Be careful: A number of fake accounts, UPI accounts, have popped up asking for donations to PM Cares fund. Please be careful to whom you are donating.

Table of Contents

PM Cares fund

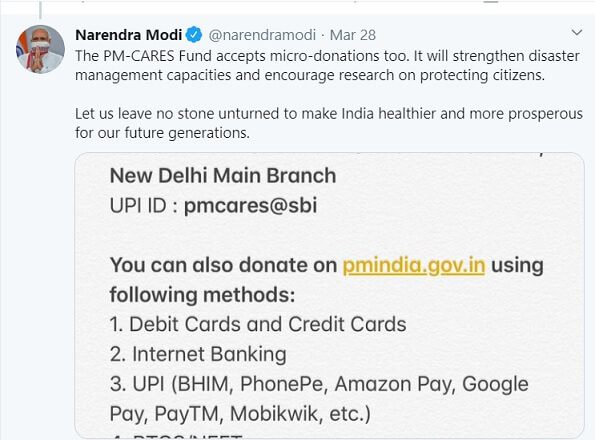

The Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund) was created on 28 March 2020, following the COVID-19 pandemic in India. The fund will be used for combating, containment and relief efforts against the coronavirus outbreak and similar pandemic like situations in the future. The Prime Minister is the chairman of the trust. Members will include the defence, home and finance ministers

The fund enables micro-donations. The minimum donation accepted for the PM CARES Fund is ₹10

It has been opened up for donations from abroad after it was exempted from the Foreign Contribution Regulation Act.

Donations to the PM CARES Fund shall be eligible for 100 per cent deduction under section 80G of the Income Tax Act. The limit on deduction of 10% of gross income is also not applicable for donation made to PM CARES Fund. PM CARES Fund has been allotted a Permanent Account Number (PAN) AAETP3993P. Note: Donations made to Chief Minister Relief Funds also gets 100% tax deduction under 80G act.

For companies, The Ministry of Corporate Affairs announced that donations to the PM CARES fund would be counted as part of the statutory Corporate Social Responsibility (CSR) obligation of the companies, with additional CSR being offset in subsequent years.

Contributions can also be made through UPI(pmcares@sbi), online through the portal of PMO i.e. pmindia.gov.in as well as through the portals of the collection banks. Cheque or demand draft drawn in favour of ‘PM CARES Fund’ can be sent to Under Secretary (Funds), PMO, South Block, New Delhi, Pin -110011 along with Name, Address, Mobile No. and E-mail ID of the donor.

Immediately after the fund was created a number of fake accounts popped up. While the original UPI accounts were pmcares@sbi and pmcares@iob, Delhi Police booked an individual for creating a UPI account removing the ‘s’ called pmcare@sbi, intended to scam people.

How does donating to PM Cares fund help in tax deduction

Donations to the PM CARES Fund will get 100% deduction under Section 80G of the Income Tax Act. The date for claiming deduction under Section 80G is up to 30 June 2020. The amount saved depends on your income tax slabs.

- You get a deduction under Section 80G on your entire donation of Rs 2.5 lakh,

- So Your taxable income reduces to Rs 17.5 lakh (Rs 20 lakh less Rs 2.5 lakh).

- So you pay less tax of Rs 78,000 (31.2 per cent of Rs 2.5 lakh).

- The Tax on 8 lakhs is Rs 75,400

- You get a deduction under Section 80G on your entire donation of Rs 10,000,

- So Your taxable income reduces to Rs 7.9 lakh (Rs 8 lakh less Rs 10,000).

- Tax becomes Rs 73,320. So you save 2,080.

You can claim deductions for PM cares fund for FY 2019-20

Date for claiming deduction under Section 80G is up to 30 June 2020 and are eligible for deduction from income of FY 2019-20. You can claim this deduction while filing your tax return for FY 2019-20; the due date for filing this tax return will likely be July 31, 2020(unless extended).

As you are aware from 1 Apr 2020, new and old tax regimes are available. Under the new tax regime, the rates of tax are lower, but there is no benefit of most tax exemptions and deductions, including Section 80G. Even if you contribute to PM Cares fund you can choose the new tax regime for FY 2020-21. Article Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21 talks about it in detail

How to contribute to PM Cares Fund online

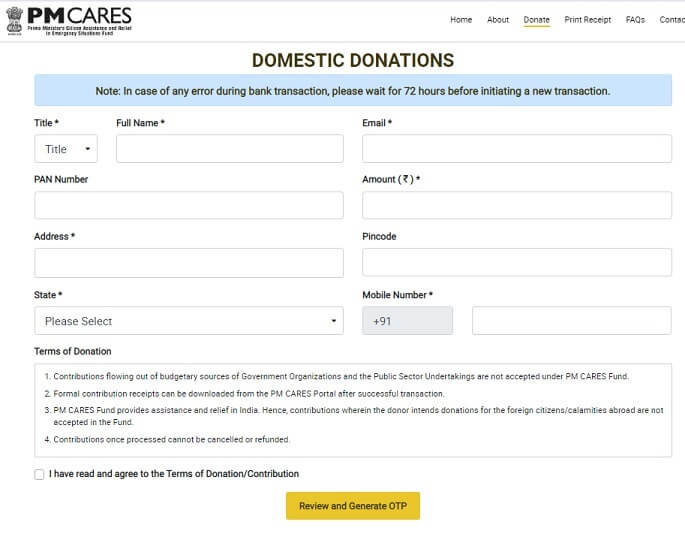

Below is a step-by-step guide to making a contribution to the pm cares fund via the online payment method:

- Visit pmindia.gov.in

- Click on ‘Click Here For Donation Details’

- Either use the QR code generated, or click on ‘Click Here For Online Donation’

- Check the box and ‘proceed’

- Select ‘Donation’ in the payment category drop-down.

- The form appears, it asks for your PAN. mobile number, email id, Address as shown in the image below.

- Click Submit once filled

- OTP is sent to your mobile number

- Confirm your details in the Confirmation screen

- A list of payment options appears. Pick the one that’s suitable to you and ‘Click Here’ at the relevant option

- Debit Cards and Credit Cards

- Internet Banking

- UPI (BHIM, PhonePe, Amazon Pay, Google Pay, PayTM, Mobikwik, etc.)

- RTGS/NEFT

- Complete your payment.

- If successful you will get details. Note the Transaction order number(you need it to generate the receipt). It will be sent as SMS to your mobile phone too.

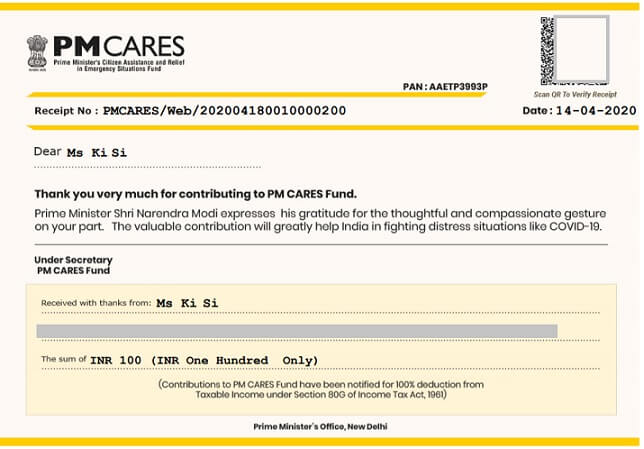

How to download the Receipt for donation to PM Cares fund

The donors can download formal donation receipts by visiting ‘Print Receipt’ Section of the PM CARES portal. The Receipt is shown in the image below.

If you have paid online at pmindia.gov.in then you can download it instantly.

If your transaction is done through NEFT/RTGS/IMPS, the transaction would be updated based on the statement received from the concerned banks. The receipts can be generated only after this. This might take at least 30days.

If your transaction is by Cheque the transaction would be updated from the bank to PM CARES. However, the payee details would be updated only if the cheque for PM CARES is presented in the same bank. If the cheque is presented in another bank, the payee details would not be updated by the bank. In such cases, the receipt can be obtained only by updating your Name, email ID, Amount etc. with cheque number and amount in the receipt generator module. The module will match the cheque number and amount and issue the receipt. This might take at least 30days.

If you have paid online at pmindia.gov.in hen you can download receipts instantly

- Visit pmindia.gov.in

- Click on ‘Click Here For Donation Details’

- Click on ‘Click Here For Online Donation’

- Click on Print Receipt

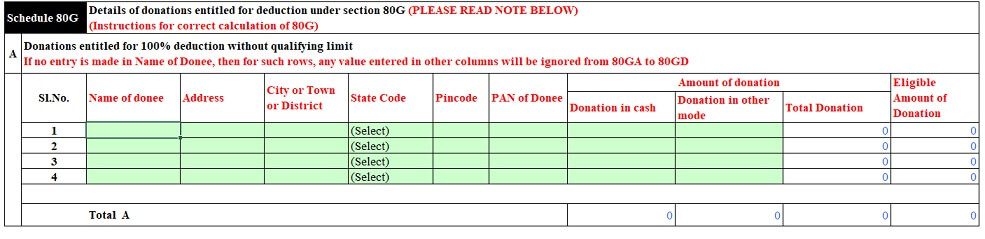

Claiming deductions under section 80G

Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G of the Income Tax Act. All donations, however, are not eligible for deductions under section 80G. Only donations made to prescribed funds qualify as a deduction. All donations do not get 100% deduction. % of deduction varies based on the organization to which donation is made. Ex

From Financial Year 2017-18 onwards: Any donations made in cash exceeding Rs 2,000 will not be allowed as deduction. The donations above Rs 2,000 should be made in any mode other than cash to qualify as a deduction under section 80G.

While Filing ITR, any ITR, you need to enter the following details in 80G in ITR as shown in the image below

Technically a donor is someone who is giving the gift and a donee the person receiving the gift. PM CARES Fund has been allotted a Permanent Account Number (PAN) AAETP3993P. If you have contributed to Chief Minister Relief fund then you need to get its PAN.

Donations made to the State governments Chief Ministers Relief Fund

You can also make donation to State Govt Chief Minister Relief funds. Donation to Chief Minister Relief Fund is also exempted under section 80G of Income tax Act to the tune of 100%. But for companies who are donating, note that Donations made to the state governments’ initiatives such as the Chief Minister’s Funds do not qualify for the CSR obligation.

Examples of few Chief Minister Relief Funds are given below

West Bengal State Emergency Relief Fund: The West Bengal Government appeals ALL to contribute in West Bengal State Emergency Relief Fund and assist the State in prevention and control of situation arising out of unforeseen emergencies like COVID-19 (CORONA). Contribution to this fund entitles you to claim 100% deduction under section 80G of the Income Tax Act.

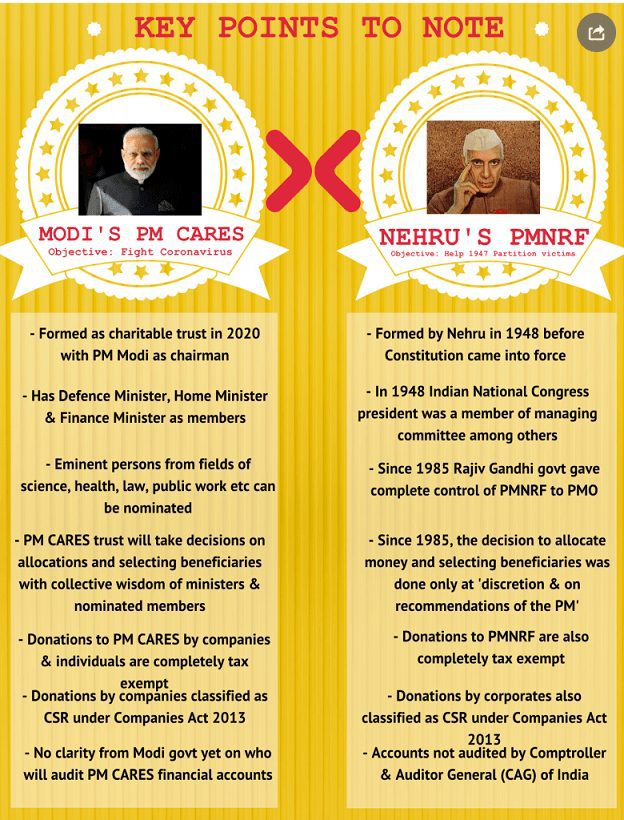

Difference between PM Cares and Prime Minister National Relief Fund

There exists a Prime Minister National Relief Fund. Following the creation of the fund opposition members raised a lot of queries as to why a separate fund was needed, when it was registered, under which act and why it did not contain any members of civil society or opposition as part of the trust. Supreme Court of India dismissed a PIL(Public Interest Litigation) filed by Manohar Lal Sharma for questioning the legality of the constitution of PM CARES Fund for COVID-19 by saying the petition as misconceived.

PM Cares and PM National Relief Fund are similar in spirit, slightly varying in mandate but is visibly different in both their setups.

The PMNRF was established in 1948 and caters to emergencies, calamities and to emerging medical expenses. The PM Cares goes a step further, and caters to research, infrastructure and to the pharmaceutical and healthcare sector.

While the PMNRF has a setup that includes the prime minister and finance minister, the president of the Indian National Congress, a representative of industry and commerce and that of the Tata Trustees; the PM Cares keeps the setup to the prime minister, and the ministers of finance, defence and home affairs. Both funds have provisions to nominate more trustees, although the PM Cares fund specifically mentions the nomination of three experts in various fields.

The PM CARES Fund will get the same tax treatment as available to the Prime Minister National Relief Fund.

The image below shows the difference between the two funds Ref: Business Standard

Related Articles:

Understand Income Tax: What is Income Tax,TDS, Form 16, Challan 280

- Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21

- Salary and perks of Indian MP, MLA and Prime Minister

- President of India and Rashtrapati Bhavan

- PM Narendra Modi Investments, Assets

Donate One Day Salary To PM Cares Fund Till March 2021 To Help Fight COVID-19: Finance Ministry Tells Staff.

Did you donate for Covid-19? To whom did you donate?