The buyer of an immovable property, valued at Rs 50 lakh or more, is required to pay TDS to the government. This article explains what is TDS on property, who pays it, how it is paid. Since when was the rule introduced? How to interpret limit of 50 lakh in case of EMI instalments, multiple buyers, multiple sellers. How TDS is reflected in Form 26AS? Downloading Form 16B?

Table of Contents

TDS on Property

TDS is a certain percentage deducted at the time of payments of various kind such as salary, commission, rent, interest on dividends etc and deducted amount is remitted to the Government account. This withheld amount can be adjusted against tax due. The person/organization deducting the tax is called as Deductor while the person from whom the tax is deducted is called Deductee.

When was the rule for payment on TDS on property introduced and why?

From 1st June 2013 the rule was introduced for compulsory tax deduction( TDS or withholding tax) by a buyer of an immovable property (other than agricultural land) valuing Rs. 50 lakh or more. This rule also covers the property purchased through home loan. It also has to paid when the buyer buys an under construction and part payment is done. TDS is deducted on Fixed Deposits,Salary etc. To know more about TDS or Tax Deducted at Source one can read our article Basics of Tax Deducted at Source or TDS

It comes under the Sec 194 IA, the Income Tax Act 1961. Section 194-IA is applicable to all including relatives, minor, senior citizens etc. However, if transfer is a gift, then one does not have to pay TDS. The main objective for introducing this rule is to track all the high value real estate transactions which were not being registered. Tax so deducted should be deposited to the Government Account online through any of the authorized bank branches using the e-Tax payment option available at NSDL.

If property is bought from Non-Resident Indian (NRI) then section 194-IA will not be applicable but section 195 will come into action. For NRI the limit of Rs 50 lakh is not applicable. If property is bought from NRI, TDS is required to be deducted at the rate of 20% plus Education Cess on the sale amount. Surcharge at the rate of 10% will be applicable if amount paid exceeds Rs 1 crore.

Does TDS on property has anything to do with resultant capital gains?

This deduction has nothing to do with the capital gains for the seller.

Who pays TDS?

Buyer has to pay the TDS. Whether the seller is a builder or a flat owner making a subsequent sale this tax would have to be paid.

How the TDS would be paid if I buy the property taking loan from a bank or housing finance company?

In such case you need to request the bank/finance company to pay the seller the loan amount net of TDS. You then pay the TDS to the government, and claim reimbursement of the TDS from the bank/finance company.

What are rules of TDS on property regarding joint purchasers or joint sellers?

Value of property should be more than 50 lakhs for TDS deduction. Threshold limit of Rs 50 lakh (50,00,000) is value of property, not for the number of instalments, the number of buyers or sellers does not matter at all. The value of property is what is specified in the transfer documents, and is not on the basis of a notional fair market value, such as a stamp duty valuation, even though such valuation may be higher. The property value will include payments to be made to the seller such as legal fees,payment for parking spaces etc.

If one is paying instalment or EMI of say Rs 50 thousand a month but property value is 90 lakh then as the property value is more than 50 lakh though EMI is less than 50 lakh the TDS would be required to be deducted for each instalment.

Same is the case for multiple buyers or sellers. If Ram,Shyam sell the jointly owned property of Rs 60 lakh, the selling price for each is 30 lakh. So though individual selling price is less than Rs 50 lakh but the sum value of the transaction exceeds Rs 50 lakh. Thus section 194-IA is applicable and buyer would have to deduct TDS.

What is the Rate of TDS on Property ?

The rate at which the buyer needs to deduct tax is 1% and it may go up to as high as 20% if the seller does not disclose his PAN. If the property purchased is for Rs. 70 Lakhs then one needs to pay tax on full amount i.e 70 lakh not only on amount more than 50 lakh i.e. Rs. 20 Lakhs. In this example if buyer knows PAN of seller then buyer would need to submit TDS @1% of 70 lakh i.e 7 lakh. Note unlike the Self assessment Tax ,No surcharge and education cess is applicable while deducting tax on sale of property.

TDS would depend on actual cost or stamp duty valuation?

The applicability of TDS is only to the actual consideration specified in the transfer documents, and is not on the basis of a notional fair market value, such as a stamp duty valuation, even though such valuation may be higher.

Does the actual consideration include any other payments other than the property valuation?

Yes. The consideration would include various payments required to be made to the seller, such as legal fees, contribution towards shares,payment for parking spaces etc.

Would Stamp duty, Registration Fees or Transfer Fees be subjected to TDS?

No. Stamp duty, registration fees or transfer fees which are to borne by the purchaser would not be regarded as payments being made to the seller as consideration and hence would not be subjected to TDS.

Will TDS be applicable in case of purchase of agricultural land?

No. The TDS on property does not apply to purchase of agricultural land Definition of agricultural land is as follows :

- It is situated within jurisdiction of Municipality or Cantonment Board which has a population of not less than 10,000 or

- It is situated in any area within below given distance measured aerially:

| Population of the Municipality | Distance from Municipal limit or Cantonment Board |

|---|---|

| More than 10,000 but does not exceed 1,00,000 | Within 2 kms |

| More than 1,00,000 but does not exceed 10,00,000 | Within 6 kms |

| Exceeding 10,00,000 | Within 8 kms |

What if buyer does not pay TDS?

If TDS is not paid then interest and penalty would be imposed on the buyer. Interest will be charged at the rate of 1% per month or part of the month if one does not deduct tax or deducts less tax from the day tax was supposed to be deducted to the day tax was actually paid. The tax deducted has to be paid within seven days from the end of the month of deduction. Interest will be charged @ 1.5% p.m or part of the month for tax deducted but not paid to the government from the date of deduction till the date of actual payment.

Process to Pay TDS on property

How does the Buyer deposit the TDS to Government?

TDS on Property is to be done online . The tax should be deposited through challan-cum-statement using Form No.26QB. Form No 16B (TDS Certificate) will be issued by the buyer/deductor within fifteen days from the due date of depositing tax. Overview of steps are as follows. These are explained below.

- Provide Information regarding the transaction of property online at TIN website at https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp. The online form available on the TIN website for providing information on TDS on property is called Form 26QB

- Pay TDS : After successfully providing details of transaction, nine digit alpha numeric Acknowledgement number would be generated. The buyer or deductor now can:

- Either pay TDS online immediately through net banking OR

- Pay TDS within 10 days through net-banking or by visiting any of the authorized Bank branches.

- On successful payment a challan counterfoil will be displayed containing Challan Identification Number CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made.

- Generate Form 16B. Form 16B is the TDS certificate issued by the Buyer to the Seller. Buyers are advised to save the Acknowledgement Number for downloading the Form 16B from TRACES website. Usually TDS certificate is available for download from the TRACES website after at least 2 days of deposit of tax amount at the Bank. For buyer TDS paid gets reflected in Form 26AS,usually after 7 days, Check in Part F of the Form 26 AS under Details of Tax Deducted at Source on Sale of Immoveable Property u/s 194(IA)

How is Form 26QB to be filled for multiple buyers and sellers?

In case of multiple sellers, Form 26QB needs to be filed for each seller separately. Similarly, in case of multiple buyers, each needs to issue Form 26QB separately. Quoting from FAQ on NSDL site

How will transactions of joint parties (more than one buyer/seller) be filed in Form 26QB?

Online statement cum Challan Form/ Form 26QB is to be filled in by each buyer for unique buyer-seller combination for respective share. E.g. in case of one buyer and two sellers, two forms have to be filled in and for two buyers and two seller, four forms have to be filled in for respective property shares.

What information needs to be provided for paying TDS for property in Form 26QB?

Information that needs to be provided for paying TDS for property in Form 26QB is as follows:

- Buyer: Name , PAN number and Complete Address of buyer. Buyer is technically called Transferee.

- Seller : Name , PAN number and Complete Address of seller. Seller is technically called Transferor.

- Property: Address of the property,

- Transaction detail : Date of Agreement, Total Value of Consideration,Payment Type (In Lump Sum or instalment), TDS details.

Can one track the TDS? How does TDS show up in Form 26AS?

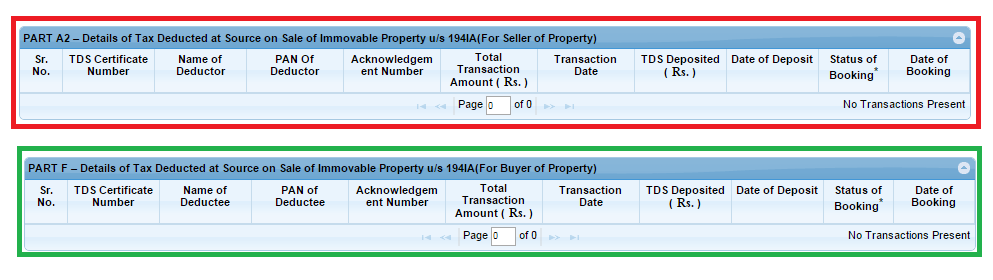

As you know Form 26AS tracks the tax paid to government, TDS on salary, advance, self assessment tax. So even TDS on Sale of property shows up in Form 26AS seven days after payment as shown im image below

- For Seller of property TDS is reflect in Part A2 under Details of Tax Deducted at Source on Sale of Immoveable Property u/s 194(IA) [For Seller of Property]

- For Buyer TDS is reflected in Part F under Details of Tax Deducted at Source on Sale of Immoveable Property u/s 194(IA) [For Buyer of Property].

Steps to pay TDS on property

Steps to pay TDS on property online with paying tax online are as follows:

- Go to NSDL-TIN website https://www.tin-nsdl.com

- Click on the option TDS on Sale of Property. It will open Form 26QB

- Fill the details as required in Form 26QB

- Then click on PROCEED button. PAN Details will be validiated.

- After validation of PAN, verify the details entered by you and click Confirm.

- After confirming, select the payment method

- If you paying immediate through netbanking, click the option for submitting it to the Bank and then login to the net-banking site with your user ID & password and enter the payment details.

- If you cannot pay online, an online receipt for Form 26QB with a unique Acknowledgment Number is generated which is valid for 10 days after generation. You can take this toone of the authorized banks along with your cheque. The bank will proceed with the online payment and generate your challan.

- On Successful payment, Challan will be generated containing Challan Identification Number (CIN) payment details and bank name through which e-payment has been made. The Challan is like a receipt, a proof of payment made.

- Buyer should check Form 26AS after 7 days. The TDS paid should be reflected there as discussed above.

- After few days, Buyer can download Form 16B from TRACES from the TRACES the website of Centralized Processing Cell of TDS (CPC-TDS) .Login to the TRACES website, and Click on DOWNLOADS tab. In the dropdown menu click on Requested Downloads. If no application has been made buyer will be asked to make a request for download, here fill in the Acknowledgment Number (Nine Digit Number) which is reflected on Form 26AS in Part F as mentioned above. Once this done, buyer will be able to view the status of his application, which generates an Application Request Number. Our article TDS, Form 26AS and TRACES explains TDS and Form 26AS in detail.

Within a couple of hours, the application gets processed and buyer will be able to view Form 16B by entering the request number which he has have obtained. He can take a printout of the same for his records as well as for handing over to the seller of the property. Download the .zip file. The password to open the .zip file is Date of Birth of Buyer/ Deductor (the format is DDMMYYYY). The form will be inside the .zip file as a pdf.

- Buyer will be responsible to give the certificate of TDS in Form 16B to the seller within 15 days from the due date of submission of the Challan and the seller thus will be able to claim the credit for such TDS against his tax liability.

Related Articles:

- On Selling a House,

- Capital Loss on Sale of House

- Basics of Tax Deducted at Source or TDS

- Income from House Property and Income Tax Return

- Joint Home Loan and Tax

- How to Calculate Capital gain on Sale of House?

48 responses to “Payment of TDS on Property”

I have just purchased a property few days back and have query around the “Total Value of Consideration (Property Value)” field that needs to be filled in the Form 26QB.

Here is my purchase scenario:

1. The property is part of the complex built and sold by a builder. So, builder is the original owner of the property. Herein called as Builder in further discussion below.

2. Builder sold the a flat (property into consideration) in the above mentioned complex to a person called as Seller. Seller purchased the flat few years back on construction linked plan in 70 lacs. He has paid 60 lacs to the builder as of now and 10 lacs is still pending.

3. I am the buyer of the property and I have bought the property in the same price as Seller bought from builder few years back. So, I paid 60 lacs to the Seller and 10 lac is to be paid to the builder when the builder demands the same (in next few months).

Now, as I have paid 60 lac to the seller, I need to pay 60 thousand as TDS against the PAN number of the seller. Also when I pay the remaining 10 lac to the Builder, I will have to pay 10 thousand as TDS against the PAN number of the builder.

I understand that I will have to fill the TDS form twice – once for seller’s TDS and second time for builder’s TDS. But what is the value that I need to fill in “Total Value of Consideration (Property Value)”?

I can think of two ways:

1. Fill the “Total Value of Consideration (Property Value)” as 70 lac and select installment option. In first installment, I enter seller’s PAN. In second installment, I enter Builder’s Pan.

2. I the first TDS form, I enter the “Total Value of Consideration (Property Value)” as 60 lac and enter the PAN of Seller. In the second TDS form, I enter “Total Value of Consideration (Property Value)” as 10 lac and enter the PAN of builder.

Which of the above ways is correct?

Hi, I am purchasing a flat (under construction). Flat cost is 55L and Registration is doing on government rate so price is ~30L. There is 1% TDS when property price is more than 50L .

Can u please let me know I need to pay 1% TDS or not ?

Please replay soon.

Thanks

Hi, I am purchasing a flat (under construction). Flat cost is 55L and Registration is doing on government rate so price is ~30L. There is 1% TDS when property price is more than 50L .

Can u please let me know I need to pay 1% TDS or not ?

Please replay soon.

Tanks

I am about to purchase a property and wanted some clarity. Property is being purchased along with my mother. All funding is coming from my Mother’s account in leiu of another property that got sold in her name as we would want to save on tax on capital gain. Complete property amount, stamp duty is paid by her. On sale deed my mother and I would be buyers. My name is there more as a joint owner but I will not be paying anything from my account. Payment is being done in lumsum with no home loans from either side . Seller is single individual. My queries :

1) For 1% TDS, should my mother be paying complete amount via form 26qb since she is funding entire purchase?

2) Do I need to file form 26QB? What I understood from discussion is that TDS is payed based on proportionate ownership. Since I have not contributed anything, I don’t have to file 25QB. Is that correct?

3) while filling form 26QB, with my mother’s PAN, do I have to mention more than 1 buyer?

My lawyer and CA said that since my mother is funding the entire amount, she should only file 26qb for entire 1% amount and I need not file it. My name can however be in Sale deed even if I have not contributed anything. Even in 26qb form, I can mention as only single buyer as she is paying entire 1% and funding the entire purchase. Is this correct approach?

I have one query, hope you can help

One of our client dealing with property sales has raised an issue, The TDS deducted & paid by the buyer at the time of sale is not reflecting in his 26 AS.

He already submitted payment counterfoils of Form 26QB as the proof of deduction to us, i already checked the given details in counterfoil like PAN no, Section Etc & every thing seems to be fine.

From my understanding the moment buyer make the payment in Form 26QB it would appear in Seller’s 26 AS.

Please also note that he hasn’t received any 16 B from Buyers, but as per my understanding it has nothing to do with TDS appearing in 26 AS.

Any help you can render, will be great.

My case is somewhat similar to Jijesh’s case. I have already paid 3 installments but without TDS; now I want to clear all previous TDS, so the question is; Can I make one payment for all the pending TDS or do I have file it seperately as per the installments paid earlier ? Do I have to first pay for delay fine + interest and then file TDS or both can be paid same time ? And how will I know the total penalty amount i.e 200 per day and 1.5% interest per month ?

Experts, Please advise.

Hi,

I hold nri status, I have brought under construstion apartment for less than 50 lakh. Do I need to pay TDS? and who can issue me TDS certificate ?

Dear Bemoneyware,

I purchased a property for 52 lakhs and as per government rules, a property above 50 lakhs is eligible for TDS. The question which is intruding me and seller is who has to pay the TDS, buyer or seller? In the FAQ’s, you have posted like buyer has to pay the TDS and in one of the replies I see like seller has to pay the TDS, this is little bit contradicting. Can you please elaborate like finally who has to bear the TDS expenses. Please provide a clarification on this.

The buyer of an immovable property, valued at Rs 50 lakh or more, is required to pay TDS to the government. Seller has to claim this TDS while filing ITR

I see this response to one query ” It is 1% of the value you are registering the property for. It is not the buyer but the seller should pay this. But it is the buyer’s responsibility to deduct 1% from the sale consideration amount payable to the seller and deposit this amount as TDS. For example if you are registering the property for 60 lakhs, you need to deduct 60,000 from the amount payable to the seller and deposit this amount with income tax as TDS. Pay the balance amount of Rs.59.40 lakhs to the seller.”

So, on similar line, I need to deduct the TDS amount and pay the balance to seller.Please let me know.

I am a bit confused whether to pay TDS. according to govt guidance value my flat cost is 51lakhs. But I purchased it at 45lkhs. Do I need to pay the TDS as the govt value is more than 50lkhs?

Short ans: It is 1% of the value you are registering the property for. It is not the buyer but the seller should pay this. But it is the buyer’s responsibility to deduct 1% from the sale consideration amount payable to the seller and deposit this amount as TDS. For example if you are registering the property for 60 lakhs, you need to deduct 60,000 from the amount payable to the seller and deposit this amount with income tax as TDS. Pay the balance amount of Rs.59.40 lakhs to the seller.

Guidance value is nothing but a price of the property as per local Government.The guidance value is a benchmark rate, below which the property can’t be registered and even if it is registered, the department can recover the amount and also levy penalty for undervaluation of property.

When you buy a property, you have to pay a stamp duty on the property value to get documents registered in your name. The property value is either the actual purchasing price or the circle rate, whichever is higher. To put a check on involvement of black money in property transactions, state governments keep revising circle rates to keep them in line with market values. However, due to subdued real estate market in certain areas of many cities in the past few years, circle rates have gone higher than the prevailing market values.

Higher circle rate is a problem for buyers and sellers. The buyer has to pay stamp duty on the higher amount, and the seller has to calculate capital gain based on the stamp value of the property. As per section 50C of the income-tax Act, while computing capital gain arising on transfer of property, if the actual sale consideration is lesser than the stamp duty value, then the stamp duty value is taken as the deemed selling price and capital gain will be computed accordingly. Say, a person sells her property for Rs.60 lakh and the indexed cost of acquisition is Rs.35 lakh. Her capital gain would be Rs.25 lakh (Rs.60 lakh minus Rs.35 lakh). But if according to the circle rate the property rate is determined as Rs.70 lakh, capital gain would be Rs.35 lakh (Rs.70 lakh minus Rs.35 lakh). The higher capital gain will mean more capital gains tax for her.

When Circle rate is more than Market Value.2 question arises

(a) How much value should one declare in Sale Deed?

(b) On what value should one pay Stamp Duty and Registration Charges?

buyer has broadly 3 options to select from. Now applicability of an option vary from case to case to basis. Also, the rules vary from state to state.

(i) Option A: Declare Market Value equals to Circle Rate

(ii) Option B: Declare actual Market Value in Sale Deed and Pay Stamp Duty & Registration Charges at Circle Rate. Some states like Maharashtra allow registration at a lower market value than Ready Reckoner Rate or Circle Rate. The rule is that Stamp Duty and Registration Charges should be paid on higher of two values i.e. Market Value or Circle Rate. In Maharashtra, Circle Rate is known as Ready Reckoner Rate.

(iii) Option C: Appeal to Sub-Registrar to charge Stamp Duty and Registration Charges at Market Value

Hardly anyone exercises this option due to delays and perceived hassles. Depending on the local state stamp act, at the time of registration you have the option to keep the registration of Sale Deed pending if you don’t agree with circle rate. In short, if circle rate is more than market value then you can exercise an option that you are not willing to pay stamp duty and registration charges as decided by the Sub Registrar.

Hi Bemoneyaware,

Thanks for quick reply, but still I didn’t get exact ans for my question. As per government rule I paid registration fees on circle value/guidance value of the property, but in the sales deed the actual purchasing price mentioned is less than 50lakhs. Now the builder/ seller is not going to pay me TDS 1% and so I am. So as in sales deed the price of flat mentioned less than 50lakhs, do I still need to pay TDS ?

Dear Sir, We entered into an agreement with a builder to purchase a row house in Nov 2014 for total amount of 1 crore. 20% of down payment made at the time of agreement and subsequently instalments paid till date disbursed by my bank as part of home loan till date to the extent of 90 lakhs. I was not aware of TDS to be deducted at 1% on each payment and in addition no reference of this was mentioned either in the agreement or periodical demand notes from the builder. Recently one of the other property owners brought this up for discussion after which the builder sent a note to all property owners asking them to Pay the TDS and to adjust this in the final instalment. On asking on the penalty applicable the builder’s CA said that it’s not the responsibility of the builder to request in any form to deduct TDS. I disagree to this and wanted to ask you if we have to bear the penalty completely in this case not knowing that TDS had to be deducted right from the first payment. I have seen demand notes from a few builders clearly mentioning buyers to deduct TDS before remitting the instalments. In my case we were completely unaware till recently that such thing had to be done. Please advise if builder is in no way responsible to make buyers aware of any such obligation to deduct TDS and an I completely eligible to bear the huge penalty for back dating the TDS payments

Thanks in advance

Lakshmi

I had jointly purchased a flat in 2015 with my wife and mother. So there are three buyers and one seller in this transaction. However, I filled only one Form 26QB and paid the entire 1% TDS using my PAN details. My mother has now received notice from IT for filling Form 26QB. How should I proceed?

I am planning to purchase a under construction Property of agreement value 8160000/-. Out of which a loan of 750000/- has been sanctioned. Kindly advice whether the TDS of 1% has to be paid as per demand letter part payment or i can pay the full TDS amount at one go.

Disbursement means payment. It refers to the release of loan amount to borrower by lender. Usually, banks disburse the loan amount once all the submitted documents have been verified and the down payments have been paid. A loan is always disbursed by cheque, which can be credited into a loan account with the bank; it is never given by cash.

A loan can be disbursed in different ways, depending on your arrangement with the bank and its policies:

Full disbursement: A full disbursement means the entire amount is paid in one go. The bank hands over entire payment to seller on your behalf.

Partial disbursement: A partial disbursement means that the payment is made in stages. If you are buying an under construction property, then the bank will disburse payments as the construction progresses. For example, after completion of first floor, 20% of the payment will be made and so on.

TDS is deducted at the time of payment or at the time of giving credit to the seller, whichever is earlier.

This TDS has to be deposited along with Form 26QB within 7 days from the end of the month in which TDS was deducted.

Hi, I have bought a property with total consideration of Rs. 53 lakhs (which includes 33.9 lakhs for sales agreement and 19.1 lakhs for construction agreement). And the property has been registered with registrar office for 33.9 lakhs based on guidance value. I have paid stamp duty and registration fees based on this 33.9 lakhs only.

Now the builder is saying that I will not have to pay this TDS @ 1% as I have property registered for only 33.9 lakhs only (i.e. less than 50 lakhs). Is it correct?? Do we need to pay this TDS based on total consideration amount of 53 lakhs or nee not pay because my property is registered with registrar office for only 33.9 lakhs. Kindly help at the earliest.

Builder is right you have to use the value on the registered agreement.

But do clarify with a lawyer.

There are joint seller (2).Tds payment through online happened to one Pan because Process not asked second pan ( but I had mentioned 2 seller in earlier steps of process)

Please guide for cancellation of this payment or how I can add second pan fot this TDs payment sharing

How will transactions of joint parties (more than one buyer/seller) be filed in Form 26QB?

Online statement cum Challan Form/ Form 26QB is to be filled in by each buyer for unique buyer-seller combination for respective share. E.g. in case of one buyer and two sellers, two forms have to be filled in and for two buyers and two seller, four forms have to be filled in for respective property shares.

In case of any further queries/concerns please contact TIN Call Center at 020-27218080 or email at tininfo@nsdl.co.in

How much refund I have got on 9 lakh TDS under 194B

Hello,

I sold my property (apartment) in Jun2013 for more than 50L. However, due to not complete clarification on the rule at that time, my we did not pay the TDS. I invested the entire amount in buying another property (apartment) for 90L.

Now me and purchaser both have received Income tax notices for not paying TDS. Do I need to pay 1% now with interest? This doesn’t make sense to me now, as I will have to claim it back due to investment in another property. What is the best way out of this?

Thanks,

Vinay

Hi,

I have received mail from CPC (TDS) for 26QB Statement not yet filed for purchase of property during FY2013-14. I wanted below clarification.

I had purchased my flat with agreement for sales dated 28th May2013 with the builder. I had paid 70% to the builder before the agreement in the month of April and May2013 without deducting the TDS as the payment and agreement was made before 1st June2013. Balance 30% payment was through bank loan which was paid by bank directly to builder without deducting TDS in the month on June2013. .

As the agreement and transaction was completed before 31st May2013, I would request you to confirm if I am liable to pay any TDS on the purchased property because as per received mail, “all such transactions with effect from June 1, 2013, Tax @ 1% should be deducted by the purchaser”

HI Suraj,

I have a similar situation , I made all the payment to the builder from my side before 31st May 2013 and the agreement happened on 31st May 2013 . After that Bank paid the rest . I was not aware of the rules as it was introduced at that time ,so neither I deducted the TDS nor I asked the bank to deduct . Can you please tell how did you proceed with yours .

Hello,

I bought a flat where the agreement value was 53 lakhs but I was not aware of the TDS and I didnt deduct the TDS from the payment made to the seller. After one year I got a email from TDS department that I need to fill Form 26QB at the earliest & at that time I came to know TDS should be paid by my pocket now & I would have to convince the seller to pay back his TDS amount which I paid.

Kindly let me know in this case is there a legal binding on seller to return the TDS amount to me on my demand?

I have also bought resale flat year back and the value is 1 cr.

At the time of registration we were not aware of TDS. Now seller is refused to pay TDS and understand that there is penalty of Rs 200/ day for the delay in TDS payment. Can any one help me how to resolve this

Advance thanks and regards

Aswin

Hello Aswin,

What you have to do in this case is pay the TDS with Interest of 1.5% per month from the date of TDS deduction and clear your dues. If you dont pay after intimation from TDS deparment you may be charged the penalty of Rs 200 / day which in your case comes to around 73000 for a year, so dont delay and pay your TDS asap. The seller is liable to pay you the TDS portion which should be around 1 Lakhs for a 1Cr. agreement, Cause when you pay the TDS it is reflected in his PAN# & he should be getting the money refund back from Govt. when he revise file his return for previous year.

I would say consult a good CA & let him handle your case but recommendation would be clear the matter at your earliest.

Hello

I booked an apartment with value 6630250 and made four installments till now.The property is jointly shared by my spouse and myself. I had paid the TDS for these installments using 26QB. For the first and third installments I paid the TDS quoting my PAN number and for second and fourth installments I paid the TDS quoting my spouse’s pan no.

What are the implications for this.

Any corrections can be made now.

Next payment will be funded by bank.Bank said that TDS has to be paid from your end.They will pay the builder the total -TDS. They will not deposit the TDS amount my bank account and said it has to be paid from me only.

Is it correct??? Should I pay this TDS from my personal income???

Kindly clarify me

Thanks in Advance

Murali

Is form 26QB also applicable to sec 195?…one time transaction for purchase of property from non resident..from 1/6/15 amendment of section 203A..non requirement of TAN for such one time transaction..or what has to be done?

No you cannot use 26QB. It is only for resident Indian seller.

When buying property from nri, you need to pay Tds using challan 281 where you should mentioned your TAN.

Some more details on buying property from NRI:

Section 195 talks about sums payable to a non-resident which are chargeable to tax in India under the Income Tax Act’1961

TDS under section 195 should be deducted at the time of making payment to NRI seller. It should be clearly mentioned in sale deed between NRI seller and buyer that TDS is deducted at specific TDS rate under section 195 and buyer will product TDS certificate to NRI Seller.

I am the buyer. At the time of agreement we haven’t discuss this tds thing as I was unaware of that. Now seller is refuse to pay TDS. He said I have to bare on my own. In such case how can I get him paid at least some amount say 50%. Or after paying TDS, if I hold the TDS certificate with me, will that be helpful to recover some amount from seller.

The buyer of an immovable property, valued at Rs 50 lakh or more, is required to pay TDS to the government. If TDS is not paid then interest and penalty would be imposed on the buyer. Interest will be charged at the rate of 1% per month or part of the month if one does not deduct tax or deducts less tax from the day tax was supposed to be deducted to the day tax was actually paid. The tax deducted has to be paid within seven days from the end of the month of deduction. Interest will be charged @ 1.5% p.m or part of the month for tax deducted but not paid to the government from the date of deduction till the date of actual payment.

You can try to scare the seller that Govt will come after him as you would show the amount. But if money is paid then seller can refuse

Hi,

I am owning a under construction flat whose value is 52L. I am paying the builder through bank loan during different stages of construction. Till date i have not deducted any TDS on each loan disbursement to builder. Two more partial loan disbursement (around 7.5L) is pending from side to builder and i am planning to deduct TDS for next two installments.

Here i would like to understand how should i calculate TDS penalty for my previous installments to builder and how to deposit the same (TDS + Penalty) to government?

Should i calculate separately TDS penalty for each installment from the date of payment to till date?

Will the TDS certificate (FORM 16B) shows TDS + Penalty amount or just the TDS amount which are supposed to be deducted for all previous payments to builder?

Thanks,

Jijesh

My case is somewhat similar to Jijesh’s case. I have already paid 3 installments but without TDS; now I want to clear all previous TDS, so the question is; Can I make one payment for all the pending TDS or do I have file it seperately as per the installments paid earlier ? Do I have to first pay for delay fine + interest and then file TDS or both can be paid same time ? And how will I know the total penalty amount i.e 200 per day and 1.5% interest per month ?

Experts, Please advise.

Hi have paid the TDS on my property in feb 2015 and possession will happen in Sep 2015. Can I claim credit in current income tax return? Also if I am using ITR-1 for filing, where/which section I need to put this in?

As per the rules, the buyer of the property is required to deduct Tax (TDS) and deposit the same with the Government.The rate at which the buyer needs to deduct tax is 1% and it may go up to as high as 20% if the seller does not disclose his PAN.

You have to give form 16B to the seller u/s 194IA of the Incometax Act.

The Seller will show the TDS not the buyer

I am a seller and the buyer has deducted TDS and deposited in Govt’s account. THe same is also reflecting in my Traces. I wanted to take the credit of the same. how is it to be done? Which ITR has to be filed?

In TDS schedule of ITR Details of Tax Deducted at Source (TDS) on Sale of Immovable Property u/s 194IA (For seller of property) As per Form 26QB]

As on sale of Land/Property comes under Capital Gain ITR1 and ITR2A will not have it.

Which ITR to fill depends on the other income you earned. For example For ITR2 the income covered are as follows:

ITR-2 Individual/HUF

1. Income from salary/pension

2. Income from house property(s)

3. Income from other sources( excluding winnings from lottery and income from races horses)

4.Income from Capital Gains.

5. Income from foreign assets.

They should not have Income from Business or Profession.

We have a Video on Which ITR to Fill which explains which ITR to fill. Please give us your feedback on it, whether it was helpful, how could it be made better.

Thanks for the detailed article.

One more point, TDS should be calculated on Base price of the property (Exclude other taxes e.g. Service Tax).

Thanks Nandini for kind words.

Thanks for pointing out the Service tax angle.

TDS needs to be deducted on the consideration amount between buyer and the seller. In short the amount which is gong in the hands of seller. Service Tax, Stamp Duty and other Govt charges shpuld not be included while calculating TDS of 1% .

Please advise on the Base price for 1% TDS calculation for an apartment.

There is a Value for agreement (Agreement to construct + Agreement to Sale).

In addition to this amount to be paid during possession includes (Water + Electricity deposit + Club Amenities + Service charges + Legal charges + PLC per sq ft + Car Parking + Maintenance fund + Sinking Fund). Do we have to pay 1% for this amount as well?

Please advise if 1% TDS is on Sale Value excluding Registration & Stamp duty

Does the actual consideration include any other payments other than the property valuation?

Yes. The consideration would include various incidental payments requiredto be made to the seller, such as legal fees, contribution towards shares,payment for parking spaces etc.

Would Stamp duty, Registration Fees or Transfer Feesbe subjected to TDS?

No. Stamp duty, registration fees or transfer fees which are to borne by the purchaser would not be regarded as payments being made to the seller as consideration and hence would not be subjected to TDS.

Thanks for the detailed article.

One more point, TDS should be calculated on Base price of the property (Exclude other taxes e.g. Service Tax).

Thanks Nandini for kind words.

Thanks for pointing out the Service tax angle.

TDS needs to be deducted on the consideration amount between buyer and the seller. In short the amount which is gong in the hands of seller. Service Tax, Stamp Duty and other Govt charges shpuld not be included while calculating TDS of 1% .

In Form 26QB, I made a mistake, and interchanged PAN of buyer and seller. So in 26AS it looks like buyer is selling. How can I correct this? I’ve contacted my AO, Traces Gaziabad – they share many people suffering from this, but nobody has solution.

In Form 26QB, I made a mistake, and interchanged PAN of buyer and seller. So in 26AS it looks like buyer is selling. How can I correct this? I’ve contacted my AO, Traces Gaziabad – they share many people suffering from this, but nobody has solution.