16 companies brought IPOs in 2020 and around 25,000 crores were raised from the IPOs. Most of these IPOs were oversubscribed, Mrs. Bectors was the highest subscribed IPO, 198 times, and gave good listing gains. Many companies are coming with IPOs in 2021. With LIC IPO being the most awaited one. Which IPOs are open in 2021, Performance of IPO in 2021, How to Increase IPO allotment chances, Things to consider before investing in IPO, Lessons from Recent IPO.

Table of Contents

Performance of IPO in 2021

| Issuer Company | Issue Open | Issue Close | Grey Market

Premium |

Issue Size (Crore Rs.) |

Issue Price (Rs.) |

Listing Day Gain/Loss |

|---|---|---|---|---|---|---|

|

Indian Railway Finance Corporation Limited IPO

|

Jan 18 | Jan 20 | 4,633.38 | 26.00 | -4.42% | |

|

Indigo Paints Limited IPO

|

Jan 20 | Jan 22 | 1,176.00 | 1,490.00 | 109.31% | |

|

Home First Finance Company India Ltd. IPO

|

Jan 21 | Jan 25 | 1,153.72 | 518.00 | 1.81% | |

|

Stove Kraft Limited IPO

|

Jan 25 | Jan 28 | 412.63 | 385.00 | 15.83% | |

|

Nureca Limited IPO

|

Feb 15 | Feb 17 | 150-160 | 100.00 | ||

|

RailTel Corporation of India Limited IPO

|

Feb 16 | Feb 18 | ₹25-30 | 819.24 | ||

|

Heranba Industries Limited

|

Feb 23 | Feb 25 | ₹626 to ₹627 Per Share |

How to Increase IPO allotment chances?

Lessons from Recent IPO

Burger King IPO date was open from 02 December to 04 December. The price band was fixed at Rs.59-60

Burger King IPO was subscribed 156.65x times, QIB 86.64x, HNI 354.11x and RII 68.15x times overall.

Burger King IPO Listed at ₹112.50 on NSE and at ₹115.35 on BSE. The IPO listed at a 92% premium against its IPO Price.

on 17 Dec 2020 Burger King hit a high of Rs 213.80 and fell to 174.14

On 28 Jan 2021 Burger King fell to 128.44

The question is, will the trend of robust listing gains continue?

Many enter the stock after listing and wonder if the stock has turned too expensive.

Before Investing in IPO

- Are you planning to invest in the IPO to make a quick profit on a listing day or do you want to hold the shares for a longer period?

- If you are in for listing gain, don’t get greedy. At least book partial profits.

- If you are buying for the long term you should know about the company’s background, its financial performance, and future prospect.

- And also

- Is IPO is made through an offer for sale or a fresh issue

- Who is doing the selling?

- What are they going to use the money for? Will the money be used for expansion of the company or old investors are selling.

Difference between IPO, FPO, and OFS

Mrs Bectors IPO was in the price band Rs 286-288 and comprised an offer for sale (OFS) of Rs 500 crore and a fresh issue of Rs 40.5 crore

In an IPO, an unlisted company issues fresh shares and goes public. IPO is a mechanism for an unlisted company to raise funds from the primary market and also list the stock in the stock exchange.

In a follow-on public offer (FPO), an already listed company issues fresh shares to new investors or existing shareholders. Companies take the FPO route after they have been through the IPO process.

In OFS(Offer for Sale) is when promoter reduces stake in a listed company. No new shares are created. An OFS only results in a transfer of ownership from one shareholder to another and does not increase the share capital of the company. This facility is available only to the top 200 companies in the share market. The ranking is based on market capitalisation.

In an OFS, the company sets a floor price and a buyer has to bid at or more than the bid price. There is no minimum limit to participate in an OFS. A buyer can bid for even a single share in the OFS process. Once the bids are placed, shares are allocated to the bidders. The only requriement for a company to bring out OFS is for the compant to inform the stock exchanges up to 2 days in advance.

Some companies combine their IPO with OFS to give partial exit to promoters and to private equity (PE) investors. The issue of Narayana Hrudayalaya launched is an of an IPO and an OFS combined.

In IPOs and FPOs, the process to raise funds is lengthy as it involves issuing a prospectus and then a wait for receiving applications and allotting shares to investors. An OFS can be completed in one trading session.

What is Grey Market Premium

The Grey market premium or GMP indicates at what price the IPO might list. The grey market is unofficial and investors track at the grey market price of an IPO to get the fixed gain of the stock. The grey market is tracked before the IPO listing and during the days from IPO start date to the allotment date.

Let us see an example. If the company comes up with an IPO of ₹100 and the grey market premium is around ₹20 then one can expect that the IPO might list around ₹120 on its listing day.

But there is no reliability.

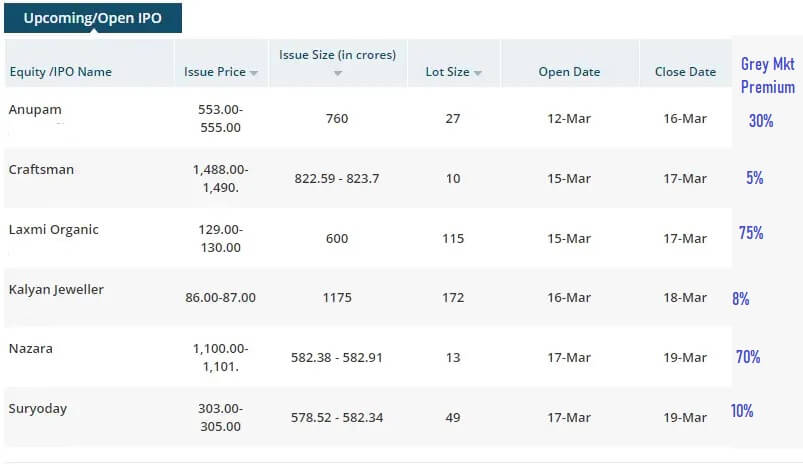

Upcoming IPO in 2021

| IPO | Tentative Issue Size (in Rs Crores)* | Tentative Date* |

| LIC | 70,000 | 2021-22 |

| Nykaa | — | 2021-22 |

| Kalyan Jewellers | 1,750 | January to March, 2021 |

| Bajaj Energy | 5,450 | 2021 |

| Studds Accessories | 450 | February 2021 |

| Suryoday Small Finance Bank | 400 | 2021 |

| Laxmi Organic Industries | 800 | — |

| Craftsman Automation | 150 + | — |

| Barbecue Nation | 1,000-1,200 | 2021 |

| Apeejay Surrendra Park Hotels | 1,000 | 2021 |

| Shyam Steel | 500 | 2021 |

| Annai Infra Developers | 200-250 | 2021 |

History of IPO

IPO list year-wise

| Year | No. of IPOs | Amount Raised

(In Rs Cr) |

Issue Succeeded | Issue Failed |

| 2007 | 108 | 33,946.22 | 104 | 4 |

| 2008 | 39 | 18,339.92 | 36 | 3 |

| 2009 | 22 | 19,306.58 | 21 | 1 |

| 2010 | 66 | 36,362.18 | 64 | 2 |

| 2011 | 40 | 5,977.47 | 37 | 3 |

| 2012 | 13 | 6,834.17 | 11 | 2 |

| 2013 | 5 | 1,283.95 | 3 | 2 |

| 2014 | 7 | 1,200.94 | 5 | 2 |

| 2015 | 21 | 13,513.17 | 21 | 0 |

| 2016 | 27 | 26,500.82 | 26 | 1 |

| 2017 | 38 | 75,278.57 | 38 | 0 |

| 2018 | 25 | 31,731.28 | 24 | 1 |

| 2019 | 16 | 12,687.32 | 16 | 0 |

| 2020 | 16 | 26,628.06 | 15 | 1 |

| 2021 * | 6 | 7,375.72 | 4 | 0 |

Related Articles:

IPO: Process,Types of Investors, Allotment, Lucky Draw for Retails investors

All About Investing in India: PPF ,Fixed Deposits, Mutual Funds, NPS, Stocks

- Stock exchange : What is it, Who owns, controls

- Stock Market Index: The Basics

- Blue Chips Stocks and Penny Stocks

- About Buyback of Shares: Types, process, why

Do you invest in IPO? What do you look for before investing in IPO? Which is the most profitable IPO you had? Which IPO are you looking out for in 2021?