Recently Several people have received notice from the Income Tax department about not depositing TDS on buying property or depositing TDS late. If you bought property worth more than Rs 50 lakh and did not deduct tax at source (TDS) or failed to deposit the amount with the income tax department on time then you would or might receive notice from Income Tax Department under . This article covers the Income Tax Notice, Understanding of Notice, Penalty, Late fees and Interest on TDS for Purchase of Immovable Property, How to pay the demand notice?

Table of Contents

Notice from Income Tax Department for TDS on Property

Why does one receive an Income Tax notice under Section 201?

The Income Tax Department has started issuing intimation under section 200A of the Income Tax Act’1961 to the deductors under section 194IA i.e the buyers of property who have paid TDS Under section 194IA late. The CPC TDS is not only charging interest under section 201, but also late fee under section 234E of the Act. The main objective for introducing this rule is to track all the high value real estate transactions, which are not being registered.

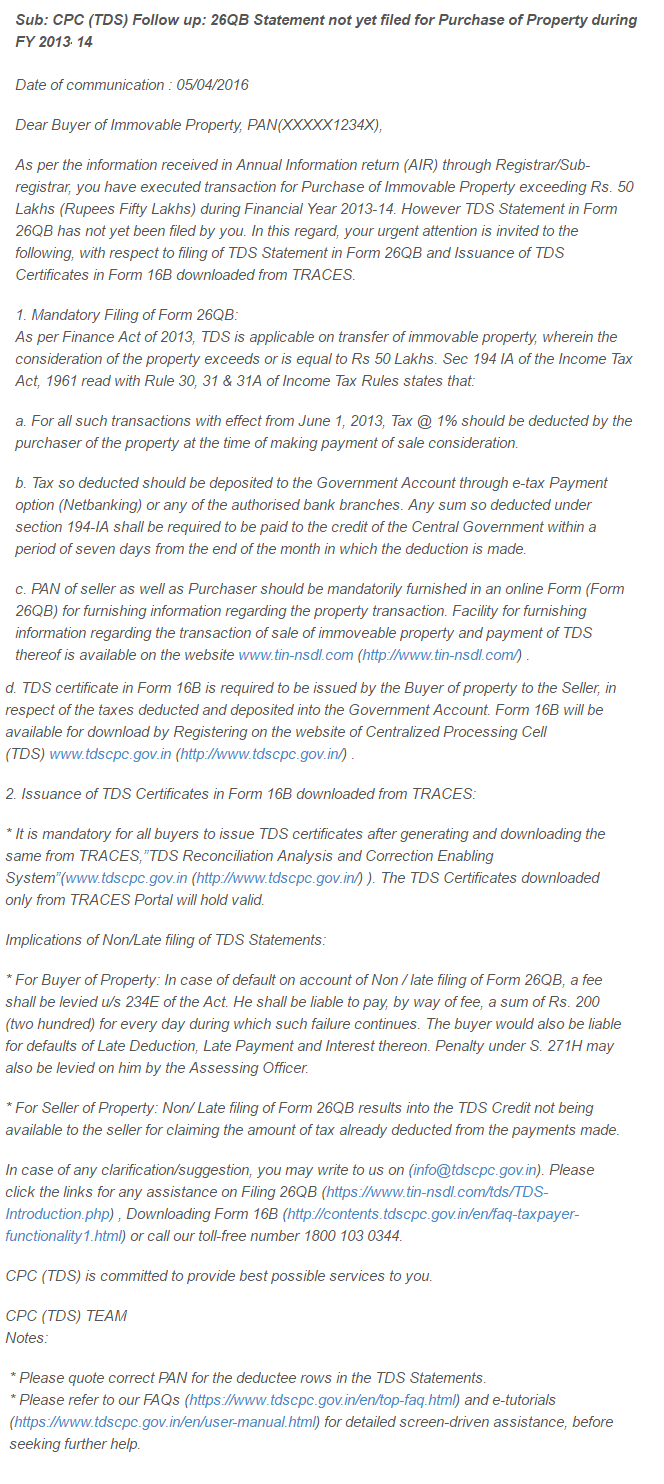

As per section 194IA of the Income Tax Act, buyers of property must deduct TDS from payment made to seller, if the sale price exceeds Rs 50 lakhs. This rule has been in effect since June 1, 2013. So, if you did not deduct TDS while making the payment then you might receive a notice. The notice is shown in image below. Excerpt from Income Tax Notice for Implications of Non/Late filing of TDS Statements Click on image to enlarge.

* For Buyer of Property: In case of default on account of Non / late filing of Form 26QB, a fee shall be levied u/s 234E of the Act. He shall be liable to pay, by way of fee, a sum of Rs. 200 (two hundred) for every day during which such failure continues. The buyer would also be liable for defaults of Late Deduction, Late Payment and Interest thereon. Penalty under S. 271H may also be levied on him by the Assessing Officer.

* For Seller of Property: Non/ Late filing of Form 26QB results into the TDS Credit not being available to the seller for claiming the amount of tax already deducted from the payments made.

In case of any clarification/suggestion, you may write to us on (info@tdscpc.gov.in). Please click the links for any assistance on Filing 26QB (https://www.tin-nsdl.com/tds/TDS-Introduction.php) , Downloading Form 16B (http://contents.tdscpc.gov.in/en/faq-taxpayer-functionality1.html) or call our toll-free number 1800 103 0344.

How does the Income Tax Department know you have purchased a property?

Annual Information Return (AIR) is submitted by Registrar/Sub-registrar, denoting and specifying the details of all the buyers who have purchased a property exceeding Rs 50 lakhs.

Why is the notice being sent now?

The income tax department recently matched the TDS data with the data they received from the property registrar for property transactions over Rs 50 lakh. Wherever there was a discrepancy , either the buyers failed to deduct or deposit the TDS, a notice has been sent

Overview of TDS on buying property

What is TDS on buying a property?

Overview of TDS on buying a property is given below, Our article Payment of TDS on Buying a Property covers the topic in detail.

- Buyer should deduct TDS at the time of payment to the seller. Note the buyer of the property needs to deduct the TDS BEFORE MAKING THE PAYMENT to the seller.

- This rule is effective from June 2013, if any property is purchased before 2013 and any payment for that particular property is made after June, 2013 TDS should be deducted.

- It comes under the Sec 194 IA, the Income Tax Act 1961.

- If the property sale price exceeds Rs 50 Lakhs(agricultural land is exempted from deduction of TDS) then the buyer has to deduct TDS at 1% of the total sale consideration.

- If PAN of the seller is not available TDS will be deducted at 20% by the buyer.

- If the payment is made in installments, then TDS needs to be deducted at the time of making each payment and it has to be deposited with the tax department.

- No surcharge and education cess is applicable while deducting tax on sale of property.

- TDS on Property is to be done online . The tax should be deposited through challan-cum-statement using Form No.26QB. The deducted amount can be deposited using ITNS-280 under the minor head-800. Our article How to pay TDS on Buying a Property explains it in detail.

- In case of multiple sellers, Form 26QB needs to be filed for each seller separately. Similarly, in case of multiple buyers, each needs to issue Form 26QB separately.

What are TDS implications if one buys property from Non Resident Indian (NRI)?

- If property is bought from Non-Resident Indian (NRI) then section 194-IA will not be applicable but section 195 will come into action.

- For NRI the limit of Rs 50 lakh is not applicable i.e even if the property value is less than 50 lakh say 20 lakh tax has to be paid.

- If property is bought from NRI, TDS is required to be deducted at the rate of 20%

- Education Cess also has to charges on the sale amount.

- Surcharge at the rate of 10% will be applicable if amount paid exceeds Rs 1 crore.

What is the due date of paying TDS deducted by buyer?

TDS is to be paid by the 7th of the next month in which the payment is made to the seller. For example If the payment is made in April, due date for paying TDS will be May 7th.

What about Seller of the property?

Form No 16B (TDS Certificate) will be issued by the buyer/deductor to the seller within fifteen days from the due date of depositing tax. This can be downloaded from the TRACES website.

- The payment of TDS is reflected on the seller’s Form 26AS under the head Part F within 7 days.

- Seller may not be able to take credit of TDS deducted in case of Non filing or Late filing of Form 26QB.

- Capital gains made from the sale of property along with the TDS information present in the Form 26AS have to be clearly shown in the seller’s income tax return.

- The amount deducted as TDS is allowed to be adjusted against the final tax liability.

- If the seller made a loss on the sale of the property, the seller can claim a refund of the 1% TDS in his income tax return.

There may be some leniency if the seller has already paid capital gains tax or claimed capital gains exemption (on the sale of property). So, if the seller has already paid the taxes, the buyer can submit Form 26A certificate from a chartered accountant and request that penalty under Section 234E should not be levied. Though this will save you from the late filing fee, the interest under Section 201 will still apply . (If you have faced the situation please share)

Examples of How much TDS should be deducted on buying a property

Buyer of the property has to deduct TDS at 1% of the total sale consideration.

- Mr. Kharbanda has purchased a property on 24th April 2016 of Rs. 60 Lakhs . He has to deduct Rs. 60,000 as TDS on making payment to the seller i.e he will pay Rs. 5940000 to the seller .Rs. 60000 will be deposited with the tax department using Form 26QB before 7th May, 2016. If the seller doesn’t have PAN, Rs. 1200000(20%) will be deducted as TDS.

- If the amount of property you have purchased is Rs 70 Lakhs, then you don’t have to pay tax only on Rs 20 lakhs(70L – 50L) but on the entire amount of sale consideration i.e. Rs 70 lakhs. the TDS would work out to be Rs 70,000.

- Mr. Khan had purchased a property on 24th April, 2013 worth Rs. 60 Lakhs. But as it was an under-construction property and one of his installments of Rs. 10 Lakhs were to be paid in 2016. The, the amount that was paid before 1st June 2013 is free from deduction of TDS. But the balance amount of Rs.10 Lakhs payable in 2016 is eligible for TDS. Any amount paid after 2013 is eligible for TDS deduction.

- Mr.Mehta bought property worth 1.5 Cr in Oct, 2010 and his amount due on or after June 01, 2013 is just 40 lakhs i.e. less than 50 lacs. Yes, even if amount due is only 40 Lacs which is less than 50 lacs on or after June 01, 2013 but since total property value is more than 50 lacs i.e. 1.5 Cr, the buyer is liable to deduct TDS on property sale and deposit with Govt. TDS will be deducted only on 40 Lacs instead of 1.5 Cr i.e. only on the amount payable on or after June 01, 2013.

- Mrs. Verma signed sale agreement on May 4, 2013 . If the agreement is signed before June 01, 2013 but either full payment or even part payment is due or made on or after June 01, 2013 than also she need to deduct TDS on property sale & deposit with Govt. This applies to under construction property also, on the payment/amount due on or after June 01, 2013. Please note that TDS is applicable only on amount due/payable on or after June 01, 2013 but not on the amount already paid before June 01, 2013.

What happens if the TDS is not deducted by the buyer of the property or TDS is not submitted to Government?

In case of non-compliance of buyer of property not deducting the TDS or paying TDS late one has to interest under section 201, but also late fee under section 234E of the Income Tax Act.

The buyer of the property has to pay Penalty under section 201:

If tax is deducted by buyer of the property and is not deposited by the 7th of next month of the month of deduction, but is paid at a later date. Then, Interest of 1.5% for every month or part of the month from the date on which such tax was deducted till the time it was actually paid. In simple words, 1.5% of the TDS amount from the due date till the date of late payment will be charged as interest. Lets see it with an example.

Example: Rs. 80000 tax was deducted on Apr 24, 2016, which required to be deposited with the government account till May 7, 2016, but if the same is paid on June 7, 2016 then number of months of default is 3, because part of April will be counted 1, full May & part of June will be counted as 1 month each, thus making a total of 3 months of default.

So Amount of Interest: Rs. 80000×1 .5% X 3= Rs. 3600

If tax is not deducted at all by the buyer on property

If TDS or tax is not deducted by the buyer of the property at all then interest at 1% for every month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted. Note: Interest calculated will be simple interest. The fraction/part of the month is considered as full month.

Example: Mr Sharma bought property in Apr 2015 for 80 lakh. Rs. 80000 tax was deducted on Apr 24, 2015, which required to be deposited with the government account till May 7, 2015, but he did not pay it. If the same is paid on June 7, 2015 then number of months of default is 3, because part of April will be counted 1, full May & part of June will be counted as 1 month each, thus making a total of 3 months of default.

So Mr Sharma has to pay = 80,000 + 800(1% of 80,000) *3 = 82,400

Penalty for not paying TDS on buying property under section 234E

In case of default of non-filing or late filing of Form 26QB, an additional penal fee along with the ones mentioned in Sec. 201 will applicable under section 234E of the Income Tax Act. Rs. 200 has to be paid for every day during which such failure continues. It cannot exceed the TDS which had to be paid. If Rs. 80,000 was to be paid by 7th May 2016, nut if the same is paid on 7th June, 2016, then late fee will be calculated as:

No. of days from 8th May to 7th June= 32 days.

Late fee= 32× Rs. 200= Rs. 6,400 or Rs. 55,000 (amount of tax) whichever is lower i.e. Rs. 6,400

For example, if TDS Amount is Rs 20,000 and delay is of 200 Days then the late fee is 200 X Rs 200 i.e. Rs 40,000. Lower of Rs 20,000 and Rs 40,000 is Rs 20,000 therefore max late fee penalty is Rs20,000. In Short, max late fee penalty cannot exceed TDS Amount

Penalty under section 271H

Assessing Officer may levy penalty under section 271H at his discretion. This section is applicable when a statement as required by the tax laws is not submitted timely. Penalty under this section is more than Rs 10,000 and can extend to Rs 1 lakh. However, if TDS is deposited with fee, applicable interest and ethical statement is submitted within 1 year of the time prescribed, no penalty shall be levied.

For those who missed to deduct the tax, get suddenly realise sometime and try to make the payment either from their pockets or with a mutual talk with the seller to reimburse later.

What to do if you received the notice under section 201 for non payment or late payment of TDS on property From Income Tax Department

For those who have received a notice, the immediate corrective step to avoid paying a penalty is to pay the TDS along with the applicable interest and late filing fee.The interest payable under Section 201 is 1% per month if tax wasn’t deducted and 1.5% in case this was done but not paid

How to make payment of such demand rasied by IT department

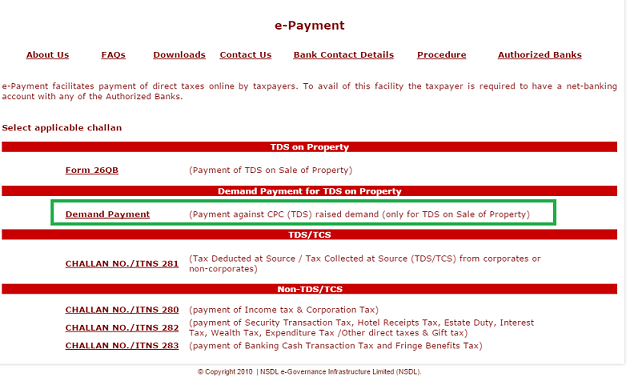

Under e-Payment option of taxes of NSDL, a link has been given as Demand Payment i.e. Demand Payment for TDS on Property which is a facility to make payment of demand raised by CPC-TDS against TDS on Sale of Property.

- Calculate payment according to the provisions specified under section 201 and under section 234E

- Go to: https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

- Select Demand Payment. (shown marked by green in image below)

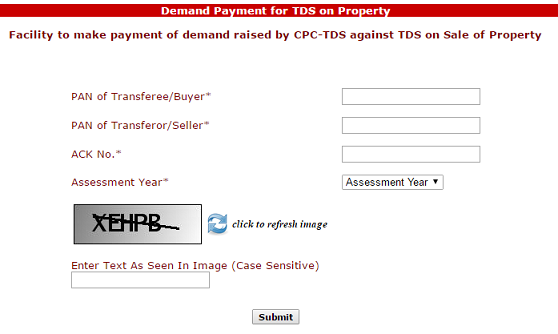

- This takes you to another window, all you need to enter details kike PAN of Transferee/Buyer, PAN of Transferor/Seller, demand Acknowledgement number. Enter these details and selection relevant assessment year and proceed for payment of demand amount.

Please provide details as present in Form for TDS on property. Please note TIN is not responsible for any mismatch in the details provided by Transferee/Buyer in the Form and the actual transaction of the Transferee/Buyer.

Related Articles:

- Payment of TDS on Buying a Property

- How to pay TDS on Buying a Property

- Tax : Income From House Property

- Income from House Property and Income Tax Return

- Joint Home Loan and Tax

Have you received any such income tax demand notice? What did you do? or still waiting to deposit tax or haven’t even deducted tax from the payment(s) made to seller of the property.

28 responses to “Income Tax Notice for non payment or late payment of TDS on Buying a Property”

I bought property and registered on 09.09.19 and submitted TDS through 26QB online on 13.09.19.still I got notice u/s 200 A for intt. on late deduction.why ? How can I appeal to tax authority?

Intimation u/s 200A of Income Tax Act 1961 is for errors in tds returns filed by deductor which can be due to following reasons.

Please check the notice again or email us at bemoneyawre@gmail.com

Invalid PAN – Where the PAN provided by deductor in tds return is invalid, it shall be deemed that the deductee has not furnished his PAN to the deductor and provision of section 206AA will apply i.e. deductor has to deduct tds at higher of the following rates –

Ø the rate prescribed in the Act / at the rate in force or

Ø at the rate of 20 %.

Deductor should check each and every PAN before filing tds returns. Where volumes of transactions are huge, deductor can used the Bulk PAN Verification Services provided by NSDL.

Short deduction / Short payment – Deductor has wrongly deducted tds @ rate lower than prescribed in section. For instance u/s 194C tds rate for Individual & HUF is 1% and for other person is 2%, however for firm; deductor has wrongly deducted tds @ 1% instead of 2%. And in other cases where deductor has made the short payment of tds to government.

No,PAN is correct .In justification report it says in Sr no 3a, as intt.on late deduction how this is late deduction?I hv deposited TDS online with in a week of property registration.what to do?

While filing 26QB, by mistake i have selected “Mode of Payment” as OFFLINE instead of ONLINE & reach the last page where it ask for download. Now can i fill the form again or do i need to pay offline in bank?

Try filling again online.

And do let us know

My brother bought a property in 2015-16 using the money i send from Ourside as i am an NRI. The property is registered in his name.

His salary is in 2 lacs range.

He now got a notice for not filling the income tax for the property.

Does he have to show from where he got the money ?

What should we do.

Property is in whose name?

Have you gifted the money to your brother or is it loan?

How did you send the money – cash or electronic transfer?

I signed Apartment Buyer Agreement with Builder in Noida in Feb 2010. In the agreement the total amount of Rs 47 Lacs was to be paid in instalments.

I have made all payments prior to 1June2013 without deducting 1% TDS.

After 1June 2013 I have made payments to Builder without deducting 1% TDS as the agreement amount was less than 50 Lacs.

Now final payment is pending and I understand that the Registration of property needs to be done at current Circle rates which makes the total amount for registration greater than 50 Lacs.

My total amount paid to Builder will still not exceed 50 Lacs.

Do I still have to deduct 1 % TDS for final Payment and all payments made after 1June 2013 ?

Very informative. I am an NRI and sold my inherited property to the buyer. He deducted the TDS claiming he will pay to IT. With the rest of the capital gains I bought property. The buyer of the property, who is also my CA , did not deposit the deducted TDS with the IT department. He said he will pay me the amount directly so I would not have to claim refund from IT. I sold my property in April 2014. He is still not giving my TDS back and neither is he giving to government. On my IT return which he filed has shown that I do not owe any taxes. How do I get the TDS amount from him? Is it legal for him to hold on to my TDS? My advocate advised him that this can be a fraud case but the buyer has been making one excuse or the the other when I ask him..

The broker and the advocate have signed off on the sale deed. He says once he sells his other property he will pay me. He has been making excuses for 3 years. Why should the payment of TDS depend on the sale of his property? We have told him time and again that we will file a complaint with IT but he says go ahead nothing will happen. How can he be so confident that he can get away with impunity?

Any advise on what course of action I should take?

Thanks in advance for your advise.

TDS is buyer’s responsibility. When Seller is NRI Buyer has to deducts TDS 20.60% u/s 195 and not @ 1% u/s 194

As your buyer is CA he must be using some loop holes. Your case seems a case of fraud. You are acting late. Buyer need to deposit TDS to the government account in ITNS 281 by 7 th of next month – you may consider sending him a proper legal notice – please check with a lawyer on how to proceed forward. But please be careful. Talk to a lawyer to understand your implications.

In a move to penalise late payers of TDS, the CPC TDS has started issuing intimation u/s 200A of the Income Tax Act’1961 to the deductors u/s 194IA i.e the buyers of property who have paid TDS U/s 194IA late. The CPC TDS is not only charging interest u/s 201, but also late fee u/s 234E of the Act.

In case of where the TDS is not paid to the Govt. account by the due date then under section 201 of IT Act 1961 interest will be levied and the deduct or (buyer of the property) is to be deemed as an assessee in default for failure to pay or for late payment of any TDS including TDS on immovable property

basic process flow for TDS deduction in case of property transactions.

Seller and buyer enter into a sale agreement

Buyer deducts TDS at applicable rate at the time of each payment

Buyer deposits TDS in government account

Buyer files TDS return

Buyer hands over TDS certificate to seller

Seller files tax return and claims credit for TDS deducted by seller

Seller gets refund of TDS

As mentioned earlier TDS deduction is the responsibility of buyer. Once the buyer deducts TDS, it is not over for seller. Seller will have to file a tax return in India, disclose this capital gain and also claim the credit for TDS – balance will be payable/refundable as the case may be. In short, deducting of TDS by buyer does not absolve seller from your tax filing responsibility.

In case seller is NRI, both buyer and seller TAN is required.

The conclusive proof that the TDS deducted by buyer is appearing in name of seller in ITD records is whether or not it appears in Form 26AS of seller. So, after getting TDS certificate from buyer, seller should login to the IT e-filing website incometaxindiaefiling.gov.in and download Form 26AS – if the amount is not appearing, he should check with buyer for any discrepancy in quoting correct PAN and if yes, request him to use the TDS challan correction process to revise the TDS return.

What does Seller have to do:

Seller has to go ahead and file the right taxes in India. Buyer will have to face tax, penalty and late fee implication for his mistake.

Facility to make payment of demand raised by CPC-TDS against TDS on Sale of Property

IN THAT 2nd step there is Intimation Number is asking what is the communications/ Intimation Number.

Dear Sir,

I have booked a flat and its under construction. I am regularly paying the TDS whenever I receive the demand letter from builder. however in two instances, i was delayed in payment of TDS and hence received demand notice from IT department levying late fee plus interest. In this respect, I have following two queries:

1) One demand notice was received on 27 March 2015 with a interest of 2794 and late fee of 20700 and thus net payable was 23490. I paid this amount today only i.e. on 21.11.2016. Will IT department again send me notice for the additional interest for the period of 27.03.2015 till today (i.e.21.11.2016) as I was delayed in payment of such amount?

2) After making the payment of 23490 through net banking, I only received the challan counterfoil from my bank in respect of this transaction. This is the only evidence I have which proves that I made the payment against the demand notice. Does IT department also issue any receipt as recipient of this amount? Do I need to collect such receipt from any other source like “Traces” website etc…. if yes, please advise the procedure to obtain it.

Your response to above issues will be highly appreciated.

Dear sir

I have purchased a old flat in Oct 2015. The value of the property is Rs.1.02 cr. All the transaction was done through cheque payment. I was not knowing the TDS formalities at the time of buying the property and not deducted the TDS amount. Kindly inform what is amount i need to pay now as TDS. Also seller is not interested to pay me the TDS amount. Is there any way to get the money back from seller legally. Kindly guide me

G.Aswin

Yes u need to deposit tds amount for that property as of now department is getting data from registrar of properties and than sending notices which may attract penalty of upto 1 lakh. Try to make the seller understand that this is necessary otherwise it will lead to a problem.

Hello

I booked a apartment with a reputed builder in NCR through the banks subvention scheme. The basic cost is approx 1cr. Since the booking in Jan 2015, the bank has been paying the demands without deducting TDS and the builder has been accepting the payment. Recently after 4 demands , i receive an invoice from the builder with a amount 17000 due(only for the last demand) ..when i enquired the answer was TDS not deducted of last demand. No invoice for TDS not deducted was received since 18 months.

I have not received any notice from IT dept.

the possession of the apartment is due dec 2017.

after reading several article i unserstand that i will have to pay the TDS with late fee and interest.

My question is how can i avoid paying any penalty which will be substantial (i read somewhere about submitting form 26A to avoid paying the penalty) can you please provide more information?

thanks

TDS on home loan is common area of confusion, Banks don’t deduct TDS for disbursement from Home Loan and in many cases Banks don’t inform borrower to deduct TDS . Best solution is that borrower should give it in writing to bank to deduct TDS. Bank can transfer TDS deducted from Home Loan disbursement to borrowers account. Borrower can complete formalities of TDS filing for each installment / disbursement and submit TDS certificate to Bank and the Seller.

In case of where the TDS is not paid to the Govt. account by the due date then under section 201 of IT Act 1961 interest will be levied and the deduct or (buyer of the property) is to be deemed as an assessee in default for failure to pay or for late payment of any TDS including TDS on immovable property.

There could be two scenarios;

a) If tax deducted is not deposited by the 7th of next month of the month of deduction, but is paid at a later date

b) If tax is not deducted at all

In first scenario where tax is not deposited by due date, interest at 1.5% for every month or part of a month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid.

In the second scenario, if tax is not deducted at all then interest at one per cent for every month or part of a month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted.

Let’s understand this with an example: If Rs. 55,000 tax was deducted on June 25, 2015, which required to be deposited with the government account till July 7, 2015, but if the same is paid on August 7, 2015 then interest calculations will be as follows:

Here number of months of default is 3, because part of June will be counted 1, full July month another 1 & part of August another 1 making a total of 3 months of default.

Interest Rate: 1.5%×3=4.5% then Amount of Interest: Rs. 55,000×(3×1.5%)= Rs. 2,475

Late Fee Applicable u/s 234E

In addition to above interests, a late fee of Rs. 200 per day u/s 234E will be levied subject to the amount of tax is to be levied for late filing of TDS statement i.e. form 26QB. Since form 26QB is treated as a statement (which generates TDS certficate as form 16B) prescribed u/s 200(3), therefore late filing of the same will attract late fee u/s 234E of Rs. 200/-per day.

Now how the late fee amount is arrired? Let refer above example, if Rs. 55,000 tax was deducted on June 25, 2015, which requires to be deposited on or before July 7, 2015. . But if the same is paid say by August 7, 2015 then, late fee will be calculated as follows:

No. of days from July 8, 2015 to August 7, 2015 = 32 days

Late fee= 32× Rs. 200= Rs. 6,400 or Rs. 55,000 (amount of tax) whichever is lower i.e. Rs. 6,400

thanks for the info. can you please answer

‘how can i avoid paying any penalty which will be substantial (i read somewhere about submitting form 26A to avoid paying the penalty) can you please provide more information?

since the idea behind the law is non payment of taxes, here in my case the builder has already paid the taxes.(not TDS though). can a form 26A be helpful.

thanks

Hi,

I missed paying TDS for the prop purchased in December 2018 as was not aware of such rule and paid the full amount to the seller.

I understand i will have to pay late fee and penalty now, but please help how can i make seller liable to pay me that 1% back. Legally does he get impacted if:

1. I have paid him 100% of amount instead of 99%.

2. I pay the tax from my pocket and as he did not pay me back, i do not pass the TDS certificate to him?

In summary, i am looking for ways to bind him to pay me back 1%.

Thank you!

My case is same as Vivek’s as I had paid full TDS from my account and nothing from my wife’s account so my wife got a notice. I also replied to their email saying that I have already paid TDS from my account and attached the challan however did not get any response from them. Can you please suggest what needs to be done further?

If you have already did a communication through mail then,What you need to to do is, reply to assessing officer by writing a letter with mentioning reconciliation of total TDS deducted and deposited. this is nothing but getting your self satisfied that no compliance has been left from your side to get this matter solved.

Since now a days everything is system based, such type of mistakes and lake of cautiousness from our side will lead to such type of things. But Write them letter with prescribing all relevant details along with copy of paid challan.

Since there is no revenue loss to government as TDS has been duly deposited not by all buyers but by one buyer ( With cumulation of all buyer) he will grant your case as resolved.

But do take care in future , always deduct & deposit tds with proper bifurcation between all buyers if property has been purchased in joint name.

Can you please explain process for getting relief from late filing fee as mentioned in the following paragraph of your article?

“There may be some leniency if the seller has already paid capital gains tax or claimed capital gains exemption (on the sale of property). So, if the seller has already paid the taxes, the buyer can submit Form 26A certificate from a chartered accountant and request that penalty under Section 234E should not be levied. Though this will save you from the late filing fee, the interest under Section 201 will still apply.”

Thank you.

I sold a property for 60lakhs. I sold it on June 2015. At the time of payment the buyer did not deduct TDS and paid me the money. Now after 1 year (July 2016) after registration he is saying he made a mistake of not cutting TDS. Now he has paid the TDS and asking me to pay him the deducted amount which he was supposed to deduct at the time of paying. I am not willing to make that payment. I want to know that will i face any legal action or receive any legal notice if i don’t pay that money?

Can any one reply on this on urgent basis.

What is the legal action of recovering TDS from seller if once buyer missed to deduct & made full payment.

It is the responsibility of buyer

You may have to reach out to the seller for recovery of the amount. Do note that buyer may have to pay interest @1% per month till the month in which the TDS is actually deposited. Or if the seller does not pay it buyer may have to deposit TDS himself.

In effect since June 2013, the regulation mandates that on sale of property exceeding Rs. 50 lakhs in India, a tax of 1% has to be deducted on the total sale consideration before making the payment to the seller.

The buyer must then deposit this 1% TDS to the Government. PAN of both the buyer and seller must be compulsorily specified while filling out Form 26QB to ensure that sellers don’t avoid taxes on the capital gains they make.

Very well explained. For comman man TAX AND DEATH are inevitable.

Very well explained. For comman man TAX AND DEATH are inevitable.

Me and my wife bought a joint property and I paid the 1% TDS from her pan card as she is the first owner of the house. Now I have got a notice on my PAN card.

Still Do i need to do something?

Me and my wife bought a joint property and I paid the 1% TDS from her pan card as she is the first owner of the house. Now I have got a notice on my PAN card.

Still Do i need to do something?