Income tax notice under section 143(1) is a message sent after processing return. It Compares your filed return with department’s computations. If you have received the income notice under 143(1)(a) due to variance in income as a mismatch with 26AS and the details are correct then You have to agree to the notice and file a revised return.

Table of Contents

Notice under section 143(1)

Notice under section 143(1) is simply an intimation in response to the tax return filed by you, which will do one of the following:

- The return filed by you matches the assessment of the AO and no further action is required

- You will be issued a refund, through the bank account stated in the return, as the amount of taxes paid is more.

- A demand notice, as you have paid less than the required amount of taxes and taxes are due by you, which will need to be paid within 30 days of receiving the demand.

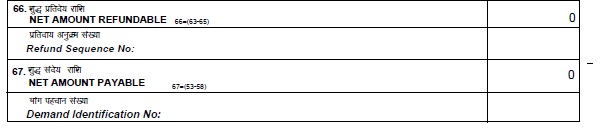

You should open the document sent in the email with the notice. Scroll down to the bottom and see what is net tax payable as shown in

Notice under section 143(1A)

Notice u/s 143(1A) is sent If there are any mismatches, such as you have not included in your return all the income as reported in your 26AS, then these computer-assisted notices will be sent seeking necessary clarification. You will need to respond to this notice within 30 days by logging onto the income tax portal and uploading the proof needed to correct the mismatch. Notice Variance due to Income From Other sources

If you have received a communication of proposed adjustment u/s 143(1)(a) notice, please read the article here. This is different from a 143(1) notice.

Income tax notice under Section 143(1)

When is the Income tax notice under Section 143(1) – Letter of Intimation served?

Three types of notices can be sent under section 143 (1)

- Intimation where the notice is to be simply considered as final assessment of your returns since the CPC or assessing officer has found the return filed by you to be matching with his computation under section 143 (1).

- A refund notice ,where Income tax refunds you for extra tax paid, then you can look forward to the cheque.

- Demand Notice where the officer’s computation shows shortfall in your tax payment. The notice will ask you to pay up the tax due within 30 days.

What is the time limit of sending the intimation?

The intimation is sent before the expiry of one year from the end of the assessment year in which the income was assessable. In other words, before the expiry of one year from the end of the financial year in which the return was filed.

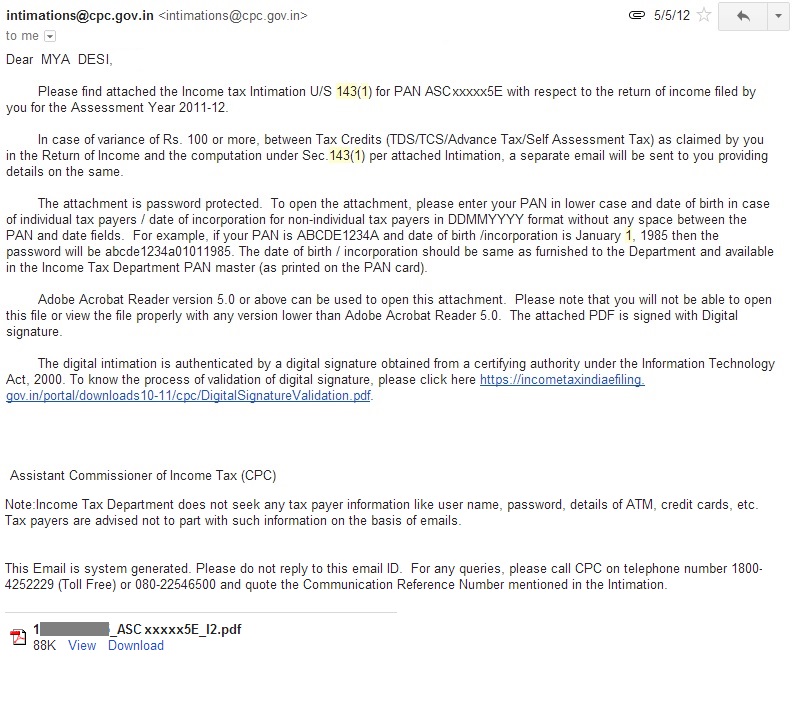

How is the intimation sent?

These intimations are sent through email to the Email address provided in filing income tax returns online. As e-return are processed by Central Processing Centre (CPC) sender is intimations@cpc.gov.in. For e-return hard copy will also be sent through post at the address associated with PAN number just like the non electronic filed ITRs. Our article Income Tax Notice :Sections,What to check,How to reply explains how to find address associated with PAN number.

Sample e-Mail sent with an attachment is shown in image below.Attachment can be a pdf file or a zip file.

As mentioned in email, attachment is password protect. Password is your PAN number in lower case, followed by your date of birth in DDMMYYYY format , for example for Mr Sharma with PAN number AJSPD8693E and date of birth as 20-Mar-1976 the password would be ajspd9693ed20031976

If it’s zip file extract the pdf and open the pdf.

The Document with Income Tax Notice 143(1)

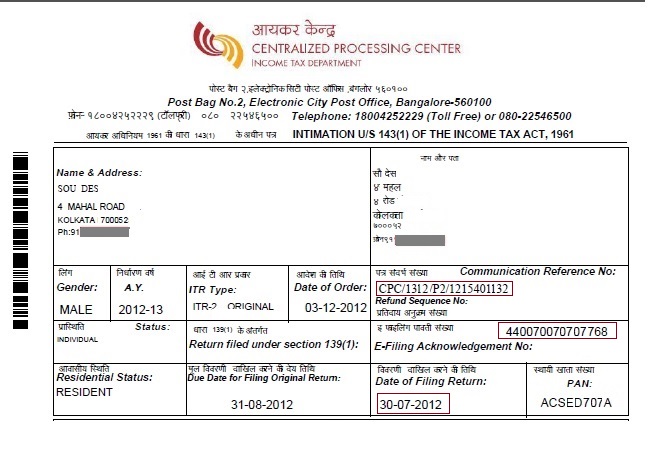

First part of the document has information on Name & Address, PAN number, ITR Type,A ssessment Year, E-Filing Acknowledgement Number ,C ommunication Reference Number, Date of Order as shown in the image below. Date of order is that Date on which order under section 143(1) was passed by the CPC Bengaluru . Please check that the intimation is for you only.

One can contact Income Tax Helpline/Toll Free Number of CPC Bangalore Income Tax Department (Bengaluru) at 1800 -425 2229 or 080-22546500 for Income tax queries. Before you contact you should have Communication Reference No (marked in image above) with you and remember your PAN card details like PAN Card number, Date of Birth

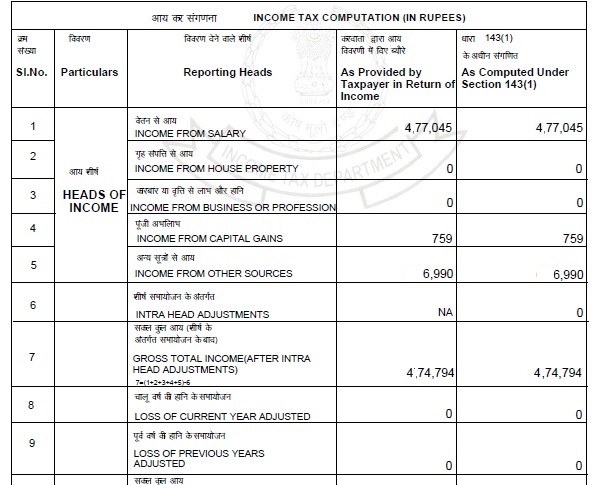

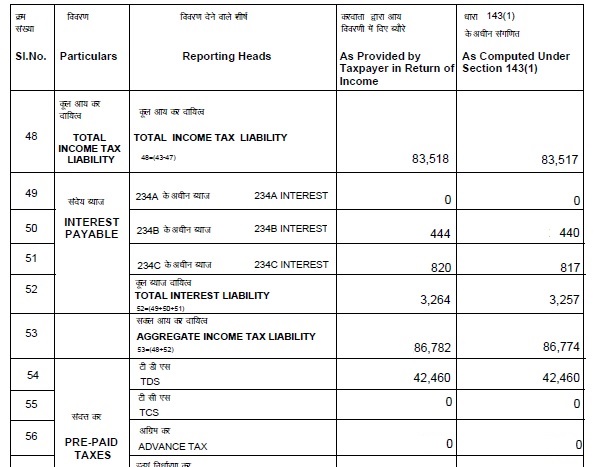

The second part of the document shows computation of income, with income reported under various categories, deductions claimed, taxable income, tax due, tax paid ex advance tax, self assessment tax, TDS, etc in two columns as shown in image below:

a) As provided by taxpayer in his Income tax return is from the ITR filed by the tax-payer.

b) As computed under section 143(1) are computations by CPC .

Part of document which shows Income type (Income from Salary, Income from House Property etc) is shown in image below. Note: The heads of income may be different depending on ITR filed by you. For example ITR1 will not have Income from Capital Gains. Please check that Income is considered properly under appropriate head. Income under one head of income is not considered as from another head or repeated under another head of income

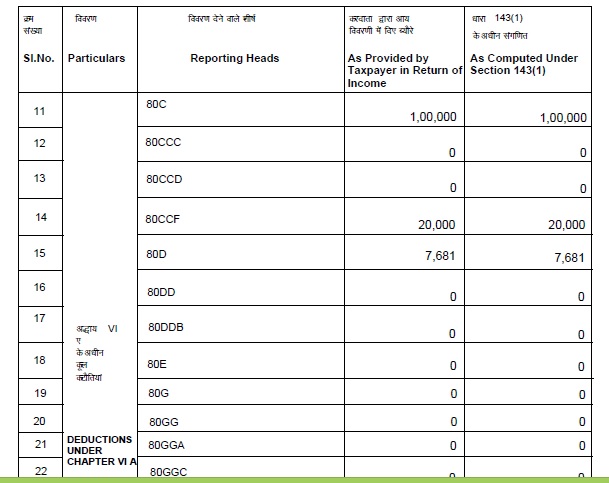

Computation in two columns in 143(1)Part of document which shows Deductions claimed under various heads such as 80C, 80D etc is shown below. Please check that deductions you have claimed under 80C and other sections of chapter VI are considered.

Part of document which shows the tax calculation is shown below.

Please check that TDS claimed, Advance Tax and Self Assessment Tax paid is reflected in the computation by CPC. CPC picks up the figures from your Form 26AS. Form 26AS is the tax department’s statement showing income tax deposited on your behalf and can viewed on TRACES website or through netbanking. One should verify Form 26AS before filing returns. If there are mismatches in Form 26AS with respect to Form 16/Form 16A then it has to be taken up with the accounts department of your company/bank and errors need to be rectified.

Small Difference in Calculations: You may see difference between the calculations in two columns for example total income after deductions As Computed Under Section 143(1) is 5 rupees more than the amount in Return of Income. This is due to Rounding of income and Income tax payable The income tax act suggests rounding off of income under Section 288A and the income tax payable Section 288B. This is discussed later in Rounding of Income and Tax

Scroll down and at the end of all calculations you would see two headings Net Amount Refundable and Net Amount Payable as shown in image below.(Row numbers may be different)

If net amount refundable mentioned in Intimation under section 143(1) more than 100 rupees, it means that tax refund is due from income tax department to tax payer. Refunds amounts less than 100 rupees aren’t refunded. You can check refund status online. He will first receive this intimation on mail then a manual intimation along with the refund cheque will reach his address. On receiving the cheque, one can deposit the cheque .

If net amount demand mentioned in Intimation under section 143(1) is more than 100 rupees, then tax payer needs to pay tax . This will be treated as demand notice for the payment of income tax due. This Intimation letter encloses challan form to pay income tax if the due is more than Rs 100. In case of Demand, this intimation may be treated as Notice of demand u/s 156 of the Income Tax Act, 1961. Accordingly, you are requested to pay the entire Demand within 30 days of receipt of this intimation“. If tax payer thinks that

- Tax Demand is valid : he needs to pay the tax.

- Tax Demand is wrong : then he must prove his case following appropriate procedure. He may make an application for rectification under section 154. He may consult a qualified CA or good tax expert for further action. However,sometime return processing by CPC becomes difficult and the taxpayer may contact local income tax officer (ITO) and submit a written application for rectifying your assessment. Support it with his TDS statements, Form 26AS, intimation under section 143 (1) and notice of demand. In a plain paper he can also submit an application for Stay of Recovery. Proceedings for requesting them to hold further proceedings till rectification is made.

If net amount refundable/net amount demand is less than Rs 100 or no difference, you can treat Intimation under section 143(1) as completion of income tax returns assessment under Income Tax Act.

Rounding off Income and Tax

Section 288A : As per section 288A of the Income Tax Act, the total income computed as per various sections of this act, shall be rounded off to the nearest Rs 10. For the purpose of rounding off, firstly any part of rupee consisting of paisa should be ignored. Thereafter, if the last digit in the total figure is 5 or greater than 5, the total amount should be increased to the next higher amount which is a multiple of Rs. 10. If the last digit in the total figure is less than 5, the total amount should be reduced to the nearest lower amount which is a multiple of Rs 10. This rounding off of income should be done only to the total income and not at the time of computation of income under the various heads. Eg: If total income is Rs. 7,83,944.50 gets reduced to 7,83,940 while if income had been 7,83,945.50 it gets rounded off to 7,83,950.

Section 288B : Rounding off Income Tax As per Section 288B of the income tax act, the total tax computed shall be rounded off to the nearest Rs 10. The rounding off of tax would be done on the total tax payable or refundable and not to various different sub-heads of taxes like income tax, education cess, surcharge etc. Rounding off would be done in the same manner as above i.e.. firstly paisa would be ignored and thereafter if the last digit in the total figure is 5 or greater than 5, the total amount should be increased to the next higher amount which is a multiple of Rs 10. Eg: If the total tax payable of a taxpayer is Rs. 79,223.25 gets rounded to 79223 and then to 79,220, while Rs.79226.25, gets rounded off to Rs 79226 and then to Rs 79230

Related Articles :

- Income Tax for Beginner

- Paying Income Tax : Challan 280

- Filling ITR 1-Form

- Articles for Income Tax arranged at our webpage Income Tax

Hi I am a State Govt. Employee and my tax deducted as TDS. I have claimed Rebate of Rs.3500/- U/s 89 in my returns for AY 2018-19 (being arrears of Revision of Pay Scales pertaining to FY 2014-2015 paid by the State Government in FY 2017-2018) so I was getting a refund of Rs.500/- in ITR1. I have filed Form 10E also online showing the arrears received pertaining to the previous period. My ITR1 was processed by the IT Dept. but I received intimation U/S 143(1) showing that the rebate U/S 89 as Rs.0/- in the column “As computed U/S 143(1)”. Thus after adjusting my refund of Rs.500/-, Net amount payable is Rs.3000/- as computed U/S 143(1). I paid the amount through Bank Challan. what should I do next?

Should I submit a revised ITR1 as I have paid the demanded tax? If yes, under which Section? Please provide detailed steps.

Hi

I have received the notice today for FY 2016-17 where they have changed the deduction under section 80TTA to 0 and are asking to Pay Rs 3500 including interest and Penalty. This is only mismatch. Can you help on how exactly should I proceed with this

You have to verify that the demand is justified.

Whether you approve or not

Consult a CA if not sure.

If you want us to look at it we charge Rs 250 and need notice, ITR and Form 26AS to our email id bemoneyaware@gmail.com

You can pay through https://www.instamojo.com/learntalkmoney/consultation-4690a/

. F. Y 2016-17 assessee files a return by showing refund Of 18000 and he got tha Same amount of refund.( here taxable income is 49000 only)…

But after completion of refund process, mistakenly filled the return once again by showing taxable income is 1450000 and tax payable is 230000… In this case we received a notice u/s 143 (1) That net payable tax amount is 230000..plz help me that how to solve this notice belongs to mistakenly filled return .

You have to file the revised return for FY 2016-17.

I have received this notice. In the 2 columns (ie tax payer column and section 143(1) column) everything was same except refund amount. In taxpayer column it was 41,140 Rs and in section 143(1) column it was Rs 42,141 . So what shall I do? Please help

I have received this notice and in the 2 columns (ie taxpayer and section 143(1)columns) everything was same except refund amount. In taxpayer column it was 41,140 and in section 143(1) column it was 41,141. So what shall I do?

It means that you are going to get a refund of 1 rupee more than you claimed.

Wait for your refund of Rs 41,141!

Hi,

Thanks for your informative blog.

I am an NRI who has only income from house rent but as i have taken loan due to the loan EMI I get loss from house property which is -151,249 which I had shown last year in ITR1.

I got intimation 143(1) as follows

HEADS OF INCOME-

Income from house property

as provided by tax payer ———– (-151,249)

as computed under 143(1) ——— (-1,51,249)

Income from other sources

as provided by tax payer ———– (521)

as computed under 143(1) ——— (521)

GROSS TOTAL INCOME

as provided by tax payer ———– (-1,50,728)

as computed under 143(1) ——— (0)

what do i take from this statement as they have acknowledged the los of income under house property but under gross total income it shows zero against the loss of 1,50,728.

This year I will be filing ITR2 as from AY2018-19 NRIs can not file ITR1.

I want to carry forward this loss from last year. can i do it ?

Please clarify after looking at the above statement.

Thanks

Peeyush

As your income is less than 2.5 lakhs which is the minimum income you don’t have to pay any tax.

Just go down a little in your notice and verify that Net tax payable is 0.

You can carry over the loss from house property but your income from house property has been adjusted in this year so why would you carry over?

Thanks for the quick reply

yes the net tax payable is 0

I wanted to carry over just in case there is a future income where it might help to offset. I am in to equity investments also. now with the LTCG of 10%coming in

if i sell any of my equity long term investments can those be offset with this carried over loss? what all incomes are elligible for offset against loss from house property?

one more question I have is if i have long term capital loss on equity selling can that be offset with long term capital gains on equity now that LTCG is taxed?

Hi,

can you please let me know if its fine to carryover losses as I have explained above to offset with any future income.

an can longterm equity gains now be offset with longterm equity capital loses?

Hi team,

I rec’d intimation u/s 143 1 in which i identified amount of tds is incorrectly filed in TCS column and also there is an difference of amount paid and claim. Please assist me how to rectify this issues

Without seeing the notice and ITR filed it’s difficult to suggest.

You should try contacting a CA or mail the details to our email id bemoneyaware@gmail.com

Hi,

I also received same communication from CPC.

Income as per Form 26AS which has not been included in computing the total income in the return-143(1)(a)(vi) (vi)

Sl.No Income as per Income

Tax Return

Amount paid/credited as

per Form 26AS

Variance

(i) (ii) (iii) (iv)= (ii) – (iii)

Other Sources 0 181737 181737

i’m not sure what to do here ? Do I need to contact customer care ?

Thanks,

Ankita

hi

I got same message

It seems that you have not included income which is in Form 26AS.

That income is Income from other sources

Please check our article How to agree to income tax notice under 143(1)(a) due to variance in income and file revised return for

Hi

I got a section 143(1) notice requesting to pay Rs. 1330. I paid the amount by netbanking. Now my form 26As as of today is reflecting it along with Self Assessment and other than TDS part. Should i refile my IT return or any other forms in the IT website or simply be happy with the Form 143 as final tax demand?

You have log in to the income tax website and agree to the outstanding demand and fill in details.

How will Income Tax department know otherwise that you have paid.

Hello Sir,

Need your help on ITR, recently I got Intimation U/S 143(1) for PAN.

As I checked, In My TDS I can see 2 TAN numbers, but ITR considered only one TAN number for processing. due to this As Computed Under Section 143(1) is getting mismatch amount (around 29,652)

Can you please do advise me on this.

Below details are mentioned in PDF file which I got from ITR department.

(1) TAN of Deductor/PAN of the buyer: MUMA14563D

(2) Amt. Claimed under TAN of Deductor/PAN of the buyer: 45,093

(3) Amount Matched: 15,441

(4) Amount of Mismatch: 29,652

(5) AY -2017

(6) Valid Tan Flag-Y

Note: Mismatch amount 29,652 is under My second TAN: MUMH07058C

Please do the needful.

I am a tax consultant and would like know more about your situation here. There are no charges from our side and would like to discuss about your filing.

Please respond with your contact details.

I got an intimation us 143(1) showing outstanding tax demand of 2600/- .

I had paid 2300/- as tax when I had originally files the self assessment ITR. It shows difference in 234B of 300/-.

Do I have to pay the whole 2600/- as seen in net amount payable or the difference as 2300 is already paid when I had originally filed the return. Also, when I went online in My account on the incometax e filling website; under Response to O/S Tam demand, it shows “no records found”. Am I suppose to pay or not?

There are 2 parts of the question: Interest under section 234B which had to be paid.

This explains section 234B

If you have to pay Rs 10,000 or more in taxes in a financial year, the advance tax may be applicable to you.

Advance Tax means paying your tax dues based on the dates (usually quarterly) provided by the income tax department. If you don’t pay advance tax, you may be liable to pay interest under section 234B.

Interest is calculated @ 1% on Assessed Tax less Advance Tax.

Radhika’s total tax liability is Rs 48,000. Radhika paid this amount on 12th June while filing her return.

Radhika’s total tax liability is more than Rs 10,000, she was liable to pay advance tax. Therefore, Radhika will be liable to pay interest under section 234B.

Interest calculation

Rs 48,000 x 1% x 3 (April, May, June)

= Rs 1,440

Radhika is liable to pay Rs 1,440 interest as per section 234B.

You would have to pay 300 only. Please read out article How to respond to Income Tax Outstanding Demand Notice? for more details.

Second part of the question is:

After paying the self assessment tax did you update your ITR?

As explained in our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

After paying income tax through Challan 280 what next? Is your responsibility over? No. You need to show the tax paid in your ITR, If you have paid Self Assessment tax through Challan 280 fill in the details in Tax paid and make sure that your tax liability is 0 before submitting the return.

Please verify your Form 26AS to see that 2300 is reflecting against your PAN

Part C of Form 26AS has details of Tax Paid (other than TDS or TCS). If you have paid Advance Tax or Self Assessment Tax it will appear in this section. Please verify that advance tax or self assessment tax details are showing up in Form 26AS, If they don’t match with your details please contact the Bank.

Hi,

I have filed my ITR without paying self assessment Tax. So I have received the demand notice(U/S 143(1) from the IT department. After getting the notice also, I did not see the “Response to outstanding tax demand” link in e filing portal to pay my tax due. So I have paid self assessment tax in online (using Challan 280) and I have taken the print out of that counterfoil.

I have a doubt now, Is there anything I need to do from my side like revised return or self assessment tax which is paid will automatically reflect in filling portal?

Kindly clarify.

Thanks & Regards

Perose Khan. H

How soon did you pay Self Assessment Tax? Check after 2-3 days.

Hello,

I got notice regarding Adjustments u/s 143(1)(a).

When I go to the website to accept the proposed addition of income [due to mistake in claiming 80C deduction] of 10518 it says “An additional income of 21036 will be added”. This is double of 10518. It is adding both under deduction and gross. Should I accept both addition and file revised return by adding 10518 in my gross?? And not worry about the 21036 message??

Do you disagree to the demand?

One way is to disagree to all the rows and attach the same proof (80C)

If you agree to one then you can disagree to other rows and say that you are disagreeing because you are worried about double the amount.

Important is to file the disagreement timely and submit proof.

I have the same problem that of Arpit Gupta .. kindly guide how to do E proceeding it I disagree to addition for any of two. It asks for deductor details wat to fill in that?

Hi Sir,

I filed the return for AY-2017-2018.

The 143(1) intimation indicates that

S.no Reporting Heads As Provided by tax payer As computed under 143(1)

in Return of Income

32 TOTAL INCOME TAX LIABILITY 1500 1501

41 SELF ASSESSMENT TAX 1500 1500

47 TOTAL INCOME TAX REFUND 0 0

48 Tax Payable NET AMOUNT PAYABLE 0 1

49. Total outstanding demand and interest payable under sec220(2) 0

to the extent adjusted with refund amount.

(Please refer to the Annexure – Outstanding Demand details attached

, to know the outstanding amounts in detail, if any)

50. NET AMOUNT REFUNDABLE 50=(47-49) 0

51. Refund Sequence No:

52. NET AMOUNT PAYABLE 52=(37-42) 0

53 Demand sequence No :

So, from the above details of 143(1) intimation , the row 41. Net amount Payable is 1, whereas row 52.NET AMOUNT PAYABLE is 0

There is no demand nor any demand sequence no

The online return status says the following:

Activity/Status Download/Status description

——————– ——————————————–

ITR Processing completed –> Date of order – 09 Aug 2017

–> Date of SMS – 09 Aug 2017

–> Date of Email – 10 Aug 2017

–> Email Address – @gmail.com

–> Please click here to submit rectification request

So, The Net refundable amount in row 50 of 143(1) is zero and the status says “ITR Processing completed ” and also has a link for rectification request.

I didnt receive any SMS, but only the 143(1) intimation through email.

I have two queries:

Q.1. Do i have to rectify and pay rs one or i need not do anything and the process is completed for this AY?

Please help me as you say in the article , as per the article section rounding off section 288A and 288B, the net amount payable will be zero ( if it is less than rs 5 and in this case it is rs 1/-)

Q.2. If i dont have to pay any amount, then why is the status/ description column has “Please click here to submit rectification request” link against the online return status? This is creating all the confusion

Please clarify on the above two questions?

hi sir,

Can you pls let me know on the above two queries?

Thanks

Congratulations you have successfully completed your ITR returns.

A1. No you don’t have to pay anything. Infact till amount 100 Rs one does not have to pay anything.

A2 That is a Bug in software.

Thanks a lot for the clarifications.

You are welcome

Sir,

I have successfully e-filed my returns for A.Y-2017-2018. The refund amount was credited into my bank acct during second week of August -2017 ( i received message from from IT saying that refund is processed and an email from the bank saying that the refund amount has been credited into my acct) But the status of the IT return is still showing “Successfully e-verified -> EVC accepted”. Also, I haven’t yet received the 143(1). Request you to please let me know, when will it move to ITR processed state. Do i need to call the CPC processing center for any further information?

You can call up CPC

Refund /Refund re-issue, Rectification, Notification & Processing 1800 425 2229

Taxpayer queries at CPC, Bangalore will be answered between 8:00 AM to 8 PM. The services are available in English, Hindi, and Kannada.

I got Intimation 143(1) (a).

1. Variance 50000 – Deductions claimed in return but not in Form 16

2. Variance 50032- 29 Rs income and 7 Rs TDS mentioned in 26 AS form for SBI Bank but not mentioned while filing return

I can response to first point by disagreeing and attaching saving proof.

But how can i response to second point.

Hi,

I recieved communication 143(1)(a) a couple of days ago. At first, this did not show up on my account on incometax site. But today it showed up. The difference between income as per form and income as per return is the amount I filled up as income from savings account interest (Rs 5550). I did not search for this online and in panic, on the site “Agreed for addition” , and filed the revised return, but did not change anything on it.

Now I see on this site that this is an error from IT dept. Please advice if I need to do anything here.

Most of the people who are salaried/Pensioners are getting intimation u/s 143(1)(a). IT department (efiling) is pointing out additional income which is actually deductions under chapter VI-A in which deductions u/s 80C, 80D, 80TTA etc and IT department has considered it as “Zero” as per there record of form 16 /Form 16A . Which shows that C.A. of cocompany/ bank has not uploaded such details of deductions which employee has reported to his/her company/bank who is responsible for issue of Form 16 bearing Part-A and Part-B. IT deptt is sending notices to such persons whose return is not exactly matching with Form16/16A. From A.Y. 2017-18 IT deptt is matching form 16, Form16A and 26AS and giving harassment to honest tax payer. More over website does not show any demo/instructions how and what to fill in all columns. This link is not user friendly, which is very confusing even C.A. is unable to tell it. We got duly signed Form 16 along with Part-B ( From traces) which shows deductions under chapter VI-A, we don’t understand why CPC Bengaluru said that our return is not as per Forn 16 and they say this amount also to be included in taxable income.

Sir For AY 2017-18 or FY 2016-17 many are receiving Income Tax Notice which says Communication of proposed adjustments u/s 143(1)(a) for PAN such as following. Please do not panic. You have 30 days to respond. It seems that CPC has sent such notice by mistake and they will be sending revised communication soon. if notice is genuine then you have to go for eAssessment/Proceedings as explained in our article here

Hi ,

How did you communicate to CPC . Kindly share the communication detail .

Thanks.

I got an email from IT department with subject “Communication of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961.”

Under ‘Part – A – Adjustments u/s 143(1)(a)’ section below amount is shown, which I am not sure about. Could you please suggest, what can be done? Thanks.

Form 16A/16-Other Income:

Income as per Return (ii): 0

Income as per Form (iii): 93499

Proposed addition of income (iv)= (ii) – (iii): 93499

Hi Team,

Could you please let me know if any action need to take from my side on this kind of notice?

===========================================================================================================

Part – A Adjustments u/s 143(1)(a)

Sl.No Form used for comparison Income as per Return Income as per Form Proposed addition of income

(i) (ii) (iii) (iv)= (ii) – (iii)

Form 16-deduction 158979 98979 60000

Form 16-Taxable Total Income 412720 472717 59997

===========================================================================================================

Thanks,

Achal Choudhary

If you have claimed investments under Section 80C or HRA that are not mentioned in your Form 16, you are likely to receive an email from the Department asking you to explain the mismatch.

Taxpayers who have also had savings bank account interest or income from fixed deposits or house property that’s not included in the Form 16 may also get this email.

How should I respond to this notice?

Gather all your supporting documents (rent receipts, life insurance statement, home loan interest certificate etc).

Then log in to the Department website and go to E-Proceedings > E-Assessment/Proceedings

Select ‘Submit’ on the next screen

You will see a list of all mismatches here same as the ones you’ve received in the email.

Click on the dropdown under Response

Agree to addition: If you have forgotten to include income from fixed deposits etc that are mentioned in your Form 26AS, select this option.

Disagree to addition: If you have added deductions in your tax return directly and have necessary proofs for it, then select this option.

When you disagree, you’ll see a section open up where you can select from a list of reasons. You’ll also need to attach supporting documents before you submit your response.

For HRA, select the reason Allowance exempt claimed in return but not in Form 16

For all Section 80 deductions, select Deductions claimed in the return but not in Form 16

Thank you for you help.

Currently, I cant see anything under E-Proceedings > E-Assessment/Proceedings.

For AY 2017-18 or FY 2016-17 many are receiving Income Tax Notice which says Communication u/s 143(1)(a) for PAN such as following. Please do not panic. You have 30 days to responsd. It seems that CPC has sent such notice by mistake and they will be sending revised communication soon. if notice is genuine then you have to go for eAssessment/Proceedings as explained in out article.

Thanks for update.

Should I revised my return once for safe side?

Thanks.

Achal

Hi

Can you please tell me whose TAN number hasbto be updated in reply of notice and what is schedule number ?

TAN of the employer if it is related to Salary and of Bank if related to Fixed Deposit Interest/Income from other sources.

Check the Video in our article Income Tax Notice: Communication of proposed adjustment u/s 143(1)a

Hi,

I got a similar notice, wherein deductions as per form (what CPC considered) are less than what I considered in return. That’s the first amount as a discrepancy.

And because of that, my taxable salary becomes more according to form (what CPC considered) with the same amount.

I called up CPC helpdesk and found that this email is sent by mistake to many people, and CPC will send a revised communication to ignore this email.

You may also reach out to CPC just to be double sure about it!

Regards,

Nirav

Thanks a lot for message Nirav.

Hi Team,

Received Adjustments u/s 143(1)(a) notice from IT. Below are the details :

There are 2 lines I found in notice:

Line 1::

Form used for comparison: Form 16-deduction

Income as per Return: 61566

Income as per Form: 41436

Proposed addition of income: 20130

Line 2::

Form used for comparison: Form 16-Taxable Total Income

Income as per Return: 875840

Income as per Form: 895971

Proposed addition of income :20131

Could you please let me know what kind of action should I take at my end? What is the source of error for above scenario?

Same here i got this as well. what kind of action should I take? or We can ignor this as only minor diffrence between Proposed addition of income in Forms (60000-59997)= 3.

——————————————————-

Part – A Adjustments u/s 143(1)(a)

——————————————————-

Form 16-deduction

Income as Return 158979

Income as Form 98979

Proposed addition of income 60000

——

Form 16-Taxable Total Income

Income as Return 412720

Income as Form 472717

Proposed addition of income 59997

Thanks,

Achal

You can ignore Proposed addition of Taxable income which is due to rounding off.

But please check Form 16 deductions.

You are claiming deductions of Rs 158979 as per your return but Form only shows 98979.

So there is question of missing 60,000?

claims under 80c ,80g,80d …might be totalling to 60000/..

This claim seems to be not accepted by CPC. Comparing the net taxable income as per our return with our Gross Income (inclusive of our deduction claim) will show the same .First row tells your claim under 80c,cc,d,gg not taken.hence the difference.

second row tells our taxable income as per return and the taxable income as per CPC including our claim under deduction.

But in e proceeding,if we submit to agree,the taxable income should be excess by either Rs60000/59997. But it totals both and looks funny. So in E Nivaran i have asked guidance, since Tan No and other details which i feel non relevant here- Only proof for investments under 80C/80CC,80D,80G Scanned and self attested copies they can ask us to upload to satisfy themselves for consideration under exemption.

I also get this kind of email.

I am not coming under taxable income

But want to know, Should I need to update anything from https://www.incometaxindiaefiling.gov.in

I got one notice today: — Communication u/s 143(1)(a) for PAN—

I have been filing ITRs for 6-7 years now and never faced this issue. Really pissed. In my notice, the Proposed addition of income is Rs. 7269 (and that’s exactly I claimed in Section 80TTA as it was the total Savings Interests).

I checked all the documents and everything looks good, I don’t know why I got such a notice. Is it that the new government stopped 80TTA benefit now ? (they are in power for 3 years, I don’t know why would they do it now?)

Should I just make the claim under 80TTA from Rs. 7269 to “Zero” and pay the balance tax by filing rectification application, if there is no other option? I don’t want to do that, but seriously its a dumb way for government to make money by cheating its citizens.

I too have received Communication u/s 143(1)(a)(vi) from IT department for Addition of income appearing in Form 26AS or Form 16A or Form 16.This notice is incorrect as i have mentioned the same Gross total income as appearing in my form 16 issued by my employer. It appears that either system of income tax department is faulty or they have not considered the loss from house property (Interest on home loan) & exemption under 80TTA shown by me. What should i do now? Should i make a reply and attach all bank interest certificates. Response is also asking for TAN No., deduction made etc. Please guide.

80TTA is stiff effective.

Without seeing the notice and associated documents it is difficult to guess?

Did you show Interest from bank account as Income from other sources?

Please check the article Interest on Saving Bank Account : Tax, 80TTA,ITR for details

You need to add interest from saving account to Income from other sources and then claim deduction under section 80TTA. If your total interest income from ALL your saving bank accounts

My brother got the same intimation just now. Same 80TTA issue. Seems like there is a bug with Income Tax software.

I have shown interest from saving bank accounts as income from other sources. This amount is Rs. 7000/- only and have claimed deduction of same u/s 80TTA. The income tax department system has not considered this deduction. Similarly, they have not considered the loss from house property which is due to interest paid on home loan during FY 2016-17. In a huryy to make their masters happy, it appears IT has decided this time to not allow any deduction and issue notices u/s 143(1)(a)(vi).

Sir, I have 2 queries:

1) I received notice u/s 143(1) for return filed for year 2015-16 with no difference in tax to be paid or refund to be received. Both are nil. Though my income for that financial year does not come under tax bracket, can I expect any scrutiny from ITD? I’ve read online that scrutiny can still happen after notice of 143 (1). I filed return for the first time this year in March 2017.

2) After receiving notice u/s 143, can I revise my return ? As I forgot to mention investments in my return which gets exempted from tax like Atal pension yojna and PM jeevan jyoti beema yojna.

Please clarify.

Scrutiny can happen any time. You have to keep tax proofs for 7 years.

In Mar 2017 if you filed for FY 2016-17 or AY 2017-18 for which last date was 5 Aug 2017 you could have revised your return.

As you have filed afterwards you cannot revise your returns.

TDS AMOUNT IS RS 100 AND REFUND IS 100. DEPT SAY NO DEMAND NO REFUND. ON CONTACTING CPC, IT WAS TOLD THAT REFUND WILL BE ISSUED IN NEXT ASST. YEAR. IS IT TRUE.WHETHER 100 WILL BE REMAINED UNPAID AND ASSESSEE HAS TO SUFFER

Removed: Please don’t leave your address and details on the public forum.

My taxable income of assessment year 2014-15 (Financial year 2013-14) was 325850, as per tax calculator tax on this income is 10903 and tax dedcuted for this F.Y (2013-14) was 10903. Still outstanding demand of 12190 is determined, please let me know how to proceed on this.

Srr, I paid my Income tax while submitting income tax return whatever show under payable category.

but in Intimation 143(1), it is still showing same amount as payable.

Can you please let me know how to proceed on this.

Dear Sir,

I got a notice 143(1), which says that:

32. Total Income Tax Liability:

As provided by Tax Payer in Return of Income: 2014

As Computed Under Section 143(1): 2014

48. TAX PAYABLE:

As provided by Tax Payer in Return of Income: 2010

As Computed Under Section 143(1): 2014

My 26AS shows that I have payed 2010.

Please suggest what should I do.

Hi I received intimation U/s 143(1). As per the computation the Total Tax liability on me and TDS deducted is correct. I do my filing on my own on IT website. As per computation it was a refund of Rs. 7380 but as per 143(1) it shows Rs. 7375 further it computes further refund of Rs. 3 (delay attribute to tax payer in months) and Rs. 37 (interest U/s 244A on Refund) so total Tax refund compute to Rs. 7,412 against Rs. 7,380.

I received a total refund of Rs. 7520 in excess of Rs. 110. This Rs. 110 is a Net amount payable with a demand identification no.

Please help/suggest what can be done. This becomes painful for no mistake of mine.

Sir, I got an intimation under section 143(1) and there is difference of only 1 rupee under the TDS I claimed and TDS shown in 26AS i.e. I mistakenly claimed Re 1 more in TDS, though my tax payable and refund still shows as Rs. 0.

Do I need to file any rectification for this?

No you don’t have to do anything. You ITR has been processed.

Sir I have received an Income Tax Intimation U/S 143(1). Actually, I had claimed Rs. 3050/- under the category Tax Collected at Source. But the notice said that there are no evidence for this claim. Then I rechecked Form 26AS, where I found that actually the amount of Rs. 3050 should be claimed under Tax Deducted at Source.Now I want to rectify this mistake.

How can I file the revised return? Or there is some other procedure to file the reply to this notice.

Sir, I forgot to upload form 10E along with ITR. I got outstanding tax demand order. But now I have uploaded form 10E and requested rectification to reprocess the case. Now should I respond to demand order from CPC or wait for rectification order. Please clarify. Thank you

sir, godevng. I have receive 143(1) intimation letter, i search two columns. First col tax payer column, 2nd col CPC prepare column. Lastly TAX CREDIT shows in column firt is Rs. 2660/ but in 2nd column Shows TAX CREDIT NIL. (no Rs 2660). This is Right or Wrong. and then our Tax Deductor Login not opened. How it is rectified. sir, thanking u.

i filed my income tax return showing refund of rs.40000.i filed revised return within the last date showing refund of rs.25000.this was due to revised lower amount of interest paid to indiabulls for housing loan.i have received rs.40000 refund.how to deposit excess refund of rs.15000 back to income tax deptt.i am salaried individual.ay 2016-17

Once your revised return gets processed, you will recceive an intimation with asking amount of 15000/- which was paid in excess of actual refund asked by you in revised return filed by you.

You shall have to pay the same along with the inyterest and same shall be waived off against demand determined.

You can check status of your revised return filed on e filed return tab, and you will received 143(1) of revised return separately once it get s processed.

Sir i filled the income tax return and it have been processed and i recive the intimation us 143( 1 )..so is there any furthur chances of scruteny?

If 143(1) shows no net tax payable and no refund. You are good for this year. Scrutiny will not happen for this year but keep all Income tax related records safe for 6 years atleast

Dear Sir

I received the Income tax Intimation U/S 143(1) with respect to the return of income filed by me for the Assessment Year 2016-17. Here it ask Net Amount Payable Rs. 60. Based on attached details it looks like mismatch occurred due to Unmatched Tax Deducted at Source.

Do I need to pay this mismatch amount/ Net Amount Payable soon , if need then how can I pay?

Your prompt response would be highly appreciated.

Regards

Rajendra Kumar

Typically you don’t have to pay if amount payable is less than 100. So enjoy!

I got a demand for rs 100 (exact), what should I do ? ignore or pay ? as you stated that only more than 100 rs are payable .

What is the meaning of Account under attachment or Account holder KYC is pending while requesting for It refund

please contact SBI Call center 18004259760 for further details

Dear Sir, Today(09/15/2016) I have received a email from intimations@cpc.gov.in with “INITIMATION U/S 143(1) OF THE INCOME TAX ACT, 1961” form.

In this SL.No. 43(REFUND AMOUNT), As Provided by Taxpayer in Return of Income is calculated as 19,400 whereas As Computed Under Section 143(1) is calculated as 19,399.

SL.No. 47(TOTAL INCOME TAX REFUND) As Provided by Taxpayer in Return of Income is calculated as 19,400 whereas As Computed Under Section 143(1) is calculated as 19,882.

SL.No 50(NET AMOUNT REFUNDABLE) is calculated as 19,880 and SL.No 52(NET AMOUNT PAYABLE) is calculated as 0.

Please let me know do I need to respond anything back to tax department. Please clarify, thanks for all your support…

Don’t worry. You don’t have to do anything. Infact its party time you will get a refund.

The two columns says what you filed and what CPC calculated.

SL. No 50 says you would get a refund of Rs 19880.

Thank you.. I was worried earlier as I have seen round-up issue which has mismtach of 1Rupee on SL.No 43.Thank you very much.

Sir,I had filed ITR-1 for A.Y 2016-17 wherein total income tax I provided for and paid was Rs 19005.Now I received an intimation u/s 143(1)(I had not paid any advance tax earlier so interest u/s 234B Rs 950 & Rs703 u/s 234c ) shows aggregate income tax liability of Rs 1653.

Net amount payable as provided by taxpayer in return of income is 19010….as computed u/s 143(1) is 20658.rounded off to 20660 ( net amt payable)

Now I accept the extra interest amount…But the total payable amount shows as 20660,I have already paid 19005 earlier in July 2016.what is the further procedure now?

Do they mean my outstanding tax demand is Rs 20660 ?

I’m confused,please guide

Thanks

Sir,

Did you add information about self assessment tax in filing ITR.

Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR talks about how to show self assessment tax in ITR

Sir,

I forgot to mention self assessment tax paid details on my itr & and submitted it on 17 july,on 17 September I got an intimation showing interest u/s234b &c for non payment of advance tax.The entire tax is showed as payable now just because I have missed out in writing self assessment tax paid details,entire amount is showing as outstanding.Now what should I do?

1. Response to outstanding tax demand..agree it??

2. Pay the differential interest amount u/s234b &c

3. File a revised return with the changes

4.again the e verification process??

Please correct me if I’m wrong.

I have made a similar mistake while filing itr of my mother,haven’t got an intimation yet.should I do the same thing in her case too now itself,or wait for the intimation to come?

Sir,

I forgot to mention self assessment tax paid details on my itr & and submitted it on 17 july,on 17 Sept I got an intimation showing interest u/s234b &c.The entire tax is showed as payable now just because I have missed out in writing self assessment tax paid details,entire amount is showing as outstanding.Now what should I do?

1. Response to outstanding tax demand..agree it??

2. Pay the differential interest amount u/s234b &c

3. File a revised return with the changes

4.again the e verification process??

Please correct me if I’m wrong.

I have made a similar mistake while filing itr of my mother,haven’t got an intimation yet.should I do the same thing in her case too now itself,or wait for the intimation to come?

No need to worry. relax .

If you received an intimation under section 139(9) from the tax department stating your ITR is defective, you need to respond or file a revised return within 15 days.

Mention the date of receipt of such notice in the revised ITR and correct all the defects as mentioned in the notice.

Revised return will be treated as an original return and no new acknowledgement would be generated.

1. Pay differential interest amount due u/s 234b/c by paying using challan 280 but Choose “(400) TAX ON REGULAR ASSESSMENT” if you get a demand notice from the Tax Department. Be careful of AY and FY. FY is when you earn income and AY is when your income is assessed. For FY 2015-16 AY is 2016-17

2. File revised income tax return by Adding details of Self assessment tax paid earlier and new tax paid. Generate the XML file.

3. Respond to outstanding notice. Article Defective return notice under section 139(9)

4. Agree with the defect because defect is genuine. select Yes under column Do you agree with defect?, and upload the respective corrected return XML.

Let us know if you face any problem

When you enter acknowledgement number (Acknowledgement number is 23 char long and is without CPC)and date of filing original return.

You can check YouTube video How to e-file in response of Notice under section 139(9) for defective return ? for more details

what if received intimation us 143(1) everything is zero; As below:

AY is zero

Acknowledgement no is zero

Due Date for Filing Original Return:is blank

Date of Filing Return:is blank

Aadhar Number: is blank

INCOME TAX COMPUTATION is 0…nothing is there evry thing is zero

What that means? I have e filed the return first time.

Please suggest!

Thanks in advance.

That should not be the case.

You can contact the CPC call centre at 1800 425 2229 for

Refund /Refund re-issue

Rectification

Notification & Processing

Or

1800-4250-0025 (9am to 8pm) to know about the status of their e-filing returns

Notice under section 143(2) of the Income Tax Act, 1961 Limited Scrutiny

Sir/ Madam/ M/s,

05/08/2016 This is for your kind information that the return of income for Assessment Year 2015-16 filed vide ack. no. XXXXXXXXXXXX on 11/08/2015 has been selected for Scrutiny.

Following issues have been identified for examination:

i. Interest Income

2. In view of the above, we would like to give you an opportunity to produce, or cause to be produced, any evidence which you feel is necessary in support of the said return of income on 26/08/2016 at 05:15 PM in the office of the undersigned. 3. Sending a communication to the undersigned in this regard shall also be treated as sufficient compliance in case no evidence is sought to be produced as required in Para 2 above. 4. Specific questionnaire/ show-cause notice shall be sent giving you another opportunity in case any adverse view is contemplated. 5. (#) The assessment proceeding in your case is proposed to be conducted through email based communication. The email provided in the said return of income shall be used for communication for this purpose. In case you wish to communicate through any other alternate email, the same may kindly be informed. A brief note regarding benefits of this facility and procedure is enclosed overleaf. In case you do not wish to participate in this taxpayer friendly initiative, you may convey your refusal to the undersigned by the above mentioned date. In case, you wish to opt out from this scheme at any subsequent stage due to any technical difficulties faced by you, the same can be done with prior intimation to the undersigned. (#) applicable only in case of taxpayers whose Income-tax jurisdiction

sir

what to do.

I am not able to understand this mail by ITO

pls help me out

Sir,

It means that your ITR for AY 2015-16 has been selected for scrutiny.

Income tax department has questions regarding Interest Income.

You have to meet the Assessing officer or send someone on your behalf with power of attorney on 26/08/2016 at 05:15 PM in the office of the undersigned. (Assessing officer signature)

Sending a communication to the undersigned in this regard shall also be treated as sufficient compliance in case no evidence is sought to be produced as required in Para 2 above

You can also send email to Assessing officer. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking covers it in detail.

sir

what if I don’t do any thing regarding this issue

As you owe Govt tax, you would have to pay penalty which will keep adding up.

Your ITR will not be processed.

It’s better not to avoid the notice. Please check your interest income (FD , RD etc) verify if its correct or not. Send details by email/meet Assessing officer

sir

does this mail means I am hiding

some money from the income tax department.

what exactly interest income means.

and how do I can calculate this money.

and what document should I send to Assessing officer to prove that I am innocent.

pls sir answer this question

I really need to now

Many people knowingly or unknowingly don’t include the interest income from their saving account, fixed deposits and recurring deposits in their income tax returns. The interest from saving account up to Rs 10,000 is tax deductible under Section 80 TTA while interest on fixed deposits and recurring deposits is fully taxable. In case of fixed deposits and recurring deposit, a TDS will be deducted in case the interest income exceeds Rs 10,000 in a financial year. But whether the interest is taxable or not, you have to disclose all your interest income in your tax return. So reveal the interest income in your return and then avail the deduction if any. Not doing so can result in a tax notice.

sir

I found that my interest is exceeding Rs10000

Now which documents should I mail to Assessing officer.

Do not panic.

What if you made capital gains by selling stocks/bonds, earned interest on fixed deposits or had rental income, but did not report these in your return? Improved tracking by the income tax department means hiding these is difficult .

You can send us the notice and associated document at bemoneyaware@gmail.com.

You can also get hold of CA to get guidance.

Sir,

I have a query regarding the same. My mother is 78 yrs and has FD deposits which fetched her 2,80,000 for FY 2015-2016. I had been submitting 15 H to the bank regularly. No TDS is cut accordingly. Her family pension was 1,30,000/ for F.Y. 2015-16

So total Income for F.Y.2015-2016

FD interests + Family Pension + SB interest ,

= 2,80,000+1,30,000+20,000= 4,30,000/ F.Y 2015-2016

Invested 1,50,000 in post office senior citizen scheme. This I claimed under 80C deduction.

So total taxable income = 430000-150000= 2,80,000 which is less than the exemption limit of 3 lakhs for senior citizens. So, filed zero tax returns.

She doesn’t get any other income.

I filed ITR 1 where I showed the family pension under Interest from salary/pension and the rest under Income from other sources. Claimed deductions under 80 C.

I have filed the returns one month back and the status is showing as EVC accepted. But haven’t moved ahead for the last 20 days. When can we expect the return to be completely processed.

I am worried whether what I have done is correct or not. Please let me know whether I am right in above calculations and return filings.

Sir,

I have been filling returns for the last 15 yrs and last 4 yrs online.

My ITR says ITR processed every year and even refund has been done but I haven’t got any 143(1) indicating refund for those I have filled online. But, refund amts are credited into my acct every year. Is there any issue or discrepancy?

There should not be any issue or discrepancy.

Earlier Income Tax Dept used to send cheque with letter to the address so you would know about refunds.

Are you getting mails/intimation from the income tax department?

I get remainders for filing returns last date etc from IT…but I don’t think I got any thing else, that i remember. I get msgs from bank saying refund credited.

Dear Sir,

I checked my old mails and I got 143(1) refund emails for A.Y 2014-2015 and A.Y. 2015-2016, respectively. Extremely, Sorry for my mistake. Thanks a lot for your patience and response.

Sir, I am working with PSU company and living flat provided by the company. My gross salary is Rs. 7,50000/- p.a. My company adding Rs. 1,12500/- as a perquisite charges and than my total salary is Rs. 8,62,500/- and i am paying income tax on it. But in same situation other employee’s of my company having company flat, and not paying income tax on perquisite charges from many years. The income tax deptt. never sent any notice to them. When they are e-filling the tax return, they are not showing perquisite charges as a income and IT Department refunded income tax deducted by the employer. Can i take rebate on perquisite charge if yes in which act. please clarify.

Dear Sir,

I checked my old mails and I found that i got 143(1) refund emails for A.Y 2014-2015 and A.Y. 2015-2016, respectively. Extremely, Sorry for my mistake. Thanks a lot for your patience and response.

I have received u/s 143 1 but no any demand for tax payble or tax refund both are mention zero by cpc ….plzz suggest what i do.

This means your ITR is processed. What you said in ITR matches with what CPC found. So give pat on back and enjoy.

I got intimation 143 1a outstanding demand 500/- i responce demand is correct when i will get refund ….

If net amount demand mentioned in Intimation under section 143(1) is more than 100 rupees, then tax payer needs to pay tax . This will be treated as demand notice for the payment of income tax due. This Intimation letter encloses challan form to pay income tax if the due is more than Rs 100. In case of Demand, this intimation may be treated as Notice of demand u/s 156 of the Income Tax Act, 1961. Accordingly, you are requested to pay the entire Demand within 30 days of receipt of this intimation“.

I filed my ITR on 21/06/2016 claiming a deduction of Rs. 35000/- u/s 89 but due to my ignorance I did not file 10e.I checked my e-filing account.It is not yet processed.Can I file 10e now ?

Sir, I filed my ITR on 21/06/2016 for the A.Y.2016-17 claiming a deduction of Rs 35000/- u/s 89 but due to ignorance I did not file Form 10e that time. I checked my e-filing portal it is not yet processed.Can I file Form 10e now ?

Dear Sir,

Firstly really appreciate the effort you are putting to educate people about Act and resolve their queries. I have already read many of your Q&A. However, I received an intimation stating:

“Please find attached the Income tax Intimation U/S 143(1) for PAN XXXXXXXXXX with respect to the return of income filed by you for the Assessment Year 2015-16. The attachment is password protected. To open the attachment, please enter your PAN in lower case and date of birth in case of individual tax payers / date of incorporation for non-individual tax payers in DDMMYYYY format without any space between the PAN and date fields. For example, if your PAN is ABCDE1234A and date of birth /incorporation is January 1, 1985 then the password will be abcde1234a01011985. The date of birth / incorporation should be same as furnished to the Department and available in the Income Tax Department PAN master (as printed on the PAN card)”

Apart from this no demand/refund has been asked.

Post-evaluating all information provided in the atachement, I noticed by mistake, I have asked for Rs.5690 as refund but the actual 26AS states Rs 5685. But I received Rs 5740/- as refund with interest. Is this the reason for the intimation?

Please clarify.

The Income department sends the information to update you , that what you had entered and what data it has matches.

Relax and enjoy

I need help, u/s 143 (1) , where said no demam no refund, what is the meaning of it?

No need to worry as there is no demand no refund , enjoy!!!

It means Income Tax Department agrees with what you have filled in ITR.

So give yourself pat on back and enjoy.

SIR I GOT THE OUTSTANDING DEMAND FOR RS 230 U/S 245 SECTION CODE-1431A FOR A.Y 2010-11 I RESPONSE TO THE DEMAND BY SUBMITING DEMAND IS CORRECT NOW WHAT TO DO FURTHER PLEASE ADVISE.

Pay the demand tax of rs. 230 by challan 280

Our article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1) explains it in detail.

Dear Sir,

I have deposited self assessment tax in wrong assessment year which I could realise only on receipt of intimation from CPC under 143(1).

How should I proceed to close the issue?

Please don’t worry. Reply to tje notice.

Please verify form 26AS for the concerned financial years

You would have to get your Challan 280 corrected by visiting your Assessing Officer.

Please read our article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1) for more details

Dear Sir,

I deposited Self assessment tax in wrong assessment year. I could realise mistake only when I have received demand notice from CPC for outstanding IT with interest.

How should I proceed to close the issue?

Regards,

All along you are telling that anything less than 100/- claimed by IT may be ignored. Please update further, as to under which rule?

The Department of Revenue, Union Ministry of Finance had issued a Press Note dated 05.1.2012 clarifying its communication about arrear demand. Further, the Central Board of Direct Taxes has issued a Notification No. 2/2012/F.No. 142/27/2011 – S.O. (TPL) dated 04.1.2012 specifying the Scheme for processing of Return of Income.

Income Tax Arrear Letter from CPC Bangalore just a communication of demand not a demand notice, No need to respond to tax notices for below Rs 100. You can read the circular here

It has been reported in some sections of the press that the Central Processing Centre , Bangalore is sending notices for payment of taxes which are as small as Rs. 1/- , 4/- , 6/-, causing unnecessary hardship to assesses . It has been stated that when the refunds for amounts less than Rs. 100/- are not issued by the Income Tax Department, then the demand for less than Rs. 100/- should also not be collected .

Clarification in this regard is as follows:

Arrear Demand Communication

The Income Tax Department has created a central repository of all demands for better demand management as required by Standing Committee of Parliament and C&AG. To achieve this, all officers were asked to collate demand lying at various places viz. IRLA, TMS and manual registers and upload onto CPC portal. This was also part of the annual action plan. Consequently AOs have uploaded the same. During a meeting with Bangalore Chartered Accountants association, it was suggested that taxpayers should also be informed about the same so as to enable them to take necessary action if the outstanding demands were incorrect. This measure was aimed at providing greater transparency. Therefore, a communication has been sent to taxpayers informing them about existing arrears. It may be clarified that this communication is not a demand notice. This measure is, in fact, an assessee -friendly exercise. The Department has also written to all chief commissioners to amend such entries, if found incorrect, when approached by taxpayers. This would correct the database if a taxpayer has proof of payment etc. As per extant procedure, demand of less than Rs. 100 is not enforced but is liable for adjustment against future refunds.

return cpc orderunder 143(1) till not recieved

For the returns filed electronically : The income tax e-filing portal has an option to send request for the demand notice sent earlier by email to your registered email id.

As explained in our article Request for Intimation for Income Tax

Step by step process to send the request to CPC is as follows

Log in to e-filing portal of Income Tax Department ie. https://incometaxindiaefiling.gov.in

On the Blue Bar(Menu Bar) selects My Account . (shown marked by red box in the image below)

From the drop down menu of My Account select Request for Intimation u/s 143(1)/154 ((shown by red box in the image below)

..Read more for article

U can contact CPC, Banglore on Toll Free No. 1800 425 2229 or Direct Line 080-22546500. Be ready with basic details of the assessee like PAN, Date of Birth/Incorporation/Address etc for verification or input. U can explain ur case to call centre executive of CPC & request them to forward Intimation u/s 143(1) on email address regd/mentioned in ITR or at regd postal address by post within a week time

Hi,

Over the last 5 years I have been filing e return (NRI with nil tax and since tds is deducted on income from other sources, refunds are issued over the last 4 years)and I have been receiving refund till 2014.. however, on 30.11.15 I have received a notice u/s 154 saying that the amount payable by me is Rs. 190 and that they have refunded Rs.15950 instead of Rs.15760 in 2010….not sure why rs.190 is asked for after 5 years….the reasons for rectifications said”Due to UID number change in CPC this order is passed”.

please advise what is to be done…

I have received a notice u/s 143(1) for an outstanding tax amount of Rs. 1,04,400/-. The amount of TDS as per Form 26AS and my calculation is 1,14,478/- whereas as per IT Dept they have mentioned TDS as Rs. 9490/-. I am unable to understand from where they have got this figure. What should be my action/ reply for this notice. Pl help. Thanking you Jayashree

First of all you can Reject Outstanding Income Tax Demand . Ascertain the nature of Income Tax Demand: First and for most thing, you have to ascertain the reason for raising demand. You will get the information from Intimation received u/s 143(1) of Income tax Act. Verify the dates of TDS.

If you Disagree with the Demand then you must furnish the details of your disagreement along with reasons. The details/reasons are the same as the mentioned above under ‘demand is partially correct’. For details you can read out article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1)

Dear Sir/ Madam,

Thank You very much for this excellent blog!!

Recently, I got Outstanding Demand Intimation under section 143(1) for Net payable amount of more than Rs. 2 lakhs for AY 2015-16. The advance/ self assessment gift tax was paid online before the receipt of a car that I won in a contest during March ’15. I have the challan(also can download it) and also it is showing as credit in Form 26 AS. In the demand intimation that advance tax paid amount is showing nil in ‘As computed under section 143(1). I filed online Return in ITR 1 and the value of the car was fed in ‘Income from other sources’ head in ITR1. I did not fill Sch TDS2. Also in the Intimation Oder my advance gift tax is shown in a table as ‘Unmatched Tax Payment Claims – Advance and Self Assessment Tax.’

What should be my future course of actions? Can I request for rectification filing of tax return (original filing was on 31-8-2015 before the due date 7-09-2015)?

After going through the details of different ITR forms I now understand that ITR1 ‘Income from other source’ head is only for income from house property and interests. But I can not figure out which ITR form and which heads are to be used for feeding value of a prize won in a contest. Kindly help !!

Just to add, I have paid the Tax by using Challan 282 under major head Gift Tax (0033)and minor head Advance Tax (100). Is it right Challan to use for paying tax under prize winning in a contest.

1. Recently, I have received intimation U/S 143(1) for AY 2015-16 wherein demand for Rs 3/- has been made. Kindly advise how to pay this?

2. Further I have also received communication from CPC i.e. rectification order under section 154 of IT act 1961, for AY 2014-15 for payment of Rs 20/- and the reason for rectification mentioned is DUE TO UID NUMBER CHANGE IN CPC THIS ORDER IS PASSED. Please advise how to make the payment for this?

As in both cases payment is less than Rs 100 you don’t need to pay it.

Sir/Madam

This has reference to intimation received by me under sector 245 IT act,1961 towards refund adjustment for last year against outstanding demand from AY 2012-13(Rs 33,570/- inclusive of interest). This demand has been raised under 1431A. As I was going through the demand statement issued , i found that TDS component is nil, however my employer during that tenure had duly deducted and paid the income tax ( as per form 16 ) and the same had been furnished by me in my ITR then. Kindly Advise.

Regards

Rahul

Rahul please check the Form 26AS. Income tax department picks up the TDS information from Form 26AS.

It seems TDS in Form 16 for some reason does not match /

You can go through our article What to Verify in Form 26AS? to get more information.

Sir/Madam

Verified data from Form 26AS, which shows the same amount of TDS deducted and paid as reflected in my Form 16.

Regards

Rahul

Please go through our article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1)http://bemoneyaware.com/how-to-pay-or-reject-outstanding-income-tax-demand-under-section-143-1/

Link to article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1)

Link to article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1) http://bemoneyaware.com/how-to-pay-or-reject-outstanding-income-tax-demand-under-section-143-1/

“The page you requested could not be found.” as on 22Jun 2015

Restored the post.

Thanks a lot Sir for informing. We have moved our site so some posts got missed.

WE PAID AMOUNT UNDER 143 (1) Rs 110/- dated 19/11/15 and next select demand is correct, still message Display Outstanding amount Rs 110/-. how can we give Reply to It. Please give reply

Our article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1) explains it in detail.

Step 1 Login to http://www.incometaxindiaefiling.gov.in with user ID, password, date of birth.

Step 2 Click on E-file and go to Respond to Outstanding Tax Demand . To submit the response click on Submit and select one of the following option : Demand is Correct, Demand is Partially Correct and Disagree with Deman

I had filed my it retun for the year 2014-2015. and got acknwoledged. This year for 2015-2016 I have filed my retunrs through a profesional. He checked and told me that my registration is not made so far. He again registerd the same and did everything. But no message or mail so far I have received. How is it possible? My PAN NO- AIWPA2180M My E-mail=biswajeet446@gmail.com. please reply.

Hello Sir,

You will not get any info through SMS and mail if either these are not given or given but not yours.

Username for e filing is PAN and you cannot have 2 logins with same username.

Ask you CA for login details.

Incase he doesn’t give you can reset the password.

To Reset Password using the ‘Answer Secret Question’ option, the steps are as below:

Step 1: In Homepage, Click on “Login Here”.

Step 2: Click on “Forgot Password?” link.

Step 3: Enter User ID (PAN), Captcha and Click on Continue button.

Step 4: Select “Answer Secret Question” from the drop down options available and

Click on Continue button.

Step 5: Enter the Date of Birth/Incorporation (DD/MM/YYYY) from the Calendar provided

(Mandatory).

Step 6: Select the Secret Question from the drop down options available (Mandatory)

Step 7: Enter the ‘Secret Answer’ and Click on “Validate”.

Step 8: On success, Enter the New Password and confirm the password.

Step 9: Click on “Submit”.

Once the password has been changed a success message will be displayed. Taxpayer can login with new password.

Using OTP (PINs)

To Reset Password using the ‘Using OTP (PINs)’ option, the steps are as follows:

Step 1: In Homepage, Click on “Login Here”

Step 2: Click on “Forgot Password?” link.

Step 3: Enter User ID (PAN), Captcha and Click on Continue button.

Step 4: Select “Using OTP (PINs)” from the drop down options available and Click on

Continue button.

Step 5: Select one of the options mentioned below

Registered Email ID and Mobile Number

New Email ID and Mobile Number

e-Filing Login Through NetBanking

Registered Taxpayer can login through NetBanking and reset the password.

1. NetBanking Login

To Reset Password using the ‘NetBanking Login’, the steps are as follows:

Step 1: In Homepage, Click on “Login Here”

Step 2: Click on “Forgot Password?” link.

Step 3: Enter User ID (PAN), Captcha and Click on Continue button.

Step 4: Click on “e-Filing Login Through NetBanking” link.

Step 5: Select the Bank from the list of Banks providing the e-Filing login facility.

Step 6: After login to NetBanking account, click on the link “Login to the IT e-Filing

account” e-Filing user Dashboard screen shall be displayed.

Step 7: Taxpayer can change the password under Profile settings.

If you need more info please do let us know

Intimation under section 143(1) is send to all tax payers or selective people only, Please clarify.

From what we know:

Intimation under Section 143(1) is sent only in the following 3 cases. If you have come across any other case please do let us know.

Where any tax or interest is found payable on the basis of the return after making adjustments referred to in Section 143(1) and after giving credit to the taxes and interest paid; or

Where any tax on interest if found refundable on the basis of the return after making adjustments referred to in Section 143(1) and after giving credit to the taxes and interest paid; or

Where adjustments referred to in Section 143(1) have been made resulting in increase/ reduction of loss declared by the assessee and no tax or interest is payable by the assessee and no tax or interest is refundable to the assessee.

sir,

there is a difference of amount of tds in my 143(!) notcie ,IT dept showing less amount of dedction ,but i have deducted all my dues .now guide me what to do to recover my amount, what steos i should taken

Hello, I have filed a returns for AY 2014-15 incorrectly. got an outstanding amount of 9700/- from cpc of 1431a. i tried to file the correct revised returns. But i dont get any response as already i have a outstanding amount. does i need to pay the amount or is there any way to correct this?

You cannot revise the return. If you think demand is just you can pay outstanding tax.

We have covered this in detail in our article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1), please go through it.

ITR for AY 2015-16, Ack No.xxxxxxx has been processed at CPC.Order u/s 143(1) will be sent by email.

What conclusions I have do?

Give me review.

Conclusion is that your ITR is processed and you need to wait for the email.

143(1) can bring good news that your return is fine no tax/refund due (or it’s less than Rs 100).

Or you have some outstanding demand due to some calculation mismatch.

Got a Notice under 143(1) for Outstanding Tax Amount, as i filled the Self Assessment Tax Under wrong Challan 282 on place of 280, please suggest what to do?

Regards,

Vikas

I have filled the self assessment tax of 2376/- arising on my Bank Interest, but while paying it online i wrongly selected Challan No. 282, now i got a notice under 143(1) for the Outstanding Tax Demand of the same amount, infact i need to use Challan No. 280, what to do, please suggest?

Regards,

Vikas

I have received an Intimation under sec 143(1) for rupees 1 Only. I can ignore this demand or need to fill ?

Please ignore the demand. Any demand/refund less than Rs 100 is not to be dealt with

I had received a Demand notice U/S 143(1)for paying the extra Tax of Rs 2560/- under demand notification No. 2015201537035298546T for the Assessment year 2015-16. Demand is OK as per my knowledge. So I want to pay the Tax. You please suggest me to how to pay the tax through E Tax section and under which section I had to Pay i.e. 300(Self Assessment Tax) or 400(Tax on Regular Assessment).

2.After paying tax weather I had to again file a ITR and under which section, please clarify?

Regards,

Suraj Shee

The outstanding tax demand can be paid online as below:

Log in to http://www.incometaxindiaefiling.gov.in and click on “My Account” option.

Cross-check the outstanding tax demand amount by clicking “Response to Outstanding Tax Demand” link under e-File menu option as shown below.

Click on “E-Pay Tax” to pay the taxes online. This will take you to “Tax Information Network” (TIN) website.

On the new window, select “Challan no /ITNS 280” option.

Select “ Income Tax – Other than companies” option. Key-in all the required details like your PAN number, Assessment Year (AY, this you can find on the first page of the Intimation), Address, Email-id and mobile no.

Select “ Tax on Regular Assessment (400) under “Type of payment” section.

Select your preferred bank through which you would like to make the tax payment.

Click on “Proceed” button and re-confirm your details.

Next you will be taken to your Bank’s Login page. Login to your bank account with your credentials.

In the next page you will be asked to enter the Demand amount. You may find different options like income tax, surcharge, Education cess, Interest, Penalty and Others. To find out the type of demand you can check the Intimation document.

After entering the required amount, you can make the payment using your net-banking facility. An online receipt will be generated . Save it for your reference.

Check the status after 1-2 weeks from the date of your demand payment.

Go to “Outstanding Tax Demand” and check the status. If your payment is received by the IT department then you may find no records.

Good. But I need to know if after filing Return in ITR-1, getting refund claimed and an Intimation u/s 143 (1)from CPC without, however, any demand naturally within a month of e-filing duly e-verified can be treated as Final Assessment Order

Yes Sir after getting refund claimed and intimation under section 143(1) it will be treated as Final Assessment order.

If you check your returns status it would say return is processed.

Sir I had received 143(1) recently where tds deducted as per 26as was 39190 and information was provided for the same. however the department has mentioned total tax refund as zero and issued 143 (1) and status was showing as no demand/no refund. How do i get the refund back ???

Your article gave me very useful information but my problem could not be solved,at least i did not understand.Ireceived a tax arrer demand notice u/s143(1) on 13-02-2012 for the AY 2001-02The demand was for RS 62411Though the demand came from CPC bengalore, I was asked contact my JAO who is the AO of ward NO,6($) earlier changed to4(4)now Pune.On 15-02-2012 itself I went there to meet my JAO As per his advice I wrote a letter saying that to the best of my knowledge I paid all tax and there is no dadueter I submitted two more letters on 21-10-2014 and15-12-2014 and also a copy of the ack of ITR filed forAY2001-02 in which I asked refund too. But on 12 10-2914 I got anothr letter notice u/s245in the AY2014-15and again the reminder on15-09 2015. Now within 30 days I have to give reply But except the demand amountofRs 62411 nothing else was given Pl.suggest me what I have to do now?

Sorry to hear about it.

Sir this happens when the case gets transferred before it could be closed.

You again have to visit the AO or send CA with power of attorney and proof of income and proof of submitted papers.

Hi