If after furnishing the original return, any omission or any wrong statement is discovered which was done totally unintentional then one may file a revised return. What is Revised Income Tax Return? What changes can be done in Revised Return? How to Revise Income Tax Return? What is the process of revising the return?

Table of Contents

Revise Income Tax Return

What is Revised Return?

If an individual has already filed the income tax return and subsequently discovers any omission or wrong statement , he can re-file the return with necessary modification. This re-filing of the income tax return is referred to as Revised Return.

When should one file Revised Return?

The revised return should be filed only if the mistake is valid or you have got the notice from income tax department under section 143(1)a. If after furnishing the original return, any omission or any wrong statement is discovered which was done totally unintentional then one may file a revised return. For example, you can revise return if

- If you have missed declaring an income.

- Or if there is mistake in any other statement you can correct the error by filing a revised return.

For instance, if you you forgot to declare tax-exempt interest from PPF or interest on Saving Bank account or you had not declared some income such as interest on your fixed deposits or you paid your self-assessment tax or you want to correct the data.

The return filed in response to notice under section 148,for the assessment of the escaped income, can also be revised provided that for such return all the provisions of section 139 shall apply

Procedure to file Revised Return

To file Revised Income Tax Return gather following information:

- Receipt No of Original Return

- Date of Submission of Original Return

- Visit the Income Tax website and log in by entering user ID (PAN) and Captcha code.

- Click the e-filing menu and then select the ‘Income Tax Return’ link.

- On the next page, your PAN will be auto-populated. Select the assessment year, ITR form number, Filing type (original or revised return), and select the submission mode as ‘Prepare and submit online.

- Under the ‘General Information’ tab, choose the ‘return filing section’ as ‘revised return’ under Section 139(5) and ‘return filing’ type as ‘revised’.

- Enter the acknowledgment Number and Date of filing of the original return.

- Then fill in or correct relevant details of the online ITR form and then submit the ITR.

- E-verify the returns

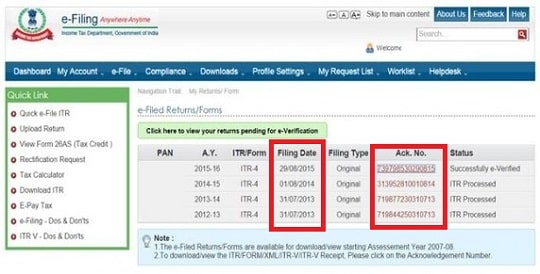

To get it from the income tax filing website, login in and click on the ‘View Return’. You would see all the returns you have submitted electronically. Get the Ack.No number as well as filing date as shown in the image below for the year fir which you are revising.

Procedure for revising return is as follows :

- Check for the discrepancy in the original return e-filed

- Log on to incometaxindiaefiling website

- Prepare Return just like like you filed the first time, correcting or filling what had got omitted earlier.

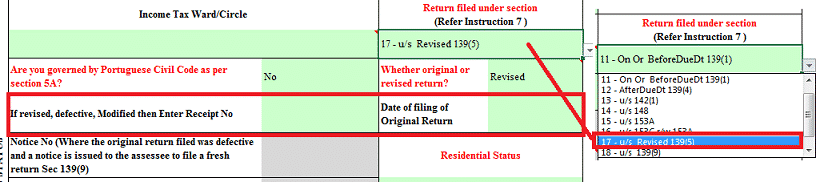

- Go to part of ITR with Filing Status , PART-A General, for example shown in image below (Fill Excel ITR form : Personal Information,Filing Status)

- For Whether original or revised return select R-Revised.

- For Return filed under section select Revised 139(5).

- Enter the E-filing acknowledgement receipt number from the ITR-V Which you would have got after filing the original return.

- Press Submit button on completion of data . You will get a new ITR-V marked as revised return.

- Once you receive the ITR-V form, you are supposed to E-verify your return or send across both original and revised return ITR-V forms to IT department Bangalore within 120 days.

You can E-verify your return as explained in our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

Can I correct the Assessment Year or change my ITR form?

Revised return ,typically, means making changes in your original return that is Assessment Year and ITR remains the same.

Assessment Year: Income Tax return, ITR, is bound to an assessment year. For income earned in FY 2015-6 assessment year is AY 2016-17. Income Tax return forms(physical and excel) of AY 2016-17 and AY 2015-16 are different,. A revised return for the correct assessment year needs to be filed using that year ITR Form . Please use correct year Excel/Java Utility/Prefilled ITR only.

Can an e-return filed with one ITR Form say ITR-1 be revised in any other ITR Form

Yes. However, the taxpayer should use the form as applicable. Ref:Top CA Firms

When can Income Tax Return be revised?

Revised return can be filed only if the original return was filed within due date, Original return is filed under section 139(1). If a return is filed after the due date,called belated return, then it cannot be revised.

Till when can one revise a return? Time period of filing the revised return?

The revised return can be filed before the expiry of one year from the end of the relevant assessment year or before the completion of assessment, whichever is earlier, As per section 139(5) of Income Tax. You cannot revise return if your return is processed.

For example: If a Return of Income for the Financial Year 2015-16 or Assessment Year 2016-17 is filed by the assessee on 28th July 2016 (before the due date of filing of Income Tax Return i.e.5 th Aug 2016), and he later discovers some mistake, he can file a Revised Return of Income Tax anytime up to 31st March 2017 or before the completion of Assessment whichever is earlier.

How many times can the revised return be filed?

Technically a return can be revised any number of times before the expiry of one year from the end of the Assessment Year or before the assessment by the Department is completed; whichever event takes place earlier.

Don’t revise for the heck of it! You could be penalized

Revised returns are more likely to be chosen for scrutiny and if any omission is found purposeful, especially if income has been revised higher, you could be penalized with a fine or even imprisonment. If revised return is filed to correct a bonafide mistake then no penalty can be levied, otherwise it can be levied which could be 100 to 300 percent of tax dues.

In case of concealment of income and furnishing of inaccurate information in income tax return an individual will be penalized under Section 271(1)(c) of Income Tax Act

What happens to the Earlier Return?

Once, a revised Return is filed, the originally filed return is taken to have been withdrawn and substituted by the Revised Return. Revised Return Substitutes the Original Return. You need the e-verify or send both original and revised return ITR-V forms to IT department Bangalore within 120 days.

Difference between Revision and Rectification of ITR?

Both Revising the return and rectification are similar but not same. A taxpayer can rectify his income tax return online if there is an apparent mistake in the return already filed. The change can be effected only after the taxpayer has received an order. Rectification enables correcting the error and refilling the return for assessment. So summarizing :

Revised Return can be filed only if you have done any mistakes(omissions or commissions) in filing your original return of income. It can be filed before the expiry of one year from the end of the relevant assessment year or before the completion of assessment, whichever is earlier.

Rectification is filed after processing of return or after receiving Intimation u/s 143(1), to rectify the mistakes in the order passed by the Income Tax department. Only those mistakes which are apparent from records can rectified u/s 154 upto 4 years from the end of the financial year in which order sought to be rectified was passed.

Is there some fine or payment for filing Income Tax Return?

No there is no fine or payment to be made for filing revised return. As you have already filed original return within due time, therefore no need to pay interest u/s 234A, but if any tax is due then you have to pay interest under section 234B, 234C. Please pay Self Assessment Tax using Challan 280, Update the tax paid in ITR and then revise the return. As explained in our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

How to Revise Income Tax Return?

How should the revised returns be filed – Online or Physical?

To file revised returns, one can use both the online and physical methods. However, you can revise returns online only if you have filed the original returns online and have the 15-digit acknowledgement number with date of filing original return.

Related articles :

- E-filing : Excel File of Income Tax Return

- Income Tax for Beginner, Income Tax For Beginner – Part II

- Understanding Form 16: Tax on income, Understanding Perquisites, Understanding Form 12BA

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Paying Income Tax : Challan 280

Hope this explains how to revise income tax returns.

Disclaimer : Please use article the for informational purpose only. We do not hold any responsibility for mis-information or mis-communication.

If you found this article helpful, please share the link in Facebook/Twitter. The links are provided below.

I filed my return (Pensioner – Senior Citizen : Age > 60 years) FY 2018-2019 before the deadline and got my ITR approved and refund has been processed. However I didnt knew about section 80TTB which provides Rs 50,000 exemption on SB/FD interest for Senior Citizen : Age > 60 years and didnt add it. Shall I file revised ITR now? I am getting additional refund when adding this 80TTB 50k exemption. Is this a valid case to file revised return ?

I have filed my returns ITR2 in XML format. It contained capital gains and Relief under section 89.

I got demand notice for Tax, as the Relief claimed under section 89 not granted for want of form 10E. How to submit this form, is there any provision in ITR2, or anything else I need to do?

Thanks

Mahesh

Starting income tax returns for the Financial Year 2014-15 (The Assessment Year 2015-16), the Income Tax Department has made it mandatory to file form 10E if you want to claim relief under Section 89(1)

Your tax liabilities for a Financial Year are calculated from the income earned by you during that year. Sometimes, that income includes arrears (past dues paid in the current year). Usually tax rates increase with time which means that you may have to pay higher taxes in such case. However, Income Tax Act provides you relief in those situations u/s 89(1). This is simply based on the principal that you should be liable to pay the taxes on your income based on the tax rates applicable for the year to which the income pertains.

If you have received any portion of your salary in arrears or in advance, or you have received family pension in arrears, you can avail some tax relief under section 89(1) read along with Rule 21A.

Calculate Relief under Section 89(1)

Before you file form 10E to get tax relief, you need to calculate the amount of relief you are eligible for.

Form 10E filing procedure in 4 Simple Steps:

Go to https://incometaxindiaefiling.gov.in/ and login with your ‘User ID’ (i.e. PAN), ‘DOB’ and ‘Password’.

Now click on tab titled ‘e-File’ and select ‘Prepare & Submit Online Form (Other than ITR)’ from the drop down menu.

Choose ‘Form 10E’ from the drop down menu, fill the relevant Assessment Year and press ‘Continue’ button.

You will find the screen shown below with instructions to e-file Form 10E.

Click on all the blue tabs one by one and fill relevant details.

Click on ‘Submit’ once you are done to complete the process.

In case if you are not able to complete the whole process at one go you can save the information filled by clicking on the ‘Save Draft’ button at the bottom of the screen and complete it any time later.

In case if you have saved form 10E in draft you can complete it later by following the same process flow as stated above.

Note: The Assessment Year you choose should be of the Financial Year to which the arrears belong, while filing Form 10E.

It’s miles highly informative and builds top-notch hobby for the readers.

For the people like us, your blogs assist to get ideal facts and information.

Never forget a significant way to prevent such adware from infecting your computer is by using the best adware remover tool.

Sir,

I am claiming both HRA and housing loan. My parents are living in the property hence I will not receive any rent

I am staying nearby office for rent. While submitting revised return I am unable to fill let out as zero value. But it was accepted during the first filing. Please help. Should I put self occupied or can I put a minimum value as 1000 RS

Per month

There might be a bug earlier which was fixed now.

Technically your property is self-occupied hence rent should be 0.

You can just claim for the Home loan interest

You are right in claiming your HRA.

Dear Sir,

I file my ITR on 16 July 2018 through a web service. I have one house property which is lying vacant. While filling details, I mistakenly showed the property as “Vacant”. The ITR 2 filed on my behalf by the web service shows the property as “Deemed To Be Let Out”. I do not have any other property. I have not yet verified the ITR V. Can I revise the return to show the property as Self Occupied? Will such revision attract scrutiny?

Yes please revise the return.

No, every revision does not attract scrutiny.

Chance of scrutiny is also if you don’t revise.

It is better to be right then be scared of revision.

I have received arrears of pension for FY 2009-10 to 2017-18 during FY 2017-18 after a long litigation. My employer wanted to deduct income tax on whole of the amount of arrears, which I objected and submitted Form 10E to IT Department u/s 89 as per provisions. A copy of Form 10E was submitted to my employer and only then, it moved accordingly. My tax liability on receipt of arrears comes for the relative previous years only for which I had already filed my returns within time. Now my querry is whether I have to file revised returns for all the previous years in terms of Form 10E, or in the present FY ending 2017-18, I have to show full amount of arrears. In this case how to show details of pension arrears for previous years as per Form 10E, because in the current FY, my tax liability including arrears of present FY (not being total arrears) is NIL. Pl. also advise if litigation expenses for getting arrears of pension can be deducted from total arrears of pension. If so how the expenses be bifurcated for each of previous year. Regards.

Sir, my CA had filled ITR-1 for AY 2016-17. Can I file ITR-4 for AY 2016-17 now?

Yes you can.

If you return for AY 2016-17 is not processed then only you can revise the return.

As explained in the article, Can an e-return filed with one ITR Form say ITR-1 be revised in any other ITR Form

Yes. However, the taxpayer should use the form as applicable.

I have filed the return of 30 july 17 without paying tax,I have e-Verified the return and got the acknowledgement email.It show I need to pay 6100rs,

I was not aware that I should have to pay this amount before filing return,Now I know that and I have paid the self assessment tax and got CIN number and all…What should I do now to the filed return..?

Please Help

I am filing for previous year and I dont have form 16 of my earlier company, but income under salary is automatically populated in the tax details. Can I put the same income in income from salary ?

Sir, I have wrongly mentioned the assessment year 2016-17 instead of AY 2017 -18 in the challan form . The amount was deposit in 3/17. The amount has been appeared in the itr for AY 16-17. Can I submit revised itr. Please advise.

It is for which year Sir?

Dear Sir,

Submitted ITR-1 (AY 16-17) physically on 26.07.2016. at Kolkata IT Office . It had Tax payable/refund – Nil

Detecting over payment done wrongly, I filled Revised return online 2 days back giving Acknowledgement number of original return with date etc.

But on clicking “submit”, a red box telling “invalid acknowledgement number” appearing.

Is there any problem for the online return system to recognise the Acknowledgement no. of physical return ?

Please advice what I should do now.

Dear Moneyaware,

I have been transferred by my company to US where I am paid a US salary in dollars.

When I was transferred I was not aware about dual taxation and since I was considered as Resident Indian for tax purpose in India FY 2015-16 (I came to US in Dec 2015 and Financial Year closing in India was March 2016) hence I had to pay dual taxation on my Indian earning and US salary .

My company Finance department did some calculation and shown I can get relief under Section 89/90 now I was not aware of the different ITR forms so I thought I need to User ITR1 for this relief and asked relief under section 89 but Income Tax department rejected it and asked for the Dues which I was claiming as relief.

Realizing issue I searched on net and this time I filed ITR2 as rectification and putting section 90 details.

I am still waiting for the confirmation from them please advise if I have done the tight thing and will there be any issues if ITR2 is rejected so what will be my option.

Hi sir my full name is sahil mann and on my acknowledgment only sahil is mention do i need to revise my return.

Plz help

I have filed ITR -1 of FY 2015-16 on 25/02/2017 but I forgot to take relief of U/s 89 for arrear payment. Now I filed a revised return on 02/03/2017 for relief u/s 89. But I received a refund amount for original return I filed. They didn’t consider the revised return due to late filing.

So my question is Can I file rectification U/S 154? Or any other option. Please tell me.

if you have received the refund of Income Tax, that does not mean that your assessment is complete. You can still revise your income tax return even if you have received Income Tax Refund. For income tax refund, intimation under Section 143(1) is sent which is different from Assessment above.

The Revision can be done either in the same ITR Form in which the original return was filed or in a different ITR Form. On filing of this new return under section 139(5), the original return filed under section 139(1) shall be deemed to be withdrawn and substituted by the Revised Return

if the revised return lowers a person’s tax liability, his or her return is likely to come under scrutiny. Of course, individuals should not bother where the case is genuine. Whatever changes one makes, the person should ensure that he has the supporting documents in case the I-T department calls the taxpayer for explanation

assessment refers to assessment made under Section 143(3) and Section 144. Assessment made under section 143(1) will not be treated as assessment for this purpose as revised return can be filed even after the intimation under section 143(1) has been served.

But I filed the revised return as belated return (as original return filed on 25/02/2017) thatswhy I am asking my revised return will be consider or not?

I have received intimation also u/s143(1) for original return I filed and it says all is ok….

When did you file the original return?

You are talking about return for FY 2015-16 or AY 2016-17. Last date for which was 5 Aug 2016.

Revised return can be filed only if the original return was filed within due date, Original return is filed under section 139(1).

If a return is filed after the due date,called belated return, then it cannot be revised.

But as you said asked can the return be rectified. Ans is Yes.

Remember In the rectification request no new deductions or exemptions are allowed to be claimed.

A rectification request under section 154(1) is allowed by the Income Tax Department for correcting mistakes when there is an apparent mistake in your Income Tax Return.

6 things you must know about filing a rectification under section 154(1) –

Errors that can be rectified under section 154(1) – An error of fact, an arithmetic mistake, or a small clerical error or error due to overlooking compulsory provisions of law. Some examples are – A mismatch in tax credit, Advance Tax mismatch, gender mentioned incorrectly, or additional details not submitted for capital gains at the time of filing return.

A rectification can be filed by a Tax Payer or an Income Tax Authority can on its own rectify a mistake which is apparent.

In the rectification request no new deductions or exemptions are allowed to be claimed.

A rectification request can be filed for Returns which are already processed in CPC, Bangalore.

When the Income Tax Return was filed online – only Online Rectification is allowed.

Do not use this rectification request for changing bank account or address details of your Income Tax Return.

Sir, I received a 143(1) intimation for AY 2016–17. My self assessment tax was not considered. I filed for rectification. The Rectification Order under Section 154 was received and the refund amount refunded. I am told Intimation under 143(1) is not assessment Order and so return can be filed after that. But I have also got Rectification Order u/s 154. Can I now rectify this return as 1 year is not yet over? I had not considered Preventive Medical Checkup under Sec 80D and now want to claim that.

sir i have claimed refund Rs 3930 on against of tds of Rs 12146 for ay 2016-17 in original itr 1 filed before due date but some income is escaped in orginal itr..now am want to include in itr and tax payable in revised return is 5966..nw my question is in revised return how could i wl show refund amount of Rs 3930..Pls guide

You can file revise return. You need not show refund anywhere just file as normal return and show income which you havent shown ealelier in original return

In case you have filed your Income Tax Returns before the due date of filing of Returns u/s 139(1) but later realised that there was any omission or mistake in filing your Income Tax Return, you need not worry as you can always file a Revised Return of Income Tax under section 139(5) stating the correct particulars.

Revised Return of Income Tax can be filed by an assessee any time before the expiry of 1 year from the end of the Relevant Assessment Year or before the completion of assessment (whichever is earlier)

Thanks

Parul Goyal

9899550422

Hi,

I filed IT returns for the assesment year 2014-15 on 26/07/2014 and claimed refund.In march 2016, I revised the same and made mistake while doing calculation. Refund claim is processed on april 2016. now i received letter regarding the genuineness of refund claim. I verified the details once again and found mistake made on my side. Can I submit revised return or is here any way to rectify it?

Thanx in advance.

Hello.

Facts:

I have filed a return in ITR 4 u/s. 139(1)

Only one income of Rs. 3,00,000 was received during the year on which TDS u/s. 194J at 10% was deducted. Therefore, ITR 4 was filed.

However a defective return notice was received for non filing of Balance Sheet and Profit and Loss A/c. I do not wish to furnish my books of accounts as there are no other income or expenses.

Options:

1. Can I revise/change the ITR form from ITR 4 to ITR 1 and treat the income as Income from Other Sources? or

2. Can I revise the Income from PGBP to IOS in the same form?

Do let know your views on this.

-Tarun

7299917001

The Jurisdiction of the Assessing Officer i.e. his Income Tax Ward/ Income Tax Circle/ Income Tax Range No/AO Code is required to be stated while filing the Income Tax Return. Furnishing these details in the Income Tax Return is optional and not mandatory

Thanks

Parul Goyal

9899550422

Thanks for your valuable suggestion. sir i have filled the income tax return but have not mentioned the ITO WARD/CIRCLE in the return should i revise it?? will it have any effect on my refund status which i have filled.

The Jurisdiction of the Assessing Officer i.e. his Income Tax Ward/ Income Tax Circle/ Income Tax Range No/AO Code is required to be stated while filing the Income Tax Return. Furnishing these details in the Income Tax Return is optional and not mandatory

Thanks

CA Parul Goyal

9899550422

Sir in my current year online return (ITR-2) i filled wrong AO/income tax ward number . should i revise my return as i have some refund also. Please suggest

Income tax is moving to online resolution, AO field is not that important.

So we would say No need to revise ITR. You are not hiding your income or anything.

I have received arrears for the period 2005-06, in 2016 and if i include this amount in current f.y., i will taxable under the bracket @ 20%. Can I file form 10E, even if Income Tax Returns have not been filed during those Financial years ? or should I have to file ITR for those years now. I was not taxable during those years after deducting my deductions under 80C. Please advise me.

I have filed the income tax return for the period A.Y-2016-17 in the form ITR 4,but a notice has been issued by the CPC as a defective return Us.139(9)and to mention the profit and loss acount details in your form,So I want to know that which have filed the income tax return in ITR-4 can I be changed that form.

ITR -4 is for Individuals & HUFs having income from a proprietory business or profession and if you have not mention profit and loss amount in the return so income tax department will ask dor the same . Futher defective return provisions are following

As per Section 139(9), an Income Tax Return is treated as a Defective Return if any of the following 8 documents is not attached with the Income Tax Return.

If the Income Tax Officer considers that the Return as a defective return, then he shall intimate the defect to the taxpayer and give him the opportunity to rectify the defect within 15 days from the date of such intimation. He can also extend the time period on an application made by the assessee.

The defect is intimated to the assessee by the Assessing Officer through a simple letter.

Defective Return if any of following Document is missing

1. A return in the prescribed form with all annexure, columns and statements duly filled in.

2. A statement showing the computation of the tax payable.

3. Proofs of tax, if any, claimed to have been deducted or collected at source and the advance tax and self assessment tax, if any, claimed to have been paid.

Provided that where return is not accompanied by proof of tax, if any, claimed to have been deducted or collected at source, the income tax return shall not be regarded as a defective return if:-

A Certificate for tax deduction or collection was not furnished to the person furnishing his income tax return

Such certificate is provided within a period of 2 years from the end of the relevant assessment year.

4. Report of Audit under Section 44AB or where the report has been furnished prior to the furnishing of the return, a copy of such report together with proof of furnishing of the report.

5. In case regular books of accounts are maintained by the assessee, then copies of:

Manufacturing Account, Trading Account, Profit & Loss Account or the Income and Expense Account and the Balance Sheet.

In case of partnership firm, the personal accounts of the partners.

In case of AOP/BOI, the personal accounts of the members.

In case of a proprietary concern, the person account of the proprietor.

In case of a partner of a firm, his personal account in the firm.

In case of a member of AOP/BOI, his personal account in AOP/BOI

6. Where the accounts of the assessee have been audited then copies of the audited profit & loss account, balance sheet and the auditor’s report.

7. In case where cost audit under Companies Act has been conducted, then the copy of such audit report.

8. Where the regular books of accounts are not maintained by the assessee, then a statement showing the amount of turnover, gross receipts, expenses and the net profit of the business or profession carried on by the assessee and the basis on which such amounts have been compted and also disclosing the amount of total Sundry Debtors, Sundry Creditors, Stock-in-hand, cash and bank balances at the end of the year.

So if theres any of the above defect in your original return do correct and file revise return

Thanks

Parul Goyal

9899550422

Sir, my gross total income is 270000/- of Ass yr. 2016-2017, after deductions my income is 230000, i forgot to mention TDS details and the ITR is processed. Now the status is no demand no refund, plz tell me what to do i can demand for refund the amount of TDS????

You can file revise return

In case you have filed your Income Tax Returns before the due date of filing of Returns u/s 139(1) but later realised that there was any omission or mistake in filing your Income Tax Return, you need not worry as you can always file a Revised Return of Income Tax under section 139(5) stating the correct particulars.

Revised Return of Income Tax can be filed by an assessee any time before the expiry of 1 year from the end of the Relevant Assessment Year or before the completion of assessment (whichever is earlier)

Thanks

Parul Goyal

9899550422

Dear Parul,

I have paid my tax for AY 15-16 and filed ITR. However forgot to mentioned paid tax details. Today I got an intimation under 143(1). Also there is difference between my calculation and IT calculatio under which I need to pay balance amount.

Could you please guide me on that.

Appreciate your response.

Thanks in advance..

Regards

Vikram

Hie vikram

You need to check difference between your calculation and department by comparing one to one point of Computation by assesse and Computation as per income tax department.

If you havent mentioned details while filling original return, mention it now and file revise return u/s 139(5).

Hope it will help you

Thanks

Parul goyal

9899550422

Hello Sir/Madam,

i had returned ITR for assesment year 2016-2017 .today had received a mail from CPC Bangalore , that my TAN number is mismatch on ITR files. i have two TAN numbers entered on ITR files , previous employer TAN number mismatch(during tax retun files its wrongly updated), how can resolve this issue.

Awiting ur suggestions , Thanks in advance….!!!

Hi Sir, I have filed my ITR online on 25-7-2016 and got it e-verified on the same day. In which i have to pay tax of Rs.3880/-, subsequently i paid the tax with bank on 26th (next day) which is not captured by me while filing return. Now i got a demand letter. Can u pls guide me the course of action to be taken now.

Thanks in advance

You can file revise return -fill the details of payment you made to income tax department while filling revise return

In case you have filed your Income Tax Returns before the due date of filing of Returns u/s 139(1) but later realised that there was any omission or mistake in filing your Income Tax Return, you need not worry as you can always file a Revised Return of Income Tax under section 139(5) stating the correct particulars.

Revised Return of Income Tax can be filed by an assessee any time before the expiry of 1 year from the end of the Relevant Assessment Year or before the completion of assessment (whichever is earlier)

Thanks

Parul Goyal

9899550422

I have file my return of income after due date claiming 89 (1) relief but forgot to upload 10E. Income tax officer rejected my claim and passed the order 143 (1) after then I got info that I have to upload 10E but I already considered the amount of relief while filling the return of income. After receiving the notice I upload my 10E. till the date of getting notice my employer not provide me 89 (1) working calculation chart. What can I do to cancelled the demand issue by the ITO. the mount is very large more than 1 lac.Due to ignorance of Income tax rules I had not upload 10E form. Plz help me in this matter

After filing the original return is it necessary to send “Signed Acknowledgement copy” to Bangalore before filing revised return.

i filed my return on 5th Aug 2016 (extended last date) with tentative data as Form-16 not received by then. did not send the Ack copy to Bangalore. Now I want to file revised return, but getting error “Return type in income details can not be revised if return not filed under section 139(5)”

Have the same problem – “Return type in income details can not be revised if return not filed under section 139(5)”.

What can be done?

Unless you send to CPC Banglore, your return status under income tax department will show “ITR – processing”.

So first send your signed copy of original retun to Banglore and then file revise return u/s 139(5)

Thanks

Parul goyal

9899550422

I would like to add that its no hinderence i have just checked.

If u have file ir return corretly then revise return can be filed even if u have not send it to CPC Banglore

Unless you send to CPC Banglore, your return status under income tax department will show “ITR – processing”.

So first send your signed copy of original retun to Banglore and then file revise return u/s 139(5)

Thanks

Parul goyal

9899550422

I would like to add that its no hinderence i have just checked.

If u have file ir return corretly then revise return can be filed even if u have not send it to CPC Banglore

Sir, i have claimed relief under section 89 but i failed to upload form 10e. Now i have received intimation from IT department that i need to pay more tax. Can i upload form 10e now and submit the revised return to get the relief?

I have filed manually ITR-V form on 30th July 2013 i.e. within time and revised return is submitted through tax planner on 22 Oct 2013 i.e. within one year. I have shown Rs.18000/- TDS in revised return which was not shown in original return by tax planner inadvertantly. He made follow up with IT deptt. but now my tax planner saying that ITO denied verbally that case is not in limit and out of date and hence revision order will not be issued. What to do? Where to make complaint. Can I complaint online for manual submission.

dear sir i am filing return in physical form ,as my income is bellow 5 lac.i am carrying forward long term capital loses in debt fund for last 6 year.how do i know that my return has been assesed ,as i have not received any intimation from IT department .however i have receipt of filling

warm regards

DEAR SIR / MADAM

I AM FILLING ITR AND CHOOSE WRONG SECTION I AM CHOOSING SECTION 142(1) BUT AFTER THAT I AM SEARCHING INFORMATION ABOUT THIS SECTION I AM FOUND SOME INFORMATION. THAT I AM NOT RECEIVED ANY NOTICE FROM INCOME TAX OFFICER AND THERE DEPARTMENT. NOW WHAT WE CAN DO. PLEASE SUGGEST ME AND HELP ME

You can file revise return -fill the details of payment you made to income tax department while filling revise return

In case you have filed your Income Tax Returns before the due date of filing of Returns u/s 139(1) but later realised that there was any omission or mistake in filing your Income Tax Return, you need not worry as you can always file a Revised Return of Income Tax under section 139(5) stating the correct particulars.

Revised Return of Income Tax can be filed by an assessee any time before the expiry of 1 year from the end of the Relevant Assessment Year or before the completion of assessment (whichever is earlier)

Thanks

Parul Goyal

9899550422

I have received refund for ITR but as I forgot to fill form10e I did not get the claim under section 89. Now when I filled 10e should I revise the return also. Or it is done automatically

Hello sir

I wrongly entered gross total amount when I file return online that’s why my tax amount show me payable. So I realized after I uploaded my ITR. I uploaded return after due date so I can not revised

I never send ITRV to Bangalore, Need help..what to do next

Hi Sir,

I have submitted my returns on aug 4th 2016, and i have done e-verification(online) on aug 26 2016. When will i get refund

It takes between a week to a year for return to be processed. You should be getting refund, if things are fine soon!

Respected team

I am a salaried person and

I filled my A.Y. 2016-17 ITR in time. Later I realised that my home loan account is left and then I revised the return. Again I found my SB account is wrong so I revised it again. Is it alright. Kindly guide.

Yes its ok to revise multiple times if the return has not been processed.

Sir, i am salaried person, For FY- 2015-16 i filled ITR 2-3 month back, While Filling i showed less income intentionally because of which income tax department refunded some 93,000 rupees to my account.

Now i wants to know what should be my action,

1. Should i tell them pro-actively through call/email that they haven’t check it correctly and return the money received in my bank account.

2. Should i fill the revised ITR again.

3. Should i wait for them to figure out the mistake and reach out to me.

4. Should i do nothing and remain silent and IT department will not figure it out and won’t take any action against me. Because after all its their mistake in check it correctly.

Did this kind of cases happened before?. if yes, what are the consequences in whose cases.

See best way to communicate department for your mistake is filing a revised return with corrected details which was missed out in original return filed by you.

Now, since now a days everything is about system based checking it might be possible that few details which were not caught up by criteria set in system and you may have got refund based on that.

Now coming to declare mistake and filing revised return point.

See, if you know that details intentionally hide by you are such material that, it can easily caught up by department in near future you should file revise return and pay taxes accordingly.

In addition to that, if you wont revise the return and if in future department comes up with same query what will happened that you shall have to pay taxes along with Interest & penalty (100%) of taxes to determined. And you know when matter goes to department they will ask you all things which may open some other details which you might not aware that it could be taxed.

So , being a honest citizen, what i suggest you should work out you net income (with proper tax planning) and pay the tax to avoid future hurdles W.R.T time & your savings.

Sir, Thanks for your valuable suggestion.

Being a honest citizen, I completely agree to file revised return also. But i filled ITR on 10July, 2016 but due date was 5th July 2016. So now system is not allowing me file revised return. I raised the same query to their customer care team also, They are saying there is no way you can revise return online now. You have to go to their department physically and check out offline way to file it. which looks very cumbersome.

Speaking about the details i filled wrongly, My Company paid around 13 Lakh Gross total income and deducted the tax accordingly. But filling ITR i mention the Gross total income as 10 lakh due to that somewhat around 1 lakh is balanced as the refundable amount. After filling i got the refund successfully in my bank account.

The whole situation is explained to you. What is your opinion on following concerns.

1. How big the mistake is ? what will be max penalty for such cases.

2. As most of the things controlled by software, What are chances that this mistake could be caught by Income tax department on later stage.

3. As the process of filling revised ITR offline physically is not clear to me and it would be more time consuming, Is it ok to suggest them to adjust the this year’s balance refund with next year’s income tax.

Due date for filing ITR for AY 2016-17 was 5 Aug 2016 and not 5th July.

Sir ,I had filed my return for AY 2016-17 ,in time and e verified it. the same has been assessed too.Everything is correct except that I made a small mistake in my SB account no.Very small amount is refundable to me which has also been cleared which I found on checking it up on web site. the refund amount is so small that it does not matter even if I don’t get it.

Need I correct the account no and if so how do I proceed ,as everything else is crrect and there is no change in Taxation.

In my ITR1 filled within due date on 28/07/2016 i have wrongly mentioned Tan of tax deductor can i revise my ITR form.

Yes.Please do so at the earliest

I filed the original return before due date this year with refund of Rs2590 and e-verify it.Then i realize that i forget to add some income so i filed revised tax with self assessment tax to get Rs 10 refund and e-verify it. But now i get refund of original ITR worth Rs 2590, not the revised return. Why so and what steps have to be taken now or income tax dept. will send any notice ?

See, If original return is filed within a prescribed time mentioned u/s 139 and same return is being revised then, revised return replaces original one and same becomes original return.

Now coming to your case, here since you were suppose to get refund Rs 10/-as per revised return but you have got 2590/- department will give you intimation stating refund already paid 2590/- against rs.10/- as per revised return and same you shall have to pay as Tax on regular assessment (400).

Respected sir/madam, this year when i closed my NSS account in Post office department they deducted the tds at 20% as they do not asked my pan when i asked for rectification they finally did it but as the last date was 5 august,till then i was not provided with for 16 A and the same was not reflected in 26 AS. I was advised to fill my return asking for refund as in the mean time the rectification will reflect in 26 AS.today the form 26 finally reflect the tds but it is double the amount both the tax credited and tax deucted,now should i ask them to again rectify the form 26 as or will i get the refund.

Also i have not yet sent the ITR V receipt to the deptt as i was asked to wait till the tax credit is shown in 26 as ,now in the light of recent events should i send it straight away.

Thanksanu

Sir, I files my original return manually. Can I revise the return using online mode?

To file revised returns, one can use both the online and physical methods. However, you can revise returns online only if you have filed the original returns online and have the 15-digit acknowledgement number with date of filing original return.

If any person is in the tax bracket of30% for the last 4 years and got arrear from his employer for the last 3 year.CONSIDERING the tax slab no benefit is coming under sec 89 but if he would want to take HRA relief of previous year of the arrear HRA portion*partly) sec 89 applicable or not?

For AY 2015-16, I did not receive the expected refund so, I filed for rectification.

But, later I realized that I had made some other mistakes in the ITR as well. The timeline to withdraw the rectification request is past now and it is still in processing.

Can I file the revised return with correct details now?

Sir, I have already filed ITR for the AY 2016-17 on line on 30 Jul 2016 and ack received/sent to HQ Bangalore. I could not claim tax relief under sec 89 for the arrears of pension related to previous years,received during FY 2015-16. Shall I submit revised ITR now. Kindly advise.

Yes, You can file your revised return claiming relief under section 89. But remember you have to upload form 10E and then file your revised return.

Hello,

I have filed ITR2 for AY2016-17 and it has already been processed by IT-dept. Now I just discovered that I didn’t report one interest income and associated TDS, what should I do now as I understand I can’t file revised return since IT-dept has already processed it with final status of “No demand/no refund” ?

Thanks

I had filed my IT Return for assessment year 2016-17 in the incometaxefiling site along with 10E. But I wrongly selected assessment year as 2015-16 for the form 10E. I got the refund amount without considering the 10E. Please tell me how to rectify. Should I rectify 10E alone or rectify ITR also?.Rectification or Revision?..

I am an salaried employee and have filled ITR 4 to mention my share trading loss and e verified the same.Last week i got mail from it mentioning defective return U/s139(9) and asked to attach audited form 44ad. And once again i logged in and selected is defective return as no.

Now my question is can i change that ITR 4 to ITR 1 and file 80k loss will not turn to income .

As per section 44AD, if a person is doing business(we’d have to assume including share trading business) and if the turnover is less than 1 crore and if your profit is lesser than 8% of turnover, you will have to get your books audited.So this would mean that if you have a loss than you will have to compulsorily have your books audited.

My advise would be to consult your CA on this

If you are a salaried person who trades in stocks, filing income tax returns can be a tricky job. Depending on the instrument, frequency of trade and volume, you can either fill the

ITR-2 form meant for the salaried with no business income

or ITR-4 is for income from business and profession.

First most important thing to do for every trader is take a stance on your trading activity because the tax liability would change based on this. Following are couple of options you have

You are an investor, who buys/sells stocks once in a while and you typically would hold the investments you make for a longer period of time.

You are a trader, you either actively trade stocks or f&o or currency or commodity.

It is your prerogative on if you call yourself as a trader or an investor, but if your actively trading on stocks or even if occasionally dabbling in f&o,currency or commodity my advice would be to declare yourself as a trader.

Sir ,I had filed my return for AY 2016-17 ,in time and e verified it. During filing i put my SBI NRI account for refund, but i forgotten rupees can not be transfer in any NRI account.

I need to correct the account no. by giving other alternative account for getting my refund back. Please advice what is procedure to get it correct.

SIR I HAVE FILED ITR4S BUT IN THAT I FILED INTEREST FROM PARTIES IN INCOME COLUMN

I NEED TO PUT IT IN INCOME FROM OTHER SOURCE COLUMN. RIGHT?

SO NOW WANT TO REVISE RETURN

I HAVE NOT SENT ORIGINAL RETURN’S ITR V

SO SHALL I SEND BOTH ITR V (ORIGINAL& REVISED ) AT THE SAME TIME

OR SEND THEM INDIVIDUALLY WITH SOME GAP OF SAY 15 DAYS ?

PLEASE HELP

Hi Sir.I have filed my itr today.I paid some self assessment tax apart from tds.By mistake in prefilled challan no.c coming I edited the same and change it to challan no. 280.

I have still not e-verified it.

Should I revise the same or I can change it.

SIR

I hv submitted my daughter’s return online + itr-v sent – which is also recd at b’lore – on taking a print of itr-1, now I realise that :

Taxable Salary in col B1

does not tally with the

wrong figure of Salary shown by employer in their return to IT – they have by mistake, shown Salary before adjusting HRA/Conv.

In fact I appear to have got some msg also but i did’nt understand the msg & went ahead with submit (though I could hv corrected the entry).

your guidance as to whether any correction / rectification to ITR reqd or I should wait for processing results.

thaks

Hi,

I have filed ITR and also e verified the form. But the problem is that there is some due amount which I have to pay.

What should I have to do now ?

Please help. Thanks in Advance

Hi,

I have also done the same mistake.

Please let me know if you get any solution to this. Thanks!

sir i have filled the income tax return but have not mentioned the ITO WARD/CIRCLE in the return should i revise it?? will it have any effect on my refund status which i have filled.

Sir mentioning ITO Ward/Circle is not mandatory. You don’t have to revise ITR.

It has no effect on your refund status.

For AY 2015-16, I did not receive the expected refund so, I filed for rectification.

But, now I have realized that I had made some other mistakes in the ITR as well. The timeline to withdraw the rectification request is past now and that is still in processing.

Can I file the revised return now?

Hi,

I got two Form 16 for this year as i changed my job in Dec 2015 but at the time of ITR filing i have submitted only latest form 16 and also i have done the E-Verification too. What can i do now? Will i get the penalty notice from IT department?

Sir Form 26AS will show TDS from two employers. So you have to show income from both employers.

You might have take double deduction and ended up paying less tax.

You can go through our article How to Fill ITR when you have multiple Form 16

You need to revise your return

My wife did not mention Home loan principle in 80c so it did not reflect in form 16. She had filed returns with the less amount in 80c. How can i correct that & resubmit? Pls help me on this

If the return has not been processed then please revise the return. Update 80C amount to include principal. She might get refund

Already itr submitted.and e-verified also.but 10E not submitted.and also taken 89 relief in itr.CAN I SUBMIT NOW 10E before receive notice from IT. IF YES THEN ORIGINAL RETURN ITR IS NECESSARY REVISED OR NOT?pls guide..

If you have relief under section 89, please fill 10E ASAP.

uNDER 10e ANNEX A–WHAT YEAR WE WRITE ASSESSMENT YEAR OR FINANCIAL YEAR?

Are you filling online? which is last date of the financial year in which you are receiving income. So if you received income in FY 2015-16 then enter 31 Mar 2016.

Online you have to fill AY.

For filling the form offline, you have to enter income ending 31 Mar

In the Anx A no5 which tax to be mentioned? As per form 16 of respective Prev year or as per itrv or as per calculation on column 2?

One thing more if it is asper itrv then should we write the total income in column 2 as per itrv of respective year?

Hi,

I have query regarding itr that Ih ave filled for A.S14-15 and A.S 13-14. For A>S 14-15 I have submitted self assessment tax online via net banking on aroung 29th Mar,2014. During filling data for self assessment tax I had wrongly selected A.S as 13-14. So when I submitted ITR for A.S 14-15, I got demand letter which I rejected because of I had already paid tax and filed many grievance stating I had selected wrong Assessment year. BUt everytime again I get demand. Now if I try to submit tax as per demand for A.S14-15 it will be sorted. But how can I get my money back which I have submitted to income tax as part of A.S 13-14. I am unable to file any rectification as end date has passed. Not sure how what needs to be done now. Also to confirm tax I have submitted is greater than what needs to be submitted, hence even after adjustment I would require refund of apprx 2000. Please suggest how can I file itr for both A.S13-14 and 14-15 so that I can get my money back.

Thanks

I filed IT returns for the assessment year 2016-17 in july 2016 i want to show wrong agriculture income in my it return.and i want to paid tax 530 rs.and i fill itr-4 bussiness return so pls suggest me how i remove in agriculture income in my itr-4

Hi,

I filed ITR for AY 2016-17 after submission found some mistakes / omissions. The verification of the ITR is still pending. Can I make changes in the submitted ITR or I have to submit revised ITR. Please suggest.

Theoretically an ITR is recognised only after it is e-verified or ITR-V is received by CPC. So you can make changes to submitted ITR and then eVerify it.

I have filed & e-verified my ITR for AY 2016-17 on 30/7/16 in which income for other sources I gave zero amount and in tax details sch TDS2 it showed tax deducted for other sources. Updated the certificate no. there. Do I need to file revise return by giving total interest received on deposits for which TDS already deducted? coz doing so refund amount differs.

since tds already paid for interest earned then why to show income of interest and why the calculator in tax details add the amount deducted for refund…

Sir Interest on FD is taxed as per your income tax slab.

While TDS is deducted is at 10% if interest in a year is more than 10,000 Rs.

One has to show entire interest earned as income from other sources

Claim TDS deducted

Pay tax on remaining amount.

Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund discusses it in detail with Video.

that means I will get refund of tds deducted and pay again tax on whole interest amount . and this time deduction will be more since this will add on to my salary and hence the rebate of sec87 wont be applied

Please suggest as I have already e-verified my ITR so need to do revise return.

also kindly note that under sec 89 relief of IT has been taken but form 10E has not been submitted.Although original ITR submitted and got e-verified.Now can I submit form 10E before processing?

You must submit Form 10E before filing your income tax return. In case you have submitted your return and not filed Form 10E, and you have claimed relief under section 89(1), most likely you will receive a notice from the tax department asking you to file Form 10E.

You can check the video How to fill Form 10 E in Tax Site for claiming Relief under Section 89 for salary arrears

Thank you very much sir..can I submit form 10E rightnow before processing or receiving notice from IT dept?

as due date also not over.

Please submit Form 10E ASAP. Why wait for notice?

thank you sir..after sumit form 10E should I submit revised ITR?

If there is no change in your tax due/tax refund, you don’t need to revise your return.

My friends taxable income above 10lac for the last 4 years.He got arrear for the last 3 year.Has taken HRA relief by breaking the income u/s 89..Is it possible?

In yerms of tax slab he is always in 30% slab..but HRA relief is admissble or not us89?

I have submitted my return.also e-verified on 31st july 2016.I did not submitted form 10E for relief sec89.Can I submit now form 10E? actually what should submit first? ITR or form like 10E? please advice?

hi,

I had to pay tax due (30000), after paying that due amount, when i entered the details in revised return filing process, i am getting tax due of another 320/- (after clicking on calculate tax).

How should i proceed with filling challan 280 this time and while filing revised itr, if i enter details of BSR code for this new challan, it will consider the previous due paid or just 320?

Why are you getting Rs 320 again? Did you not calculate the tax properly.

You can again fill the Challan 280 and submit it.

Enter details again and then submit the ITR and eVerify it again.

Make sure that there is no due amount for you.

i have entered the wrong tan number for the assesment year 2013-14 and hence i have not received any refund,now i want to file a rectification request but there are three options under the rectification category

1)Taxpayer Correcting Data for Tax Credit mismatch only

2) Taxpayer is correcting the Data in Rectification

3)No further Data Correction required. Reprocess the case

under which category should i file the request

Because you gave wrong TAN number, Income tax department could not match it.

Please choose Taxpayer Correcting Data for Tax Credit mismatch only

hello Team

I have income from Salary (TDS deducted) + interest from saving account (declared under income from other source)

there was additional tax in income from interest on saving account which I have e-pay tax and I have BSR Code.

I have submitted my ITR-1 form & verified it today , noticed that still tax payable there is amount reflecting as which paid.

I understand from above article I have file revised ITR 139 (5) , when my tax paid today will reflect and where ?

when I can file this online to see no Tax payable ?

Sir you have to update the ITR and fill TDS2 with details about Self Assessment Tax.

Tax paid takes 3-5 days to reflect. You don’t have to wait for Form 26AS to be updated.

You can revise your ITR and e-verify it.

Hi..

I have filed my ITR correctly with gross total income(after exemption of HRA, LTA etc) under Income from Salary / Pension.

However, Details of Tax Deducted at Source from Salary shows higher Income under salary (without exemptions. HRA, LTA were availed later in last financial year.) Do I need to file revised ITR?

I have filled and submitted my ITR (orignal but not e-verified it till now) but forgot pay the tax due. So I paid my tax dues and got the BSR code and challan no. After that I have filled a revised ITR return using Acknowledgement

No and date (along with BSR code and challan no. under self assessment tax) and submitted it. Also I have e-verified the revised ITR form only. My concern is “Do I still need to e-verify my original ITR?”

Good day sir,

I fill my efiling for the year 15-16.but due to mistake i fill wrong bank account no. Now can i change my account no . Please tell me.

Yes you can and you should do.

if you have e-Verified your return then revise your return and update the back account as explained in the article.

If you have not eVerfied or sent your ITR-V to CPC you can update,submit the ITR. eVerify or send latest ITR to CPC.

I have filled the income tax return form ITR-1 for the year 15-16 in assessment year 15-16(which should have been 16-17).

I am getting a return of Rs.5900 after i filled the form. But this must have been for the year 16-17.

How can i rectify this ?

Thankyou

I have filled the income tax return form ITR-1 for the year 15-16 in assessment year 15-16(which should have been 16-17)and have also e-verified it.

I am getting a return of Rs.5900 after i filled the form. But this must have been for the year 16-17.

How can i rectify this ?

Sir,

I have submitted my ITR-1 form.I have submitted my challan. But i forgot to add details of BSR code in the form. how could I correct it?

I filed ITR for assessment year 2016-17, and e-verified it. Later on, realized that I had submitted wrong challan no for self assessment tax. So, I filed revised ITR. But for the revised ITR, it does not show the e-verify link on https://incometaxindiaefiling.gov.in website. It is showing its status as “Return Uploaded”.

Could you please help how can I e-verify revised ITR?

Thanks

Dear Sir,

While filing return for a pensioner, by mistake I showed HRA as -60000 under income from one house property. I understand that this amount should be deducted from income from salary / pension. Pls let me know if I need to revise the ITR1 since the tax paid remains the same.

Thank you

Hi

I filled my ITR for 16-17 and e-verifired it but missed to add all my savings account and added only two accounts .. Do I need to revise my ITR for this purpose…

Theoretically yes.

Practically how much interest you earned in the saving accounts you missed?

Interest in all Saving bank accounts upto 10000 Rs is tax exempted.

Sir, I filed my return without interest income which later I rectified by filing revised return but this time I got tax payable nd my return was submitted without paying tax of rs 270/-.what should I do now?? Will I get notice from IT in this case or still it can be rectified

Sir while filling return by mistake I had not taken my interest income in account, so later I filed my revised return but after that it is showing 270/- tax payable. What should I do??. Can I rectify the same by paying self assessment nd filing revised again ?? Will I receive any notice from IT

Hi,

I e-filled my ITR-2A for AY 2016-17 and submitted online and e-verified it, the status is now ‘successfully e-verified’

But now I have to revise my form due to an omission in income, so can I go ahead and pay the extra tax and submit revised return after having everified the orignal . Kindly guide. thanks

Yes Sir you can revise your return.

To file Revised Income Tax Return gather following information:

Receipt No of Original Return

Date of Submission of Original Return

For Whether original or revised return select R-Revised.

For Return filed under section select Revised 139(5).

Enter the E-filing acknowledgement receipt number from the ITR-V Which you would have got after filing the original return.

Press Submit button on completion of data .

You will get a new ITR-V marked as revised return. You need to E-verify or send ITRV again.

Sir, i have filed my income tax return for assessment year 2016-17 on 20th july 2016.i committed one mistake in filling TDS2 field which is income from other source. Now what can i do to rectify my mistake? should i file once again? or should i wait for IT notice?

Hi,

My employer has issued form-16 for FY-2015-16 with incorrect income(income includes Rs.100000 which were deducted from my april-16 salary for during final settlement mentioning arrears from last financial year).

The actual income for the FY 2015-16 must be Rs.100000 less than what shown in form 16 and the employer is not ready to correct the form-16.

I have arrear deduction slip with me. Can I show the actual income while filing ITR? please let me know.

Look at your form 26AS. That should be the benchmark. Form 16 is a statement employer gives you. You can claim deductions that they have not considered while filing. Just make sure your calculations are right.

Sir I have shown my employer contribution to NPS in sec 80CCD(1B)…Should I revise my return & file it in sec80CCD(2)?

If your return is not yet processed you can go ahead & revise.

I know income tax filing is a very tedious task. To make it easier I use Tax2win which helps in the online IT Return filing. It is the best way to file your ITR online.

Hi

I filed ITR online but i have made mistake in filling gross total income. I am eligible for tax return as per my correct gross total income. Please guide me to correct this.

Regards

Digambar

Please revise your return as explained in article.

Sir

I have filled ITR1 form for 2016 17.I have included rental income as other income without furnishing details of property. I should have filled ITR2A form. Gross pcome remains same , There is no taxable income change attracting no tax in both cases.Pls advise

I believe ITR2A is for income from more than one property.

Str,

I have filled ITR1 form for 2016 2017.I have included rental income ro my gross income. I should have filled ITR2A form giving details of rented property. How I can rectify this mistake. Gross income remains same as before and there is no tax payable. Pls advise.

I am salaried person . Last year I switched my job to new company .I withdrew all my Employee Provident fund (EPF) balance around Rs 5,45,000/-on which 10 % TDS is already deducted under section 192A. I had withdrawn the EPF before completion of 5 years. Now my question is that in which ITR should i file my return ITR1 or ITR2? And ,were the above proceeds of EPF amount shall be shown in ITR(how the above proceeds shall be shown along with my salary income).i had used the above proceeds for repayment of my loan.kindly note that my own contribution to EPF has be claimed as deduction under section 80C for earlier respective assessment years.I kindly want to know am i liable to any further tax liability since the TDS is already deducted on EPF at 10 % for FY 2015-16

You can file ITR1 if you meet ITR1 requirements.

Employer contribution and interest on it has to be shown under head salaries.

Interest on employee contribution will come under head income from other sources.

You may file revised return now to correct the information and submit both original and revised return ITR-V to IT department.

You would also have to revise earlier returns if you have claimed deductions under 80C

Can we revise earlier returns that are more than one year old & have been processed? Under what section should it be filed?

Hi

I have filed Income tax return for AY 1415 after the due date. While filing the return I have wrongly mentioned Gross Salary as my Income under the head Salary. However, I should have entered my Net salary. Due to this Mistake, I have got an order from CPC u/s 143(1) for additional demand.

I need to get clarity on following points:

1. Since I have filed original return after the due date, can i revise return or rectify the return/

2. If rectification is allowed, will I be able to lower my net income under the head Salaries, since that is mistake apparent from record.

What is the best way to escape this demand liability. please let me know.

Regards

Today i was filing itr for FY 2015-16… but mistakenly forgot to mention one of the saving account, and forgot to add interest income from that particular account….. i have submitted but not e-verified yet…. kindly guide

No issues. This happens to many.

Please file the Revised Income Tax Return.

Procedure of filing Revised Return u/s 139(5)

To file Revised Income Tax Return gather following information:

Receipt No of Original Return

Date of Submission of Original Return

Procedure for revising return is simple :

Check for the discrepancy in the original return e-filed

Log on to h t t p s: // i n c o m e t a x i n d i a e f i l i n g . g o v .i n /

Prepare Return just like like you filed the first time, correcting or filling what had got omitted earlier.

Go to part of ITR with Filing Status , for example Income Details in ITR1 shown in image below (Fill Excel ITR form : Personal Information,Filing Status)

For Whether original or revised return select R-Revised.

For Return filed under section select Revised 139(5).

Enter the E-filing acknowledgement receipt number from the ITR-V Which you would have got after filing the original return.

Press Submit button on completion of data

Then E-verify your ITR.

For AY 2014-15 I paid advance tax Rs.60,000.

But while preparing ITR I made arithmetic errror and calculated tax as Rs.40,000 and claimed refund Rs.20,000

Time limit for itr filing is over. Will IT Dept penalise me for this error although in fact IT amount had been paid correctly?

Today, i was fill ITR first time. I was fill ITR-1 for AY 15-16. But unfortunately i provide worng data due to confusion between AY and FY. Then i filled revised ITR and e-verify only revised ITR. Is it necessary to also verify original ITR..?

You are not the only one who has got confused about FY & AY. It’s OK

Theoretically only Verified ITRS are considered for assessment.

Hi Sir,

I have a component of foreign tax credit in my 15-16 Form 16. I filled the IT returns and mentioned the FTC. In ITR2 the amount came under TDS- 2. On the receipt of processed assessment the Income tax department said they have not recevied any TDS under 26(A) for that amount.

I raised this query to my employer and they said that the Schedule FSI should have been used to claim Foreign tax credit. Please let me know, if this issue can be rectified through rectification process or do i need to sumbmit revised returns.

Regards,

Rajan

Sir i have filled my return for the ay 2015-16 with in time on itr1. But soon i realised that i have missed my share trading income both short term and speculative. So i filled the itr4 and payed all the tax. Are there chances of getting a scrutiny notice as the income increased by 49000. Also my original return has been processed.

i have paid rs 86,000/ income tax in the assessment year 2014-15 and refund is nil. i want to rectify as this amount is too large , can i rectify the form?

I made a mistake in mentioning my deductions under chapter IV-A in the tax returns, which reflected that I have some amount of tax left for me to pay – 31st Aug 2015. I immediately revised the return and uploaded the revised ITR-V on 1st Sept 2015.

29th Oct, I have received a letter mentioning it as an unpaid SA and it says I have to produce a copy of the tax paid to the undersigned (income tax ward officer of my city).

Can you please guide me what has to be done. I have my original and revised return acknowledgement receipts and my Form 16 and Form 12BA, which clearly show my taxes paid and ideally there’s no tax that I have to pay.

Hi,

By mistake i filed ITR 1 form and mentioned my “Foreign Tax credit” under section “U/S 89”.

Now i did not get relief for “Foreign Tax credit” and Income Tax department is saying that i need to submit form 10E to get this benefit.

So I contacted my employer and they are saying that they are not issuing any Form for Foreign Tax credit and I need to Refile the returns with form ITR 2 and update the details in FSI page of ITR2, For overseas income, FTC and Total tax paid outside India.

Please help me out for correct process to get benefits.

Sir Form 10E is to be submitted for claiming relief under section 89 by a Government servant or an employee in a company, co-operative society, local authority, university, institution, association or body.

What your employer said makes sense.

You can refer to How to claim Tax Credit on Foreign Income of a Resident for more details

Hi,

While filling up the original form (within due date) I did not upload form 10E as I was not aware that it was compulsory. Hence in the intimation us 143(1), the relief was not considered. I will be definitely uploading 10E this time. But along with it which form should I now fill up – is it the one under revision or rectification?

Secondly in the original form the gross income I filled is a few thousands less than in form 16 I received. But the tax chargeable is the same in both. Is it absolutely necessary to make this rectification? If yes, then taking both points under consideration which scheme should I opt for?

Thanks.

While filing the ITR no document has to be uploaded.

According to the said rule, in case the employee is a Government servant or is an employee in a company, cooperative society, local authority, university, institution or association of body, he/she may for claiming the relief submit the form 10E to his/her employer who is responsible for making the payment of the salary as referred to in sub section (1) of section 192 of the Income Tax Act, 1961

In all other cases, the assessee for claiming the relief should file an application in form 10E to his/her income tax assessing officer.

Dear BeMoneyAware,

I e-filled my ITR-1 and submitted online. However I haven’t e-verified or sent ITR-V yet. I had to revise my form so I submitted revised ITR and e-verified that. I need to get refund in revised ITR.

Now, I have revised ITR which is e-verified but original ITR which is not e-verified.

My question is, Do I need to e-verify both the ITR (Original and Revised) to get the refund ?

Yes you need to e verify both original and revised form. Form is not considered revised till original is submitted.

Hi,

I have wrongly filled my gross income and due to which my tax has become nill and instead have recieved refund through check, pls guide me on this

Don’t worry many people commit such mistakes.

You can revise your return. Once, a revised Return is filed, the originally filed return is taken to have been withdrawn and substituted by the Revised Return. Revised Return Substitutes the Original Return.

Filing Revised return is same as filing Original return except in two sections in ITR

To file Revised Income Tax Return gather following information:

Receipt No of Original Return

Date of Submission of Original Return

For Whether original or revised return select R-Revised.

For Return filed under section select Revised 139(5).

Enter the E-filing acknowledgement receipt number from the ITR-V Which you would have got after filing the original return.

Our article How to revise return discusses it it detail.

My IT return has submitted on 31st August 2015 through online but later I found there is some mistakes. Can I revised the same before sending the acknowledge paper. Or I should send the Acknowledgement letter now or should I send after revised the return through online

Revise your return. If you do e verification you don’t need to send ITR-V

Hi,

I was filing ITR online. After submitting/uploading the details in the ITR-V form it has come that I amount payable is 3000 (under advanced 243C + B). Can you please let me know if I need to file revised ITR? Or can I just pay the amount using Chalan-280. But I am not sure if the Income tax department can automatically take that chalan no.? Please suggest

File revised return. Add the TDS details of Challan 280

Sir, my CA has filled wrong ITR in year 2013-14.He filled ITR 4 instead of ITR 1.Now the return which is fiilled got defective due to documents not submiited to them.Can i fill return again of financial year 2013-14

I filed IT returns for the assesment year 2014-15 in March 2015. But a month back when I went to CA for ITR filing for assesment year 2015-16 I came to know I have to get some returns in assesment year 2014-15. Can I submit revised return or is here any way to claim the money?

Sorry as you filed Belated return you cannot revise your return

sir, my name visible on acknowledgement is mohammas instead of mohammad, rest all details are correct, do i need to revise my return

plz help

If u r going to loans you have to change the name r else you dont need to change

Hi,

I have by mistake not mentioned the building name under “Name Of Premises/Building/Village”. Do i still have to refile return?

Are your email and mobile details ok.

If yes you need not revise your return.

Sir, I have chosen assessment year wrongly as AY 2011 – 12 instead AY 2012-13. I have received demand notice. What should I do now. Can I fill revised return for AY 2012-13 now.