What happens if a PPF Account holder or subscriber dies? This article explains what happens On Death of PPF account holder, How to Claim using Form G. Which Form to fill? It also explains difference between Nominee and Legal heir. How to Nominate in PPF account.

Table of Contents

Overview of On Death of PPF account holder

On the death of a subscriber, the balance in the PPF account is paid on demand to his nominee or successor.Any loans or interests on loans to be repaid by the subscriber will be deducted before the credit is transferred to appropriate person(s).

If not withdrawn on death of PPF account holder

- Excess amount deposited in a PPF account after death of the subscriber will not attract any interest and will be returned as it is .

- PPF account can neither be extended, nor be transferred to any other person,No partial withdrawals are permitted.

- However, the balance, if not withdrawn, continues to earn tax-free interest.

- It is risky for the nominee to continue the account because the nominee cannot appoint a nominee.

There are following scenarios where a claim arises on Death of PPF account holder

- When a nomination exists and nominee(s) is alive.

- When a nomination exists and if any nominee(s) is dead, the surviving nominee or nominees shall, in addition to the proof of death of the subscriber, also furnish proof of the death of the decreased nominee.

- When nomination does not exist and claim is backed by legal evidence

- When nomination does not exist and the credit in the account is less than Rs.1 lakh

In the case of joint nominees, The nominees are treated as joint holders and have to apply together for the closure. Each nominee is required to identify himself to the satisfaction of the concerned officer. After completing all the formalities, a single cheque is issued in favour of all of them together. This cannot be encashed, unless all the nominees have a joint account. PPF rules allow allocating a percentage of benefits against each nominee. But the form does not provide a specific place to indicate the same and therefore, many fail to indicate the percentages.

If no nomination is in force, the balance will be paid to the legal heirs on production of the succession certificate or probate. In India, it takes an enormous time, money, and energy to obtain this. To mitigate hardships, a balance up to Rs 1 lakh may be paid to legal heirs on applying in Form-G along with i) a letter of indemnity, ii) an affidavit, iii) a letter of disclaimer on affidavit and iv) a death certificate.

To claim the PPF amount, on Death of PPF account holder

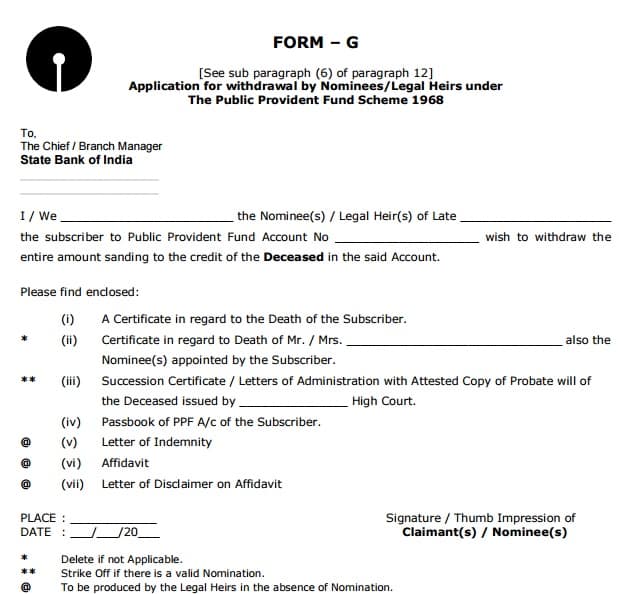

- Form G has to be filled up, an excerpt of image is shown below. The form can be downloaded online from bank or post office websites. It is a simple form that asks for information pertaining to the claim like account number, nominee details, place etc. There are 3 annexures to Form G namely Annexure I, Annexure II and Annexure III.

- Along with Passbook of the subscriber and

- Death certificate of subscriber

- The surviving nominee or nominees shall, in addition to the proof of death of the subscriber, also furnish proof of the death of the decreased nominee.

- If there is no nominee, Documents like Succession Certificate, Letter of Administration or attested copy of the will.

- If amount in PPF account is less than 1 lakh, Annexure I to Form G (Letter of Indemnity) on stamped paper, Annexure II to Form G (Affidavit) on stamped paper, Annexure III to Form G (Letter of Disclaimer on Affidavit) on stamped paper

Once submitted, the processing of the application may take over a month, after which the claims may get settled. The PF settlement process may take anywhere between 30 to 90 days.

Difference between Nominee and Legal Heir

According to law, nominee is not owner of your investments. He is only trustee of your investments. His job is to accept your assets in case of your death and distribute it to your legal heirs as per your will or if there is no will then according to succession law applicable to you. In India then succession laws are as per religion you follow if you are Muslim it will be as per Muslim law but if you are Hindu it would be as per Hindu succession act.

If there is no nominee then legal heirs have to give all kind of proofs like proof of relationship, will if any and many other things for getting the money out from the system. But once if nominee is there then he will take the money out and distribute it between legal heirs as per will or if there is no will as per applicable succession law.

Nominee is the trustee in case of

- Bank Accounts,

- Mutual Funds,

- Other Investments

Nominee is owner or beneficiary for following investments

- Shares and debentures.

- New Insurance Laws (Amendment) Act, 2015, makes nominees — restricted to immediate family members such as spouse, parents and children — the beneficiary so that the insurance money can go to the intended recipient.

- Employees Provident Fund: In case of employees provident fund also nominee is the person who will inherit the fund and not legal heirs. As per rules, in EPF account one has to appoint his family member as nominee unless he has no family at all. Also once he acquires family the old nomination is invalid and has to make new nomination. In EPF account one can have more than one nomination and assign individual shares to nominee.

Nomination and PPF account

How to add or change Nominee in PPF account

No fee is charged from the subscriber for the registration, cancellation or variation of nomination in the PPF account.

In order to add the Nomination in PPF Account one has to fill Form E.

In order to change the Nomination in PPF Account one has to fill Form F

The form E/F has to downloaded (from bank or post office website) and the form needs to be filled and submitted to the bank for records to be updated.

- Fill-up the form.

- Get it signed by two witnesses. Witness can be your family member, friend.

- Submit it to the Bank or Post Office.

- Have the new nomination details recorded in the passbook. Make sure you have both the nomination registration number and the nominee (and guardian, if applicable) details recorded in the passbook.

Multiple Nominations in PPF account, share payable,not interested

If there are more than one nominee, they should give a joint discharge on the application of withdrawal (Form G) at the time of receiving payment.

In the PPF nomination one can make multiple nominees along with share for each nominee. If the share is not mentioned, the amount due will be payable in equal share to all the nominees after the death of the subscriber.

If some nominee or nominees are not available or not interested to take payment, payment may be made to the nominee(s) who wants to take payment of his/her share(s) leaving the share of other nominee(s) in the account. In this case the Postmaster/Account should retain the pass book and issue a notice to the other nominee(s) intimating the fact of payment to the nominee(s) who has/have taken payment and calling upon him/them to take payment of his/their share(s) and the availability of the pass book with the post office/bank. The pass book will be entered in the register of undelivered pass books in deposit in the head office and will be disposed of like other pass books in deposit. Where the payment is made by the sub office, the pass book will be forwarded by the sub office to the head office for safe custody. The above procedure is being followed in case of P.O. Savings accounts and can be applied to PPF accounts also in such cases.

State of PPF account in the event of death of the guardian of the minor

In the event of death of guardian, in relation to a minor, whether PPF account standing in the name of the minor should be closed and a new account opened In the case of an account opened on behalf of a minor, the minor is treated as subscriber. The amount in the account of a minor does not become payable on the death of the guardian, because, under Section 8 of the PPF Act the amount becomes payable only on the death of the subscriber. In case of death of guardian the account of minor remains operative and a new account need not be opened. The surviving natural guardian or a guardian appointed by competent court may continue the account of minor after producing necessary guardianship certificate.

State of PPF account in the event of death of the minor

In the event of death of the minor subscriber whether the balance in the account is payable to the guardian. In the event of death of the minor subscriber the guardian does not become entitled to the payment of the balance. The balance in such cases is payable to the legal heirs of the minor in accordance with Section 8 of PPF Act and para 12(6) of the Public Provident Fund Scheme.

Form G for Claiming PPF amount on Death of PPF account holder

The nominee or legal heir will have to close the account by taking full amount due in the account in one installment. He will not be allowed to take part payment in more than one installment.

On the death of the subscriber, the balance in the PPF account does not cease to earn interest. The interest is admissible till the end of the month preceding the month in which payment of the deposits is made to the nominee/legal heirs of the deceased subscriber.

As the PPF accounts are not transferable from one individual to another, the nominee cannot continue the account of a deceased subscriber in his own name. H

Form G is a must for any claimant, be it a nominee or a legal heir. Along with the Form G one has to submit the following documents. Once submitted, the processing of the application may take over a month, after which the claims may get settled. The PF settlement process may take anywhere between 30 to 90 days.

In case of death of subscriber the nominee/legal heir is liable to pay interest on loan availed of by the subscriber but not paid before his death.

Claiming PPF amount after death When a nomination exists and nominee(s) are alive

- Form G filled by all nominees

- Death certificate of subscriber

- Passbook of the subscriber

Claiming PPF amount after death when a nomination exists but not all nominee(s) are alive

- Form G filled by all living nominees

- Death certificate of subscriber

- Death certificate of any other nominee(s)

- Passbook of the subscriber

Claiming PPF amount after death when nomination does not exist and claim is backed by legal evidence

- Form G filled by legal heir(s)

- Death certificate of subscriber

- Succession Certificate/Letter of Administration/ An attested copy of the probated will of the deceased subscriber issued by ______ High Court.

- Passbook of the subscriber

Claiming PPF amount after death when nomination does not exist and the amount is less than Rs.1 lakh

When there is no nomination or legal evidence is not produced and the amount at credit in the account is upto one lakh. The 3 annexures to Form G namely Annexure I, Annexure II and Annexure III, which are are as per Rule 12 (6) also have to be filled.

- Form G filled by legal heir(s)

- Death certificate of subscriber

- Annexure I to Form G (Letter of Indemnity) on stamped paper

- Annexure II to Form G (Affidavit) on stamped paper

- Annexure III to Form G (Letter of Disclaimer on Affidavit) on stamped paper

- Pass Book of the subscriber.

Download Form G

PPF Form G on death from StateBank of India (pdf format)

PPF Form G on death from Post office (pdf format)

Related articles:

- Understanding Public Provident Fund, PPF

- PPF Account for Minor and Self

- How to Deposit in PPF amount

- How to Close PPF account Before Maturity

- How to activate Dormant PPF account?

- Transferring PPF account

- PPF Partial Withdrawals

- Voluntary Provident Fund, Difference between EPF and PPF

- How to nominate: Demat Account and PPF

- On Maturity of PPF account

14 responses to “On Death of PPF account holder: How to Claim using Form G”

MY FATHER DIE IN 19TH DECEMBER 2019 AFTER MAKING DEATH CERTIFICATE I THE LEGAL HAIR BECOUSE NOMINEE IS NOT REGISTERED IN PPF ACCOUNT AND.AFTER COMLITING ALL DOCUMENTS.I DEPOSIT FORM G ON 15.05.2019.AND AFTER 1 MONTH 19.06.2019 BANK TELL ME TO COMPLITE SOME OBJECTION.AND AFTER COMLETING ALL OBJECTIONS.AGAIN FORM G IS SEND TO RBO AGRA.ON 26.06.2019 .AND TODAY IS 17.07.2019 .ANY MY CLAIM IS NOT SETTLED.

WHEN MY FATHER DIE BALANCE WAS 705000 .AND TODAY ON 17.07.2019 BALANCE IS 7,60000.FOR DELAY I WILL GET INTREST FOR SUCH PERIOD OR NOT. PLEASE TELL ME IN RIGHT WAY.

PPF ACCOUNT HOLDER EXPIRED.THERE TWO NOMINEE 1 WIFE OF DEPOSITER AND 2ND IS SON OF DEPOSITER. 2ND NOMINEE LEAVES IN ABRODE AND DOES NOT COME TO WITHDRAWAL OF HIS SHARE BUT 1ST NOMINEE WANTS TO WITHDRAWAL HER SHARE.HOW CAN PAYMENT MADE TO 1ST NOMINEE?

Best is to talk to the manager/postmaster of the bank/post office where they have the PPF account.

My father is no more and his ppf account is there whose old passbook has registered nominee while in new passbook there is no nominee so what can I do to claim money

I had started PPF account on my DAD name on 1991 for 15 Yrs, And Nominee was my MOM, MOM (Nominee expired in 2004 & DAD expired in 2005), We had not added another Nominee and also we had not withdrawn amount after maturity ie-2006, also account not extended.

What document will i required to withdrawn the amount ?

Will i get amount with Interest till 2018, as no amount was invested after death of DAD (ie-2005) ?

Amount at the time of dad expired was 3.51 (also the maturity was completed in the year 2006)

Please reply.

Yes the interest is paid on the amount in PPF so you’ll get the amount with interest.

Documents like form G to claim

Death certificates of both parents

Legal heir certificate or if there is a will written by your father. Any other evidence to prove that you are legal heir.

I have some query regarding PPF, my brother(aged 30) has died and nominee for his ppf account is my mother, but there is around 1 lakh due on his credit card and bank has lean marked his savings account in lieu of credit card dues . PPF account is in the same bank. So if we withdraw the money it will go in his savings account and it will be deducted by them for credit card dues. So is there any rule in PPF which says they cant deduct that money from PPF and it should go directly to the nominee. Please help. PPF amount is around 67,000.

A is ppf account holder was dead and B nomine is allaive. Now ppf amount already matured so he wants to withdraw the amount. Amount is approx 15 lacs.

Can you tell me what documents are required for this? Is there any guaranters required who have 15lacs fixed deposit? Please advise

Hmm. Let nominee visit the bank or post office which has PPF account.

If not withdrawn on death of PPF account holder

Excess amount deposited in a PPF account after the death of the subscriber will not attract any interest and will be returned as it is .

PPF account can neither be extended, nor be transferred to any other person,No partial withdrawals are permitted.

However, the balance, if not withdrawn, continues to earn tax-free interest.

It is risky for the nominee to continue the account because the nominee cannot appoint a nominee.

Documents required:

To claim the PPF amount, on Death of PPF account holder

Form G has to be filled up, an excerpt of image is shown below. The form can be downloaded online from bank or post office websites. It is a simple form that asks for information pertaining to the claim like account number, nominee details, place etc. There are 3 annexures to Form G namely Annexure I, Annexure II and Annexure III.

Along with Passbook of the subscriber and

Death certificate of subscriber

The surviving nominee or nominees shall, in addition to the proof of death of the subscriber, also furnish proof of the death of the deceased nominee.

I invest 1,50,000 self in my ppf a/c and my wife & other invest 1,00,000 in my son’s ppf a/c but I am guardian of my son’s ppf a/c. We could not take Tax exemption benefit of my son’s ppf a/c. in any IT return file.

So this investment is legally ? and not legally then how can I change guardian name in my son’s ppf a/c?

Please give answer earlier.

Max deduction you can take under 80C which includes PPF account is 1.5 lakh.

So you cannot claim IT exemption for your son as you are claiming 1.5 lakhs for yourself.

And there is no way to change the guardian.

There is no clarity on this in PPF.

However, logically yes, this is legal. The rule says investment by you (your contribution) in your PPF or in your wife’s PPF or your son’s PPF can not be more than 150000. In this case it’s your wife and others are investing in your son’s account and not you 🙂

A- REPRESENT FATHER B-REPRESENT SON

B IS HAVING PPF AC WHERE A IS REGISTERED NOMINEE

NOW A IS DEAD AND B HAVING PPF AC HAS MADE ONE REGISTERED WILL WHRE BENIFICIARY OF PPF AC HOLDER IS CLEARLY MENTION . NOW B DIES .

THE FUND LYING IN PPF AC GOES TO BENEFISERY AS MENTION IN REGISTERED WILL

KINDLY ADVISE.

Yes it will be as per the most latest WILL