Retired People, eligible for Government Pensions , have to produce Life Certificate document in Bank in the month of November where their Pension Account is. This article talks about what is Pensioner’s Life Certificate? Who gets Pension? and about Jeevan Pramaan an Aadhar based Digital Life Certificate for Pensioners.

Table of Contents

What is Pensioner’s Life Certificate?

The pensioner is required to furnish a Life Certificate / Non – Employment Certificate or Employment Certificate to the bank in the prescribed format in the month of November every year to ensure continued receipt of pension without interruption. The pensioner can also present himself / herself at any branch of the pension paying bank for being identified for issue of life certificate. The intention of producing this life certificate is the annual identification infront of PDA. In case a pensioner is unable to obtain a Life Certificate on account of serious illness , bank official will visit his residence / hospital for the purpose of obtaining the life certificate. An excerpt of Life Certificate form is shown below. You can download Life Certificate Form from here.

Alternatively a pensioner having Aadhar number can submit Jeevan Pramaan, a digital life certificate introduced by the Government of India.

Who gets Pension?

The Central government discontinued the pension scheme for all employees that are recruited from/after January 1, 2004. They all have to contribute to NPS( new pension systems) , a defined contribution pension system, where one has to deposit a certain amount every month till retirement.

A Govt. servant appointed in a pensionable establishment on or before 31.12.2003 and retired from Government service with a qualifying service of 10 years or more is eligible for pension (Rule 2, 49). From 1.1.2006, pension is calculated @ 50% of emoluments (last pay) or average emoluments (for last 10 months), whichever is more beneficial to the retiring Govt. servant. (Rule 49).

To get pension, the retiring employee has to start the process at least 6 months prior to retirement. In the process

- the employee has to open account with any branch where pension can be credited, if required with spouse (which is permitted now) and has to provide the account number to the Department from which he/she retires.

- He/she has to fill up the account details in the pension papers. While opening account the retiree has to give his/her PAN number, mobile number and email_id (if available).PAN No. will enable correct accounting of the Pensioner’s TDS.

- On receiving the PPO or Pension Payment Order the prospective pensioner has to approach the branch where from the pension is to be availed.

- He/she has to submit undertaking and Life Certificate.

- On receiving the required documents from the prospective pensioner, the documents will be sent to concern CPPC for further processing at their end.

- After completion of data entry at CPPC, pension shall be credited to the identified account within a period of 3-4 days.

- Pension is taxable and for Income Tax it comes under the head Income From Salary.

A pensioner having Aadhar number can alternatively submit Jeevan Pramaan, a digital life certificate introduced by the Government of India.

What is Jeevan Pramaan?

Jeevan Pramaan is Aadhar based Digital Life Certificate for Pensioners. It was launched by Prime Minister Narendra Modi on 10 November 2014. Jeevan Pramaan does away with the requirement of a pensioner having to submit a physical Life Certificate in November each year, in order to ensure continuity of pension being credited into their account. Jeevan Praman has been developed by the Department of Electronics and IT, Government of India.

For obtaining Jeevan Praman, he will have to enrol and biometrically authenticate himself by going to Service centers or downloading the application generating digital life certificate from the website Jeevanpramaan.gov.in. Pension paying branches will be able to obtain information about the digital life certificate of their pensioner customers by logging on to the website of Jeevan Pramaan and s downloading through their Core Banking Systems. Pensioners will also be able to forward to their bank branches by email / sms the relative link to their digital life certificate.

Jeevan Pramaan or Digital Life Certificate

What is Digital Jeevan Pramaan/ Life Certificate?

This is computer Generated electronic life certificate for pensioner. Jeevan Pramaan Certificate is produced for individual pensioner using his Biometric Credentials. Aadhaar number is necessary for Digital Life Certificate. You can Contact Aadhaar Enrolment Centre in your city for getting Aadhaar Number.

How is this different from traditional Jeevan Pramaan Certificate?

For this certificate individual pensioner has not to present himself/ herself in front of seniors Authorised Officers. This can be generated even from home. For that you need a internet connection and Biometric devices which can scan finger or iris(eye).

Is Electronic Jeevan Pramaan is must for a pensioner?

No, this facility has been given to get hassle free Life Certificate. The conventional life certificates also valid.

How many times individual has to register in a year?

Individual has to register once and later he can generate JeevanPramaan using Biometric authentication.

What is the Address for Jeevan Pramaan?

Access Jeevan Pramaan web site by using Jeevanpramaan.gov.in

Phone: (91)-0120-3076200

Mail:jeevanpramaan@gov.in

Are pensioners getting Jeevan Pramaan?

No. As per the Govt. report

A reference is invited to this office O.M.CPAO/Tech/Jeevan Pramaan/2014-15/218-259 dated 20/03/2015 (Copy enclosed) on the above mentioned subject whereby all the banks were advised to seed the pensioners’ Aadhaar numbers with their PPO and bank accounts so that online biometric authentication system of submission of life certificate Jeevan Pramaan may be implemented successfully. This task was to be completed before November, 2015. However, status report of the quarter ending December, 2015 reveals that only 44.54% of pension accounts were seeded which slightly increased during january & February 2016. As on 04.03.2016 48.80% of total pension accounts have been seeded which is much below the target of hundred percent seeding.

How to get Jeevan Pramaan certificate?

Digital Life Certificate which is electronic and recognised under the IT Act. The system frees the pensioner from having to go before the Pension disbursing Authority to prove that he is alive.

Getting a digital Life certificate is hassle free and can be obtained through

- various Jeevan Pramaan Centres which are being operated by CSCs, Banks, Government offices or

- by using the client application on any PC/mobile/tablet. You need biometric device for this

Registration for Jeevan Pramaan through Citizen Service Centre

How can I create Jeevan Pramaan if I do not have internet?

Any Pensioner having pension account in any Bank can go to CSC for certificate. Go to nearest Citizen Service Centre (CSC) or designated Offices / bank branches available on the website of Jeevan Pramaan.

What is required for registration on Jeevan Pramaan?

Pensioner needs to know following. Pensioner need to get his Aadhaar number updated in his Bank Account and Bank Pension Database by giving the PPO Number and Bank Account Number before the registration.

- Aadhaar Number,

- PPO(Pension Payment Order) Number,

- Bank Account number and branch detail,

- Name, Address etc.

How can I find the CSCs / Designated Offices / bank branches?

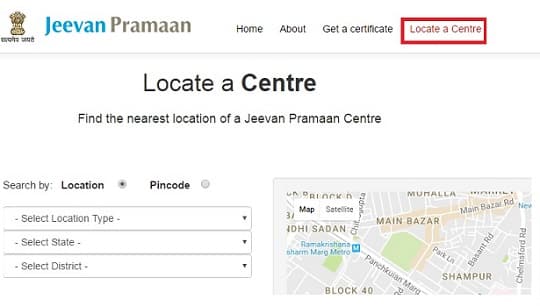

- Access Jeevan Pramaan web site by using Jeevanpramaan.gov.in in the browser and find the Centre using “Locate A Centre” option as shown in image below.

- You can send SMS to 7738299899, the SMS body must start with keyword “JPL” and after space write you pin code e.g. SMS JPL 110003 to 7738299899.

The Portal Reply message will have list all Centre’s where you can visit for Jeevan Pramaan.

Registration for Jeevan Pramaan by downloading the Application

Is it necessary that Pension need to be in India for JeevanPramaan?

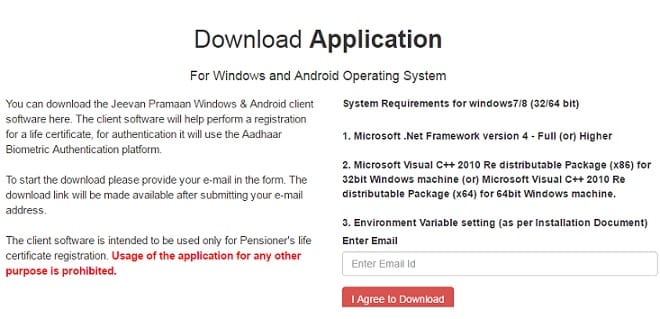

No, Individual can use Android / Windows PC based application available at Jeevan Pramaan portal and may register from any location.

Is the downloading of application free?

Yes. You need Windows 7 and above(32 and 64 bit) or Android 4.0.

You can download the application from Download link in the JeevanPramaan website.

What are the biometric devices supported?

You need a device for scanning your finger or your eye(iris) i.e. biometric. Mantra, Morpho, SecuGen finger print scanner and Iris scanner may be used.

How does registration processes for Jeevan Pramaan by downloading application works?

Pensioner’s information like Pension Aadhaar number, Pensioner Name, PPO Number, Bank Account detail, Address, Mobile number etc are fed into the system though web based / client interface. Pensioners person information are authenticated using the Aadhaar number and pensioner has to put his finger on to the finger print scanner or eye on the Iris scanner.

After successful authentication, transaction number is displayed on the screen and same has to be sent to Pensioner’s mobile as SMS from the portal. The portal generates Electronic Jeevan Pramaan for the successfully authenticated pensioner and it is stored in the central portal database.

Aadhaar number is mandatory and the same is required to be updated in the bank account and Pension Account by the pensioner, before the generation of Aadhaar Based Digital Life Certificate.

After registration for Jeevan Pramaan what does one have to do?

Pensioner has to inform to the Bank that his Jeevan Pramaan has been generated through online registration from Jeevan Pramaan portal. Bank validate the details updated in our bank records like Aadhaar Number of Pensioner, Bank A/c number, PPO number and Date of Birth and if the details matches with our bank records, the same is updated in the bank records.

Following YouTube video shows the process of registering for Jeevan Pramaan and generating Life Certificate

Related Articles:

- Senior Citizen and How to invest Retirement money

- Senior Citizen,Fixed Deposits and Tax

- SCSS or Senior Citizen Savings Scheme

- Income and Tax for Senior Citizen

- Senior Citizen Term Deposits – Features, Benefits & Rates

- How to Fill Form 15G? How to Fill Form 15H?

Have you registered for Jeevan Pramaan Life Certificate? How was the process? Do you think one should register for Jeevan Pramaan Life Certificate or process of going to bank to submit Life Certificate is okay?

12 responses to “Pensioner’s Life Certificate and Jeevan Pramaan Certificate”

What should be the type of pension on the Jeevan Pramaan app? As a KV teacher, should I select Service or Others? It’s confusing

My mother received family pension after my father had passed away 1 year back. Now when we went to do the Digital life certificate, Jeevan Pramaan at a center , we received a SMS after some days saying your Jeevan Pramaan has failed, contact Bank. United Bank of India. Bank says they are not sure how it happened. When referred to EPF office, Howrah they checked and said the Date of Birth in Aadhar and PPO mismatches, so go and change it in Aadhar as PPO date of birth cannot be changed for family member as well.

Now the issue is we dont have any document that matches the date of birth in the PPO (faulty) to get that updated in Aadhar.

U can use ppo certificate as documental proof of ur mother’s dob,for changing dob in aadhaar.it may work.i did same for my mother.

In my Digital Life Certificate, PPO No. mentioned is wrong and so is rejected by Pension disbursing authority.How can it be corrected as nowhere this procedure is given causing deadlock for paying family pension amount.Visits to EPF office have not been fruitful and bank is not concerned , resulting in non payment of pension.

Sad to hear that.

You can raise grievance at epf website. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

You can raise the issue with social media channels of EPFO twitter.com/socialepfo facebook.com/socialepfo

Pensioner is entitled for compensation for delayed credit of pension/arrears thereof at the fixed rate of 8% per annum (since October 1, 2008) and the same would be credited to the pensioner’s account automatically by the bank on the same day when the bank affords delayed credit of such pension / arrears etc. without any claim from the pensioner.

Which authority the pensioner should approach for redressal of his/ her grievances?

Branch/CPPC is the point of referral for the pensioner. Pensioners can approach the nodal officer(s) designated by the respective banks who would be holding regular meetings at different locations in their jurisdiction on lines of Pension Adalat. They can also contact the bank through toll free dedicated pension line of the respective bank to seek information related to their queries/complaints. In case of deficiency in service offered by the bank, pensioner can approach the concerned Consumer Education and Protection Cell at respective Regional Office of RBI and Banking Ombudsman under whose jurisdiction the bank branch, where the pensioner holds the account, falls.

If it applies to you. There is a Grievance Cell in CPAO which can be contacted by dialing a Toll Free number 1800117788.Presently, ten Toll free telephone lines are operational. The telephone lines are open from 10 am to 5 pm on all working days except during lunch break. The pensioner can register their grievances/problems on web site of CPAO through http://www.cpao.nic.in.The Grievance Cell also receives grievances through emails, fax, letters, or physical presence of pensioners in CPAO. Our email addresses are cccpao@nic.in and ccpensions@nic.in for registering the grievances of pensioners. On successful registration and disposal of grievances, pensioners are sent SMS wherever their mobile numbers are available in CPAO database.

Last year I registered my digital life certificate from my paying bank. This is they collected Life Certificate in their form only. whether it is enough or

I have to register every year ? If yes means how ? Please clarify.

Do you mean Jeevan Pramaan/Digital Life Certificate (DLC)?

Jeevan Pramaan is a biometric enabled Aadhaar-based Digital Life Certificate for pensioners. Jeevan Pramaan i.e DLC is generated for individual pensioner using his/her Aadhaar number and Biometrics.

Mera life cetificate create ho chuka hai phir v pension naha aa raha hai kya kare?

Aapko pension kahen se aani thi?

Kab se pension nahin mil rahi hai?

If I am out of India can I furnish Jeevan praman certificate afterwards & how?

Dear Sir/Madam bank details me marudhra gramin bank nahi he kese jeevan pramaan banana iska solution kijiye jaldi se jaldi marudhra gramin bank update kijiye

Thanking u sir/madam

Dinesh Kumaar Soni

9772339686

Can I send such generated life certificate to the home branch of pension account?

If it’s sent by speed post will the bank authority update the status?