 2016 you have an option to encash your PPF balance or to extend the maturity of PPF for 5 years upto 2020. After 2020, you can continue to extend your PPF account to years 2025, 2030 and so on.

The choice to extend the PPF account with subscription has to be made within one year from the date of maturity of the account by Filling Form H.

First you have to fill the Form H to renew and then make the deposit for that year.

The Option without further contribution is automatic,means if you do not opt for option with subscription in one year from the end of the maturity period ,second option without subscription will be applied automatically .

Once the choice is made for a block of five years, it cannot be changed.

A1 : Yes you have to visit the Specific Branch. As now Post offices are also moving to CBS , you can get online facility.

A2. Closing account means no further interest earning on compounding. There is no other benefit in PPF.

A3. No Tax liability. Entire amount is Tax free.

Thank a ton for your valuable inputs.

Now What I understand from your post is, that due to no communication from my side my PPF account has gone for auto renewal mode without subscription. Surprisingly the PPF official did not share any such detail when I deposited the minimum amount in Feb 2015. Instead they told me to keep depositing money every year…

Just guessing what would happen if I go to deposit money in my ppf account now 🙂

So when should I now keep a reminder to approach the PPF office for closure and withdrawal.

Would it be after march 2020 (validity for 1 year for withdrawal)

Hi

My PPF has been matured on 31-Mar-2016. If I continue it without further contribution, what is the maximum amount I can withdraw in the 1st year if my maturity amount comes approx. 23 lacs ?

Secondly, without contributing extension, what is the minimum amount to be kept in the PPF account for 5 years ?

Thirdly, without contributing extension, can I close the PPF account after 1-2 year of extension ?

The reason of asking the above questions is that I am going to retire on Aug-16 and my PPF account has completed 15 years on 31-Mar-16, so I was trying to find out some way to mobilise my limited resource to earn some more money.

Please advise.

Regards ? Bhaskar

It appears you are intending to utilize PPF amount as one of your additional source of income.You may adopt any of the following as per your requirement.

a)Continue with subscription option for next 5 years. During 2016-2021, you can withdraw 60% of the amount as on 31.3.16 i.e., 13.8 lacs in one go or yearly one withdrawal (Rs 2.75 lacs per year).

b) For you it may be advisable to withdraw the amount yearly, use 1.5 lacs for senior citizen’s saving scheme (this amount will give you tax rebate u/s 80c, as well as interest income of Rs 12150 per year.Use Rs 1.25 lacs for yearly family expenses-Rs 10,417 per month !)

c)In the consecutive years, your interest income will be Rs 24250,36450,48600 and 60650.

d) contribute to your PPF as per your financial strength – that will strengthen your financial power for the future.

e) Review your needs in 2021 and plan strategy accordingly.

Regards.

Thank you for your valuable advise.

Regards

Bhaskar

Sir I have opened a ppf a/c and got extended for another 5 years and matured on 8th march 2016. But when I went to sbi for further renewal they said that it can be done only in April 2016 since it will get matured after interest is posted non 31st march 2016 and if I want to make deposit in that a/c it can be made. Now I want to make 1.50 lacs in that account and close this a/c on 2nd April 2016. Can I claim tax exemption for this 1.50 lacs pl reply

Thanks for the good article. One should not close the PPF account at all and it is better to keep on extending every 5 years till such time possible. PPF is one of the best schemes today for long term savings. PPF – Please Park Funds!!

Well said Anand PF is one of the best schemes today for long term savings. PPF – Please Park Funds!! (tweeted about it at @bemoneyaware)

did the amount at maturity has been made tax deductible in 2016 ?

No Sir. PPF was and is tax free on maturity. It follows EEE. No change for PPF suggested in Budget

my ppf account open on 24-12-2015 what will be maturity date?

A Public Provident Fund (PPF) account has a maturity of 15 years but calculation of 15 years start from the end of financial year in which the account was opened. If you have opened the PPF account on 24 Dec 2015, then 15 years tenure will start from the end of FY 2016-2017 i.e. 1 Apr 2016. The lock is till 31 Mar 2031 and so you can withdraw only after be 1st Apr 2031.

Hello,

opened PPF account as resident; subsequently joined merchant navy and have maintained resident / non-resident status on and off. PPF matured in march’2008, when my residency status was “resident” for 2007-08 and 2008-09 and 2010-11. unaware of ppf regulations, continued depositing till 2015-16 into the ppf account from my NRE account (both accounts in the same bank) ; all entries of deposits and applicable interest have been updated regularly in the pass book.

Now, suddenly have been told by the bank, to close the ppf account as holding an NRE account implies i am NRI; and interest will not be paid for anything beyond 2008 (almost 10 laks would be lost by way of interest).

have below queries:

1) non-resident and NRI, mean the same?

2)

non-resident under IT = for taxation purposes;

Non-resident under FEMA = for Residency purposes

Under FEMA, would be considered resident as neither am i resident abroad nor do not have any residence outside india.

Non-resident for IT purposes, but not having any residence / alternative accommodation out of india, would imply “NRI”?

3) in case not eligible to continue beyond 2008, interest payable would be applicable till date on amount at maturity in 2008 or 2013 or 2018?

many thanks in anticpation of an early reply.

If an individual continues his PPF a/c even after maturity without any further contribution then what is the rate of interest he expects to get? Is it nominal interest?

Rate would be the regular PPF rate.

Sir,

After Maturity of the PPF i.e after 15 years. I do not intend to Continue any further and would like to liquidate the Amount. Will the Amount Accumulated will be automatically debited in my Saving Account or I will have to approach Bank Personally to liquidate it.

Sir, Default option is extending the PPF account without contribution for 5 years. You have to approach bank before completion of PPF account to close it.

Hi Kirti,

First of all i should congratulate to make us educate on PPF…

I have opened PPF Account in sbi on 18/September/2015 with Initial deposit of RS 500/- but i don’t want to deposit any fund Till March 31 2015 because i have already savings for FY 2014-2015.If i deposit RS 1,50,000 on Apr 1st 2016 on each year,which financial year will be the end of to become 15 years.

As I opened on 18th Sep 2015 (FY2015-2016) will they consider PPF account opening date or the first deposit made by us i.e Apr 1st 2016.

Please clarify?

Thanks,

-Srinivas

Sir a suggestion, please don’t invest in any product for tax purposes. PPF gives you around 8% tax free. I personally invest in PPF even though my 80C is exhausted.

Coming to your question.

1. You need to deposit min of Rs 500 a month to keep PPF active.

2. As you opened PPF account in Sep 2015, then 15 years will be 15 years from 1 Apr 2016. i.e 1 Apr 2031.

I have been greatly informed from your site. I want one clarification : I have extended my PPF account twice for 5 yrs. each with subscription and will mature on 31.3. 2016. Is it possible that I extend further for 5 yrs. without subscription as i will need about 95% of money during this period for daughter’s marriage. Can I keep remaining about 5% in next 5yrs. extension with subscription and continue further?

After the completion of 15 years of PPF account, if we withdraw the complete amount after a period of 1 month, then are we entitelled for 1 month interest?

For the period of PPF that is 15 years the PPF rate of interest will apply. For 1 month the PPF rate of Interest WILL NOT apply, since firstly, the principal and the accumulated interest can be withdrawn after the 15th year that is in the 16th year and before the 17th year. So those 1 months fall in the period in which the PPF can be withdrawn in any case so the PPF rate of interest won’t apply for the 3 months. Whether or not the savings bank interest applies or not will depend on the bank and it’s procedures.

if the PPF is not withdrawn or any instructions given to the bank by the end of the 16th year, then by default the “PPF EXTENSION WITHOUT FURTHER CONTRIBUTIONS” is applied.

I had opened PPF a/c in SBI in 1993 and got it renewed after 15 years in 2008.

Since then, I have been investing every year.

But after further 5 years period, i.e. in 2013, I did not get it renewed again but continue to deposit money.

Also the bank does not take any objection. Do I need to get another 5 years extension or is it done automatically?

if the PPF is not withdrawn or any instructions given to the bank by the end of the 16th year, then by default the “PPF EXTENSION WITHOUT FURTHER CONTRIBUTIONS” is applied. Bank should return the money

This is the Post Office and not the bank and I would like you to let me know if you can quote the relevant page from the PF rules book, where I am eligible to get interest until April 28 and not March 31.

No no.. as I said, I got it renewed in the 16th year i.e. 1998 till 2003.

But in 2014 I forgot to make further extension request and continued to invest 1.5 lakh every year.

But now I am scared since I neither have the passbook nor online banking to check transaction, balance, etc

Dear Helpdesk

My PPF account with the Post Office matured in May 2014 after 15 years and I withdrew the amount on April 29, 2015. The maturity amount of approximately 17 lacs I was shocked to see, did not include interest of almost 14K for the period of April 1 to April 29, 2015. I went back to the PO and they just could not convince me and kept referring to interest calculation only for completed months. And on demanding the rules book, showed the clause that interest is paid until closure of account. Now, I am being tossed between the PO and GPO in Bangalore. I want to know if there is a case law or clear PF rules on this. If not, by sheer logic and commonsense, they should pay until maturity and the completed months apply only during the pendency of the PPF while it is still alive.

Would appreciate an early reply.

The extension period of my PPF account hadexpired on 31 March 2014 but I forgot toextend it for another 5years within one year of expiry. However I made a contribution of Rs 150,000 during financial year 2014-15, without realising that I had not extended the account.

1 Will I be able to extend my account now? If not, will the account be deemed to have been continued without contributions?

2 Will my contribution made during the Fy earn interest?

3 Is the contribution eligible for 80c benefit?

Please guide me how to deal with this situation

Thank you

Sir Please verify it with bank or post office where you have the PPF account.

If extension is not done within an year, then by default the account is deemed to have been extended without further contribution for a period of five years.

So going by rules :

-Your account would be extended without contribution

-No It would not earn interest

-It would not be counted under 80C.

But please verify and do inform us/

The extension period of my PPF account hadexpired on 31 March 2014 but I forgot toextend it for another 5years within one year of expiry. However I made a contribution of Rs 150,000 during financial year 2014-15, without realising that I had not extended the account.

1 Will I be able to extend my account now? If not, will the account be deemed to have been continued without contributions?

2 Will my contribution made during the Fy earn interest?

3 Is the contribution eligible for 80c benefit?

Please guide me how to deal with this situation

Thank you

Sir Please verify it with bank or post office where you have the PPF account.

If extension is not done within an year, then by default the account is deemed to have been extended without further contribution for a period of five years.

So going by rules :

-Your account would be extended without contribution

-No It would not earn interest

-It would not be counted under 80C.

But please verify and do inform us/

Dear Gopalji,

I am facing a similar situation wherein I got one extension of PPF account after 15 years but forgot to get another extension after 20 years and continue to deposit 1.5 lakhs money every year.

Not sure if am getting interest and which category my PPF is currently in (w/o contribution continuation or something else)

Dear Sir,

I opened an PPF A/c with SBI on 02/01/2001.

What will be the date of maturity.

Can I subscribe after April 2015 without submitting Form H.

Please advise me.

Thanks

NAWRAJ BHATTA

A Public Provident Fund (PPF) account has a maturity of 15 years but calculation of 15 years start from the end of financial year in which the account was opened. As you have opened the PPF account on 2 Jan 2001, then 15 years tenure will start from the end of 31st march 2001. The lock is till 31 Mar 2016 and so you can withdraw only after be 1st Apr 2016.So in Apr 2015 you can contribute like earlier years.

Next year i.e in Apr 2016 you would have to submit Form H if u want to Continue With further contributions.

Dear Sir,

I opened an PPF A/c with SBI on 02/01/2001.

What will be the date of maturity.

Can I subscribe after April 2015 without submitting Form H.

Please advise me.

Thanks

NAWRAJ BHATTA

A Public Provident Fund (PPF) account has a maturity of 15 years but calculation of 15 years start from the end of financial year in which the account was opened. As you have opened the PPF account on 2 Jan 2001, then 15 years tenure will start from the end of 31st march 2001. The lock is till 31 Mar 2016 and so you can withdraw only after be 1st Apr 2016.So in Apr 2015 you can contribute like earlier years.

Next year i.e in Apr 2016 you would have to submit Form H if u want to Continue With further contributions.

Dear Kirti, have you checked from various sources that in the first paragraph of Form H, one must mention “Completion date of 15/20/25 years” and NOT “Commencement date/year of the account”? Kindly advise your sources as well.

Many thanks!

Dear Kirti, have you checked from various sources that in the first paragraph of Form H, one must mention “Completion date of 15/20/25 years” and NOT “Commencement date/year of the account”? Kindly advise your sources as well.

Many thanks!

Sorry, please read the sentence in the second paragraph of my comment as follows:

“If PPF account is maturing on 1/4/2015, one cannot deposit an installment in June 2015 and submit Form H by 31st March 2016!”

Sorry, please read the sentence in the second paragraph of my comment as follows:

“If PPF account is maturing on 1/4/2015, one cannot deposit an installment in June 2015 and submit Form H by 31st March 2016!”

Dear Kirti,

According to me, maturity date can never be 31st March. Even on 31st March, one is allowed to deposit money. Maturity date should be 1st April (next day) when no further deposit is allowed without exercising the choice of extending the PPF for a further block of 5 years. 31st March should be counted in the previous term and cannot be the date of completion.

Secondly, you have mentioned that one has to submit Form H within one year to extend PPF. You should have added that Form H can be submitted within one year but prior to the first deposit in the extended block of 5 years. If PPF account is maturing on 1/4/2015, one cannot deposit an installment in June 2015 and submit Form H by 31st March 2015! One has to FIRST extend the PPF account by submitting Form H and only then can one deposit the first installment of the extended period. Otherwise, the deposit goes into an unextended and invalid PPF account with serious consequences.

Thirdly, you have suggested that date of commencement should be mentioned in the first paragraph of Form H. Where does it ask for date? It does not refer to “date of commencement” but to the “initial year of commencement”. More importantly, the emphasis is on “COMPLETION” and not “COMMENCEMENT”. According to me, the Form H is asking us to mention the date of completion of 15 years after the initial year of commencement. It makes more sense to inform the bank that the PPF account has completed 15 years on 1/4/2015 and one wishes to continue to subscribe to the account for a further block period of 5 years.

Kirti, I too am not fully confident but we must get to the bottom of this and find out what date should be mentioned in that blank in the first paragraph of Form H. I request you to read paragraph 3 of the PPF scheme (referred to in Form H) and opine/advise.

Thanks Kapil for your input,

Checked various websites and banks and my family PPF passbook. There is confusion on maturity date whether it’s 31 Mar or 1 Apr. Referring to Simple tax india on PPF extension

In my passbook it was written as 31-Mar.

Thanks for pointing out about Form H and deposit.

Dear Kirti, 31st March cannot be the completion date (according to me) because even on 31st March of the last year (15th/20th/25th year), one can still deposit another installment. Logically, completion date is the date when the old account matures and one can take no such action until one opts for an extension. Hence, 1st April should be the date of completion/maturity! I have seen Form H printed by SBI Nariman Point Branch and IOB Mumbai Main Branch. In the portion of Form H to be filled in by the bank, the following is printed:

“The account completed 15 years on 1/4/______.”

Furthermore, in my passbook, the bank has written and stamped the follwing:

Date of opening: 4/5/1989

Date of maturity: 1/4/2015

(The date of maturity refers to completion of 25 years in my case.)

Author A.N. Shanbhag is one of the pioneers in writing books on personal finance. I am providing the link to one of his old articles which will give a clearer picture of the maturity date:

http://www.sify.com/movies/boxoffice.php?id=13300020&cid=20932

My sources were my parents PPF passbook, my husband’s and mine and Internet. I talked about it in SBI branch where I have a PPF account and they said check on the website.

Internet has conflicting articles – some say 31 Mar and some say 1 Apr.

Sir I get your point. What you said and reference to Shanbag Sir article I am convinced that it’s 1 Apr. (Shanbhag Sir books are great. My father gave me the book when I started my job though I read it many years later. His son,Sandeep Shanbhag, is also doing a wonderful job in explaining financial terms and concepts)

I have updated my article for filling Form H and maturity date.

Thanks a lot for raising the point. It would benefit many people. We appreciate it a lot. Thanks Sir.

Dear Kirti,

According to me, maturity date can never be 31st March. Even on 31st March, one is allowed to deposit money. Maturity date should be 1st April (next day) when no further deposit is allowed without exercising the choice of extending the PPF for a further block of 5 years. 31st March should be counted in the previous term and cannot be the date of completion.

Secondly, you have mentioned that one has to submit Form H within one year to extend PPF. You should have added that Form H can be submitted within one year but prior to the first deposit in the extended block of 5 years. If PPF account is maturing on 1/4/2015, one cannot deposit an installment in June 2015 and submit Form H by 31st March 2015! One has to FIRST extend the PPF account by submitting Form H and only then can one deposit the first installment of the extended period. Otherwise, the deposit goes into an unextended and invalid PPF account with serious consequences.

Thirdly, you have suggested that date of commencement should be mentioned in the first paragraph of Form H. Where does it ask for date? It does not refer to “date of commencement” but to the “initial year of commencement”. More importantly, the emphasis is on “COMPLETION” and not “COMMENCEMENT”. According to me, the Form H is asking us to mention the date of completion of 15 years after the initial year of commencement. It makes more sense to inform the bank that the PPF account has completed 15 years on 1/4/2015 and one wishes to continue to subscribe to the account for a further block period of 5 years.

Kirti, I too am not fully confident but we must get to the bottom of this and find out what date should be mentioned in that blank in the first paragraph of Form H. I request you to read paragraph 3 of the PPF scheme (referred to in Form H) and opine/advise.

Thanks Kapil for your input,

Checked various websites and banks and my family PPF passbook. There is confusion on maturity date whether it’s 31 Mar or 1 Apr. Referring to Simple tax india on PPF extension

In my passbook it was written as 31-Mar.

Thanks for pointing out about Form H and deposit.

Dear Kirti, 31st March cannot be the completion date (according to me) because even on 31st March of the last year (15th/20th/25th year), one can still deposit another installment. Logically, completion date is the date when the old account matures and one can take no such action until one opts for an extension. Hence, 1st April should be the date of completion/maturity! I have seen Form H printed by SBI Nariman Point Branch and IOB Mumbai Main Branch. In the portion of Form H to be filled in by the bank, the following is printed:

“The account completed 15 years on 1/4/______.”

Furthermore, in my passbook, the bank has written and stamped the follwing:

Date of opening: 4/5/1989

Date of maturity: 1/4/2015

(The date of maturity refers to completion of 25 years in my case.)

Author A.N. Shanbhag is one of the pioneers in writing books on personal finance. I am providing the link to one of his old articles which will give a clearer picture of the maturity date:

http://www.sify.com/movies/boxoffice.php?id=13300020&cid=20932

My sources were my parents PPF passbook, my husband’s and mine and Internet. I talked about it in SBI branch where I have a PPF account and they said check on the website.

Internet has conflicting articles – some say 31 Mar and some say 1 Apr.

Sir I get your point. What you said and reference to Shanbag Sir article I am convinced that it’s 1 Apr. (Shanbhag Sir books are great. My father gave me the book when I started my job though I read it many years later. His son,Sandeep Shanbhag, is also doing a wonderful job in explaining financial terms and concepts)

I have updated my article for filling Form H and maturity date.

Thanks a lot for raising the point. It would benefit many people. We appreciate it a lot. Thanks Sir.

You can comment here

Kirti, you’re welcome! I’m not a finance person myself (like you) but I’m always keen to know what’s right and what’s wrong. I’m still investigating. I shall report whatever I learn. Many people/banks/post offices considered me insane for following this matter in such detail. I knew Bemoneyaware.com will understand my doubt/predicament and will also help figure out the right way out. Kudos to you for instilling such trust in us for your blog!!

Thanks for your kind words.

I am also not a finance person and I am trying to figuring out the jargon with help of readers like you. In case of Maturity date of PPF the difference between 31 Mar and 1 Apr is so subtle that one can get confused. And bank officials are not much helpful.

I admire your interest (and your patience for continuing your PPF account for 25 years). Any plans of starting your own blog?

Many thanks, Kirti! No, no plans to start a blog. But I do follow all your blogs and I find them highly intelligent write-ups, covering the entire topic, in simple and lucid language.

Needless to say, if I have any opinion or additional piece of information on any topic that you cover, I shall contribute in my own small way.

In the meantime, I have reached out to the Regional Director, National Savings Institute (Ministry of Finance – Deptt. of Economic Affairs) in Mumbai. I hope to come back soon. And yes, thank you for your patience 🙂

Wow Sir. You really want to go to the bottom of the matter and have patience to reach out.

Keep up the Good work and keep us updated

You can comment here

Kirti, you’re welcome! I’m not a finance person myself (like you) but I’m always keen to know what’s right and what’s wrong. I’m still investigating. I shall report whatever I learn. Many people/banks/post offices considered me insane for following this matter in such detail. I knew Bemoneyaware.com will understand my doubt/predicament and will also help figure out the right way out. Kudos to you for instilling such trust in us for your blog!!

Thanks for your kind words.

I am also not a finance person and I am trying to figuring out the jargon with help of readers like you. In case of Maturity date of PPF the difference between 31 Mar and 1 Apr is so subtle that one can get confused. And bank officials are not much helpful.

I admire your interest (and your patience for continuing your PPF account for 25 years). Any plans of starting your own blog?

Many thanks, Kirti! No, no plans to start a blog. But I do follow all your blogs and I find them highly intelligent write-ups, covering the entire topic, in simple and lucid language.

Needless to say, if I have any opinion or additional piece of information on any topic that you cover, I shall contribute in my own small way.

In the meantime, I have reached out to the Regional Director, National Savings Institute (Ministry of Finance – Deptt. of Economic Affairs) in Mumbai. I hope to come back soon. And yes, thank you for your patience 🙂

Wow Sir. You really want to go to the bottom of the matter and have patience to reach out.

Keep up the Good work and keep us updated