Come January, it is time to claim your annual reimbursements such as medical and leave travel allowance (LTA). It cannot be claimed while filing Income Tax Return or ITR. This article talks about How to Claim LTA? How is LTA shown in Form 16 and in ITR? It also gives an overview of LTA with examples.

LTA exemption is available for 2 journeys in a block of 4 yrs. While the current block is 2018-21, one can carry it forward to the next block year. The LTA tax break can be claimed for travel of self and family members for journeys undertaken within India.

How to Claim LTA?

Employees who are eligible for Leave Travel Allowance (LTA), as part of their cost-to-company (CTC), can claim reimbursement of expenses incurred on travel. Subject to certain limits and condition

Come January, it is time to claim your annual reimbursements such as medical and leave travel allowance (LTA). These reimbursements are as good as tax savings. The difference being that you submit the required bills and treat them as tax-free income If LTA forms a part of your salary, then this allowance can be availed on a trip within India. Overview of LTA is given below.

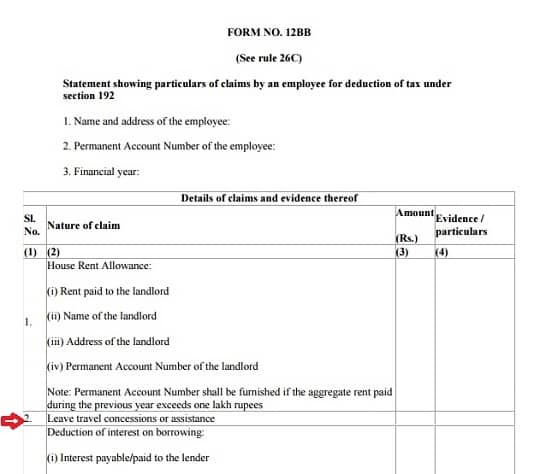

You need to submit Form 12BB to your employer before the end of the financial year along with the tickets, boarding passes (if traveling by Air) or bills(if rented a taxi). Excerpt of LTA in Form 12BB is shown below. Many companies allow one to fill the details online in company-specific website and download the form 12BB with details. Our article Form 12BB for claiming Income Tax Deductions by Employees talks about Form 12BB in detail.

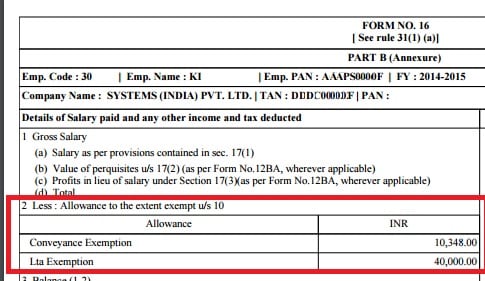

The LTA exemption given will be reflected in Form 16 Part B as shown in the image below. If you don’t take LTA exemption then that entire component of salary will be taxable. Our article Form 16, Form 12BA in detail.

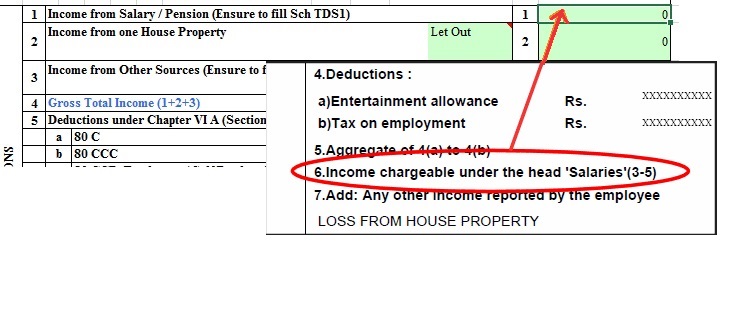

There is no provision of claiming LTA while filing ITR. Income that is used to fill in ITR is after claiming exemptions. Our articles How to fill ITR1 for Income from Salary,House Property,TDS and How To Fill Salary Details in ITR2, ITR1 discusses filing ITR in detail.

What is LTA or Leave Travel Allowance

Overview of Leave Travel Allowance (LTA) is given below

- LTA exemption comes under Section 10(5) of the Income Tax Act.

- Leave Travel Allowance or LTA can be claimed as a deduction from taxable income where the employer provides LTA to the employee. So the employee’s salary should have the LTA component as a part of his salary package. Our article Salary, Net Salary, Gross Salary, Cost to Company: What is the difference discusses salary in detail.

- It cannot be claimed while filing Income Tax Return or ITR.

- Travel has to be undertaken within India only. Overseas destinations are not covered for deduction.

- Leave application has been made for a holiday either individually or with family. That means you have to

- Take Official leave and travel with the family. You cannot claim LTA for your family trip without you.

- You can only claim for a single trip in LTA. You can not combine multiple trips. For example Kunal and his wife Swati travel to Kullu Manali on a vacation in the month of May 2016 spending Rs.15,000 on flight journeys and then again to Kerala in October 2016, spending Rs.20,000 on flight journeys. LTA received by Kunal for the year is Rs.25,000 and by Swati is Rs.10,000, Hence if Kunal claims LTA deduction for Kerala journey then he will get an exemption of Rs.20,000 since he spends Rs.20,000 on his journey. Swati, his wife will get an exemption of Rs.10,000 only for the journey made to Kullu Manali since her LTA received is Rs.10,000 even if the amount spent is Rs.15,000.

- The family can comprise your spouse, two children, brothers, sisters, and parents if they are dependent on you. You cannot claim for more than two children unless the second birth has resulted in multiple children

- The deduction will be limited to the amount of LTA received or amount spent on journeys whichever is less. If the amount of bill claimed is lower than the LTA component in your salary structure, the balance will be taxed as per your income tax bracket or carried over. For example, if Tarak Mehta gets LTA of Rs. 20,000. But he spends only Rs 15,000 on his travel fare. Then the LTA exemption shall also be restricted to Rs.15000 only.

- Only the traveling cost is covered, you cannot claim expenses on hotel rooms, sightseeing, food, etc, cannot be included under LTA. For example

- Tarak works in New Delhi.

- He gets an LTA of Rs.20000.

- He goes for a vacation from New Delhi to Goa on business class air tickets for Rs.30,000, the hotel stay bills amount to Rs.10,000 and food and refreshments cost him Rs 6,000.The actual economy air fare is Rs.20000.

- So Tarak is eligible for an LTA exemption of maximum of Rs 20,000 only. Further, he cannot claim any tax benefit for hotel bills, food bills etc.

- Expenses can only be claimed for travel by the shortest possible route. Though it’s difficult to crosscheck the route, the claim amount should reflect this. So, if one can go from Delhi to Chennai to Goa, one will be paid only Delhi to Goa fare.

- The tax exemption is limited to the fare component, which is economy class air fare, first class AC rail fare or first/deluxe class bus fare. However, if there is no public transport, you can hire a taxi or rent a car and claim for expenses equivalent to first class AC rail fare.

- While most companies ask their employees to furnish proof of travel, such as boarding passes, tickets, and rental receipts, some don’t. The Supreme Court has stated that the employer does not need to collect bills from his employees as proof to make the allowance tax-exempt. Please check with your employer. We suggest You should maintain proper proof of your travel in the form of tickets, boarding passes, bills etc. so as to justify the same as and when the need arises. Don’t make false claims just to avail the tax benefit.

- Your employer will certify the LTA exemption in Form 16.

- The tax rules provide for a deduction only in respect of two journeys performed in a block of four calendar years. The blocks are decided by the government. They are 2010-2013, 2014-2017 and so on. The current block is for 2018-2021. Please note that these blocks are not financial years (April 1 to March 31); they are calendar years (January 1 to December 31).

- If the employee does not use their exemption during any block, the exemption can be carried over to the next block and used in the calendar year immediately following that block. But you have to inform your employer and your employer has to be OK with you.

- If you and your spouse both are working and receive LTA from your respective employers, you both are entitled to claim LTA exemption but for different journeys. Both of you cannot claim LTA for the same journey. But both of you can divide the expenses of the journey.e.g. If you claim for travel fare to the holiday spot and your wife claims for the return journey. This way you both will be claiming but not for the same expense.

- If you switch jobs, you can get the LTA not only from your present organization but also from your former employer, if the concession is lying unutilized.

Related Articles:

- How to Claim Deductions Not Accounted by the Employer

- How to show HRA not accounted by the employer in ITR

- If you don’t file the Income Tax Return on time

- Understanding Form 16 – Part 3

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

3 responses to “What is LTA? How to claim LTA”

I am availed journey for LTA from 1st january 2019 for the block year 2018-19, and I am not claimed in the financial year 2018-19.Can I applied the same in the financial year 201920.

Electronic filing is the process of submitting tax returns over the Internet using tax preparation software that has been pre-approved by the relevant tax authority, such as the IRS or the Canada Revenue Agency. E-filing has manifold benefits which have made this system of tax preparation increasingly popular in recent years; the taxpayer can file a tax return from the comfort of his or her home, at any convenient time, once the tax agency begins accepting returns. The Government of India has made the income tax returns filing process easy and convenient by introducing e-filing process through online tax filing.

Are there any guidelines regarding return journey proof required to be submitted? My employer is demanding the same when I’m making claim for one way journey.