Public Provident Fund (PPF) is a safe investment option with around 8% returns that are fully exempted from Income Tax. Public Provident Fund is suggested as an ideal vehicle for long term investment and many use it as an important saving tool for children. Rules of operating minor’s PPF account are similar to the regular account. One can open PPF account for a minor but One has to know about the amount that one can put into the PPF account of minor and what to do when the child becomes major.

Table of Contents

PPF account for Minor

Rules of operating minor’s PPF account are similar to the regular account. The interest rate of PPF are declared every quarter by the Govt. Its features are given below, our article Understanding Public Provident Fund, PPF explains it in detail.

Either father or mother can open a PPF account on behalf of his / her minor child, but both cannot open the account for same child.

One can put a maximum of 1.5 lakh in one’s own account and that of Minor together. There was confusion earlier but in revised PPF rules in Dec 2019, it has been made clear, so now there is no ambiguity. You can read new rules here

Once the child becomes a major, i.e., turns 18 years of age, the operation of account has to be handled by him/her. He will submit a revised application form for opening the account. His signature on the application form will be attested by the guardian who opened the account of the minor or by a respectable person is known to the Accounts Office

Loan on minor’s PPF account: You can take a loan on the PPF from the third year of opening your account to the sixth year. So, if the account is opened during the financial year 2009-10, the first loan can be taken during the financial year 2011-12. In case of an account opened on behalf of a minor or a person of unsound mind, the guardian may apply for the loan for the benefit of the minor by submitting a certificate to the accounts office

Withdrawal from minor’s PPF account: You can make withdrawals from the sixth year i.e after the expiry of 5 years full financial years from the end of the year in which your initial subscription was made In case of an account opened on behalf of a minor the guardian may apply for the withdrawal for the benefit of the minor or a person of unsound mind by submitting the certificate to the accounts office.

Extension of Minor’s PPF account: An account opened on behalf of a minor may be extended at the request of the guardian after 15 years of opening account.

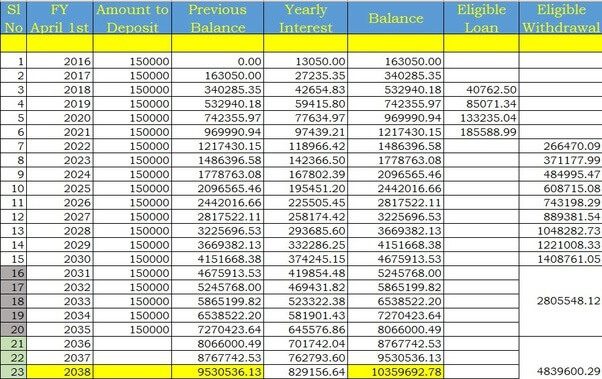

The image below shows how one can have 1 crore in PPF in 23 years for someone who started in 2016

Why open PPF account for Children?

Due to the advantages of PPF people invest in Public Provident Fund and they also want to invest for their spouse/wife and their minor children. They don’t want to claim deduction under 80C but want a safe investment option. As interest earned in PPF is completely exempt from tax under Section 10 (11) of the Income Tax Act hence even though Clubbing of income comes into play it doesn’t push your tax liability. PPF account for wife is allowed, also for the minor child in addition to self. BUT there is a lot of confusion on the amount that one can put in PPF account for minor in addition to self. But with the new rule, the confusion has been put to rest.

Limit on Investment in PPF account for minor child and Self

There have been cases where people have opened the PPF account in their name and name of their minor child and have been depositing in both the accounts (upto the limit) and earned interest too. In Dec 2019, new Rules of PPF 2019, clarified that One can put a maximum of 1.5 lakhs in one’s own account and that of Minor together.

Can I deposit 1.5 lakh each in my PPF account and my minor kid PPF account – so together 3 lakh deposit in the PPF. I would be claiming tax exemption under 80C only for 1.5 lakh for myself? Is this possible?

In the new rules for PPF published on 12 Dec 2019, it has been clearly stated that

4. Limits of subscription.-(1) A deposit which shall not be less than five hundred rupees and not more than one lakh fifty thousand rupees in multiple of fifty rupees may be made in an account in a year.

(2) Maximum limit of one lakh fifty thousand rupees as specified in sub-paragraph (1) by an individual shall be inclusive of the deposits made in his own account and in the account opened on behalf of the minor.

The question that comes up is “But what about the investment done, bank or post office did not stop me from doing so and even interest was credited?” What is the fate of money deposited till now?

In fact, people have tried to verify it from the bank officials also, as shown below from Jagoinvestor forum Total PPF investment limit including Spouse and Minor account

I met the manager of the branch of the bank (State Bank of India) where I have all these three accounts. I narrated the whole scenario. He does not see any problem with the situation. I am really confused as to continue this mode of the financial plan or to change it in the light of your clarification regarding the total PPF investment limit.

What happens to PPF account when minor becomes major?

Once the child becomes a major, i.e., turns 18 years of age, the operation of account has to be handled by him/her. He will submit a revised application form for opening the account. His signature on the application form will be attested by the guardian who opened the account of the minor or by a respectable person is known to the Accounts Office. Along with the documents required and the signature of the depositor who has become major shall be attested on the revised application form by the guardian who opened the account.

Our article Understanding PPF account has all the forms.

Loan on minor’s PPF account

You can take a loan on the PPF from the third year of opening your account to the sixth year. So, if the account is opened during the financial year 2009-10, the first loan can be taken during the financial year 2011-12. Our article How to take Loan from PPF explains the process in detail with Loan Calculator.

In case of an account opened on behalf of a minor, the guardian may apply for the loan for the benefit of the minor or the person of unsound mind by submitting the following certificate to the accounts office, namely:-

“Certified that the amount sought to be withdrawn is required for the use and welfare of Shri/Smt./Master/ Kumari………. who is a minor/ a person of unsound mind/a person incapable of operating his account due to physical infirmity and is alive on this……the day of…………..(month), ……….(year).”.

Withdrawal from minor’s PPF account

You can make withdrawals from the sixth year i.e after the expiry of 5 years full financial years from the end of the year in which your initial subscription was made. This means that from the day you open your account, you will need to complete 6 full financial years before you can make any withdrawal.

You are allowed to withdraw 50% of the balance at the end of the fourth year, preceding the year in which the amount is withdrawn or the end of the preceding year whichever is lower.

Our article PPF Partial Withdrawals explains the partial withdrawal from PPF.

In case of an account opened on behalf of a minor, the guardian may apply for the withdrawal for the benefit of the minor or a person of unsound mind by submitting the following certificate to the accounts office, namely:-

“Certified that the amount sought to be withdrawn is required for the use and welfare of Shri/Smt./Master/ Kumari………. who is a minor/ a person of unsound mind/ a person incapable of operating his account due to physical infirmity and is alive on this……the day of…………..(month), ……….(year).”

Extension of Minor’s PPF account with deposit

Provided that an account opened on behalf of a minor may be extended at the request of the guardian with or without deposit.

Overview of PPF

Public Provident Fund (PPF) is a safe investment option with around 8% returns that are fully exempted from Income Tax. Public Provident Fund is suggested as an ideal vehicle for long term investment in debt category, an important retirement saving tool for individuals. Its features are given below, our article Understanding Public Provident Fund, PPF explains it in detail.

- You need to deposit a minimum of Rs. 500 per year in a PPF account.

- Maximum amount which you can deposit in a PPF account is Rs. 150,000. (Earlier limit was Rs 70,000 it was increased to 1 lakh from 1.12.2011 then increased to 1.5 lakh)

- You can deposit lump sum or multiple installments in multiples of 50.

However, the maximum number of installments in a year can not be more than 12.(removed on 12 Dec 2019) - The duration for the investment is 15 years. However, the effective period works out to 16 years i.e., the year of opening the account and adding 15 years to it.

- PPF works on a financial year basis (April 1st – March 31st) and interest is credited only at the end of financial year.

- PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end

- The interest earned in PPF remains fixed for one year and is no longer guaranteed forever. It is actually benchmarked to the 10-year government bond yield and will be0.25% higher than the average government bond yield.

- The amount you invest is eligible for deduction under Section 80C. Remember f benefits expenses like life insurance premiums, children’s school fees qualify under Section 80C as deductions in addition to other approved investment mediums like ELSS, 5 year FD’s, NSC etc.

- Interest earned on the investment is completely exempt from tax under Section 10 (11) of the Income Tax Act.

- You cannot open a joint account with another individual. The account can only be opened in one person’s name.

It is difficult to find fixed-income instruments at the same low-risk level that can yield you comparable returns!

Investing in the name of Wife and Children – Tax Implications

But if one invests in the name of Wife and/or Children clubbing of income comes into play. Clubbing provision under Section 60-64 of Income Tax Act is meant to check tax evasion. Our article Clubbing of Income explains it in detail. Economic Times Seven ways to earn tax-free income also explains it.

For Wife : For wife clubbing happens only at the first level of income. If this money is reinvested and earns an income, it will be treated as your wife’s, not yours and then, the income will not be clubbed. You can gift money to your wife and then get her to invest in any of the several tax-free investment options such as PPF. The earning will be clubbed with your income, but since these investment options are tax-free, it won’t push up your tax liability. There’s another way to escape clubbing. Instead of gifting, give her a loan.

For Minor Child(Child less than 18): if a parent invests in a minor child’s name, the income is clubbed with that of the parent who earns more. In some cases, a minor child may have a personal income, such as a cash prize in a competition or payments for commercials and events. However, this is rare and mostly it’s the parent who invests on behalf of the child. There is a Rs 1,500 exemption per child per year for the income earned by investments made in the name of the children.You can avail of this for a maximum of two children. This means you can safely invest Rs 15,000 in a fixed deposit in your child’s name. If you have two children, that’s Rs 30,000 earning tax-free income every year. Opt for the annual payout option because the cumulative option will push up the earning beyond the tax-free limit in a couple of years as the compounding effect comes into play. Please Note: Either father or mother can open a PPF account on behalf of his / her minor child, but both cannot open the account for same child.

For Major Child (Child more than 18): After a person turns 18, (s)he is treated as a separate individual for tax purposes. This means his(her) earnings are no longer clubbed with his parent’s income and (s)he enjoys the same exemptions and deductions as any other adult taxpayer. Gifting money to a child above 18 and then investing it for taxfree gains is a perfectly legal strategy.

It’s clear one can open a PPF account for minor child and self. But now maximum amount of contribution in PPF by an individual shall be inclusive of the deposits made in his own account and in the account opened on behalf of the minor.

Note: If the account is opened in the name of the minor and the minor attains majority before the maturity of the account, the ex-minor will himself continue the account thereafter. He will submit a revised application form for opening the account to the Accounts Office. His signature on the application form will be attested by the guardian who opened the account of the minor or by a respectable person is known to the Accounts Office. Ref: PPF rules

Thanks to our readers especially Arv Raj for raising the question, CA Karan Batra for quick responses and my friends Nick, Gopi, Sangeeta, Linnet, Soumya for a lively discussion on it (and on can mutual fund create wealth?)

Related Articles :

- Understanding Public Provident Fund, PPF

- Important documents for your child

- Clubbing of Income

- Voluntary Provident Fund, Difference between EPF and PPF

- Money Awareness for Beginners

Have you opened Public Provident Fund (PPF) account for self and minor? Do you put more than 1 lakh in PPF account of minor and child? How do you interpret the law? Have your PPF account for minor completed 15 years? Did your PPF account for minor face any problem on maturity?

Hello Sir

I have a ppf account of my daughter and she being a minor i am her gaurdian. Now i will be shifting abroad ( nri status) while my wife and daughter will be in india.

Can i continue investing in her ppf and sukanya simriddhi account as minor is still resident of india and does not hold nri status but gaudian ( father will have a nri status)

A grey area.

One can argue As the wife is in India one can continue.

Depends on the Income-tax officer and if it comes under scrutiny

How long are you planning to be away from India?

Dea Sir/Madam,

My query is related to PPF Limit. I hope my query is clear. Kindly be kind enough to answer.

I have my own PPF account and PPF for my son under my Guardianship , both have my PAN Number.

Me and My husband both use our PPF limit fully and claim deduction too.

We have recently registered our HUF.

My query is — if the HUF deposits the money in my Son’s PPF account will that lead to exceeding my PPF limit (to 3 Lacs) since my PAN is present in his PPF account?

If yes, Should I change the guardian to HUF in my Son’s PPF account by adding PAN of HUF to his account?

Please suggest any other legal alternative if available so that all three PPF account’s can be used fully for investment.

Warm regards,

Kashmira Sen

Is your Son an adult?

No, He is Minor.

Hi Kirti,

In my opinion, you cannot invest more than Rs 1.5 lacs combined in your account and PPF accounts of kids where you are the guardian.

I have read about tweaks where non-guardian (in PPF) parent can contribute to PPF account of the kid and be able to invest more in PPF for the family. But I am not convinced.

Better to stick to the both letter and spirit of the law.

Hello thanks for the article . Really was helpful . One question though . I am an NRI but my wife left to India during her pregnancy and she delivered last month . She is going to be in India for another 6 months . I do have a ppf account which I opened before I became an NRI . Can I open another ppf account through my wife for the child . If she isn’t eligible since she was a NRI , can I ask my mom to play a guardian role to open ppf for my child ?

Dear sir

i have one existing PPF account in SBI. i am interested to open a ppf account on behalf of my child. in same sbi branch while i contacted for opening of new ppf account after downloaded form generated from personal banking for my son the SBI officials told we can not open ppf account for your child.

kindly guide me.

That is absolutely wrong.I personally have opened a PPF account in SBI for myself and my children.

Please visit the branch again and talk to Manager of the branch. You can show the PPF act.

The PPF act at Finance ministry website

From the PPF act

(b) “minor” means a person who is not deemed to have attained

majority under the Indian Majority Act, 1875;

(c) “Scheme” means the Public Provident Fund Scheme framed

under sub-section (1) of section 3;

(d) “subscriber” means an individual who makes subscription to the

Fund under section 4 and where such subscription is made by an

individual on behalf of a minor, of whom he is the guardian, such

minor;

If a ppf acc. Of a minor opened through father, can a working mother contribute in this account and avail benefit u/s 80c.

If minor attains majority, even then can mother and father avail benefit u/s 80cfor any contributions made to this acc.

I have a PF account owned by the private org which I work for. I pay VPF amount of 15000 per month.

Will I be getting the interest for the VPF amount which is exceeding 1,50,000 in a year? Kindly clarify.

Refer your Article:

Scenario 2

In the second scenario, the mother has one self-PPF account and opens two other accounts to her two children respectively. Therefore, she manages three PPF accounts. At this stage, she can claim a maximum tax benefit of 1.5 lakh under Sec 80C of the Income Tax Act. Moreover, she will have to invest a maximum of one lakh in all the three accounts.

my Question is : Why she will have to invest maximum of one lakh in all three accounts when permissible investment is one Lakh fifty thousand per year.

Question No.2: I have two sons, 4 years and 2 years old respectively. Can my wife open PPF accounts in both’s name. I mean 2 separate minor accounts ? she doesn’t have any PPF account till date in her name.

Sir

A1 : As per rules she can invest total of 1.5 lakh in PPF accounts. Limit for investment to 1.5 lakh was revised in Aug 2014. It can be hers, hers+1 child, hers + 2 children.

A2 : You or your wife can open PPF account in your minor children. I have opened 2 PPF account one each for my children but my husband is the guardian.

Can anyone open a ppf ac for self and his minor child on one pan card

If yes what is the investment limit and tax deduction

Yes you can open PPF for Self and Minor.

As per tax laws you can contribute max of 1.5 lakh, irrespective of whether you invest in your name or your child’s name.

There have been cases where people have opened the PPF account in their name and name of their minor child and have been depositing in both the accounts beyond the maximum limit (70,000 or 1 lakh or 1.5 lakh) and earning interest too. Many bank officials also say the same.

So do it at your own risk.

whether HUF can invest in PPF account of Minor , eventhough Karta personally investing Rs. 150000/- in PPF account in personal Capacity.

Also, are there known instances where maturity amount has been returned without (partial or full) interest after 15+ years. Aware of the rule, but what is the implementation? Neither during account opening nor in mainstream or financial news media are these issues discussed. Only in select forums like yours is there a deep dive into this topic where the far lesser known constraints come out.

I’m sure if there were multiple instances of a highly dependable (sovereign) source of investment not paying up as expected at the end of the maturity period, it would be very visible in the media.

Hello,

I invested 1.5L in the name of my daughter and myself for past 2 years (FY 14-15 and 15-16). Based on discussions on various forums, it seems this was wrong. I’m willing to cut my losses and forfeit the interest of 2 years in my daughter’s account and get back the principal now. Is that possible? How should I go about asking for a closure of the account. Given this little known detail, I doubt SBI officials will even permit the account to be closed in just 2 years.

It doesn’t seem fair that the amount is locked in for 15 years even if it is a mistake. Either the principal should be returned or PPF should be honoured despite mistake. After 15 years, 3 lakhs principal without interest will have a third or less value than it has today.

Hi,

Recently i went to apply PPF account for My kid(Age 1) in SBI.The bank Manager told ,i can’t open PPF account for my kid ,since i am having a PPF account with my PAN number tagged to the account. He advised me to apply Pan card for my kid and then open the PPF account. Is this true or wrong pls advise. Any one faced this issue.

Thanks.

Can one change guardian under PPF account? So, for instance if husband is guardian in minor children’s PPF account. Can wife be made the guardian in the account (in place of husband)? The assumption is that the husband is alive.

Hello Deepesh,

I have the same question as you (Can one change guardian under the PPF account?

Instead father can mother takes guardianship of minors PPF account)..

Did you manage to get an answer for this?

No it doesn’t seem so. But we will dig more to find out.

Why would you like to change the guardianship?

The reason is, I have linked self PAN to all PPF accounts (2 kids PPF account + self PPF) and the PPF is limited to 70K a year hence couldn’t contribute more into these PPF accounts, Please let me know if guardianship can be change (father to mother using her PAN), The SBI is not agreeing and I believe we can but need an expert advice,

Your help will really help for all people who really wish to change guardianship.

Thank you in advance

PPF limit has been increased to 1.5 lakh a year from Oct 2014.

Why don’t you open an account in name of your wife and gift her max of 1.5 lakh for PPF?

No one knows for sure what the PPF rules are and bank officials can be stubborn.

We are trying to find. Will update hopefully by Sat.

I have opened PPF account for my son (in 2007) as minor account and under guardian of my PPF account in SBI. he has turned 18 in Apr,2015. when i want to convert my son’s PPF account to major / independent PPF account, i am struggling with SBI . first, it looks , they are not clear about document needed to convert minor PPF to major PPF account. first, i was asked to produce his photo identification card and PAN card. i have applied for this PAN now. can you make it clear what document needed to convert Minor to major PPF account ?

thanks

Thiyagarajan

Unlike the bank accounts and mutual fund There is no process per to convert a minor account to major in case of PPF. Like for a bank account you can submit letter to bank and update the nomination. Minor account has no nomination while major PPF account has. Please do let us know if it works.

If PPF account matures after the child attains 18 yrs (become’s major) – In this case, the account will then be operated by the child (who has become major) and there will be no guardian. The child will then take his/her own independent decision. In this case, because the PPF account has matured after the child has attained maturity age, all the maturity amount will be income of the child itself, Now any interest income earned on this amount in future will be kid income.

Dear Sir/Madam,

I am hereby informing you that I had opened PPF in 2007. At that time I was a minor and now I am 18 years old. So that I want to convert my PPF account minor to major. Also give me all facilities which major account has like nomination. Here is my basic account information:

Name:

Account No.:

Address:

Mobile No.: 1234567890

So I kindly request you to please convert my PPF account from Minor to Major.

Yours faithfully,

(Signature of account holder)

Enclosures:

1. ID proof (Pan Card, Aadhar card, Voter ID)

2. Address proof (Ration card, Light bill, Telephone bill, Aadhar card)

Note: Please write your name, account no., address, mobile no. in a letter and also your bank name, branch code in To section as mentioned above. Attach all the necessary documents.

H,

Very good article. I opened PPF account on my child’s name now. One question, can my father invest in my child’s PPF account and claim tax rebate on it?

Thanks

Ajay

Dear Ajay,

An amount invested in PPF is eligible for Deduction under 80C, only if the contribution is made for the individual, the spouse, or the child of such individual. Contributions made by your father will not be eligible for tax rebate.

Thanks Clinton for answering. Appreciate it.

Hello sir,

i would like to ask you, am staying in abraod with family, i had a son 2yrs old, my father can open PPF on behalf of his grandson ?, please kindly suggest to me.

thanks in advance…

My father staying at india only…

No Grandfather and grandmother are not allowed to open PPF account for their grand children except in cases where the minor child has lost his parents.

And you being NRI will not be allowed to open a PPF account

Thank you for your clarification.

One more doubt, even if my father will not be able to get tax benefit, my son will be eligibale to get interest on the deposited amount? I was told that if amount depostited in one year is more than Rs. 1.5 Lakhs total, it will not be eligible for interst in that year. In this case, total amount depostited is less than Rs. 1.5 Lakhs.

Regards

Ajay Agrawal

As Clinton has said your father cannot claim tax rebate on one made for your child but he can claim if invested in your name.

From our article 80C Income Tax Deductions can be claimed in whose name

You can claim the deductions if you invest in your PPF account, your LIC policy, your home loan. But if you are an individual with family then you can also claim 80C deductions for your spouse, children major or minor. The following table shows the deduction that an individual can claim. Please note the total deduction under this section (along with section 80CCC and 80CCD) is limited to Rs. 1.50 lakh only.

Dear kirti

I have a PPF a/c in which i deposited 51K and one a/c in Minor Daughter name (Major – as Self) in which i deposited 51K and Another 48K deposited in daughter’s (Minor) name in Sukanya A/c (Major as self in the A/c)

can i Claim entire 1.5 Lakh benefit under 80 C for total 1.5L investment done by Me ? Investment in Minor;s A/c is Rs 99K and My Name is 51 K.

Suppose Minor child in earning income on account of modelling,etc and which crosses the exempted limit. N the same amount earned by minor is being deposited by the parent in PPF A/c. My question is whether, minor can claim deduction of the same under Chapter VIA or not. N if not, then is it so that income is taxable in the hands of minor child and Chapter VIA deduction is been claimed by the parent.

Kindly guide on the matter

Incomes earned by minor by use of any manual effort or use of any special skill or specialised knowledge will not be clubbed. Accordingly, income earned by child artists working in a film or TV is spared from being clubbed with that of a parent. Likewise, any tuition fee earned by a minor college-going child will not be included in the income of his/her parents.

In such case minor is considered like any other assesse and needs to file his/her return.

The tax return of a minor in respect of income not clubbed with the income of any parent is to be signed by his guardian. Parents are natural guardians, so any of them can sign the return

Ref CaClub minor income tax return

Suppose Minor child in earning income on account of modelling,etc and which crosses the exempted limit. N the same amount earned by minor is being deposited by the parent in PPF A/c. My question is whether, minor can claim deduction of the same under Chapter VIA or not. N if not, then is it so that income is taxable in the hands of minor child and Chapter VIA deduction is been claimed by the parent.

Kindly guide on the matter

Incomes earned by minor by use of any manual effort or use of any special skill or specialised knowledge will not be clubbed. Accordingly, income earned by child artists working in a film or TV is spared from being clubbed with that of a parent. Likewise, any tuition fee earned by a minor college-going child will not be included in the income of his/her parents.

In such case minor is considered like any other assesse and needs to file his/her return.

The tax return of a minor in respect of income not clubbed with the income of any parent is to be signed by his guardian. Parents are natural guardians, so any of them can sign the return

Ref CaClub minor income tax return

I was wondering if you could write about Post office investments in the name of minors and their tax implications for parents. The postal investments (e.g. MIS) do have 8.4% returns, which is comparable to PPF.

Nandini

A very good question and will write an article on it . But to answer now

Investing in name of minor actually leads to clubbing of income hence there are hardly any options for investing in minor’s name(Zero coupon bonds ex NABARD, Mutual funds)

Post office MIS offers interest rate of 8.4% but interest is taxable unlike PPF.

The Post Office Monthly Income Scheme (POMIS) is a guaranteed return investment available at the post office. On the deposit that you make with the post office, you get an assured monthly income. Currently one earns an 8 per cent interest per year on the deposit, which is paid every month and hence the name monthly income scheme. Once you make the deposit you get the interest payout each month from the date of making the investment, not from start of the month.

Anyway why would a parent want to open a MIS for a child unless it goes into Recurring account and then claim it after when child turns 18.

I was wondering if you could write about Post office investments in the name of minors and their tax implications for parents. The postal investments (e.g. MIS) do have 8.4% returns, which is comparable to PPF.

Nandini

A very good question and will write an article on it . But to answer now

Investing in name of minor actually leads to clubbing of income hence there are hardly any options for investing in minor’s name(Zero coupon bonds ex NABARD, Mutual funds)

Post office MIS offers interest rate of 8.4% but interest is taxable unlike PPF.

The Post Office Monthly Income Scheme (POMIS) is a guaranteed return investment available at the post office. On the deposit that you make with the post office, you get an assured monthly income. Currently one earns an 8 per cent interest per year on the deposit, which is paid every month and hence the name monthly income scheme. Once you make the deposit you get the interest payout each month from the date of making the investment, not from start of the month.

Anyway why would a parent want to open a MIS for a child unless it goes into Recurring account and then claim it after when child turns 18.

If I invest for my child who is six month old. During maturity he will still be a minor only. Who will receive the money.

You can also have an account in the name of a minor child of whom you are the parent / guardian. However that will be the child’s account, you will simply be the guardian.

Minor will receive the money. But in that case it is better to extend the account for five more years (unless money is needed)

if the minor attains majority before the maturity of PPF account then Ex-minor will have to take over the operation of the PPF account by registering his signature (attested by the guardian).

If I invest for my child who is six month old. During maturity he will still be a minor only. Who will receive the money.

You can also have an account in the name of a minor child of whom you are the parent / guardian. However that will be the child’s account, you will simply be the guardian.

Minor will receive the money. But in that case it is better to extend the account for five more years (unless money is needed)

if the minor attains majority before the maturity of PPF account then Ex-minor will have to take over the operation of the PPF account by registering his signature (attested by the guardian).

Good Post..but I have one question in mind.

Quoting from Indian Post website: PPF subscriber can open another account in the name of minors..but subject to maximum investment limit by adding balance in all account:

I think this clearly means that balance should not exceed Rs.1 lakh across all accounts then whats use of opening ppf account in the name of minor child???

Big confusion in this topic (hence the reason for writing the article)

For ex:from Basnivesh’s All about Public Provident Fund (PPF)

Meaning of minor is, person whose age is below 18 years. So anyone who is below 18 yrs of age can open PPF account. Yes they can invest in their 2 kids account upto Rs.1,00,000 in each account.

Infact recently in State Bank of India I met an Uncle who has been depositing in his children’s account and his wife account maximum limit , has been extending it also. He had already deposited 4 lakh total (1 lakh each in his two children, his wife and his own account)

Thanks for the reply.

But still I believe that limit of Rs 1 lakh is combining self and minor account.

(agree that spouse can have separate limit of Rs.1 lakh whether working or not.)

Some people invest more than one lakh in self account or separately in minor account..I think they may forfeit interest earned if traced doing this.

One programme comes on CNBC Awaaz named as TaxGuru where famous CA Subhash Lakhotia answers tax related queries..

One similar question was asked today by one viewer…and according to taxguru one can NOT invest 1 lakh separately in minors ppf account…but limit of one lakh is combining self & minor account.

Thanks for information Paresh and following it up. I know of the program and tax guru Subhash,

I am really confused Paresh, do I believe what I see (a man having four ppf accounts for 20+) years or do I believe the experts.

Recently I came to know that Albert Einstein never said that compounding is the 8th wonder yet and it was a marketing copyrighter who started it.

I don’t want to miss a legal way to invest in a assured 8% return but then I don’t want to evade taxes also.

Good Post..but I have one question in mind.

Quoting from Indian Post website: PPF subscriber can open another account in the name of minors..but subject to maximum investment limit by adding balance in all account:

I think this clearly means that balance should not exceed Rs.1 lakh across all accounts then whats use of opening ppf account in the name of minor child???

Big confusion in this topic (hence the reason for writing the article)

For ex:from Basnivesh’s All about Public Provident Fund (PPF)

Meaning of minor is, person whose age is below 18 years. So anyone who is below 18 yrs of age can open PPF account. Yes they can invest in their 2 kids account upto Rs.1,00,000 in each account.

Infact recently in State Bank of India I met an Uncle who has been depositing in his children’s account and his wife account maximum limit , has been extending it also. He had already deposited 4 lakh total (1 lakh each in his two children, his wife and his own account)

Thanks for the reply.

But still I believe that limit of Rs 1 lakh is combining self and minor account.

(agree that spouse can have separate limit of Rs.1 lakh whether working or not.)

Some people invest more than one lakh in self account or separately in minor account..I think they may forfeit interest earned if traced doing this.

One programme comes on CNBC Awaaz named as TaxGuru where famous CA Subhash Lakhotia answers tax related queries..

One similar question was asked today by one viewer…and according to taxguru one can NOT invest 1 lakh separately in minors ppf account…but limit of one lakh is combining self & minor account.

Thanks for information Paresh and following it up. I know of the program and tax guru Subhash,

I am really confused Paresh, do I believe what I see (a man having four ppf accounts for 20+) years or do I believe the experts.

Recently I came to know that Albert Einstein never said that compounding is the 8th wonder yet and it was a marketing copyrighter who started it.

I don’t want to miss a legal way to invest in a assured 8% return but then I don’t want to evade taxes also.

He is right. Total investment in your PPF account and PPF accounts where you acts as guardian cannot exceed Rs 1.5 lacs in a single financial year.

This is written in PPF Act. There are no two ways about it.

People have gotten away deposting more. In fact, even bank or post office staff is not aware about it. However, PPF Act is black and white.

Very helpful financial product .

Travel India

Do you have one for yourself and kids?

Very helpful financial product .

Travel India

Do you have one for yourself and kids?