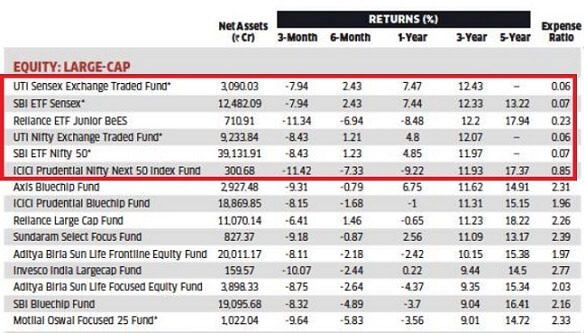

Exchange-traded funds (ETFs) and Index funds are giving better returns race than actively managed large-cap funds in the recent past. Is it a current market phenomenon? Or is the beginning of a trend? What are the ETF, Index Funds, Passive Investing? What is the difference between Index Funds and ETF? Do Index Funds work? Are Index funds suited for America and not India?

Table of Contents

Basics of Mutual Funds, Index

Let’s brush up some basics about Index, Mutual Funds.

Index

An index is an indicator or measure of something, and in the stock market, it typically refers to how the stock market has performed. In a stock exchange, it would be too difficult to track every single stock or company trading. So a smaller sample of the market that is representative of the whole is taken. Just as the average marks in a class test tells you how the class has fared in the test, just as pollsters use political surveys to gauge the sentiment of the population the stock index tells you the general health of the stock market.

- In India, Sensex is an index that captures the increase or decrease in prices of stocks of top 30 companies that are traded on the Bombay Stock Exchange or BSE. The word Sensex comes from the sensitive index and was coined by Deepak Mohoni.

- Nifty is the Sensex’s counterpart on the NSE and comprises of top 50 companies. First 30 companies in Nifty are same as in Sensex.

- S&P BSE 100 is an index to measure the performance of the top 100 large-cap companies in India that are listed at BSE Ltd.

- Nifty NV20 is a 20-stock index that provides exposure to eight broad sectors and comprises most liquid blue-chip companies in the CNX Nifty. The index consists of 20 companies which are selected on the basis of Return on Capital Employed (ROCE), Price-Earnings (PE), Price to Book Value (PB) and Dividend yield (DY)

Our article Stock Market Index: The Basics explains it in detail.

Mutual Funds

A mutual fund is a professionally managed investment scheme that pools money from many investors and invests it in stocks, bonds, short-term money market instruments and other securities in accordance with objectives as disclosed in the offer document. Mutual funds have a fund manager and a team who invests the money on behalf of the investors and charges for selecting the stocks/bonds. With mutual funds, one can invest minimum amount which is spread across a wide cross-section of securities giving one advantage of diversification.

A benchmark is a reference point against which the performance and stock allocation of a mutual fund scheme are compared. The fund houses select benchmark indices on the basis of market capitalisation and sectoral or thematic strategies of the respective funds. For example, large-cap funds would have large cap indices, such as BSE SENSEX, BSE100, Nifty 50 or Nifty 100 as their benchmark indices. Similarly, mid-cap funds would have Nifty Midcap 100 or Nifty Midcap 150 as their benchmark indices while infrastructure funds would use Nifty Infrastructure or BSE India Infrastructure India.

You may be aware that mutual fund scheme charges you 1-3% per annum as fees (also known as expense ratio), a chunk of which goes as an investment management fee, the returns are calculated after accounting for this. If there is no outperformance against a market index, then paying such fees starts to feel wrong.

Our article All About Mutual Funds: Basics, Choosing, Paperwork, Direct Investing explains mutual fund in detail

Index Mutual Funds

In Index Mutual Funds instead of researching and selecting just those stocks that the fund manager thinks will outperform, an index fund buys all the stocks that make up a particular index. For example, an Index fund based on the Sensex would invest in all of the 30 stocks that form the Index in the same weight as that of the index as shown in the image below.

This makes it a passive approach to invest in stocks which are relatively simple as compared to active investing wherein regular buying and selling take place. Index funds are ideal for investors who are risk-averse and want predictable returns.

The primary aim of an index fund is to replicate the performance of its index. An investor who buys an index fund doesn’t have to pay a fee to the fund manager. These funds need to keep some funds in liquid market or cash to meet any redemption. Currently, there are around 40 index funds, most of them following Nifty or Sensex.

While an actively-managed fund strives to beat its benchmark, an index fund’s role is to match its performance to that of its index. There is a small difference between the fund performance and the index and tracking error measures how much an index fund’s returns deviated from the benchmark it is tracking. The lower the tracking error, the better the fund’s performance.

You can buy or sell an index fund in the same way as any other mutual fund. Either go through a distributor or invest through the fund house or MF utility or apps. All you need is a bank account and KYC compliance.

FYI: In 1976 the first index fund was launched in the United States by the investment firm Vanguard Group. It was known as “Bogle’s Folly,” for John C. Bogle, the founder of Vanguard. Passive funds currently account for 29 per cent of the U.S. market, according to Moody’s.

Exchange Traded Funds or ETF

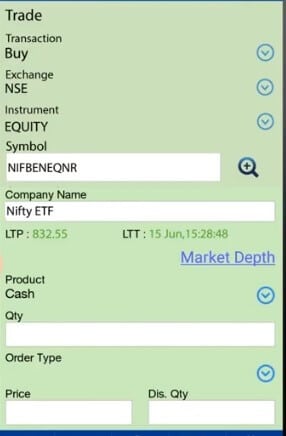

An exchange-traded fund or ETF tracks an index like index mutual fund but trades like a stock on an exchange. ETFs price changes throughout the day as they are bought and sold throughout the trading day. To buy or sell an ETF, you need to have a demat and trading account.

An ETF is bought and sold like a company stock during the day when the stock exchanges are open. Just like a stock, an ETF has a ticker symbol and intraday price data can be easily obtained during the course of the trading day as shown in the image below. Here one buys or sells units of the fund which another one would be selling. But one must have a willing party to trade, not all ETFs have high liquidity.

ETFs were started in 2001 in India. The Indian ETF universe is expanding. There are four types of ETFs already available: Equity ETFs, Debt ETFs, Commodity ETFs(Gold ETFs) and Overseas Equity ETFs.

Difference between ETF and Index Fund

| Description | Exchange Traded Funds(ETF) | Index Fund |

| Definition | It tracks the index of a stock exchange | It replicates the performance of the benchmark Index |

| It is like | It trades like a stock. Hence all features of stocks apply | You buy and sell like Mutual Funds. |

| What you need To buy and sell | You need a demat and trading account.

|

You Don’t need any special account. You can buy or sell from Distributor, AMC, Apps, Cams, MFUtility etc.

|

| When can you buy/sell? | You can buy/sell anytime during trading hours provided there is someone to sell/buy | You will get Mutual Fund units only at the end of the day. |

| Whole or Fraction | You can buy only in multiples of units. No fractional unit of ETF. For example, you have 2200 Rs and each unit of ETF is 1000. You can buy only 2 units for 2000. | You can get fractional units. If each unit is Rs 1000 and you have 2200, you will get 2.2 units. |

| At what price will you get/sell the unit | At the price at the time of buying/selling. Depends on Demand and Supply | At NAV at the end of the day. |

| Liquidity/Tradibility | As it is like stock it depends on Demand and Supply | You can buy or sell anytime. |

| Charge | You have to pay Brokerage Charges on buying and selling | You need to pay an Expense Ratio |

| Expense Ratio | is Less | is More |

Do Index Fund or ETF Work?

The Pros and Cons of Index Fund or ETF are given below. In our article Does Index Fund or ETF Work? Will it work in India we have explained the points in detail.

- People don’t talk about Index Funds or ETFs or Passive Investing. No Distributor will recommend Passive Funds like Index Funds and ETFs. Fund house will also not recommended. Reason being unki roji roti ka sawaal hai. Distributors get a commission, while Fund Managers and his team earn from the Expense Ratio. Expense Ratio of Index Funds is less than that of Active Managed Fund. Would these guys be paid if they recommended passive index funds?

- In 1973 a Princeton University professor Burton Malkiel claimed in his bestselling book, A Random Walk Down Wall Street, that “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

- Efficient market hypothesis (EMH) formulated by Eugene Fama in 1970, suggests at any given time, prices fully reflect all available information about a particular stock and/or market. Fama was awarded the Nobel Memorial Prize in Economic Sciences jointly with Robert Shiller and Lars Peter Hansen in 2013. You can’t profit from it by saying its undervalued or overvalued. According to Investors like Warren Buffet and Peter Lynch markets are inefficient and you can get bargains because Market doesn’t value stocks correctly. For a market to be efficient,

- A market has to be large and liquid.

- Accessibility and cost information must be available to investors at more or less the same time.

- Transaction costs have to be cheaper than an investment strategy’s expected profit

- US market is supposed to be efficient but India market is not efficient because there research on companies is limited, not all information is available to the consumer.

- In Dec 2017 Warren Buffet won the bet of a million dollars that he had placed in 2007. The bet was that an index fund would outperform a collection of hedge funds over the course of 10 years. He said that by investing in a boring, low-cost stock index fund you could outperform most hedge funds

- In India, due to the smaller size of mutual funds compared with those in the US, the evolving nature of the economy is not being fully captured in the benchmark indices, which create scope for local fund managers to outperform the benchmark index, many feel

This 8-minute video by Coffee Break beautifully explains about the Monkey on Wall Street. (A Must watch)

ETF and Index Funds in India

Globally, ETFs have raced ahead of active funds in popularity thanks to their low fees and simple structure. ETFs were started in 2001 in India. The Indian ETF universe is expanding.

- There are four types of ETFs already available: Equity ETFs, Debt ETFs, Commodity ETFs and Overseas Equity ETFs.

- Indian equity ETFs track the Nifty50, Nifty Next 50, Sensex 30, Nifty 100 and BSE 100, with select ETFs tracking mid-sized companies.

- Thematic ETFs mimic indices that reflect a particular theme or sector. For instance, the Reliance ETF Shariah BeES tracks the Nifty 50 Shariah index — an index of companies compliant with the Islamic law.

- Debt ETFs track liquid fund returns and returns on the 10-year government security.

- Under commodity ETFs, Gold ETFs are the key category.

- Choices in ETFs and index funds are limited, as most of these are linked to Sensex and Nifty 50. Out of 64 passive equity funds in the domestic mutual fund market, only 20 are not linked to the two indices.

Equity ETFs and index funds together have total assets under management (AUM) of around ₹82,000 crore, about 16% of the AUM of actively managed equity diversified funds at around ₹5 trillion. Roughly half of this is thanks to EPFO, which started investing in ETFs and index funds in 2015, rather than the individual fund manager.

The mutual fund industry also moved to TRI (Total Return Index) in February 2018. The move was to make the outperformance of schemes more transparent. The regulators believed that the performance claimed by the mutual fund schemes was not fair because the returns shown by the schemes had dividends from their stock-holdings whereas the benchmarks were based only on price. This bought the percentage of outperformance down by 1.5 per cent annually.

Debate on Whether one should invest in Index Funds or not?

Given below are the YouTube videos,

- One by Varun Malhotra(Director EIFS) in Hinglish, who explains why Mutual funds are not such a great investment and why Index funds are a much better alternative for stock market beginners. It is 1st of the 4 videos. He is a finance educator who conducts wealth sessions and has done with even jawans of BSF.

- 2nd video is by Pranjal Kamra, in Hindi, who says learn the complete truth about index funds and why you should stay away from index funds in India and prefer active mutual funds. He sells his Value Investing Course and How to pick good Mutual Funds.

- 3rd video in English is by Dhirendra Kumar of ValueResearchonline Should you invest in index funds

|

In Hindi+English by Varun Malhotra |

In English by Dhirendra Kumar of ValueResearchonline |

Bemoneyaware Conclusion

Movies from good actors like Thugs of Hindustan from Aamir Khan failed and movies of Ayushman Khurana (Badhai ho, Andhaduaan) have done well in 2018.

Kuch to log kahenge for anything, any topic, the more educated the more discussion. We personally think Index investing has some merit. Sensex and Nifty are best companies and if they don’t do well, well not only would they be removed from the Index but there is a high probability that other companies would not do well.

After recategorization of mutual fund schemes, we feel that instead of Large Mutual Funds one can invest in Index Mutual Fund. We have personally started SIP in an Index Mutual Fund. For Midcap and multi-cap we are still going with the active investing.

If your portfolio is modest, and you don’t have a clue what you are doing, index funds are a good bet. They are good enough for what you need and will likely save you from a lot of mistakes.

Related Articles:

- Stock Market Index: The Basics

- All About Mutual Funds: Basics, Choosing, Paperwork, Direct Investing explains

- Does Index Fund or ETF Work? Will it work in India

- Index Funds in India: Compare with ETF, Active Funds, How to buy

What do you feel about Passive Investing like Index Funds and ETFs? Does it make sense? Do you believe in Wolf of Wall Street or the Monkey of Wall Street?

5 responses to “What are Index funds? What are ETFs? Do Index Funds Work?”

If you invest regularly over months, years, and decades, short-term downturns will not have much of an impact on your ultimate performance. Instead of trying to judge when to buy and sell based on market conditions, if you take a disciplined approach of making investments weekly, monthly, or quarterly, you can avoid the perils of market timing. Thanks for the post.

Very nice. We should make people aware of Index investing in India.

An informative post. Just a. suggestion for lay people like me if the length of the post is kept smaller it will be helpful. The content you covered in one post, may be done in more than one post.

Thanks a lot, Sir for the suggestion.

Will work on it.

And thanks a ton for sharing our posts on social media. We appreciate it a lot.

Very Informative.

signalread.com