Joint bank accounts enable the joint account holders to access and manage the account. For example for housewife opting for a joint bank account with her husband would give her the convenience of not having to wait for him to sign cheques to pay bills or withdraw money from his account. But does choosing between ‘either or survivor’ and ‘former or survivor’ options of operating the account matters?What are Rights and Responsibilities of joint holders? If wife also puts money in the account. Who will be taxed for interest on the bank account? If they make investments from the money in the account say a Fixed Deposit then the bank will deduct the tax deducted at source in the name of the primary account holder. Can she claim part of TDS? What is spouse is not working? Will the other half will handle the money in the way they want?What about Nomination? What if the latent premise of ‘mine versus yours’ surfaces? Answers to such questions for saving bank account of Indian Resident are provided in this article. In our article Joint Ownership we had looked into joint ownership of different kind of financial products such as Bank Account, Property, Add-On Credit Cards, Mutual Funds, Demat Account. This is focused on only joint bank accounts.

As the name suggests, joint bank accounts of bank are designed for use by two or more people. Joint bank accounts enable the joint account holders to access and manage the account. When you open a joint bank account, each of the joint account holders will need to sign a contract, detailing the terms and conditions of the account. The Bank will, prior to opening an account, require documentation and information as prescribed by the “Know Your Customer” (KYC) guidelines issued by RBI and or such other norms or procedures adopted by the Bank prior to opening the account. The due diligence process that the Bank would follow, will involve providing documentation verifying your identity, verifying your address, and information on your occupation or business and source of funds. As part of the due diligence process the Bank may also require an introduction from a person acceptable to the Bank if they so deem necessary and will need your recent photographs.

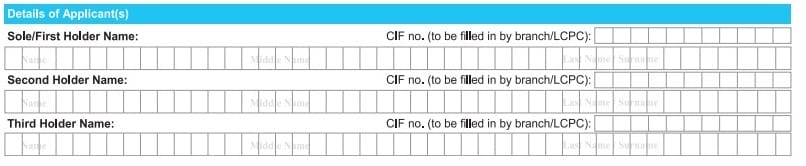

Saving bank account allow adding atmost two names as shown in the account opening form of Resident Individual of State Bank of India. For form you can refer SBI Account opening form (pdf) HDFC Account opening Form(pdf)

Table of Contents

Account Holders

An account holder is a term used for someone designated for performing transactions on an account. This term is generally used in banking, but also applies to demat, mutual fund investments. A first holder/primary account holder is the person who is listed first on the account. This person is the main user of the account and is responsible for the account. The primary account holder can add secondary account holders who also are authorized to perform transactions. Ex: Assuming you have a bank account and then once you get married you would include your spouse as a joint account holder. you will be the primary account holder and your spouse would be the secondary holder.

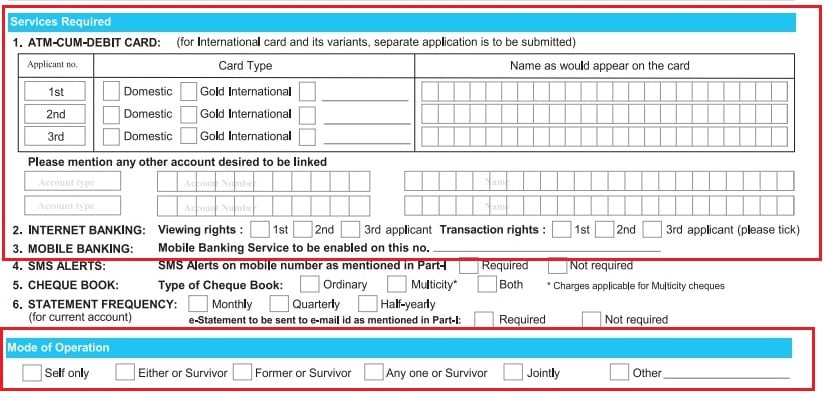

What secondary holder can do depends on the mode of operation of bank account. At the time of opening joint accounts instructions regarding operations and survivorship should be obtained from all the account holders and properly recorded duly authenticated by an officer as shown in image from SBI account opening form below.

Modes of Operation

When you open a bank account in only one name, then mode of operation is Single/Self i.e. only the account holder shall operate the account. In case of death of the account holder, the proceeds shall be paid to the nominee or the legal representative of the deceased person.

There are different types of joint account relationships which decide how the joint holders will operate when they are alive and what happens when they are not. These are:

- JOINT

- In this type of account every transaction will need the signatures of all holders. For example, Mr. A & Mr B open a joint account with mode of operation “Joint”, then both Mr. A & Mr. B would have to sign together on the cheque. If only Mr. A or Mr. B signed the cheque, the bank won’t honour the cheque.

- If any of joint account holder dies, the account can not be further operated and the proceeds shall be payable to the surviving account holder along with the nominee / legal representative of the deceased account holder.

- Under this mode of operation of a Joint account, during the life time of the joint account holders, the cheque would have to be signed by both the Joint account holders (just like a normal Joint mode of operating a bank account).

- However, in a an event whereby any of the joint holder dies, the surviving account holder can continue to operate the account as if he was the single account holder. Alternatively, the proceeds of the account can be credited to the account of the surviving account holder. For example, if Mr. A & Mr. B operate their bank account in the mode of “Joint or Survivor” and Mr. A dies, then Mr. B can individually operate the account or transfer the proceeds to his own other bank account.

- In this type of joint account either of them can operate the account. For example, if the account was opened under Either or Survivor mode, either Mr. A or Mr. B could individually operate the account as if they are the sole owner of the account.

- However, in case of death of any of the account holders, the surviving account holder can either continue to operate the account or take the proceeds into his own bank account.

- In this mode bank account can be operated by any of the account holders without requiring the other account holder(s) to sign. So this is similar to Either or Survivor.

- The difference from Either or Survivor is after any of the account holder dies, the right to operate lies with the surviving account holders but jointly. They have to decide if they would like to continue with the account as Either or Survivor or take the proceeds out of the account. In case where all but one account holder remains alive, the balance is paid to the surviving account holders.

- In this type of joint account while the primary account holder is alive, only the first account holder can operate the account.The other account holders can not operate the account.

- The other holder(s) get the right only on the death of the first after undergoing some basic formalities like submission of proof of death etc.

- This is similar to the former or survivor, but the difference is that, in this type of account, only the second account holder (latter) can operate the account.

- The survivor or the former account holder gets access to the fund only on death of the latter and on producing the proof for the same.

Other kind of joint accounts are Minor’s Account, Joint Account Holders with Special Instructions

- Minor’s Account : According to Indian Majority Act, any one who is less than 18 years of age is classified as a minor.A savings bank account can also be opened in the name of a minor jointly with a guardian. Here, only the guardian is supposed to operate the account on behalf of the minor. The guardian should be parents or in special cases, a legal guardian, as appointed by court. Some banks allow minors above the age of 12 to open and operate accounts independently.

- Joint Account Holders with Special Instructions: These types of bank accounts are more prevalent for corporate bank accounts where by the management wants to enforce internal controls based upon the materiality of the amount. In these accounts, the management specifies the limits upto which a single named account holder can sign a cheque and beyond which dual or even more than two account holders would be required to sign. For very high value transactions, it can also be mentioned that signature would be required from a specific named individual in addition to other named account holders. For example, for cheques upto Rs. 100,000 Mr. X can sign. Between Rs. 100,000 & 10,00,000 Mr. X & Mr. Y both need to sign. Any cheque beyond Rs. 10 lacs, signature of Mr. Z is required.

- Via Letter of Authority / Power of Attorney Holder: In some accounts you can authorise a third party to operate your bank account in your name. In such cases, though the third party can sign the cheques, but can not deposit any cheques of their own into your account. Simply speaking only an authority to sign cheques or perform other functions such as create demand drafts, and other banking functions can be performed by the authority holder. Such accounts are more common in case of Non Resident Bank accounts (NRE / NRO) or current accounts. All the joint account holders needs to agree before creating an authority holder to the respective bank account.

If not mentioned in a application for investments such as bank accounts, demat account, shares, bonds or mutual funds, the account may be marked as ‘joint‘ by default and you must make sure this is indeed the intention.

Quoting from SBI Online Terms of Use

The Internet Banking Services will be available in case of Joint accounts only if the mode of operation is indicated as ‘either or survivor’ or ‘anyone or survivor’ or ‘former or survivor’. For ‘former or survivor’ account, Internet Banking facility may be available only to the ‘former’. For ‘either or survivor’ and ‘anyone or survivor’ accounts, Internet Banking may be provided to each one of the joint account holders on their request. In case of ‘either or survivor’ and ‘anyone or survivor’ accounts if any of the joint account holder(s) gives “stopping of operations” instructions for the use of Internet Banking Service in writing, on any of the Internet Banking Services, it will be discontinued for the User. In case of ‘former and survivor’ account, such instructions will not be issued by other account holder.

When can Joint Holders be added/deleted

Joint holders can be added while opening the bank account.

Joint holders can also be added later. To convert an existing single account into a joint or Either or Survivor(E or S) account, a letter from the existing account holder attesting the specimen signature of the new person(s) has to be obtained and attached to the Account Opening Form. All the changes have to be properly recorded duly authenticated by an authorized officer.

The Bank may at the request of all the joint account holders allow deletion of name/s of joint account holder/s if the circumstances so warrant or allow.

In case the customer having a joint account with the Bank intends to convert the same into a single account, it is desirable to close such account by getting necessary instructions from the existing account holders and then open a new account in the name of the person in whose name the account is to be continued.

Joint ownership -Rights and Responsibilites

Joint Accounts are governed Under Section 45 of Indian Contract Act.

- All operational instructions and information in connection with the relationships formed is to be given by all the joint account holders irrespective of the mode of operation.

- Any mandate / power of attorney for operating a joint account or authorizing another person on behalf of the depositors, is to be given by all account holders or with the consent of all account holders.

- Cheques and other negotiable instruments favouring/payable to one/more of the joint account holders can be credited to the joint account. However, cheques/negotiable instruments payable to the account holders jointly cannot be credited to the individual account of the bolder/s.

- If a cheque drawn by one of the joint account holders is altered, the alteration has to be confirmed by the same signatory and not the others.

- Authority to open and operate the joint account does not confer right to borrow, overdraw or discount bills of exchange by the joint account holder/s, for which there should be a special agreement between all joint account holders and the Bank respectively.

- In the event of any dispute notified to the Bank by any one of the joint account holders, the mandate will stand revoked automatically and in such cases the account should be operated jointly by all until a fresh mandate, duly signed by all joint account holders is furnished.

- Those who enter a joint account should be aware that all partners are liable for all the dealings in an account as a single or joint entity. So joint accounts should be opened only with someone you can trust.

Ref: Corporation bank’s Right and Responsibilites of Joint Account Holders, BankBazar’s How to operate a joint account ,Banyan Financial Advisors Mode of Operating Bank Account

Once you have signed a joint account contract and agreed to share an account with other people, you must bear in mind that you will each have to act responsibly and respectfully when using the account to avoid conflict with the other account holders. The banking institution which operates the account will rarely involve itself in disputes between the account holders, for example when one holder is unhappy that another has made a withdrawal, unless one account holder is evidently abusing the account.

Joint Accounts and Nomination

Joint account holders can avail the nomination facility. At present, the account holders may nominate one person as nominee. On the death of any one of the joint account holders, the surviving account holders can make a fresh nomination if no nomination has been made in respect of the deposit account. The right of the nominee in the case of joint account arises only when all the joint account holders die.In case if both the account holder and nominee is no more, the legal heirs of depositor/s will get the funds.

In the event of death of one of the joint account holder and in the absence of Nomination or repayment clause, the balance amount in the joint account will be paid to the surviving account holders along with the legal heirs of the deceased account holder. Our article BeMoneyAware: Bank Account,Term Deposit,Locker:Paperwork Required For Claim covers how to claim money from Bank Account etc in detail.

Taxation

Questions related to tax and Joint Account

- If there is a joint account between 2 persons who have no relation to each other, in whose income/balance sheet does it have to be taxed/shown? Usually its a practice to show it in the name of the person who is the primary holder of the account or whose name appears first. But is there any chance we can show it in another person’s name? Can we by any chance divide everything into 2 and show it? Is the situation any different if both of the joint account holders are related to each other? What if they’re husband & wife? (Ref : CAClubIndia Joint Bank Account Taxibility Query)

- My father has opened a joint account in bank with my sister who is married. Now every year in april my father deposits Rs 40000 in account. And in march month my sister withdarw rs 30000. Now, plzz guide me

- Is that amount Rs 30000 will be treated as gift from father to sister in that particular year….or it is an asset of sister “Cash in bank” in her books

- Is the amount withdrawn by sister taxable in her hands in that year.

- if for 5 years my father deposits rs 40000 every year in joint bank account. and my sister withdraw Rs 100000 from account in the 6th year. is that amount taxable in her hands or it would be regarded as her asset and exempted in her hands. (Ref:CAClubIndia Tax treatment of joint account money withdrawn)

In terms of attracting a tax liability, opening a joint account with relatives, especially those with no independent income, poses the least risk. Withdrawals up to any amount, by the relative in effect, would be considered as a gift to the relative according to the Income Tax (I-T) Act. Since gift to relatives is tax-free, there would be no income tax on the recipient.

Even for joint holdings between non-relatives, there would be no tax applicable on withdrawals of up to Rs 50,000 under Section 56 of the I-T Act. However, anything above this will be taxed in the hands of the recipient.

However, if the money is withdrawn and invested by the joint account holder who is a spouse and is not working, the clubbing provision would apply. Any income that has been generated by such an investment made by the spouse would have to be included in the income of the primary holder. He/she would pay taxes as applicable under the tax slab he/she falls. Discussed more in our article BemoneyAware Clubbing Income

Income tax officials look at the source of the funds for determining taxes and so, as long as the person can explain his/her part of the income, he/she would have to pay taxes on that part only.

Answer the question about joint account of father-sister question : Any withdrawal from the bank is neither taxable in the hands of father nor in the hands of sister. Any interest income shall be taxable in the hands of that person who is the first holder. CLubbing provisions not applicable since i assume ur sister is major. But withdrawal shall be taxable if deduction u/s 80C is claimed. (Ref:CAClubIndia Tax treatment of joint account money withdrawn)

If both individuals are liable to pay taxes on their individual incomes, they should opt for opening two separate joint accounts and, thereby, maintaining clarity in their sources of funds. So, for instance, the husband could be the primary account holder in one and his wife could be the second holder. It could be vice versa in another account.

Human Angle

Having a joint account makes sense: they are super-efficient, streamline expenses. if married, both partners have a 100% stake in everything each owns. But there is queasy feeling when it comes to pooling resources. And in a relationship, monetary transactions go beyond give and take especially if both are earning a living. Money also reflects the balance of power between partners. People tend to be emotional and reactive about money, not strategic. Let’s admit it, we love our money more than we think. Counsellors say control over finances is perhaps the most important tool to assert individualism. So when a squabbling couple comes for help, no matter the problem, they probe the money arrangement between the two. It rips open the relationship, warts and all.

Relationship comprises two independent individuals. They come from different background and their approach to money is poles apart. She doesn’t spend and I like to live large. Or he’ll spend my money on funky gadgets that he’ll rarely use or are his cigars a household expense like my cheese?You’re a risk-taker, I’m risk-averse. Joint account also raises the question : who puts in how much money? Should contributions be in the ratio of incomes? So do modern-day urban couples prefer to split responsibilities than pool in the money they earn? He pays the EMIs and she looks after household expenses. School fees are on his task-list, children’s clothes on hers. Or do they take middle path: a joint account as the symbol of togetherness (route EMIs, rents and daily expenses through them,) and separate accounts for freedom and the sense of control.

[poll id=”32″]

More on it at KeyBank’s The Six Financial Mistakes Couples Make, Parenting’s Arguing over money? 6 tips to get along, Nest’s Should You Have Joint or Separate Accounts?

Related Articles:

- Joint Ownership

- Right Paper Work For Those You Love: Part 1

- Claiming Deceased’s Mutual Fund Units

Having a joint bank account affords much in terms of convenience. Those who enter a joint account should be aware that all partners are liable for all the dealings in an account as a single or joint entity. So joint accounts should be opened only with someone you can trust. And generally it is safer to keep finances separate as individual accounts clearly establish ownership of funds. If both individuals are liable to pay taxes on their individual incomes, they should opt for opening two separate joint accounts and, thereby, maintaining clarity in their sources of funds. So, for instance, the husband could be the primary account holder in one and his wife could be the second holder. It could be vice versa in another account.

59 responses to “Joint Bank Account”

When both balance sheet is done seperately of husband and wife,

How is the balance taken into consideration as on 31.03.2020

Example Closing balance of bank is Rs. 55,000

In joint savings account of my parents father is primary account holder and has lost his memory completely since nine years .my younger brother is using his net banking for transfer funds recklessly to his own account .do you think it is legally right and what I have to do to stop it

I have Joint Cash Credit a/c in Nutan Nagrik sahkari Bank with other four persons. My sister in law is on third name. Star Health Insurance co. refused to give commission of Ins business put with Star through E C S with Nutan Bank & insisted a new a/c with 1st name of my sister in law. Can Ins Co. insist for the same. Pl note that my sister in law is getting comm. from L I C of India through E C S eith same bank.

Sir my mom is having an account in sbi as a daughter can I become the second holder.if I become the second holder so on the basis of this can I get salary in that account on the basis of second holder

Yes, you can become the second holder.

And ask your salary to be debited into that account.

Go for EITHER OR SURVIVOR

My father and mother are having a joint account. After father underwent paralysis attack, he is unable to operate the account by visiting the bank, hence my mother is doing all the transactions. As my mother was opening some FD with money we received from VRS settlement, she was demanded for her PAN no. Now we have received income tax notice for my mothers PAN for FY 2016-17 and 2017-18. As mother is house wife and only operating the account, what should I mention as her income and what category to choose while submitting the return. As theoretically her income is zero.

Can my sister claim the amount deposited in the joint account of myself and my father?

What do you mean by claim?

After the death of the account holders, the nominee can close the bank account and withdraw the money.

During the lifetime, she can only withdraw money if you give her a cheque or do third party transfer

MY SAVING A/C- HAS BEEN DEBIT FREEZE BY BANK WITHOUT GIVING ME IN WRITING OR IN MAIL ID.THEY HAVE INFORM ON CUSTOMER CARE CONTACT THAT PAN NO OF the SECOND HOLDER IS NOT PROVIDED. HERE I WANT TO MENTION THAT PAN NUMBER OF FIRST HOLDER IS

ALREADY REGISTER WITH BANK.is PAN number of the second a/c holder is mandatory?

I want to add my wife as a joint account holder. She is a house wife and doesn’t have a pan card yet. My PAN is already submitted in the bank. Now the question is, if her PAN is really needed to make her joint account holder or not?

Theoretically no, as the first holder is liable for the bank account.

Most of the banks do no insist on the PAN of the second holder.

Some might. Did you check with your bank? What did they say?

My father had a saving bank a/c since 2011. He made 4 fd’s also. My mother is the nominee in the a/c and the fd’s. In 2016 my sister got her name added as joint a/c holder in the saving bank a/c. Now, my sister has after my dad’s death converted the account in her name by changing all the address and phone numbers. She has got the fd’s name also changed in ger name even though she was not joint holder in them. She had no financial contribution in tne account or the fd’s.

How can my mother contest and get the money in the account and fd’s back?

Thanks

Sad to hear about your Sister taking on all the FD and saving bank account.

For Saving Bank account as she is joint holder she can do so.

But for FD it is not correct.

Is your mother OK with you fighting with your sister for money?

First, you speak to the bank manager and find out what the bank says about FD.

Find out if she submitted death certificates.

If your father has left no will then your mother, you and your sister are rightful owners of the FDs.

Please go through these articles for more detail

Inheritance rights of Women in India: Hindu, Muslim, Christians

Inheritance Rights in India

I have joint AC with my wife. I am primary /first AC holder. I am earning. My wife is housewife.

I listen from November 2016 all entries of all AC are recorded at income tax department.

Now question is that in above AC who is taxable?

First holder of Joint account is responsible for the account, interest earned on the account

PAN number , Aadhaar number of the account is tied to that of first holder.

Dear sir

I have the E or S SB account one of the private bank me and my wife

I request Bank to remove the 1st holder myself and ask my wife as 1st holder and continue with same account number but bank to refuse to do that.

They ask me to close the account and open a fresh account in my wife name.

now i want know whether the bank said is correct or wrong.

Now i want to operate the same SB account without change the account number and remove the 1st holder name .

how to approach the bank help me

but in nationalized banks do the same with out asking any questions

[…] Joint Bank Account – Bemoneyaware.com – Having a joint bank account affords much in terms of convenience. Those who enter a joint account should be aware that all partners are liable for all the dealings in … […]

sir, my name is bro oliver from nigeria, i want to as a question relating married couple who open joint account.

For example, mr and mrs oliver open a joint account with a bank a mandate is for both to sign, and mr oliver has recently got a new job in another state and so he has to travel, the following week one of their child feel sick and has to be hospitalise, they need about #45,000. the wife come to the bank manager to help her out by honouring a cheque that was signed by her only without her husband sign. AS a bank manager, what will you do?

sir my mother and father are in very complex relation, My father left the house and now he had the cheque book so we are afraid that he shall deposit all the money so me & mother wanted to freeze the account I just want to know that shall we write a dispute application to the bank so that they stopped transactions p/s they both have a joint account but my father can withdraw money with his own signature he don’t need my mothers signature on cheque?

What kind of joint account is it?

If your mother can withdraw using just her signature then she can withdraw.

A first holder/primary account holder is the person who is listed first on the account. This person is the main user of the account and is responsible for the account.

The primary account holder can add secondary account holders who also are authorized to perform transactions

What secondary holder can do depends on the mode of operation of bank account. At the time of opening joint accounts instructions regarding operations and survivorship should be obtained from all the account holders and properly recorded duly authenticated by an officer as shown in image from SBI account opening form below

JOINT type of operation:

In this type of account every transaction will need the signatures of all holders. For example, Mr. A & Mr B open a joint account with mode of operation “Joint”, then both Mr. A & Mr. B would have to sign together on the cheque. If only Mr. A or Mr. B signed the cheque, the bank won’t honour the cheque.

But if mode of operation is EITHER OR SURVIVOR

In this type of joint account either of them can operate the account. For example, if the account was opened under Either or Survivor mode, either Mr. A or Mr. B could individually operate the account as if they are the sole owner of the account.

We have a F.D. in a bank where my mother is first holder and I am joint holder. Nominee is my wife. The mode of operation is “Either OR Survivor”.

On death of my mother, I submitted her death certificate to the bank and requested them to delete her name and continue the account in my name till date of maturity.

However the bank is insisting that the F.D. has to be compulsarily closed on death of first holder and I have to open new F.D. in my name. Is this compulsary ? The existing deposit is at 10% interest and if I open a new F.D. I will get 7.5% interest only.

Can you give me reference of any RBI circular to show that the deposit can be continued in my name?

Pradeep

Condolences for your loss. Loss of a parent is so difficult.

Coming to your question you are right RBI allows simple deletion of a deceased person’s name from a particular account.

So bank should continue fixed deposit in your name.

Regulatory guidelines, vide Master Circular dated 3rd November 2008, allow for such deletion/addition of joint holders in an account if the circumstances warrant.

You can read about case similar to yours in MoneyLife Banks flout RBI rules on retaining account numbers after the demise of a joint account-holder

Link to Master Circular of RBI is given here.

You can demand in writing about the bank’s rules.

You can tell bank that you will go to social media(twitter/facebook) of finance minister/RBI raising your query.

We did go through the circular searching for continue keyword but could not find any info wrt to Bank deposits/Saving account

We also searched for Either or Survivor and found 4 places but none are related to continuation of Bank deposits/Saving account.

If you do find us do let us know.

Given here is sample form of ICICI Bank regarding Deceased Claim . Please check option C.

C. Request you to delete the name of deceased person and continue the account in the name all

other joint account holders with same mode of operation

my sister held an account in SBI from 2010. after marriage her husband forced her to joint that account. after 2 years of marriage they are separating now.during this dispute he go to bank & give application to hold that account due to dispute. after some time again he go to branch manager & with his help he withdraw all money(arount 40K deposited by my sister only, her salary) without informing us .what action we can take now against them? please suggest.

Hello

I have a question. My wife is house wife and I do service in private organization. I want to open a joint account with her , with she being primary holder. I want to invest the money we will have in joint account in stock market. I have a demat account in my name. Will the income generated from investing the money from this joint account in stock market through my dmat account attract tax liability on her or it will attract tax liability on me as it will be through my dmat account.

Pls reply

Best Regards

Sir if you invest then you will liable for the tax.

As your wife is not earning hence her income will be clubbed with yours. As you want to invest in stock market returns are tax-free after 1 year. So why would you want to go in a round about way.

First of all thanks for reply.

I want to know if I sell before one year , then I want to show profit earned if any in my wife’s account. So can I do this, by investing the money in the joint account through my demat account which is in my name only? So that I can save my self from taxation point of view.?

We’ve have a joint saving bank account under name style A, B & C with account operating instructions as ‘Anyone or survivor’. Now, bank demand draft has been issued in favour of ‘B AND C’.

Kindly advise, Can such DD deposited in joint SB account ?

Hello! I have a question related to my Uncle & Aunt who are not Indian citizens but have had a Joint Account at the Bank of India for a long time. My Uncle inherited some property which he now wants to sell & remit the proceeds abroad. He also wants to close the Joint Account once the funds have been remitted and after tax, if any, has been paid. Is it possible for him to do this on his own as my Aunt is ill and unable to travel? If my Aunt gives him a POA, will he be able to close the Joint Account without my Aunt being present there? Thank you in advance for your assistance.

Sir it depends on what kind of joint account your uncle and Aunt have. i.e what is mode of operation of Joint account

For example If mode of operation is Joint then every transaction will need the signatures of all holders. For example, Mr. A & Mr B open a joint account with mode of operation “Joint”, then both Mr. A & Mr. B would have to sign together on the cheque. If only Mr. A or Mr. B signed the cheque, the bank won’t honour the cheque.

If it is anyone or Survivor Either (Or) Survivor – Only two individuals can operate the account i.e., primary account holder and secondary account holder. Both can access the account and transfer the funds.

Which bank do they have their joint account in? Is it NRO account or NRI account?

How much money can be deposited in joint saving account?

I have a joint account with my Daughter whose name appears first. I have deposited some amount in the Joint Account from time to time. Please advise if the amount will be shown as Income of my Daughter who is not having any income.

me & my wife are having joint accounts in 2 different banks in which in one account she is the primary holder & in the other account i am the primary holder. we both are self-employed and are filing separate ITRs.

in recent times, due to demonetization issue we have to deposit certain cash lying with us which is a mix of receipts from income sources, gifts & savings over a period of time. so kindly guide me as to how to deposit in light of the govt’s suggested limit of Rs.2.5 lakhs of deposit which will not attract any questions from the IT dept i.e. can we both individually deposit upto Rs.2.5 lakhs each in each of our joint accounts totalling to Rs.5 lakhs?

Dear Sir

My mother had opened a savings account with my son as second holder The amounts she was receiving as pension were accumulated and put into FD with the bank This income including FD interest were always below the taxable limit ( age above 80 less than Rs 5 Lacs income) Hence no tax was being paid on them I had got her a PAN card My mother died in April 16 at age 94 and the account has been now transferred into the name of my son as Principal holder He now being an NRI the account has been made an NRO account with me as mandatee Now all balance in that account is his Q I) Is there a tax implication for him on this amount which has accumulated to Rs 11 lakhs Q 2 My son also has PAN card and he wants to transfer the money to his own account abroad for his maintenance Can it be done without submission of form 15CA CB

Sir in our joint a/c I am a primary a/c holder and my husband is secondary.

He is receiving his pension in this bank a/c.

Will it create problem in future as he is receiving his pension in the a/c and I am the primary a/c holder.

Pls guide me how can I make him primary a/c holder?

Your valuable reply will be really helpful.

Sir,

I am a working woman (unmarried) and have opened a recurring account in ICICI bank with my mother (senior citizen) as primary account holder. Now I know recurring account is not tax free but since I am the secondary account holder, will this be taxable?

Sir,I have joint account in PNB and I m is the first holder and my father is 2nd holder. I don’t have PAN but my father have. Can I deposit money more than Rs 50000 in same account.

Purpose of joint account is that both can deposit and/or draw money.

So you can deposit money more than 50,000 in the account.

Please remember Furnishing PAN will be mandatory from January 1 for cash transactions exceeding Rs 50,000.

Why don’t you get a PAN?

Your father being first holder would have to declare interest from Saving Bank account as his income

Your father can make cash deposit in bank account with more than Rs 50,000 as he has PAN.

You can deposit in 2 chunks.

You can transfer money using cheque/NEFT etc without PAN.

If you have a joint account then typically both can deposit and withdraw money from the account.

But responsibility of the account rests with first holder.

So interest earned on bank account will be in name of first holder.

We would suggest you to make a PAN as you would require it later in life.

Sir m a house wife I have a joint account in jila sehakari bank. Ltd sir my self first account holder and my husband is second holder sir may i know if in future i will want deleted my husband name for this joint account so wht can I do it coz I want continuely this account life time but single account holder can i do it coz my husband is a drinker

Reply

Sir m a house wife I have a joint account in jila sehakari bank. Ltd sir my self first account holder and my husband is second holder sir may i know if in future i will want deleted my husband name for this joint account so wht can I do it coz I want continuely this account life time but single account holder can i do it coz my husband is a drinker

I have a joint account with my wife where in myself is the primary holder with mode of operation as either or survivor. She draws cheque from the account on which I have no objection.But can she use my debit card with my pin and withdraw money from my account and or made purchase of mercendise without my consent

I have joint account with my father in HDFC. I am secondary holder of the account and he is the first holder. If I make any online transaction from my user id to give someone loan, will it be associated with his PAN number or my PAN number?

The transaction is associated with primary holder PAN number.Typically for the joint accounts one Internet Banking user-id will be issued to one of the joint account holders. Bank has the option to issue additional user-id and password for any type of accounts including joint accounts

sir ,i and my daughter have opened a joint account in hdfc bank.My daughter is doing her STUDIES And i have a govt.job.should i be the first account holder or make my daughter the first account holder,which will be right or will it make no difference.

The first holder of the bank account is very important. A first holder/primary account holder is the person who is listed first on the account. This person is the main user of the account and is responsible for the account. That person is liable for interest earned and all dues with respect to her.

Joint bank accounts enable the joint account holders to access and manage the account.

If you are the first holder of the account then you would have to show interest earned from the account in your ITR.

In any case you would have to show all the accounts in ITR.

So what have decided? Who will be first holder?

Can i send a money to second account holder in joint account under his/her name? And can write a cheque under second account holder name in SBI?

Yes You can. Joint Bank accounts simply means that more than one person can have access to that bank account and carry out transactions related to the account, either jointly or on behalf

Can send a money to second account holder in joint account under his/her name? And can write a cheque under second account holder name?

Can an unmarried Indian couple open a joint account in any Indian/Overseas Bank?

If Yes, bank names would be helpful.

Thanks.

I have received a cheque with both my and my wife’s name. Do we need to have a joint account or can i deposit it in my account?

Thanks

It depends on the bank or rather the branch of the bank.Sometimes when you visit the bank and show appropriate ID proof , Bank would ask you to submit a letter saying that you are responsible for the transaction.

If not then

– Open a joint account

– Ask them to reissue a cheque in one name.

Do let us know what you did. It would help other readers

oint holders of a Fixed Deposit had given a request in the branch to change the name of the FDs into their Sons Names. What should the bank dovv

i have FD in SBI from 4.8 year . i have taken it for 8 year . my FD have two nominee , first is mine and other is of my trust. now i want to transfer this FD to my name only. is it possible without breaking the FD.

Yes, it’s important to be money-wise. Your website provides tonnes of useful info.

Thanks a lot Jayadev. Your blog too is interesting

My fiance had open a joint account with someone my neighbor so now that money is needed what can I do to help my neighbor to get that money because they refuse to give him the money

You would have to talk to them and try to get it in a friendly way.

Be careful with whom you open joint account