Nomination is the process of appointing a person to take care of one’s investments in the event of one’s death. For all investments except company bonds and stocks, nomination DOES NOT provide ownership of one’s investments. The nominee will only be the custodian of the investment till it is given to its right beneficiary(s). (S)He is a contact point for the settlement. For details on nomination Please read Right Paper Work For Those You Love: Part 1. This article is about how to nominate or change nomination or cancel nomination in bank account, mutual funds.

Table of Contents

Important information about Nomination

- Start of investment: One should appoint the nominee at the time of investment/opening an account. Usually, there is a column on a nomination in an application form.

- Minor: A minor can be a nominee provided the guardian is specified in the nomination form.

- Multiple Nominees: Some investments(such as Mutual Funds) allow more than one nominee and the percentage of share that each would be entitled to.

- Cancellation: The nomination can be cancelled at any time. You don’t even have to inform the person nominated.

- Change: Can Change the Nominee: Nothing is fixed. The nominees can be change atd any time, any number of times. No need to inform the earlier nominee about the change.

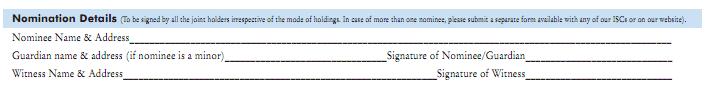

- Joint Holder: The nomination forms(Opening, cancelling, change) has to be filled up by all joint holders, irrespective of the mode of operation of the investment.

- If the nominee(s) have been appointed, to claim the investment they can produce basic documents, such as a death certificate. A claimant who is not a nominee would have to produce a host of additional documents such as a will, legal heir ship certificate, no-objection certificate from other legal heirs, among others.

How to Nominate in Saving Bank Account?

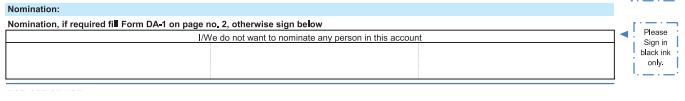

One can apply for nomination while opening the saving account in any bank of India. Every bank account opening form would have a section for nomination, such as shown in the picture below from the account opening form of State Bank of India(SBI) . The form(pdf format) can be seen here.

Appointing the nominee:To appoint nominee for bank account one needs to fill nomination form DA-1. This can be done while opening the account or later also. Yes if you didn’t nominate during opening of your saving’s account and want to do it later then visit your bank and get the Nomination form, fill it and submit it. To see sample DA-1 form click on the image below for full size or sample DA-1 form of ICICI bank . The bank would provide the DA-1 form. The form has to be submitted to the bank.

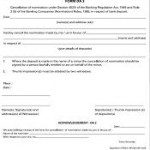

Cancelling the nomination: To cancel the nomination already made one needs to fill Form DA-2 and submit it to the bank. Form DA-2 can be obtained from the bank or downloaded from bank’s website. After filing the form which requires signature of two witnesses one has to submit it to the bank. To see sample DA-2 form click on the image below for full size or sample DA-2 form of ICICI bank .

Changing the nomination: To change the nomination already made one needs to fill Form DA-3 and submit it to the bank. Form DA-3 can be obtained from the bank or downloaded from bank’s website. After filing the form which requires signature of two witnesses one has to submit it to the bank. To see sample DA-3 form click on the image below for full size or sample DA-3 form of ICICI bank

How to Nominate in Mutual Funds?

In 2002, Securities and Exchange Board of India (SEBI) amended its Mutual Funds Regulations to allow nomination facility to the unitholders of mutual funds. Since then asset management company(AMC) provides an option to the unitholder to nominate a person in whom the units held by him shall vest in the event of his death. Please remember that Nominee does not acquire title or beneficial interest in the Mutual fund folio by virtue of the nomination

- Nomination could be made only by individuals applying for/holding units on their own behalf (including joint ownership).

- Since 1-Apr-2011 individual investors applying in single holding, Nomination is mandatory.

- Non-individuals including society, trust, body, corporate, partnership firm, karta of Hindu Undivided Family, holder of Power of Attorney can neither nominate nor be a nominee.

- A minor can be nominated and in that event, the name and address of the guardian of the minor nominee(s) should be provided by the unit holder.

- A non-resident Indian can be a nominee, subject to the exchange controls in force from time to time.

- Nominee does not have to be KYC compliant while he/she is a nominee. In the event of such nominee stepping into the shoes of a unit holder by virtue of unit holder’s death, the nominee has to complete KYC requirements in force at that time. If the nominee is still a minor in such an event, the Guardian of the minor has to be KYC compliant.

- In case of mutual funds, multiple nominees can be appointed with a percentage to be allocated to each specified. If there is multiple nominations and the percentage is less than 100% than the balance will be re-balanced to the first unitholder. If a percentage is greater than 100% then nomination would be rejected.

- The nomination is applicable for a folio. If an investor has different schemes in a folio, will all units of all schemes be transferred to the nominee? A nomination is at folio level and all units in the folio will be transferred to the nominee(s). If an investor makes a further investment in the same folio, the nomination is applicable to the new units also.

- Transfer of units in favour of a nominee would be valid discharge by the asset management company against the legal heir.(Official or technical language used is Nomination in respect of the units stands rescinded upon the transfer of units.)

- Cancellation of nomination could be made only by those individuals who hold units on their own behalf and who made the original nomination. On cancellation of the nomination, the nomination shall stand rescinded(cancelled) and the Mutual Fund / the Asset Management Company shall not be under any obligation to transfer the units in favour of the Nominee(s).

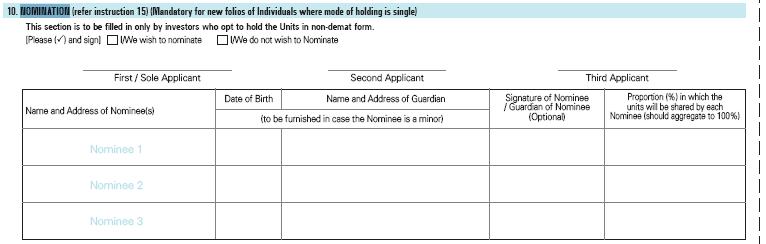

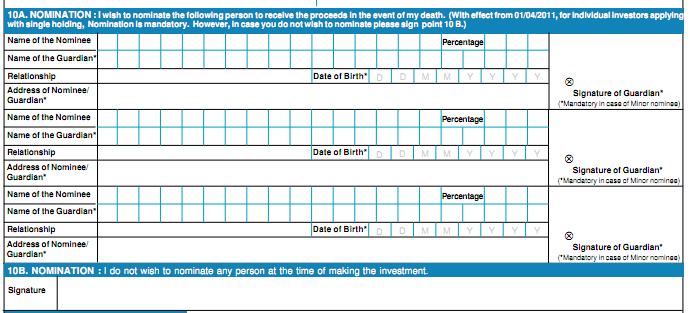

Appointing the nominee: Every mutual fund scheme(equity, debt, gold etc) application form has a section for Nomination as shown in the pictures below(click on the picture to see the actual form). This section has to be filled only by those who opt to hold units in non-demat form. (For holdings in demat form process is explained later).

If the form has an only single nominee as in case of Franklin Templeton, as shown in the picture, one needs to fill a separate form.

Note: These images are for explanation purpose only, we are not recommending these funds!

Making nomination later: If appointing nominee gets skipped somehow earlier, one can do it later through filling the form for the AMC which may be submitted with relevant particulars of the nominee. The forms are available on the mutual funds websites. Investors may also request the registrar and transfer agent(such as CAMS, Karvy) for the form.

Mutual Funds in the demat form: If one has Mutual fund units in demat form then the nomination present in a demat account will also be applicable for Mutual Fund Units held in that demat account. If you so desire, you can change the nominee in your demat account by simply filling-up the nomination form once again and submit it to your DP or open another demat account to nominate the desired person as a nominee in that demat account. (Ref:FAQ on Mutual fund units by NSDL(pdf))

How much time will the process of nomination/ change of nomination/ cancellation of nomination take? Typically it would take 7 working days from the date of receipt of the duly filled forms. Mutual Funds would send a written confirmation.

Nomination or Will?

While a Will deals with all the assets of an individual, a nomination deals with the particular investment that an individual has made.

The mutual fund is obliged to follow the instructions as given in the nomination. If there is a dispute on inheritance, the nominee is considered to hold the proceeds in trust for all the claimants till the dispute is legally settled.

Related articles: Outlook money Feb 2008 article Process of Nomination, Hindu Business Line’s:Right and responsibility, Bemoneyaware’s Paper work required to claim deceased’s bank account , Bemoneyaware’s Paperwork required to claim deceased’s mutual funds.

Please check the AMC’s website for the nomination process and/or forms. Some of them(FAQ or forms) are given below:

15 responses to “How to Nominate in Bank Account, Mutual Funds”

I recd amt as nominee 90 lacs

From my bua . As I recd money

As trustee on behalf of legal heirs . What is tax liability on

Whome shoulder and how it

Treat

Hi Khushi…. I had a question regarding nomination in government bonds like REC and NHAI that people invest in to avoid capital gains tax. Can a non resident indian be nominated?Also are these bonds in Demat format? Does the money get directly deposited in an allocated bank account upon maturity? Can that be a joint account with the nominee as the second name? Is nomination enough or is a will required as well? And finally what documents will be needed by the nominee in case the bond holder is deceased upon bond maturity?

Hi Kirti,

I checked your blog, it shows you are really very very hard working person, the efforts your put in writing each blog and also the links and information you provided in each and every blog. (excellent work)

Such type of information is available but to get that we need to do lot of search to get the desired results, but here complete information is available under roof.

very much impressed with your blog.

Thanks Khushi, like your name you have brought happiness to us by your comment.

You rightly pointed out all information is available but to get that we need to do lot of search to get the desired results, but here complete information is available under roof.

Thanks a lot. It is a big encouragement to us.

wanna knw the details of second nominee

Thanks for dropping by Sushma. We were not clear as to what exactly you wanted to know about second nominee.

Quoting from the article :

In case of mutual funds, multiple nominees can be appointed with percentage to be allocated to each specified.If there is multiple nomination and the percentage is less than 100% than the balance will be re-balanced to the first unitholder. If percentage is greater than 100% then nomination would be rejected.

[…] Those You Love: Part 1, for nomination or changing in nomination in bank account, mutual funds read How to Nominate:Bank Account, Mutual Funds. This article is about how to nominate or change nomination or cancel nomination in Demat […]

Very good information on nomination. This is an important part of money management, which I often forget.

Thanks Nandini. Yup I just got nomination of mutual funds and demat account in jan 2012. Was totally ignorant of these basics.

Just yesterday regarding my work I visited one trustee company in my city which is subsidiary of Bank of maharashtra…They are in consultation business for will drafting,execution,nominations,issues related to Minors ,power of attoerny etc.. I think help of such companies will really helpful..I forget to note their exact website but brief page can be viewed here http://www.bankofmaharashtra.in/addon.asp

I think this comment may be more appropriate for your earlier post of will execution,,but here its also fine.

Thanks a lot Paresh. I checked it out and was impressed that Bank of Maharastra’s subsidiary can be executor & or Trustee of your will, private trust or Public Trust or as Attorney to manage your property.

It was not about my will.

I went their with my 80 year old friend [i am nearly 1/3 rd of his age and I think time till has not come to do my will].His only one son has permanently settled in US and probability is too low that he will come back.He has invested heavily in physical properties which has turned into headaches today..so we went their to find solutions for him.

Oops sorry for confusion. I am impressed that you helping your friends. This problem of parents buying property in India and children settled abroad is so common. Hope you write a post or article on the solution.

I think you can write it in better way with links to different companies offerings solutions.As far I know there are number of banks which provide such add on services.

Thanks. I shall put it on my list of topics and will do research. If I can find enough material I shall surely do a post.