The NSEL scam,estimated to be a Rs. 5600 crore (around US$ 0.9 billion), is a systematic and premeditated fraud perpetrated in the commodity market of the National Spot Exchange that is based Mumbai, India. The NSEL is a company promoted by the Financial Technologies India Ltd and the NAFED. It came out to light after the National Spot Exchange failed to pay its investors in commodity pair contracts after 31 July 2013. This article explains the NSEL Scam, how it unfolded and what lessons investors can learn from it.

National Stock Exchange Limited (NSEL) Scam

Spot exchange is an electronic version of the age-old mandi, where buyers and sellers meet to exchange goods and money. NSEL, NCDEX Spot floated by the NSE group, and R-Next, floated by Reliance Capital, are the three main spot exchanges. A spot exchange normally offer T+2 contracts. Thus, if you buy on the exchange, you have to pay within two days and take delivery.The commodity is required to be delivered physically.

The exchange, NSEL, was unregulated. NSEL offered a pair of contracts for which settlement was due in two days( called as T+2 contract) and a second for which settlement was due in 25 or 35 days,called as T+25/T+35 contract . The commodity is required to be delivered physically. But the exchange facilitated use of electronic warehouse receipts, enabling investors to avail of the arbitrage, without taking physical possession of goods. Within these forward contracts, an investor could lend money for 25-50 days for a receipt of commodities stocked in warehouses, and after the end of the contract (which was after 25-35 days) get a pre-agreed fixed return and return the receipts. This allowed speculators to make financial returns without actually taking physical possession of commodities. The exchange collected a margin of 10% apart from having the security of the underlying stock. The exchange is expected to facilitate short sales, but it is believed that stockists were allowed to sell the commodity on a T+2 basis without actually depositing the commodity in the warehouse. There were also doubts about storage and quality of physical goods in the warehouse.

It was subsequently discovered that most of the underlying commodities never did exist and the buying and the selling of commodities like steel, paddy, sugar, ferrochrome etc. was being only conducted only on paper. Some of the warehouses mentioned on the NSEL website were found to be physically non-existent. The investors, who honored the T+2 payment obligation, found that the National Spot Exchange neither had the money, nor the commodities, to honor their T+25 dues. The SGF (Settlement Guarantee Fund) ,of around Rs 839 crores (about US $140 Million), as on 29 July 2013, vanished into thin air.Around 24 borrowers were given the funds by the NSEL, without any underlying commodity deposited by those borrowers. One of those borrowers who borrowed around Rs. 1000 crores is a company named NK Protein Ltd. An estimated number of 15000 investors, along with public sector units like MMTC and PEC, were victims of this NSEL scam.

The EOW (Economic Offences Wing) of Mumbai police is presently investigating this fraud and the Mumbai police has conducted various raids. The Economic Offences wing of Mumbai police finally arrested Jignesh Shah along with his trusted lieutenant Shreekant Javalgekar who were all along belived to be the masterminds of the scam on 7th May 2014 . As per Mumbai police the arrests were required as Jignesh Shah and Javalgekar did not cooperate in interrogations. They diverted questions and always laid the responsibility on the former NSEL CEO while actually it was found that Jignesh Shah approved all fraudulent contracts.

The police in January chargesheeted five persons including Anjani Sinha, NSEL’s former managing director, Amit Mukherjee, exassistant vice-president of business development at NSEL, Jai Bahukhandi, exassistant vice-president of warehousing at NSEL; Nilesh Patel, MD of N K Proteins Ltd; and Arun Kumar Sharma, MD of Lotus Refineries Pvt Ltd. Later, the police arrested Surendra Gupta, MD of Dunar Food, Indrajit Namdhari of Namdhari Food International Limited, Rajesh Mehta of Lotus and Sanjeev Bhasin.

Police had seized 1.2 lakh shares of Shah that were in FTIL. The estimated value of these shares was around Rs 179 crore. Besides this, police also sealed Shah’s Juhu bungalow, a row house at Aarey Colony (worth Rs 78 lakh), a plot in Pune worth Rs 1.6 crore, shares worth Rs 51 lakh in India Energy Exchange, and FDs worth Rs 11.8 crore in a private bank. Five demat accounts were also frozen. Shah earned Rs 160 crore by way of dividend from FTIL, police said. Till date, the EOW has frozen 322 bank accounts holding Rs 171 crore, attached over 210 properties worth Rs 2,600 crore and seized 15 high-end cars worth Rs 5.8 crore.

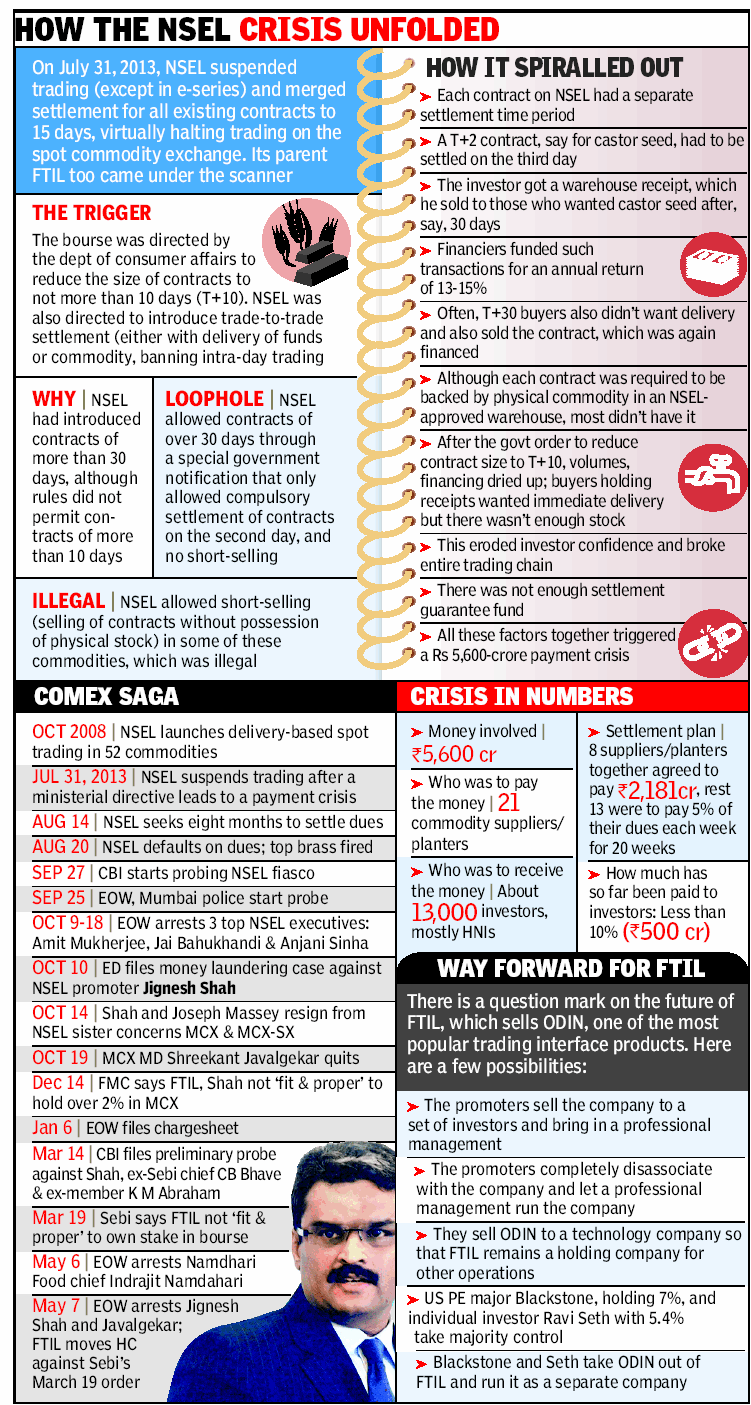

The image below captures how the NSEL Crisis unfolded. Image is from Times of India,NSEL case: Jignesh Shah held in Rs 5.6k cr fraud,( 8 May 2014)

LESSONS LEARNT

Is this the last scam we have seen? No . Scams are of various sizes and can affect anyone from high networth investors (HNI) or small ones as in case Sardha Chit fund( Understanding Chit Funds). One can blame government, regulators for not having strict regulations but finally somewhere we have to take responsibility for our own decisions discussed in our article Mis-Selling or Mis-Buying: It’s My Money, My Responsibility . Remember the old saying your parents/teachers taught you when you point finger at other four fingers point back at you. As long there is greed to earn money through short cuts scam will happen. The lessons one can learn from the NSEL crisis are:

- If someone promises high returns for very long periods, one must seek complete clarity . In case of the NSEL, there was always a doubt as to which regulator governs it, whether it was regulated at all, and whether the contracts were valid and enforceable. The press had often mentioned the gap that existed between the finance ministry, Sebi and FMC on this issue.

- While investing in an instrument that is offering high returns, the risk has to be evaluated. For example in NSEL Crisis the size of the Trade Guarantee Fund versus the volumes being reported was under question.

- As Warren Buffet says Never invest in a business you can’t understand. Understanding a business really well can help you smell trouble from miles away. Also, you can never have conviction in something you do not understand.

- There is no such thing as free money, but scammers will try to convince you that there is. If you have a gut feeling that something is not quite right, you’re probably right. Remember There is nothing called a risk-free return if someone claims that he is giving more than bank fixed deposits. Be extra careful when getting into a product which offers more.

- Many People believe there are short cuts to wealth that only a few people know. Ask yourself the question: if someone knew a secret to instant wealth why would they be spending their time telling everyone, or need to charge people money for it?

- Investors should test any new investment product for integrity before investing huge amounts.

Related Posts :

- Understanding Chit Funds

- Mis-Selling or Mis-Buying: It’s My Money, My Responsibility

- Know Your Customer or KYC

- Cyber Crime : Credit Card Fraud,Bank Account Hacked

- Understanding Bitcoin

What do you think of NSEL crisis? Will investors get their money back? Will culprits be punished? How do you evaluate an investment product? Have you been tempted by any short cut to money? How and what happened?

3 responses to “NSEL Scam”

Good Post. You seem to have a good research on this.

Would like to connect with you furthere.

Here is my latest post on NSEL

-Aashish

PGurus – NSEL Crisis : When will investors be paid back?

Hey, I thought this was a awesome article. Thank you for sharing.

Hey, I thought this was a awesome article. Thank you for sharing.