How do you check that your Employer is depositing your EPF contribution? What can an employee do if his employer is not depositing EPF money to EPFO or trust. Many companies deduct contribution towards PF from their employees’ salaries but do not deposit this with their trust or with EPFO. Employees think that company is deducting EPF and he can get it on resigning or retirement. But when they find out that there is no retirement corpus they thought they were accumulating, hell breaks loose when they. Employee don’t know their account balance, they do not know how to deal with a defaulting employer or how to fight for their right?

Table of Contents

How to check that Your Employer is depositing your EPF contribution ?

If you want to be sure that your EPF contribution has been deposited to EPFO (Employee Provident Fund Office) by your employer, here are some of the ways to check it online

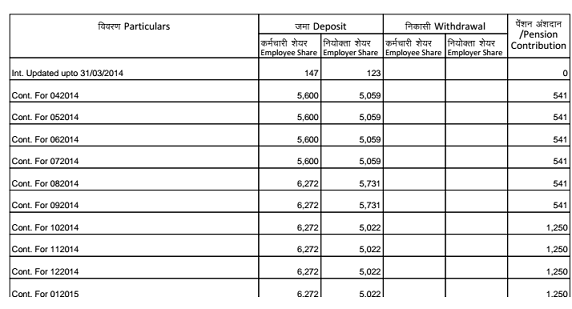

- E passbook – It contains all the transactions of your EPF account. So any amount deposited by employer to EPFO will get recorded here. It has complete information for your each month’s contribution. It gets updated in batches and in most of the cases it is outdated . Also if you are recent joinee, there won’t be any record available in E passbook.

- SMS to those who have registered UAN: Once you have register the universal account number, every month when you and your employer contribute to your EPF account, you will receive an SMS alert from the EPFO. This will be similar to the SMS alerts you receive every time your bank account is credited or debited. You can even check your total balance by downloading the EPF passbook. However, this facility is not available to employees of exempted establishments at present.

SMS says “Dear member (UAN <10 digit UAN number>), Rs xxxxx for 02/2016 has been credited in your EPF account. For details download m-epf mobile app from Google Play Store“

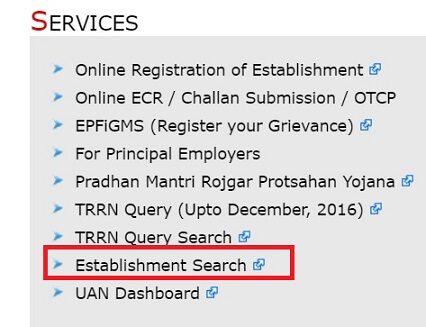

- EPFO Website – Provident Fund website has a way to find out the monthly PF deposit made by a company. One can easily use this information to verify if one’s EPF money is being deposited regularly to EPFO. Please note that you can’t find the exact money deposited on your behalf here as the money shown is the total for all employees in the company. This data is available only for companies who are submitting the EPF money using the E-Challan and Receipt (ECR) facility. To check this, please go to Establishment Information Search. This you can find at EPF Website www.epfindia.gov.in ->Our Services->Employers->Establishment Search

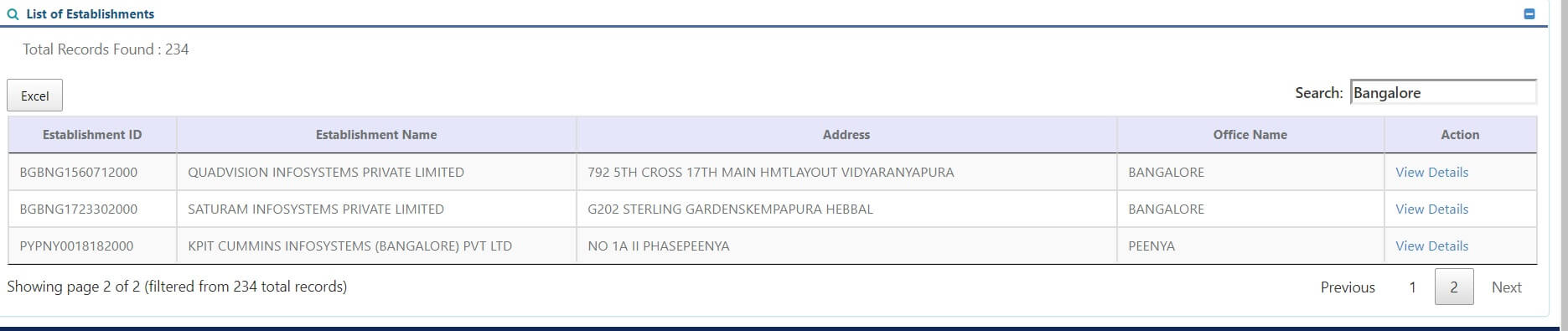

- Details can be searched through part of establishment name and/or establishment code number(only 7 digits). For e.g., when I searched on “Infosys” as shown below, I got 24 records of different establishments.

- Once you get the establishment you are looking for, click on the View Details

- Scroll down and click on the View Payment Details.

- icon or the Key icon towards the end of the row.

- When I clicked on the “Payment” icon of the second row, I got all the records of “INFOSYS LIMITED” related to EPF deposits done electronically. It shows details like “Date of Credit” of EPF money to EPFO, the “No. of Employees” for whom the money has been deposited, and the total “Amount” credited for all those employees. Below are the example screenshots

Search Results

EPF Records related to Company, click on image to enlarge

EPF Contribution if Employer has financial problems

ABC Ltd. has not deposited provident fund contributions in lacs, say 20 lakhs to the authorities, but accounted in the books? When can it be caught.

Company Auditor who audits Company’s financial book has to make sure that company is depositing the provident fund contributions.The auditor’s report under CARO, 2003 has to specifically state whether the company is regular in depositing provident fund dues with the appropriate authority and, if not, the extent of arrears of provident fund shall be indicated by the auditor. The auditor may also ascertain the period since which dues have not been paid. In this case, the failure of ABC Ltd. to deposit provident fund of Rs. 20 lacs will be reported by the auditor in CARO, 2003 issued u/s 227(4A) of the Companies Act, 1956. In indicating the arrears, the period to which the arrears relate should preferably be also given.

During the course of audit of ABC Ltd. it is noticed that out of Rs12 lakhs of provident fund contribution accounted in the books, only Rs 2 lakhs has been remitted to the authorities during the year. On enquiry the Chief Accountant informed that due to financial problems they have not remitted but will remit the same as and when the position improves?

The Companies Audit Report’s Order, 2003 required the auditor to state whether the undisputed dues of provident fund have been regularly deposited with the appropriate authorities and, if not, the extent of the arrears of outstanding statutory dues as at the last day of the financial year concerned for a period of more than six months from the date they became payable, shall be indicated by the auditor. In this case there is a default in not depositing the provident fund contribution to the extent of Rs 10 lakhs which is a lapse on the part of the company. The reason put forward by the Chief Accountant that the amount has not been deposited due to financial problems faced by the Company is no excuse for not remitting the provident fund. In fact, the company has not at all been regular in depositing the amount. Thus, the auditor shall include this in his report indicating the extent of arrears.

What happens to the payment of contribution to provident fund an an employee when company has no money and has become insolvent?

According to Section 11 of the Employees’ Provident Fund and Miscellaneous Provisions Act 1952, if the employer is adjudged as insolvent or if the employer is a company and an order winding thereof has been made, the amount due from the employer whether in respect of the employee’s contribution or employer’s contribution must be included among the debts which are to be paid in priority to all other debts in the distribution of the property of the insolvent or the assets of the company. In other words, this payment will be a preferential payment provided the liability thereof has accrued before this order of adjudication or winding up is made

EPF Withdrawal if company has Financial Problems

Often Employers don’t accept the PF withdrawal form saying that they cannot pay PF due to financial problems. The financial problems of the company have nothing to do with PF. The employer has to deposit PF money to EPFO after deduction from salary.

When the employer receives the PF withdrawal form, the employer should submit the PF forms to concerned PF office with in 5 days. It should supply the acknowledgement issued by PF office to employee. Companies should use effective mode of communication post,courier,email,SMS.

Please keep proof of submission of PF forms to company and an acknowledgement by company even if by email mentioning that your PF forms have been received. So that company may not claim forms are not received or are not traceable.

If the Employer has not Deposited the EPF contribution to EPFO or trust then what can an Employee Do

Many companies deduct contribution towards PF from their employees’ salaries but do not deposit this with their trust or with EPFO. Employees think that company is deducting EPF and he can get it on resigning or retirement. But when they find out that there is no retirement corpus they thought they were accumulating, hell breaks loose when they. Employee don’t know their account balance, they do not know how to deal with a defaulting employer. or how to fight for what they thought was theirs. What can an employee do if his employer is not depositing EPF money to EPFO or trust.

My previous employer has yet not deposited the sum that was deducted towards my provident fund. In fact, they haven’t opened a PF account. It’s been six months since I left the firm but I haven’t got my money.How can I claim it?

It is an offence to deduct provident fund and not deposit it. The financial problems of the company have nothing to do with PF. If company has been depositing employer’s and employee’s contribution regularly with PF office the funds are in the control of PF office and not employer. The PF amount, if not deposited with the PF department, then only your previous employer can be held liable to pay.

To know if your employer is depositing your EPF contribution you can ask for a copy of Form 12, which gives the details of money deducted from an employee’s salary. Employers need to send this form to EPFO towards the end of each month. But, employers may decline to furnish Form 12 to employees. You could also file a Right to Information application to the regional EPFO. You need to mention your EPF account number and your employer code.

If you still find your employer has not deposited the deducted PF with the trust or EPF then you can do following

- You can file a criminal case against your employer. You file a written complaint against your employer in the local police station.

- You can also take this up with the provident fund department by sending an email to cvo@epfindia.gov.in. To furnish a written complaint in your regional PF office, you can get the relevant contact details at http:www.epfindia.com.

- You can complain to the chief vigilance officer appointed by the labour ministry. You can email at cvo@epfindia.gov.in .

- You can approach your regional PF inspector for action against your employer.

Please ensure that for all complaints you produce your salary slips showing PF deduction and your employer’s name, address and, if possible, PF registration number.

EPFO says if a company is found to be non-compliant with its PF deposits, it will not only have to pay the dues but also pay an interest penalty on the same, depending on the number of days of delayed payment. If the delay if for less than two months, then the interest payable will be five per cent yearly above the amount payable for the number of days of delay in making payment. Similarly:

- If two months and above but less than four months = 10 per cent a year

- If four months and above but less than six months = 15 per cent a year

- If six months and above = 25 per cent a year

Please note that these redressal processes take their own time and don’t guarantee recovery all the time.

KingFisher & EPF Problems

Vijay Mallya, caught up in controversy for leaving India in the middle of a massive loan default is facing probe from several agencies including Enforcement Directorate. Under fire over dues totalling over Rs 9,000 crore of long-grounded Kingfisher in unpaid loans and interest, Mallya left the country on March 2 2016.

Kingfisher Airlines employees sought the intervention of Prime Minister Narendra Modi for non-payment of salary and provident fund dues by Vijay Mallya. The Employees’ Provident Fund Organisation (EPFO) said the company has no pending PF and that it has not received a single complaint from any employee of the now-defunct airline.

According to Labour Ministry, Kingfisher Airlines Ltd is registered as employer with EPFO since January 1, 2005. The last inspection in 2012 revealed the company has paid EPF and other dues on salary payable up to December 2012. Kingfisher Airlines contributed to the PF in March 2012 for 6,185 employees. The PF compliance to the number of employees have gradually reduced to 3,339 in the month of December 2012,.The employment strength of Kingfisher Airlines reduced after December 2012 due to closure of its operations and remittances were made for two skeletal employees up to September 2015 and thereafter minimum administrative charges were paid. The payment of EPF contribution stopped after September 2015 as it was found that Form 10, which states the date and reason for exit of employees from employment or EPFO membership, was not submitted by the company.

The ministry said a total of 5,675 PF claims were settled from 2012-13 to the employees of Kingfisher airlines. Also, it added that Provident Fund has been in respect of 12 deceased employees.

Retirement fund body EPFO has constituted a squad of enforcement officers to investigate issues related to payment of PF dues by the beleaguered Kingfisher Airlines. Notices have been issued to the company for penal damages (Rs 3,34,016), interest dues (Rs 3,55,678) for bleated remittances for certain months and payment of short remittances of Rs 71,910, involving a total liability of Rs 7,61,604,

Related Posts:

- Understanding Public Provident Fund, PPF

- UAN or Universal Account Number and Registration of UAN

- Tax on EPF withdrawal

- Losing a Job : Why the Layoffs, Managing finances

- Changing Jobs:Take Care Of Bank Account,Tax Liability

Are you aware if your employer has been depositing your EPF contribution? How do you know that your Employer is depositing your EPF contribution? Have you been in a situation where your Employer did not deposit EPF? Why did it happen? What did you do?

48 responses to “Is your employer depositing PF money to EPFO or trust, If not then what to do”

hi,

My employer hast deposited the PF deducted.

Can i lodged a police complaint against him in the local police station.

My work was in bombay, however the companies registered office is in Pune. Will i have to register the compliant in Pune or Bombay

Hi,

My claim has been rejected three times and the reason appears on epf website is because i am not eleigible for eps membership and hence employer should make remittance in employer and employee share and this can be done only after the completion of annual accounts and thereafter i can apply for claim.

Its been more then four montha since i left the company and still not getting my money.

Kindly suggest what to do.. The response above is excerpts from epf grievance portal.

My employer has deposited the whole amount in pf for some part of my tenure and then the employer has divided the amount between pf and pension.

So, the pension amount is zero for a certain part of my tenure.

Due to this, my pf and pension has been rejected by EPFO.

Kindly suggest on how to proceed further.

Why did your employer do pension amount as 0?

What is Rejection reason?

Raise a complaint in EPF to get details. Process of raising the complaint is explained in the article How to register EPF complaint at EPF Grievance website online

I see my passbook entries ending with suffix ‘[Backlog]’, what does it mean?

Can you send the picture of your passbook picture to bemoneyaware@gmail.com

Hi I am working in this company for over 1 and a half years.

Every month PF is being deducted from my salary

But on checking my Passbook today

I got to know that no money has been credited to my PF account since the beginning

A large sum has to be paid by the company

Please help me regarding this

Please check with your colleagues are they in the same situation.

Try to talk to the employer.

Else you have to raise a complaint against the owner for not depositing PF funds

I worked on 3rd party payroll on consultant they have deducted my PF amount, but not submitted in PF account.

When i am going to ask them I need my PF no and UAN no then they told that we have been working on it since 01st June – 19.

This issued will resolve if i will send mail to “cvo@epfindia.gov.in”.

Hello Parshuraam,

I’m also facing this same issue.. Did u got any solution. Please tell me how to process further. Beacause u posted this on July. Now it’s almost 4 months over. So u may got some solution. Please help me.

last two years working in Electrical engineer .VIJAY ENGINEERING, Chennai company.he has not deposited PF money,so how to do complain this matter.

My company deduct 12% from my salary continuously from 1st April 2016 to till date now but not deposited to my epf account. Nither my contribution nor his contribution.what I will do.I am still working in the company.pls. reply.

Our company deducted from my salary P.F. money till date, but not deposited deducted P.F. contribution from June 2018. Now I was retaired, Hence, I am unable to withdraw the P.F. Money without deposit of contribution. Therefore, I request you to kindly consider my request, and do my favour.

Reply

Do you have UAN? If yes, Is Date of Exit marked?

Did you check your passbook does it have details of contribution?

Did you try withdrawing? What did it say?

How long were you working in the organization?

How old are you?

Thank you! Great content!

The site you mentioned ‘Establishment Information Search’ isn’t opening.

I see my passbook entries ending with suffix ‘[Backlog]’, what does it mean?

Isn’t PF calculated on monthly basis i.e (a/c balance * interest % / 12) ?

Also I don’t receive sms from epfo.

you can find at EPF Website http://www.epfindia.gov.in ->Our Services->Employers->Establishment Search

Article has been updated on how to proceed.

Can you send the image of your passbook entries with your establishment details to bemoneyaware@gmail.com?

PF is calculated on Monthly basis but deposited at the end of the year.

Interest for Apr 2017-Mar 2018 has still not been deposited.

You will receive SMS from EPFO if your mobile number is registered with UAN.

Have you linked your mobile number to UAN?

Sir, I am Anand Poojary employe Nakshtra Brands Ltd (formerly Gitanjali Brands ltd. My. P.F No.MH/210831/242. UAN. NO. 100082416783. Our company deducted from my salary P.F. money till date, but not deposited deducted P.F. contribution from July,2017. Now I was retaired, Hence, I am unable to withdraw the P.F. Money without deposit of contribution. Therefore, I request you to kindly consider my request, and do my favour.

Sir we are just a blogger can’t help you our much.

You can raise EPF grievance as explained in our article How to register EPF complaint at EPF Grievance website online

give me your contact number

i have same issue.. could you help us ?

Sir,

I worked for AMW MOTORS LTD for five years. They have deposited employee’s share into the EPFO but have not deposited their (employers) share for two years. I applied for full withdrawal of the amount: will it be paid or will they reject my application because employers share has not been deposited into the EPFO?

Regards

Mushtaq Dar

Srinagar

Hi ,

My name is Hemant Ramesh Kunder. I was an employee in Ontime Worker

(Andheri, Mumbai) from Sept 2014 till 31 Aug 2015.

I see my pf balance as 20k in the PF passbook but when I

try to it or transfer it, it shows an error stating that the

“present employer has not made the payment in your account”. What is the exact error?Please help

Thank You!

Regards

Hemant R. Kunder

Sir Please login to your UAN account and check View->Service History.

Is the Date of Exit (DOE) mentioned there for old employee.

If you are comfortable send your UAN number and picture of the View->service history to our email id bemoneyaware@gmail.com.

Thanks

Dear friends how to find out missing credits from our accounts and if somuch of amount differance between employee and employees how can an employee recovered such amounts from employeer. Ex. April and may 2012 monthly subcription was paid. After that 3 months not paid. Again he paid September 2012.

Before Sep 2014 one had such problem.

Now with UAN passbook it is possible to check if the employer is submitting the EPF on time.

You can raise the issue with your regional office.

SIR, IJOIN 01.09.1986 MY SALARY FIVE YEARS LESS THAN 2500 AND AFTER MORE THAN 2500 IN THE AGE OF 55 I WANT VRS FROM SERVICE I WANT TO TAKE MY EARLY PENSION PL. CALCULATE MY PENSION KINDLY TELL ME MY DATE OF BIRTH IS 17.01.1963

Sir I was worked in company and I did not checked my pf balance and I not got messages also and now I changed company I joined new one and here I provided same pf no. So how should I know the status of deposit

Do you have UAN now?

Checkout our article to find How to check Member Ids or PF accounts linked to UAN

Hi Sir,

I have two PF accounts under a UAN, I have to withdraw PF from both the accounts, as per the guidelines we need to merge all accounts in the present one then only request to withdraw the PF can be consider, after raising a request got a message “Present employer has not made payment in your PF account.”

Please help me what does it mean?

Regards,

Amol Gupta

If you have two PFs under one UAN this means you worked in 2 organizations.

After quitting, the old employer will not be depositing anything into your old PF account. So is this message from old employer PF

You can have multiple PF account under 1 UAN. If you transfer then you need to withdraw from the latest PF account (after quitting if you are unemployed for 2 months) or take loan/advance form your PF.

Have you transferred from old PF account to this UAN?

Please check the passbook of both the accounts, In your latest PF account you should see that transfer from one PF account to another.

Can you send the two passbooks at our email id bemoneyaware@gmail.com

Till end of August 2017, I was working with an organisation which contributes to EPF. It operates it’s EPF under the provisions of the EPF Act 1925 as an Exempt Trust.

While leaving the organisation, I had a sizeable amount in my PF account. However, as per the rules and regulations framed by the organisation regarding the Employees Provident Fund operated by it, the following has been intimated to me:

1. I can transfer the amount to the new organisation where, and when, I join.

2. I can withdraw the total amount, only after six months, in case I do not join any new organisation.

3. I would not be paid any interest on the total amount for the period between the last date of my service in that organisation, till the date I transfer it/withdraw it (as the case may be).

I would like to know as to what has been intimated to me is in order, and especially the part of not being paid any interest on my money beyond the last date of my service with them. I feel it goes against the very basic logic of not being paid any interest up to six months on my savings.

The PF Act requires you to have a cooling period of two months after leaving your job.

Why is the company insisting for 6 months?

The inoperative account also earns interest is confirmed for EPFO but you have to check with your trust.

Press release for inoperative accounts(it does not mention trust)

Article on Times of India Even idle EPF accounts will earn interest which says

“The amended provisions will also mean an increased cost for employers running private EPF trusts. Going forward, such trusts will need to provide interest to their earlier designated inoperative accounts”.

Dear Sir,

My name is Navnath Nivrutti Salunke,My pf no is MH/VSH/5385/1380.My complaint is I am working in Pratibha Ind Ltd company from 03 Dec 2007 to June -16,sTILL THE COMPANY NOT PAID My pf.They given manual no to me.My company name is Pratibha Industries limited.Please help to get my pf.

Thanks & Regard,

Navnath Salunke

very easy method

Dear Sir,

My name is Deepak M.Patil,My pf no is MH/BAN/20877/78368.My complaint is I am working in topsgrup company from 14 july 2014 to april -17,sTILL THE COMPANY NOT PAID My pf.They given manual no to me.My company name is topsgrup india private limited.Please help to get my pf.

Thanks & Regard,

Deepak Patil

Dear Sir,

You are great blog writer in INDIA.

Thanks for encouraging words.

Sir, my previous employer has given an incomplete PF number. Please, guide me how I can get the complete PF number. I have already persued the employer on several occassion, but they did not pay any heed to my request.

DEAR SIR IAM WORKING IN GINZER INFRATRUCTURE PVT LTD IN R.T.NAGARA,BANGALORE,FROM 2015 TO PRESENT STILL AM NOT KNOWING MY EPF DETAILS BUT MONTHLY THEY DEDUCT OF ABOUT 900,THATS WHY THEY ARE NOT GIVEN EVEN 1 MONTH SALARY SLIP ALSO,AND ONE TIME THE EPF INSPECTOR ALSO CAME AND ASKED REGARDING THIS BUT OWNER HAS GIVEN SOME AMOUNT OF MONEY TO THE POLICE AND HE WENT OFF THATS IT.WHAT IS THE SOLUTION FOR THIS PROBLEM WHO IS GOING TO TAKE CARE OF THIS, EMPLOYER INSPECTOR ALSO LIKE THAT ONLY.WHOM TO ASK

i am working ISS SDB SECURITY SERVICES PVT LTD. i get my pf no in my pay slip. but i want to know how to i get UAN no. so i contact my office peringudi, chennei. and office tell me that your pf amount diposit in a trust. so you not check your pf status in online. so plz tell me how i check my pf status. i know that the govt. rules all pf amount is diposit in the govt office. so give me solution plz……….

Hi,Iam Narendra singh, presently working in iss sdb security services p ltd.i have been working in this company since 2014.Our provident fund is not depositing in government EPFO and instead of that the company deposit our provident fund in a trust,the all I need to know is how can I get my status of deposited provident fund online.plz help me..

HI..I am Abinash Biswal,previously i was working in Innovative Reatal Concept Pvt.Ltd known as BBIGBASKET.I have already applied my PF from for pf witdrawl but that company HR not deposited my form because they are not deposited the pf amount in EPFO fud.How can i get my PF amount?

plz suggest me is there any case file against the company possible?

Dear Sir,

My name is Deepak M.Patil,My pf no is MH/BAN/20877/78368.My complaint is I am working in topsgrup company from 14 july 2014 to april -17,sTILL THE COMPANY NOT PAID My pf.They given manual no to me.My company name is topsgrup india private limited.Please help to get my pf.

Thanks & Regard,

Deepak Patil

Sir I have worked one engineering in Madurai- tamilnadu, they give very low salary,but I ask the grievance they told me me, we pay the PF for your account on very reasonable amount,but they are not giving salary regularly,now I am reliving but ,they are not give last five month salary, and they are cheated me,then they do not keeping pf,I know they are frad institution , now what can I do help me

Before reading this article I haven’t thing about “how to check whether my employer depositing PF money?” Thank you very much for your valuable information !

R/sir, we are principal employers one contractor worked with us in year 2011 to 2013 he has complete his and given terminal benefits to his workers. After 4 years some workers approaching to us that the said contractor has not deposited their EPF contribution to the concerned department. Kindly advised me about the matter

Before reading this article I haven’t thing about “how to check whether my employer depositing PF money?” Thank you very much for your valuable information !

R/sir, we are principal employers one contractor worked with us in year 2011 to 2013 he has complete his and given terminal benefits to his workers. After 4 years some workers approaching to us that the said contractor has not deposited their EPF contribution to the concerned department. Kindly advised me about the matter