From 1 Apr 2016 you can close your Public Provident Fund account under certain circumstances, provided the account has completed five years. This article looks into How to close PPF before maturity i.e premature closure of PPF account. It also gives an overview of alternatives to PPF account, Partial Withdrawal from PPF and PPF Loan facilty.

Table of Contents

What is PPF account?

PPF is one of the most popular small-saving schemes with investment of up to Rs 1.5 lakh eligible for tax deduction. Interest earned on it is also tax-free.

Public Provident Fund (PPF) is one of the most popular small-saving schemes with around 8% interest which is also tax free. Public Provident Fund is suggested as an ideal vehicle for long term investment in debt category, an important retirement saving tool for individuals. An overview of its features are given below, our article Understanding Public Provident Fund, PPF explains it in detail.

- You need to deposit a minimum of Rs. 500 per year in a PPF account.

- Maximum amount which you can deposit in a PPF account is 1.5 lakh or Rs. 1,50,000. (Earlier limit was Rs 70,000 it was increased to 1 lakh from 1.12.2011 . It was increased to 1.5 lakh in Aug 2014 )

- You can deposit lump sum or multiple installments in multiples of Rs 50. No upper limit on number of deposits has been specified. In other words you can make deposits to the PPF account as many times as you want, subject to the maximum amount limit. The maximum number of installments in a year can not be more than 12 has been removed from Dec 2019.

- The duration for the investment is 15 years. However, the effective period works out to 16 years i.e., the year of opening the account and adding 15 years to it.

- PPF works on financial year basis (April 1st – March 31st) and interest is credited only at the end of financial year.

- PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end

- The interest earned in PPF remains fixed for one year and is no longer guaranteed forever. It is actually benchmarked to the 10-year government bond yield and will be 0.25% higher than the average government bond yield.

- The amount you invest is eligible for deduction under the Rs. 1, 50,000 limit of Section 80C. Remember f benefits expenses like life insurance premiums, children’s school fees qualify under Section 80C as deductions in addition to other approved investment mediums like ELSS, 5 year FD’s, NSC etc. (80C limit was revised to 1.5 lakh in Aug 2014)

- Interest earned on the investment is completely exempt from tax under Section 10 (11) of the Income Tax Act.

- You cannot open a joint account with another individual. The account can only be opened in one person’s name.

Close PPF account Prematurely ie before Maturity

What was the process to close PPF account earlier?

Earlier,before Apr 1 2016, PPF account could not not closed before completion of 15 years unless the person who opened PPF account passed away. Premature closure of the account was possible only in case of death of the person when their nominee /legal heir could close the account by submitting the required documents. So one could withdraw the amount in PPF only at the time of maturity. Most of banks and Post offices are unaware of the rule and hence don’t have details/form.

When can one close PPF account ?

You can now close your Public Provident Fund (PPF) account and withdraw the entire accumulated amount under certain circumstances. The new rule came into effect from April 1, 2016. Some modifications were made in Dec 2019.

What are conditions for premature closure of PPF account ?

- The account should have completed five years after the end of the year in which the account is opened

- Premature closure of PPF accounts shall now be permitted in cases such as serious ailment and higher education of children.

- Grounds of serious ailments or life-threatening diseases affecting the account holder, spouse, dependent children or parents on providing supporting documents and medical reports confirming such disease from treating medical authority

- The second ground of premature closure is higher education of the account holder. This has been extended to higher education of the account holder or dependent children in 2019. However, production of documents and fee bills in confirmation of admission in a recognized institute of higher education in India or abroad is mandatory.

- A change in the residency status of the account holder is introduced in 2019. One needs to produce the copy of Passport and visa or Incometax return

Is there a penalty/fine for closing the PPF account?

You can avail this facility but with a penalty of 1% less interest in all the preceding years.

How to close PPF account prematurely?

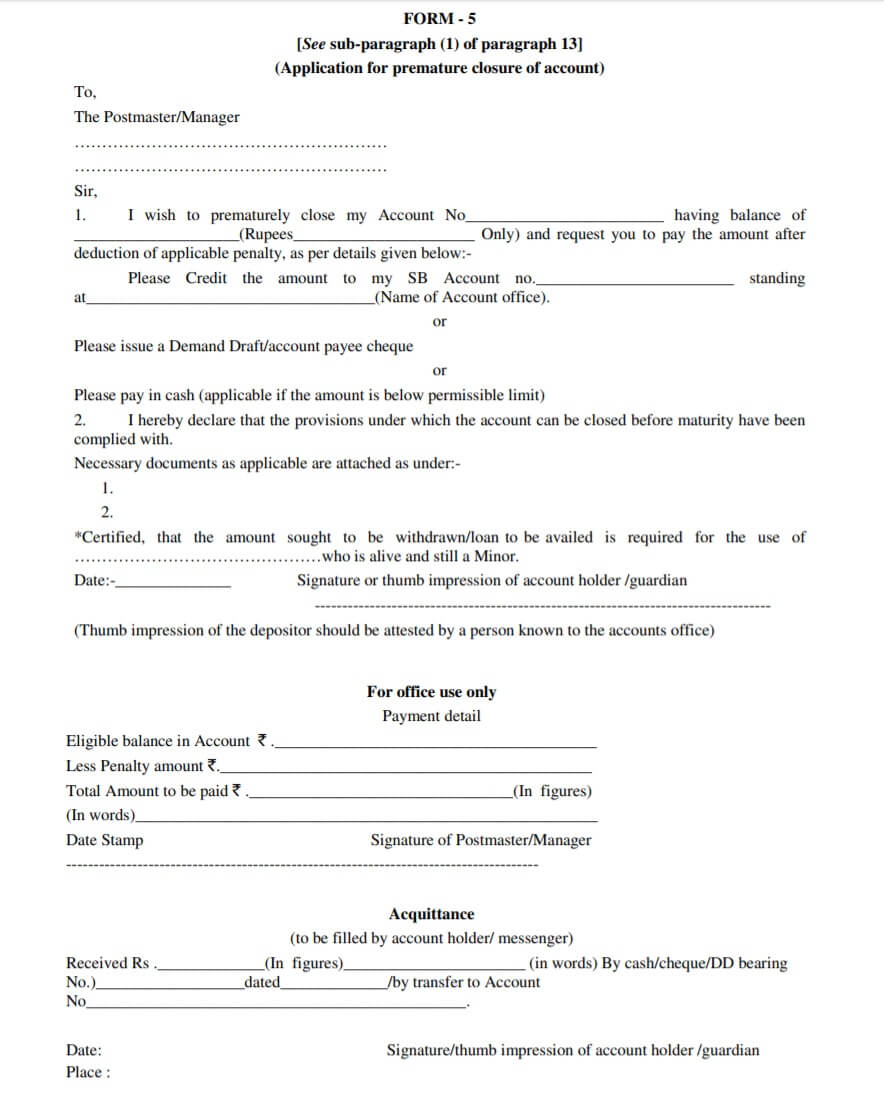

In Dec 2019, New form, Form 5, has been introduced.

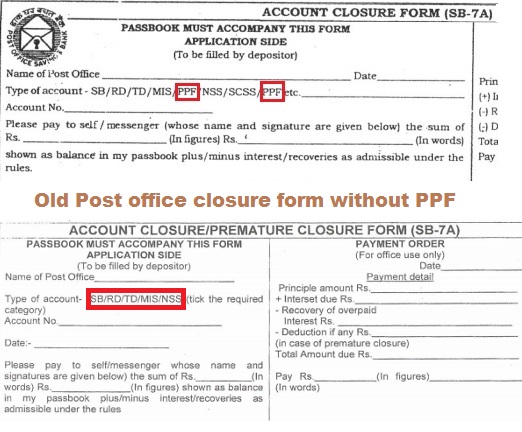

Old Form to Close PPF

One has to approach the bank/post office where one has PPF account. One has to submit the Account closure form. Excerpt Closure form of PPF from post office,Form SB-7A, is shown below. One can download the account closure form of PPF for post office here.

Alternatives to Closing PPF Account: Loan from PPF, Partial Withdrawal from PPF

PPF is a long term investment which enjoys triple tax benefit. So before you decide to close your PPF account lets look at alternatives to closing PPF account which are taking Loan from PPF, or partially withdrawing from PPF.

Loan facility in PPF account

Yes you can borrow from PPF during third to sixth financial year of opening the account. Overview of Loan facility of Public Provident Fund is as follows:

- The loan facility from PPF is available during third to sixth financial year of opening the account i.e any time after expiry of one year from the end of the year in which the initial subscription was made but before expiry of five years from the end of the year in which the initial subscription was made i.e. For example you opened your PPF account in December 2012. The end of the financial year when the account was opened is 31 Mar, 2013. The one year from the end of that financial year makes it 31st March, 2014. 5 years since 31st March, 2013 that will be 31 Mar, 2018. So you can apply for loan from 31 Mar 2014-31 Mar 2018.

- The loan can be taken up to 25% of the amount in the account at the end of the second year immediately preceding the year in which the loan is applied for. For example, if you want loan from PPF in May 2016 will be eligible for 25% of the amount as on 31 Mar 2016. The amount is PPF balance which includes interest.

- The loan repayment is required to be made in one lump sum or in two or more monthly instalments within 36 month period.

- After the principal amount of the loan is fully repaid, the subscriber shall pay the interest amount in not more than two monthly instalments.

- Interest is calculated at 2% above on the principal amount for the period commencing from the first day of the month following the month in which the loan is availed upto the last day of the month in which the last instalment of the loan is repaid. Interest is charged on the whole loan amount irrespective of partial payments. The interest would be charged on the total principal for a total loan period.

- Ex Suppose, you take loan of Rs 20,000 loan against the PPF balance and you will pay the loan amount in 24 equal monthly installments. The interest charged at the end of this payment will be Rs 800 (2*2*20000/100). If for any reason you can’t pay the total loan till 4 years, then the interest would be calculated at the rate of 6%. It would be ₹ 4800 (6*4*20000/100).

- For Loan One has to apply using Form D along with the pass book of the account.

Partial Withdrawals in PPF account before extension of PPF account

If you have not extended your PPF account,Partial withdrawals from PPF account are allowed once every year from PPF account after expiry of five years from the end of Financial Year in which the initial deposit was made i.e. withdrawal from PPF account is available from seventh year. The rule on partial withdrawals from PPF account has not been changed. Conditions for premature withdrawal are:

- Partial withdrawals from PPF are permitted after the expiry of 5 years from the end of year when subscription was made. For example, a PPF account is opened in December 2010 which is FY 2010-11. 5 years from end of FY 2010-11 is after 31 Mar 2011 i.e you will be eligible for partial withdrawals from 1st April 2016 (FY 2016-17).

- Only one withdrawal can be made per year.

- You can withdraw up to 50% of account balance at the end of 4th year immediately preceding the year when withdrawal request is made, or balance on last year, whichever is lower. So if you make withdrawal request on 1st April 2016 (FY 2016-17) you will get lower of 50% of balance as of 31st March 2013 (FY 2012-13) or 31st March 2016 (FY 2015-16).

- For Withdrawal One has to apply using Form C along with the pass book of the account.

- If you are withdrawing from minor’s Account, the guardian has to make a declaration that the money is required for the use/benefit of the minor.

Partial Withdrawals in PPF account after extension of PPF account

If you have extended your PPF account i.e you have completed your PPF account for 15 years and have extended it by 5 years.

- One withdrawal is permitted in every financial year.

- The total amount of withdrawal is restricted to 60% of the credit balance at the start of the extension block of 5 years.

- For Withdrawal One has to apply using Form C along with the pass book of the account.

Related Articles:

- Taxation of investments : EEE, ETE, TEE.

- Understanding Public Provident Fund, PPF

- PPF Account for Minor and Self

- On Maturity of PPF account

25 responses to “How to Close PPF account Before Maturity”

Thanks…for an useful info

You are welcome.

Very nice article on PPF, I have written one on similar topic recently here: http://anjandutta.com/ppf-account-benefits-ppf-calculator-2019/

I started depositing 15000 in every year since 2012. And in 2017 & 2018 I did not deposit any amount . What shall be my future course of action

Opening date of ppf account 16/12/2003.Can I close ppf account without any lose!

The duration of the investment is 15 years. However, the effective period works out to 16 years i.e the year of opening the account and adding 15 years to it.

So 15 years counted are from 2004, then 15 years will be 2019 years.

Partial withdrawal is done by me from my ppf account now i want to close my ppf account prematurely as per new rules my account has completed 5 financial years. I want to know bank will deduct withdrawl amount from my payable amount or it is must to repay then only my ppf account will close or they can debit loan amount from payable amount and close ppf account

Hi,

In my company basics component is less, so thought to increase my contribution towards epf as that will be a savings with a safe returns. Beside I am investing in sip for 5 funds. I enrolled through company online portal which can be changed only one time in a year.

Hi,

In my company basics component is less, so thought to increase my contribution towards epf as that will be a savings with a safe returns. Beside I am investing in sip for 5 funds. I enrolled through company online portal which can be changed only one time in a year.

This blog will help millions

Thanks a lot Mithun for your generous words.

One reader at a time..

This blog will help millions

Thanks a lot Mithun for your generous words.

One reader at a time..

Hi,

I have opted for VPF in my company, and the amount is getting deducted in salary slip, but in the EPF passbook this amount is not getting reflected in employee share, please let me know is there anyother way i can see this or is it a mistake done by my company. Thanks in advance.

Hi Any reply would be truly appreciable since i am not getting any info on this.

Hello

We are trying to get information on it. Did you try to find out from your company about it?

Hi,

They are saying, that the company has started contributing toward VPF and they said that the updation might take some time in the site. But my doubt is that monthly contribution for april month is already updated in UAN PF passbook, so will it get added after sometime. I have taken your help since i totally rely on this site.

Thanks in advance.

Sir,

Not many people go for VPF. So information on it is very less.

We are trying to find information.

We have a request. Will it be possible for you to tell why you went for VPF?

How did you enroll for VPF?

Hi,

In my company basics component is less, so thought to increase my contribution towards epf as that will be a savings with a safe returns. Beside I am investing in sip for 5 funds. I enrolled through company online portal which can be changed only one time in a year.

Hi,

I have opted for VPF in my company, and the amount is getting deducted in salary slip, but in the EPF passbook this amount is not getting reflected in employee share, please let me know is there anyother way i can see this or is it a mistake done by my company. Thanks in advance.

Hi Any reply would be truly appreciable since i am not getting any info on this.

Hello

We are trying to get information on it. Did you try to find out from your company about it?

Hi,

They are saying, that the company has started contributing toward VPF and they said that the updation might take some time in the site. But my doubt is that monthly contribution for april month is already updated in UAN PF passbook, so will it get added after sometime. I have taken your help since i totally rely on this site.

Thanks in advance.

Sir,

Not many people go for VPF. So information on it is very less.

We are trying to find information.

We have a request. Will it be possible for you to tell why you went for VPF?

How did you enroll for VPF?

Hi,

In my company basics component is less, so thought to increase my contribution towards epf as that will be a savings with a safe returns. Beside I am investing in sip for 5 funds. I enrolled through company online portal which can be changed only one time in a year.