It’s a common practice among NRIs to carry some amount of Indian currency with them when they leave the country, mainly for the convenience of not having to exchange forex into rupee when they return the next time. With Demonetization of 500 Rs and 1000 Rs notes which are not valid from 8 Nov 2016, questions that NRI are asking is how to exchange Rs 500 and 1000 Rs notes. This article talks about How do NRIs change their old 500 Rs and 1000 Rs notes, Tax on Deposits in NRO account,Difference between NRO And NRE account, Government Committee on Demonetization for NRIs and Others, RBI directive that NRIs, foreigners can’t leave with Rupee. What Passengers coming to India have to declare?

Table of Contents

How do NRIs deposit Rs 500 and Rs 1000 notes from 2 Jan 2017?

Among Indian citizens, two categories of individuals can avail of the facility of depositing Specified Bank Notes (SBNs), old 500 Rs and Rs 1000 notes,

- Resident Indians who were abroad during the period from November 9 to December 30, 2016, from January 2, 2017 to March 31, 2017

- Non-Resident Indians(NRIs) who were not in India during the period from November 9 to December 30, 2016.

- This facility is not available for Indian citizens resident in Nepal, Bhutan, Pakistan, and Bangladesh.

- NRIs can deposit old Notes from January 2, 2017 to June 30, 2017 only once.

- This facility will be made available through five of the offices of the Reserve Bank viz. the Reserve Bank offices at Mumbai, New Delhi, Chennai, Kolkata, and Nagpur.

- NRIs and Indians returning from abroad will have to physically show the junked 500 and 1,000 rupee notes to Customs officials at the airport and get a declaration form stamped before they can deposit the demonetised currency in RBI during the grace period.

- Notes will be restricted to a maximum of ₹ 25,000 per individual depending on when the notes were taken out of India as per relevant FEMA rules.

- Notes should be submitted along with a Form as per Annex 2.

- A Copy of Passport with immigration stamp as proof of the individual’s absence from the country during the period November 9, 2016 to December 30, 2016 should be submitted. Passport in original should be presented at the RBI counter for verification.

- Copies of statements of all bank accounts in India evidencing that no SBNs were deposited during November 10, 2016 to December 30, 2016.

- Requisite document as per provisions of Section 114B of IT Rules, 1962 are required to be submitted.

- An acknowledgment of receipt will be issued to the tenderers pending credit of admissible amount.

- On ascertaining that the NRI was abroad during the period from November 9, 2016 and December 30, 2016, the account is KYC compliant, fulfillment of other conditions and the genuineness of the notes tendered, the admissible amount will be credited to the account under advice to the tenderer.

A wrong declaration would invite fine of Rs 50,000 or five times the seized amount, whichever is higher as per the ordinance.

Not more than 10 notes of demonetised currency can be held after December 30, which will invite a fine of Rs 10,000 or five times the amount sized.

RBI offices for depositing old Notes from Jan 2, 2017

The facility of depositing old notes from Jan 2, 2017 is made available through five of the offices of the Reserve Bank viz. the Reserve Bank offices at Mumbai, New Delhi, Chennai, Kolkata, and Nagpur.

- Chennai

Reserve Bank of India,

Fort Glacis, Rajaji Salai,

P.B. No.40,

Chennai-600 001.

Office Timings: Monday to Friday : 9:45 am to 4:45 pm , Saturday : 9:45 am to 1:15 pm,

Contact: 044-25399110 044- 25387207 - Mumbai

Reserve Bank of India,

Main Building, P.O.Box 901,

Shahid Bhagat Singh Road,

Mumbai-400 001.

Office Timings: Monday to Friday : 10:15 am to 5:15 pm,Saturday : 10:15 am to 1:45 pm

Contacts: 022-22603179 - Kolkata

Reserve Bank of India,

15, Netaji Subhas Road,

P.B. No.552,

Kolkata-700 001

Office Timings: Monday to Friday : 9:35 am to 5:05 pm, Saturday : 9:35 am to 1:20 pm

Contact: 033 22312121 - Delhi

Reserve Bank of India,

6, Sansad Marg,P.B.No.696,

New Delhi -110 001.

Office Timings: Monday to Friday : 9:45 am to 4:45 pm, Saturday : 9:45 am to 1:15 pm

Contact : 011 23710538 to 42 - Nagpur

Reserve Bank of India, Dr. Raghavendra Rao Road

Civil Lines

P.B.No.15

Nagpur – 440 001

Contact : 712 2806300

How do NRIs exchange Rs 500 and Rs 1000 notes which are not valid from 8 Nov 2016 till 30 Dec 2016?

NRIs would personally need to exchange the notes in India or authorize someone to do it for them. The foreign branches of Indian banks, both public and private sector, are not accepting cash outside the country.

- If NRIs are travelling to India between 9 nov 2016 to the 30 December 2016, they can exchange or deposit it in their NRO account.

- If NRIs are travelling to the country between 02 January and 31 March 2017, they can visit any of the specified offices of the RBI along with the required documentation, passport and visa details, that prove they were out of the country and exchange the notes. Although the list of RBI offices that will accept this is still unclear

. - If NRIs have the banknotes in India, they may authorize in writing enabling another person in India to deposit the notes into their bank account. The authorized person has to come to the bank branch with the notes, the authority letter given by you and a valid identity proof to deposit the money on your behalf.

- If NRIs have the money abroad, they can send the money across to India through someone trustworthy and authorize them to deposit it on their behalf.

- Passengers(excluding citizens of Pakistan or Bangladesh) may bring or take out of India (other than to Nepal and Bhutan) can bring up to Rs 25,000 and take out Rs 25,000 in Indian currency.

- Passengers(excluding citizens of Pakistan or Bangladesh) may bring or take out of India (other than to Nepal and Bhutan) can bring in or take out unlimited foreign currency, but has to fill up Currency declaration form if total cash amount is more than USD 5000 or total is more than USD 10,000. Currency Declaration Form from RBI (pdf)

Government Committee on NRI Exchange of Rs 500 Rs 1000 Notes and Demonetization

The Government has formed a committee with ministers from external affairs and economic affairs to look into concerns expressed by NRIs, tourists from abroad and foreign missions over demonetisation. You may approach the control room of RBI by email to publicquery@rbi.org.in or on Telephone Nos 022 22602201/022 22602944.

- While foreign missions had sought Ministry of External Affairs (MEA’s) intervention to facilitate smooth collection of consular and visa fee and to allow them access to more funds. Foreign missions wanted to know if they could collect consular and visa fees in old notes. If so collected, they have sought to know how will those be exchanged.

- If somebody has money abroad, and is not travelling to India immediately, what happens? How does he get new notes for those old notes?

- The third set of issues is by the money changer associations abroad. This is quite interesting because we don’t have full convertibility…So, they have asked us the same question that what they would do with the stacks they have. How do they convert those?

What should NRI do if their NRE/NRO account is due for Re KYC, Can you still deposit old Rs 500/1000 notes in the account?

The NRI/NRO account first should be updated with KYC with valid documents before deposition of old Rs 500/1000 notes. Though this could be different from bank to bank and you should check with your bank first.

Tax on Deposits in NRO account

You cannot deposit the INR cash in your NRE account even if you have withdrawn from it and even if it is the old notes of Rs 500 and Rs 1000. You can only deposit those notes into your NRO account, which allows you to deposit Indian rupees.

If you don’t have an NRO account then You will need to make a request for opening of a NRO account in the same customer Id through the Internet banking logged in the section or by calling our 24×7 customer care or placing a request at the branch in India with your Bank. For example, if you have NRE account with ICICI then you can request to open an NRO account online by logging into your Internet Banking account. The account will be opened within 2 working days. Post which you or your authorized representative may deposit the cash in the NRO account

The NRIs can deposit their cash in the NRO accounts. All cash deposits of more than Rs 2.5 lakh to a bank account until 30 December 2016 will be reported to the tax department by banks. It will then be matched with the depositor’s income tax returns and suitable action taken. If you can explain the source of cash, then there will be no tax and penalty.

Also, filing an income tax return in India becomes mandatory for an NRI if the sum total of his taxable income from all sources (before claiming any deduction) exceeds the basic exemption limit of Rs. 2.5 lakh.

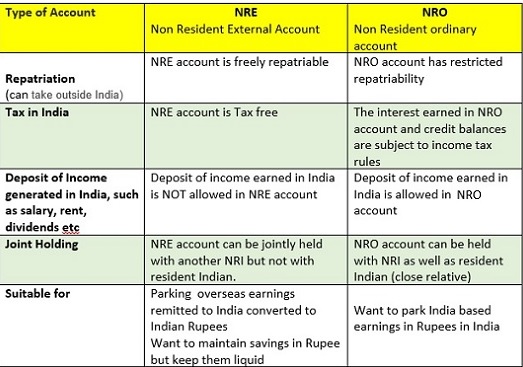

Difference between NRO And NRE account

Non Resident External accounts (NRE) and Non Resident Ordinary accounts (NRO) are meant for Non Resident Indians (NRIs). These accounts offer a host of benefits such as repatriation, tax benefits, currency flexibility, etc. The following images shows difference between these accounts. Our article Bank Accounts for NRI:NRO,NRE,FCNR discusses these accounts in detail.

NRIs, foreigners can’t leave with Rupee

According to RBI officials, in case NRIs and Foreigners have Indian currency notes in their possession before boarding the flight, Indian customs officials can act against them. A directive was issued on Sep 2013, from the Reserve Bank of India (RBI), which said that every non-resident Indian (NRI) and foreigner leaving the country will have to compulsorily change Indian rupees in their possession into a foreign currency before they board the flight. Although the rule, which is part of Foreign Exchange Management Act (FEMA), has been in place for quite sometime now. RBI has allowed forex changers to open kiosks beyond the immigration desks at international airports to facilitate NRIs and foreigners opting to exchange rupee for other currencies before they enter the aircraft.

RBI has allowed NRIs to carry up to Rs 10,000 beyond the immigration and customs desks, and to the duty-free shopping and security checking areas in the departure hall in international airports to meet miscellaneous expenses. However, this has been allowed subject to the condition that NRIs will not be allowed to carry any Indian rupee beyond SHA and that they should dispose of Indian currency before boarding the plane.

To facilitate money changing facilities for NRIs and foreigners, foreign exchange counters have been allowed in departure halls in international airports beyond the immigration and customs desks. Such foreign exchange counters will, however, only buy Indian rupees from non-residents and sell foreign currency to them subject to usual terms and conditions.

Reference: NRIs, foreigners can’t leave with rupee

NRI may approach the control room of RBI by email to publicquery@rbi.org.in or on Telephone Nos 022 22602201/022 22602944

What Passengers coming to India have to declare?

From 1 Apr 2016, Passengers coming to India and not carrying dutiable goods will not have to fill up customs declaration form from . Flyers carrying prohibited and dutiable goods will only be filling up such declaration form, which was earlier mandatory for all passengers coming to the country. Airlines provide Customs Declaration Form to passengers carrying dutiable goods and that they should fill it up on board flights so that they do not have to stand in queue after deboarding.

- Foreigners’ duty free allowance has also been increased to Rs 15,000 from the existing limit of Rs 8,000, from April 1 2016.

- The duty free allowance of two litres of alcoholic liquor or wines, 125 cigarettes, 50 cigars and 125 gms tobacco for the passengers will continue.

- The limit to bring duty-free goods worth Rs 6,000 for passengers of Indian origin and coming from China has been taken away. The duty-free allowance for people coming from Nepal, Bhutan and Myanmar has been increased to Rs 15,000, more than two times the limit of Rs 6,000 at present.

- The increase in allowance will be applicable for journey by air. Those coming to India from land borders will not be able to get any amount of free allowance, the rules said.

- The monetary limit for passengers of Indian origin coming from any foreign destination, excluding Nepal, Bhutan and Myanmar, has also been increased. Now such passengers can bring duty free goods worth Rs 50,000 from tomorrow instead of Rs 45,000 at present.

- To check gold smuggling, the government has put a cap on gold jewellery being brought by Indian passengers who have been residing abroad for over one year. As per the new rules, a male passenger can bring gold jewellery of up to 20 gms with a value cap of Rs 50,000 and a woman can carry 40 gms of gold jewellery with a value cap of Rs one lakh. Under existing rules, there is only a monetary limit of Rs 50,000 and Rs one lakh for men and women passenger, respectively.

- The Indian Customs Declaration Form has been revised to include drones in the list of prohibited and dutiable goods. It is now mandatory for the passengers to declare it from tomorrow. Drones are generally imported by government agencies for use by the security personnel for maintenance of law and order as well as for ensuring vigil along the country’s boundaries. They are also used for surveillance in Naxal-hit areas.

- The customs form currently has fields for declaration of dutiable and prohibited goods, gold jewellery and bullion (over free allowance), satellite phone, foreign currency notes exceeding USD 5,000 or equivalent and Indian currency exceeding Rs 25,000.

- The passengers also need to mention about meat, meat products, fish, dairy and poultry products, seeds, plants, fruits, flowers and other planting material in the existing customs form.

- Further, they had to report to ‘Red Channel’ for payment of duty if they carry any such items.

- The new rules will also apply to the members of the crew of a vessel or an aircraft and they will be allowed to bring articles like chocolates, cheese, cosmetics and other petty gift items for their personal or family use which shall not exceed the value of Rs 1,500.

Related articles:

- Bank Accounts for NRI:NRO,NRE,FCNR

- NRI and ITR :TDS,Tax and Income Tax Return

- NRI : Fixed Deposits, DTAA

- On Becoming NRI: What to do when you leave India to settle abroad

Im an NRI from dubai, have decalred old notes worth of 12,000. I live at thiruvananthapuram, kerala

Can i get it changed from RBI trivandrum?

If i need to go to chennai it will cost me more than 12,000

My wife submitted around 20000 SBN in RBI kolkata but she got a rejection letter from RBI as the account number she submitted was not NRO account . If anyone has this experience please let me know what I have to do next ?

Only following people can deposit old notes of Rs 500 and Rs 1000.

Resident Indians who were abroad during the period from November 9 to December 30, 2016, from January 2, 2017, to March 31, 2017

Non-Resident Indians(NRIs) who were not in India during the period from November 9 to December 30, 2016.

In which category did your wife deposit? Resident Indias/NRI?

What about the people who travel overseas for long term more than one, two years, how can they exchange within the short span of time 6 months notice, this is totally injustice.

RBI should provide at-least two years of time for NRI’s.

Who is called a Resident Indian?

I am a US citizen with India visa and wasn’t in India during demonitisation of the currenty. Can I just walk to a RBI branch in Mumbai and get the old currency exchanged?

Does this applies for OCI card holders also ?

During demonetization it was later clarified that the benefit of changing currency beyond 30th Dec, with conditions, would be for NRI’s only and not for OCI card holders.

It’s only for Nris. Pio card holder or foreign passport holder are not allowed in this scheme.

Does NRI mean people born in India only…I am a British Citizen with parents originally from India…would I be able to deposit some RS10,000 into my NRO account when I visit India in February 2017.

My sister has 50,000 Rs here in Demonetized Currency, but her house was locked and keys were with her. Now she is returning tomorrow, will she be able to deposit the amount in her NRO/NRE Account. She will not be able to show custom declaration as she is not carrying notes with her. Also the amount is higher than 25000 Rs.

Dear Kinar, Could your sister get the currency deposited at NRO/NRE account or get it exchanged to RBI centers? I have a similar situation. I have around 2L worth INR – in 1000’s kept at my home in India. I’ve been outside India since July 2016 and my house is locked and keys are with me. I’m traveling by March 1st week. How do I get them changed – I’m seeing several reports which says limit is 25000 for NRI’s and I should submit declaration from Customs Red Channel while landing at India airport. Since cash is at home, this is not possible. So your feedback is highly appreciated

My brother is in Canada having 20000 old indian 1000 rupees note. He is sending this amount by his friend to me. Now what do I need to deposit this money in rbi.

You cannot do it.

Third-party tender is not accepted under the new facility, which means your brother cannot ask someone else to deposit it for him. He has to come to India and do it himself.

My sister is in Australia(Melbourne) having 500/1000RS notes with her for 50000RS. one of my friend coming to India, if my sister give the money to my friend what are the proof or any forms given by my sister to have clearance in customs , how can i deposit here in RBI, what are the documents/proof my sister need to give to deposit money by me

can you please give suggestion on this?

Third-party tender is not accepted under the new facility, which means your sister cannot ask someone else to deposit it for her. Either she comes to India before Jun 2017 and can do it herself or she can forget about the old notes.

RBI offices for depositing old Notes from Jan 2, 2017 only in 5 locations. RBI is planning to extend this facility to other cities ?

There is no information about RBI extending this facility to other cities.

We’re confused after reading the latest RBI circular. Does it mean an NRI needs to be present in person to deposit 500 and 1000 Rs notes and only at the five designated RBI branches? Or, can an authorization letter be given to a friend who is coming to India in a month to deposit the money? so much confusion around this.

Thanks for your help!

Third-party tender is not accepted under the new facility, which means NRI cannot ask someone else to deposit it for him. He has to come to India and do it himself at those 5 places only.

CALLING ALL GLOBAL NRI’S PIO FOR A CLASS ACTION LAW SUIT AGAINST MR. MODI AND RBI FOR CONFISCATION OF OUR MONEY AND HOLDING US HOSTAGE TO FORFEIT.

This entire process was not thought out at all. I have been living in the USA since 1989 and sending hundreds of thousands of US Dollars to support my late father and mother who is now bed ridden.

Imagine this happening in the USA or another country that values its citizens and currency. I have currency for medical emergency and I don’t want to loose it because of someone elses mistake and thoughtlessness. Lets gather a petition sue them.

Cecil,

I am with you and have prepared a draft text also for the suit. How do you suggest moving forward to have others join in for a Class action (aka PIL in India). Do you have any contact with any of the organizations like GOPIO?

Hi unfortunate OCI people who has foriegn passport.

You cannot bring any Indian currency to India. There are a lot of people in US, UK, Euorope and elsewhere who are citizons of those countries but has OCI to get visa exception. A lot of them visit India and send money to India and carry few thousands of rupees abroad for future arrival to India. They can use the 500/1000 rupees to use a decorative wall paper around Modis picture, lit some candles or oil lamp hoping he will anounce in a seperate bulletin, that OCI can also bring the same amount.They contribute a lot of money to India after paying tax in those countries.I like a “Modi” fication of the rules.

Please go to the RBI website for proper details as resident Indians have no limit for depositing money only nri and also they don’t need custom approval just immigration stamp on their passport . I request bemoneyaware to make this change , as above info will cause confusion amongst people. You will be able to find complete details in RBI notification section under the PDF file dated around 31st Dec 2016.

Below is the image from RBI notification dated 31 Dec 2016 from

Custom and Limit are marked in Red. Have we missed something?

My uncle is a British citizen and a PIO. He comes every year to India. He has about 20,000/- in old notes. Can he get these exchanged, if so how?

No chance friend according to the present rule. The only way is to give that money to a NRI to take back to India, provided he can prove with documentary evidence that he has taken the money from his NRI account in India before his departure to abroad.What you are doing is illegal in one sense , but moraly acceptable. He has to go to Chennai if he is from South India or to Mumbai, Nagpur or Kolkotta RBI offices stand in the que for hours and probably come back empty handed if his documents are not correct according to the RBI office. I hope Mr Modi will change the rules for PIO/OCI people too.

‘If NRIs have the banknotes in India, they may authorize in writing enabling another person in India to deposit the notes into their bank account. The authorized person has to come to the bank branch with the notes, the authority letter given by you and a valid identity proof to deposit the money on your behalf’

Is it possible to deposit in our bank or we want to deposit in RBI…??

My father in law is an NRI , he came to India on 18 th Dec but than he was travelling . So today he found 10000 old notes with him … how can he deposit his money

I am coming back to India from Sweden on 23 dec, 2016. Currently i am having some 500 Notes(less than 5000). Is there any possibility to exchange this amount in Airport? If yes, please let me know place where I can exchange. Thanks in advance

Why Worry about demonetisation? If you are planning to Travel in India, Currency Kart is your True Currency Partner, helps you to buy or Sell currency Online anytime. Get Best Forex Rate from Market with Real Time Rate at your Door Step. Express Pick & Drop Currency Facility with Forex Expert.

1. Deposit of income earned in India can be deposited in NRO a/c. Pl correct in Table.

2. Query – i am a retired CSIR Director visiting USA for about 6 months viz. since mid Oct’16to mid April’17. I have some cash Rs500/-and 1000/- notes, say about Rs 20,000/- (wife and me), required immediately after reaching.

How can we use these notes after reaching Kolkata on 8th April?

Regards,

Thanks Sir for pointing out mistake.

We have corrected the image.

Best would be to send money through someone to India and get it deposited.

In Apr 2017 banks/RBI where old notes can be accepted would be very few.

We and all our friends relatives have sent our old 500 and 1000 notes to our relative who has gone to india to be deposited in our NRO account in india..but our relative was interrogated and treated badly by the customs in amritsar airport though they have all the documents of authority letter n passport copies to deposit the “money” into our NRO account in india..and they infact asking why dont we send money through banks or wire transfer?what a ridiculuous question knowing that all the notes is not a legal tender anymore and no banks and money changer accepting and that is why we have to send through our relatives who go to india by dec 30th.. please advise how do we get our “money” back from the customs which has confiscated rudely and harshly and stopping us from depositing in our account??

Sad to hear about your experience.

Please drop a tweet to @narendramodi and / or @PMOIndia . State your complaint.

I read somewhere that police officials failed to file FIR then person sent complaint on twitter and police officials came to his house for FIR.

An NRI can bring Indian Currency to the tune of Rs.25,000 with him/her, without declaring it, while entering India. This article wrongly mentions it as Rs.5000.

Thanks for leaving comment.

We have updated the article.