The Income Tax Department launched its new e-filing website www.incometax.gov.in on 7 June 2021 to provide a modern, seamless experience to taxpayers. In this article, we explore the new Income Tax website for electronic filing of Income Tax Returns in detail.

You can access the new e-filing website at www.incometax.gov.in.

A new mobile App to file ITR will be also launched soon.

The Finance Ministry has urged taxpayers/stakeholders to be patient after the launch of the new portal “since this is a major transition”.

Table of Contents

New Income Tax Website Features

The new income tax portal aims to simplify income tax return (ITR) filing and enable a taxpayer to file ITR from one’s mobile phone as well.

Taxpayers can not only file ITRs but also raise complaints about refunds and other works with the IT Department. Taxpayers can proactively update their profile to provide details of income including salary, house property, business/profession which will be used in pre-filling their ITR.

The IT Department will utilize this website not only to process filed tax returns but also for responding to taxpayers’ queries and giving orders like assessments, penalties, exemptions, and appeals.

4200 crores were spent to update the new income tax website

Features of the New Income Tax Website. You can check out the guided tour of the website here

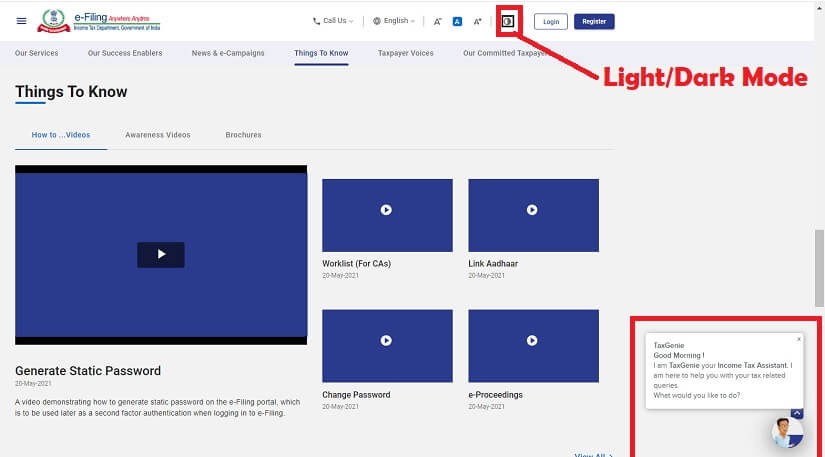

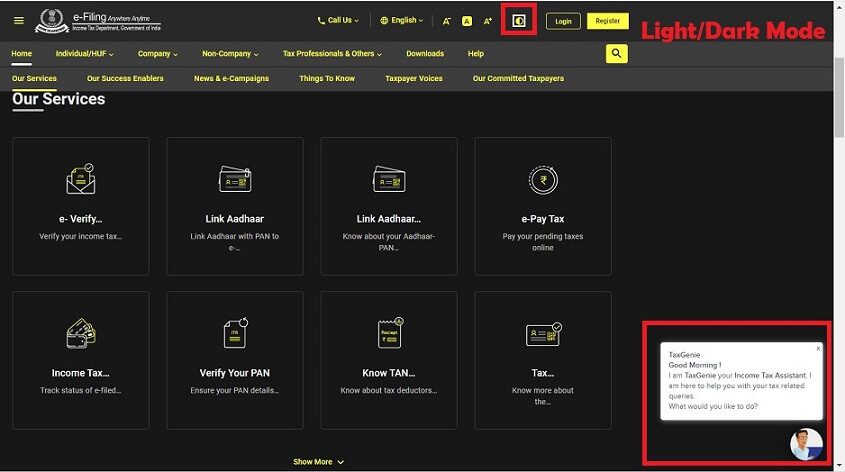

- Simple, Modern with Dark Mode

- New online payment system with multiple payment options like net banking, UPI, credit card, and RTGS or NEFT from any account of the taxpayer in any bank, compared to the existing system which only had UPI, Credit Card for payment of taxes.

- Detailed FAQs, User Manuals, Videos

- Chatbot/live agent at bottom right

- eVault facility

- New call center for taxpayer assistance for prompt response to taxpayer queries

- It has been developed by Infosys.

Overview of Filing ITR for FY 2020-21

For details, You can read our article How to File ITR for FY 2020-2021

- Due to the Covid pandemic, the due date to file ITR has been extended to 30th September 2021 this year.

- The employer is required to issue Form 16 to employees before 15th July

- Excel and Java offline Utility for filing ITR has been discontinued

- A new offline utility based on JSON is to be used.

- Choose Old and New Tax Regime for FY 2020-21

- One has to inform the Income Tax Department of his choice of Old or New Tax Regime.

- Those with business Income have to file Form 10-IE electronically and give an Acknowledgment number before filing

Look and Feel of the New Income Tax Website

The website is simple but modern. You can check out the guided tour of the website here

Chatbot also called as Tax genie is at the bottom right

It has Detailed FAQs, User Manuals, Videos

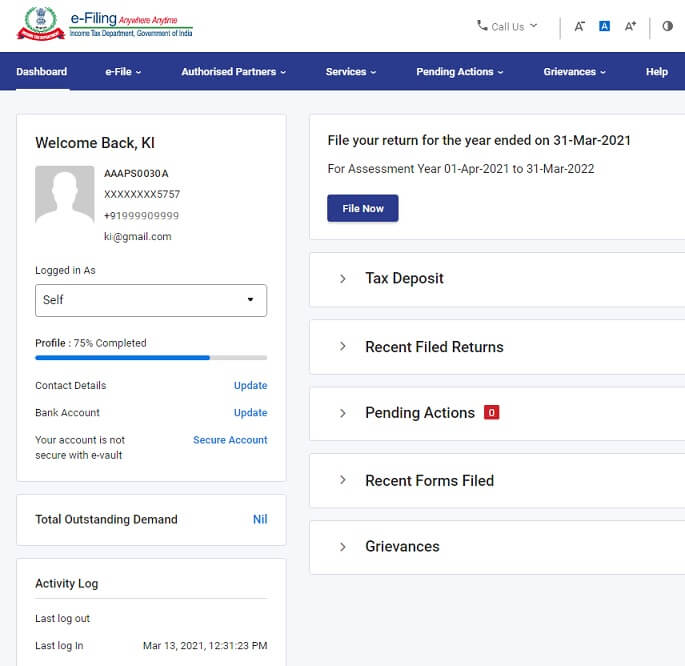

After Login the options are presented in a simple clean interface as shown in the image below. One can

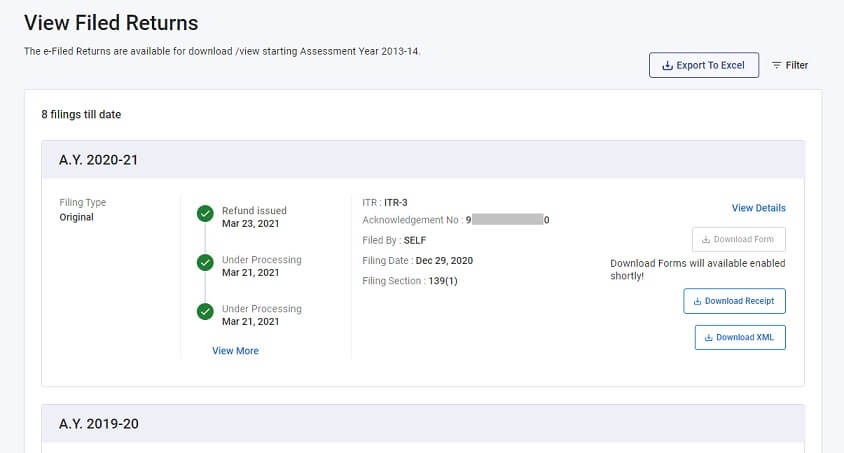

The Past returns from 2013-14 are available with all information as shown in the image below

Light and Dark Mode of New Income Tax Website

You can view the website in the black background using the moon icon next to Login button

Feedback of the New Income Tax Website

After the launch, there was a backlash on Twitter.

The Finance Ministry has urged taxpayers/stakeholders to be patient after the launch of the new portal “since this is a major transition”.

Many experts have criticized the wrong time of the launch. It also consumes a lot of data.

From Financial Express-News Article

CA Karan Batra, Founder and CEO CharteredClub.com, said, “Such a heavy site is being made live in the peak season with so many bugs and errors is not something which the taxpayers will appreciate.” May to October is the peak season, when there is a lot of load on the income tax website, and from November to April, there is low traffic on the income tax website

Amit, who used the site, got a message that 50 per cent of his high-speed quota of 1.5GB data was used up within a few minutes of opening the new e-filing site.

Be Aware of Income Tax

Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280 covers all articles related to Income Tax slabs, Types of Income, the tax on different types of Income when it is taxed, dates and year related to Income Tax, tax cut i.e TDS, how to see TDS, how and when to pay advance tax, how to pay the tax due.

How to file ITR Income Tax Return, Process, Income Tax Notices lists all the articles for understanding Income Tax Return or ITR, filling Income Tax Returns

We have come up with a workbook With Examples and Worksheets that explains what is Income, Income Tax slabs, Types of Income, the tax on different types of Income, dates related to Income Tax, tax cut i.e TDS, how to see TDS, how and when to pay self-assessment tax, how to pay the tax due, how to File ITR More details of the workbook here

You can also enroll in our training here

Related Articles:

Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280

Would you prefer to use a mobile app to file ITR? What do you feel about the new Income Tax Website? Which features did you like? Which features you did not like?