For salaried Indians, the finance department asks to submit proof by early February so the frenetic tax-savings season begins in January. As investors clamour for tax-saving instruments, thinking only on how much to put in PPF, NSCs, bank FDs, insurance policies and tax-savers from mutual funds. The financial services companies also push new and existing products during that time. It is great to see people so keen to save but do we think about these before saving tax. This article talks about How to save Tax?

- Is the tax planning a part of our overall financial plan,

- Does it depend on our financial needs and goals,

- Are our tax saving investments distributed among assets classes to reap the dual advantage of lowering tax burden as well as building wealth .

Don’t make last minute tax investments in tax saving instruments which are much publicized. You may end up buying an expensive recurring product, like an insurance scheme, thinking that much amount will be saved from a tax perspective every year but you would be locking your money, would have to pay the premium very year and the returns would be around 5-6% per annum. Is this what you want ?

Table of Contents

Maximum tax one can save

Maximum of Rs 46,345 can be saved under 80C on invesment of 1.5 lakh rupees There is a limit on how much tax you can save under various tax saving options, some like 80C depend on tax slab while for Medical Insurance (Section 80D) ,home loans(section 24), Education loan(80E). For FY 2013-14 (AY 2014-15) the various tax brackets and maximum amount are given below in the table. So one in 30% tax bracket i.e earning more 10 lakh need to put Rs 1.5 lakh every year to save at most Rs 30,900. More on tax slabs at Understanding Income Tax Slabs,Tax Slabs History

| Section | Description | Maximum deduction | Investment Amount | Options |

| 80C | Long term tax saving | |||

| Income above 10 lakh Rs | 30,900 | 1.5 lakh(along with 80CCC and 80CCD) | EPF,ELSS, tax-saving 5-year bank fixed deposits,PPF,NSCPrincipal of Home Loan,Senior Citizen Scheme,Tution Fee | |

| Income in 5 -10 lakh Rs | 20,600 | |||

| Income in 2-5 lakh Rs | 10,300 | |||

| 80D | Medical Insurance | 15,000

20,000 for Senior Citizen |

15,00020,000 | |

| 80CCC | Pension Funds | 1.5 lakh(along with 80CCC and 80CCD) | ||

| 80CCD | National Pension Scheme(NPS) | 1 lakh(along with 80CCC and 80CCD) | ||

| 80CCG | RGESS | 50% of max amount | 50,000 | Gross annual income is Rs 10 lakh or less |

| Section 24 | Home loan Interest | 1.5 lakh | ||

| 80E | Interest on Education loan for higher education | Full Interest amount | ||

| 80TTA | Interest on saving bank account | 10,000 |

Tax on income from tax saving instruments

Keep tax treatment in mind while making these tax saving investments, as interest income is taxed differently. Interest earned from PPF is tax free, whereas interest income from bank FDs and NSCs are taxable. Hence, if you are in the 30% tax bracket, PPF may be a better investment from a tax perspective

Example of How Tax Saving works

Let us assume that your taxable income is Rs. 5.5 lakhs that means that your total tax liability is Rs. 35,000.

If you submit medical bills worth Rs. 12,000 as a part of your medical allowance. Your taxable income becomes Rs. 5.38 lakhs and Tax liability Rs. 32,600.

If you claim House rent allowance deductions of Rs. 83,000 then taxable income comes down to down to Rs. 4. 55 lakhs which means that the new tax you have to pay is just Rs. 18,500

Now if you invest Rs. 30,000 in tax saving option (PPF, Life Insurance ) etc your taxable income comes down to Rs. 4.25 lakhs (4,50,000 – 30,000). This means that now the tax you have to pay is Rs. 15,500 which is less than half of 35,500.

How to save tax?

Know your Incomes

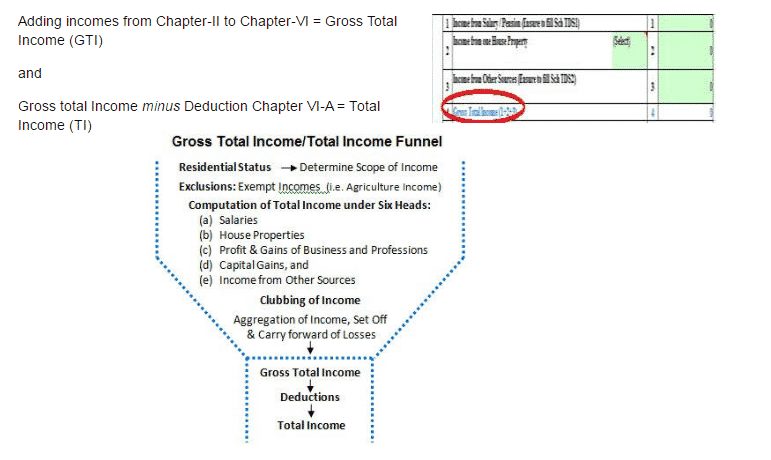

Estimate your income The first step to knowing your tax-saving target would be to get a fix on all sources of your income. Your income could come under any one or more of the five heads : salary income, business income, capital gains, house property or other sources.

Estimate your taxes

Once you have a fix on your gross total income, ascertain which category you come in —individual, senior citizen . For each of these categories, there is a basic exemption limit. Ascertain the various deductions available to you.

Know existing tax saving investments or expenses

Get a fix on your existing tax saving investments and expenses. Also the section or category under which they fall.

For 80C, 80CC, 80CCD : For a salaried employee, a contribution towards Employees Provident Fund (EPF) is mandatory . Renewal premium towards life insurance policies and the principal repayment towards home loan qualifies for deduction. Any tuition fees paid for children also qualifies for similar deduction. Remember The upper limit for deductions can’t exceed Rs 1 lakh.

Non 80C : Are you paying any medical insurance premium,interest on a home loan or an educational loan.

Know how much to save

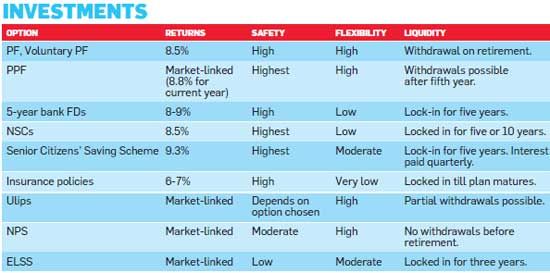

You have to figure out how much more you need to invest to reduce your taxable liability. Your fresh investments or expenses could be in any of the non-80C or Section 80C instruments. You may consider repaying a portion of your home loan or get an extra health cover for your family members. Investing in any tax-savings instrument should take into account things such as your age, risk appetite, financial liabilities and goals and, most importantly, your income slab. And remember, most tax-savings instruments are for a long-term and, therefore, the choice should align with your long-term financial needs. Comparison of Tax saving options for 80C in terms of returns, safety, flexibility, liquidity are as follows .

Does it make sense to save tax?

Investments should not be driven only by the tax-saving consideration. Do you really need to save tax? Is it worth it? Do you understand the tax implications on investment, on income from the investment, on maturity, on exiting the option in between (say you sell your house after two years or stop paying premium after 4 years) . Does locking up Rs 1 lakh every year to save at most Rs 30,900 makes sense?

Summary of How to save tax?

Saving Tax consists of steps given below.Tax-planning exercise should not be a random, out of blue kind of activity. Last minute tax planning should be avoided as much as possible (how many of us have regretted the life insurance policy we tool just to submit the tax proof).

- Knowing your income under various categories

- Knowing how much you have saved (through EPF, Home loan Principal etc)

- Knowing How much more to save

- Understanding the Tax saving options

- Understanding the returns

- Understanding the time period

- Understanding frequency of investment option

- Understanding any tax implications of stopping or on maturity.

- Understanding your risk profile.

- Choosing the option that suits you.

- Submitting the proof

- Keeping the document proofs safely

- Claiming tax deductions while filing income tax return (explained in detail in e Filling ITR-1

)

Explained in detail in Choosing Tax Saving options : 80C and Others

Related Articles:

- Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24

- Understanding Income Tax Slabs,Tax Slabs History

- Choosing Tax Saving options : 80C and Others

Investments should not be driven only by the tax-saving consideration. Does the mad scramble to save tax really make sense? How do you go about saving taxes? Do you plan your taxes or do randomly. Do you make your tax saving plan beginning of the year or postpone it till when you are required to submit proofs.

9 responses to “How to save tax?”

Sir, have invested Rs 50,000 in equity ETF’s to avail deduction under RGESS (50% of 50,000).However, the condition of taxable income should be less than 12 Lakhs, has me confused. Does taxable income include ‘EXEMPT INCOME’? I have received gifts/inheritance amounting to some Lakhs. Will this high EXEMPT AMOUNT nullify the RGESS Deduction which I have claimed? Please clarify & oblige.In case this was not allowed, normally ITR-2 displays ERROR WARNINGS. But while filling up the Excel sheet offline, no such warning was displayed.

Income Tax is payable on the total income at the rates of income tax prescribed. Difference between Gross Total income and taxable income is shown in image

Sorry Sir, did not understand. Could you be more clearer and respond to my specific situation please?

Thanks for the post..!

Thanks for the post..!

This is one post that everyone should read and then learn it up completely because every word that is written is of utmost importance.

Thanks for encouraging words and tweeting about it

This is one post that everyone should read and then learn it up completely because every word that is written is of utmost importance.

Thanks for encouraging words and tweeting about it