From 1st May, 2016 NACH will replace ECS. You have to use NACH facility to give auto instruction of debit from your bank account. ECS (electronic clearing service) mandates used for doing Systematic Investment Plan (SIP) in Mutual Funds is being replaced by National Automated Clearing House (NACH) a new system of clearing. National Payments Corporation of India (NPCI) has implemented NACH. All new mutual fund SIPs will have to be registered using NACH. You can read NPCI circular . This article explains the Payment Systems in India, How Payment Systems have evolved,About NACH, One Time Mandate Form for NACH.

What is Payment System?

Payment System is Financial system supporting transfer of funds from payers to payee, usually through exchange of debits and credits among financial institutions. It consists of a paper-based mechanism for handling checks and drafts, and a paperless mechanism (such as electronics funds transfer) for handling electronic commerce transactions.

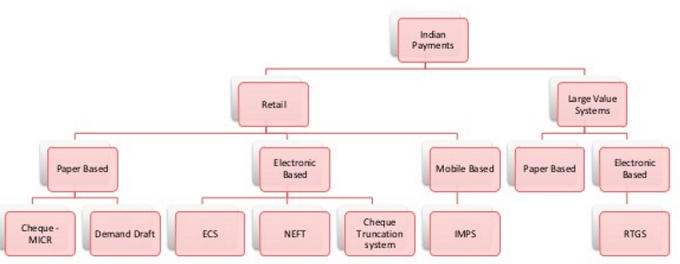

What are examples of Payment Systems in India.

India has multiple payments and settlement systems. Resever Bank of India(RBI) continues to evolve new payment methods and slowly revamping the payments and settlement capability in India. An overeview is given below for more information you can go RBI’s webpage on Payment and Settlement Systems in India

Use of paper-based instruments (like cheques, drafts, and the like) accounts for nearly 60% of the volume of total non-cash transactions in the country. Electronic mode of Payment is gaining popularity due to the concerted efforts of Reserve Bank of India to popularize the electronic payment products in preference to cash and cheques..

- Paper Mode: Reserve Bank had introduced Magnetic Ink Character Recognition (MICR) technology for speeding up and bringing in efficiency in processing of cheques. Recent developments in paper-based instruments include launch of Speed Clearing (for local clearance of outstation cheques drawn on core-banking enabled branches of banks), introduction of cheque truncation system (to restrict physical movement of cheques and enable use of images for payment processing), framing CTS-2010 Standards (for enhancing the security features on cheque forms) and the like.

- Electronic Clearing Service (ECS) Credit : ECS (Credit) scheme was introduced during the 1990s to handle bulk and repetitive payment requirements (like salary, interest, dividend payments) of corporates and other institutions. ECS (Credit) facilitates customer accounts to be credited on the specified value date and is presently available at all major cities in the country.

- The ECS (Debit) Scheme was introduced by RBI to provide a faster method of effecting periodic and repetitive collections of utility companies. ECS (Debit) facilitates consumers / subscribers of utility companies to make routine and repetitive payments by ‘mandating’ bank branches to debit their accounts and pass on the money to the companies. This tremendously minimises use of paper instruments apart from improving process efficiency and customer satisfaction. There is no limit as to the minimum or maximum amount of payment. This is also available across major cities in the country.

- National Electronic Funds Transfer (NEFT) System : Introduced in November 2005 for facilitating one-to-one funds transfer requirements of individuals / corporates. NEFT system provides for batch settlements at hourly intervals.

- Real Time Gross Settlement (RTGS) System RTGS is a funds transfer systems where transfer of money takes place from one bank to another on a “real time” and on “gross” basis. “Gross settlement” means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable. This was introduced in in 2004 and settles all inter-bank payments and customer transactions above Rs 2 lakh.

- Clearing Corporation of India Limited (CCIL) : CCIL was set up in April 2001 by banks, financial institutions and primary dealers, to function as an industry service organisation for clearing and settlement of trades in money market, government securities and foreign exchange markets.

- Other Payment Systems are Pre-paid Payment Systems,ATMs / Point of Sale (POS) Terminals / Online Transactions, Mobile Banking.

- Aadhaar Enabled Payment System(AEPS), connects the banks with the unbanked and the underbanked. The AEPS system leverages Aadhaar online authentication and enables Aadhaar Enabled Bank Accounts (AEBA) to be operated in anytime-anywhere banking mode through Micro ATMs. This system is controlled by the National Payments Corporation of India (NPCI). The 5 Aadhaar enabled basic types of banking transactions are:Cash Withdrawal,Cash Deposit,Aadhaar to Aadhaar Funds Transfer,Gateway Authentication Service.

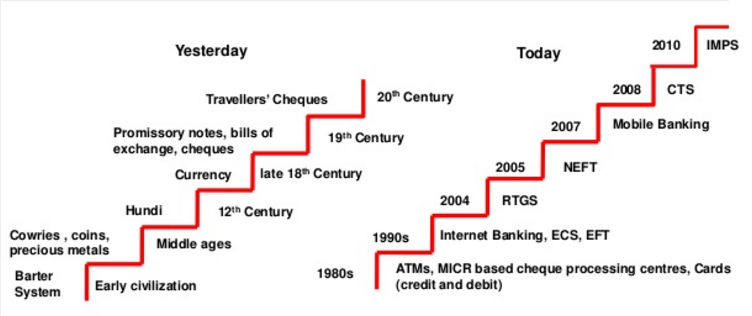

How have Payment Systems evolved over time?

Who regulates the Payment and Settlement Systems in India?

In India, the payment and settlement systems are regulated by the Payment and Settlement Systems Act, 2007 (PSS Act) which was legislated in December 2007. The PSS Act as well as the Payment and Settlement System Regulations, 2008 framed thereunder came into effect from August 12, 2008. In terms of Section 4 of the PSS Act, no person other than the Reserve Bank of India (RBI) can commence or operate a payment system in India unless authorised by RBI. Reserve Bank has since authorised payment system operators of pre-paid payment instruments, card schemes, cross-border in-bound money transfers, Automated Teller Machine (ATM) networks and centralised clearing arrangements

What is National Payments Corporation of India?

The Reserve Bank encouraged the setting up of National Payments Corporation of India (NPCI) to act as an umbrella organisation for operating various Retail Payment Systems (RPS) in India. NPCI became functional in early 2009

What is NACH?

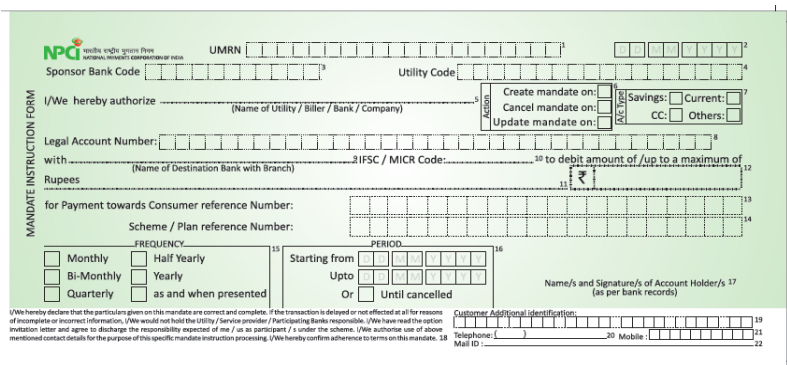

The National Payments Corporation of India (NPCI) has implemented an electronic payment service termed as National Automated Clearing House (NACH) for banks, financial institutions, Corporates and Government Departments. NACH ,National Automated Clearing House, is a funds clearing platform set up by NPCI similar to the existing ECS of RBI

- NACH has both Debit and Credit variants and it aims at facilitating interbank, high volume, debit/credit transactions, which are bulk and repetitive in nature. T

- he primary motive of NACH is to handle low value, high-volume transactions based on electronic files.

- Ideally implementing this mandate will allow transactions to be cleared in real-time mode rather than batch mode.

- The NACH platform will have national footprint which will cover 82000+ bank branches.

- The new centralized ACH solution or NACH is expected to consolidate the current multiple ECS systems and provide a framework for removal of local barriers /inhibitors and harmonization of standards and practices.

What is NACH, NACH Credit and NACH Debit?

NACH Credit is an electronic payment service used by an institution for affording credits to a large number of beneficiaries in their bank accounts for the payment of dividend, interest, salary, pension etc. by raising a single debit to the bank account of the user institution.

What is difference between NACH and ECS?

The prevalent Electronic Clearing Service (ECS) in India is available at around 89 centers in the country. While it is operated by the RBI at 15 centers, it is operated by commercial banks at the remaining centers. The ECS model lacks a standardized operating model, uses manual processes and has other inherent challenges such as inconsistent timelines around post transactional query management and servicing.

| NACH | ECS |

| A robust Mandate Management System, that will include a standardized mandate format and a defined workflow for mandate verification. | Mandate verification is done based on physicals, resulting in verification issues and delayed timelines. |

| Unique mandate registration reference no will be available, which will allow for better tracking. | No such concept of a unique mandate registration reference number. |

| Provision to capture destination bank’s unique mandate registration in the transaction file resulting in lesser rejects. | Higher number of rejects observed on account of mandate related issues. |

| Same day presentation and settlement, including returns processing. | Presentation and settlement is spread over 3-4 day period. |

| Well defined Dispute Management System; electronic platform to raise and resolve issues. Oversight by the NPCI. | Is Dispute management is left to the discretion of the Destination Bank |

NACH applies to all ECS transactions.

From 1st May, 2016 will be applicable to all your ECS transactions. This applies to Utility Bills, Insurance Premiums, Credit Card Bills, SIP of Mutual Funds, or any payment, which is recurring in nature . Note your current ECS will not be affected. They will be honoured. But fresh registration of ECS will be stopped.

Convertion of the existing ECS to NACH will NOT be done default. If you want to register fresh ECS or when your ECS tenure expires you would have to move to NACH.

Most of the Organizations will provide Enrollment for NACH by filling up the physical form. But Banks will be allow NACH enrollment electronically through E-Mandate as well.

Ref: NPCI NACH Procedural Guidelines

What is the benefit of NACH in investing in Mutual Fund?

NACH cuts the registration time for a SIP from the current 30 days to 10-15 days.

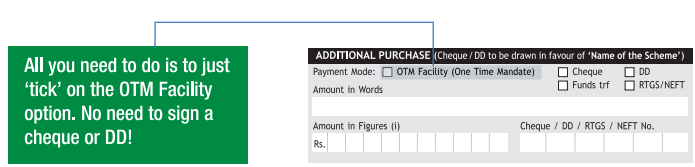

Once NACH One Time mandate is registered an investor can invest offline without having to write a cheque or transferring money online via a payment gateway . Investors can make use of this payment mode for their Lump-sum Mutual Fund investments apart from SIPs in the same folio with the fundhouse. Realisation of funds from the investors account happens on the day which helps investors track their payments on time.

How will NACH modify investing in mutual funds?

NACH is a one time registration process which allows an investor to do lumpsum or SIP investments in mutual funds. By registering this mandate, you will authorise the relevant bank (which is registered in your Folio) to debit a certain maximum amount per day , towards investment in a mutual fund scheme of the fund house. This mandate can either be given for a fixed period (say one year) or perpetual till you cancel it. One mandate works for one folio in the fund house.

If you have SIPs in different fund houses, you have to fill separate NACH forms.

NACH will cover all core banking platform enabled bank branches and will not be restricted to only ECS locations as per current ECS model.

For Lumpsum Purchase:

- Investor needs to submit the One Time Mandate NACH form through the AMC’s aggregator as a standalone form for registration of Bank details.

- Post successful registration, an investor can avail for additional purchase, SIP transactions and other modes of purchase transactions which will be introduced shortly viz SMS and transactions through phone etc.

- One Time Mandate NACH form can also be registered to avail of email/fax transactions that we have enabled for our investors. Presently investors need to transfer the funds through NEFT/RTGS mode before sending email/fax transaction. By registering One Time Mandate NACH form which is a one-time process, investor can then just submit an email/fax transaction conveniently and avoid the fund transfer that needs to be effected for each and every transaction.

SIP Registration:

- In case you wish to register for SIP, you need to submit the SIP registration form along with the One Time Mandate NACH form to ensure you avail the advantages of NACH in case your bank is activated for NACH.

- In case your bank is not activated for NACH, you will have to fill in the ECS mandate form which through which the SIP will be processed; based on the existing procedure.

- Note: In case your registered bank, lists amongst the NACH activated list of banks, then the registration of SIP will be done within 15 working days, else it will be done in 30 working days as per existing process.

Does NACH affect existing Mutual Fund SIPs?

No. Existing Investors need not worry about ongoing SIPs. The existing mandates will continue to be valid the present SIP cycle. No changes will be made to your ongoing SIPs.

Once the tenure or current ECS mandate ends, if you wish to renew the SIP , you will have to fill in a NACH form, for the same.

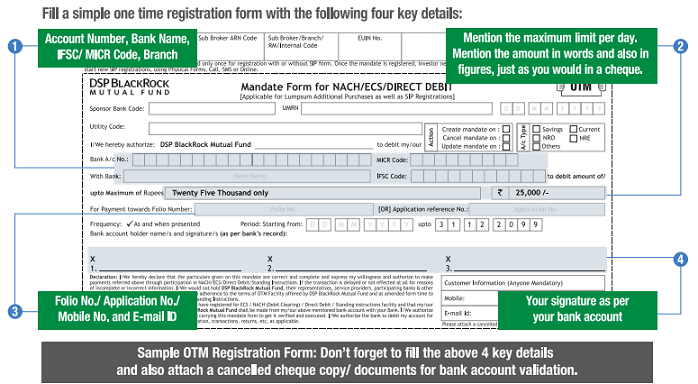

What is NACH OTM (NACH One Time Mandate) Form?

Following image shows the NACH OTM for DSP Blackrock. You need to register it once with following details. Attach a cancelled cheque/copy for validation. Note: We are just using DSP BlackRock as example.

- Account Number, Bank Name,IFSC/MICR Code,Branch

- Mention the maximum limit per day. Mention it in words and also in figures.

- The time for which the Mandate is effective. Period starting from . By default ending period is 31/Dec/2099.

- Folio Number/Application Number/Mobile No and Email ID.

- Your signature as per your Bank account.

How to register for NACH?

- Fill in the NACH OTM Mandate Form.

- Submit it to your advisor or Mutual Fund company (AMC)

- OTM Form will be sent to your bank for registration

- OTM Form will be confirmed in 10-12 days

Once your OTM is registered with a Mutual Fund company you can invest without issuing cheques.

Which Banks support NACH?

The list of banks activated for NACH system keep changing on regular intervals with introduction of new banks. Presently, the NACH system is applicable to about 1000 banks. To view the list of banks, you can visit NPCI website and download Excel file from Products & Services > National Automated Clearing House > NACH Live Banks

What are advantages of registering Mutual Fund SIP through NACH?

- Giving Mandate for Mutual Fund SIP using NACH will reduce the time for registration of Mutual Fund SIP from 30 working days in normal ECS registration to 15 working days . The time gets reduced because of

- Elimination of physical movement of mandate forms to destination bank branch and work on scanned images

- Registration online (through Bank Portal)

- Positive confirmation of Registration as compared to today where 100% confirmation is not received across participating banks

- Due to the centralized and automated nature of the process, the probability of errors is reduced significantly.

- Since there are no paper-flows to the bank branches, there will be no more ‘ECS mandate not found’ related errors

- You can also avoid any internet banking related issues for payment

- Investors need not submit a physical cheque against each of their purchase transaction. The amount will automatically get debited from the investor’s bank registered with NPCI.

How does NACH benefits consumers, banks and organizations?

- For Consumers:

- Timely payment of bills /installments /premium without remembering the due dates.

- Faster processing time and less manual intervention.

- For Banks:

- Less dependence on cheques and paper based transactions.

- Faster processing time and less manual intervention.

- Better service to customers and affiliate organizations.

- For organizations:

- Better customer service.

- Timely dispersal of salaries, dividends and clearance of bills.

- Facilitates automatic credit of variable benefits like allowances, scholarships etc.

- Less dependence on cheques and paper transactions.

Related Articles:

- Cheque: Clearing Process, CTS 2010

- Third Party Fund Transfer : NEFT,RTGS

- Number of ATM Transactions

- What is Mobile Banking

- Saving Bank Account:Do you know how interest is calculated and more

- Interest on Saving Bank Account : Tax, 80TTA

India is slowly and steadily moving towards digital way of financial transactions. What do you feel about NACH? Did you give NACH Mandate?

5 responses to “NACH: What is NACH? NACH OTM,How NACH will replace ECS”

How to cancel otm online ….

OTM, or ‘One Time Mandate’ is a one time registration process that will allow you to invest with a mutual fund in a simple, convenient and paperless manner.It is an authorization to your bank account to debit money up to a certain limit in a day to a mutual fund of your choice.

There is no online way to cancel OTM.

You need to request for cancellation of the OTM facility by submitting the One Time Debit Mandate Form and indicating cancellation.

बहुत ही उम्दा …. बहुत ही सुन्दर प्रस्तुति …. Thanks for sharing this!! 🙂

Best knowledge

Best knowledge of Bach.thanks