The Income Declaration Scheme provides an opportunity to persons who have paid not full taxes in the past to come forward and declare the undisclosed income and pay tax, surcharge and penalty totalling in all to 45% of such undisclosed income declared. The advantage of the scheme is that once an assessee declares income under this, she will get immunity from penalty or prosecution proceedings under the Income-tax Act, 1961, and the Wealth-tax Act, 1957, related to such income. This article explains Income Declaration Scheme in detail, what is Income Declaration Scheme, Features of Income declaration Scheme, How to get details of Undisclosed Income using registered valuer, How to declare under Income Declaration Scheme using Form 1 online and offline.

Table of Contents

Income Declaration Scheme

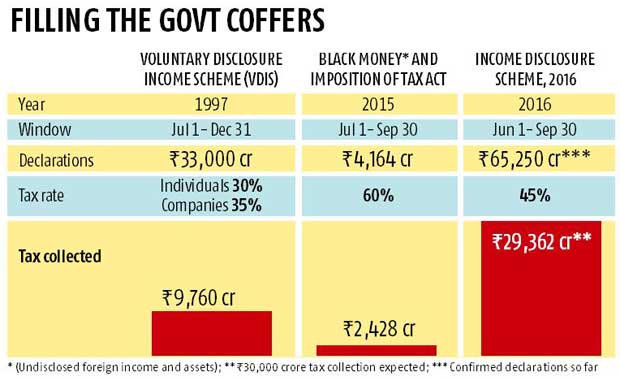

Finance minister Arun Jaitley had announced the Income Disclosure Scheme 2016, in the Union Budget in February 2016, to enable persons to disclose their unaccounted income and wealth. After the Voluntary Disclosure of Income Scheme in 1997, this was the first such income disclosure scheme announced by the government. The scheme commenced on 1 June 2016 and ended on 30 September 2016.

Official website for information about Income Declaration Scheme is incometaxindia.gov.in/Pages/income-declaration-scheme.aspx

Collection under Income Declaration scheme

The Government’s black money declaration scheme received Rs 65,250-crore disclosures during the four-month window that closed 30 Sep 2016. A total of 64,275 declarations were made under the Scheme, an average of about Rs 1 crore per disclosure. This is expected to translate into tax collection of Rs 29,362 crore, of which the exchequer should get Rs 14,700 crore by the end of 2016-17, half of which will come by November 30. Comparison of the collections in various Income Tax declaration scheme by Government is given in image below from Business Standard.

On measures taken over the last two years to reduce tax avoidance, Finance Minister Arun Jaitley said a quantum jump in the searches and surveys resulted in the seizure of Rs 1,986 crore as well as undisclosed income of Rs 56,378 crore in the last two-and-a-half years. According to the finance ministry, Rs 16, 000 crore has been collected by using non-intrusive measures on account of upgraded IT database.

Who Can Make a Declaration under Income Declaration Scheme?

All ‘persons’, such as individuals, HUFs, companies, firms, association of persons (AOP) etc., are eligible to make declaration under the Scheme. A taxpayer who is involved in litigation or proceeding under the income-tax Act or any other Act (specified under the scheme) cannot adopt for disclosure under this scheme.

The scheme gives an opportunity to tax evaders to disclose their unaccounted income or assets, and come out clean by paying the applicable tax, cess and penalty totaling 45% of the undisclosed income. This will help them regularise their wealth. But IDS is also for those who may have unknowingly not paid tax on certain income or assets bought from the income. For instance, one could have missed paying capital gains tax on the money received from sale of an inherited property.

Scope & Coverage of Income Declaration Scheme

Declaration can be made in respect of

- any undisclosed income

- investment in any asset representing undisclosed income relating to any Financial Year up to 2015-16

Income Declaration Scheme does not apply if

- Notice has been issued under section 142(1)1143(2)1148/ 153A/153C of I-T Act, 1961 (debarred only for AY for which notice is issued)

- Search/Survey has been conducted (debarred for affected years only)

- Income sought to be declared is chargeable under the Black Money Act, 2015

- COFEPOSA detainees, persons notified under Special Courts Act (1992), cases of prosecution under NDPS Act, Prevention of Corruption Act, and certain offences under Indian Penal Code

Amounts payable by declarant under Income Declaration Scheme

- Tax @ 30% of undisclosed income

- Surcharge @ 7.5% of undisclosed income

- Penalty @ 7.5% of undisclosed income

TOTAL:45% of UNDISCLOSED INCOME DECLARED

Benefits of Declaration under Income Declaration Scheme

- No Wealth Tax on assets declared

- No scrutiny or enquiry under Income-tax Act and Wealth—tax Act in respect of declaration

- Immunity from prosecution under Income-tax Act and Wealth -tax Act in respect of declaration

- Immunity from Benami Transactions (Prohibition) Act, subject to transfer of assets by the benamidar to the real owner before 30.09.2017

Immunity is provided only for the undisclosed income declared under the scheme and not for the income that remains to be disclosed.

Effect of Non-declaration under Income Declaration Scheme

Undisclosed income and the value of any asset acquired out of such income in any year upto FY 2015-16 which is not declared under the Scheme will be brought to tax in the year in which notice is issued by the Department And All consequences including, interest, penalty & prosecution under I-T Act will follow accordingly.

Critical Dates of Income Declaration Scheme

- Scheme is effective from: 1st June, 2016

- Declarations may be filed up to: 30th September, 2016

- 25 per cent tax payment needs to be made by November 30, another 25 per cent by March 31 and the remaining 50 per cent by September 30 next year, modifying earlier rule of Tax, surcharge and penalty to be paid by: 30th November, 2016

Forms to be used for Income Declaration Scheme

In e-Filing portal, only Form for Income Disclosure – Form 1 is available for e-Filing.

- Form 1 – Declaration form (to be filed by declarant by 30 Sep, 2016). The form can be submitted online by using the digital signature of the declarant, or using an electronic verification code.

- This form can be accessed on the Income Tax e-filing portal and filled up online.

- Alternatively, it can be downloaded in xml format, filled up, then scanned and uploaded on the portal.

- Once the form is uploaded, the IT department will issue Form 2 as an acknowledgement of the receipt of Form 1.

- Form 2 – Acknowledgement of declaration (to be issued by Pr. CIT/CIT within 15 days from the end of the month in which declaration is filed). Once Form 2 is received the declarant can make the payment of income tax on the undisclosed income at the rate of 45% (including surcharge and penalty).

- Tax has to be paid using Challan No. 286, which is Challan for Income Declaration Scheme .

- Form 3 – Intimation of payment of tax, surcharge & penalty (to be furnished by declarant to Pr. CIT/CIT by 30 Nov, 2016). After making the payment, proof of payment must be furnished by uploading Form 3. The proof of payment of tax also needs to be attached

- Form 4 – Certificate of declaration (to be granted by Pr. CIT/CIT within 15 days from the date of intimation of payment

How to get details of Undisclosed Income

If you want to make use of IDS, ensure that the undisclosed income is valued properly and taxes are calculated correctly, because once paid, these taxes and penalties won’t be refunded.

Get details about the income to be declared under Income Declaration Scheme

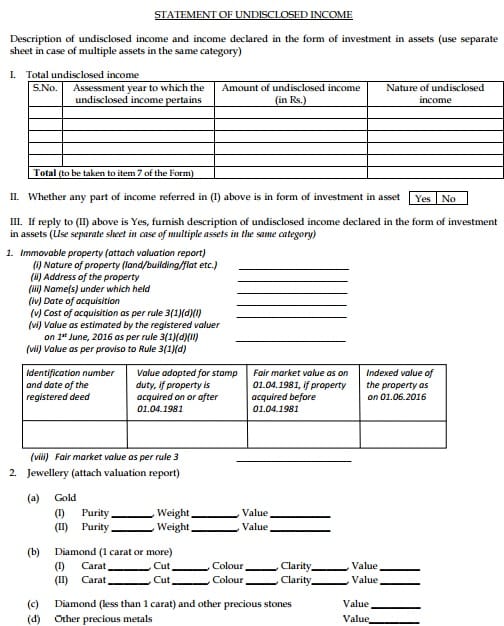

The declarant is required to provide basic details about the year(s) for which the declaration is being made, the head of income to which it pertains and amount. Where the undisclosed income is easily accessible, one can simply put the amount. If the undisclosed income has been converted to assets, the fair market value of assets as on 1 June 2016 must be disclosed. Tax has to be paid based on the declared value of the assets. Rule 3 of IDS Rules prescribe the method of determining Fair Market Value (FMV) of assets, including

- Bullion, jewellery or precious stone

- Shares & securities (quoted & unquoted)

- Drawings, paintings, sculptures or any work of art

- Immovable property

- Archaeological collections

- Interest in a partnership firm

- Any other asset

The tax department has issued guidelines to evaluate FMV.

- For instance, for assets such as bullion, jewellery or precious stones, between the cost of acquisition and the price it will fetch if sold in the open market on the valuation date (i.e., 1 June 2016), the higher amount has to be considered for tax purpose. The same applies to other assets such as immovable property (house or commercial space), or archaeological collections, drawings, or any work of art.

- In case of financial assets such as shares and securities, the process is slightly different. The asset’s FMV will be higher of these two costs—cost of acquisition or the average of the lowest and highest price quoted on any established securities market on the valuation date.

Therefore, if you had earned an income of Rs.10 lakh in 2010, on which tax was not paid, and if this amount was invested in a plot of land or a piece of art whose market value has now appreciated to Rs.1 crore, you would have to pay tax on the current fair market value of Rs.1 crore, though what you had earned in 2010 was only Rs.10 lakh. Such tax, charged at 45% (including surcharge and penalty) would amount to Rs.45 lakh, far more than the income that you had actually earned.

Report of Registered Valuer to be obtained

Get a certified copy from a registered valuer (as per section 34AB of the Wealth-tax Act). The tax department has recently taken out a list of such valuers at incometaxindia.gov.in/Pages/income-declaration-scheme.aspx (Scroll down towards the end).

Valuers are licenced, and their charges are prescribed. For instance, for the first Rs.5 lakh of an asset’s value, the fee would be 0.5% of the value. For the next Rs.10 lakh, it would be 0.20%. For the next Rs.40 lakh, 0.10%, and 0.05% for the remaining value. Charges are excluding service tax. So, for example, if a value of Rs.80 lakh is ascertained for a house, a valuer’s charge for it would be Rs.9,750.

The value thus ascertained has to be mentioned in the tax declaration form and the assessee will have to keep the certified report for each asset for future reference.

How to declare under Income Declaration Scheme

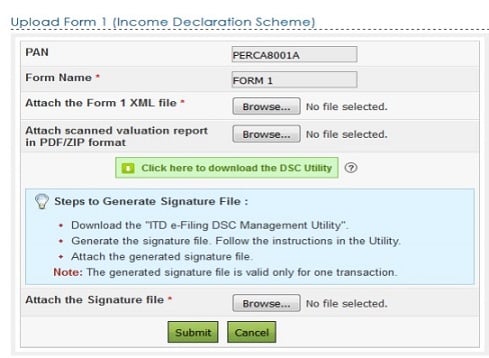

You can file the declaration online or offline. The online process, however, is available only for those who have a valid digital signature. others have to submit the form offline. In e-Filing portal, only Form for Income Disclosure – Form 1 is available for e-Filing.

- To file the declaration, login to your tax filing account on the tax department’s website (https://incometaxindiaefiling.gov.in).

- Under the e-file tab, see “Upload Form 1 (Income Declaration Scheme, 2016)”.

- For Form 1 one has to upload XML file.

- A valid XML file should be generated using the JAVA Utility available under downloads. The JAVA utility of Form for Income Disclosure – Form 1 can be downloaded from the path Downloads : Forms (Other than ITR) ->Form for Income Disclosure – Form 1.

- A valid XML can be generated by following the process,

- Extract the JAVA Utility of Form for Income Disclosure – Form 1 Right click and Open the JAR file of Form for Income Disclosure – Form 1

- Fill all the Mandatory fields

- Click on “Generate XML”.

- Once the Form for Income Disclosure , Form 1 is uploaded, success message will be displayed on the screen. A confirmation mail is sent to the registered email id.

- Once the form is uploaded, the IT department will issue Form 2 as an acknowledgement of the receipt of Form 1 within 15 days from the end of the month in which such declaration has been made

- If the declaration is rejected, it shall be deemed that no declaration was made. In such a case, the tax department can initiate necessary action as prescribed under the income-tax Act.

Pay Tax using Challan 286

If the acknowledgment states that your declaration is accepted, the next step is to pay the due tax. Say, someone bought a house for Rs.40 lakh in 2010, and paid Rs.20 lakh (50% of the asset’s value) for it out of her undisclosed income. If she wants to declare that income now, she will have to evaluate the FMV of the house as on 1 June. If the assessed FMV is Rs.80 lakh, she needs to pay 45% tax on 50% of FMV, i.e. Rs.18 lakh (45% of Rs.40 lakh).

While the income declaration window will remain open till 30 September, tax on such income can be paid till 30 November.

Inform Payment of Tax using Form 3

Once tax is paid, the assessee is also required to submit the proof of payment of tax, Krishi Kalyan Cess and penalty to the designated officer using Form 3. Failure to pay the entire amount of tax (including Krishi Kalyan Cess) and penalty on or before 30 November 2016, or any misrepresentation or suppression of facts or information, will render the declaration void.

Get Acknowledgement of Tax paid in form of Form 4

Certificate of declaration (to be granted by Pr. CIT/CIT within 15 days from the date of intimation of payment)

The income declaration scheme is not successful till now

Last year the government came up with a similar scheme for persons having unaccounted black money abroad. Disclosures during that window were charged with a total tax and penalty of 60%. A total of Rs 4,147 crore of undisclosed wealth was declared during the 90-day foreign black money compliance window that ended 30 September. At 60% (30% tax and 30% penalty), the government got a net tax of Rs 2,500 crore from the declarations.

It is a good opportunity and those who have knowingly or unknowingly not disclosed or have under-disclosed their income, one would expect many to use it. The income disclosure scheme has not yet taken off in a big way, though it is now entering its last month.

One of the key aspects, as clarified by the government, is that if an undisclosed income has been invested in an asset, the market value of the asset as of 1 June 2016 is required to be disclosed.In the past, such schemes have been far more attractive to tax evaders, who could get away by merely bringing in foreign remittances, or investing in certain specified bonds at a nominal interest rate, or paying a nominal rate of tax on the undisclosed income.

For instance, if someone has purchased a house valuing Rs.10 lakh out of her undisclosed income in 2005 and she wants to declare that income now, she will have to get the FMV of the house as on 1 June. If the valuer assesses the FMV of the house to be Rs.50 lakh, she needs to pay 45% of the FMV as tax, i.e., Rs.22.5 lakh, by the end of November 2016. This is more than the undisclosed income. However, if she plans to sell the house in future, the cost of acquisition of the asset would be its FMV as on 1 June for the purpose of calculating capital gains.

Declaration without a registered valuer’s support is effectively not permissible under the scheme. Many tax evaders are also not fully convinced that they would not invite greater scrutiny of their tax returns in the future.

Related Articles:

- Understanding Income Tax Notice under section 143(1)

- Income Tax Notice :Sections,What to check,How to reply

- How to Revise Income Tax Return (ITR)

- Compliance Income Tax Return Filing Notice

- Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

- Defective return notice under section 139(9)

I am trying to submit Form 3 online but it says that the details do not match with the system. Form 3 is to be submitted thrice or only once on 30 Sept 2017?

It has to be submitted thrice

To submit Form 3, the steps are as below:

Step 1: After the assessee has uploaded Form 1, the CIT will issue Form 2 against such

Form 1. Once the Form 2 has been submitted by the CIT, the assessee will be able to

upload Form 3 post login under IDS View Forms (Income Declaration Scheme,

2016).

It has to be submitted thrice and proof of payments attached.

Verify your details

-for Payments made on or before 30 Nov 2016

-For payments made after 30 Nov 2016 but before 31 Mar 2017

-For payments made after 31 Mar 2017 but before 30 Sep 2017

while submiting Form 3 online error occurs saying tax/Tds

details do not match with the system. unable to submit form 3.

I have submitted Form 1 of IDS and also paid tax before submitting the Form 1 online. The Form 1 does have column to show the tax deposited prior to online submission. Now I have received the Form 2. Now again I am filling the details of Tax paid (which were made prior to submission of Form 3) in challan 286 (IDS) & trying to submit Form 3. On submitting button, the sites gets logged out. The “Submit Form 3” still appearing. I am not sure whether Form 3 is not getting accepted because taxes were paid before receipt of Form 2 or there is other technical problems. I have followed all the guidelines for browser setting etc. But matter does not resolved. Please help me.

Form 1 had the option to provide the challan paid while filing.

Purchased a plot in march 2016, but i am a salaried employee, all saving income invested for purchasing the plot, i am also filled ITR in the July month and it is acknowledged by incometax dept.

1) is there any provision to show purchase of plot in ITR form

2) shall i have to declare now under IDS or IDS is applicable to me

You would have to show plot when you sell the plot as long term capital gain or loss.

On selling the land, tax would come as follows:

You will first need to check if this is a long term or a short term capital asset. Land is a short term capital asset when held for 36 months or less. If held for more than 36 months it is considered a long term capital asset.

Now Calculate your Capital Gains-

To arrive at the Short Term Capital Gains – From the total Sale Price of the asset deduct cost of acquisition, expenses directly to sale, cost of improvements(if any) also deduct exemptions allowed under section 54(as applicable, we’ll see below what these are) – > the resulting amount is the Short Term Capital Gain.

In case of Long Term Capital Assets, the only difference is, one is allowed to deduct Indexed Cost of Acquisition/Indexed Cost of Improvements from the sale price. Indexation is done by applying CII (cost inflation index). This increases your cost base (and lowers your gains) since the purchase price is adjusted for the impact of inflation.

What are the Tax Rates

STCG are included in your taxable income and taxed at applicable tax rates basis your slab. See latest slab rates.

LTCG are taxed at 20%

nice post