On 1 Dec 2015, the Central Government has directed the Central PF Commissioner that the employees whose details like AADHAAR Number and Bank Account Number have been seeded in their Universal Account Number (UAN) and whose UAN have been activated, may submit claims in Form-19, Form-lOC and Form 31 directly to the Commissioner even without attestation of their employers, for fast settlement of claims, with immediate effect. You can read the EPF notice

On 20 Feb 2017 EPFO(Employees’ Provident Fund Organisation) has introduced Composite PF Claim Forms (Aadhar based and Non-Aadhar based) which replaces existing Forms No. 19, 10C, 31, 19 (UAN), 10C (UAN) and 31 (UAN). This is to simply the form for claiming the partial and full withdrawal from the EPF. Now you can submit the form to your previous employer or to your EPFO. Our article EPF New Composite Claim Forms for Full and Partial Withdrawal Aadhar and Non Aadhar based explains these forms in detail

What was the process of submission of EPF Forms?

Before 1 Dec 2015, subscribers who wanted to withdraw submitted their claims through their current or former employers. The attestation,sign and seal ,by their employer, of the forms was compulsory as it was only the employer who could identify the worker and his details.

Why is the attestation of EPF Withdrawal forms not required now?

After launch of UAN, EPFO has started collecting the KYC details such as Aadhaar, PAN, Bank details etc. duly attested by the employer. The process of withdrawal for such employees is made very simple as the employee is not required to verify the form by his employer. He can provide mobile number, UAN and cancelled cheque of one’s bank account and address as basic details and submit the same using one’s signature. Based on his KYC submitted by employer the money will be sent to one’s bank account provided by the employer while seeding attested KYCs.

According to EPFO website, as on Dec 2015, 5.65 crore UANs have been allotted and 2.13 crore subscribers have activated their UANs.

How will the submission of forms work now?

Subscribers can file their claims directly without employers’ attestation , if they have UAN activated and KYC done. They would have to use new forms 19 UAN, 10-C UAN and 31 UAN. UAN suffix is added to differentiate new forms from old forms.

Forms have to be submitted manually by subscribers directly to the respective jurisdictional EPF Offices.

What are the conditions to use the New EPF Forms with UAN?

- You must have UAN number activated.

- You must linked your Aadhaar number with UAN.

- You must provided your Bank details to your UAN.

- Your KYC must be verified by your employer.

What about those employees who have not activated or updated their UAN?

The employees, who still have not activated or updated their UAN will not be able to use these new forms. They would have to use the old forms 19, 10C and 31 for partial and full withdrawals and submit it to their earlier employer.

What can you do if KYC is not verified by an employer and employer is not attesting the EPF Forms?

If Employer does not attest your forms, you have to fill the regular Form 19, Form 10C or Form 31 and submit it to regional EPFO. For withdrawal if your last employer not co-operating with you for withdrawal, then you can follow the below process. These forms are explained in our article Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F

- Fill Form 19 (EPF withdrawal) and Form 10C (EPS Withdrawal).

- Get attested by anyone of-Manager of a bank (PSU preferred or where you have a savings account), By any gazetted officer or Magistrate / Post / Sub Post Master / Notary.

- Write a letter to regional EPFO stating the reason for not getting attestation from an employer.

- Send the filled form to regional EPFO along with cancelled cheque.

Which Forms can be submitted and for what purpose?

So New forms are Form 19 (UAN) for EPF withdrawals, Form 10C (UAN) for EPS withdrawals and Form 31 (UAN) for advance or loan from EPF. UAN suffix is added to differentiate new forms from old forms. These new forms are of half a page size compared to two to three pages applications used at present for withdrawal of PF.

- EPF withdrawals : UAN-Based_Form 19 . Please do submit Form 15G to avoid TDS deduction if your service is less than 5 years.

- EPS withdrawals :UAN-Based_Form 10C(note that EPS withdrawal is only allowed if you have not completed 10 years of service.)

- Claiming Advance or Loan from EPF : UAN-Based_Form31

How to verify Details at UAN portal?

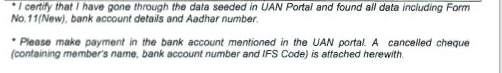

The form asks one to verify that data in UAN portal is correct including bank account number, Aadhaar number as shown in image below.

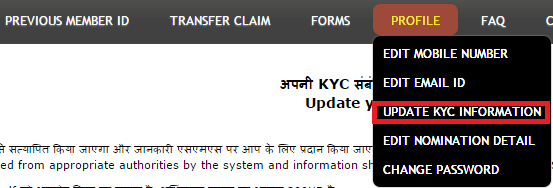

One can Verify the KYC Details that is associated with your UAN. Login to your UAN account at uanmembers.epfoservices.in.

Select Profile->Update KYC Information as shown in image below.

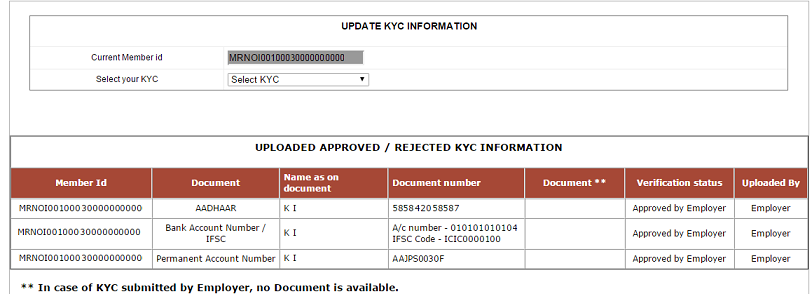

The KYC details with UAN are shown as figure. In the following image All the documents are verified by the employer and hence one can use the new forms.

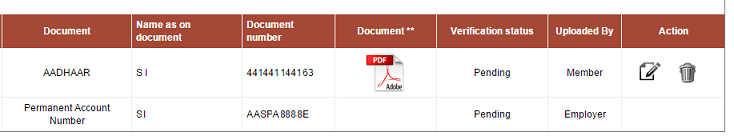

But if the KYC is pending as in image below one cannot use the new forms

How to locate the regional EPF office?

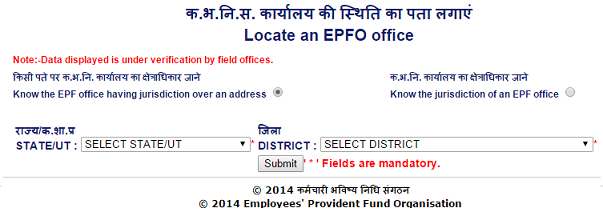

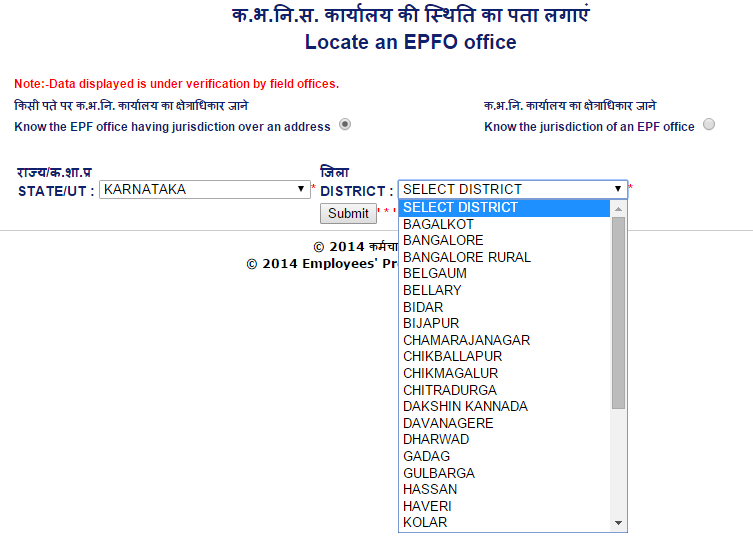

One can Locate Employees’ Provident Fund Organisation office in various states in the country. You can find details upon choosing the name of the state, office location and district name from the drop down menu.

Step 1: To locate your EPF visit http://search.epfoservices.org:81/locate_office/office_location.php Or go to epfindia website then under For employees click Locate an EPFO Office.

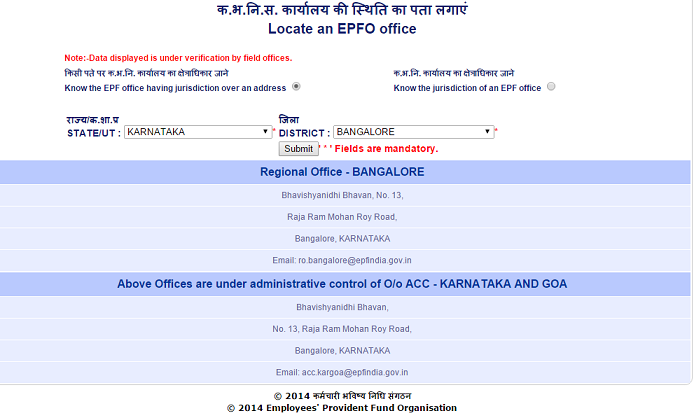

Step 2: choose the State and District then press Submit.

The details of Regional Office along with email id

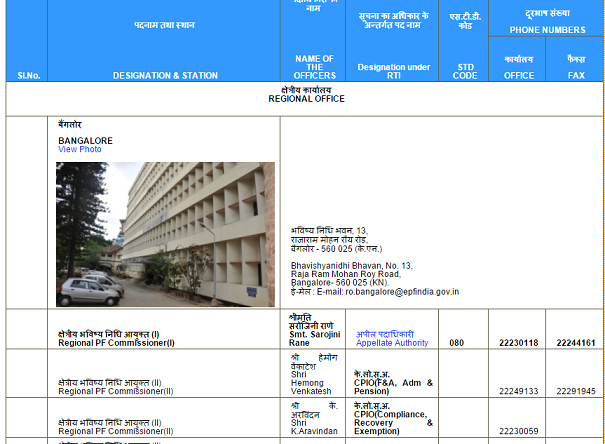

You can get more details at Regional Websites of EPFO For example for Bangalore, Contact us gives us details as shown in image

New & Revised EPF UAN Forms

New forms are Form 19 (UAN) for EPF withdrawals, Form 10C (UAN) for EPS withdrawals and Form 31 (UAN) for advance or loan from EPF. UAN suffix is added to differentiate new forms from old forms. Let’s go through these forms in detail. You also have to provide a Cancelled cheque as EPFO wants to assure that EPF amount goes into the right account. The account number in the cheque is cross checked with the account number available at UAN data. It is therefore necessary to give the cheque of the account which is mentioned in UAN portal. The UAN portal has the details of your account, bank name and IFSC code.

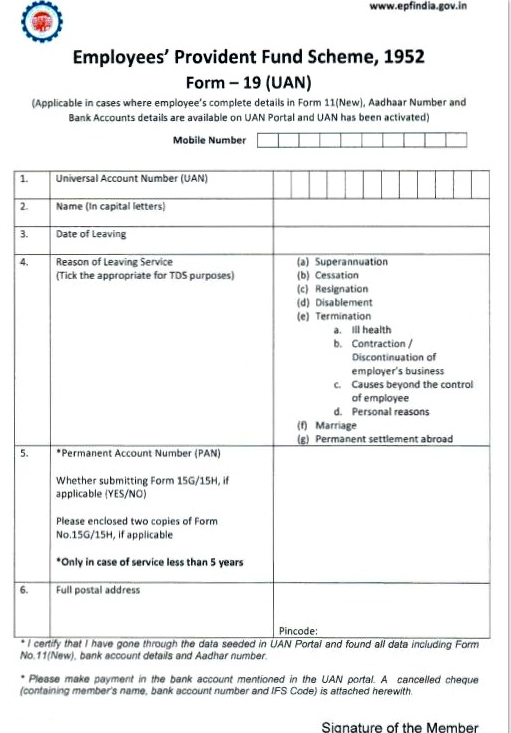

New Form 19 (UAN) for EPF withdrawal

One has to use this form to withdraw EPF amount when one quits job due to retirement, resignation, disablement, termination, marriage, or permanent settlement abroad. You can withdraw from EPF and EPS if you are unemployed for 2 months. You can also wait for two months to get a new job and then you can get your PF Account transferred to the new Account. However, in case of not getting the job , apply for the settlement before 36 months from leaving the last job as no interest will be paid after 36 months and the account will become inoperative.

You can withdraw EPF both the employee and employer contribution by submitting Form 19 UAN.

The form is simple. You just have to provide your UAN number, mobile number, name, date of leaving, reason for leaving and postal address. When service is less than 5 years, you have to give PAN number along with two copies of Form 15G/15H .

You would have to submit doctor certificate if you are resigning due to permanent and total incapacity due to bodily or mental infirmity, copy of Visa, Passport Journey Ticket if you are migrating from India and offer of appointment letter and copy of Visa, Passport Journey Ticket in case of taking up employment abroad.

Please note that if you join a new job then your UAN will be linked with the new member ID or the new PF account number so EPFO can track whether you are employed or not and since when.

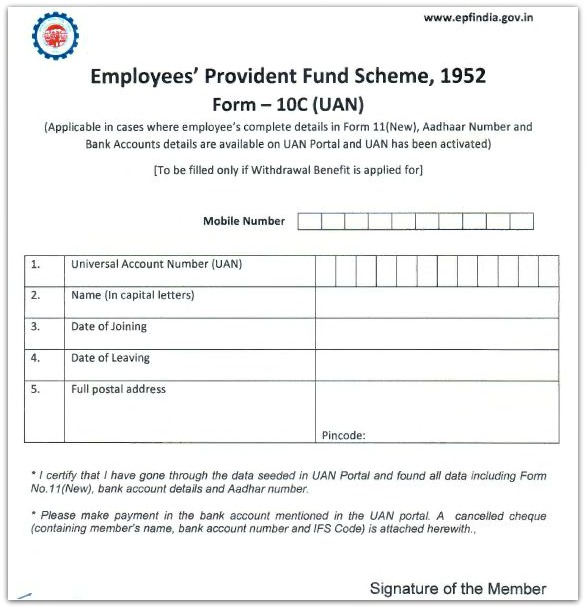

New Form 1OC (UAN) for EPF withdrawal

This form has to be filled only if Withdrawal benefit for EPS is applicable. Withdrawal from Employee Pension Scheme, EPS, depends on if you have less than 10 years of contribution to EPF. If you have more than 10 years of contribution to EPS you will get a Scheme Certificate. You can apply for EPS Withdrawal Benefit Form 10C UAN .

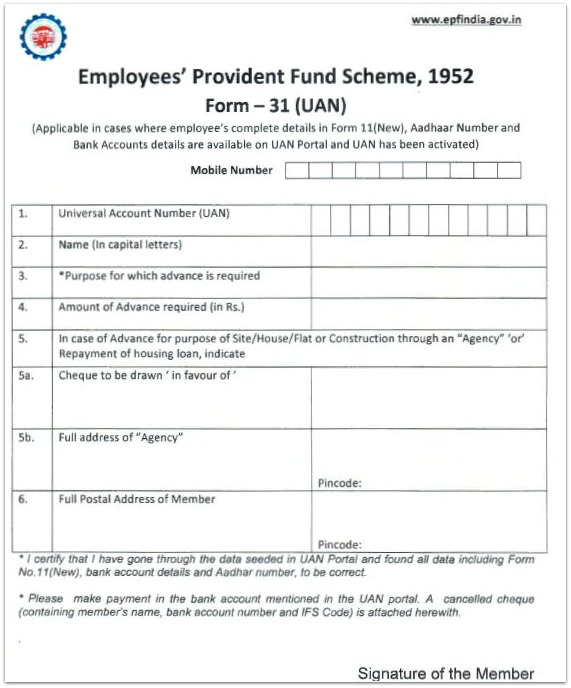

New Form 31 (UAN) for Partial PF Withdrawals / Advances.

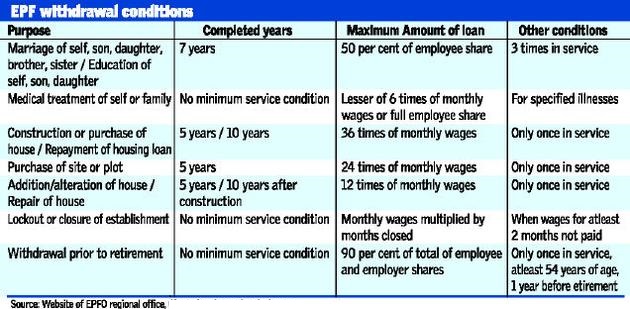

Use this form to avail advances or withdrawal from EPF while one is working. Advance or Withdrawals may be availed for the purposes,such as Marriage, Treatment, after putting in at least 5 years of service. The amount that can be withdrawn depends on the purpose, depends on the number of years of service . How many times can one withdraw for the same reason depends on purpose for example one can withdraw for marriage of self, son or daughter, brother or sister 3 times after one has completed 7 years of service . For marriage purpose one can withdraw 50% of employee share but for treatment one can withdraw upto 6 times of Wages. Table below given an overview of Purpose,Completed Years, Maximum amount of Loan and Other conditions. Our article EPF Partial Withdrawal or Advance covers it in detail.

You can download the new UAN based EPF forms from EPF website

- EPF withdrawals : UAN-Based_Form 19 . Please do submit Form 15G to avoid TDS deduction if your service is less than 5 years.

- EPS withdrawals :UAN-Based_Form 10C(note that EPS withdrawal is only allowed if you have not completed 10 years of service.)

- Claiming Advance or Loan from EPF : UAN-Based_Form31

This new initiative from EPFO helps employees to withdraw EPF without the employer signature. It may help in fast settlement of PF account. Do you think this is a good initiative by EPFO? Would you prefer to submit EPFO form directly with employer’s attestation or go through your employer? Have you got UAN registered and activated? If you use the new EPF Forms please do share your experience.

HI

On my pass book I have account no my name customer I’d bank name and bank phone no however on the ph I have updated bank address also it is work to get ifsc code only by pf department. Because I have submitted my form on 13th and till date it is showing under process.

Hii

i want to withdrawal my full pf amount.i have activated my UAN account and same verified by employer.which form and docements are neccesary to submited in pf office and also documents are self attestted or not.xerox of bank passbook mentioning IFSC code will work in case of cheque.

Thanks

Hi we have a customer I’d on pass book with account no is it wored?

hi

i have submitted my pf withdrawal form without canceled chq but i have attached the pass book copy of my account and all documents was attached by my employer. do i still need to submitted canceled chq… please provide me the solution.

No brother. Bank statement would also work. I have also done the same thing so u dont need to worry at all.

Thanks for ur response I have one more question on pass book we have only name account no customer I’d and bank name do we still required isfc code?

For electronic transfer to the Bank account one does require IFSC code.

But if the passbook has the branch id, one can get it easily.

So there should not be a problem.

Do keep us updated.

I submitted my pf withdrawal form a month ago my hr submitted the form but there’s some mismatch in my bank account name(akansha singh) and in my pf withdrawal form(akanksha singh). My hr said she need to send a declaration about it she is now not responding to my calls. I don’t have my UAN activated. Can i directly submit any form or affidavit regarding my name mismatch in pf office.

Can I send any legal notice to my hr

I applied EPF withdraw by manual form with employer signature then it is also necessary to update kyc documents updated in UAN ID?

No, then its not required.

ok thanks

yes it is. It is better to have the KYC updated.

I applied epf withdraw form by employor signature then it is also necessary for kyc information updated in UAN ID or not?

I have applied the pf with new 19uan and 10c uan method. Everrthing is seeded with adhaar car and uan and also approved by employer on uan portal. My doubt is that in my pancard the date of birth is incorrect and on my adhaar card is different. I have also submitted the affadevit regarding the same. So do i need anything to worry about? Please guide me.

Please wait. It should not cause a problem. Hopefully you should get your PF. We’ll worry if your withdrawal is unsuccessful.

After 15 days of submitting docs, i called epf deprtment to check the status and they said they have not reveived my form yet. How can they say like that if i have and got the pf claim receipt?

I want to withdraw PF using new UAN based system . I have my UAN activated and for KYC only bank details and pan number are approved by employer. Is it possible to withdraw the epf amount without emploer’s approval or aadhar card is must for new uan based withdrawal system.

kindly help me can i apply with out employer approval.

Regards,

Shalu

the conditions to use the New EPF Forms with UAN are as follows:

You must have UAN number activated.

You must linked your Aadhaar number with UAN.

You must provided your Bank details to your UAN.

Your KYC must be verified by your employer

If you meet them then you submit the new EPF form with UAN without employer approval directly to the respective jurisdictional EPF Offices.

I have applied the pf with new 19uan and 10c uan method. Everrthing is seeded with adhaar car and uan and also approved by employer on uan portal. My doubt is that in my pancard the date of birth is incorrect and on my adhaar card is different. I have also submitted the affadevit regarding the same. So do i need anything to worry about? Please guide me.

Hi,

I have my UAN verified and KYC verified, I am in Bangalore and my PF no is from Chennai.

Should i courier or send a register post to the Commissioner of PF in Chennai or Bangalore or to Delhi ? – request your advice please.

Faster would be where your PF office is, which in your case is Chennai.

Hi,

In 2014, I had applied for PF withdrawal after submitting the documents to my previous employer which included form 19 and 10c. Due to some issues, form 19 got rejected but I got the EPS amount into my account.

Now I have got a job and was trying to transfer the EPF amount into my new PF account. I have raised an online request and sent the same through my present employer. But this time again the request was rejected saying “your form 13 has been rejected as your form 10 C already settled in April 2014. Hence, you are requested to submit form 19 for settlement of PF.”

Could you please guide me, how can I now transfer the EPF amount into my new account in this scenario.

Appreciate your timely reply.

I want to withdraw PF using new UAN based withdraw . I have my UAN activated and for KYC only bank details are approved by employer. now uploded Adhaar card , Pan card & Bank cheque leaf employer not approved kyc status showing pending employer approvalbut i called employer asked but they are not responding.

kindly help me can i apply with out employer approval.

Regards,

Pavithra.

Hi sir,

I have send my 10 c UAN,19 UAN and 15 g forms to Pf office .my adhar details and bank details are verified by employerm. How long it will take to get money into my bank account.

Hi sir,I was given resignation two months back.i want to apply for pf.but employer is not attesting my kyc link.still its showing pending….what is the solution…pls clarify

If your Employer is not attesting your KYC then you have to go through old method of EPF withdrawal without employer’s signature. This method is still valid for those who don’t fulfill the criteria of the KYC not updated method which is as follows:

You must have the UAN. UAN is allotted by the EPFO. You can check UAN status online. Even, you can generate UAN as well.

You must have given the bank account and Adhaar number into UAN database.

The employer should have verified the Adhaar number of the employee.

In this method, you have to verify your identity. Since, employer do not verify, You have to attest your EPF withdrawal form from other credible authorities. These authorities are –

Manager of a bank.

Any gazetted officer.

Member of the Central Board of Trustees./ committee/ Regional Committee (Employees’ Provident Fund Organization).

Magistrate/ Post/ Sub Post Master/ President of Village Panchayat/ Notary Public

As you can see, the list is long, who can attest the withdrawal form. But in practice attestation by the bank manager is preferable. Also, Manager should be from the branch, where you maintain an account.

Note that you have to take signature and stamp in every page of the application.

Since this is an alternative route, EPFO does not encourage this process. Also, there is more chance of fraud as well. Hence, It asks for a letter which should state the reason of the direct application for EPF withdrawal.

It is advisable to attach evidence, if any, of ‘non-cooperation’ by the employer. This will give weight to your application. Try to correspond in writing with your employer, so that you have some evidence of non-cooperation

Attach an indemnity bond (affidavit) in a 100 rupee stamp paper. Although it is not mandatory according to rules. But you should not take any chance.

Also, attach service proof. Hence, you should attach copies of payslip, ID card, form16 or appointment letter from employer to substantiate your claim.

Also, attach a copy of your identity proof and address proof.

Other points:

If the bank account number would be same as with the EPF record then it will help. Try to give your salary account of the previous job.

Also, If the attesting bank manager will be from the branch of your salary account branch then it would be better.

PSU bank manager carries more weight.

What about declaration form for form 31 advance. There is showing employer signature. Is it mandatory for advance. There is no clarity. We need uan declaration form also. Pls help me

I am not able to check my pf withdrawal status. My employer said that my documents are submitted to the PF office on 13th Feb 2016. Please can you help me with this. My pf number is TN/30027/36526

Hi,

I want to withdraw PF using new UAN based withdraw . I have my UAN activated and for KYC only bank details are approved by employer. Is adhar card also to be linked in KYC documents.Please clarify .

My PF number belongs to Mumbai but i am in Bangalore, where should i submit these form 19 (UAN)

R u working or resigned? If u resigned since 2 months completed you can apply for withdrawal otherwise u can transfer in present company. If u transfer u r service, u will get personable service soon. If u mention of account details, I Wil explain u where I had to submit u r claims.

Dear Concern,

I applied for PF Withdrawal .Last three applications was rejected by PF department for non matching my UAN profile with the documents.

My Name, father’s name, Date of birth is showing wrong that’s why application rejected again and again.

Kindly give me solution how can i do edit my UAN Profile without my previous requiter.

Thank You.

Sadly the details in UAN can be corrected only by the old employer. You can approach your regional EPFO and try submitting the documents.

Hi,

My employer had given wrong IFSC code in KYC and i corrected it by uploading the new details and got approved by the employer. But the problem is in Form(11) it is still showing the wrong IFSC code. Is it a problem to apply for PF using New withdrawal forms? How to correct it?

Please answer me ASAP.

Along with your Application form did you not submit the blank cheque leaf? EPFO verifies the form with cheque leaf.

You can wait to hear from EPF. If form is rejected then submit again through employer or new forms.

Hi,

Thanks for the immediate response.

I am yet to submit my PF forms but not sure where to! As my PF num belongs to Pune and my office was at Bangalore. Could you please advice me on this?

I just want to know if they tally my cheque which has my account number and IFSC code with Form(11) to approve my PF.

Thanks

Theoretically yes, that’s the entire purpose of asking for cheque leaf.

One choice is :

Submit the form and If it works well and good,

Second choice is to wait for KYC to get updated and then apply.

Best of Luck. Do keep us updated

I want to know whether can I draw my EPF amount using new UAn form of my previous job when such UAN not there as there is no provision of old EPF no from amount to be withdrawal in Uan form.I have activated my UAN acount

Yes Nilesh, your doubt is justified.

use the old forms 19, 10C and 31 for partial and full withdrawals and submit it to their earlier employer.

Do keep us updated

Then who can use new UAN form for EPF withdrawal

Hi,

Is the declaration form still required along with the new form 31 UAN???

Because the declaration form does required attestation from the employer.

Everyone is saying that “Now, employer signature is not required”!!!

But if declaration form is required than this is not true at all and its a misleading info.

Please clarify

These new forms are Applicable in cases where employee’s complete details in Form 11 (New), Aadhaar Number and Bank Accounts details are available on UAN Portal and UAN has been activated.

If we check the new Form 31 UAN then we see that no declaration is required.

Hi…thx for quick reply.

I still have doubts about declaration form. This form require property details (in case someone purchase a flat)

So i guess this could be required…. I am not sure though.

I visited epfo office in hyd and to my surprise nobody knew whether declaratio form is required or not. They even dont have new form 31. I talked to PRO there and she was clueless.

Yes usually ground office is not aware of recent developments announced.

As you rightly said Declaration Form is required . You can check out the form at http://epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form31_Declaration.pdf

Thanks a lot for this brilliant article. It will help a lot of people in understanding the procedure.

I have a query, you have mentioned that

Forms have to be submitted manually by subscribers directly to the respective jurisdictional EPF Offices.

I have moved to some other city in the same state. Is it possible that I send the form by post or it has to be personally submitted.

If it can be sent by post, which exact department and person(designation) should I address on the envelope.

I know this may be a common sense question but with government departments, it is always wise to be a 100% sure.

Looking forward to your response

Thanks in advance

the next thing that is pending is online submission of these forms and it would be the next great move from EPF.

Yes Raj, well said. That’s the next on EPFO agenda.