Indians go abroad, for a better future for self or for one’s children, better work and career opportunities, better facilities to utilise one’s skills or for the simple reason of earning big money in dollar, euro or dirham. If you packing your bags, there are a few financial issues you must attend to before you board the flight. This article explains what to do when you leave India to settle abroad. What do you do with the bank accounts that are operational at home? How do you service the loans that you might have taken? Should you hold on to your stocks and mutual fund investments? Do you need the life and health insurance covers that you purchased? What are the tax implications of the move abroad?

Table of Contents

Who is Non Resident of India or NRI?

When you move out for long periods on such job opportunity, you become an NRI. A ‘Non-resident Indian’ (NRI) is a person resident outside India who is a citizen of India. An individual is considered a resident in India if any one of following conditions is satisfied.

- He is present in India for 182 days or more during the financial year; or

- He is present in India for 60 days or more during the financial year and present in India for 365 days or more in the last four financial years.

A ‘Person of Indian Origin (PIO)’ is a person resident outside India who is a citizen of any country other than Bangladesh or Pakistan or such other country as may be specified by the Central Government. Basically PIO (Person of Indian Origin) holds another countries’ citizenship/nationality i.e. he/she is holding foreign passport. In respect of facilities available in economic, financial and educational field, PIO/OCI is considered the equivalent of an NRI.

NRIs are eligible to invest in India. An NRI requires a bank account and necessary documents to begin investing in India. Apart from the real estate sector, they can choose the mutual funds and stocks. If an investor finds it difficult to operate the account in India, they can choose a person who would manage the entire operation through power of attorney. There are different processes for residents and NRIs for various kind of financial products. Like, if you become an NRI and want to do something with banks, mutual funds, life insurance policies (traditional or ULIPs), you will first have to update your KYC and only then can you do something.

Banking on becoming NRI

Types of Bank accounts that an NRI can have

By law, NRIs are not allowed to hold regular savings accounts in India. So either close it or convert your account from Indian resident account into NRI account. An NRI has 3 options of savings account to choose from an overview of which is given below. Our article Bank Accounts for NRI:NRO,NRE,FCNR discusses it in detail

- Nonresident (ordinary) account (NRO),

- if you are expecting income from sources like rent, interest etc. in your account you can get it converted into Non- Resident Ordinary account.

- NRIs can deposit all the Indian income into their NRO account and also make payments like EMI payments, and other kind of investments from their NRO account.

- The money lying in NRO account CANNOT be taken outside India i.e the money in NRO account is NOT repatriable.

- If those earnings if falls into tax slab of that financial year, you should declare it in your Indian Income tax return(which usually happens in June-July of the following financial year)

- The interest will be the similar to the interest on a regular savings bank account, that is, around 3%. The interest will be taxable and tax will be deducted at source at the rate of 30.9%.

- Non-resident (external) rupee account (NRE) : if you have to send money back to India,also called remittance, you can choose Non-Resident External (NRE) account.

- You can open an NRE savings account, current account or fixed deposit.

- An NRE account allows you to deposit only foreign funds and these can be freely transferred to your foreign account and vice versa.

- The NRE account is a rupee account and you can send back the amount to the residence country .

- You cannot deposit local earnings like rent, interest, dividends into this account but you can use NRE funds for making local rupee payments.

- You can also use these funds for investment purposes, the sale considerations of which you want to repatriate.

- The interest accumulated in that is also tax free. You cannot transfer money directly to a non-NRE account in India since it would be illegal. Instead you can transfer it first into your NRE account and then into any other normal savings/current account in India. This is how the government regulates the inflow of foreign money to India.

- Interest rates and taxability: Interest on NRE accounts, whether savings or fixed deposit, is tax free. On your NRE savings account you can earn an interest of around 3% while on the NRE fixed deposit, you can earn between 2-4% depending on the tenure.

- Foreign currency non-resident account (FCNR) :FCNR account is similar to NRE account but the funds are in foreign currency.

Refrence RBI Accounts in India by Non-residents

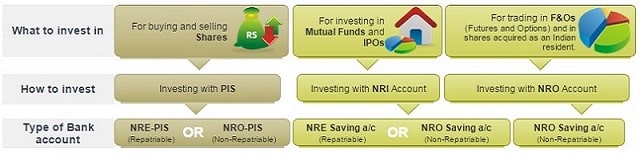

It is advisable that you maintain two separate accounts – NRO and NRE and channel your money based on repatriation requirements. overview of what kind of Bank accounts can be used for NRI

Can NRI open more than one NRE, NRO or FCNR account ?

Yes, an NRI can more open more than one NRE, NRO or FCNR accounts with same bank or different banks in India. For example, you can open one NRE, one NRO and multiple FCNR deposits with a bank. Or Open NRE accounts with HDFC Bank, and NRO with Kotak Mahindra or YES bank.

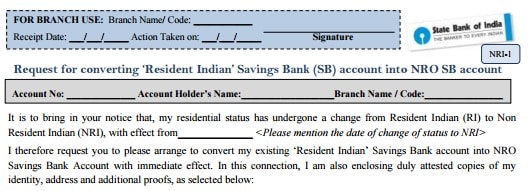

How to convert Your Saving Bank account to NRO account

Visit your bank branch and fill up the required forms. You would need to submit two photographs, a copy of your passport and copy of your visa.

Already moved abroad? If you have already moved abroad without completing this formality, you can get copies of all your documents attested by the Indian Embassy or Notary and send them to the branch.That is why it is preferable to do it before leaving India if you expect to have earnings in India.

For more information on opening of NRO accounts.

- SBI NRI account

- ICICI NRI account

Sample application form of SBI for converting Resident Saving Bank Account to NRO account is shown below. Click on image to enlarge.

How to Open a NRE Account

Open an NRE account if you may have substantial repatriation requirements i.e you need to transfer money to India. You can repatriate any amount of any kind from the NRE accounts. There is no restriction, ceiling or chartered accountant certificate needed. The procedure to open NRE account is the same as the NRO account

Joint Bank Accounts on becoming NRI

Account jointly with your spouse/any other resident Indian

If you hold an account jointly with your spouse/any other resident Indian where you are the first holder and your spouse is the second or the joint holder, then that account will also be converted into an NRO account on you informing the bank.

Account with your spouse/any other resident Indian as first holder and you as a joint holder:

If your wife or any other resident Indian is the first holder of the accounts and you are a joint holder then once you update your status as an NRI, your operating pattern will be on a former or survivor basis, which means that you cannot operate the account until the first holder of the account lives.

Fixed Deposits on becoming NRI

NRIs also cannot hold a resident fixed deposit. So, if you have an NRI family member as a joint holder in an FD, he needs to intimate the bank about his status. The bank may allow you to hold the deposit till maturity and not renew it further. Or, you may be asked to break the deposit and open a fresh one. If the NRI is opening the deposit, it has to be an NRO deposit and a resident Indian can be the second holder. However, you can have an NRI as a nominee for an FD

Usually banks like ICICI and HDFC automatically convert your fixed deposits to NRO deposits when you change savings bank account status. But some banks still need you to do it separately. So check with your banker and change your fixed deposit to NRO deposit. The interest earned will be taxed at 30.9% TDS.

If you have any debt, either close the loan or give ECS mandate to your bank for timely payments. Do this also for insurance premium and mutual fund systematic investment plan payments.

Home Loan on becoming NRI

As an NRI, you can continue to service a home loan. Shift to the auto payment mode so that the payment of monthly instalments is not affected However, you may need to give fresh post-dated cheques or if the EMI goes through ECS, you will have to route it through your NRO account. Also, register for receiving e-alerts and loan account statements through Net banking. This will allow you to know the principal and the interest portion paid when you file your tax returns abroad.

If you are the gurantor for a loan, make sure that repayments are regular. A gurantor’s credit score is affected if the borrower defaults. Keep track of your credit history.

Insurance on becoming NRI

Bear in mind that it is not so easy to buy insurance in India after you become an NRI. So, if you’re planning to return back to India in some years time, it makes sense to evaluate your insurance coverage and buy the right insurance policies BEFORE becoming NRI. Check the geographical coverage & read the fine print before buying these policies. While life and personal accident insurance policies cover death globally, in case of mediclaim, only the treatment is taken in India is covered. If you already have an insurance policy, you should inform insurer of the new address to ensure continuity in service updates, if any.

Please note that NRIs can buy insurance:

- On their visit to India – insurance cover is canvassed in India and all formalities regarding filling in the proposal forms, obtaining medical examination report / special medical reports and Moral Hazard Report are completed during their stay in India.

- From their present country of residence – known as MAIL ORDER BUSINESS – where all or some of the formalities regarding filling in the proposal forms, obtaining medical and special reports are completed in their present country of residence.

HEALTH INSURANCE on becoming NRI

Claims are not met for hospitalisation abroad. Should you discontinue your health plan? If you are sure that you will never come back then yes. Else You must consider the age at which you return and whether any insurer will provide a cover at that age. If you are in the older age group, it may charge a high premium. Health and medical care regulations vary from country to country. Many times it is best to surrender the existing health policy and buy a new one in the country where you are shifting. . For instance, certain countries demand the proof of vaccinations you have taken as a child.

LIFE INSURANCE Policies on becoming NRI

The life insurance policy purchased in India will cover death that occurs anywhere in the world. With life insurance, you can either continue with the existing term plan or discontinue it after you buy one in the new country of residence. Generally, term plans are cheaper overseas. In places such as Europe, Singapore and Dubai, the premium for term plan is 20% cheaper than in India, while in the US, premium for term plans are 30-40% cheaper. Once the term cover gets activated, you can discontinue the life cover that you bought in India. If you continue enjoying all your insurance policies and pay premiums on it. However, it is important to inform your insurer about your new status.

Regarding LIC Policy on becoming NRI

Existing policies taken while in India will continue in Indian Currency even after your moving to foreign countries as NRI. You can check details at NRI Centre at LIC website

- Please keep the concerned servicing branch of LIC informed about your new status i.e. NRI and your new address.

- Please submit to them NRI questionnaire form duly filled and signed. (See Annexure-II).

- You may continue to pay premiums through various approved channels to LIC ECS,Online,Net Banking.

What are the rules regarding death and maturity proceeds?

1. If policy was taken before becoming NRI, this does not affect the status of the policy and the proceeds remain repatriable to the extent of premium paid in foreign currency in relation to the total premium paid.

2. If premiums are paid fully in Indian rupees through the NRO account, the death or maturity proceeds will not be repatriable.

Demat account on becoming NRI

Non-resident Indians have restrictions when it comes to equity investments in India.RBI has a long guide of dos and don’ts for NRIs to make investment in Indian Companies. Like, a NRI cannot hold more than 10% of the company’s paid-up share capital. An NRI customer can invest or trade in shares and stocks through the secondary market only through a designated account called as PIS or PINS (portfolio investment services).

- PIS is only for trading in Indian equities and not mutual funds.

- Under PINS, NRIs are not allowed to speculate, in that, the NRI investor should take delivery of the shares purchased and give delivery of shares sold.

- A NRI can have only one PIS account.

- When you change the status to NRI with the DP (share broker), you need to distinguish between shares that can be repatriated and those that cannot. There are two types of Demat Accounts available for NRIs to open i.e. – Repatriable and Non-Repatriable. So you can have two separate trading accounts based on NRE & NRO.

- Repatriable Demat Account: Repatriable Demat Account is used to hold securities that purchased using funds that are repatriable. When you sold these sales proceed of these shares is usually credited to the NRE Bank Account.

- Non-Repatriable Demat Account: Non-Repatriable Demat Account is used to hold securities purchased using funds that are non-repatriable funds or bought when you were an Indian citizen. The sale proceed of these securities are generally credited to NRO Bank Account.

- Under RBI’s Portfolio Investment Scheme, NRI are allowed to trade in Indian secondary market on opening a PIS account with authorized dealer banks – “Designated Bank” (banks who are authorized by RBI to deal with PIS). The bank where you have your NRE/NRO account will get this done for you.

- You can open PINS account with only 1 bank.

- Brokerage charges for NRI are higher compared to that for residents of India

- Once you become a resident again, you must close the PINS account.

Most leading banks offer PINS to their NRI clients. Under PINS, the NRI should apply to the concerned bank, which will then open an NRE/NRO account for the NRI under the Scheme. PINS is required as the RBI stipulates certain ceilings in investment beyond which NRIs cannot invest into any company. The bank (known as the Authorised Dealer in this context) keeps a track of the NRI investments such that these don’t go beyond the stipulated limits. The demat provider will collect the necessary documents for submitting your application for opening NRO and NRE account, get RBI approval and opening PINS account through which you can begin purchasing shares, sell and transfer money

As per section 6(5) of FEMA, NRI can continue to hold the securities which he/she had purchased as a resident Indian, even after he/she has become a non resident Indian, on a non-repatriable basis. If you have existing shares best is to open a PIS account and notify your bank to transfer the shares under that holding so that in future when you wish to sell these shares you can do so through the PIS route.

PPF account before becoming NRI

NRIs cannot open new PPF accounts. But they can only continue existing active PPF accounts. Prior to 2003, NRIs did not enjoy the benefit of investing in PPF and had to close the account before leaving the country. Meaning, one can hold the account to maturity and even extend it every five years, twice thereafter. So it is advisable to open a PPF account before becoming NRI. Our article Understanding Public Provident Fund, PPF discusses PPF in detail.

However, the continuation of the investment is possible only if the operating account is in function prior to becoming an NRI. You can use the funds available in the NRO or NRE account to make an investment in the PPF account.

Mutual Funds on becoming NRI

Since, January 1, 2011, compliance with know-your-customer (KYC) norms for mutual funds has been made mandatory for all MF investors. Therefore, the asset management company needs to be updated about the change in status (from citizen to NRI). And, the KYC needs to be renewed, as your account used for electronic clearance system (ECS) or auto debit for the systematic investments in the MF will change. Also, the residential address would differ . On the change in status, link your investments in India to the NRE or NRO account. According to the Central Depository Services (CDSL) website, “NRIs must submit a certified copy of the passport and overseas address. If any of the documents (including attestations/certifications) towards proof of identity or address are in a foreign language, they have to be translated into English. The documents can be attested,by the consulate office or overseas branches of scheduled commercial banks registered in India.”

NRIs can invest in all Indian mutual funds, except in funds promoted by Asset Management Companies based in the U.S. (Fidelity, Franklin Templeton and HSBC.) The payment can be made from any of NRE/NRO/FCNR accounts. If they make payments from NRE/FCNR account, then it can be on repatriable basis (They can take the profit and principal out of country.) But, if they make payment from NRO account then it will be on non-repatriable basis. However, the dividends can be on repatriated. No prior or extra permission, needs to be taken from RBI for this.

Real estate on becoming NRI

You can continue to hold residential and commercial properties in India. You can also lease them and repatriate the rental income received after paying the due taxes, if any.

- A tenant who pays rent to an NRI owner must remember to deduct TDS at 30%. The income can be received to an account in India or the NRI’s account in the country he is currently residing.

- When an NRI sells property, the buyer is liable to deduct TDS @ 20%. In case the property has been sold before 3 years from the date of purchase a TDS of 30% shall be applicable. NRIs are allowed to claim exemptions under section 54 and Section 54EC on long term capital gains from sale of house property in India. Limits and conditions for repatriation are different based on the funds used for buying property

Credit Card on becoming NRI

It’s better to not use the Indian credit card abroad due to the costs attached to overseas expenses. In case of credit cards, you can either surrender them or maintain for future visits in India. Note that credit card bills can be paid only through an NRO account and not an NRE account,

When credit card is used overseas, apart from the normal charges, following charges are also applicable

- Foreign currency conversion: This rate also called as cross-currency mark-up is levied on every transaction you make abroad using your Indian credit card. The normal range is 3-5% and varies for each bank, and the rate is applied on the date of settlement and not on the date of transaction. So for e.g. if you use credit card on 20th June but the settlement is done on 24th June then rate on 24th June will be applied.Typically it is around 3%, based on type of cards.

- Foreign Transaction Fee (FTF): Visa and mastercard is the world’s most widely used and accepted payment network. They act as mediator between the card issuing bank and the merchant from which you have purchased goods/service. So when you use Indian credit card abroad, two parties charge a transaction fee: Visa, mastercard and other payment networks charge 1% and your card issuing bank such as HDFC, Axis bank, SBI and others charge 2%.

- International card withdrawal fee: In addition to the cash advance fee there is overseas withdrawal fee .This is an additional fee charged when you use Indian credit card for ATM cash withdrawal in foreign country. And this cash advance fee is between 1-2%. Also be aware, the moment you make cash withdrawal abroad the interest rate starts.

If you decide to surrender your credit card. Pay off your credit card dues and surrender your cards. Do get closing statement from the credit card company.

Gas connection on becoming NRI

If you don’t refill for more than 6 months your gas connection gets deactivated.

- For reactivating LPG connection which is deactivated due to not availing refill for more than 6 months, you have to submit a written application to your nearest dealership. Make sure to carry your original ID and address Proof along with 2 coloured photographs. The format has to be something like this Indane Gas connection reactivation form.

- You can transfer to a family member during life time along with KYC Form. Transferee should not already be in possession of LPG connection from any of the Government owned Oil companies.

- You can put your Gas connection in Safe custody for a year with your gas distributor for period of 1 year. So when you come back you can resume the connection soon.

- You can surrender your connection, i.e submit cylinder(s) and pressure regulator to your Distributor and obtain a refund of the deposit amount.

Mobile phones on becoming NRI

If you don’t use your number for 3 months your number will be deactivated and some other person will be continuing to use your number after 3-4 months. For Postpaid connection, you need to pay full amount then go to service provider’s office and submit an application to close your postpaid connection. If you do not pay the bill, then the company will be calling you to pay the bill on your alternate number. If you do not pay further, after a few days they can send you a legal notice for nonpayment of the bill at your address.

If you don’t want to surrender your mobile phone Activate international roaming on your existing India number and carry it with you outside India. This is to ensure that you receive the One Time Password (OTP) while transferring funds from your bank accounts in India.

Income tax Return for NRI

According to Section 174 of the Income Tax Act, any person leaving India who plans to stay away for a long time, is required to file his return for the total income earned during the financial year up to the date of his departure. Guidelines for NRI for filing Income Tax Return in India are given below. Our article NRI and ITR :TDS,Tax and Income Tax Return discusses it in detail.

- Only the income which is earned in India is taxed in India.Such income would typically include salary received in India, rental income from properties in India, interest on bank deposits or other securities, dividend income, capital gains etc.

- Income earned by NRI outside India is not taxable in India.

- Rates of taxation for various types of income applicable to NRI are same as those applicable to resident Indians.As a thumb rule you must file an IT Return in India for if your Gross Income is more than exemption limit or Rs 2,50,000 (assuming you are less than 60 yrs old. Rs 3,00,000 if 60-80yrs old and Rs 5,00,000 if more than 80 years old).

- However, tax-exempt incomes like that earned on investments in PPF will continue to be exempt in India. How the foreign country treats the amount for taxation would depend on its rules

- Interest on NRE or FCNR(B) deposits is exempt from tax in India. Hence, TDS is not applicable.

- On the other hand, interest on NRO deposits is taxed as per the income tax slab of the investor. TDS on such interest income will be deducted at 30% for NRI investors. It is quite possible that the NRI investor does not fall in the highest income tax bracket. However, the bank is not aware of this. Hence, it deducts the TDS at the maximum possible tax rate. If you fall in the lower tax bracket, you can get the refund after filing returns.

Locker on becoming NRI

As It is mandatory for the holder to operate locker once in the six-month else bank has a right to break the locker. Once you become NRI it won’t be possible for you to operate locker every six months. So before leaving India you need to either close your locker or add joint holder in the locker.

Nomination

You should make sure that all your financial assets have nominees. A nominee is important as in the event of any unfortunate incident the fate of your financial assets will be uncertain in the absence of any person who can lay claim to them. Our article How to Nominate:Bank Account, Mutual Funds talks about im detail.

Power of Attorney on becoming NRI

Give power of attorney to someone in India as it is operationally easier if you have someone you trust manage your bank accounts and other financial transactions for you. A power of attorney can be given to mange almost all your financial matters including operating bank accounts, buying and selling real estate, renting out your property, signing your tax forms, issuing cheques from your account etc. A POA holder cannot open bank accounts on your behalf. He can only operate bank accounts once they are opened.

Remember PoA is very important. So give it to only whom you trust absolutely. Make sure you contact a lawyer to do this the right way. Once PoA is registered , submit copies to banks and other institutions such as mutual fund house or bank, preferbly before leaving India. There are two types of power of attorneys:

- A general POA : A generally power of attorney gives sweeping rights to the holder to conduct a broad number of transactions on your behalf, such as banking transactions, real estate transactions.

- A specific POA. The specific power of attorney is more restrictive in that each power of attorney defines a specific scope such as power to rent property, power to issue cheques on your behalf etc., thus implying greater safety.

Scan all your policies, bank accounts, pan card, passport and other documents like marks certificates, marriage certificate and send a copy of the same to yourself,your husband and also store in a account in the web if need be, they are always handy.

Related articles:

- Bank Accounts for NRI:NRO,NRE,FCNR

- NRI and ITR :TDS,Tax and Income Tax Return

- NRI : Fixed Deposits, DTAA

Re-locating outside India is definitely some work. While one plans the trip and associated things, if one also draws up a checklist for to-do’s on financial aspects, it can greatly help avoid the undue hassle and pain of paperwork that may result . What did you or someone you know did when you moved out of India.

23 responses to “On Becoming NRI: What to do when you leave India to settle abroad”

It may be a challenging problem for NRIs and their dependents to select the most appropriate and safest Mediclaim or family medical insurance package. Factors such as family medical background, pre-existing medical conditions, ethnicity, age, body mass index (BMI), marital status, and so on should be weighed. Health insurance is beginning to gain a great deal of importance in India today. That is why the best ways to choose a Mediclaim or medical insurance for your needs are provided by Prosperity.

Thank you so much for this information. Also, I found more information related to NRI applying for PAN card, here it is How to get Pan Card for NRI ?

Thank you for sharing the information. I will take advantage!

Thanks for sharing such a useful information here. i have clear some doubt about consumer rights in india keep it up with good work!

If suppose i am not staying more then 180 days in outside of india in this financial year then i am not NRI and from next financial year i will be NRI? When will i convert my account? while in India or after having the address proof ?

Can you write a post for those who are moving outside of India temporarily say 3 years? What should they need to manage in personal finance and how do they invest from outside of India?

Thanks for the idea.

Will work on it.

Oh. Its an amazin article. I have been looking around for this information. Thanks for the detailed information. It is truely helpful. Keep posting more. Thanks. Bank Account Types

Hello everybody, here every one is sharing these kinds of know-how, therefore it’s good to

read this blog, and I used to pay a quick

visit this webpage daily.

Can an NRI do PF withdrawal into his NRO account?

Is this the same account which is associated with your UAN?

For how many years have you contributed?

what are the repercussions if a person on becoming NRI does not intimate change of status to Banks where savings and deposit accounts are held?

Yes NRI can make investment in Mutual Funds through NRO accounts after KYC is done.

Interest on PPF is tax exempt and you cannot claim it under 80C.

Contact your bank or broker through which you have Demat account and tell them that you are now NRI. There are types of trading accounts based on NRE & NRO.

Hi, I am immigrating to the U.K. in the next two months. My current savings are held in mutual funds (equity & debt) and PMS. I plan to redeem all investments in to my savings bank account. In addition, I have a land/house holding that I intend to keep for when I return once every year. My question is (1) whether I can transfer all of my savings bank funds to my new savings bank account in the U.K. or is there a limitation on the amount of money I can transfer each financial year. Ideally, I would like to transfer all my savings (tax paid) to U.K., so I can purchase a home and settle there. (2) can I continue to hold the land/house and what is the procedure to transfer the funds should I decide to liquidate it after a few years? Or should I sell it right away before becoming an NRI. Kindly advise asap. Thanks in advance.

Sir, looking forward to your kind response. John

Which bank do you have account in and you want to use for future?

Did you speak to bank official?

Which type of visa do you have? Depending on this your taxing might change a little.

(1) Yes, you can transfer your tax paid money to UK. As far as I know, there are no taxes to be paid to money transferred into UK bank account. While buying a home, you might have to declare the source of this income and if required a proof might be needed. So, keep the documents just in case.

(2) https://www.gov.uk/tax-foreign-income – UK resident do pay tax on foreign income provided you don’t pay tax in your foreign country. There is a tax relief to avoid double taxation.

You don’t have to sell your properties. UK is a friendly country in terms of taxation and is very transparent. use http://www.gov.uk for all your information.

We have a demat acct now that we have become NRI is it compulsory to change to NRO demat.we are above 75 years

Cant ,handle the confusing procedures please advise me kin simple words tell me how to change to demat NRO

Thanks

savithri_gopalan@yahoo.com

Non-resident Indians have restrictions when it comes to equity investments in India.RBI has a long guide of dos and don’ts for NRIs to make an investment in Indian Companies. An NRI customer can invest or trade in shares and stocks through the secondary market only through a designated account called as PIS or PINS (portfolio investment services).

Contact your bank or broker through which you have Demat account and tell them that you are now NRI. There are types of trading accounts based on NRE & NRO.

Repatriable Demat Account: Repatriable Demat Account is used to hold securities that purchased using funds that are repatriable. When you sold these sales proceed of these shares is usually credited to the NRE Bank Account.

Non-Repatriable Demat Account: Non-Repatriable Demat Account is used to hold securities purchased using funds that are non-repatriable funds or bought when you were an Indian citizen. The sale proceed of these securities are generally credited to NRO Bank Account.

You have said that NRI can continue the PPF account which was opened while they were Resident in India.

I would like to know whether NRI can get benefit under section 80C for the contribution and interest received on PPF ?

NRIs can avail the same deductions under Section 80C that are available to resident Indians. For instance, you can claim deductions on premium for life insurance, term deposits, pension schemes, and on contribution to PPF.

Interest on PPF is tax exempt and you cannot claim it under 80C.

Can an NRI remit funds from abroad directly into his NRO account for investing them in mutual funds?

Yes NRI can make investment in Mutual Funds through NRO accounts after KYC is done.

An NRI cannot make the investment in foreign currency. He needs to give us a Rupee cheque from his NRE, NRO bank account in India. He may also send a Rupee cheque from abroad payable in a bank in India.

In NRO account, Inward remittances from outside India, legitimate dues in India and transfers from other NRO accounts are permissible credits to NRO account. So you can remit money from outside to your NRO account and use it for Mutual Funds Investment.

Please check RBI guidelines Accounts in India by Non-residents