Have you heard the saying that the journey is more important than the destination? Don’t you think that the journey to your destination may be made better when you travel in your own dream car? Are you wondering how to finance the purchase price of your dream car? Buying your own car is not impossible especially if you plan your finances in a proper manner. Here is how:

Available buying options for car

One way to buy your own car is by availing of a vehicle loan. However, assuming debt to fund your dreams may not be financially prudent.

Another option is to use your savings to buy your dream car. But you may want to use your savings for emergencies. You may consider liquidating your investments to buy the car. However, that leaves meeting your future financial goals in jeopardy.

There is no need to despair. You may still be able to buy your dream car through mutual fund investments.

Mutual fund investments to buy your car

If you choose to buy the car using a loan, you need to ensure you make timely payments of the monthly installments. Moreover, the interest paid on the loan significantly increases the total price of your car.

If you use your savings or liquidate your investments, you need to restart financial planning to achieve your other goals.

However, when you opt to invest in mutual funds to accumulate the money needed to buy the car, you do not have to assume any debt nor dip into your savings. With the power of compounding and a little patience, you will be able to accumulate the necessary money to fund the purchase of your dream car.

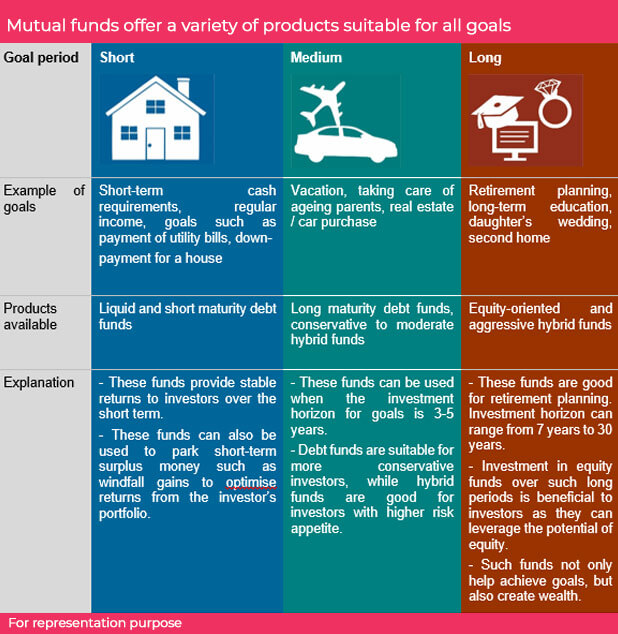

“An investor without investment objectives is like a traveller without a destination,” said Ralph Seger. Investment planning should be in sync with goals across life stages and should not aim at only maximising returns. A holistic approach results in better asset allocation. Mutual funds are a good tool to take care of your investment needs, but do proper due diligence before investing. In fact, Different Types of Mutual Funds can be used to meet different goals in Life. (Ref: Market Express)

Benefits of mutual funds

There are several benefits of mutual funds as discussed below:

- Multiple options

You may choose among different options while investing in such funds. There are various schemes such as debt, equity, balanced, and several other types offered by the fund houses. All these schemes have unique investment philosophies and based on your risk profile, investment horizon, and financial situation, you may choose one or more of these schemes.

- Power of compounding

The returns on your initial capital are reinvested to earn a higher income. This allows you to accumulate a higher corpus through the power of compounding especially if you remain invested for the long-term.

- Systematic Investment Plans (SIPs)

You may invest as less as INR 500 per month through SIPs in your chosen funds. Therefore, you are able to inculcate financial discipline, which is crucial to achieving your financial goals. Moreover, you will be able to enjoy regular savings without feeling any liquidity crisis through a SIP amount that suits your financial situation.

- Professional expertise

Investing in the stock markets is risky even for seasoned investors. Therefore, if you do not have the experience and the expertise to directly invest in the stock market, opting for equity-based funds is a prudent option. These schemes are managed by trained and experienced professionals who make accurate investment decisions based on market movements.

To ensure you are able to achieve your dream car at the earliest, it is recommended you start investing early. When you begin early, your investment has more time to grow to help you build the corpus needed to fund the purchase of your car. It is also recommended that you opt for direct plans provided by the fund houses to enjoy higher returns, Net Asset Value (NAV), and lower expense ratio. If you opt for indirect funds, you need to pay the intermediary fees that reduce your effective returns on investments.

Start your SIP today and drive home your dream car soon.