If one sells an asset such as bonds, shares, mutual fund units, property etc, one must pay tax on the profit earned from it. Tax is applicable on this gain or profit in the year in which asset was sold. The taxability of capital gains depends on the nature of gain, i.e., whether short-term or long-term. This article talks about What are Debt Mutual Funds from tax perspective, what are the Short Term Capital Gain and Long Term Capital Gains of Debt Mutual Funds, Computation of Long-Term Capital Gains with example, How to show the Long Term Capital Gain in ITR.

Table of Contents

Tax on Debt Mutual Funds

Mutual fund Redemption or selling are subject to tax depending on the category of the funds you own. Debt funds and equity funds are taxed differently.

Difference between Debt Funds and Equity Funds

Equity funds: An equity fund is a type of mutual fund that invests principally in stocks. The equity mutual funds are principally categorized according to company size, the investment style of the holdings in the portfolio and geography. If a fund invests more than 65 per cent of their portfolio in stocks, they are generally considered as equity funds.

Debt funds are type of mutual fund that invests shareholder’s money in fixed income securities such as bonds and treasury bills. A debt fund may invest in short-term or long-term bonds, securitized products, money market instruments or floating rate debt. Debt Funds are those which have less than 65% in equity.

Capital Gains on Debt Mutual Funds

Redemption is as per first in first out (FIFO) method wherein units first bought are assumed to be redeemed first. Hence your costs for the purpose of taxation will be considered as per FIFO method.

Short Term Capital Gains: You sell them within 3 years, capital gains on debt funds will be treated as short term. It will be added to your income and taxed as per your applicable tax slab. Our article Short Term Capital Gains of Debt Mutual Funds,Tax, ITR talks about it in detail

Long-term capital gains: if you sell funds after 3 years, they are taxed at 20 per cent with an indexation benefit on your cost.

If you sell at a higher price then cost price you have a profit which is called Capital Gains. The tax paid on this amount of capital gains is called Capital Gains Tax. Conversely, if you make a loss on sale of assets, you incur a Capital Loss. Basics of Capital Gain

How to Calculate Long Term Capital Gains of Debt Mutual Funds

To calculate Long-term capital Gains on Debt Mutual Funds one needs the following information

- Name of the scheme

- Date of Purchase

- Number of Units Purchases

- NAV on the Purchase Date

- Date of Sale

- Number of Units Sold

- NAV on the Selling Date

- Indexation of the Year of Purchase

- Indexation of the Year of the Sale

One needs to calculate the Indexed cost of Purchase = (Cost Inflation Index of Year of Purchase/Cost Inflation Index of Year of Sale ) * number of units * NAV of purchase price

The Capital Index for the years from 2001 are given below

| Financial Year | CII Number |

| 2022-23 | 331 |

| 2021-22 | 317 |

| 2020-21 | 301 |

| 2019-20 | 289 |

| 2018-19 | 280 |

| 2017-18 | 272 |

| 2016-17 | 264 |

| 2015-16 | 254 |

| 2014-15 | 240 |

| 2013-14 | 220 |

| 2012-13 | 200 |

| 2011-12 | 184 |

| 2010-11 | 167 |

| 2009-10 | 148 |

| 2008-09 | 137 |

| 2007-08 | 129 |

| 2006-07 | 122 |

| 2005-06 | 117 |

| 2004-05 | 113 |

| 2003-04 | 109 |

| 2002-03 | 105 |

| 2001-02 | 100 |

Example of Calculating the Long Term Capital Gains of Debt Mutual Funds

| Name | Number of Units | NAV | Purchase Date | Sale NAV | Number of Units Solf | Date of Sale |

| HDFC FMP 793D FEBRUARY 2014 1 SERIES 29 – REGULAR – GROWTH | 20,000 | 10 | 26-Feb-14 | 13.32 | 20,000 | 3-May-17 |

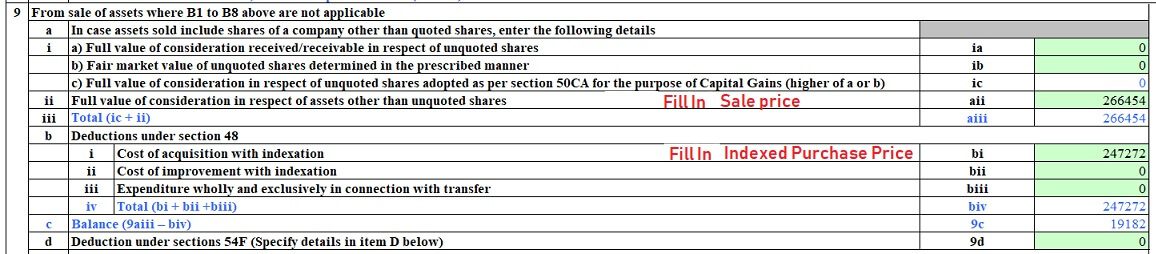

One then needs to Calculate the Indexed Cost of Purchase Price.

The index for FY 2013-14 is 220 and FY 2017-18 is 272

So Indexed Cost of Purchase = Number of Units * (NAV * Indexation of FY 2017-18/Indexation of FY 2013-14)

=20,000 * 10 * (272/220) =247272.73

Sale Price =2,66,454=13.3227 * 20,000

Capital Gain/Loss = 2,66,454-247272.73=19,181.27

You can use our calculator Capital Gain Calculator from FY 2017-18 with CII from 2001-2002 to find the indexed cost

If you sold many Debt Mutual Funds in the year then you have to do for each of the Mutual Fund or sold units were bought at different times you need to calculate the capital gains for each set.

How to Show Long Term Capital Gains of Debt Mutual Funds in ITR

One cannot use ITR1 to show long term/short term capital gains. One has to fill ITR2 or ITR3 or ITR4.

Schedule CG or Capital Gain in ITR2

One needs to fill in Schedule-CG for showing Computation of income under the head Capital gains.

In Schedule-CG Section A is for Short Term Capital Gain while Section B is for Long Term Capital Gain.

Capital gains arising from sale/transfer of different types of capital assets have been segregated. If more than one capital asset within the same type has been transferred, make the combined computation for all such assets within the same type. Under short-term capital gains items 3 and 4 are not applicable for residents. Similarly, under long-term capital gains items 4, 5 and 6 are not applicable for residents.

For computing long-term capital gain, cost of acquisition and cost of improvement may be indexed, Few of the sections are:

- B1. Sale of Real Estate after 3 years

- B2. For Sale of bonds/debentures (other than capital indexed bonds issued by Government)) etc sold after a year: Indexation benefits are not available and they are taxed at a flat rate of 20%.

- B3. For listed securities, like tax-free bonds, NCDs etc sold after a year: Same as 2 above except that they are taxed at flat rate of 10%.

- B4, B5, B6 are skipped, not applicable to Resident Individuals

- B9. For items not covered so far: For example, Debt funds, Gold ETFs sold after one year or physical gold/e-Gold sold after 3 years come under this category.

The B10, From the sale of assets where B1 to B9 above are not applicable, with details of Long-term Capital Gains on Debt Mutual Funds is shown in the image below

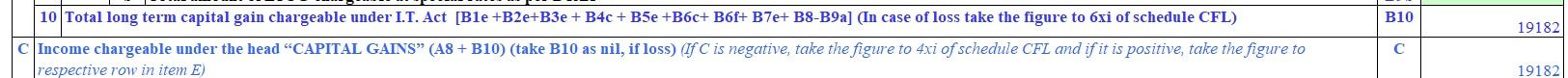

Check that Total Long Term Capital Gain.

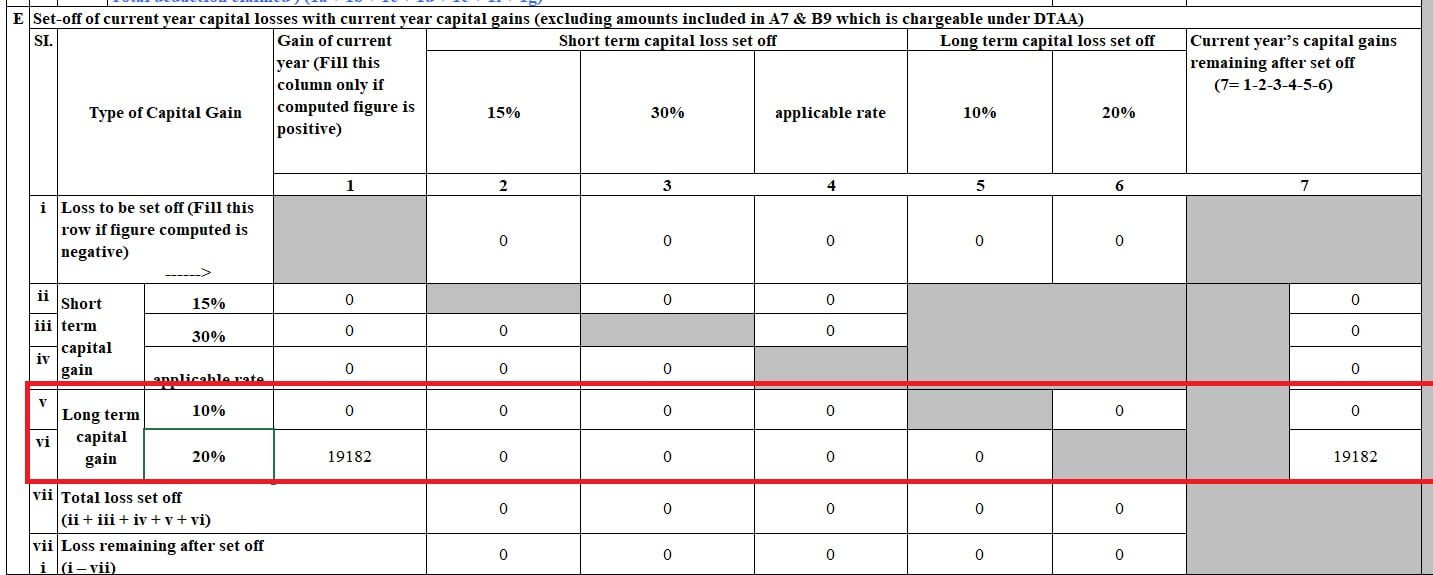

Fill in CG Section E

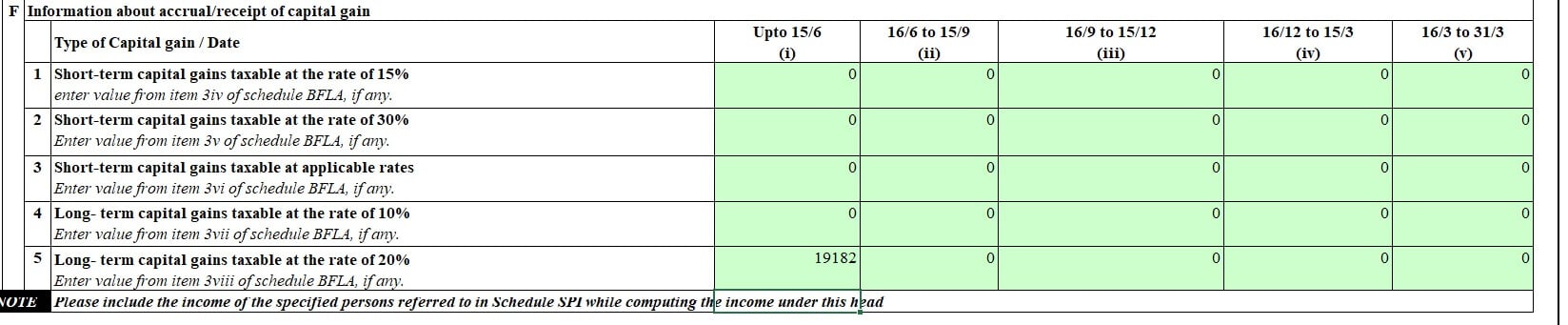

Fill in Long-Term Capital Gain in ITR in CG F5

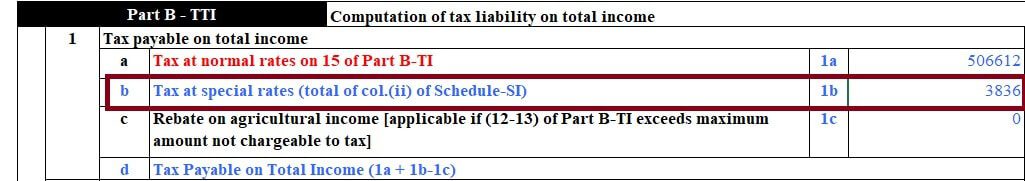

If you Calculate Tax and then check the Tax you would not notice that tax is only 20% (.2 * 19,181.27=3836.4)

Related Articles:

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- DDT on Dividends of equity mutual funds, LTCG,Growth or Dividend option

- RSU of MNC, perquisite, tax , Capital gains, eTrade

- Basics of Capital Gain

- Changes in Mutual funds in 2018

22 responses to “Long term Capital Gains of Debt Mutual Funds: Tax and ITR”

Excellent explanation. Indeed very helpful article. Doubts cleared ,

Thanks a lot.

Can you share the word around?

If one wishes NOT to opt for Indexation, for the LTCG on DEBT funds and avail taxation @ 10%, where would it need to be shown in the IT-2 CG schedule (FY 2020-21 AY 2021-22)? Please advise. Thank you.

B9 is not available in Form No. 3 – where should i show it?

Use B10 From sale of assets where B1 to B9 above are not applicable

Excellent article. Helped me fill the form after much confusion.

I wish there was similar article for ST and LT CG for both Equity and Debt.

Thanks so much. I got tremendous help from your this article as I am filling for the first time debt fund long term CG.

Glad to know it helped.

If you could share the article on Social media, many more might be helped!

thanks a lot for your descriptive blog it really helped me . very well explained till the last entry which hardly others do

B7 is not showing under ltcg in itr2. Im unable to find column for debt fund units with indexation.

Arun Kumar Mukhopadhyay

Kolkata

mukherjee1455@gmail.com

In this year ITR it is in section B9.

We have updated the article.

Thanks for pointing it out.

For the ay 2019-20, I have LTCG on Bonds, and I am filling up ITR2, but I am not getting to enter the cost with indexation. Taxes are 20% with indexation. Kindly help

Which section are you using?

GREAT article with SANAPSHOTS is a GREAT HELP!!

You deserve credits for such good works!

FABULOUS HARD WORK !!! VERY VERY APPRECIABLE.

Please post a similiar article for LTCG and STCG for EQUITY Mfs.

Thanks

Thanks for kind words.

Will do so

Explained step by step in lay man’s terms. Thank you so much. Very few people can elaborate in detail the way you have shown.

Thanks a lot, Jyoti for your kind and encouraging words.

Appreciate it.

Do spread the message around.

Which other articles would you like to see?

If you can let us know we will fill in the ap

helpful informative post thanks to sharing

Easiest and fully detailed article. Thanks a lot for writing such article. This blog helped me a lot to file my IT returns. Other website and blogs are too less informative.

Thanks for taking time out to write such kind words.

We Appreciate it.

Very well explained! Until I read this article, it was not clear to me that I need to use B7 to list LTCG from Debt MFs. The article is also complete in respect of the other places where LTCG needs to be mentioned. Thanks a lot!

Thanks for kind words Tarun and thanks for suggesting the topic.