Right of Inheritance is passing of the property, titles, debts, rights, and obligations to another person on the death of an individual. The loss of a loved one in the family is quite painful but the pain doubles up when disputes with respect to inheritance arise. Different laws are applicable based on types of succession(will or no will) and religion. This article explains the Inheritance rights in India.

Table of Contents

Inheritance rights Differ based on Will or No Will

When a person dies his or her assets are distributed amongst the persons as specified in the will. This is technically called as testamentary succession. While nominations help in transferring movable assets like bank deposits or insurance policies, a will takes legal precedence over a nomination. The person who makes the will is known as the testator and the person in whose favour the will is made is called the legatee. If there is a discord, a will is the best option.

However, if a person who dies didn’t leave a will, technically called intestate, then the assets would be distributed according to the law based on his or her religion. This is technically called as non-testamentary succession.As India has no uniform civil law and hence personal laws based on religion guide the rights.

The succession of Hindu, Jain, Buddhist and Sikh is governed by the Hindu Succession Act. Muslim succession is governed by the Muslim Law and Christians are governed by the Indian Succession Act.

Inheritance rights of women in India are primarily decided by her religion or rather by the religion of the person whose wealth she is claiming. Earlier it was practically a given that women had no rights over property and other assets left behind by her ancestors or father or husband. But things have changed, especially for Hindus since 2005, and Indian women are in a much better position than before.

Inheritance Rights and Self-acquired or Ancestral property

It is important to understand what can be defined as ancestral property. It is the property which was inherited by three generations of male lineage – father, his father (grandfather), his grandfather (great-grandfather). That is, the property should have been in the family for four generations and not have been divided at any point in time.

Separate property- When a person acquires property from any other relation, which is not subjected to be treated as joint family property is classified as separate property.

Self-acquired Property Property acquired in any other way is considered self-acquired and the owner can will it to anyone he pleases.

Please consult a lawyer if there is a doubt on what can be considered ancestral property or self-acquired.

Movable and Immovable Property

Immovable property is a property that can only be moved after destroying or altering it. It is bound by geographic coordinates or by reference to local landmarks, depending on the jurisdiction. Examples of Immovable property are: houses, land, campuses, property rights, Mere delivery is not enough to consider the transfer a valid transfer.

Movable property can be moved from one location to another. Movable property has no need to be registered under the Indian Registration Act, 1908. It is purely voluntary. Mere delivery with an aim to transfer the movable property completes the transfer. Example of Movable property are: Cash, Bank accounts, FD, Term Deposits and all other types of deposit investment in Bonds, debentures/ shares and units in companies/ Mutual funds, Motor Vehicles/ Aircraft/ Yachts/ Ships etc, Jewelry, bullion and valuable thing(s).

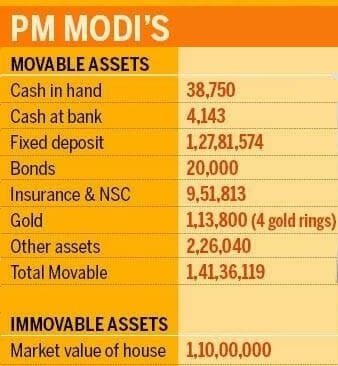

The image below shows the movable and immovable assets of PM Narendra Modi, The PM owns movable property, a house in Gandhinagar built on on a 3,500 sq ft of land, bought in 2002 for Rs 1.30 lakh. Its worth is more than 1 crore in 2018-19.

How is Inheritance Taxed?

There is no inheritance or gift tax if the property is inherited from a relative or is acquired through a will. Once inherited, any source of income, such as rent or interest, is transferred to the new owner and he must pay tax on it.

Once succession to the immovable property is confirmed, the heir must apply for mutation of property in his own name. Mutation updates the government records and doesn’t act as a transfer of title. Once you acquire the property, you can reside in, lend or sell the property.

Tax is levied on capital gains when the inherited property is sold. The gain is based on the period for which the property is held by the owner. This also includes the period for which it was held by the previous owners.

If held for more than 24 months, it is treated as a long-term gain/loss. The transferer has the right to deduct the cost of acquiring and improvement, while adding the rate of inflation to cost for the holding period. Then the tax is levied as per the applicable rate.

If it is less than 24 months, it is treated as a short-term gain and taxed as per the tax slab applicable to the owner or transferer. the actual cost of acquisition and improvement are deducted and the balance is treated as short term gain/loss.

What are the Inheritance laws in India?

- Hindu Succession Act, 1956

Laws of succession apply to Hindus, Sikhs, Jains and Buddhists for the nontestamentary or intestate succession and inheritance. This was modified in 2005 to award equal rights to daughters in their fathers’ ancestral property.

- Indian Succession Act, 1925 specifically under Sections 50 to 56

Applicable to Parsis for intestate succession

- Indian Succession Act, 1925 specifically under Sections 31 to 49.

Laws of succession applicable to Christians and Jews

- Muslim Personal Law (Shariat) Application Act, 1937

Laws of succession governing Muslims for non-testamentary succession. Where a Muslim has died with a will, the issue is governed by the Indian Succession Act, 1925, where a will relates to immovable property within the states of West Bengal, and that of Madras and Mumbai jurisdiction.

- Special Marriage Act, 1954

Laws of succession in case of interfaith marriages

Inheritance laws for Hindus

Hindus are governed by the Hindu Succession Act, 1956. And this is applicable primarily where ancestral property (movable and immovable) is concerned or if the person has not left a will (non-testamentary succession).

- The law makes no distinction between natural and adopted children.

- If the widow of a pre-deceased son or the widow of a pre-deceased son of a pre-deceased son has remarried, she is not entitled to receive the inheritance.

When a Hindu man does not leave behind a will, what happens?

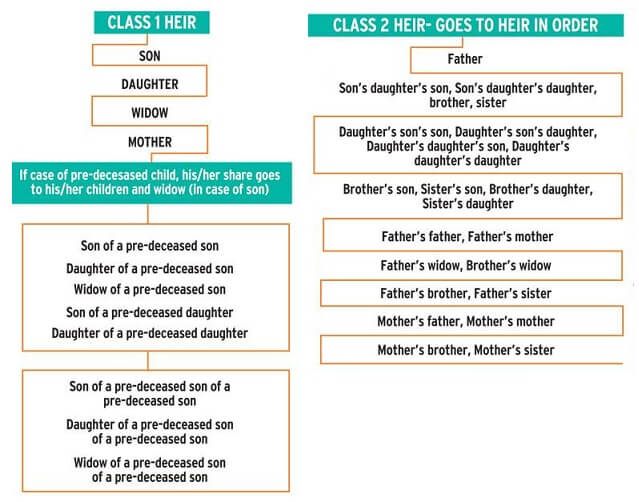

The property can be claimed by 4 types of heirs – Class I, Class II, Agnates (who are related by blood or adoption wholly through males), Cognates (who are related by blood or adoption not necessarily through males). The table below shows the overview of Class I and Class II heirs and image below explains it in detail.

Intestate is a person who has died without a will. Predeceased child means the child who has died before the father.

For Example, Shyam dies without leaving a will. He is survived by his wife, Nirmala, his son Kishan and daughter Meena. The son is married to Soni and has two children, Nirvan and Arya. Meena is also married to Hemant and has two daughters.

The right of Shyam’s property vests in his wife Nirmala, his son Kishan, and daughter Meena. All of them will share equal right in the property i.e. 1/3 each

However, if Kishan had died before Shyam, then on death of Shyam intestate(without a will), the right in property shall vest in Nirmala, Meena, Soni, Children together(Nirvan and Arya). Where, Nirmala, Meena and Soni, (Nirvan and Arya) will share 1/4th each of the property. Therefore Nirvan and Arya will together get 1/4th share and the individual share of Nirvan and Arya shall be 1/8.

Class I Heirs:

|

Class II Heirs:

|

The first preference is to Class I heirs. In any Class heirs there is a category of relatives in a hierarchy sort of. For example, on death of Hindu Man His Wife, Suviving Children, Mother and heirs in the branch of every pre-deceased son or daughter of the intestate are considered first. They have equal share. If he doesn’t have any living wife, children and mother only does one go down to the hierarchy.

If no Class-I heirs are available,Class-II heirs are considered. Among the heirs specified in Class II, those in the preceding entry take the property simultaneously and in exclusion to those in the subsequent entries.

In the absence of class 1 and class 2 heirs, the agnates can stake their claim and cognates are last in the order of preference.

Within a class of Heirs, If even one such heir exists, all other relatives who do not fall within this category are excluded automatically.If there are several heirs in the same categroy, then there are certain rules as to how they will share the properties amongst themselves. For example, For Class 1 Hier, The widow, mother and each of the children (son or daughter, the law makes no distinction) take equal shares. Where one or more of such sons or daughters is no more, then, the Class 1 heirs in that branch will all jointly stand in the place left behind by such deceased son or daughter.

In simple terms for a Hindu Family, rights based on property types are as follows

|

Property type |

Wife |

Daughter |

Son |

Right |

|

Ancestral/ joint family property |

No right |

yes |

yes |

Both son and daughter have equal rights. |

|

Father’s separate/ self-acquired property while he is living |

No |

No |

No |

Father can bequeath the property by will or gift. |

|

Father’s separate/ self-acquired property |

yes |

Yes |

Yes |

They have equal rights if the father has not written a will. |

Who inherits the property if a Hindu Female dies intestate?

The ownership of a Female Hindu dying intestate shall be divided as per the following rules:

- first among the sons and daughters (including the children of any pre-deceased son/daughter) and the husband

- then amongst the heirs of the husband

- then among the mother and father

- then amongst the heirs of the father

- then among heirs of the mother