Forex brokers are firms that provide platforms for traders to buy and sell foreign currencies. When looking for the forex broker, look for several key features and benefits such as fees (for spreads and commissions), trading platform(s) ( mobile, software, web-based, charting), customer support, trading education along with currency research, and trustworthiness. Let’s Look at how to choose a reliable broker in detail.

Rule 1. The brokerage company’s history

Look for how many years the brokerage services is in business. Use the ones that have been operating for 3-5 years. They usually provide interesting offers (including bonuses or multipliers).

Rule 2. The quality of the trading platform

The quality of the trading platform (terminal) is important. The trading platform offers software that you use to monitor currency pairs, make trades and analyze assets. It must be high-quality products. What you need to look at is the interface clear, does it offer a demo account for trading virtual currency units. Does it offer choice of indicators and graphical analysis tools( to predict price changes using special strategies). Often you need to use the RSI, Stochastic, Bollinger Bands and SMA indicators.

For example, the image below from Olymp Trade shows the clean interface. It also shows the RSI indicator for the EUR/NZD currency pair. It helps to come up with the strategy that when the RSI line is below the horizontal level of 30, you should buy the asset. Or If you had invested $10 in a trade using an x500 multiplier (a multiplier increases your trade amount manifold), your profit would have been at least $40.

Rule 3. Training for traders

Does the broker provide training for traders? A broker earns if the trader earns stably as more trades are made, the greater their volume and the more profit is made by the broker. If brokerage company experts provide training programs and hold webinars, it benefits the trader and then loyalty increases.

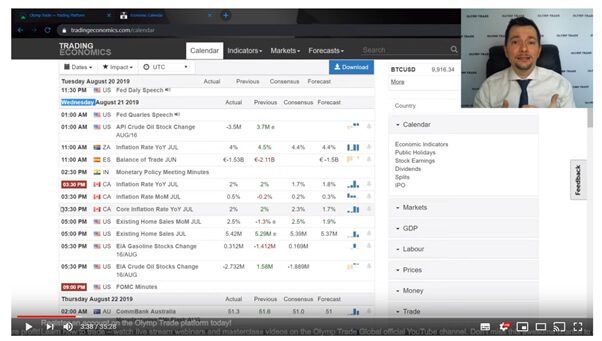

The following is a screenshot of the Olymp Trade webinar. You can see an expert speaking about economic news and how to earn on it.

Rule 4. Guarantees

You need to trust your broker that your funds are protected. Whom to approach if your rights are violated?

There are many regulators, but retail forex brokerages are often licensed by FinaCom, an international organization that ensures fair relationship between traders and the broker.

The FinaCom certificate means that if your rights are violated, you can be eligible for compensation of up to 20000 euros offered by the FinaCom Fund.

I hope you found this article useful. There are a lot of brokerages offers in the market do consider Olymp Trade.