You can change Pension Fund Manager(PFM), your investment choice ie Active/Auto choice, or your allocation between schemes(E, C, G) Online through the CRA(Central Record Keeping Agency) website of NPS or offline by submitting the physical application form to your Point of Presence. This article explains in detail how to change NPS Pension Fund Manager, Active or Auto Choice or Allocation in Schemes with images.

Table of Contents

How to change NPS Pension Fund Manager, Active or Auto Choice or Allocation in Schemes

For both Tier I and Tier II, NPS gives the subscriber the flexibility to choose any one of the available Pension Fund Managers(PFMs), decide the percentage in which the selected PFM will invest the funds i.e, what proportion of your contribution you want to invest in equity, corporate or government bonds etc and mode of Investing. NPS offers two modes of investing- active and auto. In the auto mode, the proportion of your investments is pre-decided based on your age. If you wish to change this ratio, you need to switch to the active mode first. However, this preference can also be changed if you wish to do so. You can change the NPS Pension scheme, allocation or Active choice maybe after seeing the performance of different schemes given in our article Returns of NPS. Steps to make the change online or offline are given below

- You can change your Pension Fund Manager once a year

- Active/Auto Choice and allocation in schemes can be exercised two times in a financial year.

- A fund change doesn’t involve any taxation or exit load.

- For Corporate NPS subscribers, the corporate can either select the Scheme Preference or can give such option to its employees/subscribers.

- Offline:

- you can download the application form, UOS-S3/CS-S3, from NPS website

- submit it to your point of presence (PoP).

- Acknowledgement number will then be issued by the PoP.

- Forms for Tier 1 and Tier 2 accounts should be submitted separately.

- Form is shown in the article later

- Online:

- The Subscribers has to login to the CRA system (www.cra-nsdl.com) or NPS Mobile App (downloadable from Google Play / IOS store) with his/her User ID and IPIN.

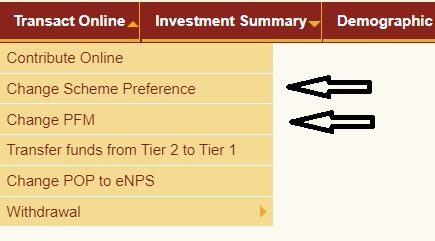

- Click on Transact Online or in Mobile App choose the Change Scheme Preference sub-menu.

- Click on Tier Type and provide the type of Tier (I or II) in which you want to make changes,

- Select the Scheme-preference type and Click on submit.

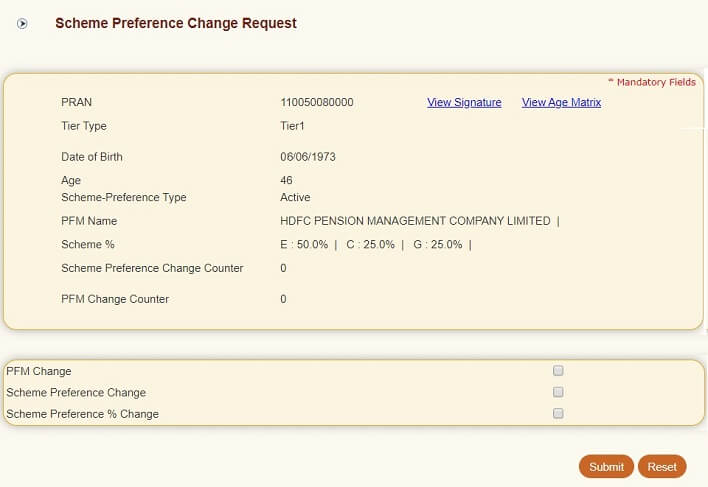

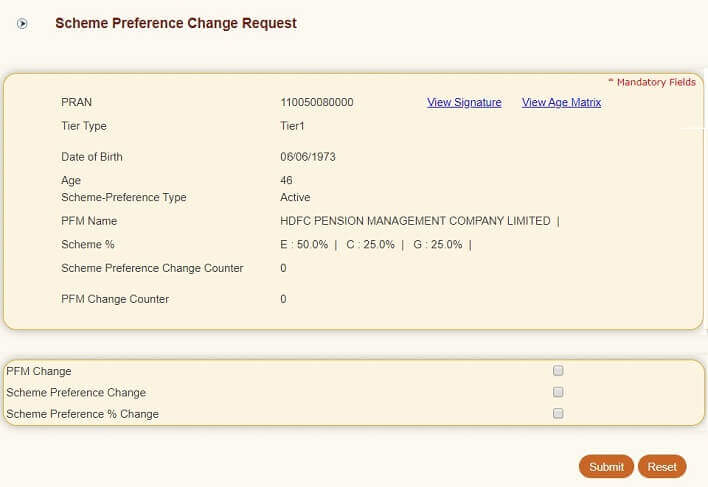

- You will see an option to Change Pension Fund Manager(PFM), Scheme Preference and its percentage of contribution in case of the subscriber has chosen option of active choice.

- Enter the OTP sent to your registered mobile number. Confirm the changes.

- Acknowledgement number will be displayed on the screen.

- The CRA system will send an email to your registered email id once the request is processed.

How to make changes to NPS account Online

Log-in to your NPS account with the User ID & Password. The User ID will be your PRAN.

From the menu Transact Online select Change Scheme Preference or Change PFM as shown in the image below

Select Tier type ie Tier I or Tier II

Choose what you want to change PFM Change which is changing the Pension Fund Manager, Scheme Preference Change: Changing Active/Auto Choice and Changing allocation in different types of NPS Class, Equity, fixed income, Govt securities, Investment trusts like that of Real Estate.

How to change the Pension Fund Scheme or PFM in NPS

- The Subscribers has to login to the CRA system (www.cra-nsdl.com) or NPS Mobile App (downloadable from Google Play / IOS store) with his/her User ID and IPIN.

- Click on Transact Online or in Mobile App choose the Change Scheme Preference sub-menu.

- Click on Tier Type and provide the type of Tier (I or II) in which you want to make changes,

- Select the Scheme-preference type and Click on submit.

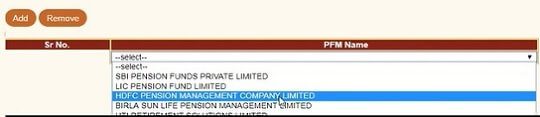

- Select PFM Change for changing the Pension Fund.

- Click on Add Button

- Select the Pension Fund from the choices in the drop-down

- Click on Send OTP. An OTP will be sent to your email id and mobile number

- Enter the OTP in the box and click on Submit OTP

- You would get an acknowledgement

- You would be informed of the change by email and SMS.

How to change Auto/Active Choice in NPS

In Active choice, Subscriber has the right to actively decide as to how his contribution is to be invested, based on personal preference. In Auto choice, also called as LifeCycle(LF) Fund, the proportion of funds invested across three asset classes will be determined by a pre-defined portfolio (which would change as per age of Subscriber). There are three different options available within Auto Choice: Aggressive, Moderate and Conservative. An overview of the Active/Auto Choices is given below.

- The Subscribers has to login to the CRA system (www.cra-nsdl.com) or NPS Mobile App (downloadable from Google Play / IOS store) with his/her User ID and IPIN.

- Click on Transact Online or in Mobile App choose the Change Scheme Preference sub-menu.

- Click on Tier Type and provide the type of Tier (I or II) in which you want to make changes,

- Select the Scheme-preference type and Click on submit.

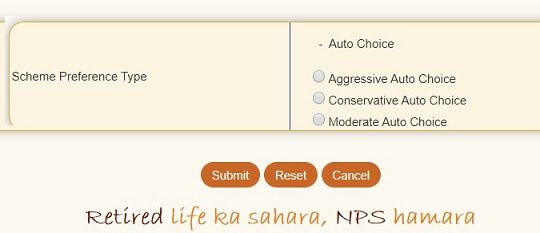

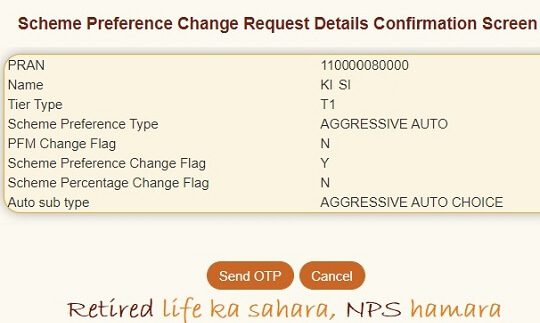

- Select Scheme Preference Change. If your current scheme preference type is Active then you can change it to Auto Choice as shown in the image below or vice versa. Select the Type.

- Click on Submit. You will see a Confirmation scheme.

- Click on Send OTP. OTP will be sent to your registered mobile number and email id.

- Enter the OTP and click on Submit OTP.

- Acknowledgement number would be displayed.

- You would be informed of the change by email and SMS.

Active and Auto Choice in NPS

In Active choice, Subscriber has the right to actively decide as to how his / her contribution is to be invested, based on personal preference. The Subscriber has to provide the PFM, Asset Class as well as percentage allocation to be done in each scheme of the PFM.

In Auto choice, also called as LifeCycle(LF) Fund, the proportion of funds invested across three asset classes will be determined by a pre-defined portfolio (which would change as per age of Subscriber). As age increases, the individual’s exposure to Equity and Corporate Debt tends to decrease. Depending upon the risk appetite of Subscriber, there are three different options available within Auto Choice: Aggressive, Moderate and Conservative. An overview of the Auto Choices is given below.

An overview is given below. More details in our article Understanding National Pension Scheme – NPS

- Aggressive Life Cycle Fund or LC75: In Aggressive Auto choice maximum you can invest is 75% of your investment in Equity. The exposure in Equity Investments starts with 75% up to 35 years and gradually reduces as per the age of the Subscriber.

- Moderate Life Cycle Fund or LC50: In Moderate Auto choice maximum you can invest is 50% of your investment in Equity. The exposure in Equity Investments starts with 50% up to 35 years and gradually reduces as per the age of the Subscriber

- Conservative Life Cycle Fund or LC25: In Moderate Auto choice maximum you can invest is 25% of your investment in Equity. The exposure in Equity Investments starts with 25% up to 35 years and gradually reduces as per the age of the Subscriber

How to change Allocation in Schemes in NPS

- The Subscribers has to login to the CRA system (www.cra-nsdl.com) or NPS Mobile App (downloadable from Google Play / IOS store) with his/her User ID and IPIN.

- Click on Transact Online or in Mobile App choose the Change Scheme Preference sub-menu.

- Click on Tier Type and provide the type of Tier (I or II) in which you want to make changes,

- Select the Scheme-preference % change and Click on submit.

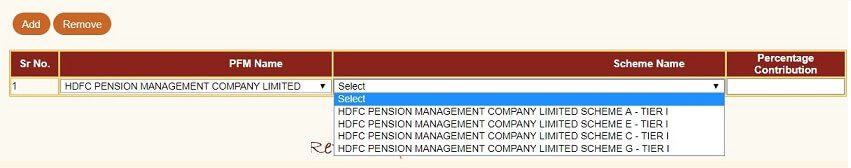

- Click on Add Button

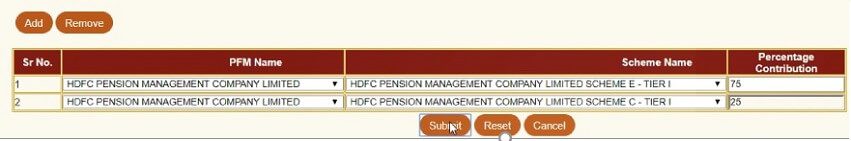

- Select the Pension fund from choices/drop down in PFM Name. For example, if you are currently investing in HDFC Pension Fund, select HDFC Pension Fund

- Select the Pension Fund class from choices/drop down in Scheme Name.

- Enter the Allocation percentage number. For example if you want 75% in Equity enter 75.

- If you want to change more repeat the process of clicking on Add Button, Choosing PFM scheme, Choosing Scheme Name, Choosing Allocation Percentage.

- Once you done click on Submit

- You will see a Confirmation scheme.

- Click on Send OTP. OTP will be sent to your registered mobile number and email id.

- Enter the OTP and click on Submit OTP.

- Acknowledgement number would be displayed.

- You would be informed of the change by email and SMS.

A form S3, has to be filled in and submitted to the PoP-SP through which the NPS account was opened.

A 17-digit acknowledgement number will then be issued by the PoP. Forms for Tier 1 and Tier 2 accounts should be submitted separately.

Loading…

Loading…

To Recap

- You can change your Pension Fund Manager once a year

- Active/Auto Choice and allocation in schemes can be exercised two times in a financial year.

- A fund change doesn’t involve any taxation or exit load.

- For Corporate NPS subscribers, the corporate can either select the Scheme Preference or can give such option to its employees/subscribers.

- Offline: you can download the application form, UOS-S3/CS-S3 and submit it to your point of presence (PoP).

- Online: The Subscribers has to login to the CRA system (www.cra-nsdl.com) or NPS Mobile App (downloadable from Google Play / IOS store) with his/her User ID and IPIN.

- Click on Transact Online or in Mobile App choose the Change Scheme Preference sub-menu.

- Click on Tier Type and provide the type of Tier (I or II) in which you want to make changes,

- Select the Scheme-preference type and Click on submit.

Related Articles:

Have you made changes in NPS? How did you find the process?