Do you have to file your income tax returns for the first time or you are employee and have been filing it but want to understand the income tax TDS etc then you have come to the right place. It explains in question answer form what is income tax,different kinds of income, tax slabs, how is tax calculation done. It explains Income Tax to a Beginner what is salary income, how tax is deducted from salary every month,how one can reduce the tax . This is first part of Income tax for beginner. Next part is about Form 16, verifying TDS, Form 26AS and filing income tax returns.

Table of Contents

Income Tax for Beginner

What is Income Tax?

It is a tax imposed by the Government of India on any body who earns income in India. This tax is levied on the basis of an Act called Income tax Act (IT Ac t) which was passed by the Parliament of India in 1961. But every year rates of income tax, education cess, surcharges, deductions, exemptions etc are revised by the the Finance Minister in budget(called as Finance Bill). So one needs to be aware of the budget or at-least the income tax rates and deductions. Our article Income Tax rates Since AY 1992-1993 has information on income tax rates, education cess, surcharges.

Who is supposed to pay Income Tax?

Any Individual or group of Individual or artificial bodies who/which have earned income are required to pay Income tax on it. The IT Act recognizes the earners of income under seven categories. Each category is called a Status . These are

Individuals,Hindu Undivided Family [HUF],Association of Persons [AOP],Body of individuals [BOI],Firms,Companies,Local authority,Artificial juridical person.

When Companies pay taxes under the Income tax Act it is called Corporate tax . In this article we shall focus on only individual.

Is Income tax Act applicable only to residents?

The Income tax Act applies to all persons who earn income in India. If an individual stays in India for 182 days or more in a year, he is treated as resident in that year regardless of his citizenship. If the stay is less than 182 days he is a non-resident. Our article Non Resident Indian – NRI discusses it in detail. In this article we shall be talking of resident individual.

What is the period for which a person’s income is taken into account for purpose of Income tax?

Income earned in the twelve months in the period from 1st April to 31st March on next year,commonly called Financial Year (FY), is taken into account for purposes of calculating Income Tax. Under the income tax Act this period is called a Previous year . Income earned in the financial year is assessed (evaluated, calculated) in the next Financial year which is called as the Assessment year. In the Assessment year a person files his return for the income earned in the previous year. For example for income earned in Financial Year (FY) 2012-13 the Assessment year (AY) is 2013-14.

What does the Income Tax Department consider as income?

The word Income has a very broad and inclusive meaning. In case of a salaried person, all that is received from an employer in cash, kind or as a facility is considered as income. For a businessman, his net profits will constitute income. Income may also flow from investments in the form of Interest, Dividend, and Commission etc. Under the Act, all incomes earned by persons are classified into 5 different heads, such as:

- Income from Salary :

- Income can be charged under this head only if there is an employer-employee relationship between the payer and payee. Salary includes basic salary or wages, any annuity, gratuity, advance of salary, leave encashment, commission, perquisites in lieu of or in addition to salary and retirement benefits. The aggregate of the above incomes, after exemptions available, is known as Gross Salary and this is charged under the head income from salary.

- Income from House property

- Any residential or commercial property that you own will be taxed. Even if your piece of real estate is not let out, it will be considered earning rental income and you will need to pay tax on it. If you have home loan then interest part of it would also be considered as negative income from House property.

- Income from Business or Profession

- Income earned through your profession or business is charged under the head ‘profits and gains of business or profession.’ The income chargeable to tax is the difference between the credits received on running the business and expenses incurred

- Income from capital gains :

- Any profit or gain arising from transfer of capital asset held as investments(such as house,Jewellery, are chargeable to tax under the head capital gains. The gain can be on account or short- and long-term gains. Our article Basics of Capital Gain talks about in detail.

- Income from other sources :

- Any income that does not fall under any of the four heads of income above is taxed under the head income from other sources. Example is interest income from bank deposits, winning from lottery, any sum of money exceeding Rs 50,000 received from a person (other than from relative, on marriage, under a will or inheritance).

Total income is sum of income earned under all these categories.

Does every one has to pay same amount of tax?

No Income tax depends on the income earned, more the income, more the tax. The income slab also varies with age(less than 60,between 60 – 80 years, more than 80), residence(india/non-resident India), gender(male/female) and financial year. For quite some time India has four income slabs or groups

- income not taxed at all,

- income taxed at 10%,

- income taxed at 20% and

- income taxed at 30%.

As per Financial Year 2015-16(FY 2015-16) or Assessment Year (AY 2016-17) tax -slabs are as follows :

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| No Tax (Basic Exemption) | 250000 | 250000 | 500000 |

| 10% tax | 250001 to 500000 | 250001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 12% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

There is a limit of income below which one need not pay tax,called as Exemption limit. Our article Understanding Income Tax Slabs,Tax Slabs History covers the tax slabs and history of slabs in detail.

Example of Income Tax calculation

For indian man/woman less than 60 years of age for For Financial year 2015-16 or Assessment Year 2016-17 is as follows. You can also use Income Tax Department Calculator for same purpose. Our article Examples of Income Tax Calculation also explain in detail (for FY 2011-12 or AY 2012-13)

| Level of income | Tax |

| 1. Where the total income does not exceed Rs. 2,50,000/-. | Nil |

| 2. Where the total income exceeds Rs. 2,50,000 but does not exceed Rs. 5,00,000/- | 10 per cent of the amount by which the total income exceeds Rs. 2,50,000/- |

| 3. Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/-. | Rs. 30,000/- plus 20 per cent of the amount by which the total income exceeds Rs. 5,00,000/-. |

| 4. Where the total income exceeds Rs. 10,00,000/-. | Rs. 1,30,000/- plus 30 per cent of the amount by which the total income exceeds Rs. 10,00,000/-. |

Education Cess at 2% of Tax and Secondary and Higher Education Cess at 1% of tax is added to tax calculated or 3% of tax

For example tax on income for Indian male earning 6,00,000, is calculated as follows:

- 10% on 5,00,000-2,50,000=2,50,000 i.e 25,000 and

- 20% on 6,00,000-5,00,000 = 1,00,000 i.e 20,000.

So total tax becomes 45,000(25,000+ 20,000)

Total tax = Tax + Education cess (2% of tax) + Secondary and Higher Education Cess (1% of tax)

= 50,000 + 1000 + 500 = 51,500

Male/Female below 60 years of age with different amount of salary and tax calculation is shown below.

|

Particulars

|

Rupees

|

Rupees

|

Rupees

|

Rupees

|

|

Gross Salary

|

2,00,000

|

5,00,000

|

10,00,000

|

20,00,000

|

|

(A) Tax thereon

|

Nil

|

30,000

|

1,30,000

|

4,30,000

|

|

Add:

|

||||

|

(i) Education Cess @ 2% of Tax.

|

Nil

|

600

|

2,600

|

8,600

|

|

(ii) Secondary and Higher Education Cess @1% of Tax

|

Nil

|

300

|

1,300

|

4,300

|

|

Total tax payable

|

Nil

|

30,900

|

1,33,900

|

442,900

|

Income : Salary and others

What is considered as Salary income?

Whatever is received by an employee from an employer in cash, kind or as a facility (perquisite) is considered as Salary. If a person has the right/power to hire and fire another, then he is an employer of the latter. Our article Salary, Net Salary, Gross Salary, Cost to Company: What is the difference explains it in detail,quoting from it .The salary consists of following parts.

- Basic Salary: As the name suggests, this forms the very basis of salary. This is the core of salary, and many other components may be calculated based on this amount. It usually depends on one’s grade within the company’s salary structure.It is a fixed part of one’s compensation structure.

- Allowance: It is the amount received by an individual paid by his/her employer in addition to salary to meet some service requirements such as Dearness Allowance(DA), House Rent Allowance (HRA), Leave Travel Assistance(LTA) , Lunch Allowance, Conveyance Allowance , Children’s Education Allowance, City compensatory Allowance etc. Allowance can be fully taxable, partly or non taxable.

- Perquisite: Is any benefit or amenity granted or provided free of cost or at concessional rate such as Rent free unfurnished house, Rent free furnished house, Motor car facility, Reimbursement of Gas, Electricity & Water, Club facility, Domestic Servant Facility, Interest Subsidy on Loan , Reimbursement of medical bills, Reimbursement of Hospital bills, Reimbursement of telephone bills, Benefits derived by employee stock option, and so on.

If you have invested in Fixed Deposit(Income from other Sources) or sold a house or are paying home-loan(income from house property) then they would come under different category of income.

How is salary income taxed?

Income earned by doing a job with employer-employee option comes under the category of Income From Salary. As mentioned earlier income tax is taxed based on the total income earned. For example if you invest in Fixed Deposit, interest earned comes under income from Other sources and is added to Income from salary. Other than total income income tax varies with age, gender etc. Male/Female below 60 years of age with different amount of total income and tax is shown below.

|

Particulars

|

Rupees

|

Rupees

|

Rupees

|

Rupees

|

|

Total income

|

2,00,000

|

5,00,000

|

10,00,000

|

20,00,000

|

|

Total tax payable

|

Nil

|

30,900

|

1,33,900

|

442,900

|

Tax is deducted from Salary every month

Paying a tax at end of year in one shot is difficult. So as per Income tax law some tax is deducted by the employer from the salary every month, called as Tax deducted at source or TDS. At the time of payments of various kind such as salary, commission, rent, interest on dividends etc, tax is deducted called as Tax deducted at Source (TDS) as per the Income tax laws. This withheld amount can be adjusted against tax due. The person/organization deducting the tax is called as Deductor while the person from whom the tax is deducted is called Deductee. The concept of TDS envisages the principle of pay as you earn. It ensures regular inflow of cash resources to the Government and distributes the payment of tax, pay little over a year rather than a big amount at the end of the year. Our article Basics of Tax Deducted at Source or TDS covers it in detail.

Is there a legal way in which I can reduce paying tax (or not pay any tax)?

Yes you can reduce your tax liability. The Income Tax Act, 1960 has provided Section 80C,80CCD, 80CCC, 80CCCE benefit to save tax by investing upto 1 lakh in different options, each suited to a different need. One can choose a combination of fixed income, life insurance and market-linked investments depending on one’s financial goals and investment horizon.

If you and your employer are contributing to Employee Provident Fund (EPF) then you are doing tax-saving. Employee Provident Fund (EPF) is implemented by the Employees Provident Fund Organisation (EPFO) of India. An establishment with 20 or more workers working in any one of the 180+ industries should register with EPFO. Typically 12% of the Basic, DA, and cash value of food allowances has to be contributed to the EPF account. Your employer also usually contributes the same amount. Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS discusses it in detail.

Typically at the beginning of financial year (Apr) the finance or payroll department asks one to declare how much would they be saving tax. Based on declarations the finance department cuts TDS. Proofs need to be submitted by mid-Feb so as to verify that employee have made the declared tax saving investments. If employee has not made any tax saving investment or made less than declared the TDS is adjusted in salary in month of Feb and Mar.

Each tax-planning instrument has a different underlying objective, which needs to be understood by the taxpayer before making an investment. Example Life insurance is to protect life, Public Provident Fund(PPF) is simple government backed tax-free option, ELSS is tax saving through investments in Equities. Your choice should be defined by how soon you need the money, your expectations of returns,risk you are willing to take, your life stage, financial goals. Choose an option that fits into your overall financial plan, not because it offers good returns or your neighbour or bank is selling it. Our article Choosing Tax Saving options : 80C and Others discusses it in detail.

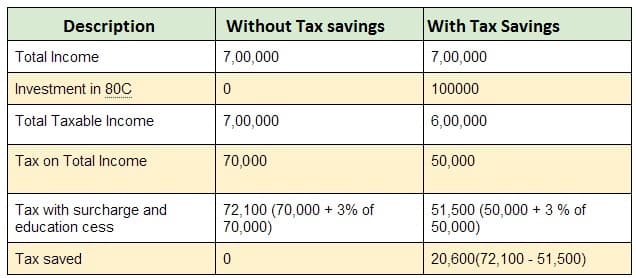

Example of tax saving

Let’s take case of Mr. T Mehta , who is resident individual less than 60 years of age. He has annual income of Rs 7,00,000 and if he invests Rs 1,00,000 in section 80C, his taxable income is reduced to Rs 6,00,000. So As per the current tax laws, his saving will be Rs. 20,000 or (20,600 with education cess) if he takes benefit of section 80C provision.

A person in 10% tax slab less than 60 years will save 10,000(10,300 with education cess), person in 30% tax slab will save 30,000(30,900 with education cess) by investing in 80C tax saving investments.

|

Particulars

|

Rupees

|

Rupees

|

Rupees

|

Rupees

|

|

Gross Salary

|

2,00,000

|

5,00,000

|

8,00,000

|

20,00,000

|

|

Less: Deduction U/s 80C

|

45,000

|

1,00,000

|

1,00,000

|

1,00,000

|

|

Taxable Income

|

1,55,000

|

4,00,000

|

7,00,000

|

19,00,000

|

|

(A) Tax thereon

|

Nil

|

25,000

|

70,000

|

3,70,000

|

|

Add:

|

||||

|

Education Cess + Higher education cess @ 3% of Tax.

|

Nil

|

750

|

2,100

|

11,100

|

|

Total tax payable

|

Nil

|

20,600

|

72,100

|

3,81,100

|

|

Tax payable without tax saving

|

Nil

|

30,900 | 92,700 |

4,12,000

|

Related articles:

- Understanding Income Tax Slabs,Tax Slabs History

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Choosing Tax Saving options : 80C and Others

- Basics of Tax Deducted at Source or TDS

If you are based in Bangalore and can arrange a group of 10 people bemoneyaware can do a session on income-tax, finance. Drop us an email at bemoneyaware@gmail.com

This article is dedicated to our reader Subin (and others) and is based on questions asked by them and our replies.

In the next part,Income Tax for Beginner Part II, we talk about Form 16, verifying TDS, Form 26AS and filing income tax returns. Hope the article helped in understanding what is income tax,different kinds of income, tax slabs, how is tax calculation done, what is salary income, how tax is deducted from salary every month,how one can reduce the tax . If you have queries, doubts,feedback please share in comments section.

12 responses to “Income Tax for Beginner”

This is very informative to all the business persons and tax payers. thank you so much for sharing such a details information with us.

Income tax return

Good Job! It is very good to find all the information in one place!

In the example For tax on income for Indian male earning 6,00,000

How did the total tax increase from 45000 to 50000?

I strongly recommend every new job holder to read this article. Good job…

I filed my ITR online (2015-16)in ITR4S as a profession 607 code

my Gross income is 305615.00 dedudtion under chapter VIA presumptive income @8% and deduction u/s 80c 60200.00 (tuition fees) and net taxable income is 245420.00 but the ITR V.pdf file u/s 143(1)notice shows gross total income 24500 deduction under chapter VI A 24500 please help me how can I Rectify this is there I have any tax liability.

Sir

Some basics on ITR-4S are given below. It seems that Govt calculation is different from yours. Its better to contact a CA or tax lawyer.

The Sugam ITR-4S Form is the Income Tax Return form for those taxpayers who have opted for the presumptive income scheme as per Section 44AD and Section 44AE of the Income Tax Act.

Income Tax Department has laid out some simple provisions where your income is assumed based on the gross receipts of your business. This method is called the presumptive method, where tax is paid on an estimated basis.

Features of this Scheme are

Your Net Income is estimated to be 8% of the gross receipts of your business.

You don’t have to maintain books of accounts of this business.

You don’t have to pay Advance Tax for such a business.

You are not allowed to deduct any business expenses against the income.

No business expenses are allowed to be deducted from the net income. Depreciation is also not deductible.

Gross receipts or Turnover mean the total collections of the business. The receipts shall be inclusive of VAT & Excise Duty. The receipts shall also include delivery charges as well as receipts from sale of scrap.

Discounts given, advances received and money received on sale of assets should be excluded.

itrv recipt

Very nice article , I have recently started working and was in search of a web site that can provide guide on finance and taxsaving. I must say that using this only single web site is kind of handy for me to look at a web page and get the complete details with a numerical example.

Thanks

Krishna Oza

Thanks Krishna for your words. But there are many sites (jagoinvestor, onemint) which are very helpful

Reading this post, reminded me of my graduation days. I wish India has a more stringent tax laws and businessman who are evading taxes are brought under notice. Why only salaried class has to part with their hard earned money.

Government takes money from where it can!