National Savings Certificates or NSC, from Indian Postal Service is used for small savings and income tax saving investments in India. These are investment tools that can help investors get returns on the money invested and also get benefits in their taxable incomes. The inception of the NSC can be traced back to the 1950 when the government issued savings certificates in order to raise money to help fund the development of a new and independent India.

Table of Contents

National Saving Certificate

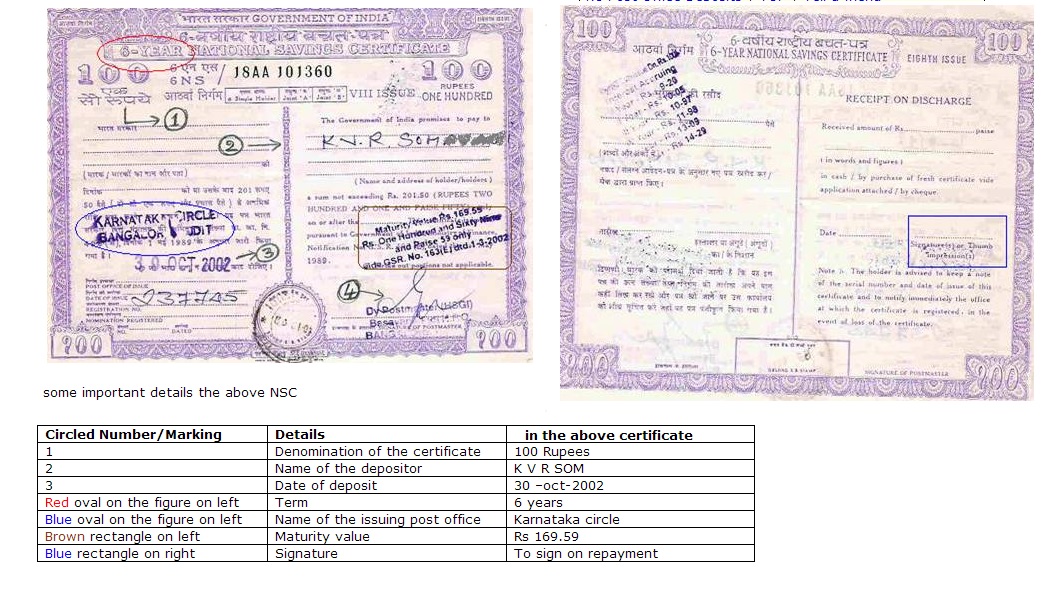

NSC is a fixed income investment product, which means one earns a predefined interest during the period of holding. A person can purchase any no. of certificates of any denomination. At the time of maturity, the holder of the certificate submits the certificate to the Post Office and gets the amount invested plus the interest.

Indian post office (run by Govt. of India) offers small saving schemes in India. National Savings Certificates (NSC) are issued by Department of Post, Government of India are available in denominations of Rs 100, Rs 500, Rs 1,000, Rs 5,000 and Rs 10,000. NSC are backed by Govt. of India, are available at post offices, offer decent returns, are tax exempt under section 80C not only during investment but the interest earned(which is reinvested) can also be claimed as tax deduction. Which made them very popular earlier.

- Scheme specially designed for Government employees, Businessmen and other salaried classes who are Income Tax assesses.

- No maximum limit for investment.

- No Tax deduction at source.

- Certificates can be kept as collateral security to get loan from banks.

- Trust and HUF cannot invest.

Interest rate and NSC or National Savings Certificate

What are the issues of National Savings Certificate (NSC) currently available?

Only NCS VII valid for 5 years is currently available , NCS VIII issue and NSC IX issue.

- Till 30th Nov 2011 NSC VIII was available for period of six years but from 1st December 2011, this has been reduced to 5 years.

- NSC (IX issue) with maturity period of 10 years discontinued with effect from 20th December 2015.

Interest rate on NSC are given in table below

| Period | VIII Issue(5 years) | IX Issue(10 years) |

| Upto 30.11.2011 | 8.00% | NA |

| 01.12.2011 to 31.03.1012 | 8.40% | 8.70% |

| 01.04.2012 to 31.03.2013 | 8.60 | 8.90% |

| 01.04.2013 onwards | 8.50 | 8.80% |

| 01.04.2013 to 19.12.2015 | 8.50% | 8.80% |

| 20.12.2015 to 31.03.2016 | 8.50% | Discontinued |

| 01.04.2016 to 30.09.2016 | 8.10% | – |

| 01.10.2016 onwards | 8.00% | – |

How is interest rate calculated in NSC?

The Interest Rate on NSC is compounded half yearly but paid at maturity(cumulative scheme). Every year in April, the interest rates are reset according to what the market yield for government debt is. While the interest rate for NSC will stay locked at the rate when the investment is started, PPF returns changes every year.

What does compounded half yearly mean?

Compounded means that at the end of the period, interest earned is added to the principal. This sum then serves as the new principal for computing the interest for the next period. You continue doing this for every period, with the period being that which is agreed upon–monthly, quarterly, yearly, etc. Compounding tells us how many times our interest will be calculated. Our article First lesson in financial education:Compound Interest talks about it in detail.

- Compounded yearly means the bank applies interest once a year.

- Compounded half yearly means the bank applies interest twice a year (once every 6 months)

- Compounded monthly means the bank applies interest once a month.

Tax and NSC or National Savings Certificate

NSC is the only small saving scheme wherein not only the initial deposit, but also the interest for the years (other than the last year), is eligible for a deduction under section 80C. Tax exemption or Tax deduction for NSC and Income Tax Return

- The interest is not paid to the investor every year but is reinvested so a tax payer can claim the interest as tax deduction under section 80C. Remember that Section 80C has a maximum limit of Rs 1.5 lakh. Provident fund contributions, insurance premiums, housing loan principal repayments, tuition fees, PPF, tax saving mutual funds and bank deposits and any fresh investment in NSC are also covered under the same Rs 1.5 lakh limit

- if not claimed as deduction, Interest on National Savings Certificate (NSC) is taxed as per the Income Tax Slabs of the Individual.

- No TDS is deducted on interest (but one has to pay tax on the interest earned)

- The interest earned on NSC on a yearly basis can be added to the total income under the head Income from other sources and the same can be claimed as deduction under Section 80C, making the interest tax-free. But if the accrued interest is not taxed every year on an accrual basis then the entire income is taxable on maturity. We shall discuss it in detail in another article

Comparison of NSC and PPF

- At time of Investment : Investment in Both NSC and PPF can be claimed for tax deduction under section 80C (Remember that Section 80C has a maximum limit of Rs 1 lakh.) In both the PPF and NSC, the return is eight per cent, though in the latter case, the yield works out slightly higher at 8.16 percent due to the half-yearly payment.

- Lock in period : PPF for fifteen years while NSC for 5 or 10 years.

- Interest earned : PPF interest is tax free , whereas the NSC interest becomes tax free on account of the deemed reinvestment under Section 80C. If not claimed as deduction interest earned is taxable.

How to buy NSC or National Saving Certificate?

The main objective of investing in the NSC is to avail tax deduction on deposits and guaranteed returns on investment. The five and ten year tenure is used by many to create a regular monthly income stream in retirement or investing in name of minor children timing it for their higher education .

Any individual singly or jointly with other adult.A guardian on behalf of a minor. There are three kinds of NSC certificates

- Single holder Type Certificate: This type of NSC is issued to the holder himself or on behalf of the minor.

- Joint A type Certificate: This type of NSC is issued jointly to 2 adults payable to both the holders jointly.

- Joint B type Certificate: This type of NSC is issued jointly to 2 adults payable to either of the holders.

Minimum Amount to be invested in National Savings Certificate is Rs. 100 and there is no maximum limit on the amount to be invested in the NSC

Who cannot buy NSC?

- HUF’s and Trusts are also not eligible to invest in this savings scheme

- NRI’s are not eligible to purchase National Savings Certificate (NSC). However, if a person was a Resident Indian at the time of purchasing the NSC and become a NRI during the maturity period, then he can continue holding the certificate till maturity.

Can NSC be transferred from one post office to another?

Yes National Saving Certificate can also be transferred from one post office to another by filling Form NC-32 NSCs can also be transferred from one person to another by paying a small fee.

How to Buy NSC

National Savings Certificates (NSC) are issued by Department of Post, Government of India, and are available at most post offices in the country in denominations of Rs 100, Rs 500, Rs 1,000, Rs 5,000 and Rs 10,000. Once you have decided on the sum that you wish to invest:

• You need to fill the NSC application form NC 71 (for VIII issue) available at the post office.

• Carry original identity proof for verification at the time of buying.

• You can buy the certificate with cash, cheque or demand draft drawn in favour of the postmaster of the post office from where the NSC is being bought.

• Choose a nominee and get a witness signature to complete the formalities when buying the certificate.

The Postmaster shall issue the new NSC Certificate on the spot or shall otherwise issue a provisional receipt to the purchaser which can later be exchanged with the National Savings Certificate (NSC) .

Nomination in NSC

The purchaser of the National Savings Certificate (NSC) may nominate any person as a nominee at the time of purchasing the National Savings Certificate in application Form. The person so nominated shall be entitled to claim the maturity proceeds in case of death of the Original Holder.One can cancel the nomination or change Nomination previously made by submitting form NC-53.

If NSC is lost or stolen

If the National Saving Certificate is lost, stolen, destroyed, mutilated or defaced, the rightful owner of such certificate may apply for the issue of a duplicate certificate with required information in the form NC-29 to the post office where the certificate is registered or to any other post office which shall forward the request to the post office from where the certificate has been issued

Maturity of NSC or National Saving Certificate

On Maturity

National Saving Certificates (NSC) can only be redeemed on maturity of the specified term. At the time of maturity, the holder of the certificate needs to submit the certificate to the Post Office. On receipt of the maturity amount, the holder needs to sign on the back of the certificate and surrender the certificate to the Post Master.

Certificates are encashable at any post office in India provided one has obtained transfer of the certificate to the desired post office. (Some say NSC can be encashed at any other Post Office subject to satisfactory verification of the identity of the presenter)

In case of certificates purchased on behalf of a minor who has since attained majority, the certificate shall be signed by such a person himself, but his signature shall be attested either by the person who purchased the certificate on his behalf or by any person who is known to the Postmaster.

Maturity proceeds not drawn are eligible to post office savings account interest for a maximum period of two years

Premature Encashment of NSC or National Saving Certificate

A National Saving Certificate may be prematurely encashed in case of

- Death of the holder

- Forfeiture by a pledgee being Gazetted Government Officer when the pledge is in conformity with these rules

- When ordered by the Court of Law

Amount one gets on premature encashment

- If the Certificate is encashed within one year from the date of certificate, only the face value of the Certificate shall be payable.

- If the certificate is encashed after expiry of one year but before the expiry of three years from the date of certificate, an amount equivalent to the face value together with simple interest is payable.

- The amount payable after expiry of three years from the date of the certificate (VIII issue) on certificate of Rs 100 is as under:

-

Period lapsed from the date of certificate Maturity Amount Purchased before 30.11.2011 Purchased during 01.12.2011 to 31.03.2012 Purchased after 01.04.2012 > 3 years < 3 years and 6 months 121.15 123.14 Not Available > 3 years and 6 months < 4 years 125.09 127.49 Not Available > 4 years < 4 years and 6 months 129.16 131.99 Not Available > 4 years and 6 months < 5 years 133.36 136.65 Not Available > 5 years < 5 years and 6 months 137.69 Not Applicable Not Applicable > 5 years and 6 months < 6 years 142.16 Not Applicable Not Applicable

Laddering of NSC

Laddering involves creating an income ladder, one rung at a time.

You can use FD and NSC to create 5 year ladder.If you want a five-year ladder, you cannot reach the fifth rung without climbing the first four. So, instead of investing your entire corpus, say, of Rs 5 lakh, in a five-year deposit, you break it up into five equal parts of Rs 1 lakh each. Then invest one block in a one-year deposit, another in a two-year deposit, and so on till you invest the fifth in a five-year deposit. A year down the line, the one-year deposit will mature and it can be reinvested in a five-year paper to create the sixth rung. When the two-year deposit matures, it can be reinvested in a five-year deposit to create income in the seventh year

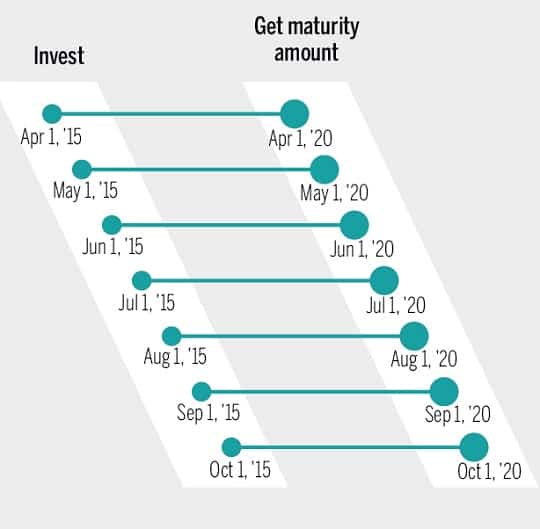

It can be used to create Monthly ladder as shown in image below.

The assured return on NSC, can be used to create an income ladder. Certificates for appropriate denominations,can be bought every month or quarter which on maturity will act as a steady income stream. Some people use this ladder effect to create an income stream that will last 5 years by timing NSC maturity and re-investment to create an assured income in retirement.For instance someone retiring in 2019, can create an income ladder by investing a fixed sum every month from August 2014.

Forms related to National Saving Certificates

Forms related to National Saving Certificates can be downloaded from Post office webpage

Related Posts

- Understanding Public Provident Fund, PPF

- Choosing Tax Saving options : 80C and Others

- Fixed Deposits and Tax

- How Gold Ornament is Priced?

- Investing : Articles about Investing organized.

Please give your comments or feedback on the article. Do you invest in NSC? Why or Why not? Do you invest in Post office saving schemes? How do you plan your investments? If you liked the article please share with your friends and family.

9 responses to “What are National Savings Certificate (NSC)”

Do we have to buy the certificate at once or monthly??

Depends on your convenience and purpose for which you are buying.

Started employment this year in India. How much is the maximum amount to invest on NSF? Can I invest on both ppf and nsf

I have a 7 year old kid. So please suggest.

1.5 lakh under 80C in PPF and NSC and includes EPF , Life Insurance premiums etc

I am out of India for past few years and my certificate matured last year. Can I post the signed NSC certificate to the post office with my bank details for redemption?

Suppose if i buys 10000 Nsc certificate monthly for 5 years and after maturity i wanted to re-invest, then how would i get the money and what is the process.

To buy NSC one has to go to Post office.

To redeem also one has to go to the Post office. Preferably the same post office from where you have bought NSC.

If you do it from another post office, you would have to submit a letter and wait for confirmation. (This will slowly go off as Post offices are moving to CBS or Core banking service and using technology.

Things you need for NSC encashment.

1- Original NSC certificate

2- Proof of Identity (e.g. Valid Indian Passport, Indian Driving License etc.) of the holder.

3- NSC Encashment Form

4- The investor/nominee must sign behind the certificate as a receipt for amount received on encashment

The amount is to paid in cash or credited to an Saving Bank Account.

If you intend to renew NSC after maturity then it’s like closing the account and opening a new one. So open post office saving bank account. Money would be credited into your Post office saving bank account which can be used to buy new NSC certificates.

You can also use services of agent who deals in NSC.

With the new rule in dec 2015 can old NSCs be cashed prematurely

The only change we know of NSC is NSC (IX issue) with maturity period of 10 years discontinued with effect from 20th December 2015.

Could you tell us about other changes?