The sheer number of mutual fund schemes on offer in India can be intimidating for the ordinary investor. The fact that many of these are similar in flavour makes it worse. In our earlier article How to Choose Mutual Fund we had talked about before investing you should do some homework as to you should know why are you investing and the fund type that matches your investment objective, risk appetite, tenure. In this article we shall focus on how to find that fund in which to invest.

Table of Contents

Journey so Far

We did homework on understanding ourselves, why are we investing, for how long, finding the fund type that matches our investment objective, risk appetite, tenure. At this stage we have a fair idea on

- Type of fund we want to invest : for example equity, debt, Gold

- SubType : Large cap or Midcap Equity Diversified Fund or Short Term or Gilt Mutual funds or Gold Fund or Gold ETF or Sector Funds such as Banking.

Now comes the part of finding the needle in the haystack, choosing the fund from among chosen type of class or type of funds. There are so many funds in any class that we are spoilt for choices. We tend to get swayed either by recent top performance of a fund or by sharp sales practices. So how should we choose a mutual fund.

Fund Ratings

Fund ratings is a measure of both return and risk, which gives an idea about a Fund’s ability to deliver returns for a given level of risk. Do chances of earning better returns go up if you were to buy one of the higher rated funds?

- The ratings are based on different time periods—trailing 3 years, 5 years or 10 years.

- After the ratings are calculated, stars are assigned on the basis of the percentile in which the mutual fund is positioned. For instance, the top 10% funds are assigned a 5 star rating, while the bottom 10% funds are slapped with a 1 star rating.

- Fund ratings are issued by various rating agencies, such as Morningstar, Value Research, Icra,Crisil, etc.

- Fund ratings look backwards and past performance is no guarantee for the future,

- Fund ratings are dynamic and can change very easily.

- The ratings provide investors an idea about a fund’s credibility and its ability to perform.

What do these ratings reveal? Essentially, this mechanism only serves to provide a snapshot of how the fund has performed relative to other funds in its category. Fund ratings should be used only as a starting point. These ratings should be considered only as a filtering mechanism in the process of selecting a fund. The ratings primarily help avoid the lousy funds as indicated by the lower ratings The fund rating would be of no use if one chooses an inappropriate category in the first place. Economic Times Should you buy a mutual fund based on its rating? discusses it in detail.

Fund Performance

Kitna deti hai, as the advertisement of Maruti Car reminds us, we want to know how has the fund performed. Remember that past performance is not indicative of the future performance of any fund. It involves understanding

- Short term performance: Investing styles and asset classes tend to move in cycles. A fund that has done well recently may be benefiting from such a cycle, which may or may not continue.

- Long-term performance record : Comparing long-term performance can indicate how a fund has performed through various market cycles

- Variation : How widely has the fund’s performance varied from year to year?

- Benchmark : How has it performed against benchmark : A benchmark is standard against which the performance of a fund is measured.

With the information about the past performance you can identify categories of the funds performing better in the past,How consistent is the fund’s approach to achieving its goals? You can opt for such Mutual Fund hoping it will perform well in the near future as well.

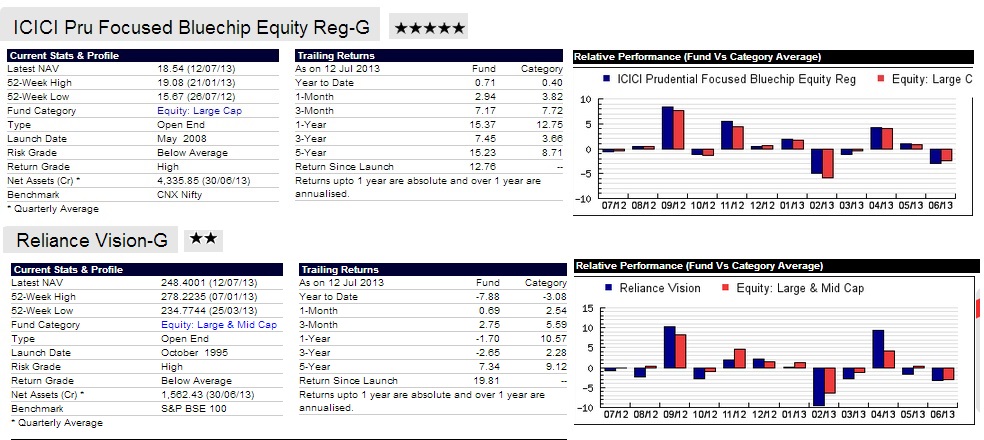

For example comparison of two funds ICIC Pru Focused BlueChip Equity Reg (Growth) and Reliance Vision (Growth) are given below (data from Valueresearchonline)

Fund : Expense Ratio, Load Structure

Types of fees which are charged by the mutual funds are given below. These are regularly reported in the Mutual funds literature and financial press.

- Entry Load , Exit Load: These are one-time costs incurred when one enters or exits a fund, and are charged as a percentage of investment/encashment amount.

- Recurring Charges such as Expense ratio. It comprises some of the major expenses that a fund incurs:

- Investment management and advisory fees

- Transfer agent fee and expenses

- Custodian fees

- Various operating expenses

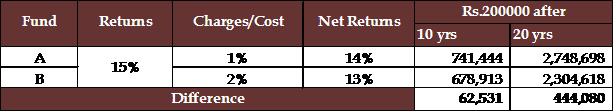

It is advisable to keep an eye on the exit load charged while comparing two funds as different funds charge different exit loads. How much would a difference of 1% expense ratio between 2 funds would turn out to be? Consider an investment of Rs. 200,000 in two funds giving the same returns. The net return after accounting for the costs shows a substantial difference as shown in image from Moneycontrol Hidden costs in Mutual Funds below

Fund Pedigree :Fund House, Fund Manager

Before zeroing in on a scheme of your choice, you must also consider fund houses on which you have enough faith to invest your money.Before investing in a mutual fund scheme, check its parentage, history of existence and track record across schemes. This gives an indication of how robust its investment processes are. A strong parentage would ensure efficient processes, which are a combination of investment processes, risk measures and operational efficiency, which would ensure a sustained performance over a longer period. Try to identify fund houses that have a strong presence in the financial world and have a reasonably long and consistent track records. Just like when we consider the prospective bride/groom we not only look at the bride or groom but also their family for sanskar(values) etc.

A passively managed fund is generally designed to try to match that of a given index of securities. The return of an actively managed fund depends in part on the manager’s selection and timing of individual securities. A fund manager plays a key role in the success or failure of the fund . In 2005, when Sandeep Sabharwal, fund manager and head of equities at SBI mutual fund moved out to join Lotus Mutual fund, the fund went into a crisis. It took SBI some time to get the fund back on track. So be cautious if you intend to follow star fund managers. It is better to focus on fund houses which have discipline and processes.

Fund Size

Many of use believe that larger the size of fund (Assets under Management or AUMs) managed by a mutual fund house, the better it is. Yes, sure it does depict the magnitude of the trust evinced by several investors, but it does not always signify that you are making a prudent investment decision.

For example : In the past year, HDFC Mutual Fund’s popular equity scheme – HDFC Top 200 Fund with assets of Rs 12,017 crore returned 5.6%, compared to peer average of 9.17 per cent. Another one, HDFC Equity Fund with assets of Rs 11,500 crore, returned 4.13 per cent.The funds have generate 12-14 per cent annualised returns in the past five years, compared to the industry’s category average returns of eight-nine per cent. What could have affected the performance of the two schemes during the year is the sizeable exposure to some of the laggards. For instance, State Bank of India and Infosys, which have been underperformers, are among the top holdings in funds managed by Jain. Prashant Jain ,HDFC Mutual Fund’s celebrated chief investment officer (CIO), likens a fund manager’s performance to a batsman in cricket. One year is like one match for us. What’s important is the batting average. Ref Business Standard When size becomes a constraint

We are not saying that all mutual schemes with large AUMs are bad. But just don’t make your investment decisions sorely based on the large AUM size. Understand why the fund is lagging behind.

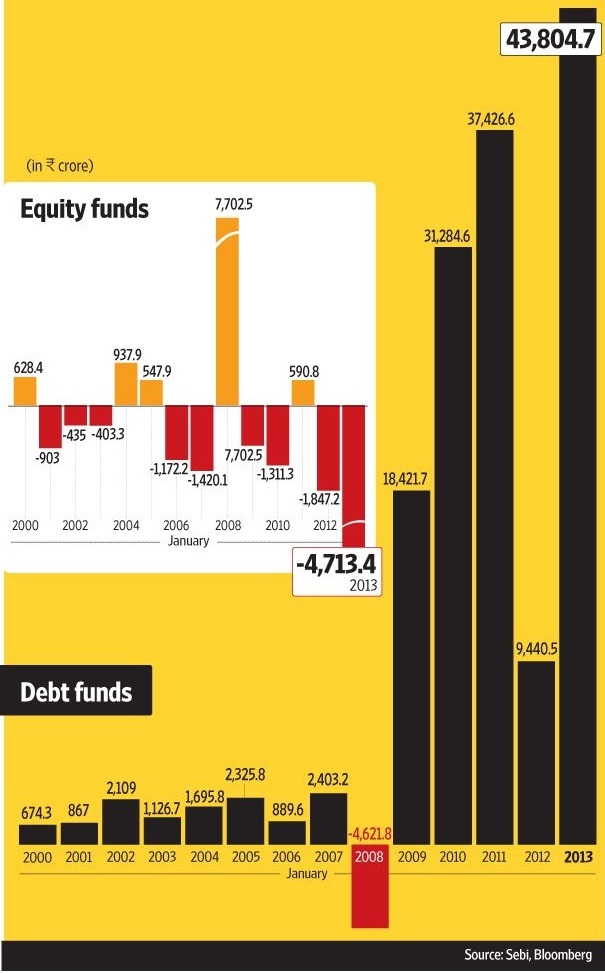

Are Indians investing in Mutual Funds, if yes where, the following picture from Livemint traces Mutual Fund Investments in debt and equity

[poll id=”42″]

Related Articles:

- Direct Investing in Mutual Funds

- Not All Mutual Funds Do Well -the Laggards

- Many Mutual Funds: Diversification or Diworsification

- Number of Mutual Funds

- Investing in Mutual Funds for Beginner

So while selecting the mutual funds, after understanding our needs and investment objective, choosing the type of mutual fund we should consider fund performance, fund ratings, fund size, fund house. While most of us give too much emphasis on performance, fund size etc what it is required along with it, is the need to judge whether the mutual fund scheme follows sound investment processes and systems.

Hi,

I’d like your opinion on 2 recent funds. First up, I’m not sure if they are Liquid MF’s or Debt-based MF’s. So it would be useful if you can clarify this also –

1. IDFC’s Fixed Term Plan Series 30 http://www.idfcmf.com/uploads/idfc-ftp-series-30-form-kim.pdf

2. Sundaram Fixed Term Plan – DU http://www.sundarammutual.com/pdf2/2013/SID/SID_Sundaram_FTP_DU_366Days_Aug13.pdf

Both dont mention any tentative rate of return. I’m assuming it’ll be around the 9-10% range. What is your take on these two?

Sorry missed the comment hence didn’t reply.

Did you apply for those , they seem to be like FMPs?

Hi Kirti,

Nope, I haven’t invested yet. Confused since a few more options popped up – Muthoot & SREI NCD’s. Then another FD from KCP Cements.

Hi,

I’d like your opinion on 2 recent funds. First up, I’m not sure if they are Liquid MF’s or Debt-based MF’s. So it would be useful if you can clarify this also –

1. IDFC’s Fixed Term Plan Series 30 http://www.idfcmf.com/uploads/idfc-ftp-series-30-form-kim.pdf

2. Sundaram Fixed Term Plan – DU http://www.sundarammutual.com/pdf2/2013/SID/SID_Sundaram_FTP_DU_366Days_Aug13.pdf

Both dont mention any tentative rate of return. I’m assuming it’ll be around the 9-10% range. What is your take on these two?

Sorry missed the comment hence didn’t reply.

Did you apply for those , they seem to be like FMPs?

Hi Kirti,

Nope, I haven’t invested yet. Confused since a few more options popped up – Muthoot & SREI NCD’s. Then another FD from KCP Cements.