At times one is short of money and needs to borrow. Taking Personal loan is better than paying minimum on the credit card because of lower interest rate. How fast can one get a personal Loan? Less than 90 seconds without running around to banks etc, minimal documentation(PAN and Aadhaar) and instantly with few simple clicks. The leading digital lending platforms have brought in a shift in the perception of loans for people. MobiKwik offers loans upto Rs 1,00,000(was 60,000 when first launched in Oct 2018) which are sanctioned as well as disbursed in a matter of 90 seconds. Let’s look at the MobiKwik Instant Loan Feature Boost in detail.

Table of Contents

Taking Loans

One should have emergency funds. But there may be cases where you need money in a short notice(accident, sickness, job loss, family emergency). many people resort to using credit cards or max or taking personal loans.

A recent survey suggests that there has been a surge in personal loan sanctions, especially to the salaried employees. The working population now prefers taking personal small loans in order to tick their long list of expenditures. The leading digital lending platforms have brought in a shift in the perception of loans for people.

Earlier loans have often been known to help in sudden and urgent need of money but also included a high risk factor. To borrow money, it was imperative to keep jewellery, house or any valuable object with equal or more value as a security or collateral. In case of failure in repayment of the loan amount, the ownership of the security would by default be shifted to the lender. Additionally, applying for a loan automatically involved countless visits to the bank, looking out for a higher approach in order to receive a hassle-free and quick loan and paperwork after paperwork to read, verify and sign.

People now consider online personal loans as a solution to this problem. Personal loans are unsecured loans, that means the borrower is not bound to give anything as security to the lender. Money borrowed under personal loans can be unaccountably spent on shopping, travelling, paying never-ending bills, medical requirements or on legal requirements.

Amidst the money lending and borrowing, the salaried people are busy earning. Working-class of today are stuck in the cycle of getting their salary, spending more than half of it in the first two weeks and then waiting for their payday, to pay the bills they were unable to pay. MobiKwik launched its Instant Loan App. It is a common belief that credit cards have made the lives simpler considering the high spending limit and the ease to use. But beneath the effortless usage, lies the over the top interest.

MobiKwik Boost Loan

Credit card interest rates are now over the roof. To combat the problem, MobiKwik launched its Boost Loan with the aim to financially empower the masses. The salaried population can now access this quick loan service on the MobiKwik app. This easy loan facility removes the need to visit banks. MobiKwik has partnered with a number of NBFCs to offer this service to its users. MobiKwik is the first wallet player to disburse loan amount in the user’s mobile wallet.

Users can apply for loans ranging from Rs. 5,000 upto Rs 1,00,000 through MobiKwik app.

Only Aadhaar card number and PAN number are required to avail the loan. This instant cash loan that requires no documentation or security

Mobikwik will instantly pull up your credit scores based on these details. Depending on the score, the app will share the loan amount you are eligible for and the rate of interest you need to pay on it.

Personal loan rates can be viewed on the app itself.

The loan amount is payable in easy instalments of 6 and 9 months. They can either payback from the MobiKwik app or can enable MobiKwik’s partner to auto-debit the monthly EMI from their bank account.

Loan are easily sanctioned in less than 5 mins is no less than a revolution for the people who have been dependent on credit cards despite their sky high interests.

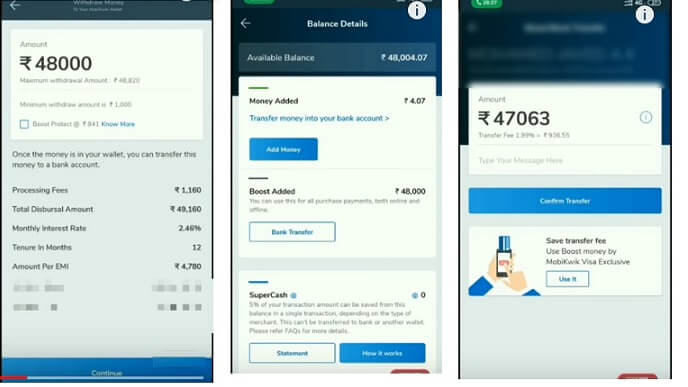

Amount would be credited to the MobiKwik wallet. The amount credited can be utilized by the app users across a range of use cases including urgent purchases, marriage expenses, travel plans, hotel bookings, medical emergency, as well as payments to offline and online merchants.

MobiKwik users who avail loans via the app also have the option to transfer their loan amount to their bank account.

How to apply for a personal loan on MobiKwik?

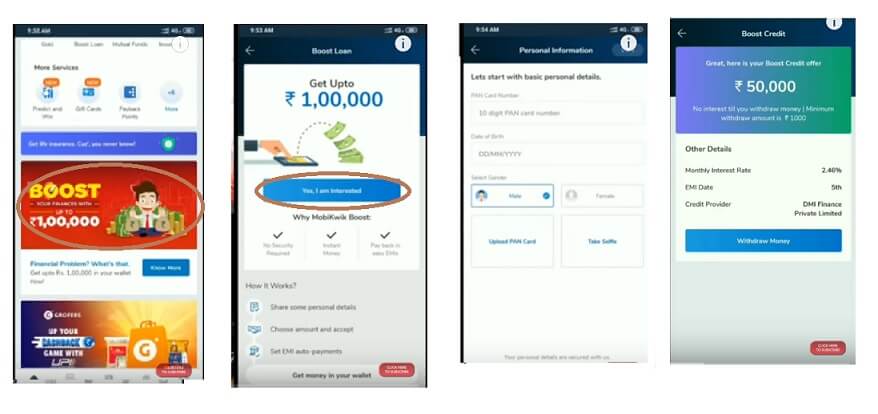

In order to avail instant personal loan on MobiKwik, you only need to follow a few simple steps given below.

- Open the MobiKwik app and click on Boost loan

- The instant cash loan page will appear on the page. Click on ‘I am interested’ .

- The next step to avail the instant loan online, type in your personal details i.e Aadhaar card number and PAN number.

- MobiKwik will check your eligibility for instant loan online. The amount you are eligible for will be reflected on the screen.

- You can type the amount you want to withdraw and click on ‘boost credit’.

- Set up your EMI auto-payments and loan agreements at the same time.

- The amount will instantly reflect in your wallet as a an instant loan online i.e small loan.

Video on How to use MobiKwik Boost Loan

This 7 minute shows how to get Instant loan on Mobikwik

Our review of MobiKwil Boost Loan Offer

- We will recommned you to save at least 3 months salary for emergency situations

- Credit offers convinence but at high cost.

- Personal loan is a good alternative.

- And MobiKwik Boost Loan is a very good feature.

One response to “How MobiKwik is Revolutionizing Personal Loans: Instant Boost Loan”

Password