Employees generally receive a house rent allowance (HRA) from their employers. An employee can claim exemption on his HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer. This explains what is House Rent Allowance (HRA), how much of it is taxable and how much is exempt, how to calculate HRA exemption, how to then show it in Income Tax Return (ITR) for individuals for ITR1 and ITR2.

Table of Contents

What is House Rent Allowance?

Allowance is defined as a fixed quantity of money given regularly for meeting specific requirements of the employees in addition to salary. As a general rule, all allowances are to be included in the total income unless specifically exempted.

House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose. House Rent Allowance so paid by the employer to his employee is taxable under head Income from Salaries , but it can help you save taxes under Section 10(13A) of the Income Tax Act.

Self-employed professionals cannot be considered for HRA exemption under this act, as they do not earn a salary. However, they can claim benefits on the house rent expenses incurred under section 80GG, which resembles section to 10 (13A) but is subject to certain conditions.

Calculation of HRA

When you are calculating HRA for tax exemption, you take into consideration four aspects, which are

- Salary

- HRA received

- Actual rent paid

- Place of residence i.e where you reside, a metro or non-metro city. Tax exemption for HRA for a metro city(Mumbai, Kolkata, Delhi or Chennai) is 50% of the basic salary, while that for non-metro cities is 40% of the basic salary.

Basic Salary for the purpose of HRA Calculation is Basic pay + Dearness Allowance + Commission based on fixed percentage on turnover and excludes all other allowances and perquisites. If the rent paid by you does not exceed 10 per cent of your salary , then you get no tax exemption on the HRA received. As per income Tax act, for calculation House rent allowance least of the following is available as deduction. HRA Exemption Calculator :

- Actual HRA received

- 50% / 40%(metro / non-metro) of basic salary

- Rent paid minus 10% of salary.

Example of HRA calculation

Mr T.Mehta earns a basic salary of Rs 40,000 per month and rents an apartment in Delhi for Rs 20,000 per month . The actual HRA he receives is Rs 25,000. These values are considered to find out his HRA tax exemption:

| Description | Amount(Rs) | |

| 1 | Actual HRA received | 25,000 |

| 2 | 50 per cent of the basic salary,(metro City) | 20,000 |

| 3 | Excess of rent paid over 10% of salary20,000(Actual rent) – Rs 4,000(10% of 40,000) | 16,000 |

| HRA exemption (least of 1,2,3) | 16,000 | |

| Taxable HRA amount25,000 (HRA received -16000 (HRA exemption) | 9,000 |

If these aspects remain constant through the year, then tax exemption is calculated as a whole annually, if this is subject to change, as in a rent hike, pay hike or shift in residence etc., then it is calculated on a monthly basis. There are different ways of calculation as explained by SimpleTaxIndia in HRA exemption calculation monthly, yearly or period basis

For calculation purpose, only salary pertaining to periods in which accommodation was occupied and rent paid will be taken into account. Also, salary is calculated on due basis. This means that if you receive salary arrears of earlier years or advance salary pertaining to future years, it will not be considered while calculating the tax exemption.

Conditions for claiming HRA exemption

- You must live in a rented residential accommodation, and pay rent for the same. If you stay in your own house, or in a house where you don’t pay rent, you cannot claim the exemption.

- If you pay house rent to your spouse, this does not qualify for exemption. But you can claim exemption on rent paid to others including parents, brother, sister in-laws etc.

- If you rent the house for only part of the year, the HRA exemption is allowed only for that period.

- Also, you must actually pay the rent to claim the exemption. If rent is due but unpaid, the benefit of tax exemption on HRA is not available. Employers usually require proof of rent payment (receipts from the landlord) before adjusting the HRA tax exemption in the monthly tax calculation.

- If both husband /wife are working and living in same house on rent both can claim HRA subject to rent is shared/paid by both and individually,both can claim exemption up to share of rent paid actually paid by you.

- The deduction is available only for the period during which the rented house is occupied by the employee and not for any period after that.

- From fiscal year 2011-12 You need to give PAN details of landlord if rent exceeds Rs. 1.8 lakh year or Rs. 15,000 per month. According to the CBDT circular, if your landlord does not have a PAN, he is required to write a declaration signed by him with his complete name and address. The landlord needs to identify himself by attaching valid identification proofs. In the declaration, the landlord has to specify that he does not hold a PAN card.

Home Loan and HRA

Tax benefits for home loans and HRA are two separate aspects and have no direct bearing on each other. If your own home is rented out or you work from another city etc then As long as you are paying rent for an accommodation, you can claim tax benefits on the HRA component of your salary, while also availing tax benefits on your home loan. Please account for any rental income you receive from the property you own under income from House Property.

HRA Exemption Calculator

Please enter the details for calculating HRA. You can enter annual or monthly values of inputs such as Rent, HRA from Payslip.

| Details (Rent,HRA,Basic Salar) entered are | AnnualMonthly |

| Rent that you pay (Rs.): | |

| Basic Salary (Rs.) : | |

| Dearness Allowance(DA) (Rs.) : | |

| HRA (Rs.) : | |

| Do you live in metro city of Delhi,Mumbai,Kolkata,Chennai | Yes No |

| Num of months claiming HRA for: | |

HRA Exemption :

HRA and Form 16

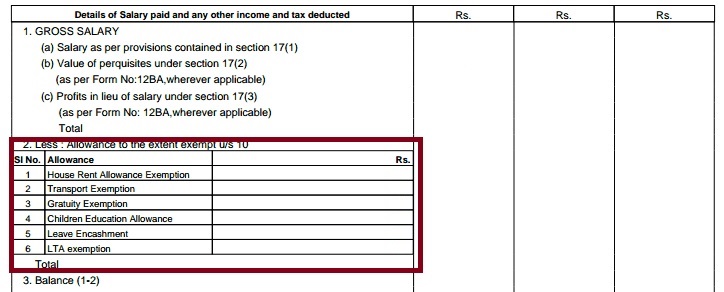

Form 16, shows the HRA exemption as shown in image below. House Rent Allowance (HRA) Exemption would be calculated by your employer and shown in Form 16 if rent receipt were submitted on time.

ITR2 and HRA

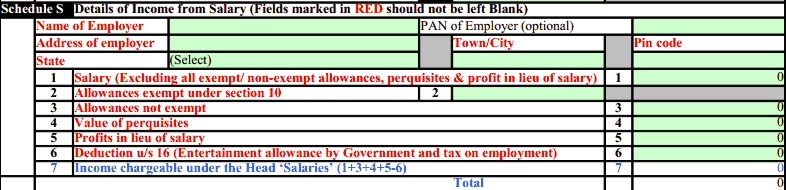

ITR2 shows the schedule (or section) S, Income from Salary

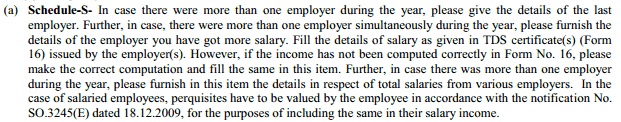

Instructions to Fill Schedule S from ITR2 are as follows

Filling of Schedule Income from Salary from Form 16 (Click on image to enlarge)

1 Salary (Excluding all exempt/non-exempt allowances,perquisites & profit in lieu of salary ) should be filled from Gross Salary (a) part marked as 1 in Form 16 in maroon. Fill in the other information matching corresponding numbers ex: Profits in Lieu of Salary is 5 in Schedule S and 5(in color maroon) in Form 16.

If your HRA has not been accounted in Form 16, you can still claim it by using the calculation of HRA shown earlier. As the HRA was not claimed, taxable income would be more hence employer would have deducted tax on it. Now when you claim it in ITR you tax liability would get reduced (and in cases where you have paid more tax than due you might get refund also) Our article How to Claim Deductions Not Accounted by the Employer explains it in detail.

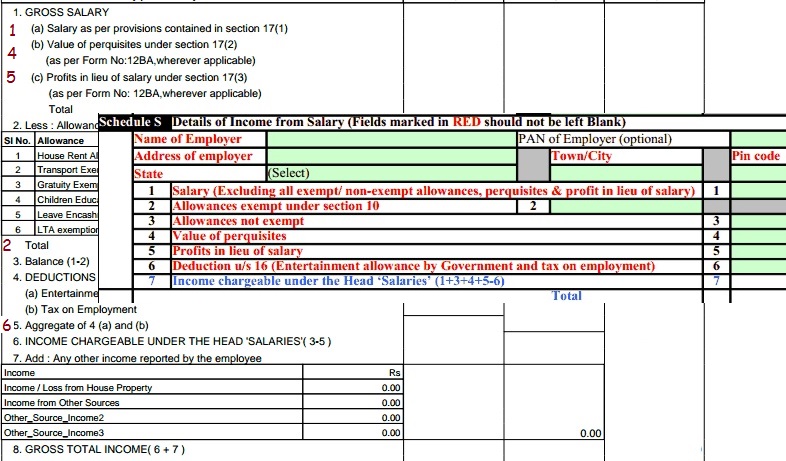

ITR1 and HRA

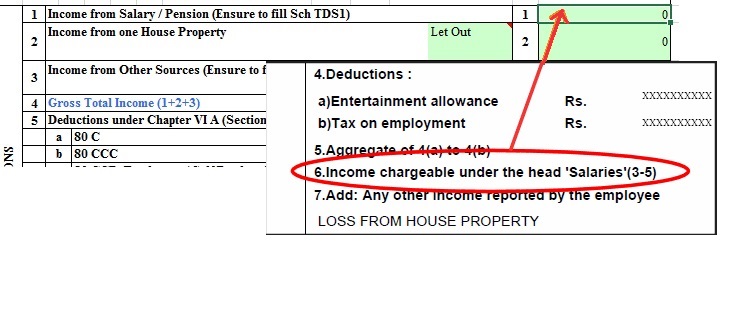

ITR1 has only one field for filling Income From Salary. So for field Income chargeable under the Head Salary/Pension , on your Form 16, you need to fill in Gross Salary which takes care of all deductions,allowances etc . Fill information in point 6, as shown in image below. Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax explains it in detail.

Articles that may be useful to you are:

- E-Filing of Income Tax Return

- E-filing : Excel File of Income Tax Return

- Which ITR Form to Fill?

- Fill Excel ITR form : Personal Information,Filing Status

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

Hope it helped in clarifying doubts on HRA? Looking forward to your comments and feedback.

35 responses to “HRA Exemption,Calculation,Tax and Income Tax Return”

Hello Sir,

Suppose my actual rent paid per year is 144000(all required documents are in place) and my annual HRA exemption is 100000,

So can i get tax return on remaining 44000 when i file ITR.

If yes, how we can do that?

Regards,

Divyaprakash Singh

No you cannot claim more than HRA exemption.

As per income Tax act, for calculation House rent allowance least of the following is available as deduction. HRA Exemption Calculator :

Actual HRA received

50% / 40%(metro / non-metro) of basic salary

Rent paid minus 10% of salary.

If there is something more than this exemption limit you would have to let it go.

So don’t claim more than what you are eligibile for.

[…] needs to give PAN of Landlord to claim HRA if rent is more than Rs 1 lakh per annum of Rs 8,333 per month. Earlier the limit was Rs. 1,80,000 […]

Is it required to submit PAN Card of landlord if annual rent is 40,000.

No as annual rent is less than 1 lakh you don’t need PAN Card of landlord

Salaried taxpayers, who want to claim I-T exemption on house rent allowance exceeding Rs one lakh per annum, will have to obtain the PAN card number and other details of their landlord on a plain A-4 size paper before submitting it to their employer.

There is a difference between salary and basic salary and in calculation for tax benefit for HRA only basic salary is considered but in example this is not the case, a confusion is created please check it and hope to get my doubt clear.

As long as you are paying rent for an accommodation, you can claim tax benefits on the HRA component of your salary, while also availing tax benefits on your home loan. This could be the case if your own home is rented out or you work from another city etc.

Dear Sir,

I am working in Software Company.

I have some confusion to fill tax online.

Example:

let my total gross salary (Form 16 column 1(d))= 1000000

exempt under 10C (Form 16 column no 2) = 200000

Income chargeable under the head (Form 16 Column 6) = 800000

my employer mentioned total gross salary (as above 1000000) during deposit the tax so 26AS is showing

Total amount Paid credit = 1000000 against TAN of deductor.

and total tax deducted in 26AS is = 56650 (same as in form 16)

My query is that:

what would be the value under below column during ITR1 fill online:

B1. Income from Salary / Pension (Ensure to fill Sch TDS1)= ?

Sch TDS1 – Details of Tax Deducted at Source from SALARY [As per FORM 16 issued by Employer(s)]

the above field is showing pre mentioned value as per 26AS

Income under salary= 1000000 and Tax deducted = 56650

Do I need to change the above value if yes then what would be the

value in column “Income under salary= ? ”

If yes and i made changes then how income tax department will verify it,they will

show mismatch becuase as per 26AS total income is 1000000 so in this case I have to

pay tax?

Regards,

Atul

I have my form 16 and there is not HRA exemption, because I missed the proof submission before closing of Financial Year. Now I want to claim HRA in ITR filing. So in which section I should claim HRA?

1. I referred section 80GG, but I have HRA as my salary component. Can I fill this seciton?

2. Can I deduct HRA amount from my “Income chargeable under the head ‘salaries’ (3-5)” and put the resulting amount as “Income From Salary” section?

Your reply will help a lot.

Thanks in advance.

Yes Hemant for ITR1 the way you have said works. Deduct the HRA from Income at Pt 6 (salaries 3-5).

Forgot to submit rent receipts to your employer on time? If you live on rent and have made rent payments you can claim deduction on House Rent Allowance at the time of filing your return. All you need is your rent receipts and PAN of your landlord (where rent payments are more than Rs 1,00,000 per annum).

You can use Cleartax’s HRA calculator to find out how much HRA will be exempt from tax.

Now re-calculate your total taxable income after adjusting this exemption. Finally calculate your tax dues.You can then claim a refund of excess tax deducted by your employer in your Income Tax Return.

Hi,

I have received HRA from my previous employer but he forgot to give HRA exemption.

So,

Now I have to show HR exemption in ITR1..My previous employer forgot to give me HR exemption. From this video, it is pretty clear that we can deduct this HRA from “Salary Income”. Now, my Question is that if I should deduct the same HRA exemption from “Income under Salary” mentioned under “Tax Details tab” under Sch TDS1, where I am mentioning the tax dedicated at source, or I should show the same complete salary here as mentioned in Form 26AS. Suppose Income shown in form 26AS for 6 months by previous employer is 300000. and now say I have to show 40000 HRA exemption. So, as understood from above video, I would include 260000 as income from salary under Income Details tab. So, What should I mention under “Tax Details tab” —> Sch TDS1 —> Income from Salary:

3000000 as mentioned in form 26AS, or

2600000

Please suggest.

Also, is it necessary to fill ITR2, to show this HRA exemption?

Regarding section 80GG.

Usually HRA forms part of your salary and you can claim deduction for HRA. If you do not receive HRA from your employer, and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence, you can claim deduction under section 80GG towards rent that you pay.

Dear Sir,

I’m working with a Private Limited company . I would like to know about Conveyance Allowance, House Rent Allowance, Medical Reimb Payment allowances are comes under extent exempt u/s 10.

I need to do e-filing.

Under which section i need to place these allowances in ITR-1?

Thanks & Regards,

Vishnu

HI,

I haven’t submitted my HRA while filing the income tax in Feb-March’15 (for 2014-2015), I understand I can claim in while doing e-filing the ITR.

Can someone tellme where should I enter the rent details while e-filing, to get that amount back

Yes you can claim HRA. Our article How to Claim Deductions Not Accounted by the Employer explains how to claim it by legitimatelly modifying salary details in detail

No It does not cover how to claim HRA. Kindly guide us how to do that?

Hi,

As per my understanding Allowance under section 10 are expected to be exempted from Actual Salary and same is shown in my Form 16.

But when I File in ITR2 form in Schedule S, I see that Point 7 ( Income under Head Salaries) is not reducing the amount calculated in Point 2 (Allowances under section 10).

Is it that the Exemption is not being considered under section 10 in case of ITR2?

Regards,

Gargi

Hi,

I filed incorrect(much less) HRA at my employer. Can I change it in ITR and claim a return on it?

Dear Sir/Mam

I am a working lady. I stay in the house owned by my husband. I sign a annual rent agreement with him and claim HRA tax exemption by producing the rent receipts. We have purchased a new house in the same city about 2 Kms from our present house, in joint name taking a joint loan from the bank. I have following questions : 1. Can both of us claim or either of us claim exemption under home loan interest paid on home loan if the house is vacant? 2. Do we need to show some income from the new house to claim interest exemption. If notional income to be shown what will be minimum amount? 3. Can I continue to get HRA rebate that I am currently getting staying in my husband’s house and also claim interest exemption from new house.

Thanks -Priya

Hi,

Can someone claim the HRA while filing IT return if he/she has not claimed the same through employer?

Thanks

Yes Sir one can. Not only HRA but any other deduction that you are entitled to.

You would have to re calculate the salary.

Our article HRA Exemption,Calculation,Tax and Income Tax Return explains it in detail.

Thank you for sharing your information. Sikka Kimantra Greens Noida new housing Project by Sikka Group which is located at sector 79 Noida. Sikka Kimaantra Greens offers 3/4 BHK & Villas with sizes ranging from 1355 to 2695 Sq. Ft.

For details Click Here

That’s a really good article. Thanks for sharing this with us

Thanks a a lot for good comment. It is encouraging

Thanks for this huge article. It’s so helpful, and not only for me, but it will help also other people.

From my salary IT paid. In that IT statement

HRA Rs 9000 excess paid by me kindly return to me.

Sir you can claim refund it while filing ITR.

Dear Sir,

I’m working with a Private Limited company . I’m Statying in Ahmedabad Gujarat & My company is based on Pune Maharastra . My EPF Account is based on Pune . How to check my EPF Account Statement.

Thanks

Sanjay Gupta

Manager MIS,

MD India Health Care Ltd.

EPF accounts are online so you can check from anywhere. Follow the following steps. these are explained with pictures in our article Basics of Employee Provident Fund: EPF, EPS, EDLIS

A: From July 2011 one can check the EPF Account balance online. Follow the following steps.

1) Go to http://www.epfindia.com/MembBal.html

2) Select EPFO Office where PF account it maintained. Suppose the account is in Punjab. Select Punjab from the Drop Down.

3) Select the office name: Once you select state in earlier state, it would then show code for various EPFO offices in Punjab. Say your EPFO office was in Ludhina. So select the office name Ludhiana, the establishment code would be LD-LDH. This would take you to next screen which has LD LDH filled for establishment code.

4) Enter PF Account Number which is in the format :

EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit)

PF Account Number may not have Extension code, in that case leave it blank.

Enter the Account Number.

Note: Your PF account number may have just two alphabets for EPFO Office Code then you can search the new Code at EPFI Establishment Information Search This is also available on 1st step mentioned above: Member Balance Information Search Your Establishment Code here.

5) Enter your Mobile and Name, Accept Terms and condition and Submit.

Dear Sir,

I’m working with a Private Limited company . I’m Statying in Ahmedabad Gujarat & My company is based on Pune Maharastra . My EPF Account is based on Pune . How to check my EPF Account Statement.

Thanks

Sanjay Gupta

Manager MIS,

MD India Health Care Ltd.

EPF accounts are online so you can check from anywhere. Follow the following steps. these are explained with pictures in our article Basics of Employee Provident Fund: EPF, EPS, EDLIS

A: From July 2011 one can check the EPF Account balance online. Follow the following steps.

1) Go to http://www.epfindia.com/MembBal.html

2) Select EPFO Office where PF account it maintained. Suppose the account is in Punjab. Select Punjab from the Drop Down.

3) Select the office name: Once you select state in earlier state, it would then show code for various EPFO offices in Punjab. Say your EPFO office was in Ludhina. So select the office name Ludhiana, the establishment code would be LD-LDH. This would take you to next screen which has LD LDH filled for establishment code.

4) Enter PF Account Number which is in the format :

EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit)

PF Account Number may not have Extension code, in that case leave it blank.

Enter the Account Number.

Note: Your PF account number may have just two alphabets for EPFO Office Code then you can search the new Code at EPFI Establishment Information Search This is also available on 1st step mentioned above: Member Balance Information Search Your Establishment Code here.

5) Enter your Mobile and Name, Accept Terms and condition and Submit.

There’s always confusion in calculating the HRA.And you make it such task easy with a good example.

Thanks Easwar!

There’s always confusion in calculating the HRA.And you make it such task easy with a good example.

Thanks Easwar!