Table of Contents

Conversation on Twitter

Life insurance as a ‘happiness’ product

Parag Parikh explains that this is because of mental association. These refer to the mental linkages that the consumers immediately make when they come across something. While such associations may be seen as an extension of the cognitive bias of heuristics or mental short-cuts taken to process information, some of them could be the outcome of our own experiences. Whatever the antecedents, manufacturers and distributors of financial products find it convenient and profitable to integrate these associations in their marketing strategies.

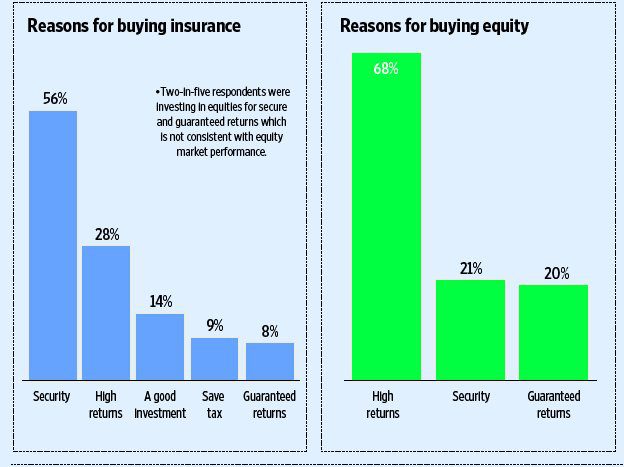

Mental Association extends to other products too. Parag Parikh says: The notion of equity being ‘risky’ and debt being ‘safe’ is another example. One reason for this is that equities are viewed as instruments for trading while debt instruments are usually held to maturity. Wealth managers also encourage their clients to purchase ‘safe’ investments. While they may genuinely believe that the client could benefit more in the long run through equity investing, they also fear losing him in case he suffers short-term losses.

Monthly income plans (MIPs) by MFs is yet another example where people associate these Mutual funds with Post Office Monthly Income Scheme (POMIS), which guarantees a predetermined amount of interest each month and is favoured by conservative investors. MFs would be doing greater service to investors if they marketed these funds as debt-oriented balanced funds suitable for a certain section of conservative investors.

Other Financial Products

Mis-selling or Mis-buying?

Are the products mis-sold or mis-bought? Quoting from P.V. Subramanyam article on Business Standard Mis-selling or mis-buying?

Last month, I met a retiree and his wife to review their investment portfolio. Apart from 32 mutual funds—most of them NFOs launched in the past 3-4 years—and a long list of equity shares, they had endowment policies, Ulips and a pension plan. It is improbable that the retired petroleum engineer and his homemaker wife understood the various charges and loads for these products before they bought them. These were sold to them by five relationship managers of three banks, a friendly neighbourhood independent financial adviser and a national distributor.

- Insurance in India is not bought but sold. Some people buy to please a friend, neighbour or a relative even though neither the client nor the salesperson understands the product.

- Another reason is ego. The customer’s ego does not allow him to admit that he does not understand the product. He convinces himself that if a big organisation is selling and the product has been approved by Sebi or Irda, it must be good.

- The third reason is that most big purchases are made without professional input as customers do not know whom to ask. So, a customer should not complain about mis-selling by an agent because he is also guilty of mis-buying.

Non Financial Products

But is Mis-selling or Mis-buying restricted to just financial products? Sadly no.

You purchase a brand new mobile for Rs. 10,000. The first year you have a free warranty. The salesman offers you a warranty for the second year for Rs. 500. What are the chances of your mobile conking off in the second year. May be 1% looking at the track record of all the mobile phones in the last few years. So your warranty is worth only Rs.100. However you believe that the salesman is your best advisor and pay Rs.500 for something which is worth only Rs. 100 . You fall for the bait and buy the second year warranty. This example is from Parag Parikh’s Irrational consumers

A superior course, global exposure, international faculty and dollar salaries… claims many universities. Careers360 investigation on IIPMs Best only in Claims.

Why is it that people become sitting ducks for such schemes? Read a story in Readers Digest about Parable of the Talents or Parable of the Pounds of the talents or minas which says For to everyone who has will be given, and he will have abundance, but from him who doesn’t have, even that which he has will be taken away. Or as my mother often told me Fool and his money are soon parted.

Factors against you

As Parag Parikh explains in the article If consumers are irrational it makes sense for companies to cater to that belief rather than eradicate it Quoting from it

We are in a market where firms compete for the same consumers. Some sell cigarettes and some help you to quit smoking. Some sell fast food while others advise you for diet. If all are rational human beings then there is no argument which competing interest will win. However the problem is that consumers are humans and make irrational decisions leading to bad choices. Here is how firms benefit out of their irrational behavior. In stock markets we have opposing interests like day traders v/s long term investors and stock tips v/s value investors. Irrational investors add to the chaos making it easy for firms to benefit from their irrationality. Your business news channel has become your stock advisor, the banks salesman is your financial advisor,and your friendly neighbor is your portfolio manager.

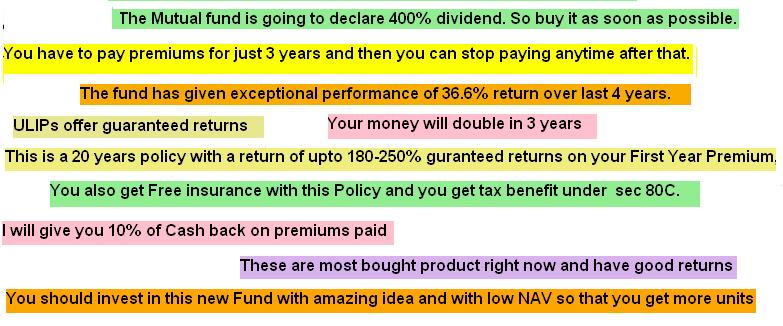

Finance Industry has very smart people at higher level , CEO , Relationship managers , advisors and everyone. they are smart people. they understand human psychology . They know Indian public more than indian public knows them selves . They know what words to use when and how to divert our minds , our thinking . Why do they come up with “Guaranteed return products” when markets are low ? That the the perfect and the most right time for everyone to enter Equity , but companies know we are afraid of loosing , we dont like losses , we have lesser risk appetite, and then all the Jeevan Astha and JeevanNishchay and other Secured products like RGF will pop up. Most of the NFO’s will come in the bull markets and when markets are already up because that is the time we are charged up and ready to bet our home on anything , that is the time when we have to avoid those things .

Responsibility: It’s my money

As it is your hard-earned money you have to take responsibility for it just like J.D.Roth of US who runs getrichslowly.org which is often voted as the best personal finance blog (Time voted it one of the best blog of 2011 ). He was an average American who found himself deep in debt. When debt became overwhelming he looked for switch solutions. “My research revealed that few people get rich quickly, but almost anyone can get rich slowly by patiently following some simple rules.” Know more about him and His rules and his Free at Last! Saying Good-Bye to 20 Years of Debt

You would find many who have mis-bought LIC policies, NFO’s, IPO’s, penny stocks, let money lie in Saving’s account(including me!). Is it because of our ego or laziness or ignorance or our parents don’t teach us or their advice is outdated or we don’t ask the right people? We don’t allow people to drive a car without taking a driving test for license but allow them to enter complex financial world financially uneducated. It’s not only investing but investing properly-did you invest as Joint with Either or Survivor, Did you declare nominee for your investment? If your paperwork is not proper your family will not be able to get your money easily.

Yes blaming others is of no use and then till how long can you hide behind it. Finally realized that there is no easy way out, no short cuts. My mother used to say “Baacha agar rooye nahin hain to main bhi usse doodh nahin deti hain“(The kid has to work : if he doesn’t cry then his mother might not give him milk). No Pain No Gain. We have to start learning, making mistakes (Even Warren Buffet, the legendry investor, makes mistakes), learning from the mistakes. We all learnt how to cycle after falling from it many times right? For life is a hard teacher because she gives the test first, the lesson afterward. We have to become literate financially, be money aware so that we can empowered.

There is a quote in Hindi Chahe chakko tarbooz pe pade ya tarbooz chaooke pein par katda to tarbooz hi hai (If knife falls on water-melon or water-melon falls on knife it’s the water-melon that will get cut). As it is your hard-earned money you have to take responsibility for a fool and his money is soon parted. Do you think products are mis-sold or mis bought? Is it only insurance products or ULIPS but others too? Do you think we need to take responsibility for our actions ? How can we smoothen the learning?

4 responses to “Mis-Selling or Mis-Buying: It’s My Money, My Responsibility”

Very nice and resourceful article

Companies have been so aggressively trying to increase their sales that employees are also forced to say wrong facts just to get a sale done as they also have to achieve their targets.

Infact the scenario is so bad that one of my friends resigned last month because his employer was forcing him to reveal wrong facts just to get a sale done. The employer wanted my friend to say to an elderly couple that the instrument he is endorsing is a Tax-saving Instrument although it was not a Tax-Saving Instrument.

After hearing the above case, I strongly advise everyone to go through the Terms and Conditions rather than just relying on wrong facts being shared by agents/employees

Thanks a lot Karan. Sad to hear about your friend’s resignation Confessions of a misseller in our article at business today describes the similar situation. There are lot of people who don’t resign from the job because of “papi pet ka sawaal” .

We need to fend for ourselves and our money for as they say “Fool and his money are soon parted”

Excellent article supported by other live article links , I highly admire your effort and wish that this article is added to the induction text of agents taking the licenses for selling the financial products.

Amitesh Thanks a lot. I have learnt a lot through those links and they all seem so isolated but so connected hence I took this opportunity to gather them. I am not sure about agents but every consumer should understand it before they buy any product!