How to nominate for Demat account, PPF account, Post Office Saving Schemes

Nomination is the process of appointing a person to take care of one’s investments in the event of one’s death. For all investments except company bonds and stocks, nomination DOES NOT provide ownership of one’s investments. The nominee will only be the custodian of the investment till it is given to its right beneficiary(s). (S)He is a contact point for the settlement. For details on nomination Please read Right Paper Work For Those You Love: Part 1, for nomination or changing in nomination in bank account, mutual funds read How to Nominate:Bank Account, Mutual Funds. This article is about how to nominate or change nomination or cancel nomination in Demat account, PPF account, Post Office Saving Schemes.

Demat Account and Nomination

In case of shares the nomination process is significant as the rights of a nominee to shares of a company would override the rights of heirs to whom property may be bequeathed or nomination always supersedes the will. This is because Section 109A of the Companies Act, is applicable for shares. As explained in Right Paper Work For Those You Love: Part 1, For instance, if you nominate your daughter as the nominee for the shares of a particular company held by you, your daughter will be the final beneficiary of the investment after your death. It does not matter even if the will states your son will be the beneficiary of all your investments.

A case discussed in High Court on Nomination Nominee, not heir, to get shares after holder’s death: HC at economictimes.com

Harsha had married Nitin in December 2004 and Nitin passed away in 2007. A year later Harsha moved the HC seeking to sell the shares in Nitin’s demat account. It was found that a year before his death Nitin had nominated his nephew in respect of the shares. Harsha’s lawyers argued that she was entitled to the shares as she was her late husband’s heir and legal representative . The court said that Harsha Kokate would have no rights over the shares owned by her deceased husband. Justice Roshan Dalvi said ” The Companies Act sets out that the nomination has to be made during the lifetime of the holder, according to legal procedures. If that procedure is followed, the nominee would become entitled to all the rights in the shares to the exclusion of all other persons (following the death of the shareholder),”

Ref: Nominee of shares superior to legal heirs:Business Standard(May 2010)

From NSDL’s FAQ Section V of Nomination.

1. Who can nominate?

Ans. Nomination can be made only by individuals holding beneficiary accounts either singly or jointly. Non-individuals including society, trust, body corporate, partnership firm, karta of Hindu Undivided Family, holder of power of attorney cannot nominate.

2. Can joint holders nominate?

Ans. Yes. Nomination is permitted for accounts with joint holders. But, in case of death of any of the joint holder(s), the securities will be transmitted to the surviving holder(s). Only in the event of death of all the joint holders, the securities will be transmitted to the nominee.

3. Can a NRI nominate?

Ans. Yes, NRI can nominate directly. But, the power of attorney holder cannot nominate on behalf of NRI.

4. Can a minor nominate?

Ans. No, a minor cannot nominate either directly or through its guardian.

5. Who can be a nominee?

Ans. Only an individual can be a nominee. A nominee shall not be a society, trust, body corporate, partnership firm, karta of Hindu Undivided Family or a power of attorney holder.

6. Can there be more than one nominee?

Ans. No, only one nomination can be made for one depository account.

7. Can a minor be a nominee?

Ans. Yes, a minor can be a nominee. In such a case, the guardian will sign on behalf of the nominee and in addition to the name and photograph of the nominee, the name, address and the photograph of the guardian must be submitted to the DP.

8. Can separate nomination be made for each security held in a depository account?

Ans. No. Nomination can be made account wise and not security wise.

9. Can a NRI be a nominee?

Ans. Yes, NRI can be a nominee subject to the exchange control regulations in force from time to time.

10. What is the procedure for nomination?

- The nomination form duly filled-in should be submitted to the DP either at the time of account opening or later.

- The account holder, nominee and two witnesses must sign this form and the name, address and photograph of the nominee must be submitted.

- If nomination was not made at the time of account opening , it can be made subsequently by submitting the nomination form.

11. Can the nominee be changed?

Ans. Yes, the nomination can be changed anytime by the account holder/s by simply filling up the nomination form once again and submitting it to the DP.

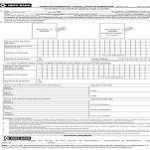

Images of the Sample forms for the appointing nominee or changing nominee for a demat account of Nomination form of Icicidirect.com, Nomination form of HDFC Demat account are given below. Click to enlarge.

Personal experience: In Jan 2012 I registered nominee for my icicidirect demat account in Bangalore. I downloaded the form, filed the form(with nominee photo and signature of two witnesses), went to the nearest ICICIdirect branch(Note: not icicibank branch) with my PAN Card and PAN Card of my husband whom I wanted to appoint as nominee. The officer at icicidiect saw the PAN card’s, made me attest the xerox of the PAN cards and took the form. In 5 minutes the process was over!

PPF Account and Nomination

Public Provident Fund(PPF) a 15 year scheme is a great investment option. Nominations can be made by the subscriber to receive the amount standing to his credit in the event of his death. Nomination once made can also be cancelled or varied. If the nominee is a minor, the depositor can appoint any person to receive the amount due during the minority of the nominee. The facility of nomination is also available in case of HUF but not for minors.

In the event of death of subscriber, the amount standing to his credit after making adjustments, if any shall be paid to the nominee or nominees on making an application by them together with proof of death of subscriber. If any nominee is dead, the proof of death of nominee is also required. However, if the balance is not withdrawn, it will continue to earn interest.Fresh contributions and partial withdrawals by nominee are not permitted after the death of the account holder.

Where there is no nomination, the balance after making adjustments shall be paid to the legal heirs on production of succession certificate/probate acquiring which requires lot of time and paperwork. Therefore, to reduce hardships if the balance is up to Rs1 lakh, it will be paid to legal heirs on production of i) a letter of indemnity, ii) an affidavit, iii) a letter of disclaimer and iv) the death certificate. But in practice, if the bank manager is convinced and closely acquainted, he usually pays you the entire sum of money.

Q. How can I apply for nomination in PPF account?

Ans. While opening the PPF account or later By filling Form E, you can apply for nomination in your PPF Account. Image of the Sample Form E at indiapostgov.in is given below. Click to enlarge.

Q: How can I change the nomination in PPF Account?

Ans: By filling up Form F, you can apply for change of nomination in your PPF account at no cost, yes it’s free. Image of the Sample Form F at indiapostgov.in is given below. Click to enlarge.

Related article:

How to Nominate:Bank Account, Mutual Funds

Having a nominee has no financial implication on the investor. Its advantage lies in the ease it brings to the transfer of benefits of the investment on the death of the investor. Have you nominated for demat account and PPF account? If not why do you think it is not important to nominate? If the information is missing or incomplete or you would like more details Please let us know.

6 responses to “How to nominate: Demat Account and PPF”

If a single demat account holder dies leaving a nominee, the transmission procedure is simple

The law on nomination of shares held in companies has taken a new meaning with perhaps the first interpretation of the provisions governing nomination in the Companies Act, 1956 by the Bombay high court.Interpreting Section 109A of the Companies Act, the court has ruled that the rights of a nominee to shares of a company would override the rights of heirs to whom property may be bequeathed. In other words, what one writes in one’s will would have no meaning if one has made a nomination on the shares in favour of someone other than the heir mentioned in the will.There are many wbsites like angelbroking.com where one can learn rom basis about the demat account

Sir:

I have a problem with Late wife’s Demat a/c. Nominee is my daughter whose PAN card is with her maiden surname and house address prior to marriage. Her nomination surname is her husbands surname and his address. I now wish to transfer Demat a/c to her name. I have an original affidavit showing her married name for declaration of marriage. Can I submit this affidavit to the bank for transferring Shares to my daughter’s new Demat a/c ?

anyone out there willing to have a demat account, please contact me on

We have deleted your contact number and email. Please do not leave such messages.

[…] form(pdf) Related article: Bemoneyaware’s How to Nominate: Demat Account and PPF Having a nominee has no financial implication on the investor. Its advantage lies in the ease it […]