In our earlier article Tax : Income From House Property we had given an overview of how to calculate Income From House Property. In this article we shall consider the case of one house for self-occupied purpose i.e being used by the owner for residences and no other property. It gives an overview of Income from Self Occupied House Property, Income Tax on Income for Self Occupied Property. Then it explains various cases with examples of computation of income from one Self Occupied House property like House constructed before 1-Apr-1999, House constructed after 1-Apr-1999, for interest in pre-construction stage of the house, when house is co-owned and both husband and wife are paying EMI,when house is co-owned but husband is paying EMI, Unoccupied property and HRA allowance, Carry Over the Loss From Income From House Property.

Table of Contents

Overview of Income from House property

Annual Value of a home is the capacity of the property to earn income i.e sum for which the property might reasonably be expected to be let out from year to year. Computing income from house property is shown in table below :

| Gross Annual Value | **** |

| Less: Municipal Taxes (if paid by owner) | **** |

| Net Annual Value | **** |

Less:Deduction under Sec.24

|

**** |

| Income from house property | **** |

Where GROSS ANNUAL VALUE(GAV) is the highest of

- Rent received or receivable

- Fair Market Value.

- Municipal valuation.

If however the Rent Control Act is applicable, the GAV is the standard rent or rent received, whichever is higher.

How to show Income from Self Occupied House Property in ITR1

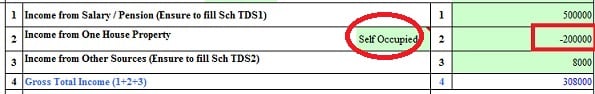

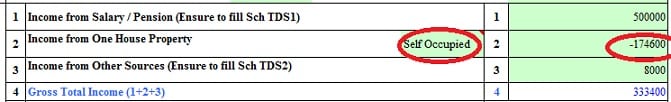

Maximum Income form House property for 1 Self Occupied House that you claim is = Maximum of(2,00,000 and Income from House property for 1 Self Occupied House calculated )

You have to fill in maximum of 200000 irrespective of how much your home loan interest is if its self occupied.

If Total Income from House property for 1 Self Occupied House is less than 2,00,000 then you enter that amount as Income from House Property as shown in image below

Income Tax on One Self Occupied Property

Self Occupied Property is house used for own residential purposes throughout the year. This means

- House is not let out for whole or part the previous year

- No any other benefit is derived by the owner

Annual Value : Section 23 (2) (a) prescribes that annual value of such house shall be taken to be nil, if the conditions mentioned below are satisfied:

- the property (or part thereof) is not actually let during whole (or any part) of the previous year; and

- no other benefit is derived therefrom

Statutory Deduction Sec 24 (a) : Deduction of 30 % of Net Annual Value (NAV) is allowed . No deduction is provided if Net Annual Value is NIL hence for Self Occupied Property one cannot claim deduction.

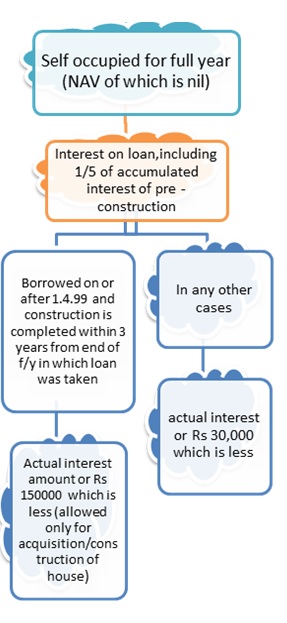

Interest on borrowed capital for self occupied property

For claiming income tax deduction, the Equated Monthly Installment (EMI) amount is divided into the principal and interest components. The repayment of the principal amount of loan is claimed as a deduction under section 80C of the Income Tax Act up to a maximum amount of Rs. 1 lakh

The maximum amount of interest permissible in cases of self-occupied property is Rs. 2,00,000 (from FY 2015-16 limit of 1.5 lakh was raised to 2 lakh) in respect of funds borrowed on or after 01.04.1999 and 30,000 before 01.04.1999).

Loss of income from House Property

If there is a Loss from House Property, the same can be set-off against income from any other head in the same Assessment Year as per the provisions of Section 70

If the Loss cannot be set-off against income from any other head in the same Assessment Year, the Loss is allowed to be carried forward and set-off in 8 subsequent Assessment Years against income from House Property only as per the provisions of Section 71B.

Unoccupied property

Unoccupied property is property which cannot be occupied by the owner because of his employment/business/profession carried out at any other place he stays in a rented premise in such other place. Taxation of income from unoccupied property is same as the Self occupied property. So In case of unoccupied property

- Gross taxable value of such property is considered as NIL

- Deduction of interest on housing loan for acquisition is allowed deduction up to Rs 2,00,000

- He can also claim House Rent Allowance (HRA ) As per income tax act both benefits(HRA and deduction of interest) are independent of each other and there is no relation what to so ever in claiming HRA exemption and House loan interest ,if person fulfill conditions checked separately for each section. For details you can read SimpleTaxIndia Tax Benefit on HRA and Home Loan available or Not. To Refresh for calculation of HRA, least of the following three options will be exempt from tax

- 50% of the basic salary and DA, where the residential house is situated at Mumbai, Kolkata, Delhi or Chennai and an amount equal to 40% of above salary where residential house is situated in any other place.

- HRA actually received by the employee in respect of the period during which rented accommodation is occupied by the employee during the financial year

- The excess of rent paid over 10% of the salary.

Examples of Computation of income from Self Occupied Property

Mr Mehra owns a house property. It is used by him throughout the year for his and his family members residence.

| Municipal Value | Rs 1,66,000 | |

| Fair Rent | Rs 1,76,000 | |

| Standard Rent | Rs 1,50,000 | |

| Expenses | ||

| Repairs | Rs 20,000 | |

| Municipal Tax | Rs 16,000 | |

| Insurance | Rs 2,000 | |

| Loans | ||

| Interest on capital borrowed to construct the property | Rs 1,36,000 | |

| Interest on capital borrowed by mortgaging the property for daughter’s marriage | Rs 20,000 | |

| Income | ||

| Income from Business | Rs 7,10,00 |

Computation of income from House Property will be as follows :

| Num | Description | If Loan is before 1-Apr-1999 | If Loan is taken after 1-Apr-1999 |

| 1 | Gross Annual Value(As it is self occupied property) | Nil | Nil |

| 2 | Less Municipal Tax(Municipal Tax deduction is not allowed if Annual value is Nil) | Nil | Nil |

| 3 | Net Annual Value | Nil | Nil |

| 4 | Less Interest on borrowed capital(maximum is Rs 30,000 if borrowed before 1.Apr.1999 else 1,50,000 ) | -30,000 | -1,36,000 |

| 5 | Income from house property | -30,000 | -1,36,000 |

| 6 | Business Income | 7,10,000 | 7,10,000 |

| 7 | Net Income (6+5) | 6,80,000 | 5,74,000 |

Mr. Sharma purchased a house property in April 2012 by taking a housing loan from Bank which is self occupied. Compute the income from house property for the year given following details

- Interest paid on loan upto 31st Mar 2015 1,70,000

- Principal paid towards the loan 80,000

- Municipal Taxes paid 8,000

- Insured Premium 3,000

- Income from his salary is 6,00,000 and other sources Rs 50,000

| Num | Description | Amount(Rs) |

| 1 | Gross Annual Value(As it is self occupied property) | Nil |

| 2 | Less Municipal Tax(Municipal Tax deduction is not allowed if Annual value is Nil) | Nil |

| 3 | Net Annual Value | Nil |

| 4 | Less Interest on borrowed capital(maximum is Rs 30,000 if borrowed before 1.Apr.1999 else 1,50,000 ) | -1,70,000 |

| 5 | Income from house property | -1,70,000 |

| 6 | Income from Salary | 6,00,000 |

| 7 | Income from other sources | 50,000 |

| 8 | Net Income (5+6+7) | 4,80,000 |

Example for interest in pre-construction stage of the house

Mr Kapoor has one house property in Delhi where he stays with his family.Rent of similar property in neighborhood is Rs 25,00 per month. The municipal valuation is Rs 23,000 per month. Municipal taxes paid is Rs 8,000. The house was constructed in the year 2010 with the loan of Rs 20 lakh taken from PNB. The construction was completed on 30-Nov-2012 . The accumulated interest upto 31-Mar-2015 is Rs 1,50,000. During the previous years 2015-16 he paid Rs 1,74,000 as interest.

| Num | Description | Amount(Rs) |

| 1 | Gross Annual Value(As it is self occupied property) | Nil |

| 2 | Less Municipal Tax(Municipal Tax deduction is not allowed if Annual value is Nil) | Nil |

| 3 | Net Annual Value | Nil |

| 4 | Less Interest on borrowed capital(maximum is Rs 30,000 if borrowed before 1.Apr.1999 else 1,50,000 ) | -1,74,000 |

| Less Interest for pre-construction stage (1/5th of 1,50,000) | -30,000 | |

| 5 | Income from house property (maximum is Rs 2,00,000) | -2,00,000 |

M As per income-tax Interest up to the end of Financial year ,immediate proceeding to the year in which house is completed is considered as Income tax pre construction period . As construction was completed in Nov 2012 he can claim interest upto Mar 2015 in five installments in income tax from FY 2012-13 to FY 2017-18. Hence Kapoor can claim 1/5th of interest paid in pre-construction stage every year for 5 Years.

Example when house is co-owned and both husband and wife are paying EMI

Mr and Mrs Khanna have jointly taken a home loan for a house they are living in. Mr Khanna pays 75 percent of the EMI. What will be their individual tax benefits?

For claiming income tax deduction, the EMI amount is divided into the principal and interest components.

- The repayment of the principal amount of loan is claimed as a deduction under section 80C of the Income Tax Act up to a maximum amount of Rs. 1 lakh individually by each co-owner.

- The repayment of the interest portion of the EMI is also allowed as a deduction under section 24 of the Act, which is given under the head “income from house property”.

- In case a person is just a co-borrower of a loan and not a co-owner in the property, he cannot claim the tax rebates.

- If the co-owners are equal owners of a property but if the share of the loan is 2:1, the tax benefits can also be availed in the same ratio.

As they are living in the house for which home loan is taken, both of them are entitled to deduction in the ratio (3:1) on account of interest on borrowed money up to a maximum of Rs 2 lakh from AY 2016-17 (before it was 1.5 lakh) individually.

Example when house is co-owned but husband is paying EMI

Flat is registered in name of Mr and Mrs Kale. In registration share of partnership is not defined. Whole EMI is paid by Mr Kale. Even though Mrs Kale is co-applicant in flat, can Mr Kale claim 100% interest loss for that property as he is paying 100 % EMI ?

Though the Flat in Joint name but the payment has been(are /will be) paid by you and wife has not contributed any money in the Flat purchasing . As per section 27(i) of the income tax act ,ownership shall be deemed for taxing income from house property :

(i)When house property is transferred to spouse (otherwise than in connection with an agreement to live apart) or minor child (not being a married daughter) without adequate consideration (Section 27(i))

So if house is transferred to wife/Husband without any consideration then Husband/wife remains the deemed owner of the house and income from house property will be added in transferor’s income.

In this case Mr Kale has given his wife name in flat for convenience and he has contributed full money in the flat. Hence he has become the deemed owner as per Section 27 of the income tax act . So as per this Section full(100%) Income from house /Flat is to be added in his income. Income here means loss also.

What if Mrs Kale starts earning and has to file Income Tax Return?

As Mrs Kale is also earning now however Mr Kale should not take contribution in the house from her. Let her invest money with her own choice . If he needs money for repaying loan then he can take loan from her.

Example of Unoccupied property and HRA allowance

Mr Paul has HRA as Rs 30,000 per month or Rs 3.6. lakh per year, and he pays a rent of Rs 22,000 per month. For his basic salary of Rs 60,000 per month, HRA computation would be

- The actual HRA he gets is Rs 30,000 per month.

- The actual rent paid less 10% of his salary works out to Rs 16,000 (Rs 22,000 – 6000 ) 6000 is 10% of Rs 60,000.

- And 50% of his basic salary works out to Rs 30,000.

The minimum amount works out to Rs 16,000 per month or Rs 1.92 lakh per year. And that is the amount that you can claim as a deduction from your taxable income. The remaining portion of your HRA i.e. Rs 1.68 lakh (Rs 3.6 lakh – Rs 1.92 lakh) will be added to his income for the year.

For his Unoccupied house (even when he is not staying but his parents are) his interest for loan is Rs 1,60,000

| Num | Description | Amount(Rs) |

| 1 | Gross Annual Value(As it is self occupied property) | Nil |

| 2 | Less Municipal Tax(Municipal Tax deduction is not allowed if Annual value is Nil) | Nil |

| 3 | Net Annual Value | Nil |

| 4 | Less Interest on borrowed capital(maximum is Rs 30,000 if borrowed before 1.Apr.1999 else 1,50,000 ) | -1,60,000 |

| 5 | Income from house property (maximum is Rs 2,00,000) | -1,60,000 |

Example of Carry Over the Loss From Income From House Property

Mr Khan has one property which is self occupied with Municipal valuation Rs 50,000 Fair rent Rs 60,000 Municipal tax paid by the owner (including Rs. 1000 of last year)10,000 Interest on loan borrowed for construction (started after 01.04.99 and completed before 1.4.2003) 1,80,000. His salary is Rs 90,000.

| Num | Description | Amount(Rs) |

| 1 | Gross Annual Value(As it is self occupied property) | Nil |

| 2 | Less Municipal Tax(Municipal Tax deduction is not allowed if Annual value is Nil) | Nil |

| 3 | Net Annual Value | Nil |

| 4 | Less Interest on borrowed capital(maximum is Rs 30,000 if borrowed before 1.Apr.1999 else 1,50,000 ) is 1,80,000 | -1,50,000 |

| 5 | Income from house property (maximum is Rs 2,00,000) | -1,80,000 |

| 6 | Income from Salary | 90,000 |

| 7 | Net Income or rather Loss which will be carried forward to next year | -90,000 |

Net Loss will be carried forward to next year for being set off as per the provisions of Section 71B

Related Articles :

- Tax : Income From House Property

- On Selling a House,

- Capital Loss on Sale of House

- Income Tax for Beginner

- Income Tax Overview

In this article we have tried to explain about tax on income from only one house which is Self occupied and explained how income from house property is taxed with examples in various cases. If there are some mistakes or errors please let us know we shall correct it.

44 responses to “Tax and Income From One Self Occupied property”

I bought a flat “A” in 2004, which was offered as self occupied property. I claimed housing loan interest and repayment benefits as per IT Act….in Oct 2016, my mother gifted one of her residential property “B” to my name….Now can i change my self occupied property from A to B….There is no loan for B, but the market value of B is 5 times more than A….So if i offer property B as my self occupied property, then later when i want to sell that house B, i can claim Capital Gain exemption with the profit on sale of B, which i can reinvest in another house….Also i would offer capital gain tax to be paid on my house A without reinvesting…….is my calculation correct? please advice

I am a central Govt employee. I have taken a hba loan for purchasing a flat. The principal amount has already been deducted. And now the interests are being deducted from monthly salary bill. In the meantime, I have taken another loan from LIC for purchasing another flat. Presently, I am residing at the new flat keeping the first one vacant.How can I get tax benefits from the loans taken. I have taken the benefit of accrued interest from the first loan taken from the central govt office. a suggestion in this regard will be a great help to me.

Please note that though your home is vacant you still have to consider it for income tax purposes.

Tax benefits with two home loans

The tax treatment for home loans is determined based on which of your properties is self-occupied. The other property is automatically considered rented out, whether or not it has actually been rented.

For the property that you have deemed self-occupied, you are liable for tax relief both on the interest and principal amount you’re paying towards your home loan. You can claim a tax deduction of up to Rs 1.5 lakh under Section 80C on principal repayment and Rs 2 lakh under Section 24(B) for interest repayments.

For a second home loan, you will get tax deductions only on the interest repayment and not on the principal repayments. There’s no ceiling to the deductions towards interest payments on the second home loan. Therefore you can claim deductions on the actual interest paid.

Remember tax benefits for home loan is limited for an under-construction property. You can avail a deduction on 20% of the total interest paid during the pre-construction phase for a five-year period.

Dear Sir,

An excellent, extremely useful article written in a simple lucid style. Thanks for giving this useful information for free.

Hi , Will be shifting to my new house in Jan which has a housing loan x. For my previous house with housing loan y i will be putting on rent after 2-3 months after repair. Once i put on rent i will show that, but it might be after March 2016. So for this year what all can i claim .

can i show y, then do i need to show nominal rent , i dont know for ho many months? and what will be that amount.

For x , OC is obtained , anything else is required. also we dont know for EMI if i say 70-30 can i change next year as it could change and me and to be frank what exact EMI contribution we find it difficult

Can i claim loss of income from rented property if NO municipal tax is levied. Is it mandatory to produce municipal tax reciept

Purchased one flat in Dec 2013, got loan approval in Jan 2014.

But first loan disbursement was in Apr 2014.

Builder is expected to complete construction and handover flat in May 2017.

Will I eligible for Pre EMI tax benefit?

yes but after getting the possession in 1/5 equivalent share

If no house loan has been availed. Can you claim deduction of vacant self occupied house for loss of rent up to Rs 200000.

If you don’t have home loan you cannot claim it as negative income from House property.

How many houses do you have?

Though the tax under the head “income from house property” is supposed to be on income, this is a tax levied not on rent but on the inherent capacity of a building to yield income. This is termed as “annual value” and it has been defined as the sum for which the property might reasonably be expected to be let out year to year.

So, if you have one house, which you occupy, its annual value will be considered as nil. But if you own more than one house and are using all of them for “self-occupation”, you are entitled to exercise an option. You can choose which of the properties should be considered for nil value for taxation. Based on your choice, the annual value of the other-self occupied house properties will be determined on a notional basis as if these had been let out.

Before arriving at the net annual value, you can claim few deductions, such as municipal taxes. This can be done if the property was vacant, or let out partially or for whole of the previous year. The municipal taxes must be borne by the landlord, not by the tenant, and must be paid during the year itself.

The other permissible deduction is standard deduction of 30% of the annual value.

If you have a vacant property and need to calculate its annual value, you first need to find out its notional annual value. This would be the standard rent, if the property is under the jurisdiction of the Rent Control Legislation, or the rent based on the municipal value of the property, or the rent equivalent to what other similar properties are fetching in the same locality.

Could you clarify :

– have a house self occupied with home loan – claiming interest subsidy upto

Rs.2L per annum.

– Have a source of income from another house through rental.

How do I show both in the ITR1?

Regards,

Sp.

use itr2

I took a home loan in June 2010 for a group housing flat. The builder got the OC in Oct 2013, which falls within three years period. However he gave physical possession of the flat in Dec 2014. The flat is self occupied. Can I apply for 2 Lac rebate on home loan interest under 24B?

Regards

Amit

I had taken a home loan in Jun 2012 for a under construction house.

Possession taken on 29th March 2016.

I had paid interest from Jun’2012 – Mar’2015 Rs. 3,50,000

Interst Apr’2015 – Mar’2016 : Rs.1,85,000

At present i am still staying in a rented house and pay rent and claim HRA

pleaase guide how much interest i cam calim under sec 24

: 1,85,000 + (3,50,000/5)

= 1,85,000 + 70,000 = 2,55,000

Or only 2,00,000

As i had taken the possessions in march, so can’t let out the property in FY 2015-16.

I am staying in own house ( bangalore ) and don’t have any home loan .

Also , not in service . Can i show some amount in my income tax for any rebate purpose 2015-16.

Its a self occupied house so other than home loan interest you can’t claim anything

If i am claiming my Pre EMI in income tax return for 16-17 , do i need to submit ITR-2?

If you have got possession of the house, you can claim it as pre construction interest over 5 years. It comes under Income from House property.

There are various ITR forms such as : ITR-1 (Sahaj) ,ITR-2A,ITR-2 ,ITR-3, ITR-4 and ITR-4S( Sugam). ITR-5 and ITR-6 which differ in information required and hence number of pages. You can read out article Which ITR to fill for more details.

There are different Income Tax returns form based on

Who has to fill (individual, Hindu Undivided Family(HUF), Business etc). Did you know that Fourth Character in PAN specifies the type of tax-payer. For Individual’s it’s P , HUF it’s H, Firms F etc.

Whether a resident of India or not Our article Non Resident Indian – NRI explains who is NRI?

On types of Income earned ex: Income from Capital Gains or Income from House Property.

On whether losses are carried forward or not.

I am still confused at one point regarding the municipal taxes paid for the self occupied house. I pay municipal taxes for the house which I occupy & home loan is also going. Can I claim Tax exception for the property tax paid for the same property.

If Self-occupied property, i.e. property which is in occupation of the owner for the purpose of his own residence and he does not derive any other benefit out of it. Our article Tax and Income From One Self Occupied property discusses it in detail.

For a self-occupied property rental income i.e Annual Value is taken as zero.

You will not get credit for any municipal taxes paid nor will there be any standard deduction of 30%.

If Home loan taken for property :

You can deduct the interest paid on the loan availed subject to a specified limit of 2,00,000 per individual.

Principal paid to be added to other tax saving investments made under section 80C which has a limit of 1.5 lakh.

my parents are occupying my second own house(at cochin) but at a place away from my work place(hyderabad). I have a house at hyderabad(place of work).I wish to show cochin house as deemed to be let out. What will be its gross annual value. Can i show notional rentals . do i need to have proof for this? while computing tax?

I have a interest comp is 1.64 L for FY 2015-16. Its a self occupied (unoccupied prop). How much i can claim as income from house property? The whole interest part? right? Do i need to subtract taxes?

You have to enter 1.64 lakh. If Total Income from House property for 1 Self Occupied House is less than 200000 then you enter that amount as Income from House Property as shown in image in article .

.

If someone have only rental income.If the total rental is less then 2.5L after deduction of 30% . Does he needs to file ITR?

I have running home loan, where the interest component is about 80,000 per month. My home was rented out for 8 months in the FY 14-15, with the rent at 35,000 per month. Currently (FY 15-16) I am staying in the house myself, can I claim loss on self occupied property in this case – assuming projected interest at 80,000 per month and deemed rent at 35,000 per month

I have a query : I have a released deed from my mother & sister after the equal partition (father no more). we had constructed an house in my partition property. We had taken housing loan (joint loan my husband and myself). We have a Tax benefit 50% for both from last three years, now my husband office has a query, since the deed is reflecting only wife name and husband as nominee, is he not eligible for Tax ? kindly let me know ?

I purchased home in 2006 with bank loan and repayed the loan in 2012. Now there is no loan. the house is self occupied. how can I save tax on self occupied house?

We can’t think of a way.

Nice Information. Please let me know which itr form need to be filled When Loan amount is 36 lakhs under section 24, first time buyer

Very nice and usefull article keep it up

[…] the investor takes the loan for a self-occupied property, he/she may get the permission of deduction of the principal amount to be […]

[…] the investor takes the loan for a self-occupied property, he/she may get the permission of deduction of the principal amount to be […]

Hi,

I have a home (self occupied) which i have taken in year May, 2011.

I have been paying interest on this loan as below:

FY 2011 – 2012 : Interest INR: 1,95,000

FY 2012 – 2013 : Interest INR: 1,82,000

FY 2013 – 2014 : Interest INR: 1,71,000

FY 2014 – 2015 : Interest INR: 1,65,000

Now, for the FY 2014-2015, i have claimed whole interest of INR 1.65,000 for tax exemption for interest on housing loan (as housing loan exemption limit is raised to INR 2,00,000). So, i can still claim tax benefit of INR 35,000 (2,00,000 – 1,65,000) towards tax rebate for housing loan interest for FY 2014-2015

But for other financial years, i was claiming only INR 1,50,000 towards tax exemption for husing loan interest.

Can i claim the left over interest for FY (2011-2012, 2012-2013, 2013-2014) in the FY 2014-2014 i.e.

INR 45,000 from FY 2011-2012 , INR 32,000 from FY 2012-2013, INR 21,000 2013-2014

Thanks, Anurag

No Sir as limit from 1.5 lakh to 2 lakh is applicable from FY 2014-15 and cannot be used for past years

Date of completion of house was not mentioned in this case; if constructed.

It’s remarkable to visit this website and reading the views of all mates regarding this paragraph, while I am also zealous of getting know-how.

It’s remarkable to visit this website and reading the views of all mates regarding this paragraph, while I am also zealous of getting know-how.

Nice and helpful Information along with good examples

Travel India

Thanks Vishal . I like your travelogue’s enjoying your current one of Varanasi.

Thanks Vishal . I like your travelogues enjoying your current one of Varanasi.

Nice and helpful Information along with good examples

Travel India

Thanks Vishal . I like your travelogue’s enjoying your current one of Varanasi.

Thanks Vishal . I like your travelogues enjoying your current one of Varanasi.

Good