A standard bike insurance cover is sufficient for a regular bike. However, if you have a super bike or a high-end sports bike, you will need a few riders to help you protect it properly. Why does a sports bike need added covers? Take a look at this article to get your answer.

Reasons why you need extra insurance for your Sports Bike or Super Bike

Take a look at the points mentioned below and you will be able to understand why you need extra insurance for your precious sports bike:

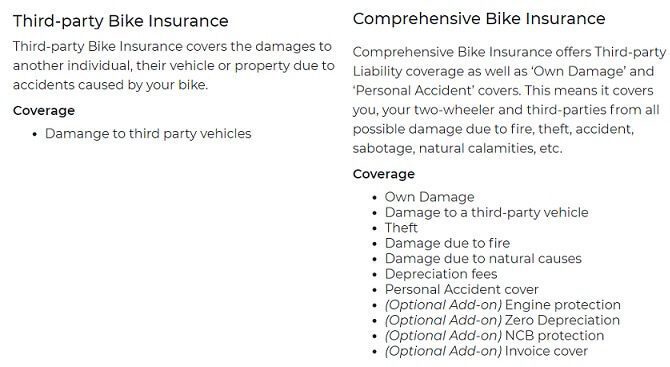

- Super bike needs Add-ons: A third-party policy will not cover damages to your super bike. A Comprehensive cover will do that to an extent. For enhanced coverage, you will need suitable Add-ons/riders. The image below shows the difference between the Third Party and Comprehensive cover.

- The spare parts are expensive: The spare parts of a superbike are quite expensive. For instance, if the mirror breaks, you can’t just install any mirror. You will need the special mirror fit for the model you own. This will cost you a lot of money and a generic online two wheeler insurance plan may not cover it.

- The engine maintenance is crucial: The engine of a sports bike is large and different from that of a standard two-wheeler. You need to get an engine protection rider along with your bike insurance plan to ensure the bike’s engine is always maintained and all repairs are carried out as soon as there is a requirement.

- Roadside assistance rider is helpful: Look for the roadside rider when you buy bike insurance online. When you have this, your insurance provider will send you a towing vehicle if your superbike breaks down in the middle of the road. It will carefully be taken to a nearby garage and mended accordingly.

- You need a cover for your pillion: Accidents happen in which the pillion rider is also injured. You, therefore, need to get cover for your pillion as well. This is available in the form of a rider. Buy the Pillion Rider cover and keep your passengers safe too.

- Safety from calamities: When you buy bike insurance online, you are given a list of exclusions. You will find that claims are not paid out by the insurance provider if your bike is destroyed or damaged in certain manmade or natural disasters. But as a sports bike owner, you need this cover at all costs. So, speak to your insurance provider and ask for an increased cover to keep your bike protected against all types of calamities.

- Return to Invoice Cover: Such a cover becomes essential in case of total loss of a vehicle. Total loss pertains to theft or damage that is beyond repairs. If you have a Return to Invoice cover, then the insurer will pay you your bike’s invoice value in case of total loss. Without such a cover, you will receive the bike’s Insured Declared Value, which is bound to be less than the invoice value.

These are some important reasons why you need added bike insurance coverage for your sports bike. Some of the super bikes in India are given in the image below

In conclusion

As you can clearly see from the points mentioned above, a super bike is expensive and a regular bike insurance plan is not enough to keep it secured. You, therefore, need extra coverage and should speak to your insurance provider when you buy the plan to see how it can be customized. Thankfully, there are some excellent online two wheeler insurance riders available for sports bikes that you can buy to protect your vehicle.

One response to “7 Reasons Why Regular Insurance Is Not Enough for Your Sports Bike”

Thanks a lot for sharing with us some great information. Keep posting good information!