Pick up a financial newspaper or a magazine you would see a section on personal finance makeover. In that section the person gives details about his investments, lists his/her financial goals with the underlying message “I have started investing, but I am not sure if my investments are enough to meet the future value of my goals” . The expert analyses, finds the loopholes in his investments, helps him to evaluate his goals and suggests the changes and the strategy which will help to achieve their goals.

Let’s see some examples:From Economic Times Investment revamp critical for Kapadias to achieve goals

Pranay Kapadia, a 31-year-old research analyst with an MNC, stays with his wife, Radhika, 30, daughter Jayani, 2, sister Purvi, 29, and parents Chandresh, 62, and Mridula, 59, at their own house, in Mumbai He has a monthly income of Rs 54,100 and, combined with the average dividend earned from stocks and interest from fixed deposits, the total income rises to Rs 57,767. Accounting for household expenses, insurance premium, mutual fund SIP and home loan EMI, the family is left with a cash surplus of only Rs 6,042. This is inadequate considering the overhaul that their investment patterns need for achieving their goals. These include saving for their daughter’s education and marriage, plan for the second child, buying a car and building a corpus for their retirement.

From Outlook money Financial Engineering

Brajesh Kumar Rai, 39, is the sole earning member of his family. He works as senior engineer with a private construction firm in Hyderabad. His wife Rina, 32, is a homemaker. The couple have three children, daughter Simran, 11, and twin sons Sarthak and Saksham, 9. His father has retired and lives with the family in Bettiah, Bihar. Rai’s financial priorities are the education of his children and the marriage of his daughter. He also wishes to build a comfortable corpus for his retirement and has earmarked specific investments towards his goals.

Rai also plans to purchase a car and take out his family on a vacation, but these are his secondary goals.

What major financial goals does an average Indian family pursue? : a car, a foreign vacation(s), a house, children’s education, children’s marriages and retirement.

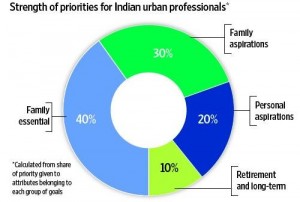

This was answered to some extent by TNS’s survey Trends & Insights into Financial Goals of Indian Consumers conducted by Ameriprise Financial . They surveyed affluent urban Indian consumers age 28-45 with an average household income of at least Rs 12 lakh or $25,000 residing in major metropolitan centres of Delhi, Mumbai, Chennai and Bangalore. Through a series of focus groups, personal interviews and quantitative surveys the study found out their goals, aspirations and dreams regarding their financial lives, and the factors that influence them.

Table of Contents

Family comes first

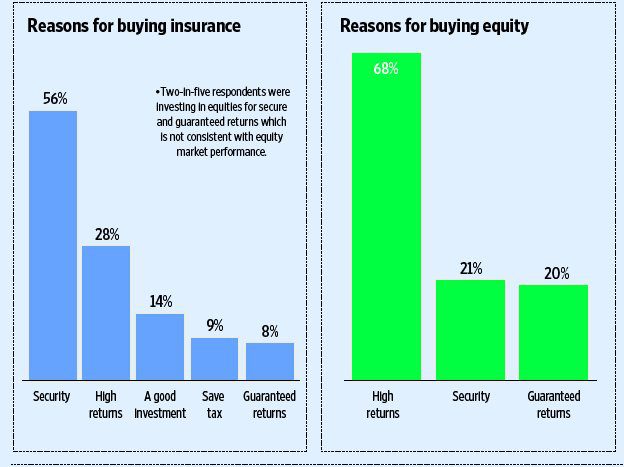

Right Products But Wrong Reasons

Different Cities Different Preferences

There are strong preferences for certain products in specific cities. Every city has its preference for certain instruments. Mutual funds and gold are preferred by Delhi, Stocks are favoured by Mumbai, Chennai wants real estate and Bangalore is into debt.

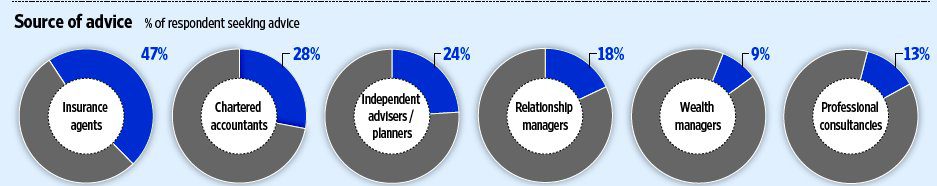

Different Products Different Advisers

Indian consumers currently rely on different financial professionals for recommendations on specific products. While most acknowledge that financial planning is a complex and scientific process, their awareness of the planning process is limited. Many view financial planning as a means to achieving a financial return, tax-saving benefit or short-term goals, decisions to invest are typically triggered by specific life events instead of being proactive or strategic. They feel that there is a lack of a single source who can serve their financial needs.

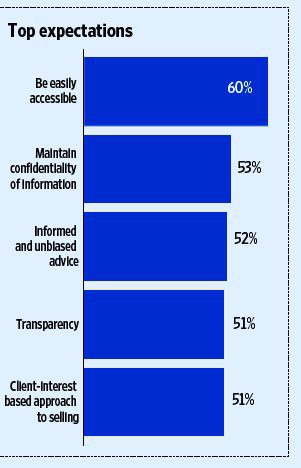

Indians Want An Advisor

Indians want an advisor. Consumers want an advisor they can trust to provide unbiased advice, simplify their finances and ultimately help them feel more prepared and confident about the future. But only a few have sought professional advice for a fee. Family and friends remain the most trusted sources of advice.

What are they looking for? Consumers are looking for professional services they can depend on. Consumers want a long-term and dedicated advisor who understands the complete product landscape and can provide a comprehensive suite of financial products and services to help meet their goals in a fully transparent manner.

Ameriprise Financial Inc

Ameriprise Financial Inc, the US-based financial planning solutions provider, has begun operations in India. The 117-year old company has a client base of over 2 million in US and it manages assets of over $600 billion through its mutual funds and life insurance companies in US and Europe. They are moving to India as “With the 34% savings rate, India offers great opportunity in the space of financial planning,” Ameriprise Financial president (financial planning and wealth strategies) Kim M Sharan said. “With its trillion dollar economy, India is not only an important market from a business perspective, but also one where our unique approach to planning could truly transform the way consumers manages their finances”.

Ameriprise India Private Ltd, Indian subsidiary of Ameriprise Financial, has set up offices in Delhi and Mumbai and plans to expand its reach to other metros in the future. The company will start with providing holistic and tailor-made financial planning for individuals having annual income of over Rs 20 lakh.They say that USP(unique selling point) of the company is going to be comprehensive unbiased advise at competitive fee through the well-trained advisors. Livemint’s Ameriprise starts India operations of 11-Jan-2012 has a video of Bimal I Gandhi of Ameriprise Financial, in which he tells why he believes his firm’s financial advisors are different and how he plans to retain them.

Financial Planning Services in India

Ameriprise are offering three plans, namely Ameriprise Em-power (comprehensive financial planning worth Rs 12,500), Ameriprise Envision(plan for specific financial goal such as child’s education, buying a house for Rs 5000) and Ameriprise Explore(offering advice on specific products and investments, no charge).

Icicidirect has also recently started financial planning services which is a fee based fee based service for a face-to-face meeting Rs.7,500 and for a telephonic discussion Rs.5,000.

Jagoinvestor financial planning services Basic financial planning Rs 10,000 and Financial coaching Rs. 18,000.

Hemant Beniwal who writes about financial articles at tflguide.com also has his financial planning firm, Ark Financial Planners.

Why we wrote this

First a clarification. We have no tie-ups with Ameriprise Financial or other websites mentioned here. We found the information on the survey Trends & Insights into Financial Goals of Indian Consumers interesting and so thought of sharing it. The information about the survey is based on various reports(Business Standard, Business Standard on Neighbours are not financial wizards, Times of India, Ameriprise website, and images are from livemint ).

Does American company starting operations in India for financial planning for affluent urban Indian consumers signal a trend that affluent urban Indian consumers will move towards paying for organized financial advice? Will it help to demarcate advisers and distributors or reduce the conflict-of-interest issues with products which suits the client and sales commissions? Do you have a financial advisior? Will you pay to get a financial plan?

Disclaimer: We have no tie-ups with Ameriprise Financial or other websites mentioned here. We have not used their services personally and we are not recommending anyone. We are not finance professionals, all content on this site is for general informational purposes only – you should not construe this as professional financial advice. Rates and offers shown here may change so please visit referenced sites for up to date information.

13 responses to “Insights into Financial Goals of Indians!”

Thanks for the great write-up, I was searching for details such as this, going to take a look at the other posts.

[…] of the need and more important the risk taking ability of each person would differ greatly. Our Insights into Financial Goals of Indians covers the TNS’s survey Trends & Insights into Financial Goals of Indian Consumers conducted […]

online shopping websites…

[…]Insights into Financial Goals of Indians! « Be Money Aware Blog[…]…

[…] Financial Goals of Indian Consumers conducted by Ameriprise Financial covered in my earlier post Insights into Financial Goals of Indians! Survey covered affluent urban Indian consumers age 28-45 with an average household income of at […]

Hi,

Good post.

But majority of people will not like to pay for obvious things like SIPs,mutual funds where even planner can not give you performance guarantee.

Thanks Paresh.

You are right when free advice is available why pay? But I have seen people(the affluent ones) now moving towards paid financial advice.

My take Paid or Unpaid one needs to be in the driving seat as it is one’s hard earned money. And Risk is everywhere, what we need to learn is how to balance it with reward!

No no..I am not talking about free or pay advice..neither its true that paid advice is always superior.

Just important point is that how to assure that your Driver will lead you to Destination, not Disaster..is there any method,other than just go for trial and error.

Where ever blog I go I read that equity will give you 15% returns in long term in future..is it true education?but truth is that it is capable to offer you -15% returns in longer term s well ..But,no one much more talks and write about risk..why???

Sorry I thought you were taking about paid or unpaid advice.

I agree with you that paid advice may not always be superior.(I have found that out the hard way :-()

Coming back to your question, how to assure that you will reach your destination I had read somewhere that in Space exploration rocket is off the path most of the times. But the way it reaches its destination is by adjusting its path once it realizes that it is off the path. This is because it has a plan and it is able to see that it is off it.

Failing to plan is planning to fail it is rightly said. So if you know the reasons why you have invested and you find that they are not met you need to take corrective actions. As Warren Buffet says “You only have to do a very few things right in your life so long as you don’t do too many things wrong.”

Same here you talk to a financial planner, or read money magazines all say equity is expected to give 15% returns that will beat inflation Something like when Sachin hits century India loses. or ,b> Go to school, get good grades and your life is settled Whether these are Facts or opinions one needs to do due diligence. In my article Fact or opinion:Do Due Diligence I have tried to answer these questions and also highlight the article I read in Capital Mind In the 17 year period that the Nifty has existed, the return, net of inflation, is 55%. The long term return of the Nifty, net of inflation, is 2.6%.

Why people don’t talk about risk? Because it hurts their cause. Who would buy equity or Mutual Funds if they say so? Cigarette smoking is injurious to health we all know, cigarette companies are forced to put these warnings on the pack under stress by the Govt.

One would need to work hard, find right sources of information.

Thanks for your reply.

I meet number of peoples every day..communicate with them..i placed my insights based on that only..

Wow dealing directly with people every day! I am interested to know what other insights do people share with you (in general terms), if possible. My articles are influence by what I read, my personal experiences and those of my friends so in a way they are limited.

About other insights,I do not now what to share?

But you can go through

http://www.saving-ideas.com/2012/01/mind-of-confused-investor/#

Please do not laugh with my English writing as its as not superior like yours or some of the other bloggers have.

I think even if you have a portfolio, you need to restructure it after some time. Some investment which had 5 stars at one time becomes not so effective. But yes, drawing a good plan with very limited means is a very difficult task.

Great work…Helped me a lot…:)Thanks!

Yes Saru you are right and gave me an idea for another post! We can buy and forget it, we need to evaluate it again atleast half yearly.

But the first thing is to have a plan ” Failing to plan is Planning to fail”

Thanks Saru glad you liked it.