From January 1 2016, MF Utility has gone online. Now You can transact in direct plans of MF schemes sitting in the comfort of your room.This article explains what is MF Utiltiy, how to enroll for MF Utility for direct Plans of Mutual Funds, get CAN number, How to use it to buy, sell, switch Mutual Funds , how to start SIP in Mutual Funds directly?

Table of Contents

Direct Plans of Mutual Funds

What are Direct Plans of Mutual Funds?

Since Jan 1, 2013, all mutual fund schemes come in 2 variants – a regular plan and a direct plan.

- Regular plan is one in which you invest in through a mutual fund distributor and for which a distributor earns a commission, paid out by the mutual fund company which indirectly comes from you.

- Direct plan, where you bypass the distributor, and invest directly with the fund house. So you save all the brokerage and commission that are otherwise paid to a distributor in a regular plan.

Direct Plan have Separate Net Asset Value (NAV) and Lower expense ratio , compared to Regular Plan. Our article Direct Investing in Mutual Funds explains Direct Plans in detail.

How could one buy Mutual Funds directly?

There are a few ways to do it. One, you can make a paper application directly with the registrars of the mutual funds such as CAMS, Karvy, Franklin or Sundaram BNP for the scheme that you want to invest in.

Two, you can go to the mutual fund’s website and create your account there and invest online. Some of the mutual funds do not allow you to invest directly with them for the first time. You will have to submit a first time physical application at their or registrar’s office

Now you can buy Mutual Funds units directly through MF utility. MF utility is available as Web version as well as App.

What is MF Utility?

MF Utility (MFU) is a shared services initiative by the Association of Mutual Funds in India (Amfi). With MF Utility, you can invest in direct plans of multiple mutual fund schemes across many fund houses using a single transaction. MF Utility is not the only portal that lets you invest in direct plans of MF schemes from multiple mutual fund houses/AMCs. There are many portals that have come up recently such as Invezta, UnoVest, OroWealth etc.

There are absolutely NO charges or any fee payable by the investor for getting a CAN or doing the transactions. MF Utility (MFU) facilitates the following through the Portal. Our article MF Utility : Investing in Mutual Fund Direct Plans online explains it in detail.

- Common Account Number (CAN) registration for Investors

- Submission of documents to KRAs for KYC Registration for those investors who are seeking CAN creation

- Commercial transactions like Purchases, Redemptions and Switches

- Registration of Systematic Transactions like Systematic Investments (SIP) using a PayEezzMandate, Systematic Withdrawals (SWP) and Systematic Transfers (STP)

- Non-commercial transactions (NCT) like Bank Account changes, facilitating change of address through KRAs etc. based on duly signed written requests from the Investors

CAN Common Account Number

To invest through MF Utility Investors have to get themselves a Common Account Number (CAN) . CAN is a unique identifier issued by MFU. You need to register for CAN by filling in CAN registration form and submitting the CAN registration form at any MF Utilities India arm or a distributor signed-up with MFUI or a participating AMC branch. Investors, then will be provided login access to MF Utility where they can access the information across all MF investments.

You can download the CAN registration form and submit the completed form at MF Utility Points of Service (POS). This is a one-time procedure and free of cost. Along with the filled application form one needs to submit. The filled form with necessary proofs can be sent by courier to the MFU office.

- PAN

- Proof of KYC, KYC Compliance is compulsory for CAN creation. If you are not KYC compliant, you can give your KYC application along with your CAN application.

- Proof of date of birth

- Proof of bank account for bank mandates registered under the CAN

- Proof of depository account if you want to go for Demat

- Proof of guardian relationship (in case of minor applicants)

You can fill the CAN form online also. Individual Investors may use this facility to fill the CAN Registration Form online and have the Form downloaded or emailed as a PDF I could not fill it online properly. Printout was very crude. If you are able to fill the form successfully please let us know, it will help other readers. This utility is only to facilitate the filling of the CAN Form. CAN will be created based upon submission of the signed form with all the required details and documents

CAN is not transferable. In case of eventualities like demise of one or more holders in the CAN, the surviving holders have to request for transmission with MF Utilities India.

You can hold multiple CANs for different combinations of holders. For example, Rahul can have a

- CAN in his individual name : In which he invests as single holder.

- CAN in their joint names with his name as primary holder and wife as second holder

- CAN in their joint names with his wife name as primary holder and him as second holder

On submitting the CAN Registration form, you will receive an SMS and an email or your registered mobile phone and email address, confirming the CAN allotted to you. This can take upto a week.

How do you get online access in MF Utility?

Online access is not default under MF Utility. This means you won’t get online access details after registration of CAN. You will have to ask for online access. Once your CAN is generated, you can send an e-mail to clientservices@mfuindia.com requesting them for online access. You will get access in a couple of days.

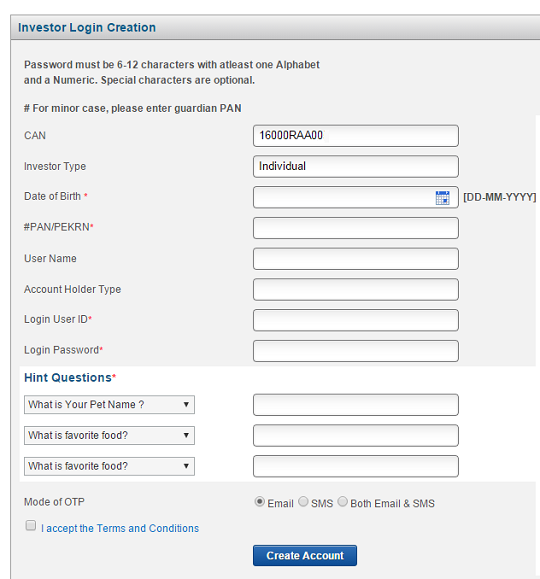

You would get mail from MF Utility for creating Login ID.

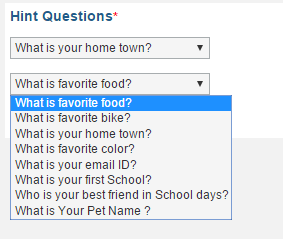

You can change the Hint Question/Order of Hint Questions. Please note down the Hint Questions and Answers that you provide. These will be needed if you forget your Password.

- Select the Mode of OTP (One Time Password).

- Accept Terms and Conditions

- Click on Create Account.

You would get OTP in either SMS/Email or both depending on the mode you have chosen. Now you are good to go.

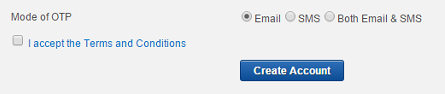

How do you gain access to MF Utility?

MF Utility provides browser-based access to MF investors, with connectivity to Registrars and Transfer Agents (RTA), banks, AMCs, payment gateways and KYC registration agencies or KRAs. You access the MF Utility Online portal by going to https://www.mfuonline.com. Please note the POP BLOCKER should be set to OFF as said in image below.

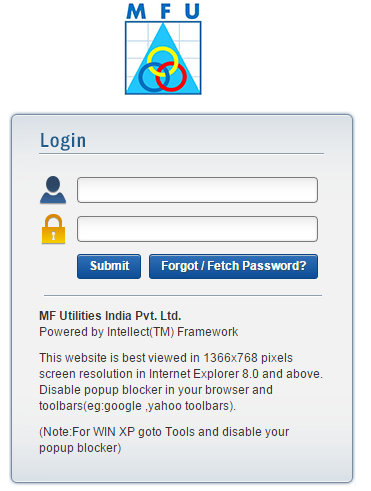

Start Screen of MF Utility on Logging in

Even though you might not have used MF Utility to Purchase any Mutual Fund units, you might see some earlier mutual fund investments on logging in. This is because upon creation of a Common Account Number (CAN), MFU will map the existing folios of the investors across fund houses to the CAN, based on the PAN and the holding pattern. So if you have existing investments based on PAN and holding pattern it would be mapped to your CAN. You will get a mail telling you about the folios being mapped to CAN.

What can you do after logging on to MF Utility platform?

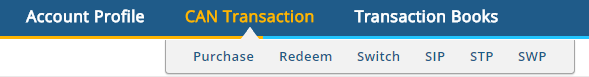

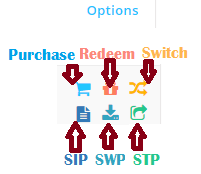

You can Purchase, Redeem, Switch, Start a SIP, Start STP (Systematic Transfer Protocol), SWP( Systematic Withdrawal) by clicking on CAN Transactions for New Investments

For existing investments you can click on the Icons next Mutual Fund.

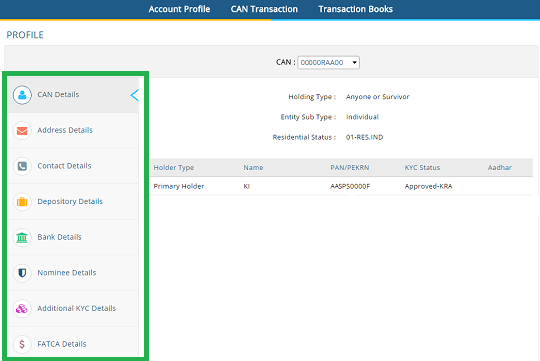

Account Profile on MF Utility Plaform

You can also check the details,CAN Details, Address Details, Contact Details etc of your Account by clicking on Account Profile. The various details, such as CAN Details, Address Details, Contact Details, are organised in left hand side and information related to subtopic displayed in middle of page. The image below shows CAN Details of the account, note the blue line on Left Hand side and Blue arrow on Right Hand Side. To get info about say Bank Details just click on Bank Details.

Check Transaction Details

If you do transactions through MF Utility i.e you buy,sell, SIP through MF Utility then you can see the details in this section. This is explained later in article.

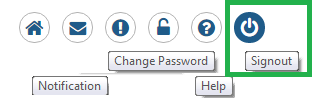

Signout from MF Utility

You can signout from MF Utility by clicking on Signout button on right hand corner of screen as shown in image below.

How to Purchase Mutual Fund Units directly Using MF Utility Platform

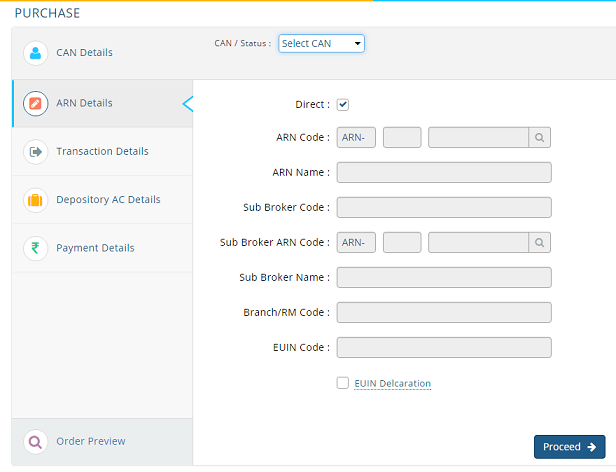

Click on the Purchase menu in the Transactions or use the symbol beside the fund name as explained above. To purchase the Mutual Funds you need to fill following details. Click on the Proceed button to move to next set of information.

- CAN Details : You can have Mutiple CANS so select the CAN for which you are buying.

- ARN Details : For those who are investing Directly, it should be Direct. ARN stands for AMFI Registration Number. It is a number issued by Association of Mutual Funds in India(AMFI) to its registered Mutual Fund advisors. AMFI, the association of SEBI registered mutual funds in India of all the registered Asset Management Companies, was incorporated on August 22, 1995, as a non-profit organisation. As of now, all the 44 Asset Management Companies that are registered with SEBI, are its members.

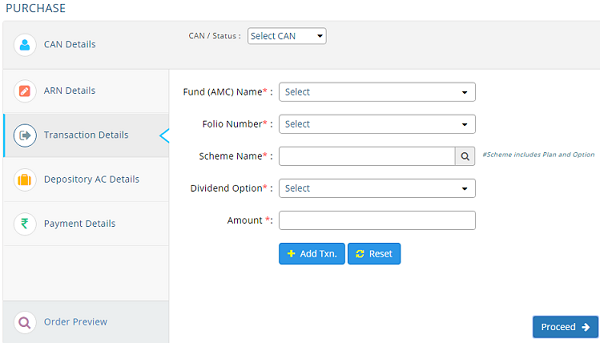

- Transaction Details : Mutual Fund company (HDFC, ICICI Pru etc),Mutual Fund scheme(ex HDFC Top 200) you are investing in, Amount,Dividend option etc. For Dividend, If you select Growth option, it automatically changes to Not Applicable

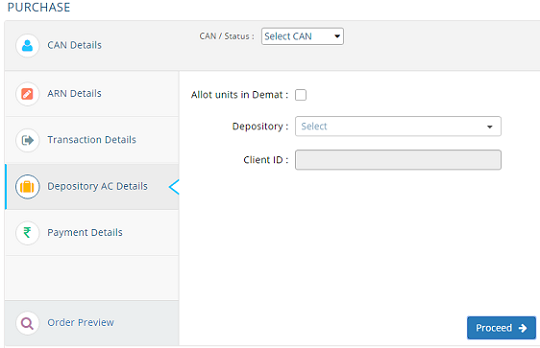

- Depository AC Details: if you wish to hold Units in DEMAT form. It is optional.

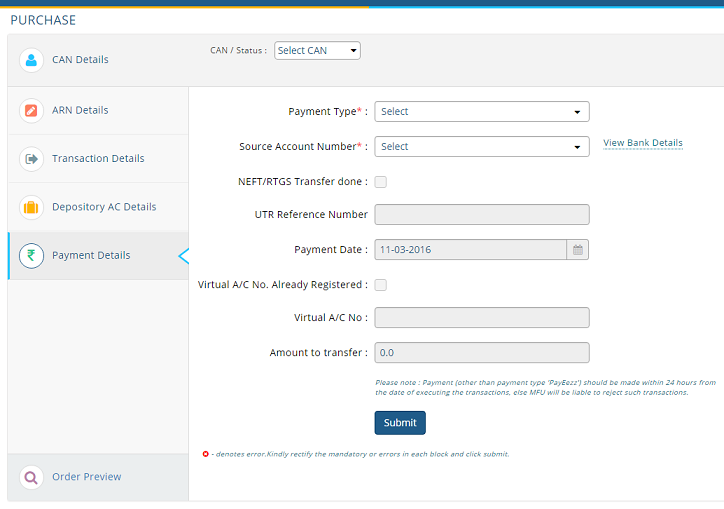

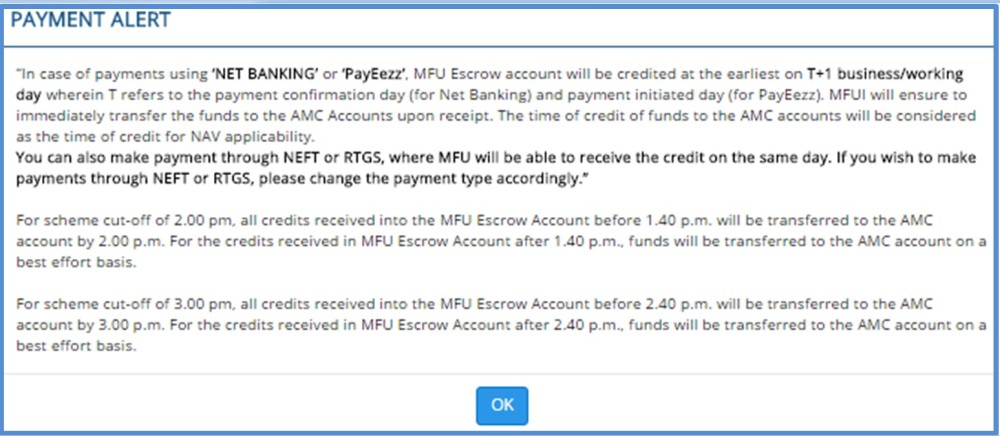

- Payment Details : There are 4 payment types to buy Mutual Fund units:

- Net Banking: Select the Source Account Number from where you wish to pay. On clicking the Submit button, you will be redirected to the Net Banking site.

- NEFT: Please obtain the virtual account number and IFSC for your CAN from clientservices@mfuindia.com and set them as NEFT beneficiaries in your Net banking account. The Net banking account to process the NEFT should be similar to the bank accounts set in CAN. To Do NEFT to transfer money to MFU account,you will require the beneficiary details i.e the IFSC and the Account Number of MFU to send money via NEFT. If you write to clientservices of MFU, they will give you a IFSC and an account number. The account number that they provide is a combination of 4 letter code suffixed with your CAN. Since, MFU has not opened so many “real” bank accounts in that branch, it is actually a virtual account number where you transfer money via NEFT.

- RTGS: For investments above 2 lakh.

- PayEezz: You need PayEezz for SIP Transactions. If you want to use PayEezz you need to register for PayEezz. By registering under PayEezz, investors need not issue cheque or other payment instructions every time they make an investment through MFU up to the amount mentioned in the PayEezz mandate. This brings ease and convenience in subscribing for mutual fund units through MFU. This will also enable you to transact paperless. or more details you can read https://www.mfuindia.com/PayEezz FAQ

Transaction Details while Purchasing Mutual Fund using MF utility

You need to fill in Mutual Fund company (HDFC, ICICI Pru etc),Mutual Fund scheme(ex HDFC Top 200) you are investing in, Amount,Dividend option etc. For Dividend, If you select Growth option, it automatically changes to Not Applicable.

If you want to buy more funds in other AMCs, you select the Add Txn button. That will create a line item under the Scheme Name section. If you have make multiple Purchase transactions or Multiple redeem transactions, all these will appear under a Single Group. The group number will denote the basket. Within a group, the individual transactions will be displayed.

The round about time from the Net banking to the MFU Site is only 5 mins. So if you are waiting for OTP from Bank or taking time to put the OTP on the screen and you surpass the 5 min window, then you will get a failure message.

Filling in Depository AC Details using MF Utility

If you wish to hold Units in DEMAT form then you need to fill in the details. select the Allot units in Demat and then you can select Depository and Client ID. You need to have your Depository details set up.

Filling in Payment Details using MF Utility

You can choose the way you want to Pay for the Mutual Funds units. Options are Netbanking, NEFT,RTGS and PayEezz.

About Virtual Account : To Do NEFT to transfer money to MFU account,you will require the beneficiary details i.e the IFSC and the Account Number of MFU to send money via NEFT. If you write to clientservices of MFU, they will give you a IFSC and an account number. The account number that they provide is a combination of 4 letter code suffixed with your CAN. Since, MFU has not opened so many “real” bank accounts in that branch, it is actually a virtual account number where you transfer money via NEFT.

On selecting the Payment Type, you get a pop up message telling you about the cut off time.

You should be able to get units on the date of SIP or date when the lumpsum transaction was placed (provided before 10 AM).

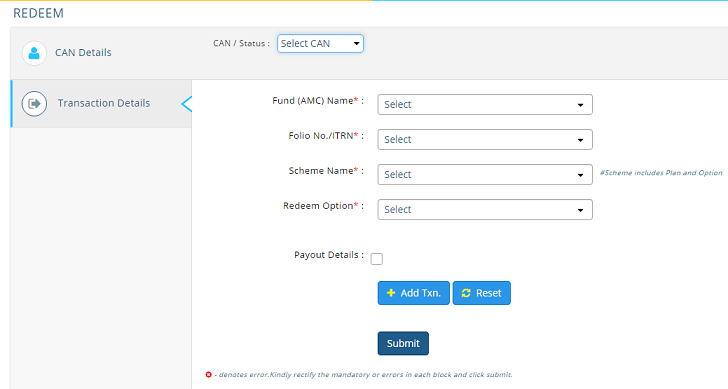

How to Redeem Mutual Fund Units directly Using MF Utility Platform

Click on the Redeem menu in the Transactions or use the symbol beside the fund name as explained above. To purchase the Mutual Funds you need to fill CAN Details, Transactions Details as shown in image below.

- Select the Fund

- Select the Folio No.

- Select the Scheme which you want to redeem

- Select if you want to redeem all units or amount specific

- Tick the Payout Details if you want to change the bank account where the redemption proceeds are to be credited. It will enable the Payout Account drop-down list.

- In Payout Account drop-down list, you can select the Bank Account of your choice. The bank Accounts which are present or recorded in the Folio are displayed.

- If you want to redeem more funds in other AMCs, you select the Add Txn button. If you have make multiple Purchase transactions or Multiple redeem transactions, all these will appear under a Single Group. The group number will denote the basket. Within a group, the individual transactions will be displayed.

- Click Submit

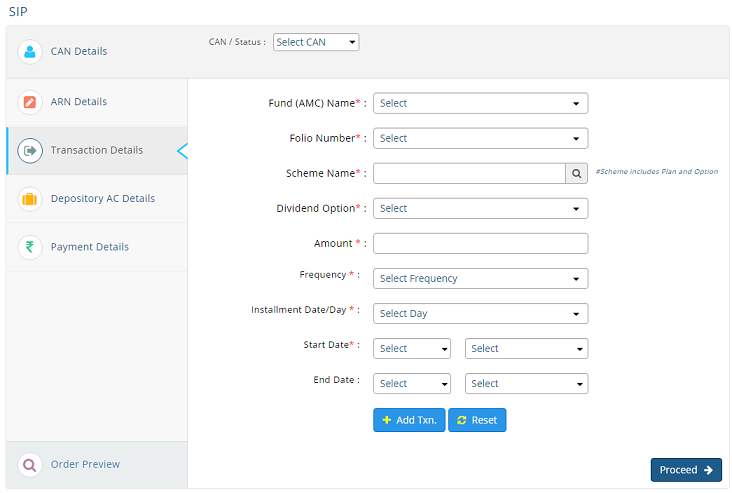

How to Start SIP in Mutual Funds directly Using MF Utility Platform

Starting a SIP is just like purchasing the Mutual Funds using MF Utility Platform. You have to specify CAN Details, ARN Details, Transaction Details. Depository Details(Optional Demat Details), Payment Details. In the Transaction Details You also have to specify the Frequency of SiP, Installment Date, Start and End Date as shown in image below.

For SIP you need to register for PayEezz. SIP works only on PayEezz option.

You should be able to get units on the date of SIP or date when the lumpsum transaction was placed (provided before 10 AM). For SIP will get the NAV of the date of SIP,as the debit instruction will reach your bank prior to 10 AM. The funds may get debited anytime in the day, but the payee bank will send a confirmation message that they will pay within the cut off. Since for SIP, the funds will get credited on T or T+1 (in worst case), so AMC will give you allotment of units based on NAV of T day.

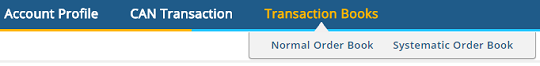

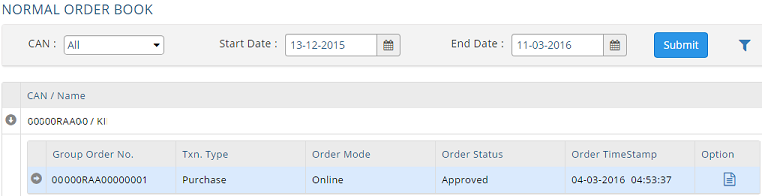

Check Transaction Details in MF Utility

Once your transaction is complete, you can check the status of your transaction.

- For Lump Sump: On Transaction Books click on Normal Order Book

- For SIP: On On Transaction Books click on Systematic Order Book

Normal Order book transaction details are as shown in image below

If you have make multiple Purchase transactions or Multiple redeem transactions, all these will appear under a Single Group. The group number will denote the basket. Within a group, the individual transactions will be displayed

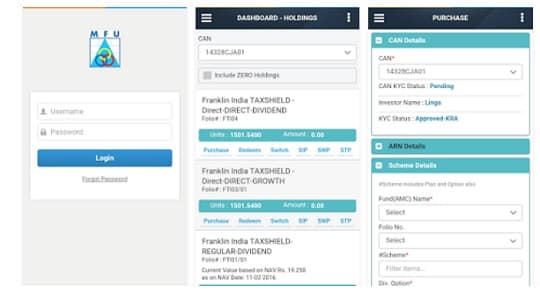

MF Utility App

From 15 June MFU has introduced android app, goMF, available in Google play store at no extra cost. It can be used for Android version 2.1 and up One can use same login ID and password to access account . Snapshot of MF Utility App goMF is shown in image. It offers the following features :

- Initiate a Purchase, Redemption, Switch, Systematic Investments, Systematic Transfers, Systematic Withdrawals.

- View and track all orders submitted through MF Utility.

Contact Details of MF Utility

If you have any further queries, please call 1800 266 1415 (Toll Free) or +91 22 3952 6363 or write to clientservices@mfuindia.com .

Related Articles

- Switching of Mutual Funds

- Investing in Equities: Stocks vs Mutual Funds

- Registrar and Transfer Agent : CAMS, Karvy

- Redeeming Mutual Funds : Check Exit Load,Taxes

- Mutual Fund Manager’s Limitations

If you are confident of investing in Mutual Funds directly then you can try Mutual Fund Utility Platform. If you try MF Utility please do share your experiences. Please let us know what we have missed out so that it can help other readers.

52 responses to “MF Utility: How to buy and Sell Mutual Funds Directly”

[…] Some additional info on MFUtility can be obtained on a good article I found here […]

[…] Some additional info on MFUtility can be obtained on a good article I found here […]

While starting a SIP I’m getting error “Lead time between SIP registration date and start date should be 15 days for existing mandate”

SIP registration date ‘6 Feb 2018′

Start date ’21 Feb 2018’

Still getting the error. Please help.

Choose Date as 22 Feb then it should work.

HI, I am also getting same error, i put SIP start date after 15 days still error is not going.

I believe error may go once 15 days would complete after registration

Hi, Can I redeem “Regular” MF that i had purchased prior to opening a CAN from MF Utility Online as earlier folios are visible?

Yes

On the redeem screen, please fill the details in the following order

Select the AMC

Select the Folio No.

Select the Scheme from where you wish to redeem

Select if you want to redeem all units or amount specific

Tick the Payout Details if you want to change the bank account where the redemption proceeds are to be credited. It will enable the Payout Account drop-down list

In Payout Account drop-down list, you can select the Bank Account of your choice. The bank Accounts which are present or recorded in the Folio are displayed

After I register for CAN and after my folios get migrated can i still see my investments when logging in MYCAMS or KARVY website? Also can i still continue to invest via MYCAMS?

I am in the process of getting CAN registration. I have at present investments in Regular, Direct and in demat form. Will these folios too after CAN registration get automatically mapped in mf utility? Can I carry out transactions ( purchase, redeem and switch ) in these existing folios?

MF Utility (MFU) will not migrate the existing investments of the investors. However, upon creation of a Common Account Number (CAN), MFU will map the existing folios of the investor/s across Mutual Funds, to the CAN, based on the PAN, holding pattern and certain other parameters.

CAN-Folio mapping is a technical exercise which happens without any manual intervention. Upon successful creation of a CAN, MFU Server makes an electronic request to all the RTA servers to find out whether there are any folios which are matching the CAN criteria. Based on the RTAs response, the folios are mapped to the CAN.

Ideally, all the folios matching the CAN criteria should automatically get mapped to the CAN. However, either due to some technical reasons or some data mismatch between the CAN & Folio, the CAN-Folio mapping may fail in certain instances. In such cases, if the investor writes to MFU the MFU team will do the needful

After 3 days from the time of CAN approval, an email is sent to the investor with the list of folios mapped to the CAN with a request to notify the unmapped folios, if any. If the investor writes to MFU with the folio numbers which are not mapped, the MFU team coordinates with the RTA for getting the folios mapped to the CAN.

Thanks.

Thanks a ton for a detailed walkthrough of the process, it is very helpful.

Although I have read the directions on PayEezz on MFU site, still wanted to confirm if there is some complete online process for that, or I have to submit a physical form.

Thanks,

Vishal

You still have to send the physical form for PayEezz

Hi,

I am a regular follower of bemoneyaware blog.

I wanted to understand:

1. How do you track your portfolio? Do you use any free or paid online service?

2. Do you use any transaction aggregating portal or have login accounts in different AMCs?

Please advise, much appreciate your help here

Thanks

I am not that much of a tracker.

I check using valueresearchonline.com, CAMS and MF Utility plaform

Hi,

Thank you.

Have you imported your portfolio details on valueresearchonline and use their tools?

Or you spot check each fund as and when required?

Thanks

Hi,

Thanks for your inputs.

Do you mean you have imported data on the Portfolio feature of VRO or you just spot check their website as and when required?

I have done both. What are you looking for?

Thank you very much! Yours is the first post that actually explains how to go from getting the CAN number to actually accessing the MF Utility portal! I have been searching for half an hour for the Login screen!!

Thanks for kind words.

We do try out things before writing and provide a complete solution.

i want to change my address for communication

Where do you want to change the address for communication?

Is it related to MF utility or specific Mutual Fund?

If specific Mutual Fund then which one?

Hi Team, I have tried applying CAN, KYC, PayEZZ registration form and CAMs office in Visakhapatnam, Andhra Pradesh. We are first time investors and it went smooth. By default if you are doing first time for KYC with CAMS or Karvy it will be IPV (in person verification) It will be good for us. The over all process went smooth.

Thanks for article.

I have queries regarding SIP purchasing through CAN.

1. How can I stop my SIP at random time through mf utility app- “GoMF”?

Thanks a lot. This was very useful.

thanks for the detailed post. it was indeed a useful piece of information.

Mutual fund utility without distributor

or NSE MF II with distributor whats the difference

can I open account with both the portals

As I feel there are significant transaction charges that would be involved in NSE MF II with distributor

If I link my DP with CDSL, would it necessitate that the distributor gets linked and there would be commission paid to him irrespective for wherever I buy it from

Thanks for very informative article. Much help for a direct investor.

Though you have cleared almost everything, I have one question, “Äfter converting my existing folios to CAN/MFU, will my existing SPIs & STPs in those folios be continued? Or I need to recreated then from MFU platform?”

Many thanks once again.

Your existing SIPs will continue. No need to recreate those in MFU.

However, if your existing SIP are in regular plans, you may want to cancel existing SIPs and restart new SIPs in direct plans.

By the way, there is no conversion to CAN/MFU. Your existing folios merely get mapped to your CAN.

Hi! I got CAN and am able to see all of my earlier invested funds. But, at the time of applying for CAN, I didn’t mention my nominee’s date of birth (DOB). As a result, it has taken default DOB. So, now it’s showing wrong DOB for my nominee. I have 3 queries.

1. How to change my Nominee’s DOB details?

2. Is there any problem in future if we leave it without modifying DOB of my Nominee?

3. If anything happens to me, how nominee can get that money? What is the process?

1. Please review the answer to the question: “How can I change Bank Mandate and other details in CAN?” in https://archive.quantumamc.com/FAQ/Transactions/MFU_Common_Account_Number.aspx . You may have to visit the nearest MFU POS. You try updating the “Nominee” section & resubmit the CAN details (through the eCAN facility). If that doesn’t work, consider visiting the nearest MFU POS to submit a non-financial transaction.

2. Why take the risk? Let there be correct data.

3. Please review the answer to the “Question # 2. What are the benefits of registering a nomination?” in http://www.icicipruamc.com/Download/News/Nomination_Benefits.pdf .

AFAIK, nominee DOB is required iff nominee is minor.

However, you can confirm/rectify it by visiting POS at: https://www.mfuindia.com/MFUPOS or post your query at: http://www.mfuonline.com/onlineComplaint?reqComplFlag=Q

When I tried to purchase & went to ‘Scheme Search’ for any AMC name, I see that plan type is always mentioned as ‘Regular’ and ‘Direct Allowed’ is shown as ‘No’, so wondering do they allow direct plans at all? If yes, how to check? Please advise.

There is a checkbox with the title: “Direct” in the first step of the purchase transaction entry page i.e., “ARN/Transaction Entry Details”. Please tick it and move forward to the next step. Then only the “Direct” plans will be available.

mfu is a very good initiative for single source direct investment.. transections are pretty simple.. however it lacks detailed reports like days invested in.. gain.. cagr report..etc.. also how to obtain report for capital gain from IT FILING ?

pl. through light on same as in the absence of same i am discouraged from using it

MFU is a transaction aggregation portal and that’s about it. MFU is not a robo advisory platform (e.g., Oro Wealth, Invezta, so on).

It is also not a portfolio manager. But we can record our transactions (completed ones) into certain portfolio managers, e.g., valueresearchonline one at no cost & get analytics/valuation.

To get individual folio level capital gains, we might be required to create online access accounts with individual MFs (should still be OK, we might be needing such data once in an year for filing). Again, this happens at no cost.

Those that can spend a few bucks for convenience can sign up with the upcoming Robo Advisories under different packages – e.g., Oro Wealth, Invezta, so to speak. Per media reports, there are around 45 such robo advisory firms as of now. This number is only likely to grow in the coming days, and we might get spoilt for choice!!!

Thanks a lot for this insightful article. Its very helpful.

Can you explain how the holding of MF units takes place with CAN? If I don’t choose to hold units in Demat, how will it be held?

The process of buy and sell are difficult but your article solves the problem of how to buy and sell. It is great plan for us to do in appropriate manner. You explained all the information in a perfect way that is easy for us to know all these in the best probable method ever.

Hello, I already have the CAN no with me and online access to mf utility online portal. I had a small query. Since PayEZZ registration will take time, I took a couple of funds after CAN registration by directly approaching the AMCs (ICICI and Franklin). Will such folios after CAN registration too will get mapped automatically to mf utility?? I am not talking about folios already existing at the time of CAN registration but those folios which gets generated after that but not through MF utility. Kindly respond please.

Yes it will. Instead of individually applying, you could have gone for STP thru MF Utility. It would have been easy.

Very informative article. I hope direct plan picks up the pace at the retail investors level.

Very informative article. I hope direct plan picks up the pace at the retail investors level.

Thank you for such informative article

Thank you for such informative article

I have burnt my hands badly in MF …. Your post is surely helpful 🙂

I have burnt my hands badly in MF …. Your post is surely helpful 🙂

Thanks for the detailed post but Is it safe to expose your PAN number in one of the screen shot posted above.

Thanks for the detailed post but Is it safe to expose your PAN number in one of the screen shot posted above.

Thanks a lot Vivek Sir for such an encouraging comment. Appreciate it.

Thanks a lot Vivek Sir for such an encouraging comment. Appreciate it.

Thanks a lot Kirti Mam, for such a knowledgeable article.

Thanks a lot Kirti Mam, for such a knowledgeable article.