“Please submit your investment declarations by 15 Dec…” said the mail from Finance Department. During December or January, employers start asking employees to submit documentary proofs of investments and expenses that qualify for tax deduction and exemption under various sections of Income tax Act, 1961. This is in respect of the investment declaration made by the employee at the beginning of the financial year, to the employer. This article talks about Income Tax Proof Submission to the Employer, Why does one need to declare the investments to employer? Why does one need to submit the investment proof? What if you can’t submit investment proof on time? What are the investment proof that one needs to submit?

Learn Tax Properly: Check out our course on Income Tax here.

Check out the Workbook on Income Tax here.

Table of Contents

What is the process of Investment declaration, proof submission to Employer?

- The employers ask employees for a declaration of their proposed investments for tax exemptions/deductions from employees in the beginning of the financial year (April itself). Based on your declaration and the investments that qualify for deductions and exemptions, your employer deducts tax on your salary every month.

- By December or January employer asks for submission of the proofs for all proposed tax saving investments.

Please note that your employee contribution to EPF is also considered as an investment in 80C.

Why does the employer ask for proofs of investments?

The employer asks for this information because they want to approximate how much will be your final taxable income after deducting the tax saved through 80C investments, HRA, Home loan and medical bills. So that they can deduct a constant amount of TDS each month. When an employee fails to submit investment proofs as declared earlier then

- The employer has to take into account the actual amount of investments and expenditure incurred and re-compute employees taxable income and tax liability. For instance, if you fail to invest, say, Rs. 1 lakh (before the deadline to submit the proofs) in an instrument that qualifies for deduction under section 80C of the Act (maximum limit is Rs.1.5 lakh), your tax liability will go up by Rs. 30,900 if you fall in the highest tax bracket. Similarly, for a person in the 20% tax bracket, the tax liability will go up by Rs 20,600, and by Rs 10,300 for someone in the 10% bracket (this is including cess of 3%).

- This tax will get deducted from your salary in the remaining months of the financial year.

Let’s see that with an example

- Raj has a salary of 10 lakh a year, and in April he declares to his employer that he will invest Rs 1.5 lacs in tax saving investments under section 80C/80D.

- Based on Raj’s declaration employer will calculate that Raj taxable salary is 8.5 lakhs and will be based on that suppose the total income tax for the year is 97,850. So Raj’s taxable salary for the year will be 8.5 lacs – 97,850 = 7.52150 lacs. This 7.5 lakhs divided by 12 will be 62,700 approx which he will get on monthly basis and the employer will deduct Rs 8154.167 TDS and deposit the tax deducted to Government on monthly basis

- In Jan, when the employer asks Raj to give them the investment proof if Raj is able to provide investment proof of Rs 1 lakh including his EPF contribution.

- So now employer will take Raj’s real taxable salary as 9 lakhs and not 8.5 lakh as declared by him. So the employer has to do tax calculation again and he finds that Raj’s tax for the year was 1,08,150 instead of 97,850. So additional 10,300 Rs tax more has to be deducted. The employer will deduct this extra tax in salary during Feb & Mar.

What if one can’t submit Income Tax proof to the employer?

If you don’t give proof to your employer within the deadline, you can invest till the end of the financial year i.e till 31 Mar and claim tax deduction while filing your ITR. But additional taxes would be cut as a result of non-submission of proofs. But note certain expenses cannot be claimed with ITR. Our article How to Claim Deductions Not Accounted by the Employer discusses it in detail.

Which exemptions cam only be claimed through the employer?

- Exemptions such as Leave travel allowance (LTA) must be claimed only through the employer, According to income tax rules, LTA can be claimed twice in a four-year block (current block is 2014-2018). If someone missed claiming it this year, she can either carry forward this benefit to the next year or claim exemption for fresh travel next year. But this can be done only if the employee submits the required travel bills to the employer.

- Similarly, tax exemption for medical allowance can be claimed only by submitting bills to the employer. Else, applicable tax on the medical allowance will be applied and the remaining amount will be given to you at the end of each financial year.

Rest of the exemptions such as Investment in PPF,Life insurance etc can be claimed while filing Income Tax Return if investment is done till 31 Mar.

Can I submit details of my other investments like Saving Bank Interest, Fixed Deposit Interest to my employer?

Yes you can share your saving bank interest, FD/RD interest earned during year, any capital gains from shares or mutual fund, rental income and other kind of incomes with your employer, so that they get a complete picture of your taxable salary/Then your employer would recalculate your tax liability and also pay tax on your other investments like FD on your behalf. But if you don’t then you need to pay the tax due yourself through Challan 280 either as Advance Tax or Self Assessment Tax.

What happens if you invest and submit proof for less than what you declared to your employer in the beginning of the year?

As explained in the example above if you submit proof to your employer for the amount less than declared, employer will recompute your tax liability and deduct more tax in remaining months. Your take home salary until the end of financial year ie March becomes less.

What happens if you invest and submit proof for just what you declared to your employer at the beginning of the year?

As explained in the example above if you submit proof to your employer for the amount equal to what you had declared, the employer will deduct TDS as per the calculation done earlier and there will be no change in your take-home salary in this financial year.

What happens if you invest and submit proof for more than what you declared to your employer in the beginning of the year?

As explained in the example above if you submit proof to your employer for amount more than declared, employer will recompute your tax liability and deduct less tax in remaining months. If the Your take home salary till the end of financial year ie March becomes more. If Your tax liability is not recomputed or somehow you still have extra tax paid you can claim it while filing income tax return.

Do we have again submit proofs while filing income tax return?

NO. While filing income tax returns, you just have to furnish the information about your investments, you need not attach any investment proof.

Why do we have to submit proof of investments to the employer when Income tax Department does not ask for proofs?

Investment proofs are required by the employer because they are deducting the TDS and as a third party, they need the documents for verification purpose. Yes if you are claiming the benefits yourself at the end of the year, you just need to declare things. However note that you should keep the receipts and all the required documents with you for 7 years, because if there is any scrutiny or questions later, you need to be prepared to answer income tax authorities along with documentary evidence.

Please provide true information about your investments which you have not done in reality.

Which documents do you need to store for Income tax purposes and for how long?

It is very important to keep a record of all the paperwork safely as legal proceedings under the income tax act can be initiated within a span of six years and therefore keep all income tax related documents safely for at least seven years. Following records are advisable to be kept for future references.

- Form 16, Form 12BA

- Filed ITR along with ITR-V

- Copy of Challan for tax paid

- Tax deducted at source (TDS), Form 16A

- Tax exemption documents

- Bank account statements

- Gifts deeds

- Intimation from the IT department (soft copy email) and hardcopy etc.

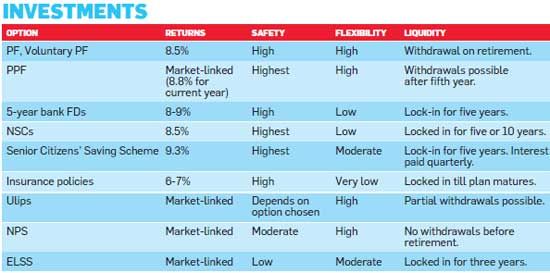

Which tax saving option should I choose?

Each Tax saving option offers a different combination of returns, safety, flexibility, liquidity. The Provident Funds(EPF,VPF,PPF) and pension plans are very safe, but they lock up the money for the long term. NSCs and five-year fixed deposits are also safe and have a shorter lock-in period, but the returns are low. ELSS funds can give extraordinary returns but come with high risks. Traditional life insurance policies, offer low returns, low flexibility and low risk. Add to this the low risk cover and you will know why endowment and moneyback plans are poor investments. Our articles How to save tax? Choosing Tax Saving options : 80C and Others and Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24 covers various tax saving options in detail. An overview of Comparison of Tax saving options in terms of returns, safety, flexibility, liquidity are as follows. Please note that the your employee contribution to EPF is also considered as investment in 80C.

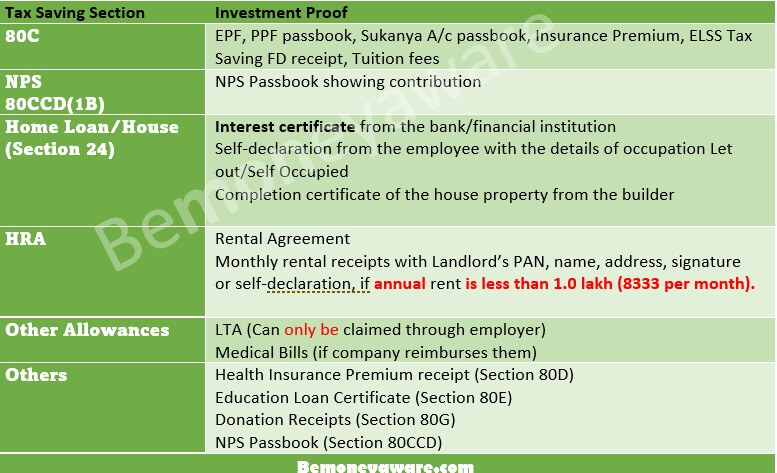

What proofs need to be submitted to your Employer and under which section

| Tax Saving Investment | Exemption/Deduction to Claim | Guidelines |

| Rent Payments | HRA |

|

| Interest on Housing Loan- Self Occupied Property. | Section 24 |

|

| Principal Repayment of Housing Loan | 80C | Same as interest on housing loan mentioned above. |

| Income / Loss from House Property- Let out Property

|

Income |

|

| Insurance Premium/ULIP/Pension scheme. | 80C | Premium receipts paid during current financial year, in name of self, spouse, children. |

| National Saving Certificate (NSC) | 80C | Copy of NSC certificate in the name of employee. |

| Public Provident Fund- PPF | 80C | Copy of the stamped deposit receipt, paid during current financial year

or |

| Interest accrued on N S C deposited in the earlier FYs. | 80C | Copy of the NSC’s purchased in the previous FYs.Interest accrued will be considered as other income too. |

| Tax Saving Funds | 80C | Copy of investment certificate with the employee name, Investment Date, Amount, Type of Investment Only the investments made under Tax Saving Fund / Plan will be considered |

| ELSS | 80C | Copy of investment certificate with the employee name, Investment Date, Amount, Type of Investment.

Only the investments made under Tax Saving Fund / Plan will be considered. |

| Children Tuition Fees. | 80C | Copy of Tuition Fees paid to educational institution.

Payment in nature of Donations, Capitation fees, Uniform fee, Sports fee, Van Fees, Shoes & Sock etc., are not allowed. |

| Post Office –Term Deposit with more than 5 year term. | 80C | Copy of deposit receipt. |

| Tax Saving Fixed Deposits with Scheduled Banks. | 80C | Copy of Deposit Receipt invested during current financial year, qualified benefit under Sec 80C of the Income Tax Act. |

| 80CCG – RAJIV GANDHI EQUITY SAVINGS SCHEME | 80C | The investment is made in listed equity shares/Mutual funds.

Deduction is limited to 50% of the amount invested in such equity shares subject to a maximum of Rs. 25,000 |

| MEDICLAIM –including preventive health check up. | 80 D | The investment in health or medical insurance of self or family members is exempted under Section 80D upto Rs. 30,000 for senior citizens and upto Rs. 25,000 for others. This includes the deduction upto Rs 5,000 spent on health checkup. |

| Medical Treatment on Handicapped Dependant | 80 DD | Proof of

|

| Medical Treatment Expenses for the specified disease Deduction U/S 80DDB | 80DDB | Medical Bills / expenditure incurred by way of medical treatment for a specified disease along with a certificate from a hospital in the prescribed form.

Form 10-I |

| Interest paid on Higher Education Loan | 80E | Copy of Bank certificate stating that the loan and interest has been paid and amount payable during the financial year.

|

| For Self – Permanent Disability | 80U | Form 10 I-A |

| NPS | 80CCD(1B) | Copy of the stamped deposit receipt, paid during current financial year and copy of the Passbook with clear mention as NPS Account. |

Related Articles:

Learn Tax Properly: Check out our course on Income Tax here.

Check out the Workbook on Income Tax here.

- Understand Income Tax, Fill ITR,Income Tax Notice

- Financial tasks you should complete before 31 March

- Income Tax Overview

- Leave travel allowance (LTA)

- How to show HRA not accounted by the employer in ITR

- Tax Saving Fixed Deposits

Hope this article helped you in understanding submission of Income-tax investment proofs to the employer. It is better to make all your tax-saving investments before the last date of submitting proofs with your employer.If you have any questions or if you want to share some important information on this topic please do so.

Thanks for sharing such a wonderful blog post.

I really loved reading your article full of insights

I have concern regarding LIC. I have two Life Insurance Premium on 28th Feb 2018 and 28th March 2018 for the FY 2017-2018 ,and the company where i am working has given last date as January 10 2018.

When i have raised a requiest they have replied with “we cannot continue to verify the investment proofs till Mar-18 and request you to claim those during your ITR Filing”.

Kindly suggest.

You can claim it while filing your ITR.

Just fill the total amount under 80C and keep the receipts.

Our article How to Claim Deductions Not Accounted by the Employer discusses it in detail.

Hi,

My employer sets a deadline in early Feb for submitting all tax related proofs. I periodically submit medical bills to claim exemption against medical allowance of my salary.

However, any such expenditures in Feb-March month, can’t be submitted for exemption. So I wanted to know if these can be claimed separately while filing ITR? Or if there are any sections/deductions where I can claim these? Thanks.

Swapnil, tax exemption for medical allowance can be claimed only by submitting bills to the employer. Else, remaining amount is given to you at the end of financial year. and applicable tax on the medical allowance is applied.

You can talk to your HR about how unjust it is not have submissions for Feb/Mar month. I mean you cannot control your medical expenses

This is the second year in row where I’m seeing my employer demanding all proofs (esp and including LTA/medical bills) by Jan end. I have raised this issue within my organization but to no avail. I’d like to understand my options for a legal recourse. Would filing an RTI to IT department in this regard help? Please advise. Thanks!

Why are against submitting proof before Jan end?

The employer has to take into account the actual amount of investments and expenditure incurred and re-compute employees taxable income and tax liability. For instance, if you fail to invest, say, Rs. 1 lakh (before the deadline to submit the proofs) in an instrument that qualifies for deduction under section 80C of the Act (maximum limit is Rs.1.5 lakh), your tax liability will go up by Rs. 30,900 if you fall in the highest tax bracket. Similarly, for a person in the 20% tax bracket, the tax liability will go up by Rs 20,600, and by Rs 10,300 for someone in the 10% bracket (this is including cess of 3%).

This tax will get deducted from your salary in the remaining months of the financial year.

If you don’t give proof to your employer within deadline, you can invest till end of the financial year i.e till 31 Mar and claim tax deduction while filing your ITR. But additional taxes would be cut as a result of non-submission of proofs. But note certain expenses cannot be claimed with ITR. Our article How to Claim Deductions Not Accounted by the Employer discusses it in detail.

Exemptions such as Leave travel allowance (LTA) must be claimed only through the employer, According to income tax rules, LTA can be claimed twice in a four-year block (current block is 2014-2018). If someone missed claiming it this year, she can either carry forward this benefit to the next year or claim exemption for fresh travel next year. But this can be done only if the employee submits the required travel bills to the employer.

Similarly, tax exemption for medical allowance can be claimed only by submitting bills to the employer. Else, applicable tax on the medical allowance will be applied and the remaining amount will be given to you at the end of each financial year.

Rest of the exemptions such as Investment in PPF,Life insurance etc can be claimed while filing Income Tax Return if investment is done till 31 Mar.

I’m referring to your earlier comments here,

“You can talk to your HR about how unjust it is not have submissions for Feb/Mar month. I mean you cannot control your medical expenses”

I’m sure you understand LTA/medical bills can’t be claimed separately later on.

Yes, you cannot control your medical expenses.

But rest of the investments you do submit, right?

You can discuss it with your HR.

Many offices do allow submission of medical bills till last week of March.

Hi ,

I would like claim 80C on registration and stamp duty charges. Is that a valid investment. My employer portal doesn not have that section for claiming in 80c.

Is it only in ITR I can ?

Thanks

If you have purchased or constructed a house property, stamp duty & registration charges and other expenses which are directly related to the transfer are allowed as a deduction under Section 80C. The maximum deduction amount allowed under this section is capped at Rs.1,50,000.

Yes Many employers don’t have it in their portal. You can speak to your employer and he might accept it.

When can you claim this deduction?

This deduction can only be claimed in the year the actual payment is made towards these expenses. If you buy the property on 30th August 2014 and pay its stamp duty and registration charge, you can claim these expenses under section 80C only in FY 2014-15. Both an individual and a HUF can claim this deduction in their income tax return.

Joint Owners

If you have purchased the property jointly, the co-owners can claim these expenses in their respective income tax returns based on their share in the property. However, the maximum limit of Rs. 1,50,000 available under section 80C shall apply.

I joined my organasation in August 15 and leaved in feb16.how can deposit my investment proof.I have declared my investment plan and on the basis company deducted TDs from my salary every month.now what will do.

My organisation missed to consider the PPF contribution. Now, it won’t appear in my Form-16 as well. How can I claim that investment during filling my tax online?

Show it under section 80C while filing ITR as explained in our article Fill Excel ITR1 Form : Income, TDS, Advance Tax

Hi,

For Home Load Interest and Principal amounts Bank is giving Provisional Statement for current FY which is not acceptable in my company. HR is accepting only actual Interest and Principal paid till date i.e. Home Loan Statement / Certificate stating total EMI paid and Interest and Principal components till January 2016 end.

What work around could be when Bank is firmly refusing to issue such certificate and Company is asking for it?

Your advise is much appreciated.

Thanks.

Claim it while filing ITR

Hi,

I Have worked in my previous organisation for 40days and switched to my current company in may 2015.For that 40days i don’t have any documents(Form 16) to support(except my payslip) my current organisation is done for the rest of the year.What i can do for that 40days period???My previous salary is about 3,50,000.Reply is appreciated.

Yes Sir. Your earlier organization would have deducted tax on the income it paid you for 40 days. So please check your Form 26AS. Our article What to Verify in Form 26AS? explains it in detail.

Your previous company should provide you Form 16 at end of financial year.

What specifically do you want?