Table of Contents

Difference between our Parents Time and Ours Financially

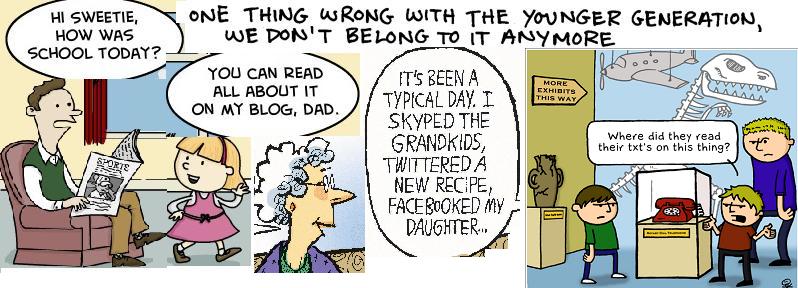

This is true for Gen X, who are born in the 1970’s and 1980s and have seen life before the 1990s.

Our parent’s investments were conservative, inadequately diversified, heavily weighted towards physical assets such as gold and real estate, or invested in low-yielding instruments such as endowment plans.

Low fixed income returns: Our parents lived in a time where risk-free assets such as fixed deposits yielded 13-15% interest. Today’s interest rates are a measly 5-7% and may continue to fall as our economy develops. Hence, we must look at options such as equity along with debt, where the combined return of the portfolio beats inflation comfortably. Being risk-averse could be one of the biggest risks to financial independence.

Financial products are more complex today: The most common investment avenues then were private or government deposits, LIC policies, gold, and property. Stocks were for the adventurous few. Today, the plethora of financial instruments is mind-boggling. There are 4000+ mutual funds, Many private insurance players. Choosing a mutual fund or life insurance policy involves hours of scrutiny to determine features and risks, including the complicated fine print that comes along with it.

Life expectancy: On average, we will live longer than our parents. The average lifespan is expected to increase by one year every three years. The previous generation retired at 58 and lived till about 75 years on an average, and hence needed to plan for only 15-20 years of retirement.

Today, our employment is no longer guaranteed to 58. And with all the medical advancements, we can expect to live till even 100. This leaves me with 20 years of earning and 45 years of retirement. Dying young or living too long are both problematic. If we haven’t planned for such possibilities, we will either grapple with ‘too less money at the end of your life’ or ‘too much life at the end of your money.’

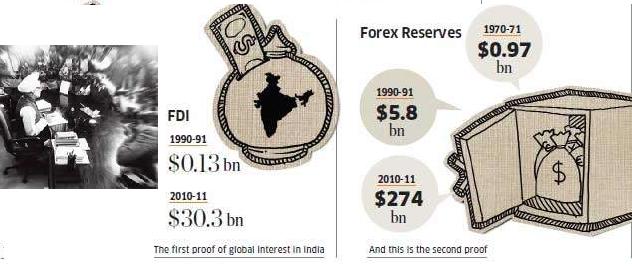

1991 the game changer

Earning money before 1990s and now

The Government was the dominant employer and the jobs came with lifetime guarantee along with assured pensions. Employment and business opportunities outside the government were few. Before industrial sector had a nominal share in the economic activity of the country but post 1991, a stark contrast was evident as it brought out the rise of technologically advanced sectors.

After 1991 there was influx of multinationals that vied to establish their market to earn profit and flourish here. Today, virtually all the big MNCs in the world have operations in India including McKinsey, Texas Instruments, Procter & Gamble, IBM, Samsung, LG, General Motors, Ford, Pepsi, Accenture, EDS, Intel, Microsoft, Oracle, General Electric and Coca-Cola. Life after 1991, Jobs have become less secure but opportunities have increased. The average income levels have gone up. Soaring salaries, VRS, early retirement, salary cuts, getting fired. switching jobs, working spouses, startups is the new order. We have moved from an age of security to a time when the only thing secure in our knowledge base and that also we need to keep updating.

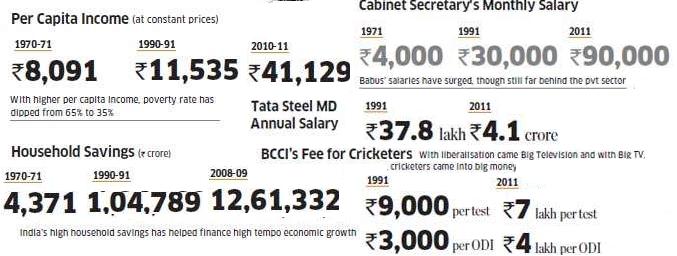

Spending money before 1990s and Now

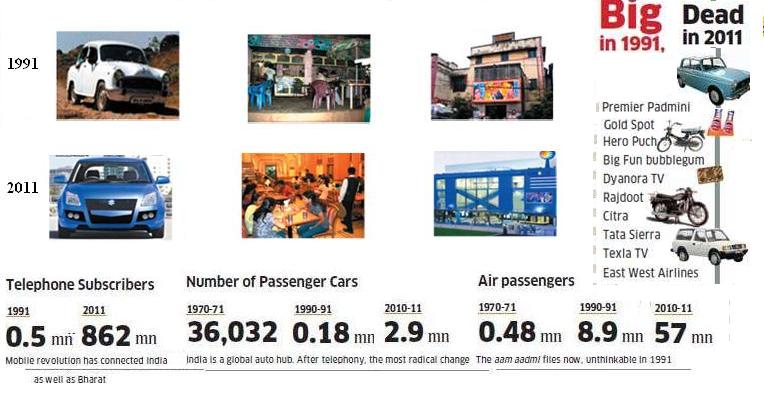

We watched Chitrahaar every Wednesday night. Eating out was at the local chaatwallah, cusines like Italian, Japanese were not heard of! Vacations meant visiting relatives. Cars(Ambassadors) were few and only rich people had it. In 1991, owning a Maruti 800 (Rs 1.48 lakh in Delhi) was a middle- class status symbol. Scooters like Bajaj Chetak and Lambretta accounted for more than half of the two-wheelers sold in the country. A bottle of soft drink, be it desi versions like Gold Spot or Thums Up, cost just Rs 4.50. Our parents budgeted hard. They cut down on their luxuries and comforts. They built home out of retirement lump sums or by taking loans against their provident funds.

And post liberalization the change is drastic especially in spending. Today, we are one of the consumption engines of the world as we are guzzling colas, downloading music on our iPads and zipping around in our sedans. Lanes are choked with cars. Shopping malls, multiplex cinema halls, credit cards, branded stuff, fast food, are conditioners-all things considered luxuries are fast becoming comforts. Restaurants have sophisticated ambience with multi-specialty cuisine. Fast food chains are mushrooming. People spend more on entertainment. The old cinema hall with tickets at Rs. 5 to 40 is giving way to the multiplex with ticket prices from Rs. 150 to 500. Digital entertainment is in vogue.

Lifestyle in 1990s and Now

Parents’ dream was to send children to missionary schools aka Convent schools. If cannot afford missionary school fees for both children at-least send the son. He was to take care of them after retirement. As for girls well parent’s responsibility was to get them married. Provident funds meant for retirement were happily broken to spend on daughter’s weddings. Having a phone, buying a car, building a house was for the rich ones. If one needed loan one took it from relatives and friends and paid them off as soon as possible.

Expenses are big too! We spend more on our children(at most 2 ) Playschools charge Rs 1000 a month for a two-three year old. International school charge more than 5 lakh annually. Cocurricular activities are now an important part spending on classes-dance, music, martial art, computer, football, cricket. People are more inclined to take loans they don’t consider borrowing as dangerous or unwise. People are willing to take debt for their dream vacation to Paris or Singapore. People are taking a loan to buy the house soon after they start earning unlike their fathers who bought the house of their retirement money. India’s middle-class is growing rapidly.

Retirement is no longer a time when we dangle our grandchild on our laps while gossiping with the neighbour as our daughter in law cooks inside. We are living longer than 60 years and are not dependents on our children. At times even if we stay in the same city we don’t live together

Investment in 1990s and now

The Government decided where we saved and how much interest we got. Our banks were owned by the government, private banks were not many. People insured with government monopolies – LIC and GIC. People put our money in the post office scheme – the PPF and the Monthly Income scheme, the Recurring Deposit – or government bonds and Unit trust of India. Returns were high, assured and guaranteed a. Even the stock market was sanitised by the Controller of Capital Issues an institution that actually kept the price of issues so low so that ‘small’ investors benefited when the issue was listed.

It’s a different world today.

The government has stopped assuring making even PPF returns are linked to market transferring the risks from the government to us individuals.

Now we have choices other than public sector banks, We have private banks, private insurance companies and mutual funds.

Banks dispense cash out of machines, they have become service providers that pay bills. Interest rates are changing to keep pace with inflation and have become market determined rather than government controlled.

The stock market is now state of the art.

Mutual fund products have grown from a mere 82 schemes from six fund houses in 1990 to thousands schemes from more than 40 fund houses. From just one, the LIC, we have more than 13 companies offering life insurance products. From four general insurance companies we have more than 11 now.

Papa Kehte Hain?

So “Papa kehte hain” advice may not work in current times. Jagoinvestor has listed following points in his article Papa Kehte Hain” problem in Personal Finance Quoting from it:

- Unsuitable Psychology : A person has to be more updated these days than what our Fathers were in their days.

- No Idea of Investments and documents: You may also not be aware of where your parents are investing money on your behalf, they might not tell you about it, may forget to tell you where the documents are kept, When is the maturity of some products? and issue like these, which looks like a small issue but can become very major when some bad things happens .

- No Self-dependency and hence lack of knowledge: It might look rude, but believe me, your parents will go someday and not knowing a lot of thingsnnabout your parent’s finances will be a horrible situation. Where he you took his/her insurance from, where did he invest? when it’s maturing , etc ,etc . It’s like starting all over . It can be painful , you are always dependent on your parents then . Its a bad thing .

Is the advice of parents outdated?

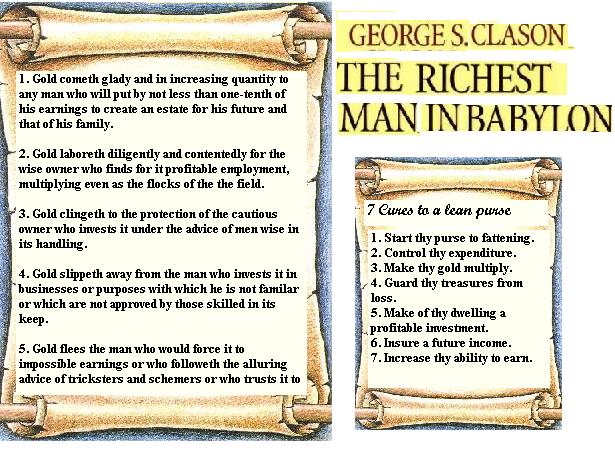

Read in the book Richest Man of BabyLon by George Samuel Clason

When youth comes to age for advice he receives the wisdom of years. But too often does youth think that age knows only the wisdom of days that are gone, and therefore profits not. But remember this, the sun that shines today is the sun that shone when thy father was born, and will still be shining when thy last grandchild shall pass into the darkness. ” ‘The thoughts of youth,’ he continued, ‘are bright lights that shine forth like the meteors that oft make brilliant the sky, but the wisdom of age is like the fixed stars that shine so unchanged that the sailor may depend upon them to steer his course”

The 5000 years old laws of Gold are still valid.

A college student challenged a senior citizen, saying it was impossible for their generation to understand his. “You grew up in a different world,” the student said. “Today we have television, jet planes, space travel, nuclear energy, computers…”

Taking advantage of a pause in the student’s litany, the geezer said, “You’re right. We didn’t have those things when we were young; so we invented them! ”

Times will keep changing. As they say Only thing that is constant is Change.

This article been inspired by reading Monica Halan’s financial planning book Seven Steps to Financial Freedom discussed in Personal Finance Books For Adults And Young Adults.

The financial landscape has changed completely, with traditional fixed income schemes now offering market-linked returns. Other investment options are too complex or too costly. It’s like driving into a new city only to discover that your road map is outdated. The road signs confuse you and passersby either have incomplete information or mislead you. Un-scrupulous agents are forever trying to palm off high-commission investments to gullible investors. We need a new way to manage out financial lives. Depending on the knowledge and awareness, the choice could be frightening or liberating.

We live in an era that is very different from that of our parents and grandparents. Investment decisions need to be made carefully and in line with our goals and risk appetite.

Do you think that we are better off than our parents? What can we learn from our parents? How can we adapt to changing times?

4 responses to “Parents & Us, 1990’s, Changes in the Way We Earn,Spend,Invest”

[…] Parents & Us:Changes in the Way We Earn,Spend,Invest […]

[…] from those of our parents and so is the way in which we earn, spend and save. As discussed in Parents & Us:Changes in the Way We Earn,Spend,Invest. Our parents(mostly fathers) worked in the same or at most two jobs in one career, they retired on […]

so detailed & covering almost every aspect

Thanks Sujatha. I endeavor to provide complete information.