“The phone costs 10,000 Rs and the display to change it costs 3000 Rs. It just doesn’t make sense. Do I get it changed or buy a new phone?” asked Suresh. ” I would change my screen as my iPhone is expensive”, said Aryan. “Isn’t there some insurance that covers it?, laughed Sarita. Yes there is. Today you can either get your smartphone or tablet insured over the counter or buy policy online. These policies cover the cost of things that are not covered under the one-year manufacturing warranty, including damage and theft. This article talks about mobile phone insurance. Please note We are not associated with any of the above mentioned mobile insurance companies.

What is mobile phone insurance?

Mobile phone insurance is the insurance of your mobile phone to cover up the incidents like theft, loss,damage etc. It compensates the cost of the smartphone as per the terms and conditions of insurance. Insurance has to be bought at the time of purchasing a mobile device. The premium depends on the cost of the phone.

Mobile Insurance plans usually have a limited tenure. For ex, Biscoot offers insurance for new handsets only and covers for just one year from the date of purchase. At best, you may get a two-year insurance policy, as is offered by Gadgetcops and Warrantyasia.

Similar to mobile insurance is also gadget insurance like laptop, tablets, consumer electronics. Our article When you lose your mobile : What to do? talks about what to do when you lose you mobile?

Isn’t warranty or extended warranty enough?

A typical smartphone ships with a one-year warranty from the handset maker and after that tenure expires, the customer is on his/her own. Typical terms of warranty are given below.One can, at times extend the warranty by paying extra. called as the Extended Warranty. Please note that the warranty should be bought within three days of buying the handset. There is no warranty beyond the second year.

Extended warranty can be purchased for proper repairs and ensure functional condition of the smartphone after the handset maker’s warranty expires. Every company offers and adheres to different terms and conditions in the extended warranty. For a Rs 40,000 phone the cost of extended warranty is less than 10000 Rs and this could be as low as Rs 300 for a phone costing Rs 10,000-15,000.

So if you buy an expensive phone, then to protect your self from loss of phone due to theft,accident etc one should go for mobile insurance. It’s not very expensive. Generally mobile insurance policy premium is calculated at about Rs 15 to Rs. 20 per Rs.1 000 of the amount indemnified. So For a premium smartphone costing Rs 45,000 the premium can range between Rs. 675 to Rs. 900. You cannot replace the phone but at least financial loss can be minimised.

What are typical terms of Warranty?

If you look at terms of Warranty it seems to favour the manufacturer. Some of warranty terms are as follows:

- The warranty card is not duly filled and mailed back / submitted to the nearest Authorised Service Centre of the company within 2 weeks of purchase.

- The completed warranty card is not presented to the service engineer at the time of repairs being undertaken / requested.

- The product purchased is not used according to instructions given in the INSTRUCTION MANUAL, as determined by the authorised service centre / company personnel.

- Site (premises where the product is kept) conditions that do not confirm to the recommended operating conditions of the machine/unit.

- Warranty does not cover user manuals or any third party software, settings, content, data or links, whether included/downloaded in product.

- Warranty does not cover normal wear and tear (including, without limitation, wear and tear of camera lenses, batteries or displays).

- Warranty does not cover defects or alleged defects caused by the fact that the product was used with, or connected to, a product, accessories, software and/or service not manufactured, supplied or authorised by <company> or was used otherwise than for its intended use, Defects can be caused by viruses from your or from third party’s unauthorised access to services, other accounts, computer systems or networks. This unauthorised access can take place through hacking, password-mining or through a variety of means.

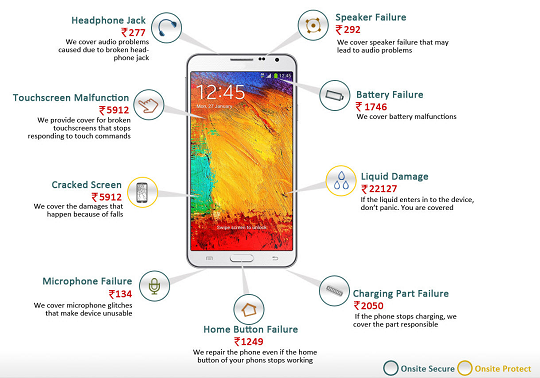

What is the cost associated with mobile repair?

From onsitego.com some of the cost associated with repair of mobile parts for a phone around 22,000 are given below.

What does mobile phone insurance cover?

Typically, mobile phone insurance plans covers

- Accidental physical damage to the device,

- Failure due to liquid/fluid spilling and entering the phone’s internal circuit,

- Burglary: theft and housebreak-in,

- lightening and explosion,

- Act of God perils and

- Damage or theft during riots/strikes.

Many of them offer Pick up and Drop facilities available for repair of phones.

However before you take the plunge for insuring your phone, make sure you read the terms and conditions of the insurance service provider. For example Theft of a mobile from an unattended vehicle is not covered under mobile insurance.

What does the mobile insurance does not cover i.e what are the exclusions of mobile insurance?

Conditions vary from insurance company to insurance company. Usually the cover is not applicable for

- The wear and tear, climatic condition or gradual deterioration,

- Inherent defect or from any process of cleaning, repairing or maintenance.

- Battery, charger and memory card-related complaints,

- Intentional damage to the handset for ex If the insured overcharges, overloads and does any sort of experimentation imposing any abnormal conditions for the mobile phone

- Loss or damage of unattended device or lent on hire or loan to a third party including friends and relatives.,

- Loss or damage due to poor maintenance and pet bites

- Loss or damage during war, nuclear perils, and flood or from any water-borne craft

- Loss of mobile phone due to the negligence of the insured

Also, companies may have a 48-72 hours of waiting period for the policyholder to be registered with the insurance company. So, claims made before this period may not be entertained.

So I will get the full amount if I buy mobile insurance?

No you will rarely get full amount of your mobile or any other asset for that matter ex Car.The monetary value of an asset decreases over time due to use, wear and tear or obsolescence. This decrease is measured as depreciation.

When you file a claim, your mobile insurer will employ a rather complex formula to ascertain the amount payable. This formula factors in depreciation, leaving you to pay a fraction of the overall costs. Typically 10% of the purchase price for 90-day-old handsets, 25% for 91-180-day-old phones and 50% for phone that are more than six months old.

There is also a standard clause of 5% co-payment in most mobile phone policies, which has to be borne by the insured. Sometimes this may be as high as 10%. Co payment is a flat fee you pay toward services such as health insurance or mobile insurance. This is your initial payment for service, no matter what your visit is for.

Usually You can claim more than once limited to the cost of gadget .

What is the premium associated with the mobile insurance?

To give you an idea Premium for mobile phones from some companies is as follows Ref : Economic Times(May 2015)

How to claim mobile insurance?

To file a claim, you need to retain the purchase invoice of the mobile phone and know the serial number of the phone. For loss of theft of phone you would first need to file an FIR within the first 24 hours after the loss or theft. File for the claim within 48 hours with the claim intimation and FIR. You will also need to attach the original price invoice and other details.

Where can one buy mobile insurance?

Insurance has to be bought at the time of purchasing a mobile device. The premium will depend on the cost of the phone.

Some of the insurance companies which offer insurance covers for mobile phones in India:

- New India Assurance Company

- National Insurance Company

- Oriental Insurance Company

- Bajaj Allianz

Some third-party service providers such as

- Gadgetcops : via Iffco Tokio insurance, New India Assurance

- InfyShield

- WarrantyBazaar

- Onsite

- AppsDaily

- SyskaGadgets :provides . Quickheal, YourMovies & Games

- Biscoot : New India Assurance

Disclaimer: We are not associated with any of the above mentioned mobile insurance companies. Please conduct your due research before choosing any insurance provider for your gadget.

Related Articles:

- What does Your Mobile Phone Say About You?

- What is Mobile Banking?

- Financial Apps for India

- PostPaid Mobile Connection and Prepaid Mobile Connection: Comparison, Switching between Prepaid and Postpaid

- JAM Trinity: Jan Dhan Yojana, Aadhaar and Mobile number

- When you lose your mobile : What to do?

Do you think mobile insurance makes sense? Have you ever taken mobile insurance? If you have did you claim it, How was the experience? Would you recommend to take mobile insurance?

6 responses to “Insurance for Mobiles and Gadgets”

Hi,

I read your whole blog. Your blog is very interesting and valuable. It is good to know for every one buy expensive mobile. looking for more intresting blog from your side

An amazing article. It’s nice to read a quality blog post. I think you made some good points in this post

Hi,

I read your whole blog. Your blog is very interesting and valuable. It is good to know for every one buy expensive mobile. looking for more intresting blog from your side

hi my self abhipray keshwani my claim no. is 1500062579 u have received my all documents on 15th december 2015 but still I have not received my claim amount in my bank account n its now 20th january 2015 I have filled claim on 30th september it’s almost 5 months n no body has informed about any thing when ever I call it takes lot of time to answer the call n they always say server is down m waiting from a long time to receive my claim amount I have spend rs.23500 from my pocket for the replacement of New iphone 6 as per your request n u have received all the documemts on 15 th december 2015 I want my claim amount now as soon as possible

my phon demage how to days

my demage how to days