Mutual funds are one of the best investment options available today, as said by media, financial planners. But there are various types of mutual funds, equity funds, debt funds, balanced funds, income funds, index funds etc. with several schemes equity has large cap,small cap, debt funds have short term, gilt. Availability of so many mutual fund categories and schemes in the current volatile markets can put the investor in a fix of how to choose mutual fund to suite his/her needs Before you make an investment in mutual fund, first you need do some homework. Outlined below are several key questions to consider before investing in a particular mutual fund.

Table of Contents

Know Thyself

Start with understanding your needs as an investor. Try to answer following questions:

- What is the purpose of investing : Are you investing for growth, for monthly income, for dividends?

- How long do you want to invest? 1 month, 1 year, 3 years, 5 years. If you open PPF you are making commitment for 15 years, in Equity Linked Saving Scheme minimum commitment is for 3 years, for Life Insurance policy your premium paying term

- How much risk can you take ? In money or financial terms Risk means the possibility of losing money. While investing we need to do a trade off between Risks and Returns. An example of trade-off is choosing Travelling vehicle which is a trade off between time and money. Travelling by planes are faster but more expensive than travelling by train. So are you a conservative investor or aggressive?

- What is the liquidity that you expect from the investment ? Liquidity means how easy or quickly you can convert investment product to cash i.e. how accessible is the your money invested in that product. The most liquid asset is cash as it can always be used easily and immediately. Fixed Deposits are less liquid, because there is usually a penalty for withdrawing it before their maturity date.Stocks, Mutual Funds are considered fairly liquid as they can be sold any time the stock market is open

- Frequency of Investment : Are you planning to invest once in lump sum or it would be a periodic investment?

- Who is suggesting the product : Is it someone who is doing for his own interests (ex Bank Relationship manager, agent) or who has my financial interest in mind(a good financial planner). or You heard about it in newspaper, TV, magazines,blogs, friends, family.

- How does it fit into my financial plan ? Failing to plan is Before building a house, we recognize it’s a good thing to have a carefully considered blueprint or plan. Similarly to build a secure financial future we need to avoid we’ll work out the details as we go along approach and have a unique plan which takes into account OUR finances, OUR goals,OUR spendings,

No one solution fits all. Our Answers to these questions are different for everyone. Before investing in any product think of Think about Liquidity,Safety,Returns,Risk,Tax. as the investment you choose will depend on that, and so will the returns you earn.

Understand Why You want to invest in mutual fund?

So you have decided to invest in Mutual Funds. You need to understand why you have chosen Mutual Fund, the pros the cons, as your investment vehicle. Why not Fixed Deposits or Stocks or Post Office or … For example lets see the Comparison between Equity Mutual Funds and Stocks

Stocks: It is recommended that one invests in stocks is as they provide the highest potential returns. And over the long term, no other type of investment tends to perform better. On the downside, stocks tend to be the most volatile investments. This means that the value of stocks can drop in the short term. Sometimes stock prices may fall for a period. For . Bad luck or bad timing can easily sink your returns. You need to manage them yourself so you need time and expertise to manage them on regular basis.

Mutual Funds: Equity based mutual funds can offer similar returns to investing in stocks on your own, but without all the extra work. When you invest in a fund, your money is pooled with that of other investors, and then it is managed by a group of professionals who try to earn a return by selecting stocks for the pool. Other key advantage of funds is that they can be less volatile. Individual stocks can and sometimes do go to zero. But if a mutual fund holds 50 stocks, it’s very unlikely that all of them would become worthless.The flip side of this reduced volatility is that fund returns can be muted relative to individual stocks.Another disadvantage the professionals running mutual funds do not do so for free. They charge fees, and fees eat into returns.

You would have heard the disclaimer in any advertisement of Mutual Funds Mutual fund investments are subject to market risks Please read the offer document carefully before investing. You must understand that Mutual Funds performance is tied to the fate of the securities it invests in i.e. it is market related and does not offer any guarantee of returns. If stock market is not doing well then your equity based Mutual funds’ fate will not be different. If Gold is going down your Gold ETF will also give negative return. A good fund will try to minimize the downfall.

There are thousands of mutual fund schemes on offer of different kinds. There are 44 registered mutual funds companies in the market managing 7.22 lakh crore of investments(in Mar 2013), jostling for space.The picture given below shows how money is distributed across various types of funds(as on Mar 2013).

With so many mutual funds How do I choose Mutual Fund?

First step is selecting the right type of funds.

Does the Mutual Funds investment objective matches my investment objective?

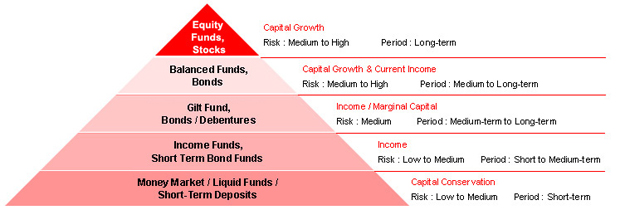

Having a clear idea about your investment goal, your risks taking ability are important things to do before you make any kind of investment. If your investment objective is growth say college eduction of your kids 15 years later then investing in a Gold ETF or Debt Mutual Funds would not be the appropriate answer but Equity Mutual Fund will meet your needs. You should understand what a fund invests in, how it fits into your overall portfolio, and how it attempts to achieve its investment objective. Once your objective is clear, you can easily decide upon which type of fund you need i.e. whether to go for growth funds or for steady and regular income funds. If your objective is to earn attractive returns during equity bull markets and stabilize its portfolio during equity bear markets then Balanced Mutual Fund may be your answer. The picture given below shows the type of funds, the purpose they suit (Capital Conservation, Growth etc), Risk and Period for which they make sense.

Does the Mutual fund meet my investment tenure and liquidity prospects?

You should be aware of the period you will remain invested in a particular fund and what are the liquidity factors ie how can one withdraw money before maturity etc . For example in equity linked saving schemes (ELSS) the lock in period is 3 years . The tenure can be short, medium or long. So if you want to invest for a tenure of 1 year investing in Equity mutual fund will not serve purpose but investing in Short term debt fund will.

Does the Mutual Funds risk match my risk appetite ?

Knowing one’s risk appetite is a very important thing to keep in mind before selecting a fund. For example

- If you zeroed on to Equity Mutual Funds then you find that there are different types of schemes like large cap, mid cap, small cap, sector funds, theme funds etc. As small-cap funds invest in companies that are less stable than large-cap companies, the funds can be quite volatile infact in times of market instability, small-cap funds can suffer greatly. Small and mid-cap funds tend to outperform in a bull market. For example, in a bull market in 2007, 2009 and recently in 2012 these funds have outperformed largecap funds by a decent margin. However, these funds tend to underperform in bear markets, like in 2008 and 2011. Economic Times Mid-cap funds bring big returns, and risks too , Want to bet on small, mid-cap stocks? Trust mutual funds to make the right bets throw light on it.

- If you have zeroed on in debt mutual funds then whether it is gilt funds or short term or liquid funds match your requirements.

- If it is tax savings then Equity Linked Saving Scheme should be a viable option.

- If investing in Gold then you should have narrowed down to Gold Fund or Gold ETF.

Know the Tax implications

Investors should know the nature of return they will obtain from investing in a particular MF scheme and its tax implications. Usually investors get dividend and/or capital gains by investing in mutual funds. Dividend received is tax free whereas, capital gains are taxable.

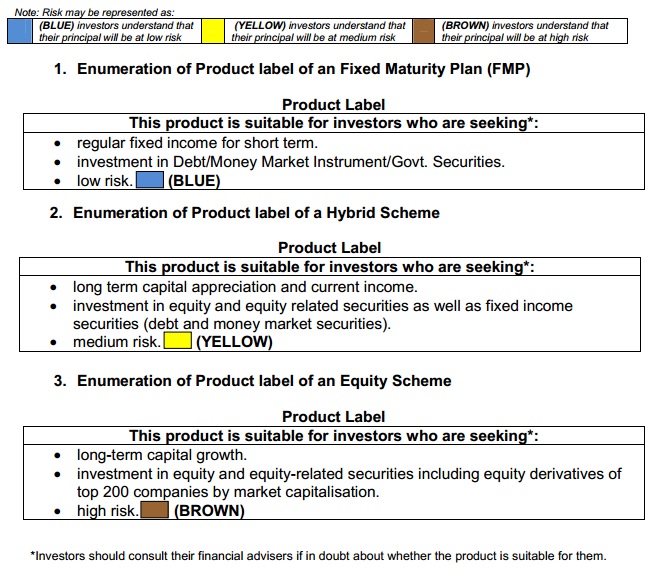

Effective July 2013, all mutual fund schemes will carry a label that will, among other things, indicate its risk level. The colour mark is something like the colour code that you find on food and beverage packets in India; a green dot, if it is vegetarian and a red dot if it is a non-vegetarian item.

- A blue mark means it is a low risk scheme.

- A yellow mark would mean that your scheme is a medium-risk scheme.

- A brown mark would mean that it’s a high risk scheme.

From SEBI Product Labeling of Mutual Funds (pdf)

At this point you should have narrowed down to

- Type of funds for example Equity, Debt, Gold

- Actively or Passively Managed

- SubType : Large cap or Midcap Equity Diversified Fund or Short Term or Gilt Mutual funds or Gold Fund or Gold ETF or Sector Funds such as Banking.

In our article How to Choose a Mutual Fund – Ratings, Fund House size we shall explain on how to go further and zero on the mutual fund.

5 responses to “How to Choose Mutual Fund”

If a fund has an alpha of 10%, it means it has outperformed its benchmark by 10% during a specified period. Thanks for sharing a great article.

I have invested in IDFC Mutual fund, and I think I got a good return from it.

Good to hear that. Just keep reviewing your fund every 6 months!

I have invested in IDFC Mutual fund, and I think I got a good return from it.

Good to hear that. Just keep reviewing your fund every 6 months!