PPF rates are 7.1% from April 2020 to June 2020. Is Public Provident Fund Interest Rate fixed? How often does it change? What has been the interest rate of Public Provident Fund over the years? This article answers these questions.

Table of Contents

PPF interest rate

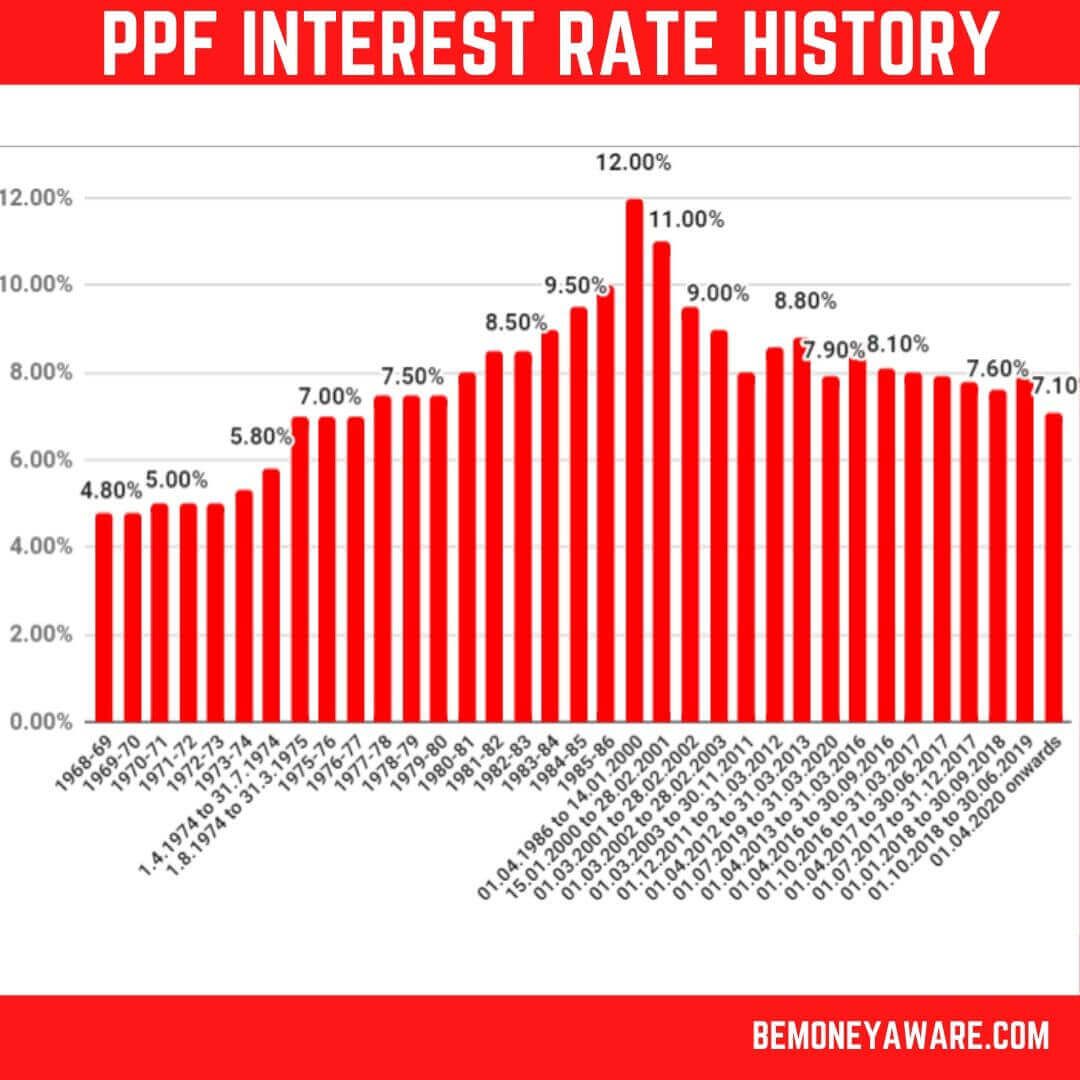

PPF was launched in 1968-69. The historical returns of PPF or Public Provident Fund since 1968 are given below.

Earlier the interest rates used to be announced yearly once. However, from 2016-17, the rate of PPF interest is announced quarterly, based on previous quarter’s yield on benchmark government securities (or bonds of corresponding maturities) and some extra (around 0.25%).

Remember that the PPF interest is calculated on the lowest balance between the 5th day and end of the month every month but the interest is credited only at the end of the financial year.

- PPF Interest rate in 1968-69 & 1969-70 was 4.8%.

- It was slowly raised and reached a peak of 12% between 1st April 1986-86 to 14th Jan 2000.

- Then it was slowly reduced and became 8% in 2011.

- Then it was again slowly increased and became 8.8% in 2012-13

- It became 7.9% in Jun 2019 and stayed till Mar 2020.

- It was reduced to 7.1% in Apr-Jun 2020.

PPF interest rate over years

PPF Interest rate over years in also shown in the table below

| 1968-69 | 4.80% |

| 1969-70 | 4.80% |

| 1970-71 | 5% |

| 1971-72 | 5% |

| 1972-73 | 5% |

| 1973-74 | 5.30% |

| 1.4.1974 to 31.7.1974 | 5.80% |

| 1.8.1974 to 31.3.1975 | 7% |

| 1975-76 | 7% |

| 1976-77 | 7% |

| 1977-78 | 7.50% |

| 1978-79 | 7.50% |

| 1979-80 | 7.50% |

| 1980-81 | 8% |

| 1981-82 | 8.50% |

| 1982-83 | 8.50% |

| 1983-84 | 9% |

| 1984-85 | 9.50% |

| 1985-86 | 10% |

| 01.04.1986 to 14.01.2000 | 12% |

| 15.01.2000 to 28.02.2001 | 11.00% |

| 01.03.2001 to 28.02.2002 | 9.50% |

| 01.03.2002 to 28.02.2003 | 9.00% |

| 01.03.2003 to 30.11.2011 | 8.00% |

| 01.12.2011 to 31.03.2012 | 8.60% |

| 01.04.2012 to 31.03.2013 | 8.80% |

| 01.07.2019 to 31.03.2020 | 7.90% |

| 01.04.2013 to 31.03.2016 | 8.70% |

| 01.04.2016 to 30.09.2016 | 8.10% |

| 01.10.2016 to 31.03.2017 | 8.00% |

| 01.04.2017 to 30.06.2017 | 7.90% |

| 01.07.2017 to 31.12.2017 | 7.80% |

| 01.01.2018 to 30.09.2018 | 7.60% |

| 01.10.2018 to 30.06.2019 | 8.00% |

| 01.04.2020 onwards | 7.10% |

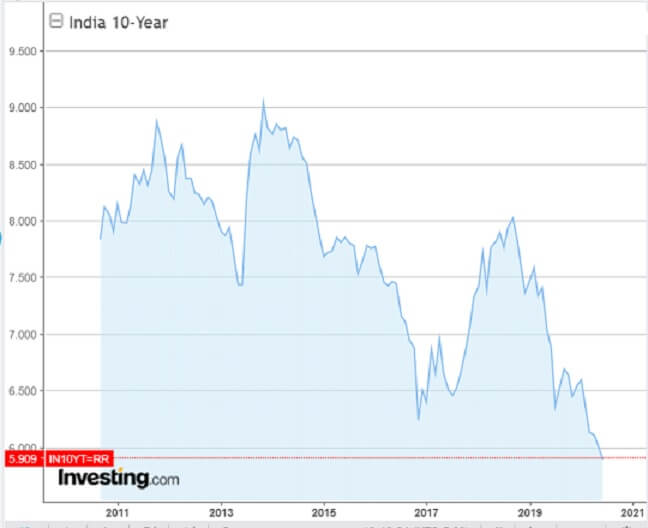

Why PPF Interest Rate change? Govt 10-year bond

Earlier PPF interest rates used to be announced yearly once. However, from 2016-17, the rate of PPF interest is announced quarterly, based on previous quarter’s yield on benchmark government securities (or bonds of corresponding maturities) and some extra (around 0.25%).

The 10-year Treasury bonds are issued by Govt to fund itself. It is a debt obligation issued by the government with a maturity of 10 years. A 10-year Treasury note pays interest at a fixed rate once every six months and pays the face value to the holder at maturity. In Jun 2020, the benchmark 6.45% bond maturing in 2029 offered 5.97% yield, lowest since January 27, 2009. The interest rate of the 10-year Govt bonds is shown below

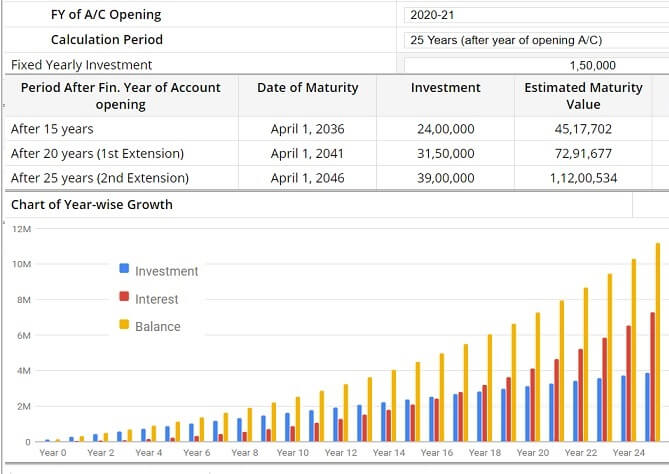

Can PPF make one crorepati?

With PPF interest rates going down, one needs to invest longer to become crorepati by investing in PPF. Using 7.1% interest for the entire period one can become crorepati after investing in PPF for 25 years as shown in the image below.

Should one invest in PPF?

PPF is run by the Government of India and hence it is risk-free(almost) and extremely safe to invest in. It also comes under EEE(Exempt Exempt Exempt) category.

- The money you invest is eligible for tax deduction under Sec.80C (Up to Rs.1,50,000 currently).

- The interest income earned every year is tax-free. (You must show it in your ITR)

- The maturity amount is also completely tax-free.

Hence for many PPF is a part of their debt portfolio. It gives me peace of mind as returns don’t fluctuate like stocks or equity MFs.

Related articles:

Understanding Public Provident Fund, PPF

Do you invest in PPF? With PPF interest reducing will you continue to invest in PPF?